Professional Documents

Culture Documents

Sofia Paystubs

Uploaded by

SuiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sofia Paystubs

Uploaded by

SuiCopyright:

Available Formats

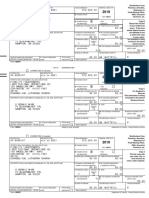

Pay Date: 10/31/2014 - Regular

Motiva Company Sofia De La Torre

P.O. Box 4282 909 Texas Ave

Houston, TX 77210-4282 Apt. 816

Houston, TX 77002

Employee ID ******** Pay Advice # 0019364300203

Pay Frequency Semi-monthly Period Begin Date 10/16/2014

Period End Date 10/31/2014

Taxes State Codes Marital Status Allowances Additional Amounts

Federal Single 1

Primary State Exempt 0

Secondary State 0

Local 0

Messages

INQUIRIES? Hours: Contact your Timekeeper. Pay: Contact HR Service Desk-Americas 713-245-4800. For Benefits: Fidelity 1-800-30SHELL or click on Fidelity NetBenefits.

Make sure that your original 2014 W-2 will be received electronically – not by snail-mail. Click on W-2 Services to find out.

Direct Deposit, W-4 Tax Withholding and other FAQs: Choose the "HR Online" tab from the Shell Online portal page - On the HR Online home page choose My Pay > Payroll Employee Services Payroll and scroll to topic.

Earnings Rate Hours This Period YTD

Prior Regular Pay - Salaried -902.06 0.00

Regular Pay - Salaried 3,500.00 65,198.38

Regular Pay - Salaried 2,756.25 70,552.57

Prior Vacation 36.08247 25.00 902.06 0.00

Performance Bonus Prior Yr 0.00 4,300.00

Performance Bonus Prior Yr 0.00 4,300.00

Regular Pay - Salaried 3,500.00 67,796.32

Vacation 0.00 3,809.22

Vacation 0.00 2,907.16

Performance Bonus Prior Yr 0.00 4,300.00

Holiday Pay Base 43.75000 17.00 743.75 2,138.21

Holiday Pay Base 0.00 1,394.46

Vacation 0.00 3,809.22

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Holiday Pay Base 0.00 1,394.46

Shares Cash Balance 0.00 76.81

Shares Cash Balance 0.00 76.81

Misc Reimburse Non Taxable 50.00 50.00

Misc Reimburse Non Taxable 50.00 100.00

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Shares Cash Balance 0.00 76.81

GESPP Exercise 0.00 590.00

GESPP Exercise 0.00 590.00

Performance Bonus OT NonBen 0.00 480.49

Misc Reimburse Non Taxable 0.00 50.00

Performance Bonus OT NonBen 0.00 480.49

Special Recog Award Gift-Net 0.00 200.00

Special Recog Award Gift-Net 0.00 200.00

GESPP Exercise 0.00 590.00

Performance Bonus OT NonBen 0.00 480.49

CGLI - FICA Only 3.54 74.34

CGLI - FICA Only 3.54 67.26

Special Recog Award Gift-Net 0.00 200.00

CGLI - FICA Only 3.54 70.80

Total Earnings : $3,550.00 $75,094.26

Pre-Tax This Period YTD

Medical Insurance Pre Tax 77.43 1,548.60

Dental Ins Pre Tax 4.25 85.00

401(k) Pre Tax 315.00 5,435.62

Vision Pre Tax 5.08 101.60

Vacation Buy Pre Tax 60.31 1,085.58

Total Pre-Tax : $462.07 $8,256.40

Taxes This Period YTD

Federal 522.24 12,118.29

EE Social Security Tax 208.10 4,489.66

EE Medicare Tax 48.67 1,050.00

Total Taxes : $779.01 $17,657.95

POST-TAX This Period YTD

Plan Loan 1 140.56 562.24

Parking 0.00 635.00

Charity 10.00 200.00

Shell Employee Club 0.00 10.00

Personal Exp on Corp Card 0.00 60.00

GESPP Post Tax 210.00 3,850.00

TOTAL POST-TAX: $360.56 $5,317.24

Net Pay This Period YTD

Total Net Pay : $1,948.36 $43,465.31

OTHER BENEFITS & INFORMATION

Description Percent This Period Year-To-Date

401(k) Pre Tax 9.00 315.00 5,435.62

Member Provident Fund 0.00 0.00 0.00

Member Provident Fund II 0.00 0.00 0.00

Company Provident Fund 2.50 87.50 1,845.00

Catch-up Contribution 0.00 0.00 0.00

GESPP Post Tax 0.00 210.00 3,850.00

pre-tax post-tax

Summary Earnings Taxable Wages

deds taxes deds net pay*

This Period $3,550.00 $462.07 $3,041.47 $779.01 $360.56 $1,948.36

YTD $75,094.26 $8,256.40 $66,978.31 $17,657.95 $5,317.24 $43,465.31

Pay Distribution List

Description Type Amount Account # Bank

Direct deposit 1 Checking or Money Market $1,948.36 <...8122> JPMorgan Chase Bank, National Association

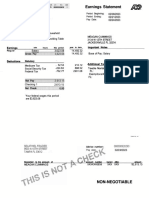

Pay Date: 11/14/2014 - Regular

Motiva Company Sofia De La Torre

P.O. Box 4282 909 Texas Ave

Houston, TX 77210-4282 Apt. 816

Houston, TX 77002

Employee ID ******** Pay Advice # 0019364300207

Pay Frequency Semi-monthly Period Begin Date 11/01/2014

Period End Date 11/15/2014

Taxes State Codes Marital Status Allowances Additional Amounts

Federal Single 1

Primary State Exempt 0

Secondary State 0

Local 0

Messages

INQUIRIES? Hours: Contact your Timekeeper. Pay: Contact HR Service Desk-Americas 713-245-4800. For Benefits: Fidelity 1-800-30SHELL or click on Fidelity NetBenefits.

Make sure that your original 2014 W-2 will be received electronically – not by snail-mail. Click on W-2 Services to find out.

Direct Deposit, W-4 Tax Withholding and other FAQs: Choose the "HR Online" tab from the Shell Online portal page - On the HR Online home page choose My Pay > Payroll Employee Services Payroll and scroll to topic.

Earnings Rate Hours This Period YTD

Prior Regular Pay - Salaried -902.06 0.00

Regular Pay - Salaried 3,500.00 65,198.38

Regular Pay - Salaried 2,756.25 70,552.57

Prior Vacation 36.08247 25.00 902.06 0.00

Performance Bonus Prior Yr 0.00 4,300.00

Performance Bonus Prior Yr 0.00 4,300.00

Regular Pay - Salaried 3,500.00 67,796.32

Vacation 0.00 3,809.22

Vacation 0.00 2,907.16

Performance Bonus Prior Yr 0.00 4,300.00

Holiday Pay Base 43.75000 17.00 743.75 2,138.21

Holiday Pay Base 0.00 1,394.46

Vacation 0.00 3,809.22

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Holiday Pay Base 0.00 1,394.46

Shares Cash Balance 0.00 76.81

Shares Cash Balance 0.00 76.81

Misc Reimburse Non Taxable 50.00 50.00

Misc Reimburse Non Taxable 50.00 100.00

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Shares Cash Balance 0.00 76.81

GESPP Exercise 0.00 590.00

GESPP Exercise 0.00 590.00

Performance Bonus OT NonBen 0.00 480.49

Misc Reimburse Non Taxable 0.00 50.00

Performance Bonus OT NonBen 0.00 480.49

Special Recog Award Gift-Net 0.00 200.00

Special Recog Award Gift-Net 0.00 200.00

GESPP Exercise 0.00 590.00

Performance Bonus OT NonBen 0.00 480.49

CGLI - FICA Only 3.54 74.34

CGLI - FICA Only 3.54 67.26

Special Recog Award Gift-Net 0.00 200.00

CGLI - FICA Only 3.54 70.80

Total Earnings : $3,500.00 $78,594.26

Pre-Tax This Period YTD

Medical Insurance Pre Tax 77.43 1,626.03

Dental Ins Pre Tax 4.25 89.25

401(k) Pre Tax 315.00 5,750.62

Vision Pre Tax 5.08 106.68

Vacation Buy Pre Tax 60.31 1,145.89

Total Pre-Tax : $462.07 $8,718.47

Taxes This Period YTD

Federal 522.24 12,640.53

EE Social Security Tax 208.10 4,697.76

EE Medicare Tax 48.67 1,098.67

Total Taxes : $779.01 $18,436.96

POST-TAX This Period YTD

Plan Loan 1 140.56 702.80

Parking 65.00 700.00

Charity 10.00 210.00

Shell Employee Club 0.00 10.00

Personal Exp on Corp Card 0.00 60.00

GESPP Post Tax 210.00 4,060.00

TOTAL POST-TAX: $425.56 $5,742.80

Net Pay This Period YTD

Total Net Pay : $1,833.36 $45,298.67

OTHER BENEFITS & INFORMATION

Description Percent This Period Year-To-Date

401(k) Pre Tax 9.00 315.00 5,750.62

Member Provident Fund 0.00 0.00 0.00

Member Provident Fund II 0.00 0.00 0.00

Company Provident Fund 2.50 87.50 1,932.50

Catch-up Contribution 0.00 0.00 0.00

GESPP Post Tax 0.00 210.00 4,060.00

pre-tax post-tax

Summary Earnings Taxable Wages

deds taxes deds net pay*

This Period $3,500.00 $462.07 $3,041.47 $779.01 $425.56 $1,833.36

YTD $78,594.26 $8,718.47 $70,019.78 $18,436.96 $5,742.80 $45,298.67

Pay Distribution List

Description Type Amount Account # Bank

Direct deposit 1 Checking or Money Market $1,833.36 <...8122> JPMorgan Chase Bank, National Association

Pay Date: 11/26/2014 - Regular

Motiva Company Sofia De La Torre

P.O. Box 4282 909 Texas Ave

Houston, TX 77210-4282 Apt. 816

Houston, TX 77002

Employee ID ******** Pay Advice # 0019364300209

Pay Frequency Semi-monthly Period Begin Date 11/16/2014

Period End Date 11/30/2014

Taxes State Codes Marital Status Allowances Additional Amounts

Federal Single 1

Primary State Exempt 0

Secondary State 0

Local 0

Messages

INQUIRIES? Hours: Contact your Timekeeper. Pay: Contact HR Service Desk-Americas 713-245-4800. For Benefits: Fidelity 1-800-30SHELL or click on Fidelity NetBenefits.

Make sure that your original 2014 W-2 will be received electronically – not by snail-mail. Click on W-2 Services to find out.

Direct Deposit, W-4 Tax Withholding and other FAQs: Choose the "HR Online" tab from the Shell Online portal page - On the HR Online home page choose My Pay > Payroll Employee Services Payroll and scroll to topic.

Earnings Rate Hours This Period YTD

Prior Regular Pay - Salaried -902.06 0.00

Regular Pay - Salaried 3,500.00 65,198.38

Regular Pay - Salaried 2,756.25 70,552.57

Prior Vacation 36.08247 25.00 902.06 0.00

Performance Bonus Prior Yr 0.00 4,300.00

Performance Bonus Prior Yr 0.00 4,300.00

Regular Pay - Salaried 3,500.00 67,796.32

Vacation 0.00 3,809.22

Vacation 0.00 2,907.16

Performance Bonus Prior Yr 0.00 4,300.00

Holiday Pay Base 43.75000 17.00 743.75 2,138.21

Holiday Pay Base 0.00 1,394.46

Vacation 0.00 3,809.22

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Holiday Pay Base 0.00 1,394.46

Shares Cash Balance 0.00 76.81

Shares Cash Balance 0.00 76.81

Misc Reimburse Non Taxable 50.00 50.00

Misc Reimburse Non Taxable 50.00 100.00

Tax Result SRA Gift Net-TaxAsst 0.00 96.96

Shares Cash Balance 0.00 76.81

GESPP Exercise 0.00 590.00

GESPP Exercise 0.00 590.00

Performance Bonus OT NonBen 0.00 480.49

Misc Reimburse Non Taxable 0.00 50.00

Performance Bonus OT NonBen 0.00 480.49

Special Recog Award Gift-Net 0.00 200.00

Special Recog Award Gift-Net 0.00 200.00

GESPP Exercise 0.00 590.00

Performance Bonus OT NonBen 0.00 480.49

CGLI - FICA Only 3.54 74.34

CGLI - FICA Only 3.54 67.26

Special Recog Award Gift-Net 0.00 200.00

CGLI - FICA Only 3.54 70.80

Total Earnings : $3,550.00 $82,144.26

Pre-Tax This Period YTD

Medical Insurance Pre Tax 77.43 1,703.46

Dental Ins Pre Tax 4.25 93.50

401(k) Pre Tax 315.00 6,065.62

Vision Pre Tax 5.08 111.76

Vacation Buy Pre Tax 60.31 1,206.20

Total Pre-Tax : $462.07 $9,180.54

Taxes This Period YTD

Federal 522.24 13,162.77

EE Social Security Tax 208.11 4,905.87

EE Medicare Tax 48.67 1,147.34

Total Taxes : $779.02 $19,215.98

POST-TAX This Period YTD

Plan Loan 1 140.56 843.36

Parking 0.00 700.00

Charity 10.00 220.00

Shell Employee Club 0.00 10.00

Personal Exp on Corp Card 0.00 60.00

GESPP Post Tax 210.00 4,270.00

TOTAL POST-TAX: $360.56 $6,103.36

Net Pay This Period YTD

Total Net Pay : $1,948.35 $47,247.02

OTHER BENEFITS & INFORMATION

Description Percent This Period Year-To-Date

401(k) Pre Tax 9.00 315.00 6,065.62

Member Provident Fund 0.00 0.00 0.00

Member Provident Fund II 0.00 0.00 0.00

Company Provident Fund 2.50 87.50 2,020.00

Catch-up Contribution 0.00 0.00 0.00

GESPP Post Tax 0.00 210.00 4,270.00

pre-tax post-tax

Summary Earnings Taxable Wages

deds taxes deds net pay*

This Period $3,550.00 $462.07 $3,041.47 $779.02 $360.56 $1,948.35

YTD $82,144.26 $9,180.54 $73,061.25 $19,215.98 $6,103.36 $47,247.02

Pay Distribution List

Description Type Amount Account # Bank

Direct deposit 1 Checking or Money Market $1,948.35 <...8122> JPMorgan Chase Bank, National Association

You might also like

- Your 2024 Social Security Cost of Living IncreaseDocument4 pagesYour 2024 Social Security Cost of Living IncreasenazoyaqNo ratings yet

- Elite Audit 4Document1 pageElite Audit 4arinzeshedrack30No ratings yet

- JournalSheet.com Profit Loss StatementDocument21 pagesJournalSheet.com Profit Loss StatementThird WheelNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Letteroh lampNo ratings yet

- Garner, D 4:21 PDFDocument1 pageGarner, D 4:21 PDFAaliyahNo ratings yet

- Feb 2020Document4 pagesFeb 2020andreaNo ratings yet

- Fidelity Sample StatementDocument8 pagesFidelity Sample StatementPawPaul MccoyNo ratings yet

- Visit: Your Payment Is Due Your Total Due How To Contact UsDocument2 pagesVisit: Your Payment Is Due Your Total Due How To Contact UsMirtha Gonzalez100% (1)

- CustomerOrder#H4705 208050 PDFDocument3 pagesCustomerOrder#H4705 208050 PDFSindy CruzNo ratings yet

- Teaching CertificateDocument1 pageTeaching Certificateapi-359162285No ratings yet

- Statement of Earnings: NON NegotiableDocument1 pageStatement of Earnings: NON NegotiableireneNo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Mohamed MahdiDocument5 pagesMohamed Mahdimohamed khadarNo ratings yet

- 1 Statementgo2ban23290319Document7 pages1 Statementgo2ban23290319alihussle3200blxkNo ratings yet

- Citi 201205Document10 pagesCiti 201205sinnlosNo ratings yet

- Comed Sample BillDocument2 pagesComed Sample BillAlberto CayetanoNo ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableWILLIE WRIGHTNo ratings yet

- Apple Cash StatementDocument13 pagesApple Cash Statementmikey whiteNo ratings yet

- GeicoDocument2 pagesGeicotfuyuicgufgyu5469No ratings yet

- Proof of home insurance for Riata AustinDocument1 pageProof of home insurance for Riata AustinTascie CookNo ratings yet

- View DocumentDocument2 pagesView Documentltasha24100% (1)

- Petition for issuance of second owner's duplicate titleDocument2 pagesPetition for issuance of second owner's duplicate titlebernard jonathan Gatchalian100% (1)

- DeclarationDocument11 pagesDeclarationTammy Reeves WhiteNo ratings yet

- Luci’s CPA Method Earn With Rewards SiteDocument3 pagesLuci’s CPA Method Earn With Rewards Sitemaster-rich0% (1)

- Suncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingDocument3 pagesSuncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingolaNo ratings yet

- Paystub 2019 05 31 PDFDocument1 pagePaystub 2019 05 31 PDFAnonymous wkIlICXmQfNo ratings yet

- Statement 6Document2 pagesStatement 6kezjana dardha0% (1)

- Account # 0304459148: Lifegreen CheckingDocument4 pagesAccount # 0304459148: Lifegreen CheckingViktoria DenisenkoNo ratings yet

- (Sept 1, 2016) Schwab Wire Confirmation To Marek - Redacted PDFDocument2 pages(Sept 1, 2016) Schwab Wire Confirmation To Marek - Redacted PDFDavid HundeyinNo ratings yet

- Date Transaction Description Amount (In RS.)Document2 pagesDate Transaction Description Amount (In RS.)MITESH KUMAR100% (1)

- Paystub 202303 PDFDocument1 pagePaystub 202303 PDFahmad zakariaNo ratings yet

- Frazier0224 PDFDocument1 pageFrazier0224 PDFshani ChahalNo ratings yet

- 美国metabank账单Document2 pages美国metabank账单juliaechardhqa85No ratings yet

- Understanding Your PaystubDocument2 pagesUnderstanding Your PaystubmashaNo ratings yet

- Wayne September 2022 EstatementDocument2 pagesWayne September 2022 EstatementWayne HargettNo ratings yet

- Chase Bank February Statement SummaryDocument1 pageChase Bank February Statement SummaryAbhishek VNo ratings yet

- ListDocument4 pagesListNathy FrometaNo ratings yet

- Pay Stub DetailsDocument1 pagePay Stub DetailsCresteynTeyngNo ratings yet

- Amanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Document6 pagesAmanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Amanda Scott100% (1)

- Internet Att BillDocument4 pagesInternet Att Billben tenNo ratings yet

- Documento PDFDocument6 pagesDocumento PDFangye08vivasNo ratings yet

- Customer PDFDocument2 pagesCustomer PDFSuraj BhandariNo ratings yet

- The Circular Economy Opportunity For Urban Industrial Innovation in China - 19 9 18 - 1 PDFDocument166 pagesThe Circular Economy Opportunity For Urban Industrial Innovation in China - 19 9 18 - 1 PDFaggarwal_996354920No ratings yet

- Chime Bank Statement Summary May 2021Document3 pagesChime Bank Statement Summary May 2021Kalila JamesNo ratings yet

- Efce 32 BCDocument2 pagesEfce 32 BCsteph chengNo ratings yet

- CII IF2-General Insurance Business-1Document276 pagesCII IF2-General Insurance Business-1paschalpaul722100% (1)

- Rental Company: Quality Living From The Team That CaresDocument1 pageRental Company: Quality Living From The Team That Cares5gt6kdfdqhNo ratings yet

- 6 Month Transaction BankDocument15 pages6 Month Transaction BankShravan KumarNo ratings yet

- Yap vs. Lagtapon (Digest)Document2 pagesYap vs. Lagtapon (Digest)Justin IsidoroNo ratings yet

- The Price of Civilization by Jeffrey D. SachsDocument15 pagesThe Price of Civilization by Jeffrey D. SachsRandom House of CanadaNo ratings yet

- Pay Stub Portal3Document1 pagePay Stub Portal3cwhite2150No ratings yet

- 1 5136803172601299942 PDFDocument3 pages1 5136803172601299942 PDFnurulamin00023No ratings yet

- January 2016 - InternationalDocument72 pagesJanuary 2016 - InternationalAlis Pastrana100% (1)

- Soriano Et Al., v. CIR Facts: The Case Involved Consolidated Petitions For Certiorari, ProhibitionDocument4 pagesSoriano Et Al., v. CIR Facts: The Case Involved Consolidated Petitions For Certiorari, ProhibitionLouise Bolivar DadivasNo ratings yet

- Invoice 42010Document1 pageInvoice 42010ragiphani karthikNo ratings yet

- Transaction Summary: Contact UsDocument1 pageTransaction Summary: Contact UsJesseneNo ratings yet

- Enrollment PackageDocument11 pagesEnrollment PackageJose EspinozaNo ratings yet

- HTR 043235 PDFDocument4 pagesHTR 043235 PDFCjNo ratings yet

- Confirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTDocument1 pageConfirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTKarthik SheshadriNo ratings yet

- Account statement activityDocument1 pageAccount statement activityZakaz SpainNo ratings yet

- Savings Account Statement: Tax InvoiceDocument2 pagesSavings Account Statement: Tax InvoiceSIPHOSETHU MAGOSONo ratings yet

- Social Security Administration Office LetterDocument1 pageSocial Security Administration Office LetterTom KnobNo ratings yet

- UL PayStub 2019.01.15Document1 pageUL PayStub 2019.01.15Marcus GreenNo ratings yet

- Intertek Fuel Doctor FD-47 Testing Review ResultsDocument17 pagesIntertek Fuel Doctor FD-47 Testing Review ResultsFuel DoctorNo ratings yet

- USA Citibank BankDocument1 pageUSA Citibank BankPolo OaracilNo ratings yet

- Edna Unzueta: Direct Deposit Enrollment FormDocument1 pageEdna Unzueta: Direct Deposit Enrollment FormAll Result BD 2019No ratings yet

- Xiao Enterprise Payslip Mar15Document5 pagesXiao Enterprise Payslip Mar15D Jay ApostelloNo ratings yet

- Workday1Document1 pageWorkday1raheemtimo1No ratings yet

- OrgBoat - Trademark Status & Document RetrievalDocument2 pagesOrgBoat - Trademark Status & Document RetrievalSuiNo ratings yet

- CRAFTING AND RECORDING SOUND - Ver.1.0Document6 pagesCRAFTING AND RECORDING SOUND - Ver.1.0SuiNo ratings yet

- Installation Guide: A. OverviewDocument4 pagesInstallation Guide: A. OverviewSuiNo ratings yet

- Ex 7Document17 pagesEx 7api-322416213No ratings yet

- Thời gian làm bài: 180 phút (Đề thi gồm 10 trang, thí sinh làm bài ngay vào đề thi này)Document11 pagesThời gian làm bài: 180 phút (Đề thi gồm 10 trang, thí sinh làm bài ngay vào đề thi này)Hải VũNo ratings yet

- Báo cáo cuối kì môn thực hành an ninh mạngDocument5 pagesBáo cáo cuối kì môn thực hành an ninh mạngDương Thành ĐạtNo ratings yet

- Former Ohio Wildlife Officer Convicted of Trafficking in White-Tailed DeerDocument2 pagesFormer Ohio Wildlife Officer Convicted of Trafficking in White-Tailed DeerThe News-HeraldNo ratings yet

- DRRM School Memo No. 7Document5 pagesDRRM School Memo No. 7Mime CarmleotesNo ratings yet

- End of Schooling at the Village SchoolDocument7 pagesEnd of Schooling at the Village SchoolHelna CachilaNo ratings yet

- Doctrine of Limited LiabilityDocument6 pagesDoctrine of Limited Liabilitymina villamorNo ratings yet

- Annex 7 Workshop at Eastern Partnership Youth ForumDocument4 pagesAnnex 7 Workshop at Eastern Partnership Youth ForumGUEGANNo ratings yet

- Full Text of Results CPA Board ExamDocument2 pagesFull Text of Results CPA Board ExamTheSummitExpressNo ratings yet

- Acr-Emergency HotlinesDocument2 pagesAcr-Emergency HotlinesRA CastroNo ratings yet

- BBGP4103 Consumer BehaviourDocument6 pagesBBGP4103 Consumer Behaviournartina sadzilNo ratings yet

- Essay Draft: Orwell and BaconDocument6 pagesEssay Draft: Orwell and BaconiydesantoNo ratings yet

- Make Versus Buy: Facts of The CaseDocument2 pagesMake Versus Buy: Facts of The CaseJAYA KIRTANA.SNo ratings yet

- Matrix - PALC and DP RequirementsDocument25 pagesMatrix - PALC and DP RequirementsTajNo ratings yet

- Tata Teleservices Limited.: Project ConnectDocument28 pagesTata Teleservices Limited.: Project ConnectshekarNo ratings yet

- Lightcyber Behavioral AnalyticsDocument4 pagesLightcyber Behavioral AnalyticsasadaNo ratings yet

- Money MathsDocument9 pagesMoney Mathsk_vk2000No ratings yet

- PCL LT 1 Application and Agreement - A A - FormDocument6 pagesPCL LT 1 Application and Agreement - A A - FormAmrit Pal SIngh0% (1)

- Adam Elfeki - GDP Free Response Questions PDFDocument1 pageAdam Elfeki - GDP Free Response Questions PDFWilliam HolyNo ratings yet

- (Cont'd) : Human Resource ManagementDocument14 pages(Cont'd) : Human Resource ManagementMohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- ACCOUNTS RECEIVABLES 7-8 - Sheet1-2Document3 pagesACCOUNTS RECEIVABLES 7-8 - Sheet1-2Astrid AboitizNo ratings yet

- Global Citizenship and Global GovernanceDocument13 pagesGlobal Citizenship and Global GovernanceDanna Francheska100% (1)