Professional Documents

Culture Documents

Senior Sales Manager

Uploaded by

api-769298620 ratings0% found this document useful (0 votes)

26 views2 pagesSenior Sales Manager with 20 years experience looking for a Middle Management position.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSenior Sales Manager with 20 years experience looking for a Middle Management position.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views2 pagesSenior Sales Manager

Uploaded by

api-76929862Senior Sales Manager with 20 years experience looking for a Middle Management position.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 2

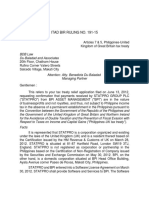

Patrick Flinn

12130 Laneview Drive 713-922-5583

Houston, Texas 77070 pf50e17a@westpost.net

PROFESSIONAL PROFILE

A highly accomplished Management and Business Development Executive with proven

record of growth and success in building businesses from startup to profitable o

perations, in highly competitive environments. Highly skilled in identifying ma

rket opportunities and developing effective implementation strategies, proven tr

ack record in setting tactical direction, executing to plan, optimizing operatio

ns and leading high-performance teams.

BACKGROUND SUMMARY

More than twenty years of varied experience includes:

Daily Operations Review Operations Optimization Turnaround Management

Strategic Planning New Business Development Mergers and Acquisitions

Client Relations Financial Management Change Leadership

Business Consolidations Capital Funds Development Investor Relations

Market Development Contract Negotiations Facilities Management

Corporate Finance Business Case Analysis Asset Optimization

EMPLOYMENT HISTORY

Industrial Investments Inc., Houston, Texas

Current Managing Direc

tor - Middle-Market Mergers & Acquisitions

Engage buyers and sellers of operating companies in the middle market industrial

manufacturing sectors in Texas, Oklahoma and Louisiana as a business intermedia

ry. Directs and oversees all aspects of systematic process for the successful c

ompletion of ownership transfers of private-held companies.

Risk Removal, Fort Collins, Colorado 2008 - 2009

Transition Operations Manager

Served as transition manager for this regional hazardous material abatement cont

ractor. Purchased by Morrow Holdings in September 2008, directed the ongoing da

y-to-day field service operations, installed new procedures and directed all mar

keting, project estimating, contracts and business development activities for th

is 18-year old firm.

Morrow Holdings, Denver, Colorado 2007 - 2008

Mergers & Acquisition Consultant

Identified and assessed privately-owned, small to mid-market companies for acqui

sition; concentrating on energy service companies in the Gulf Coast region and c

onstruction service companies in Colorado. Conducted assessment analysis on num

erous firms with $ 3million to $30 million in revenue.

Tanner Companies Inc., Houston, Texas 2006-2007

Chief Operating Officer

Concentrated on managed growth for this middle market Louisiana-based oil field

services company.

* Orchestrated the transition of a flat-structured, sole proprietor managed oil

field services company into a functional corporate structure with six operating

divisions, 10 facilities and 800 employees in two states. In the eight month tr

ansition, the company increased revenue by 20%, improved its profit margin; earn

ing $20 million in revenues in the first quarter 2007.

* Restructured the corporate accounting department of this $80 million revenue c

ompany in three months. A new staff was hired; new reporting processes and proc

edures were installed along with computer hardware and software programs in 60 d

ays.

* Directed the acquisition and assimilation of two oil field service companies o

ver a four-month period. These acquisitions enhanced revenue by $2.0 million a

month; held 20 percent net profit margin; and expanded the company's market reac

h to offshore oil and gas producers.

Industrial Investments Inc., Houston, Texas 2002-2006

Group Managing Director

Managed this mergers and acquisitions boutique firm founded in 1981.

* Launched the firm's first effort to concurrently represent a buying group seek

ing to purchase oil field services companies with revenues between $10 million a

nd $80 million and to secure financial partners and funding for the buying group

to fund the transaction. Over 30 companies were analyzed, four formal offers w

ere presented, and two accepted. Three private equity firms, two large asset le

nders and two hedge funds ultimately competed to be the financial partner. This

transaction was the largest ever handled by this 15-year old M&A firm.

* Secured the firm's first retained acquisition search contracts with two large

oil field manufacturing companies. Both contracts required monthly presentation

of vetted candidate companies for acquisition. Both clients made strategic acq

uisitions totaling over $50 million within the first year of our representation.

Educational Software Development, Houston, Texas 1992-2001

President

Built the company from startup to successful operations, supervising all aspects

of the business including product development, sales and marketing.

* Expanded this software development company's reach in focusing on the delivery

of educational courses and training for distance learning. This small company s

ecured contracts with the UK Government, the American Heart Association and the

University of Texas Medical Branch.

* Raised $2 million through private placements for research and development of a

pplications software for the control and delivery of distance learning courses o

ver the internet in 90 days. Business plans and projections were presented in s

everal forums in funding raising efforts.

Thrifty Car Rental, Honolulu, Hawaii 1990-1992

Franchisee

Purchased the Thrifty Car Rental franchise for the state of Hawaii with a privat

e equity partner.

Central Intelligence Agency, Langley, Virginia 1976-1990

Clandestine Service Officer

Served in both domestic and foreign assignments.

EDUCATION

Master of Science, Economics

Bachelor of Science, Economics

Colorado State University, Fort Collins, Colorado

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Strategic Level-2 (S6) Strategic Management: Part - Aweightage 15%Document7 pagesStrategic Level-2 (S6) Strategic Management: Part - Aweightage 15%Tabish RehmanNo ratings yet

- UnSigned TVSCS PL ApplicationDocument13 pagesUnSigned TVSCS PL ApplicationArman TamboliNo ratings yet

- Taxation Principles and Remedies Finals ReviewerDocument39 pagesTaxation Principles and Remedies Finals ReviewerRamilNo ratings yet

- ACCY 231: The Conceptual FrameworkDocument30 pagesACCY 231: The Conceptual FrameworkVinny AujlaNo ratings yet

- 3 Spreadsheet PR 3.5ADocument2 pages3 Spreadsheet PR 3.5ARizkyDirectioners'ZaynsterNo ratings yet

- Montes Et Al. (2016)Document16 pagesMontes Et Al. (2016)DiegoPachecoNo ratings yet

- Libta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingDocument21 pagesLibta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingAlexandru BogdanNo ratings yet

- The Oxford Business Report Djibouti 2016Document155 pagesThe Oxford Business Report Djibouti 2016Mahad AbdiNo ratings yet

- Wallstreetjournalasia 20170621 The Wall Street Journal AsiaDocument22 pagesWallstreetjournalasia 20170621 The Wall Street Journal AsiaKoutsoupisNo ratings yet

- History of Mutual FundDocument2 pagesHistory of Mutual FundArchana VishwakarmaNo ratings yet

- Banate vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc., G.R. No. 163825, July 13, 2010Document2 pagesBanate vs. Philippine Countryside Rural Bank (Liloan, Cebu), Inc., G.R. No. 163825, July 13, 2010Wella BrazilNo ratings yet

- Icici: Broad Objectives of The ICICI AreDocument7 pagesIcici: Broad Objectives of The ICICI Aremanya jayasiNo ratings yet

- Annuity Calculator: Withdrawal PlanDocument2 pagesAnnuity Calculator: Withdrawal PlanAjay SinghNo ratings yet

- Union Budget 2023 - 2024: A Plenary DiscussionDocument17 pagesUnion Budget 2023 - 2024: A Plenary DiscussionKAVITHA K SNo ratings yet

- Itad Bir Ruling No. 191-15 Uk VatDocument8 pagesItad Bir Ruling No. 191-15 Uk VatKarla TigaronitaNo ratings yet

- Nepse Chart - Nepal Stock InformationDocument2 pagesNepse Chart - Nepal Stock InformationkabyaNo ratings yet

- Business Plan TemplateDocument9 pagesBusiness Plan TemplatemmarquarNo ratings yet

- Business Plan QuestionnaireDocument4 pagesBusiness Plan Questionnaireshantanu_malviya_1No ratings yet

- FOREX Funded Account Evaluation My Forex Funds 2Document1 pageFOREX Funded Account Evaluation My Forex Funds 2SujitKGoudarNo ratings yet

- VP Director Strategic Marketing in New York City Resume Valerie ObenDocument2 pagesVP Director Strategic Marketing in New York City Resume Valerie ObenValerieObenNo ratings yet

- What Do We Mean by Currency and Foreign Exchange?Document9 pagesWhat Do We Mean by Currency and Foreign Exchange?Christian Gerard Eleria ØSCNo ratings yet

- Meaning and Concept of Capital MarketDocument11 pagesMeaning and Concept of Capital Marketmanyasingh100% (1)

- RBS MoonTrading13Jun10Document12 pagesRBS MoonTrading13Jun10loreelyNo ratings yet

- Form Purchase OrderDocument16 pagesForm Purchase Orderrahmat8420No ratings yet

- Financial AccountingDocument16 pagesFinancial Accountinggarg19118No ratings yet

- Invoice 62060270Document1 pageInvoice 62060270Chandru PrasathNo ratings yet

- Cma612s - Cost Management Accounting - 1st Opp - Nov 2019Document7 pagesCma612s - Cost Management Accounting - 1st Opp - Nov 2019Nolan TitusNo ratings yet

- luật asm2Document5 pagesluật asm2hoattkbh01255No ratings yet

- Changes in Partnership Ownership Caused byDocument3 pagesChanges in Partnership Ownership Caused byKrizzia MayNo ratings yet

- Ingenious July August 2023Document24 pagesIngenious July August 2023Ankur ShahNo ratings yet