Professional Documents

Culture Documents

You Are Managing A Portfolio of 10 Stocks Which Ar.

Uploaded by

Tan Chee SengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

You Are Managing A Portfolio of 10 Stocks Which Ar.

Uploaded by

Tan Chee SengCopyright:

Available Formats

Home Study tools My courses My books My folder Career Life

Find solutions for your homework

Find solutions for your homework

SearchSearch

home / study / business / finance / finance questions and answers / you are managing a portfolio of 10 stocks which are held in equal dollar amounts. …

Question: You are managing a portfolio of 10 stocks which are held in equ… Post a question

Answers from our experts for your tough

homework questions

(2 bookmarks)

You are managing a portfolio of 10 stocks which are held in equal dollar amounts. The current beta of the portfolio is 1.55, and Enter question

the beta of stock a is 2.0. If stock A is sold and the proceeds are used to purchase a replacement stock, what does the beta of

the replacement stick have to be to change the portfolio beta to 1.7?

A. 4.4

B. 5.3

C. 3.2 Continue to post

D. 3.5

13 questions remaining

E. 4.1

Expert Answer My Textbook Solutions

Anonymous answered this

Was this answer helpful? 1 0

69 answers

Answer is : D . 3 . 5

1.55 = 0.9(bR) + 0.1(bA) Vector... Vector... Money...

10th Edition 9th Edition 5th Edition

1.55 = 0.9(bR) + 0.1(2.0)

View all solutions

1.55 = 0.9(bR) + 0.2

1.35 = 0.9(bR)

bR = 1.50

Now find the beta of the new stock that produces bp = 1.5

1.70 = 0.9(1.50) + 0.1(bN)

1.70 = 1.35 + 0.1(bN)

0.35 = 0.1(bN)

bN = 3.5

Comment

Questions viewed by other students

Q:You are managing a portfolio of 10 stocks which are held in equal amounts. The current beta of the portfolio is 1.64, and

the beta of Stock A is 2.0. If Stock A is sold, what would the beta of the replacement stock have to be to produce a new

portfolio beta of 1.55?" Group of answer choices 1.1 1 0.9 0.75 0.5

A: See answer

Q:Consider the following information for the Alachua Retirement Fund, with a total investment of $4 million. The market

required rate of returnis 12%, and the risk-free rate is 6%. What is its required rate of return? Stock Investment Beta A

$500,000 1.2 B 500,000 -0.4 C 1,000,000 1.5 D 2,000,000 0.8 Total 4,000,000

A: See answer

Show more

COMPANY LEGAL & POLICIES CHEGG PRODUCTS AND SERVICES CHEGG NETWORK CUSTOMER SERVICE

About Chegg Advertising Choices Cheap Textbooks Chegg Math Solver EasyBib Customer Service

Chegg For Good Cookie Notice Chegg Coupon Mobile Apps Internships.com Give Us Feedback

College Marketing General Policies Chegg Play Sell Textbooks Thinkful Manage Subscription

Corporate Development Intellectual Property Rights Chegg Study Help Solutions Manual

Investor Relations Terms of Use College Textbooks Study 101

Jobs Global Privacy Policy eTextbooks Textbook Rental

Join Our Affiliate Program DO NOT SELL MY INFO Flashcards Used Textbooks

Media Center Honor Code Learn Digital Access Codes

Site Map Honor Shield Uversity Chegg Life

Chegg Writing

© 2003-2022 Chegg Inc. All rights reserved.

Created with the free version of PDF Mage

You might also like

- Point StrategiDocument5 pagesPoint StrategiTan Chee SengNo ratings yet

- International Cooperation Among NationsDocument29 pagesInternational Cooperation Among NationsTan Chee SengNo ratings yet

- Your Paragraph TextDocument8 pagesYour Paragraph TextTan Chee SengNo ratings yet

- Solved - What Are Some of The Internal Controls That Prevent and - or Detect Fraudulent BehaviorDocument1 pageSolved - What Are Some of The Internal Controls That Prevent and - or Detect Fraudulent BehaviorTan Chee SengNo ratings yet

- Sexual HarrDocument2 pagesSexual HarrTan Chee SengNo ratings yet

- Lecture 7Document24 pagesLecture 7Tan Chee SengNo ratings yet

- Lecture 4Document39 pagesLecture 4Tan Chee SengNo ratings yet

- 8-10. (Common Stock Valuation) The Dividend Policy...Document1 page8-10. (Common Stock Valuation) The Dividend Policy...Tan Chee SengNo ratings yet

- Singapore-English Standards of Business Conduct December 2019Document31 pagesSingapore-English Standards of Business Conduct December 2019Tan Chee SengNo ratings yet

- Health Threats by McDonaldsDocument8 pagesHealth Threats by McDonaldsTan Chee SengNo ratings yet

- IR MODULE 5 DismissalDocument22 pagesIR MODULE 5 DismissalTan Chee SengNo ratings yet

- (Weighted Average Cost of Capital - ) Crawford Ente.Document1 page(Weighted Average Cost of Capital - ) Crawford Ente.Tan Chee SengNo ratings yet

- The Value of Natural Justice' and Substantial Ju...Document1 pageThe Value of Natural Justice' and Substantial Ju...Tan Chee SengNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Manual Campana TEKA CNL1-2002Document32 pagesManual Campana TEKA CNL1-2002FernandoNo ratings yet

- CertificationsDocument3 pagesCertificationsmuthuks2892No ratings yet

- Narrative-Report-HABANA BANANADocument14 pagesNarrative-Report-HABANA BANANAkrisha chiu0% (1)

- Ar2019 ManagementDocument48 pagesAr2019 ManagementNurul AinNo ratings yet

- OTC Sponsorship Proposals 2020 - 2021Document4 pagesOTC Sponsorship Proposals 2020 - 2021Dylan AdrianNo ratings yet

- Field Study - Letter Head FormatDocument13 pagesField Study - Letter Head FormatDON BENNYNo ratings yet

- Business Mathematics 1631124113Document468 pagesBusiness Mathematics 1631124113shivaji veluriNo ratings yet

- Moreblessing Assignment 1Document10 pagesMoreblessing Assignment 1Donald ChivangeNo ratings yet

- Business School: COURSEWORK Session 2020/2021Document5 pagesBusiness School: COURSEWORK Session 2020/2021Noman SiddiquiNo ratings yet

- Growthinks Car Dealership Business Plan TemplateDocument15 pagesGrowthinks Car Dealership Business Plan TemplatebiswajeetNo ratings yet

- C2 Proficiency Sample Paper 1 WritingDocument5 pagesC2 Proficiency Sample Paper 1 WritingVEDA TOPPERNo ratings yet

- Strategic Management J Component: Brand Name: Hindustan Unilever Guided by Dr. Selvan.DDocument20 pagesStrategic Management J Component: Brand Name: Hindustan Unilever Guided by Dr. Selvan.D18ucs 046No ratings yet

- Marketing Strategy RevisedDocument50 pagesMarketing Strategy RevisedpayalNo ratings yet

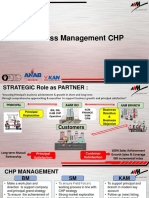

- SDP-Business Management CHPDocument15 pagesSDP-Business Management CHPvdrtNo ratings yet

- Four Types of Control Mechanisms Starbucks UsesDocument7 pagesFour Types of Control Mechanisms Starbucks UsesMai Phương AnhNo ratings yet

- Ahmed Abd Elshafy CVDocument2 pagesAhmed Abd Elshafy CVahmedzeezouNo ratings yet

- Seminar Ski - Marketing Mix (Engleski Jezik II)Document9 pagesSeminar Ski - Marketing Mix (Engleski Jezik II)Mikica91No ratings yet

- Inside The Minds - The Art of Public Relations Industry. Visionaries Reveal The Secrets To Succes - SubliniatDocument266 pagesInside The Minds - The Art of Public Relations Industry. Visionaries Reveal The Secrets To Succes - SubliniatLavinia SusanNo ratings yet

- Literature Review of Footwear IndustryDocument5 pagesLiterature Review of Footwear Industryissyeasif100% (1)

- Amazon Go: Venturing Into Traditional Retail: Report by - Epgp-Batch-14B - Group-2Document7 pagesAmazon Go: Venturing Into Traditional Retail: Report by - Epgp-Batch-14B - Group-2Virender SinghNo ratings yet

- Marketing PlanDocument15 pagesMarketing Planapi-589529533No ratings yet

- Marketing Strategies of Banking Industry & Recent TrendsDocument40 pagesMarketing Strategies of Banking Industry & Recent TrendsShubham BawkarNo ratings yet

- Digital-Skills-Digital-Marketing Certificate of Achievement Uqwvwg1Document2 pagesDigital-Skills-Digital-Marketing Certificate of Achievement Uqwvwg1Khánh LinhNo ratings yet

- CH 10 11 - Pricing - Understanding and Capturing ValueDocument28 pagesCH 10 11 - Pricing - Understanding and Capturing ValueMd. Rabiul AlomNo ratings yet

- Articles and Case Studies - Prof. Apalak Khatua - STMH21-3Document3 pagesArticles and Case Studies - Prof. Apalak Khatua - STMH21-3Yash BhasinNo ratings yet

- Business Model of Vinfast Group 3Document2 pagesBusiness Model of Vinfast Group 3hwall crescentNo ratings yet

- Consult Club IIMA Casebook - 2018Document113 pagesConsult Club IIMA Casebook - 2018NRLDCNo ratings yet

- A Summer Training Project Report ON HavellsDocument65 pagesA Summer Training Project Report ON HavellsShubham Khurana100% (2)

- Resume Rohit AgrawalDocument2 pagesResume Rohit Agrawalc2rohitNo ratings yet

- L12 Notes On Introduction To MarketingDocument11 pagesL12 Notes On Introduction To MarketingDICKENS KIPKOECHNo ratings yet