Professional Documents

Culture Documents

Definition of The Statement of Financial Position and Its Element

Definition of The Statement of Financial Position and Its Element

Uploaded by

Rica VillanuevaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Definition of The Statement of Financial Position and Its Element

Definition of The Statement of Financial Position and Its Element

Uploaded by

Rica VillanuevaCopyright:

Available Formats

Definition of the Statement of Financial Position and Its Element

SFP stands for statement of financial position, is statement that gives the

financial condition of a business as of a given date.

Another name of SFP is balance sheet.

Composed of 3 elements and they are assets, liabilities and capital.

Assets are the things owned by the business.

Liabilities are the debts owed by the business to persons other than the

owner.

Capital refers to the investment or equity of the owner in the business.

Example of financial information:

ASSET

Are properties of rights on properties owned by the business. They are

items of value that belong to the business. In general, common examples of

assets are cash, tools and equipment, building and land.

THE FOLLOWING DESCRIBE FURTHER WHAT AN ASSET IS:

Assets are controlled by the enterprise.

Assets result from past events.

Assets give future economic benefits.

Assets can be used by themselves alone to yield income.

LIABILITIES

Think of debts to be paid by the business to its suppliers of products for sale, or

supplies to be used.

Us a debt of the entity resulting from a previous transaction such as a loan, a purchase

from a supplier, or an agreement to assume the debt of another party.

Liabilities can be settled in various items, but the terms should conform to the

established agreement between the parties involved or rules set by a governing body.

Is incurred to realize a transfer of economic benefits.

Past transactions may give birth to a liability, as in the case of the Notes Payable.

The payment of a liability may be done through

1. Cash payment

2. Distribution of other assets

3. Rendering of services

4. Substitution with another liability

5. Conversion of the liability into ownership interest of the lender in the borrower’s

entity.

CAPITAL

Capital is also reflected in the SFP.

A proprietor invests capital in the form of funds, merchandise, equipment or any

other property to operate his or her business.

The capital will grow when the business earns profits, but will decrease when the

business incurs a loss.

Equity in a single proprietorship is termed as capital account.

CLASSIFICATION OF THE SFP ELEMENTS INT OCURRENT AND NONCURRENT

A. BASIS OF CHECKING ASSETS AND LIABILITIES

Examples of Current and Noncurrent Assets

CURRENT ASSETS NONCURRENT ASSETS

Cash Land

Trading account securities Building

Receivables (accounts, notes) Equipment

Merchandise inventory Furniture and fixtures

Prepaid expenses Leasehold right

Current Liabilities

Are debts or obligation normally expected to be settled in the normal

course of the company’s operating cycle or within one year by using

current assets or creating other current liabilities.

Noncurrent Liabilities

Are long term debts which will be settled beyond one year.

Examples of Current and Noncurrent Liabilities

Current Liabilities Noncurrent Liabilities

Accounts payable Note payable (due more than 1

Loans payable year)

Utilities payable Mortgage payable

Interest payable Bond payable

CONCEPT OF NORMAL OPERATING CYCLE FOR A MERCHANDISING BUSINES

Description of Acount Titles in the SFP

The following are the account titles usually used in the SFP.

a. Cash

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Apollo Cash Audit Mini Case 03-29-21+Document30 pagesApollo Cash Audit Mini Case 03-29-21+Trevor Putnam0% (1)

- Speedy Auto Wash Is Contemplating The Purchase of A NewDocument1 pageSpeedy Auto Wash Is Contemplating The Purchase of A NewAmit PandeyNo ratings yet

- Science 7 - 2ND QuarterDocument4 pagesScience 7 - 2ND QuarterRica VillanuevaNo ratings yet

- Scope & Sequence (SCIENCE 4)Document3 pagesScope & Sequence (SCIENCE 4)Rica VillanuevaNo ratings yet

- Science 6 - 2ND QuarterDocument6 pagesScience 6 - 2ND QuarterRica VillanuevaNo ratings yet

- Science 10 - 2ND QuarterDocument4 pagesScience 10 - 2ND QuarterRica VillanuevaNo ratings yet

- Velasco Business Finance ModuleDocument23 pagesVelasco Business Finance ModuleRica VillanuevaNo ratings yet

- Science 4 - 2ND QuarterDocument5 pagesScience 4 - 2ND QuarterRica VillanuevaNo ratings yet

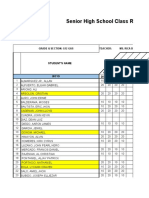

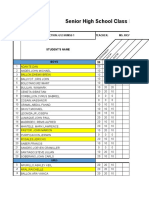

- Senior High School Class Record: Grade & Section: G12 Gas Teacher: Ms. Rica B. VillanuevaDocument4 pagesSenior High School Class Record: Grade & Section: G12 Gas Teacher: Ms. Rica B. VillanuevaRica VillanuevaNo ratings yet

- Science 5 - 2ND QuarterDocument4 pagesScience 5 - 2ND QuarterRica VillanuevaNo ratings yet

- 12 Humss 1 & 2 (Practical Exam)Document1 page12 Humss 1 & 2 (Practical Exam)Rica VillanuevaNo ratings yet

- 12 - HUMSS - 2 - DIASS - GS - Academic Track - All Other SubjectsDocument10 pages12 - HUMSS - 2 - DIASS - GS - Academic Track - All Other SubjectsRica VillanuevaNo ratings yet

- SHS Class Record (12 ABM 1)Document1 pageSHS Class Record (12 ABM 1)Rica VillanuevaNo ratings yet

- Shs Class Record (12 Humss 1)Document4 pagesShs Class Record (12 Humss 1)Rica VillanuevaNo ratings yet

- BM Week 1Document2 pagesBM Week 1Rica VillanuevaNo ratings yet

- ONLINE CLASS PREFFERRED MODALITY (Updated)Document2 pagesONLINE CLASS PREFFERRED MODALITY (Updated)Rica VillanuevaNo ratings yet

- Final-Module - Bus. MathDocument9 pagesFinal-Module - Bus. MathRica VillanuevaNo ratings yet

- HUMSS - Disciplines and Ideas in The Social Sciences CG - 1 PDFDocument7 pagesHUMSS - Disciplines and Ideas in The Social Sciences CG - 1 PDFAlexander Justin Salvador75% (4)

- Corona Virus (Covid - 19)Document3 pagesCorona Virus (Covid - 19)Rica VillanuevaNo ratings yet

- Students For Billing Grade/Section: Name of Adviser: RICA B. VILLANUEVADocument2 pagesStudents For Billing Grade/Section: Name of Adviser: RICA B. VILLANUEVARica VillanuevaNo ratings yet

- My ScheduleDocument1 pageMy ScheduleRica VillanuevaNo ratings yet

- Empowerment Technology: Senior High School Instructional ModuleDocument25 pagesEmpowerment Technology: Senior High School Instructional ModuleRica VillanuevaNo ratings yet

- Ucsp CidamDocument11 pagesUcsp CidamRica Villanueva100% (2)

- X X X X X X X X X X X X: Course/s (Only For TVL) Date (Last Name, First Name, Name Extension, Middle Name)Document21 pagesX X X X X X X X X X X X: Course/s (Only For TVL) Date (Last Name, First Name, Name Extension, Middle Name)Rica VillanuevaNo ratings yet

- Financial Statements HRUMDocument98 pagesFinancial Statements HRUMAkbar Rianiri BakriNo ratings yet

- CH 09Document9 pagesCH 09Yousef ShahwanNo ratings yet

- Advanced Financial Accounting Chapter 2 LECTURE - NOTESDocument14 pagesAdvanced Financial Accounting Chapter 2 LECTURE - NOTESAshenafi ZelekeNo ratings yet

- 4e86702bd82b423e8aa86485f50ad4a4Document12 pages4e86702bd82b423e8aa86485f50ad4a4All FreeNo ratings yet

- Chapter 1 The Accounting ProcessDocument15 pagesChapter 1 The Accounting Process5555-899341No ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- Current LiabilitiesDocument5 pagesCurrent LiabilitiesPhoebe Dayrit CunananNo ratings yet

- 2017 CMA CGM Annual ReportDocument81 pages2017 CMA CGM Annual Reportmiquel20No ratings yet

- UntitledDocument2 pagesUntitledNur AsnadirahNo ratings yet

- Company Profile and Financial Analysis of ITC LTD - 1Document44 pagesCompany Profile and Financial Analysis of ITC LTD - 1Swarnaprabha PradhanNo ratings yet

- Prelims - P2 MockboardsDocument15 pagesPrelims - P2 MockboardsRommel RoyceNo ratings yet

- Forecasting - Module 4 AllDocument22 pagesForecasting - Module 4 AllSandeepPusarapu50% (2)

- Accounting For LeasingDocument36 pagesAccounting For LeasingAKSHAJ GOENKANo ratings yet

- CF EstimationDocument97 pagesCF Estimationdanish khanNo ratings yet

- Research Paper On Cash Flow StatementDocument8 pagesResearch Paper On Cash Flow Statementgz9fk0td100% (1)

- Private Equity Valuation - PresentationDocument13 pagesPrivate Equity Valuation - Presentationjoe abramsonNo ratings yet

- STT FinancilaDocument22 pagesSTT FinancilaravNo ratings yet

- Capital and RevenueDocument20 pagesCapital and RevenueDr Sarbesh Mishra100% (1)

- Level I CFA Quiz 1Document5 pagesLevel I CFA Quiz 1Kumar GaurishNo ratings yet

- 8 Steps in Accounting CycleDocument2 pages8 Steps in Accounting CycleMarko Zero FourNo ratings yet

- Acca f7 Slides 2014Document73 pagesAcca f7 Slides 2014KodwoP100% (1)

- Red Flash PhotographyDocument18 pagesRed Flash Photographylaale dijaanNo ratings yet

- Week 12 Lecture Notes (1 Slide)Document48 pagesWeek 12 Lecture Notes (1 Slide)Kevin ShajiNo ratings yet

- CFAS ReviewDocument15 pagesCFAS ReviewRyou ShinodaNo ratings yet

- MBA (Travel & Tourism) 1st Year Sylabus 2020-21 - 28th SeptDocument34 pagesMBA (Travel & Tourism) 1st Year Sylabus 2020-21 - 28th SeptHimanshuNo ratings yet

- Block 2: Question Block Created by Wizard 1 of 6Document5 pagesBlock 2: Question Block Created by Wizard 1 of 6wcatNo ratings yet

- Relevant Costs For Decision MakingDocument69 pagesRelevant Costs For Decision MakingSederiku KabaruzaNo ratings yet

- Financial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test BankDocument16 pagesFinancial Statement Analysis and Security Valuation 5th Edition by Penman ISBN Test Bankcindy100% (26)