Professional Documents

Culture Documents

Math Ils 2

Uploaded by

therese sonzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Math Ils 2

Uploaded by

therese sonzaCopyright:

Available Formats

INDEPENDENT LEARNING SESSION NO.

BUYING AND SELLING

PROFIT AND LOSS

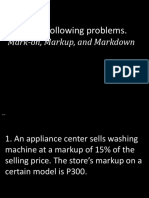

Answer the following questions. Show your solutions.

1. A liter of natural drinking water cost P18.50. When it is sold for P25, how much is the markup of

the drinking water?

2. A package of 50 chocolates that cost P634.50 was sold, and the total income from reselling it

was P750. What was the selling price, unit cost, and unit mark-on of the chocolates?

3. What is the rate of mark-on based on cost for a stand-alone drawer that is being sold for

P899.75 if it costs P779.75?

4. An ABM Student buys a pad of yellow paper (50sheets) for P50.75 and resell it for P2 per sheet

to his classmates, compute the rate of mark-on based on cost.

5. If the selling price of an item has been increased from P495 to P650, what is the mark-up rate?

6. What is the new selling price of a smart TV worth P34,999 when the store manager decided to

give a markdown rate of 15% on all items as part of the store’s 15 th year anniversary promo?

7. To boost the sales of your store, you decided to apply a markdown rate of 35% on all items. If

the original price of an item was P790, what is its new selling price?

8. What is the net price of an item listed for P55,780 and has a trade discount series of 20/15/10?

What is the equivalent single rate for the discount series?

9. Your store manager received an invoice dated April 29 amounting to P4,950 with terms of 10/15

and n/30. How much cash discount was given by your supplier if the invoice was paid on May 5?

10. Determine the Cost of Goods sold if company records show that your company has a beginning

inventory of P2,464,000, purchases of P765,432 and ending inventory of P915,000.

11. Based on the accounting record, your firm has an ending inventory of P 675,489, and its cost of

goods sold was P987,654. If you have a beginning inventory of P524,310 on record, what is the

amount of purchases that your firm made?

12. The manager reported that the net sales for the month was P975,690 and the gross sales was

P1,024,650. How much was the sales returns and allowances of the company?

13. What is your gross sales if your net sales is P876,543, sales returns and allowances amount to

P210,000, and discount is P25,000?

14. Your business partner informed you that the average monthly cost of goods sold was P45,075

and the desired profit was 35% of the average monthly cost of goods sold. Calculate the

required monthly net sales of your business.

15. Compute the net profit/loss of a business that has a gross profit of P124,500 and operating

expenses is P76,825.

16. If a young entrepreneur declared a net profit of P56,270 from her gross profit of P175,480 last

month, how much were the operating expenses that he incurred?

17-20. You own a small business that sells snacks. Your record shows the following

ITEM SELLING PRICE VARIABLE COST PERCENT OF SALES

Burger P35 P15

Lumpia P20 P7

Turon P15 P5

Mineral Water P20 P11

You decided to join the market fair, so you rented one booth for P5,000 per day. You estimated your

labor cost to be P800

a. What is your BEP in pesos per day?

b. How much of each item would you expect to sell per day to break even?

You might also like

- Bussiness Math Quiz 2 SonzaDocument2 pagesBussiness Math Quiz 2 Sonzatherese sonzaNo ratings yet

- August 1 2 8 9 15 16 Trade DiscountDocument26 pagesAugust 1 2 8 9 15 16 Trade DiscountEDSERLITO REÑOS100% (2)

- 2QUIZ3 - With AnswerDocument1 page2QUIZ3 - With AnswerMarilyn Nelmida Tamayo100% (1)

- Preliminary ExamDocument2 pagesPreliminary ExamMichael Angelo BunyiNo ratings yet

- Worksheet Business MathDocument9 pagesWorksheet Business MathShela RamosNo ratings yet

- Buying and SellingDocument35 pagesBuying and SellingIreneRoseMotas100% (3)

- BES Module 2Document18 pagesBES Module 2Celyn DeañoNo ratings yet

- Week 7 - Profit and Loss Week 8 - Break-Even Point: Business Math Leap - W7 & W8Document23 pagesWeek 7 - Profit and Loss Week 8 - Break-Even Point: Business Math Leap - W7 & W8david austriaNo ratings yet

- Business Math 2Document46 pagesBusiness Math 2joel alanoNo ratings yet

- Profit and LossDocument11 pagesProfit and Lossdarlene martinNo ratings yet

- Lesson 7 - Buying and SellingDocument50 pagesLesson 7 - Buying and SellingJohn Philip Echevarria100% (1)

- Buying and SellingDocument20 pagesBuying and Sellingmaine50% (2)

- Module 4 Acc Fevelyn R EcotDocument9 pagesModule 4 Acc Fevelyn R EcotMary Cris DalumpinesNo ratings yet

- Word Problem Statement of Comprehensive IncomeDocument1 pageWord Problem Statement of Comprehensive IncomeRyan San Juan0% (4)

- Business Mathematics: Quarter 1, Week 7-Module 11 Differentiate Profit From Loss - ABM - BM11BS-Ii-6Document11 pagesBusiness Mathematics: Quarter 1, Week 7-Module 11 Differentiate Profit From Loss - ABM - BM11BS-Ii-6Dave Sulam100% (1)

- SLO BUSINESS MATH QTR 2 Wk1Document9 pagesSLO BUSINESS MATH QTR 2 Wk1Alma Dimaranan-AcuñaNo ratings yet

- Gross Profit and LossDocument5 pagesGross Profit and Lossjay oroyanNo ratings yet

- AQIB Break Even AnalysisDocument22 pagesAQIB Break Even AnalysisArmaghan BhattiNo ratings yet

- UntitledDocument7 pagesUntitledIan VinoyaNo ratings yet

- Module 7. Mathematics of Buying and SellingDocument6 pagesModule 7. Mathematics of Buying and SellingMicsjadeCastilloNo ratings yet

- Problem #2 Statement of Financial PositionDocument1 pageProblem #2 Statement of Financial PositionJhazz KyllNo ratings yet

- Entrep Forecasting RevenueDocument29 pagesEntrep Forecasting RevenueKevin GatanNo ratings yet

- Business Math PROFIT AND LOSSDocument14 pagesBusiness Math PROFIT AND LOSSalcanciadokarl605No ratings yet

- Assignment No. 3 Profit Planning CP AnalysisDocument5 pagesAssignment No. 3 Profit Planning CP AnalysisBEA CATANEONo ratings yet

- 05 Cost Volume Profit Analysis 2022Document7 pages05 Cost Volume Profit Analysis 2022Elle WoodsNo ratings yet

- 4 Common TesdaDocument4 pages4 Common TesdaStevenNo ratings yet

- Dee Hwa Liong Academy: Buying and SellingDocument21 pagesDee Hwa Liong Academy: Buying and SellingkelvinNo ratings yet

- Cost - Volume - Profit AnalysisDocument36 pagesCost - Volume - Profit AnalysisAndrea Bercy CoballesNo ratings yet

- Profit or LossDocument22 pagesProfit or LossArmea Torreliza BanaagNo ratings yet

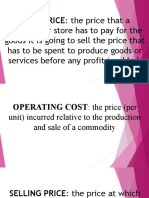

- COST PRICE: The Price That ADocument47 pagesCOST PRICE: The Price That AAlma Agnas100% (3)

- Entrep Module 8Document8 pagesEntrep Module 8Trisha BantingNo ratings yet

- CVP AnalysisDocument2 pagesCVP AnalysisJackielou BasaNo ratings yet

- Cookery m4Document5 pagesCookery m4Nheedz Bawa JuhailiNo ratings yet

- Business Math Profit or LossDocument1 pageBusiness Math Profit or LossAnonymous DmjG6o100% (2)

- Business Math - Profit or LossDocument1 pageBusiness Math - Profit or LossFaith D Villasor100% (1)

- Wil To Play and PopTV Presentation DISTRIBUTORDocument54 pagesWil To Play and PopTV Presentation DISTRIBUTORBilly Gabriel M. Racho IINo ratings yet

- Trade Discount - Supplementary ProblemsDocument2 pagesTrade Discount - Supplementary ProblemsRafael OcampoNo ratings yet

- Mark Up Versus MarginDocument18 pagesMark Up Versus MarginCaryl GalocgocNo ratings yet

- Busmath-Markup Markdown and MarkonDocument23 pagesBusmath-Markup Markdown and MarkonCharisse RizonNo ratings yet

- Grade 7 Cookery Lesson 5Document9 pagesGrade 7 Cookery Lesson 5yuyiguftfNo ratings yet

- Bus Math Grade 11 Q1 M1 W5Document7 pagesBus Math Grade 11 Q1 M1 W5Ronald AlmagroNo ratings yet

- PrefinalDocument2 pagesPrefinalDonil PedrasaNo ratings yet

- Business Math Module 11Document9 pagesBusiness Math Module 11James Earl AbainzaNo ratings yet

- Costing ActivityDocument2 pagesCosting Activitygene roy hernandezNo ratings yet

- 4.1 Problem Solving Buying SellingDocument11 pages4.1 Problem Solving Buying SellingKate BambalanNo ratings yet

- Activity Sheets in Fundamentals of Accountanc2Document5 pagesActivity Sheets in Fundamentals of Accountanc2Irish NicolasNo ratings yet

- CVP Cost For IEDocument1 pageCVP Cost For IEValerie Aubrey Luna BeatrizNo ratings yet

- 01 - Cost-Volume-Profit AnalysisDocument56 pages01 - Cost-Volume-Profit AnalysisSuzanne SenadreNo ratings yet

- Markup, ...Document10 pagesMarkup, ...Juanito0% (6)

- Group Activity Questions Buss. MathDocument1 pageGroup Activity Questions Buss. MathIreneRoseMotas100% (1)

- LT - 081914Document8 pagesLT - 081914Jun Guerzon PaneloNo ratings yet

- ACC111 Activity 31Document4 pagesACC111 Activity 31Cali SiobhanNo ratings yet

- Break Even AnalysisDocument22 pagesBreak Even Analysiskhirad afNo ratings yet

- Module 4. Practice Set 6 AnswersDocument2 pagesModule 4. Practice Set 6 AnswersRonna Mae DungogNo ratings yet

- Buying and SellingDocument54 pagesBuying and SellingAna Valenzuela75% (4)

- Potato Chip Economics: Everything You Need to Know About Business Clearly and Concisely ExplainedFrom EverandPotato Chip Economics: Everything You Need to Know About Business Clearly and Concisely ExplainedNo ratings yet

- Full Beds Forever: How to Market Your Care Home in 3 Simple StepsFrom EverandFull Beds Forever: How to Market Your Care Home in 3 Simple StepsNo ratings yet

- Small Island Big Business: The Insider's Guide to Success in the British MarketFrom EverandSmall Island Big Business: The Insider's Guide to Success in the British MarketNo ratings yet

- The Effects of Using FacebookDocument2 pagesThe Effects of Using Facebooktherese sonzaNo ratings yet

- Acctg Ils 2Document2 pagesAcctg Ils 2therese sonzaNo ratings yet

- Unadjusted Trial Balance Adjustments Adjusted Trial BalanceDocument3 pagesUnadjusted Trial Balance Adjustments Adjusted Trial Balancetherese sonzaNo ratings yet

- Unadjusted Trial Balance Adjustments Adjusted Trial BalanceDocument3 pagesUnadjusted Trial Balance Adjustments Adjusted Trial Balancetherese sonzaNo ratings yet

- Acctg Ils 2Document2 pagesAcctg Ils 2therese sonzaNo ratings yet

- Biography of Jane AustenDocument1 pageBiography of Jane Austentherese sonzaNo ratings yet

- Executive Summary - Sena Kalyan Insurance Co. LTDDocument1 pageExecutive Summary - Sena Kalyan Insurance Co. LTDImran KhanNo ratings yet

- Hsslive Xii Acc 5 Dissolution of A Partnership Firm QNDocument6 pagesHsslive Xii Acc 5 Dissolution of A Partnership Firm QN6E13 ALMubeenNo ratings yet

- Test 3 - PM - ADocument16 pagesTest 3 - PM - ADữ NguyễnNo ratings yet

- Ind As Summary Charts PDFDocument47 pagesInd As Summary Charts PDFVinayak50% (2)

- Winter 2022-FMGT 2152 Team ProjectDocument3 pagesWinter 2022-FMGT 2152 Team ProjectKCNo ratings yet

- Module 5A CBO Corporate Banking Topic 1Document17 pagesModule 5A CBO Corporate Banking Topic 1RajabNo ratings yet

- PDF Abm 11 Famb1 q1 w4 Mod5 DDDocument18 pagesPDF Abm 11 Famb1 q1 w4 Mod5 DDMargie Sorquiano Abad QuitonNo ratings yet

- FA3Document17 pagesFA3krishnendu_balNo ratings yet

- DRHP AimlDocument636 pagesDRHP AimlSubscriptionNo ratings yet

- Sino ForestDocument14 pagesSino Forest靳雪娇0% (1)

- Untitled DocumentDocument2 pagesUntitled DocumentPeter Jun ParkNo ratings yet

- Problems - Adjusting EntriesDocument3 pagesProblems - Adjusting EntriesaNo ratings yet

- RFBT 34corp1-2Document1 pageRFBT 34corp1-2Emmanuel TeoNo ratings yet

- Project Report-Corporate RestructuringDocument26 pagesProject Report-Corporate Restructuringchahvi bansal100% (1)

- Project On Ratio and Cash Flow Analysis For Titan Industries PVTDocument15 pagesProject On Ratio and Cash Flow Analysis For Titan Industries PVTRita100% (3)

- Risk in Capital Structure Arbitrage 2006Document46 pagesRisk in Capital Structure Arbitrage 2006jinwei2011No ratings yet

- Adjusting Trial BalanceDocument15 pagesAdjusting Trial BalancejepsyutNo ratings yet

- Fin223 Group 39Document13 pagesFin223 Group 39Xenos KhewNo ratings yet

- Ma. Acctng.Document7 pagesMa. Acctng.Kaname KuranNo ratings yet

- Summative Test in Business FinanceDocument1 pageSummative Test in Business FinanceRhea Jane V. CagasNo ratings yet

- Chapter VIII - Duties of DirectorsDocument11 pagesChapter VIII - Duties of DirectorsSui100% (2)

- Higher.: Similar Assets I A Market That Is Not ActiveDocument2 pagesHigher.: Similar Assets I A Market That Is Not ActiveAia SmithNo ratings yet

- Principal Notification Letter For E-CashDocument2 pagesPrincipal Notification Letter For E-CashAizat HermanNo ratings yet

- ACCT 215 - Introductory Financial Accounting I: Course DescriptionDocument5 pagesACCT 215 - Introductory Financial Accounting I: Course DescriptionJayden FrosterNo ratings yet

- Summary of IFRS 12Document3 pagesSummary of IFRS 12Dwight BentNo ratings yet

- Dokumen - Pub Derivatives Theory and Practice 1nbsped 1119595592 9781119595595Document872 pagesDokumen - Pub Derivatives Theory and Practice 1nbsped 1119595592 9781119595595Santiago HernándezNo ratings yet

- FABM2 Q1 PPT 3 - Statement of Changes in Owner's EquityDocument24 pagesFABM2 Q1 PPT 3 - Statement of Changes in Owner's EquitySpencer Marvin P. EsguerraNo ratings yet

- IJAAS Covid 19PandemicandFinancialReportingJoshiprintDocument10 pagesIJAAS Covid 19PandemicandFinancialReportingJoshiprintTaymaa OmoushNo ratings yet

- Financial Accounting: Tools For Business Decision Making: Chapter OutlineDocument218 pagesFinancial Accounting: Tools For Business Decision Making: Chapter Outline20073201 Nguyễn Thị Ngọc LanNo ratings yet

- Companies Act 2017Document167 pagesCompanies Act 2017muhammadnomanansari6441No ratings yet