Professional Documents

Culture Documents

Chapter 10 Inventories

Chapter 10 Inventories

Uploaded by

Clyde Saladaga0 ratings0% found this document useful (0 votes)

8 views40 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views40 pagesChapter 10 Inventories

Chapter 10 Inventories

Uploaded by

Clyde SaladagaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 40

CHAPTER 10

9] wveEnToriEs

TECHNICAL KNOWLEDGE |

|

:

To understand the meaning of inventories.

To identify the major classes of inventory.

To account for inventory transactions using periodic and

perpetual inventory system.

To know the gross method and net method of recording

purchases. se

To identify the items i:

i=

A

>

Definition

Trave

, Ventories are aeseta held for sale in the ordinary course

pales, in the process of production for such sale or in the font

°f materials oy supplies to be consumed in the production proces,

or in the rendering of services.

lnventorios encompass goods purchased and held fo,

resale, for example

‘Merchandise purchased by a retailer and held for resale

Land and other property held for resale by a subdivision

b.

entity and real estate developer.

Inventories also encompass finished goods produced, goods

in process and materials and supplies awaiting use in

the production process.

Classes of inventories

Inventories are broadly classified into two, namely inventories

of a trading concern and inventories of manufacturing concern,

A trading concern is one that buys and sells goods in the same

form purchased.

The term “merchandise inventory” is generally applied to goods f

held by a trading concern, ~

A manufacturing coi

altered or converted

available for sale.

The inventories of a

a. Finished good:

b. Goods in pro

pefinitions

finished goods are completed products which are ready for sale

finished goods have been assigned their full share of

manufacturing costs.

Goods in process or work in process are partially completed

produets which require further process or work before they

can be sold.

2rials ave goods that are to be used in the production

or process has been done on them as yet by the entity

No worl

jnventorying them.

Broadly, raw materials cover all materials used in the

manufacturing operations.

However, frequently raw materials are restricted to materials

that will be physically incorporated in the production of other

goods and which can be traced directly to the end product of

the production process.

Factory or manufacturing supplies ave similar to raw materials

but their relationship to the end product is indirect.

Factory or manufacturing supplies may be referred to as

indirect materials.

entory 5

jnv'

wee ple in the title shall be j

Goods includible ch the © tity has Pe ina

voods to WTR. of loca” who i

As arule eae regardless a legal language which

‘n the inventory 2” s »

re praae vps ttle’ fmnersbp changes. Mey his W

‘the Prat of ime ab We FOB 5!

Legal test q 1g to be inventoried? Under

—] eg umomna om Bea transf

— is the entity ative, the £0 e include, , int |

f the answer 18 Ut the offir mat ded iy 2

the inventory. Thus,

she goods shall be excl

If header isto eres the & ded frop, iprere)

he inventory. A

ee erie aired ; coor

Applying the legal test, the following it © includible j, charg

inventory:

a. Goods owned and on hand 5 On th

h. Goods in transit and sold FOB destination is tra

c. Goods in transit and purcbased FOB shipping point goods

d. Goods out on consignment

e. Goods in the hands of salesmen or agents A

£ = .CCOl

Goods held by customers on approval or on trial charg

Exception to the legal test poi

Installment cont;

racts: i

the seller tint the ue Brovide for retention of ti Ba. B

e selling pri of title by

J J Price is fully coll, pen”

Following the legal tes! lected. wher

are sti 1, Ue goo ; A

ill the propert ds sold on installment basis whic

ineludible in his inp is

: nve ~*t and therefore normally

ever, ‘ " a This

mm

who is the owner of goods in transit?

this will depend on the terms, whether FOB destination or

yoB shipping point. FOB means free on board

yader FOB destination, ownership of goods purchased is

Pansferred only upon receipt of the goods by the buyer at the

aint of destination.

P

hus, under FOB destination, the goods in transit are still the

property of the seller.

‘Accordingly, the seller shall legally be responsible for freight

charges and other expenses up to the point of destination.

On the other hand, if the term is FOB shipping point, ownership

is transferred upon shipment of the goods and therefore, the

goods in transit are the property of the buyer.

Accordingly, the buyer shall legally be responsible for freight

charges and other expenses from the point of shipment to the

point of destination.

when goods are shipped, regardless of the P

which title passed. is

This procedure is e:

In practice, during an accounting period, the accountant

normally records purchases when goods are received and Beles

=e

estates

Ant charge on the gg

thin means that the reve Ter shall collect

Freight oles a aid. The common St "freight charge is

shipped is not yet pal yo, under this, :

same from the aoe

Getually paid by the buyer ;

8

Freight prepaid ~ This, Me2D® Nhe

goods shipped is already P' © aeiseo tipi

1 -ms "FOB destination Soe ae

heme feat, ane ou Se a

aE aed estination.

th ne end to the point of destina’

he :

ht collect" "freight ee ce the

See ae paid the freight charge bu’ z © Party

Bee ate y the freight charge

who is supposed to legally pay

Freight terms

hat the freight charge on g,

seller.

and

Maritime shipping terms

i : who ships FAS must beg

alongside — A seller w ‘:

Aiecaneeeatd risk involved in delivering the goods to the

oat to or alongside the vessel on which the goods are

to be shipped.

The buyer bears the cost of loading and shipment and thus

title passes to the buyer when the carrier takes possession

of the goods.

CIF or Cost, insurance and freight — Under this shipping

contract, the buyer agrees to pay in a lump sum the cost ‘

the goods, insurance cost and freight charge.

The shipping contract may

that the buyer agrees to pi

goods and freight charge

In either case, the seller m

title and risk of loss shall

the goods to the carrier.

Ex-ship — A seller who

expenses and risk of lo,

which time title and risk

— = — 1

consigned goods

consigninent is a method of marketing goods in which the

owner called the consignor transfers physical possession of

tain goods to an agent called the consignee who sells them

er ne owner's behalf

0

nsigned goods shall be included in the consignor’s inventory

and excluded from the consignee’s inventory.

ight and other handling charges on goods out on consignment

are part of the cost of goods consigned.

When consigned goods are sold by the consignee, a report is

made to the consignor together with a cash remittance for the

amount of sales minus commission and other expenses

chargeable to the consignor.

For example, a consignee sells consigned goods for P100,000.

This amount is remitted to the consignor less commission of

P15,000 and advertising of P2,000.

The consignor simply records the cash remittance from the

consignee as follows:

Cash 83,000

Commission 15,000

Advertising 2,000

Sales 100,000

Wi

With co;

eities nid the

take DW

>

ories fot invento

ang for inventories,

ass ating » Nang

eyster hy

Tw _gical counting of

e he phys ieee

pe ; stem call period to determine quant %

‘The periodic 99* ‘counting ‘tig,

The Pre the end of the plied by the COFrespondin, ‘

x tren multiplier pelance sheet puree

re quantities 9t@ HT vale Jor a] inventories, Pt

costa tot BEIT yal oF PID” :

This approach & : val

nerally used wh

: , procedure 1S ; len

The periodic inventory proved small peso investment, suc

ifldual inventory 2S parts. %

groceries, hardware

i tem re

the perpetual sys quires

bee ‘called stock cards that usually oftat®

nds caliqory inflow and outflow, © 8

and decreases are reflected in the g

ce represents the invento;

ries "Y. Thi

On the other h

maintenance of ret

running summary of

Inventory increases

cards and the resulting balant

approach gives book or perpetual invento

The perpetual inventory procedure is commonly

ic Ly use

Tie ae tieieelniiually represent ‘a “<0

large peso investment such as jewelry and cars. ‘elatively

In an ideal per :

‘petual system, th

dnd codicoll both Ghee ate eae cards are kept to reflect

Consequently, the enti

: tity. we

on hand at a particular ities" shia to know the inventory

2.

In recent ye

Years, the wi

Practically all large es

aintain a perpetual j 3

silustré

4. Pure

Pure

y

2. Pay

Frei

3. Ret

4.

Acc

Sa

pr

Aci

ylustration — Periodic system

1. Purchase of merchandise. on account, P300,000.

8 o, Purchases

ica ‘Accounts payable Bon o0) 300,000

a 3, Payment of freight on the purchase, P20,000. :

‘ Freight in 20,000 2

Cash f 20,000 -

he |

ag 3, Return of merchandise purchased to supplier, P30,000. |

Accounts payable 30,000 |

a Purchase return ‘ 30,000 4

:

a .

4, Sale of merchandise on account, P400,000, at 40% gross

profit. :

7 Accounts receivable 400,000

3 Sales 400,000

5. Return of merchandise sold from customer, P25,000.

25,000

Sales return

Accounts receivable

25,000,

6. Adjustment of ending inventory, P65,000.

Merchandise inventory-end

Income summary

= |

Ta gise OM accounts

Pur go of mere pane an

iM rayabl ee

ee » purchase

wht om the

i 20,000

2. Payment of fren

erehi andise inventory

Cash surchased to SUPPIiex, P3O,09,

merchandise F

20,00, or exa™mP

ps5. 900, #!

Me

jnventory ©

3. Return of 2

; 000 i

vi Merche

Accounts payable 3

Aco eandige inventOrY 0,009 cn

he inve

sooount, P400,000 at gross prof; Seat

Sale of merchandise on BCCOUN'» j000 at ge it of pecans

; as of meet of merchandise eold is 60% or P240,000, preakage

Accounts receivable 400,000 Howeve

Sales 400,009 separate

Cost of goods sold 240,000 a

Merchandise inventory 240,000 Trade

Trade d

in order

is clearly actua)ly

Under the perpetual system, the cost of me

. the co: srcha

is IAG soaues. thie. wee

determinable from the stock card.

5. Return of merchandise sold fro Thus, t

cost of th i m customer, P2!

e merchandise returned is 60% or Sec The The pr

Z : increas

price a

_ Cash

©0,009

000

000.

000

it of

he,

entory Shortage or overage

the

g re of

jance

:the end of the

ferent amou

an. adjustment is necessa:

“ge or overage,

andise inventory (65,000 - 55,000)

pecause this is often the result of normal

preakage in inventory.

However, abnormal and material sho

separately classified and presented as othe:

Trade discounts and cash discounts

in order to arrive at the invoice price whic

actually charged to the buyer,

Thus, trade discounts are not recorded.

The purpose of trade discounts is to enco

price at

illustration, the merchandise inventory account has debit

Sunting period, a physical count indicates

ry to recognize

or example, if the physical count shows inventory on hand of

000, the following adjustment is necessary:

ortage 10,000

10,000

qhe inventory shortage is usually closed to cost of goods sold

shrinkage and

xrtage shall be

YY expense,

Trade discounts are deductions from the list or catalog price

h is the amount

urage trading or

crease sales. Trade discounts also suggest to the buyer the

his nay be resold. a

=,

1

sees 1 is P500,000 ogg

i chase?

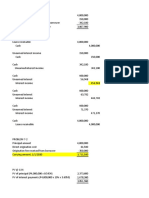

Illustration = ear din

ercnandive f

Te of th credit tor” and 10%, and. the cash

20% and 10%, )

E oun! ts 2 eas days:

ne trade dil a ad

Dune 3 D750" a if the e payment is madg

discount is ee pasmen

cunt of the inv Cae vperiod O!

at ‘ ine pes! : 500,000

al (200,009

0

List prot scott (20% x 500.00 ) conte

First trac (20,00

100)

Second trade discount (10% * 400,01 a

(18,000)

Invoice price «76x 980,000) ee

Cash discount . cam

Payment within the discount Pen 342.000

e is:

‘The journal entry to record the purchas

360,000

Purchases a

‘Accounts payable

Note that the trade discounts are not recorded. The

journal entry to record the payment of the invoice within

the discount period is:

Accounts payable

pin 360,000

Purchase discounts

Methods of recording pure

1. Gross meth

ho

recorded at Bo, EB ‘urchases

2 Net meth

at net, oe Purchases and

ustration - Gross method

s

count, P200,000, 2/10, n

a LAID

LID

LOD

196,000

it is made within the discount period

196,000

196,000

discount

~~

ot method a

. ethod vs. n¢ ll

Gross meth the net method TePre ents the a x

jor the od reprovent the

The cost measured - tne of Pay Sent s va <

equivalent Plovrect historical cost rs

y correct his

theoretica: record purchases at. grog an

most entities Te ‘

However, in practice, pra

d

shod violates the matching Pringp e

Technically, the ne saeeded only when eniorariey cash The

because con ‘a when purchases that gt Se to the diff

is paid rather thi ae

discounts are made.

allocate discount:

Moreover, this procedure does not allocate discounts taken Me

between goods sold and goods on hand. eet

, for

Despite its theoretical shortcomings, the gross method jg ae

supported on practical grounds.

Ci

The gross method is more convenient than the net method from,

a bookkeeping standpoint. T

‘pea re

Moreover, if applied consistently over time, it usually produces

no material errors in the financial statements. ti

Cost of inventories “

L

Tl i ; ‘¢

‘he cost of. Inventories shall comprise: : '

a. Cost of Purchase t

b. Cost of conversion Fees.

¢ Other cost incurred in

Present location and

mre cost of purchase of inventories comprises the purchase

price import dutiea and irrecoverable taxes, freight, handling

ther costs directly attributable to the acquisition of

od goods, materials and services.

ade cigoounts, rebates and other aimilar items are deducted

determining the cost of purchase

phe cost of purchase shall not include foreign exchange

which arise directly from the recent acquisition

aventories involving a foreign currency

Moreover, When inventories are purchased ‘with deferred

eettiement terms, the difference between the purchase price

for normal credit terms and the amount paid is recognized

as interest expense over the period of financing.

Cost of conversion

The cost of conversion of inventories includes cost directly

related to the units of production such as direct labor.

It also includes a systematic allocation of fixed and variable

production overhead that is incurred in converting materials

into finished goods.

Fixed production overhead is the indirect cost of production

that remains relatively constant regardless of the volume of

production,

Examples are depreciation and main te

and equipment, and the cost of

administration.

Variable production overhead is

that varies directly with the volui

Examples are indirect labor and

ere {jf -_—_ =p

on. overhead

= Allocation of fixed product!

ead to the cogt

f the productig,

cation of fixed Pl

based on the BO}

hi

duction over!

oom nal capacity ©

The all ema

conversion is

facilities

juction expected to be achieved on

rod!

ene periods OF seasons under normal

loss of capacity resulting

Normal capacity is t

jnto account the

average over a num

circumstances talking

from planned maintanance-

iocated to each unit of

The amount of fixed overhead all

d as consequence of low production

production is not increase

or idle plant.

Unallocated fixed overhead is recognized as expense in the

period in which it is incurred.

Allocation of variable production overhead

Variable production overhead is

le allocated to each uni

/ production on the basis of the actual use of the prod i

‘lon,

facilities.

A production

i process may result in

being produced simultaneously. more than one product

This is the ca:

se, for examy

or where there is a oa

Va the costs of converg

aa allocated betwee

nt basis, fo

, for

value of each product

Most by-products by theis

oth

othe

that

jocat

For

aesi

inve

Hlov

invé

incl

— al’) dss?

er cost

cag ea :

Luce Of une c0st is included in the cost of inventories only to the extent

x Wieit is incurred in bringing the inventories to their present

Yi raion and condition.

ved

Orme yor example, it may be appropriate to include the cost of

whist gesiening Pro uct for specific customers in the cost of

ting javentorics.

owever, the following costs are excluded from the cost of

jnventories and recognized as expenses in the period when

it of

Ction jncurred:

4, Abnormal amounts of wasted materials, labor and other

the production costs.

Storage costs, unless these costs are necessary in the

production process prior to a further production stage.

Thus, storage costs on goods in process are capitalized but

of

on storage costs on finished goods are expensed.

c. Administrative overheads that do not contribute to bringing

ct inventories to their present location and condition.

d. Distribution or selling costs

Cost of inventories of a service provider

The cost of inventories of a service

of the labor and other costs of

providing the service, includin

attributable overhead.

Labor and other costs re

@dministrative personnel are

xpenses in the period in

ag a |

=a QuESsTIONS pRO}

ries.

1. Define invent lasses of inventory. probl

two 2

2, Explain the snctudible in inventory Amiab

ds are : ‘

3. What goo" atte determining inventory inclu ene

4, What is the legal ts J me Items

of goods in transit! pe

— 5. Who is the owner Items

6, Fxplain FOB destination. ca

7. Explain FOB shipping point Sa

8, Explain freight prepaid. re

Item:

9: Explain freight collect. Siar

Item

10, What do you understand by the maritime terms FAS, gp Item

F and Ex-ship? i rede

/ 11. What is consignment? Roe

12 Who is the owner of goods on consignment? ae

13. Explain the statement Re

14. Expl Presentation of inventories,

Explain the two system:

ems of accounti 7 ‘ Co

16, Distinguish trade di nting for inventories,

vade discounts and

16. 3 j aah,

discounts,

xplain the two methods

17. What are

18, Explain Cost of Purchase

19. Explaj

n Cost of

Conversg;,

the componen;

20, Explain

the Cost

of inve,

pROBLEMS

problem 10-1 (IAA)

amiable Company provided the following data at year-end:

Jtems counted in the bodega 4,000,000

Items included in the count specifically segregated

per sales contract 100,000

Itemsin receiving department, returned by customer,

in good condition 50,000

Items ordered and in the receiving department, :

invoice not received 400,000 ‘

Items ordered, invoice received but goods not

received. Freight is paid by seller. 300,000

Items shipped today, invoice mailed, FOB shipping point — 250,000

Items shipped today, invoice mailed, FOB destination 150,000

Items currently being used for window display 200,000

Items on counter for sale 800,000

Items in receiving department, refused by us because

ofdamage 180,000

Items included in count, damaged and unsalable 50,000 4

Items in the shipping department

Required:

Compute the correct amount

I

._¢ information:

) ylowine ¥

x0 Ea ® 1,400,

Problem 10-2 Oya 0

Natal Company see

als ordered on

materi i

inventors, tons 2,000.08

Unespired insurane pr SbipPing ts

a | :

Veit Bt fo owned retail sen

1 en

Finished goog gxe probiton cost gneea including 400,009

aeons in hands ofCO™ .

Ri i profit on sales astomers, SRIPP' ol

F inished goodsin transit toc! 25009

i on at cost teost y

rinsed gos out on approval a 52.09

Unsalable finished goods, a 4 ,

Office supplies ade fe oint,

Materialein transit shipned ob ip as

excluding freightot PHM sales price, cost P150,000 200,000

Goods held on consignment,

Required:

Compute the correct amount of inventory.

Problem 10-3 (IAA)

Luminous Company provided the following information at

current year-end:

Finished goods in storeroom, at cost including over]

of P400,000 peed

Finished goods in transit, including freigh it charge

P20,000, FOB shipping point q #

Finished goods held by eal j

cost, P100,009. mena

2,000,000

Goods in process

terials

problem 10-4 (IAA)

ummer Company is a wholesaler of car seatcovers. At the

peginning of the current year, the entity’s inventory consisted

9f90 car Seatcovers priced at P1,000 each. During the current

years the following events occurred:

_ Purchased 800 car seatcovers on account at P1,000 eack.

Returned 50 defective car seatcovers to supplier and

received credit.

Paid 600 of the car seatcovers purchased.

4, Sold 790 car seatcoyers at P2,000 each.

Received 20 car seatcovers returned by a customer and gave

credit. The goods were in excellent condition.

6. Received cash for 680 of the car seatcovers sold.

7, Physical count at year-end revealed 60 units on hand.

Required:

tments to record

Prepare journal entries, including adjust

s periodic

the above transactions assuming the company use‘

system and perpetual system.

a.

b. Determine the cost of sales under each inventory system.

Problem 10-5 (ACP)

Winter Company received quotations from two entities for an

item of merchandise as follows: sicpiaiiee , ;

From Company A: List price P500

shipping point

From Company B: List price P50

point, 2/10, n

Required:

For each quotation, compute the

tobe paid by the buyer within

oi

»

I

6 (AA) followin® transactions fo, e ise

problem 10 a r

problem provi od operation Pe

Pe tn a vice price of P4,756 ane

current seat He 4 an inv’ 9 190g, tra

noe aise ab 4/10, n /30 ear,

me are 2 “nt is allocated ty .. year

1 ‘the freieh! 3 von

5 ; p3,717,000, of which f 1,617, is

” purchase rchases Fe io “ey |

+ haan paymentonfie discount Pe unpaid accounts payay,

vane er that all discou™

4. It is expected tha he merchandise remaing »

» lost. seen ore

5. Ot pecember 31, one fift

hand

Required: he transactions y

ries to record th iiah

3.

ti

2. Prepare journal entries |

gross method and net method,

ry and cost of sales under each method

b. Compute invento

Problem 10-7 (IAA)

nt year. The entity

Fall Company began operations in the cu

used perpetual inventory system.

1 pug the year, Fall Company purchased merchandise

having a gross invoice cost of P1,000,000, All

made under the terms 2/10, n/30, FOB ees aaa

50,000.

2. Fall Company paid freight

3. During the year, Fall Cor

merchandise within the

The remaining 20% was

5. Fall Company sold 70% of

cash of. P1,200,000, Th

year-end, a

Required;

Prepare journ;

method and

problem 10-8 (AICPA Adapted)

myriad Company revealed the following purchase

(aera nay occurred during the last few days of the fiscal

year, Which ends December 31, and in the first few days after

that date.

1, An invoice for P50,000, FOB shipping point, was received

and gree on December 27. The shipment was received :

in satisfactory condition on January 2. The merchandise

was not included in the inventory.

g, An invoice for P75,000, FOB destination, was received

and recorded on December 28. The shipment was received

in satisfactory condition on January 3. The merchandise

was not included in the inventory. 4

3. An invoice for P30,000, FOB shipping point, was received

and recorded on January 4. The invoice shows that the

goods had been shipped on December 28 and the receiving

report indicates that the goods had been received on,

January 4. The merchandise was excluded from inventory.

An invoice for P90,000, FOB shipping point, was received

on December 15. The receiving report indicates that the

goods were received on December 18 but across the face

of the report is the notation “merchandise not of the saine

quality as ordered - returned for credit, December 19”. j

The merchandise was included in the inventory.

=

‘An invoice for P140,000, FOB

and recorded on January 4.

that the goods were rece

merchandise was included

Required:

Prepare the adjustments on

open.’

| L Aa

ga d)

te

AdaP’ December 31, 299 oblex

10-9 AICPA yento¥Y °F JF goods Priced ag of Biers

a Problem ny 3ep0! teh a ‘cal es djustment relating thy Densact

Hero Company yon a PPYE aye ae

6,000,000 er acesst «wore goods billeg 4, Freight P

and be! , n exer ine ae

following: physical Pon ‘December 31, 2029, a event P

: Included ip Sipping pot 96,000 and were Picked ty, i No sales

customer F ¢ of P125, a

da COS! ogg. what

Those goods PAE puary 10, int on December 28, 99, year-en

he carrier 0 ng poi _ , 2099 A

- shipping re received on Janys 4. 700,

: * Goods shipped FOB oe pany 00, y b. 650,

from a vendor to Hero 5 300,000. ce

4, 2021, The invoice orted as inventory on Decembe, d. 600

Id be rep’

What amount shou. Ob)

31, 2020?

a. 5,875,000 Kindn

b. 6,000,000 a tre

©. 6,175,000 ee

d. 6,300,000 pes

50,0

Problem 10-10 (AICPA Adapted) P50,

Empty Company reported inventory on December 3 1, 2020 at What

P2,500,000 based on physical count priced

any necessary adjustment for the following:

Merchandise costing P100,000, shipped FOB shippi Point

from a vendor on Decembi wes

recorded on January 6, 2021, 1 “020 WAS xeceived and

Goods in the shippin,

area ¥

although shipment aa Oe n

The goods billed to

jitesdyee the cus

mber 30, 2020 had cog

What

31, 20299 Ut Should be

at cost and before

20 a problem 10-11 (AICPA Adapted)

t Co

Cos; ity, ompany had the fe i t

tory shipped on consignment i

t Jnxignt paid by Dignity Companyr eg 299000

‘Og frventory, received on consignment from a consignor 800,000

Jeigne paid by consignor 30,000

) by No sales of consign¢ 1 goods were made during the current year.

yyhat amount should be reported aa consigned inventory at

120 pene

wy

er

problem 10-12 (AICPA Adapted)

Kindness Company regularly buys sweaters and is allowed

dirade discount of 20% and10%.

The entity made a purchase on March 20 and received an.

invoice with a list price of P900,000, a freight charge of

50,000, and payment terms of net 30 days.

What is the cost of the purchase?

a. 648,000

b. 630,000

c. 698,000

d. 680,000

Problem 10-13 (AICPA Adapted)

On June 1, Compassion Company sold merchandise with a

list price of P1,000,000 to a customer.

The entity allowed trade discounts of 20%

were 5/10, n/30 and the sale was made

The entity prepaid P50,000 of deliver

an accommodation. The customer pa

What amount is received from the

ed) re

pA Adapt

Problem 10-14 (alc able on December

tea accounts POY*she following dat ey plas

Kew Company reported 2° gideriné a 302

2020 at P2,200,000 Pe! ing point on Decoy relZ

shipping P

Goods shipped to Kew Frit ripPiinvoice cost Of PA0,oy) e

anal

22, 2020 were Jost in

recorded by Kew:

On January 7, 2021, Kew ld?

the common carrier. 4

thorized Kew to ret,

fon Deeemibee 21 202One enue tm

for fall credit goods shipped and billed at P70,000 on

December 15, 2020.

goods were shipped by Kew on Decembey

edit memo was received anq

was not

P40,000 claim againg

The returned

28, 2020. A P70,000 cr

recorded by Kew on January 5, 2021.

On December 31, 2020, Kew has a P500,000 debi

, 2020, E it

Es accounts payable to Ross, a supplier, eau coal

500,000 advance payment for goods to be manufacieal ©

ed,

What amount should b

December 31, 20202? "sed 88 accounts payable om

a. 2,170,000

b. 2,680,000

© 2,730,000

4. 2,670,000

problem 10-15 (AICPA Adapted)

ted 1 yack Company reported accounts payable on December 31,

‘ata; a 3020 at P4,500,000 before any necessary year-end adjustments

ed ‘ relating to the following transactions:

m

40,008 ‘ + On December 27, 2020, Black Company wrote and recorded

j checks to cred tors totaling P2,000,000 causing an overdraft

of P500,000 in Black Company's bank account on December

Baings 31,2020. The checks were mailed out on January 10, 2021.

» On December 28, 2020, Black Company purchased and

turn, received goods for P750,000 terms 2/10, n/30.

Black Company records purchases and accounts payable at

net amount. The invoice was recorded and paid January 5,

2021.

* Goods shipped FOB destination, 5/10, n/30 on December

20, 2020 from a vendor to Black Company were received

January 15, 2021. The invoice cost was P325,000.

On December 31, 2020, what amount should be reported as

accounts payable?

Problem 10-16 (IAA)

ity

20 revealed that Joyoy, ad aacits

5 of 0,000. “i

December 31) © ¢ p4,410,0 Doce be

x cotravenvary with «2% De

pompany ad saventon fs s amount: :

Company had inv ee ten coir os

9 were 6X ; of.

rhe following items wer DS tea none

The following a Z

* Merchandise of P6 Se. . |

Merch ¢ P380,000 was pee ae seyous eee

* Merchandise pe ier De ste

FOB destination e ,

cted to receive the goods ow ood

omer was expe dest

ary 5, 2021. 2020

60,000 was shipped by Joyous

Merchandise costing P460,

y 29, 2

FOB shipping point to a customer on December 29, 2029,

*

The customer was expected to receive the goods on

January 10, 2021. entit

* Merchandise costing P830,000 shipped by & vendor FOB Ba God

destination on December 31, 2020 was received by Joyous FOE

on January 15, 2021. ae

r

Merchandise costing P510,000 Purchased FOB shippj Sue

I ‘Pping

Point was shipped by the supplier on December 31, 2020

and received by doyou:

's on January 5, 2021.

What amount of invent

ites ntory should

& 5,300,000

b. 4,690,000

© 8,800,009

4. 4,920,099

plem 10-17 (AA)

sity Company counted the ending i

aaber 31, 2020 and reported the amount of P:

fee ony. correctiona:

pel

nventory on

2,000,000

of the following items were included when the total

int oF the ending inventory was computed:

ge

goods located in the entity's warehouse

150,000

are oF consignment from another entity

Goods sold by the entity and shipped FOB

destination were in transit on December 31,

2020 and received by the customer on

January 2, 2021 200,000

Goods purchased by the entity and shipped

FOB shipping point were in transit on

December 31, 2020 and received by the

entity on January 2, 2021 300,000

Goods sold by the entity and shipped

FOB shipping point were in transit on

December 31, 2020 and received by the

customer on January 2, 2021.

What amou

31, 2020?

. 2,500,000

. 2,350,000

. 2,900,000

. 2,750,000

Pe sp

400,000

nt of inventory should be reported on December

1

“ 5,850,009

4 5,800,009

>

opie

od)

cpa Adapte J count on Decem, P down |

a 10-18 (Al da PoYrie with a total eggett guido

r nducted AF dine 4

4 Company conden

whieh rev?

5t210)9,000

$7,600.

77,000

wvealed that the following |, Goods

: » further investigation Toone Janua

Haver « sxaladed fom * hich are being held for yecord

si sold toa customer aig convernieHiCe with a cog The go

¢ i oe to call at the cus 3: ee point.

90,000. t costing P500,000 w, .

es 1 a product co . ag Goss

*” goetdad ae conta en when the physiegs ics

tanding in the sh

vas taken a ee

inventory was tal ncluded in the inventory because i, pee

The product was not inc’ instructions’ thoug!

was marked “hold for shipping aoe ae

vestigation revealed that the customer's order w, * A P35

The investiga a ONgRBUE HAT the case was shipped 31, 20

dated December 28, , P 209 E

a the customer billed on January 5, 2021 inven

* A special machine costing P250,000 fabricated to order The gi

for a customer was finished and specifically ania

segregated at the back part of the shipping room on

December 31, 2020. * An in

‘The customer was billed on that date and the machine “he

was excluded from inventory although it was shipped ihe

on January 5, 2021, Bia

Geods in process costing P800,000 hel ‘ iniclin,

Processor for further processing, @ bY an outside

*

“ Goods costing P50, 000 shi AB.

50,000 shi

on December 3 poate Pee by 4 vendor FOB seller 30, 2

January 10, 299)" onc ream

ed by the entity

What is the ce

at rrect amount of ; ‘

reported on December 31 20207 “

& 6,500,009

5,550,009

300

ein 10-19 (LAA)

1 Company i8 preparing the 2020 year-end financial

rts. Prior to any adjustments, inventory is valued at

Goods eons a Teo eEey were received from a vendor on

y 5, 2021. The related invoice was received and

phe goods were shipped December 31, 2020 FOB shipping

point

Goods costing P850,000 were shipped on December 31, 2020

foa customer FOB shipping point.

‘Tho goods were included in ending inventory for 2020 even

though the sale was recorded in 2020.

cn . A P350,000 shipment of goods to a customer on December

pp 31, 2020 FOB destination was not included in the year-end

inventory.

‘The goods cost P260,000 and were delivered to the customer

on January 15, 2021. The sale was properly recorded in 2021.

An invoice for goods costing P350,000 was received and

recorded as a purchase on December 31, 2020.

The related goods shipped FAS were in transit on December

31, 2020 and received on January 5, 2021 and were not

included in the physical inventory.

+ AP1,050,000 shipment of goods to a customer on December

30, 2020 FOB destination was recorded as a sale in 2020.

The goods costing P840,000 and delivered to the customer —

on January 5, 2021 were not incl . 2020 =

inventory. r

What is the correct inventory on

& 9,300,000

4. 7,610,000

% 8,100,000

4 8.450,000

of

ted) a pr

opA AdaP 0 days, FOB shipping

e1 20 (AICPS , are net 60 C4955 000,01 1

Problem 10:90 (AT wr mS aed FOODS ell

White Company Cf ret wo, before Ye oc

t. Sales, d bot aber ot 2 a pany authorized pegeamer ps

the yea 90, White Company 4g pilled a ,000.50

2020 ds shippe? on

* goods on,

ceive by, White, Company ay) Sa

oenaa were seco’ aso wasioouctangy wit

The return f and a 60,00 wee

January 5, 2021, ae

nee £300,000 were | ‘

‘ s with an invowre amon. The goods were shipped oy, Ho

yon danuary 10, 2! 2

1, 2020. + of P200,000 were billed ang ee

* Goods with an invoice amour o0. The goods were shipped cae

recorded on December 30, 202

on January 5, 2021. 1 :

tomer notified Company |

: On Jama ot 300,000 and shipped on December 81, ber

that goods billed

2020 were lost in transit.

’ or rr‘ ye a.

What amount of net sales should be reported for the current year? =

a. 5,050,000 3

b. 5.550,000 a

c. 4,550,000

d. 4,450,000 ‘i

Problem 10-21 (AICPA Adapted) "

Purple Company had sales of

of the current year. Experien

equaling 7% chaeee will be

additional 3% will be ret

merchandise is readily reg

merchandise

T merchandis

What am,

of December? should be

probiers 10-22 (AICPA Adapted)

: yow Company, a distributor of machi ht a

net | velinine from the manufacturer in Soeenabey 2020. for

~ ioe

ep

FY on December, 30, 2020, the entity sold this machine for

T] %50,000, under the following terms: 2% discount if paid

One jjehin a oe ays, 1% discount if paid after thirty days but

the | “jinin sixty days, or payable in full within ninety days if not

vit! i

paid within the discount periods.

0

on yowever, the customer had the right to return this machine

to Yellow Company if it was unable to resell the mrachine

] fefore expiration of the ninety-day payment period, in which

ag ase the customer's obligation to Yellow Company would be

a ganceled.

; Inthe net sales for the year ended December 31, 2020, what

C ~} amount should be included for the sale of the machine?

a, 750,000

"735,000

¢ 742,500

d. 0

Problem 10-23 (AICPA Adapted)

On October 1, 2020, Indomitable Company sold 100,000

gallons of heating oil at P80 per gallon. Fifty thousand gallons

were delivered on December 15, 2020, and the ren ining

50,000 gallons were delivered on Januar: 4

Payment terms were: 50% due 6n

the first delivery, and the remain

delivery,

b What amount of sales revenue

D—

: Retailers we

' Goods were in transit; fy

re >

_—' .

arcra Adapted)

Problem 10-24 ( ributor of automotiy,

Problem wholesale distr ollowing initia)

Fancy Company 18/0) ntity reves

lacement Pa - 31, 2020:

amounts on December I count 1,250,00,

ce 1 based on physic® 1,000,009

tory at December 31 D8 9,000,009

payable

Accounts Pal

ion

i informatior :

AddletonAlit from another entity to Fangy

A. Parts held on consignment from ting to P165,000, wery

un

Bip DoaeteTe soni Dacomber 31, 2020).ai

ber 31, 2020.

Company, the consig

included in the phy:

in accounts payable on Decem|

sed and paid for in

2 yhich were purchase:

Dechuitec Meters caainithe last sweek of 2020 and

appropriately recorded as sales of P28,000.

The parts were included in the physical count on December

31, 2020, because the parts were on the loading dock waiting

to be picked up by the customers.

Parts in transit on December 31, 2020 to customers, shipped

FOB shipping point, on December 28, 2020, amounted to

P34,000.

The customers received the parts on January 6, 2021 Sal

of P40,000 to the customers for the arts were. seal

Pancy Company on January 2, 2021. asacorse a

biti isst ips ¢

re holding P210,

ds on consignme

tores on December BL

Cember 3], 2020, The ood

The goods

2020,

29, Wete shipped Fy

what is the correct amount of inventory?

1,300,000

1,320,000

1/334,000 4

1,090,000

what is the correct amount of accounts payable?

Boge

a. 835,000

p. 960,000

¢. 975,000 .

d. 860,000

What is the correct amount of sales?

a. 9,250,000

b. 9,290,000

¢. 9,040,000

d. 9,000,000

= ~~. ~~

>»

ed)

all tools, provided

of December 31, 2029!

end

(arc Adapt

ure)

Problem 10-25

yam

yarry Compa the year

1,750,009

a prmation oe .

Reiss 1 based on physical co unt Be

‘ te payable at Decembe

infor ion

Additional informatio) ae a ite :

1 coun por 31, 2020. Those tools had

ace

Included in the physica

led at P35,000.

FOB shipping point on D

ast of P28,000 and were bi

in loading dock waiting to be picked up by

A

The shipment

the common

Goods were in transit from a vendor to Quarry Company

on December 31, 2020.

The invoice cost was P50,000, and the goods were shipped

FOB shipping point on December 29, 2020.

Work in process inventory costing P20,000 was sent to an

outside processor for plating on December 30, 2020,

Tools returned by customers and held Pending inspection

in the returned goods area on December 31, 2020 were not

included in the physical count,

On January 5, 2021, the ‘ools costing P26,000 were i

and returned to inventory,

Credit memog totali 3

on the same fae P40,000

E. Tools shi

Cost of Pos, 000. transit on

», Goods, with an invoice cost of P30,000, received from a

F vendor at 6:00 P.M. on December 81, 2020, were recorded

on @ receiving report dated January 2, 2021.

The goods were not included in the physical count but

the ah © was included in accounts payable on December

31, 202

Goods received from a vendor on December 26, 2020 were

Ga

included in the physical count,

However, the related P60,000 vendor invoice was not

included in accounts payable on December 31, 2020

because the accounts payable copy of the receiving report

was lost

4. On January 10, 2021, a monthly freight bill in the amount

of P20,000 was received. The bill specifically related to

merchandise purchased in December 2020, one-half of

which was still in the inventory on December 31, 2020.

The freight charge was not included in either the

inventory or in accounts payable on December 31, 2020.

What is the correct amount of inventory?

a. 1,883,000

b. 1,911,000

ce. 1,885,000

ce. 1,925,000

What is the correct amount

a. 1,330,000

b. 1,280,000

c. 1,250,000

ad. 1,270,000

3. What is the correct amo

8,460,000

8,500,000

8,465,000

8,425,000

RO op

ey

sple choice UFRS) :

Problem 10-26 Multiple ae

.hould nol in

1 uc of he an to reno

when de

d goods

a. Storage costs of part-finished ©

discounts

See BOE ory inwata

é Import duties on shipping:

ry does not include

a

I

2. The cost of inventor

ries taff i

i Salarios of frerecessary in the production process

tage

bofore a further production s .

c. Abnormal amount of wasted materials

d. Irrecoverable purchase taxes

3. Which of the following costs of conversion cannot be

included in cost of inventory?

a. Cost of direct labor

b. Factory rent and utilities

c. Salaries of sales staff

d. Factory overhead based on normal capacity

4. Which of the following should be i &

taken int.

when determining the cost of inventory? cons

8. Storage cost of part-fj

b. Abnormal freight in ted goods

©. Recoverable

6

. When determining the cost of

MGEwe

Inventories encompass all of the following, except

: es andise purchased by a retailer

pb. Land and other property not held for sale

Finished goods produced

d. Materials and supplies for use in production

A ee deyelonee must classify properties that it holds

for sale in the ordinary course of business as

Inventory

b. Property, plant and equipment

Financial asset

d. Investment property

Factory supplies to be consumed in the production process

are reported as

Inventory

b. Property, plant and equipment

Investment property

d. Prepaid expenses

Which of the following should not be reported as inventory?

a, Land acquired for resale by a real estate firm

b. Shares and bonds held for resale by a brokerage firm

iC

Partialy completed goods held by a manufacturing entity

d, Machinery acquired by a manufacturing entity

haa Ss

following should not be incl

Interest on loan obtained

Commission paid when

Labor cost of the invento

Depreciation of plant eq!

BerD

I

x

jple choice GAA)

problem 10-27 Multiple cho’

r¢

ry included in the computation of net incomes

1. Why is inventory in

1. To determine cost of goods sold

b. To determine gales SUE in

c. To determine merchandise | ose

d. Inventory is not included in the Pi ng

income

2. Which of the following is a characteristic ofa Perpetua)

inventory system?

a. Inventory purchases are debited to a purchases account,

b. Inventory records are not kept for every item.

¢. Cost of goods sold is recorded with each sale.

d. Cost of goods sold is determined as the amount of C

purchases less the change in inventory.

3, Which of the followin,

g is incorrect abo

inventory method? ut the perpetual

a. Purchases are

b. The entry to

goods sold a

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Managerial Economics QuestionnairesDocument26 pagesManagerial Economics QuestionnairesClyde SaladagaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Loan ReceivableDocument10 pagesLoan ReceivableClyde SaladagaNo ratings yet

- Measure of PositionDocument5 pagesMeasure of PositionClyde SaladagaNo ratings yet

- Chapter 4 Concept MapDocument1 pageChapter 4 Concept MapClyde SaladagaNo ratings yet

- Gender Society ReportDocument34 pagesGender Society ReportClyde SaladagaNo ratings yet

- College of Teacher Education: A. Concept DigestDocument4 pagesCollege of Teacher Education: A. Concept DigestClyde SaladagaNo ratings yet

- 10 Filipino Women Entrepreneurs Who Are Success (Business) Chow Paredes, ZipmatchDocument9 pages10 Filipino Women Entrepreneurs Who Are Success (Business) Chow Paredes, ZipmatchClyde SaladagaNo ratings yet

- College of Teacher Education: A. Concept DigestDocument4 pagesCollege of Teacher Education: A. Concept DigestClyde SaladagaNo ratings yet

- Chapter 1 CONCEPT MAPDocument1 pageChapter 1 CONCEPT MAPClyde SaladagaNo ratings yet

- College of Teacher Education: A. Concept DigestDocument4 pagesCollege of Teacher Education: A. Concept DigestClyde SaladagaNo ratings yet

- Four General Forms of Decorative DesignDocument1 pageFour General Forms of Decorative DesignClyde SaladagaNo ratings yet

- Global Production,: Outsourcing, and LogisticsDocument47 pagesGlobal Production,: Outsourcing, and LogisticsClyde SaladagaNo ratings yet

- Women and Armed ConflictDocument6 pagesWomen and Armed ConflictClyde SaladagaNo ratings yet

- Measure of PositionDocument5 pagesMeasure of PositionClyde SaladagaNo ratings yet

- Art Appreciation (ART TALK)Document2 pagesArt Appreciation (ART TALK)Clyde SaladagaNo ratings yet

- Lesson 7 Detailed Lesson PlanDocument2 pagesLesson 7 Detailed Lesson PlanClyde SaladagaNo ratings yet

- Cultural Practices and Sexual ViolenceDocument10 pagesCultural Practices and Sexual ViolenceClyde SaladagaNo ratings yet