Professional Documents

Culture Documents

Welcome To Central Record Keeping Agency

Uploaded by

Abhishek SenguptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Welcome To Central Record Keeping Agency

Uploaded by

Abhishek SenguptaCopyright:

Available Formats

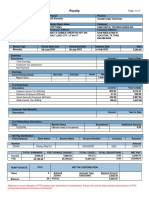

NPS Transaction Statement-ATAL PENSION YOJANA (APY) for Tier I Account

Statement Period: From Apr 01, 2021 to Aug 20, 2021 Statement Generation Date : Aug 20, 2021

PRAN 500006482414 Registration Date 14-Feb-2017

Subscriber PRAN Migration Date Not Applicable

MR ABHISHEK SENGUPTA

Name

Saving Bank A/C No 0060104000314411

P 139 CIT ROAD SCHEME VIM KANKURGACHIAPC PARK

APY-SP Bank Reg. no. 7001945

KOLK

Address APY-SP Bank Name IDBI BANK LTD

WEST BENGAL - 700054

WTC COMPLEX IDBI TOWER,

CUFFE PARADE

APY-SP Bank Address

,

MUMBAI, 400005

INDIA

APY-SP Bank Branch

IRA Status IRA compliant NPS205627G

Reg No

Mobile

9874118158 APY-SP Bank Branch

Number IDBI Bank MUMBAI -CHEMBUR18

Name

Email ID <Please Provide>

APY-SP Bank Branch

12-16, Sunny Estate IISion Tro,

Mumbai, 400071

Date Of Birth :

20-Jul-1979 Address

Marital Status : Married Pension Amount

5000

Selected

Spouse Name :

PRERANA SENGUPTA

Periodicity of

Half Yearly

Nominee Contribution

: PRANTIK SENGUPTA

Name

Percentage : 100%

Summary

The total contribution to your pension account till Aug 20, 2021 was Rs. 64150.00.

Value of your Holding (investments) as on Aug 20, 2021 is Rs. 83159.27.

Changes made during the selected period

No change affected in this period

Contribution/ Redemption Details

Contribution

Govt. Co-

Date Particulars Uploaded By Subscriber

Contribution/Overdue Total

Contribution

Charges (Rs)

(Rs)

(Rs)

01-Apr-2021 Opening balance 57735.00

08-Apr-2021 By Contribution for H1, 2021-2022 IDBI BANK LTD (7001945), 6415.00 0.00 6415.00

20-Aug-2021 Closing Balance 64,150.00

Billing Summary

Perticulars Am ount

Summary of Billing during the statement period (12.14)

Government Co-contribution Details

No records found for the selected period

Notes for Transaction Statement

1.The section 'Contribution Details' gives the details of the contributions processed in subscriber's account during the period.

The Central Government would co-contribute 50% of the total contribution or Rs.1000 per annum, whichever is lower, to each eligible subscriber for a period of 5

years, i.e., from Financial Year 2015-16 to 2019-20, who joins APY before March 31, 2016 and who are not members of any statutory social security scheme &

2.

who are not income tax payers. This Government co-contribution is payable into subscriber's savings bank account half yearly basis in a Financial Year once

subscriber has made the entire contribution for six months.

3.The Transaction statement is dynamic. The value and other computations in the Transaction statement depend upon the generation date.

The balances and respective narrations reflecting in your account are based on the contribution amount and details uploaded by your APY bank branch. In case

4.there is no/less/excess contribution for any month or no clarity in the narration, please contact your APY Bank Branch. In case of any discrepancy, you must

contact your APY bank branch immediately.

Contribution amount is invested as per the guidelines of Government of India (upto 85% of the money will be invested in debt and government securities and

5.

upto 15% will be invested in equity).

6.Best viewed in Internet Explorer 9.0 & above or Mozilla Firefox Ver 3 & above with a resolution of 1024 X 768.

The amount shown in the field 'Pension Amount Selected' is the guaranteed pension that will be received (irrespective of present value of your holding), if you

7.

continue to contribute till 60 years of age.

C RA Home | Downloads | FAQs | C ontact Us | System C onfiguration | Entrust Secured | Privacy Policy | Grievance Redressal Policy

C opyright © 2010 CRA. All Rights Reserved. Best viewed in Internet Explorer 6 & above or Firefox Ver 1.5 with a resolution of 1024* 768.

You might also like

- Welcome To Central Record Keeping Agency - PRDocument2 pagesWelcome To Central Record Keeping Agency - PRAbhishek SenguptaNo ratings yet

- Account Statement 2019-2020Document2 pagesAccount Statement 2019-2020suhasNo ratings yet

- Transaction Statement1705415418Document1 pageTransaction Statement1705415418bhavanakatakam0No ratings yet

- Wa0007Document2 pagesWa0007sandhya.iyyanar1992No ratings yet

- Welcome To Central Record Keeping Agency PDFDocument2 pagesWelcome To Central Record Keeping Agency PDFparthi janaNo ratings yet

- Transaction Statement1700677173Document2 pagesTransaction Statement1700677173Madhav LungareNo ratings yet

- Welcome To Central Record Keeping Agency 22-23Document2 pagesWelcome To Central Record Keeping Agency 22-23tsvvpkumarNo ratings yet

- Welcome To Central Record Keeping Agency 2023Document2 pagesWelcome To Central Record Keeping Agency 2023pratik patilNo ratings yet

- Transaction Statement1705397004Document2 pagesTransaction Statement1705397004sureshpatil25No ratings yet

- Welcome To Central Record Keeping Agency 2019Document2 pagesWelcome To Central Record Keeping Agency 2019pratik patilNo ratings yet

- Transaction Statement1624372022Document1 pageTransaction Statement1624372022RamakantaSahooNo ratings yet

- Transaction Statement1698469666Document2 pagesTransaction Statement1698469666rk370666No ratings yet

- Transaction Statement1627022355Document1 pageTransaction Statement1627022355RamakantaSahooNo ratings yet

- Transaction Statement1676126669Document1 pageTransaction Statement1676126669Vasanth EllendulaNo ratings yet

- Transaction Statement1704420433Document2 pagesTransaction Statement1704420433palakaamresh46No ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Transaction Statement1656568636Document2 pagesTransaction Statement1656568636Gulzar Ali QadriNo ratings yet

- Transaction Statement1673011931Document1 pageTransaction Statement1673011931SAMIR KUMARNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Client Master List: National Securities Depository LimitedDocument2 pagesClient Master List: National Securities Depository Limitedmrcopy xeroxNo ratings yet

- Transaction Statement1676376886Document2 pagesTransaction Statement1676376886mukeshpradhan675No ratings yet

- Client Master List: National Securities Depository LimitedDocument2 pagesClient Master List: National Securities Depository Limitedsumit sinhaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- Transaction Statement1563132579Document1 pageTransaction Statement1563132579Vincent VNo ratings yet

- 1378 FormDocument2 pages1378 FormDinesh Kumar Bhilala (Dinya)No ratings yet

- Branch Letter To CBIDocument2 pagesBranch Letter To CBIchandan bhatiNo ratings yet

- CN0187835730 081222 10 56 16Document1 pageCN0187835730 081222 10 56 16Avinash TiwariNo ratings yet

- Client Master List: National Securities Depository LimitedDocument2 pagesClient Master List: National Securities Depository LimitedSubinsonNo ratings yet

- Pradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Document2 pagesPradhan Mantri Shram-Yogi Maandhan - (PM-SYM)Honey Ali33% (3)

- For SSC Use Only: Address For Communication Permanent AddressDocument4 pagesFor SSC Use Only: Address For Communication Permanent AddressShakti singh gaurNo ratings yet

- LDC ReceiptDocument2 pagesLDC ReceiptKaja NajeemudinNo ratings yet

- CPB 9857796Document1 pageCPB 9857796Aashi ShrinateNo ratings yet

- National Pension System (NPS) Subscriber Registration FormDocument2 pagesNational Pension System (NPS) Subscriber Registration Formkumarvaibhav301745No ratings yet

- वववगवगDocument7 pagesवववगवगDeva RathodNo ratings yet

- Reliance Infrastructure Fund-Retail Plan - Dividend Plan: Account Number: 42099713571 Anil Kumar YadavDocument2 pagesReliance Infrastructure Fund-Retail Plan - Dividend Plan: Account Number: 42099713571 Anil Kumar Yadavashokparashar06No ratings yet

- Ilovepdf MergedDocument6 pagesIlovepdf MergedNagi ReddyNo ratings yet

- Sbi Life - Rinn Raksha Membership Form (Uin: 111N078V03) Sbi Life Insurance Company LTDDocument5 pagesSbi Life - Rinn Raksha Membership Form (Uin: 111N078V03) Sbi Life Insurance Company LTDPRABHAKAR REDDY TBSF - TELANGANANo ratings yet

- Client Master List: National Securities Depository LimitedDocument2 pagesClient Master List: National Securities Depository LimitedEmrald ConsultancyNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- Small 277Document269 pagesSmall 277Guru SivanNo ratings yet

- E-Receipt For State Bank Collect PaymentDocument1 pageE-Receipt For State Bank Collect PaymentAkankshaNo ratings yet

- Annexure KDocument1 pageAnnexure KHeet ShahNo ratings yet

- 2023 10 27 17 03 59sep 23 - 110094Document4 pages2023 10 27 17 03 59sep 23 - 110094datacom7065No ratings yet

- PDF DownloadDocument2 pagesPDF DownloadKnitting ProductionNo ratings yet

- Inv Fki Jne 2Document1 pageInv Fki Jne 2heri.accNo ratings yet

- New CCFormsDocument2 pagesNew CCFormsSouvik BanerjeeNo ratings yet

- 126687Document2 pages126687DiptiNo ratings yet

- Office of The PO Cum DWO, PURULIA District: Government of West BengalDocument3 pagesOffice of The PO Cum DWO, PURULIA District: Government of West BengalJharna RoyNo ratings yet

- PYTMPPABFL6966491134 Convenience Tax Invoice 7 2023Document1 pagePYTMPPABFL6966491134 Convenience Tax Invoice 7 2023SWAPNIL BAHEKARNo ratings yet

- Delhi Mumbai Industrial Corridor DevelopmentDocument1 pageDelhi Mumbai Industrial Corridor DevelopmentSaravanakumar N100% (1)

- The PrologueDocument2 pagesThe Prologueanuprabhakara.gNo ratings yet

- Prakash Vadilal Mehta AADPM6701F 302 A Dena Apartments Sodawala Lane Near Pandya Hospital Borivali WDocument5 pagesPrakash Vadilal Mehta AADPM6701F 302 A Dena Apartments Sodawala Lane Near Pandya Hospital Borivali WAditya MehtaNo ratings yet

- InvoiceDocument1 pageInvoiceUdit jainNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)aamir mustafaNo ratings yet

- Ediga Paramesh GoudDocument10 pagesEdiga Paramesh GoudgopalNo ratings yet

- Mouse Invoice Rs 799Document1 pageMouse Invoice Rs 799Prashant SharmaNo ratings yet

- Invoice Format - KAPIL - AUG - 2023Document1 pageInvoice Format - KAPIL - AUG - 2023Kapil JainNo ratings yet

- Welcome Kit Term Plan-PS - PDFDocument35 pagesWelcome Kit Term Plan-PS - PDFAbhishek SenguptaNo ratings yet

- Tubular Solar BatteriesDocument6 pagesTubular Solar BatteriesAbinash ChikunNo ratings yet

- SECI000051 8393969 RfSfor1200MWinKA ISTS X FinaluploadDocument99 pagesSECI000051 8393969 RfSfor1200MWinKA ISTS X FinaluploadAbhishek SenguptaNo ratings yet

- Welcome Kit Term Plan-PS - PDF2Document34 pagesWelcome Kit Term Plan-PS - PDF2Abhishek Sengupta0% (1)

- Tentative Module LayoutDocument1 pageTentative Module LayoutAbhishek SenguptaNo ratings yet

- Policy Renewable West Bengal 2012Document42 pagesPolicy Renewable West Bengal 2012Abhishek SenguptaNo ratings yet

- REVISEDTEDRFPDocument65 pagesREVISEDTEDRFPAbhishek SenguptaNo ratings yet

- Floating Solar PV Project at Raja Pokhar Talab Under BREDA: Gensol GroupDocument12 pagesFloating Solar PV Project at Raja Pokhar Talab Under BREDA: Gensol GroupAbhishek SenguptaNo ratings yet

- Solar Park Development ModelDocument20 pagesSolar Park Development ModelAbhishek SenguptaNo ratings yet

- RFP For Centralized Monitoring of Solar Pumpset 02-01-2019Document30 pagesRFP For Centralized Monitoring of Solar Pumpset 02-01-2019Abhishek SenguptaNo ratings yet

- Model RFP - Selection of Implementation Agency - 2018 PDFDocument602 pagesModel RFP - Selection of Implementation Agency - 2018 PDFRavinderSinghNo ratings yet

- International Health Tender v2 - 5Document20 pagesInternational Health Tender v2 - 5Abhishek SenguptaNo ratings yet

- TCS Connected Universe Platform: Innovation LabsDocument2 pagesTCS Connected Universe Platform: Innovation LabsAbhishek SenguptaNo ratings yet

- Model Panchayat Cadre Manual: Shri Ram Centre For Industrial Relations, Human Resources, Economic & Social DevelopmentDocument170 pagesModel Panchayat Cadre Manual: Shri Ram Centre For Industrial Relations, Human Resources, Economic & Social DevelopmentPavan KumarNo ratings yet

- LED WiFiDocument24 pagesLED WiFiEassy BazarNo ratings yet

- 8902265282021104424AMSLAtester GEM 2021 B 1230502Document20 pages8902265282021104424AMSLAtester GEM 2021 B 1230502Abhishek SenguptaNo ratings yet

- 03 e Measurement Book Ver 1.0Document40 pages03 e Measurement Book Ver 1.0TyagaraniNo ratings yet

- Model Panchayat Cadre Manual: Shri Ram Centre For Industrial Relations, Human Resources, Economic & Social DevelopmentDocument170 pagesModel Panchayat Cadre Manual: Shri Ram Centre For Industrial Relations, Human Resources, Economic & Social DevelopmentPavan KumarNo ratings yet

- Tender Document: Supply, Erection & Commissioning OFDocument60 pagesTender Document: Supply, Erection & Commissioning OFAbhishek SenguptaNo ratings yet

- Annexure-K1 Proforma of Service Level Agreement (Sla)Document10 pagesAnnexure-K1 Proforma of Service Level Agreement (Sla)Abhishek SenguptaNo ratings yet

- Quiz 1 Akhand TomarDocument2 pagesQuiz 1 Akhand TomarmstomarNo ratings yet

- SP1 2021Document1,848 pagesSP1 2021HANSHU LIUNo ratings yet

- Labour LawDocument7 pagesLabour LawAkarsh KumarNo ratings yet

- Learner Guide 242564Document35 pagesLearner Guide 242564palmalynchwatersNo ratings yet

- Life Insurance and The Extent To Which It Is Permitted in A Case of Need ZarabozoDocument77 pagesLife Insurance and The Extent To Which It Is Permitted in A Case of Need ZarabozoMohammad AtiqueNo ratings yet

- Personal Finance 2Nd Edition by Jane King Full ChapterDocument41 pagesPersonal Finance 2Nd Edition by Jane King Full Chaptermargret.brennan669100% (25)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageBill ChenNo ratings yet

- Concepts in Federal Taxation 2017 24th Edition Murphy Test Bank 1Document40 pagesConcepts in Federal Taxation 2017 24th Edition Murphy Test Bank 1hiedi100% (38)

- PayslipDocument1 pagePayslipblackson knightsonNo ratings yet

- CPT Math StatsDocument63 pagesCPT Math StatsVivek Vincent86% (7)

- Asian PaintsDocument8 pagesAsian PaintsRahul Gandhi100% (1)

- MASTER CIRCULAR-Partial WithdrawalDocument12 pagesMASTER CIRCULAR-Partial WithdrawalArvind KumarNo ratings yet

- Proformas of Service BookDocument25 pagesProformas of Service BookToshiba Tv100% (1)

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- 1121 Special Pension BriefingDocument21 pages1121 Special Pension BriefingAnn DwyerNo ratings yet

- Exide Life Elite Term Insurance Plan BrochureDocument8 pagesExide Life Elite Term Insurance Plan Brochuremohit mondalNo ratings yet

- UN Promise of ProtectionDocument128 pagesUN Promise of Protectionary yunian putriNo ratings yet

- Practice QuestionDocument1 pagePractice QuestionKhalid IMRANNo ratings yet

- Auditing: Control & Substantive Tests in Personnel & Payroll by David N. RicchiuteDocument19 pagesAuditing: Control & Substantive Tests in Personnel & Payroll by David N. RicchiuteTri Yuli ManurungNo ratings yet

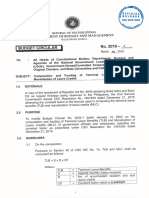

- BC 2016 - 2 - Computation and Funding of Terminal Leave Benefits and Monetization of Leave Credits PDFDocument3 pagesBC 2016 - 2 - Computation and Funding of Terminal Leave Benefits and Monetization of Leave Credits PDFGlenn RomanoNo ratings yet

- Payment of Gratuity ActDocument32 pagesPayment of Gratuity ActPrikshit SainiNo ratings yet

- TZ Public Service Pay and Incentive Policy. PDFDocument37 pagesTZ Public Service Pay and Incentive Policy. PDFNicole TaylorNo ratings yet

- Form 16: Wipro LimitedDocument6 pagesForm 16: Wipro LimitedSanjay RamuNo ratings yet

- Benefit CalculationsDocument52 pagesBenefit Calculationsananth-jNo ratings yet

- Owner in Good Faith B-P-S in Good Faith Materials Owner in Good FaithDocument1 pageOwner in Good Faith B-P-S in Good Faith Materials Owner in Good FaithZymon Andrew MaquintoNo ratings yet

- Affidavit1 17398Document1 pageAffidavit1 17398Mahitha ManiNo ratings yet

- Z June 2018 Module 2.06 (Suggested Solutions)Document20 pagesZ June 2018 Module 2.06 (Suggested Solutions)M Nasir ArifNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- TOPICS Income TaxDocument9 pagesTOPICS Income TaxJaizer TimbrezaNo ratings yet

- Provident Fund ApplicationDocument3 pagesProvident Fund ApplicationSouban Javed100% (1)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet