Professional Documents

Culture Documents

Act 3 Tax PDF

Uploaded by

Damayan Xeroxan0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

ACT_3___TAX.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageAct 3 Tax PDF

Uploaded by

Damayan XeroxanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

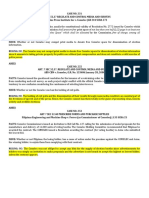

1. Mariposa is a resident citizen employed by Maganda Corporation.

She received the following from her employer during 2020:

Basic compensation income P900,000

13th month pay 75,000

P3,000 monthly transportation allowance 36,000

Productivity incentive pay (10,000-10,000) 0

Christmas bonus ( 25,000 – 5,000) 20,000

Uniform allowance (16,000 -6,000) 10,000

Actual medical allowance (10,000 -10,000) 0

Rice subsidy( 36,000 -24,000) 12,000

117,00

(90,000 )

In excess ceiling 27,000 27,000

963,000

2. Basic compensation income P900,000

13th month pay 75,000

P3,000 monthly transportation allowance 36,000

Productivity incentive pay (10,000-10,000) 0

Christmas bonus ( 25,000 – 5,000) 20,000

Uniform allowance (16,000 -6,000) 10,000

Actual medical allowance (10,000 -10,000) 0

Rice subsidy( 36,000 -24,000) 12,000

137,000

Ceiling -90,000

In excess of 90,00 47,000 47,000

983,000

This study source was downloaded by 100000818317222 from CourseHero.com on 02-15-2022 21:10:18 GMT -06:00

https://www.coursehero.com/file/95010965/ACT-3-TAXpdf/

Powered by TCPDF (www.tcpdf.org)

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Assignment Gcas03Document2 pagesAssignment Gcas03Damayan XeroxanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Pre - Employment Orientation Seminar: Dannug, Samson Trabado September 24, 2022Document1 pagePre - Employment Orientation Seminar: Dannug, Samson Trabado September 24, 2022Damayan XeroxanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Quiz 1 Ecope05Document1 pageQuiz 1 Ecope05Damayan XeroxanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Midterm Gcas05Document3 pagesMidterm Gcas05Damayan XeroxanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Provinces Cities Dialects Tourist Spots: Chapter IV: Literature in Ilocos and Cagayan RegionDocument3 pagesProvinces Cities Dialects Tourist Spots: Chapter IV: Literature in Ilocos and Cagayan RegionDamayan XeroxanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Conceptual Framework and Accounting Standards 1 Overview of Accounting (Quiz 1)Document6 pagesConceptual Framework and Accounting Standards 1 Overview of Accounting (Quiz 1)Damayan XeroxanNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Activity 7 Essay Test-Joash SulitDocument1 pageActivity 7 Essay Test-Joash SulitDamayan XeroxanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- PAS 2 (Inventories) Use The Following Information For The Next Three QuestionsDocument2 pagesPAS 2 (Inventories) Use The Following Information For The Next Three QuestionsDamayan XeroxanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Is Economic Growth Possible Without Economic Development?Document3 pagesIs Economic Growth Possible Without Economic Development?Damayan XeroxanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Read and Answer The Following Questions BelowDocument2 pagesRead and Answer The Following Questions BelowDamayan XeroxanNo ratings yet

- Certificate of Recognition: Cleo Moselle D. Ruflo & Ma. Gelou Jane S. SuñerDocument15 pagesCertificate of Recognition: Cleo Moselle D. Ruflo & Ma. Gelou Jane S. SuñerDamayan XeroxanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- ICCT Colleges Foundation, Inc. Conceptual Framework & Accounting Standard - CBACTG01Document1 pageICCT Colleges Foundation, Inc. Conceptual Framework & Accounting Standard - CBACTG01Damayan XeroxanNo ratings yet

- Cbtax01 Chapter 2 ActivityDocument2 pagesCbtax01 Chapter 2 ActivityDamayan XeroxanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ICCT Colleges Foundation, Inc.: - Activity / AssignmentDocument2 pagesICCT Colleges Foundation, Inc.: - Activity / AssignmentDamayan XeroxanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Imp TopicsDocument11 pagesImp TopicsRavikumarMechNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Unit 5 Week 5Document5 pagesUnit 5 Week 5api-239261925No ratings yet

- Non Disclosure AgreementDocument3 pagesNon Disclosure AgreementtessNo ratings yet

- CREW v. Cheney Et Al: Regarding VP Records: 11/3/08 - Status Report (Document 32)Document2 pagesCREW v. Cheney Et Al: Regarding VP Records: 11/3/08 - Status Report (Document 32)CREWNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- READPH2NDSHIFTDocument31 pagesREADPH2NDSHIFTBerlinn CastroNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 251-253 Philippine Press V Comelec - Filipinas Engineering V Ferrer ShotgunDocument2 pages251-253 Philippine Press V Comelec - Filipinas Engineering V Ferrer ShotgunFatima AreejNo ratings yet

- Foreign Policy dbq-0Document12 pagesForeign Policy dbq-0Kazeem HassanNo ratings yet

- Sarangani V COMELEC DigestDocument1 pageSarangani V COMELEC DigestOnnie LeeNo ratings yet

- AsfadsrDocument2 pagesAsfadsrJishan AshrafNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CLAW - Notes For Lesson 1 Part 1Document4 pagesCLAW - Notes For Lesson 1 Part 1Princes Emerald ErniNo ratings yet

- ATMIS Will Deliver On Its Mandate, SRCC and Head of ATMIS Assures Somalia's PartnersDocument4 pagesATMIS Will Deliver On Its Mandate, SRCC and Head of ATMIS Assures Somalia's PartnersAMISOM Public Information ServicesNo ratings yet

- Late Registration of BirthDocument1 pageLate Registration of BirthNagaraja ReddyNo ratings yet

- MMRCL Public Holiday List 2021Document2 pagesMMRCL Public Holiday List 2021Mayank SharmaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 10th Pro Bono Enviro Moot PetitionerDocument32 pages10th Pro Bono Enviro Moot Petitionerkarti_am100% (9)

- 12 Month Success Calendar PDFDocument29 pages12 Month Success Calendar PDFmagdalena100% (1)

- Ybrs. Dr. Norazam Bin HarunDocument12 pagesYbrs. Dr. Norazam Bin Harunkamalab04No ratings yet

- Full Name Assigned Cases: 1 ACERADO, Sweetzel ADocument13 pagesFull Name Assigned Cases: 1 ACERADO, Sweetzel AJulius David UbaldeNo ratings yet

- Comment To Omnibus Motion - Dorado Case Oct. 2015Document9 pagesComment To Omnibus Motion - Dorado Case Oct. 2015Bill Ernest TamondongNo ratings yet

- Full Download Introductory and Intermediate Algebra 6th Edition Lial Test BankDocument35 pagesFull Download Introductory and Intermediate Algebra 6th Edition Lial Test Bankisaaccy1d100% (32)

- Ethics+and+Social+Responsibility +PPTDocument20 pagesEthics+and+Social+Responsibility +PPTsatadeep100% (3)

- Requisites of A Judicial InquiryDocument2 pagesRequisites of A Judicial InquiryMarvin Cabantac100% (1)

- The Bar To ReenlistmentDocument12 pagesThe Bar To ReenlistmentMark CheneyNo ratings yet

- Hist-1012 ppt-7Document80 pagesHist-1012 ppt-7dagi92% (13)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lea-Set ADocument12 pagesLea-Set AcriminologyallianceNo ratings yet

- Bobbio The Future of DemocracyDocument191 pagesBobbio The Future of DemocracyGary Goach100% (6)

- JBTC - 5 Years Master PlanDocument16 pagesJBTC - 5 Years Master PlanWayne OngNo ratings yet

- Is A World Without Racial Conflict An Impossible DreamDocument3 pagesIs A World Without Racial Conflict An Impossible DreamCalvin NisbanNo ratings yet

- Ranil & Batalanda - SSP Douglas PeirisDocument4 pagesRanil & Batalanda - SSP Douglas PeirisRight Wing Sri Lanka100% (1)

- Full Download Corporate Finance Canadian 2nd Edition Berk Solutions ManualDocument35 pagesFull Download Corporate Finance Canadian 2nd Edition Berk Solutions Manualkisslingcicelypro100% (22)