Professional Documents

Culture Documents

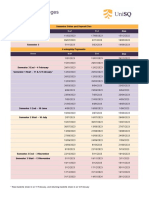

PBC List For RFP

Uploaded by

MDS TeamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PBC List For RFP

Uploaded by

MDS TeamCopyright:

Available Formats

Washburn University

FYE June 30, 2019

Schedules to be Prepared by Client

General Items Requested:

Please prepare confirmations for the following. All confirmations should be prepared as of 6/30/19.

(1)

Please mail all prepared confirmations to the attention of

a. Year end funds held at State municipal investment pool

b. Year end certificate of deposit balances

c. Year end other investment balances held directly by the University

d. Sales tax received from the State during FY 2019

e. Property tax received from Shawnee County during FY 2019

f. Year end revenue bonds and KBOR loans

(2) Draft of MD&A document for our review

(3) Draft the Report including footnote disclosures

Draft the Supplemental Disclosures

Other Items Requested Prior to Final Fieldwork:

Copies of all agreements/contracts entered into during FYE 6/30/19. (notes receivable, notes payable,

LOCs, leases-operating and capital, commissions, incentive compensation/bonuses, deferred

(4)

compensation, repurchase, post-retirement, severance, employee/personnel guide, benefit plans,

Trust Agreements etc.)

(5) Year-end trial balances - BAQE and SNA detail for Washburn U and Washburn Tech

Items Requested for Final Fieldwork:

Cash

(6) Updated cash control matrix that we provided at interim

(7) Copies of bank reconciliations at 1/31/19 and 6/30/19 for all cash and cash equivalent accounts

(8) Detail listing of all reconciling items supporting 6/30/19 bank reconciliations

(9) Copies of banks statements for the months ending 1/31/19, 6/30/19 and 7/31/19

(10) Listing of all checks processed and held at year end

Listing of intercompany/interbank transfers occurring 5 business days before and after YE over

(11)

$100,000.

(10a) The January P-Card Statement (corporate credit card)

Investments

(10) Listing of collateral pledged against deposit account balances at 6/30/19

S:\FinanceOffice\Accounting\Audit\FY19 Audit\1 - General\180 PBC workpapers\PBC lisr for RFP.xlsx 1

(11) 6/30/19 audited financial statements for Washburn University Foundation

(13a) The St******er Investment Statements

Accounts/Notes Receivable

Detail listing of Student Accounts Receivable as of June 30, 2019 and reconciliation to the general

(12)

ledger balance

(13) Schedule of Allowance for Uncollectible Accounts as of June 30, 2019

Detailed summary of cash collections received subsequent to year-end on student account balances

(14)

that were outstanding at 6/30/19

From the schedule of sales tax receipts provided on the confirmation sent to the state of Kansas, we

(13) will select individual receipts and vouch to notifications received from the State and proof of receipt on

the operating bank account statement. Please have these schedules available.

Schedule of "DRC Fund - Calculation of Property Taxes Receivable" & "Tort Claim Fund Calculation of

(14)

Property Taxes Receivable" for 6/30/19

(15) Proof of subsequent receipt of 5/2019 and 6/2019 Sales Taxes

Provide the detail for the Perkin's receivable. This should be year end reports from the UAS detailing

(16)

loans receivable by classification

Tuition revenue detail obtained from Director of Budget detailing credit hours by fee type for the

(21a) purpose of developing the 2019 FY budget. This schedule is developed from banner using "5th week"

enrollment figures (enrollment after the deadline for dropping courses).

(21b) Calculation/spreadsheet of tuition and housing discounts obtained from RT

(21c) FY 2019 enrollment by class, resident and non-resident.

WUF Receivable

(17) Confirmation from WUF showing Due to Washburn University by classification

Detail listing of: Pledges, Life Insurance, Endowment Balances, and Cash Available Balances

(18)

confirmed by WUF

(19) Update WUF Memo and include any changes/modifications in the current year

Detail of current and non-current "Receivable from Washburn University Foundation" that will reconcile

(20)

to the confirmation from Jim Stogsdill

(21) Cash Flow Report of all outstanding pledges - aging schedule 6/30/19

(22) WUF summary of net income available by fund for the first half of CY 2019

(23) WUF summary of net income available by fund through 6/30/2019

(24) WUF report titled "Summary of Transactions on Available Funds" for FY 2019

(25) WUF report showing 2019 rollforward of quasi-endowed funds attributed to KTWU

S:\FinanceOffice\Accounting\Audit\FY19 Audit\1 - General\180 PBC workpapers\PBC lisr for RFP.xlsx 2

Inventory

(26) Report showing final count for all bookstore inventory counted at year end.

(27) Please provide a detail of instructions used for the Fiscal Year-End Inventory for FYE 2019

Property, Plant & Equipment

(28) Schedule of Capital Assets, Net of Depreciation

Fixed asset detail including a rollforward of fixed assets and accumulated depreciation To be used for

(29)

footnote support and cash flow calculation.

(30) Rollforward and Detail of Construction in Progress at 6/30/19

(31) Detail of Projects in Progress at 6/30/19

Provide a list of fixed asset additions during the CY. This list should include description, life of asset,

(31)

cost, and CY depreciation taken.

Provide a list of fixed asset disposals during the CY. This list should include description, CY Depr.

(32)

Expense, Accumulated Depreciation, Gain/Loss, and any proceeds received.

Have available upon request supporting documentation for capital asset additions or disposals in

(33)

excess of $250,000.

(34) Schedule of Capitalized Interest

(35) General ledger detail for all Repairs & Maintenance Expense accounts greater than $50,000.

Prepaid Expenses/Other Assets

Provide a detail supporting all 6/30/19 prepaid expenses over $50,000, nature of the prepaid,

(36)

amortization period, etc. and a reconciliation of the expense side of the more significant prepaids.

Accounts Payable

Detail of listing of Accounts Payable at 6/30/19, with reconciliation to general ledger, for all funds.

(37)

Please provide this detail in excel.

(38) General ledger detail of Accrued Expenses (for Washburn and Washburn Tech)

(39) Internally produced health insurance claims history report

(40) Health insurance claims IBNR calculation along with claims history reports from BCBS

Provide a detail of all check registers (in excel) subsequent to year end up until date of fieldwork and

(41)

please pull invoices over $250,000 on the subsequent check register.

(40) Calculation of WU ERIP and WIT OPEB liabilities

Bonds Payable

Rollforward of any bonds payable, including beginning balance, additions, capitalized interest payments

(41) and ending balance. Schedule of accrued interest showing beginning balance, interest expense,

interest paid, and ending balance.

S:\FinanceOffice\Accounting\Audit\FY19 Audit\1 - General\180 PBC workpapers\PBC lisr for RFP.xlsx 3

(42) Amortization of premium and issuance cost of bonds.

(43) Calculation of economic gain on all refunded bonds

Accrued Expenses

Schedule of accrued compensated absences by department as of 6/30/19. Also need calculation of

estimated amount of accrued compensated absences that will be used by employees during the next

(44)

calendar year. Please provide details about how much of this balance should be classified as short

term and long term liability.

Schedule of accrued salaries and payroll taxes at 6/30/19. Include copies of supporting documentation

(45)

for the 1st payroll period paid in July 2019.

(46) Detail of TIAA-CREF accrual for 6/30/19

(47) Calculation of Deferred Tuition Revenue

(48) Listing by individual of Housing Deposits.

(49) Listing by individual of Damage Deposits.

Net Assets

(50) Please prepare the rollforward of Net Assets and the net asset breakdown.

Revenues, Expenses, Report Disclosures

A comprehensive analytical review on selected operating expense accounts and/or programs will be

(51) performed during audit fieldwork. We will provide you with a list of accounts with significant fluctuations

from prior year for explanations and corroborating evidence to support all comments.

The "Student Credit Hours" Report by term and residency and student type for 2019. Also include the

(52)

report for summer 2019 classes.

Student detail used to create the "Student Credit Hours" report (in the prior year, this report was

(53)

referred to as "20th Day Enrollment Census" information)

Schedule of Washburn Tech secondary and post secondary headcount for Fall 2018 and Spring 2019

(54)

semesters by course.

Report from Residential Life showing occupancy rates in all dormitories for Fall 2018 and Spring 2019

(55)

semesters. Please also include a blank residential contract showing room and board pricing.

(56) Report showing head count by department for FYE 2019

(57) Please provide a list of journal entries made during the year in excel.

S:\FinanceOffice\Accounting\Audit\FY19 Audit\1 - General\180 PBC workpapers\PBC lisr for RFP.xlsx 4

You might also like

- Institute and Faculty of Actuaries Examination: Subject CM1B - Actuarial Mathematics Core PrinciplesDocument3 pagesInstitute and Faculty of Actuaries Examination: Subject CM1B - Actuarial Mathematics Core PrinciplesarunNo ratings yet

- f3 Specimen j14 PDFDocument21 pagesf3 Specimen j14 PDFBestNo ratings yet

- F3 Specimen Exam 2014 PDFDocument21 pagesF3 Specimen Exam 2014 PDFgrrrklNo ratings yet

- Group Assignments Acc 217Document4 pagesGroup Assignments Acc 217Phebieon MukwenhaNo ratings yet

- Communication SBAsDocument5 pagesCommunication SBAsNikit DesaiNo ratings yet

- Specimen Examen F3 AccaDocument21 pagesSpecimen Examen F3 AccaGNo ratings yet

- Events After The Reporting Period (IAS 10)Document16 pagesEvents After The Reporting Period (IAS 10)AbdulhafizNo ratings yet

- Consolidated Financial Statements For Bank Holding Companies-FR Y-9CDocument56 pagesConsolidated Financial Statements For Bank Holding Companies-FR Y-9CamiistNo ratings yet

- AssignmentDocument3 pagesAssignmentDùķe HPNo ratings yet

- Consolidated Financial Statements For Holding Companies-FR Y-9CDocument65 pagesConsolidated Financial Statements For Holding Companies-FR Y-9CarunNo ratings yet

- 7 Consolidation Package - TemplateDocument369 pages7 Consolidation Package - TemplateOUSMAN SEIDNo ratings yet

- Major Project Specification BAFI1065 82284290Document1 pageMajor Project Specification BAFI1065 82284290Zain NaeemNo ratings yet

- 161 Quiz CH 6 Debt Sevice KEYDocument2 pages161 Quiz CH 6 Debt Sevice KEYChao Thao100% (1)

- Audit of General Insurance CompaniesDocument20 pagesAudit of General Insurance CompaniesZiniaKhanNo ratings yet

- May 28 2019-C1bDocument62 pagesMay 28 2019-C1bWL TribuneNo ratings yet

- Case Studies On Accounting & Auditing Standards: Lucknow Chartered Accountants' SocietyDocument12 pagesCase Studies On Accounting & Auditing Standards: Lucknow Chartered Accountants' SocietyReema TembhurkarNo ratings yet

- Sa f7 Preparation All McqsDocument21 pagesSa f7 Preparation All McqsCharles Adonteng67% (3)

- Draft Amendment in The Nature of A Substitute December 14, 2012 - Chairman Phil MendelsonDocument8 pagesDraft Amendment in The Nature of A Substitute December 14, 2012 - Chairman Phil MendelsonSusie CambriaNo ratings yet

- Ffa Past Paper 3 (F3)Document21 pagesFfa Past Paper 3 (F3)Shereka EllisNo ratings yet

- Chapter 19 Interim ReportingDocument6 pagesChapter 19 Interim ReportingEllen MaskariñoNo ratings yet

- 1 Topic Tutorial PTD AFU08605-TUTORIAL SET-1-2022Document5 pages1 Topic Tutorial PTD AFU08605-TUTORIAL SET-1-2022John diggleNo ratings yet

- Mid-Term Revision Exercises (ch4-5)Document3 pagesMid-Term Revision Exercises (ch4-5)Cheuk Ying NicoleNo ratings yet

- Report of Disbursement - 1st QuarterDocument2 pagesReport of Disbursement - 1st Quartertesdaro12No ratings yet

- 20 Government Accounting - ANSWER KEYDocument4 pages20 Government Accounting - ANSWER KEYRica ManaloNo ratings yet

- ACFrOgBfohBN8hE0dT33pLz5eb756Gdk6-qUJtyRFFaNNpNtAmTzQTgrEBH nTVcyGWWRNNrWxMRVKZjAPpUNRm61nvXxp7znKrN66nYDb3 C vHsDdyxlX0UEi5hlCV8kPr0sH321Yhy5zg7UFDocument8 pagesACFrOgBfohBN8hE0dT33pLz5eb756Gdk6-qUJtyRFFaNNpNtAmTzQTgrEBH nTVcyGWWRNNrWxMRVKZjAPpUNRm61nvXxp7znKrN66nYDb3 C vHsDdyxlX0UEi5hlCV8kPr0sH321Yhy5zg7UFColdBruNo ratings yet

- Chapter 009 Test BankDocument13 pagesChapter 009 Test Banknadecho1No ratings yet

- Budget Call Circular 2020 21Document26 pagesBudget Call Circular 2020 21National Highway AuthorityNo ratings yet

- DM Salas FInance 3Document3 pagesDM Salas FInance 3Jomar's Place SalasNo ratings yet

- Final Audit - Insurance Audit Notes PDFDocument9 pagesFinal Audit - Insurance Audit Notes PDFBhavin Nilesh PandyaNo ratings yet

- TB and FRDocument11 pagesTB and FRPia Bianca ManulatNo ratings yet

- Inter P-5 New Dec-10 PaperDocument6 pagesInter P-5 New Dec-10 PaperBrowse PurposeNo ratings yet

- Budet Manual and Constitution 1Document134 pagesBudet Manual and Constitution 1Police Station Mauli JagranNo ratings yet

- 1.pilot Paper 1Document21 pages1.pilot Paper 1Eugene MischenkoNo ratings yet

- JB Hi Fi Familiarisation ExerciseDocument2 pagesJB Hi Fi Familiarisation ExerciseRobertNo ratings yet

- FR MJ23 Examiner's Report - FINALDocument24 pagesFR MJ23 Examiner's Report - FINALdeepshikhagupta514No ratings yet

- Budget Call Circular 2020 21Document26 pagesBudget Call Circular 2020 21KAMRAN ALINo ratings yet

- Reappropriation of AccountsDocument8 pagesReappropriation of AccountsZeeshan AjmalNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- Test Bank Solutions For Government and Not For Profit Accounting Concepts and Practices 5thDocument25 pagesTest Bank Solutions For Government and Not For Profit Accounting Concepts and Practices 5thAnonymous 1m13hVlta733% (3)

- Management Directive: Overnor S FficeDocument12 pagesManagement Directive: Overnor S FficeAnji SanagalaNo ratings yet

- SMR For BIR-uploadDocument1 pageSMR For BIR-uploadRich Gatdula100% (6)

- Chapter 12 - Events After The Reporting PeriodDocument3 pagesChapter 12 - Events After The Reporting PeriodFerb CruzadaNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument4 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- UZ LB 301 - July 2020Document4 pagesUZ LB 301 - July 2020Clayton MutsenekiNo ratings yet

- Test Papers - Intermediate Group IDocument8 pagesTest Papers - Intermediate Group IRohan Jeckson RosarioNo ratings yet

- AF210 ExamDocument11 pagesAF210 ExamrobkhNo ratings yet

- Corpo Housekeeping PresentationDocument27 pagesCorpo Housekeeping PresentationRachell RoxasNo ratings yet

- COA Cir No. 80-65-A-Submission of FS For AFRDocument3 pagesCOA Cir No. 80-65-A-Submission of FS For AFRcrizalde m. de diosNo ratings yet

- Budget Guildlines 2023-24 GO.207Document9 pagesBudget Guildlines 2023-24 GO.207EE MI NandyalNo ratings yet

- Intermediate Group I Test PapersDocument57 pagesIntermediate Group I Test Paperssantbaksmishra1261No ratings yet

- PCNC ChecklistDocument3 pagesPCNC Checklistmrbsespkmg LawNo ratings yet

- Accounting ManualDocument273 pagesAccounting Manualkailasasundaram100% (3)

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Wiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2016: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Update Your Subaru Navigation Maps in Just A Few Easy Steps!Document2 pagesUpdate Your Subaru Navigation Maps in Just A Few Easy Steps!huyhnNo ratings yet

- Tuition Fee - Public - 2018 - 2019 Pasacasarjana PDFDocument1 pageTuition Fee - Public - 2018 - 2019 Pasacasarjana PDFkoreswilsonNo ratings yet

- Jabra Step Wireless User Manual RevB - EN PDFDocument16 pagesJabra Step Wireless User Manual RevB - EN PDFShanewilks58No ratings yet

- Your Financial Review Checklist: For Even The Smallest Business, Periodic Financial Reviews Are A Fact of LifeDocument2 pagesYour Financial Review Checklist: For Even The Smallest Business, Periodic Financial Reviews Are A Fact of LifeMDS TeamNo ratings yet

- Jabra Step Wireless User Manual RevB - EN PDFDocument16 pagesJabra Step Wireless User Manual RevB - EN PDFShanewilks58No ratings yet

- Final - Eng - Arrival Guidelines For International Travelers To IndonesiaDocument20 pagesFinal - Eng - Arrival Guidelines For International Travelers To IndonesiaMDS TeamNo ratings yet

- Prepared For: Lecturer's Name: Ms. Najwatun Najah BT Ahmad SupianDocument8 pagesPrepared For: Lecturer's Name: Ms. Najwatun Najah BT Ahmad SupianBrute1989No ratings yet

- An Overview of Asset Protection DocumentationDocument4 pagesAn Overview of Asset Protection Documentationjan l.No ratings yet

- Chapter 7Document45 pagesChapter 7Chitose HarukiNo ratings yet

- Biel CITY BANKDocument1 pageBiel CITY BANKogaNo ratings yet

- RES411: ..Mathematics.. of ..Valuation.Document28 pagesRES411: ..Mathematics.. of ..Valuation.faith siahNo ratings yet

- EU DirectivesDocument67 pagesEU DirectivesNazneen SabinaNo ratings yet

- Credit Transaction Notes (Incomplete)Document16 pagesCredit Transaction Notes (Incomplete)Antoinette Janellie TejadaNo ratings yet

- Reserve Bank of IndiaDocument40 pagesReserve Bank of IndiahakecNo ratings yet

- Accounting EquationsDocument2 pagesAccounting EquationsRavi UdeshiNo ratings yet

- 4.6 Balance of PaymentsDocument25 pages4.6 Balance of PaymentsMatthew CNo ratings yet

- FY19 Green BookDocument283 pagesFY19 Green Bookandre yoke himawanNo ratings yet

- Budget: Prepared By: Joseph R. Mendoza CPA, MBADocument5 pagesBudget: Prepared By: Joseph R. Mendoza CPA, MBApot poootNo ratings yet

- Test 1 Cheat SheetDocument3 pagesTest 1 Cheat SheetGabi FelicianoNo ratings yet

- Schedule of Fees 2023Document1 pageSchedule of Fees 2023AhsanNo ratings yet

- Universitas Tadulako: Kementerian Pendidikan, Kebudayaan, Riset, Dan TeknologiDocument2 pagesUniversitas Tadulako: Kementerian Pendidikan, Kebudayaan, Riset, Dan TeknologiYudi Indra SusantoNo ratings yet

- Indian Stock MarketDocument60 pagesIndian Stock Marketmokshasinchana100% (1)

- Spouses Tirso Vintola and Loreta Dy VS Insular Bank of Asia and AmericaDocument2 pagesSpouses Tirso Vintola and Loreta Dy VS Insular Bank of Asia and AmericaEvangeline OngNo ratings yet

- 06-Receivables TheoryDocument2 pages06-Receivables TheoryRegenLudevese100% (4)

- The Power Tends To Corrupt, Absolute Powers Corrupts AbsolutelyDocument3 pagesThe Power Tends To Corrupt, Absolute Powers Corrupts AbsolutelySuci SabillyNo ratings yet

- Wharton Business Essentials For Executives PDFDocument8 pagesWharton Business Essentials For Executives PDFRubi ZimmermanNo ratings yet

- Customer Relationship ManagementDocument88 pagesCustomer Relationship Managementphanindra_madasu0% (1)

- KMV Merton ModelDocument36 pagesKMV Merton ModelAhmad Munir Abdullah0% (1)

- GROUP ASSIGNMENT - 7-ELEVEN COMPANY - PDFDocument17 pagesGROUP ASSIGNMENT - 7-ELEVEN COMPANY - PDFNurul AzlinNo ratings yet

- Info - BOP Tier 2 Capital InstrumentDocument6 pagesInfo - BOP Tier 2 Capital InstrumentInformation everythingNo ratings yet

- CFO April May 2020 PDFDocument52 pagesCFO April May 2020 PDFDaniel EstebanNo ratings yet

- Market Strcuture of Banking IndustryDocument8 pagesMarket Strcuture of Banking IndustryNatala WillzNo ratings yet

- How To Start Trading The No BS Guide PDFDocument43 pagesHow To Start Trading The No BS Guide PDFZac Ver100% (2)

- Econ 100.1 - Problem Set 2 - Answer KeyDocument4 pagesEcon 100.1 - Problem Set 2 - Answer KeyjevieNo ratings yet

- 1 Amalgamation FlowchartDocument2 pages1 Amalgamation FlowchartHarith HnryusanNo ratings yet

- Trading The Elliott Wave Indicator. Winning Strategies For Timing Entry & Exit Moves. R. Prechter. EWI - mp4Document2 pagesTrading The Elliott Wave Indicator. Winning Strategies For Timing Entry & Exit Moves. R. Prechter. EWI - mp4laxmicc33% (3)