Professional Documents

Culture Documents

Chapter 3

Chapter 3

Uploaded by

Marcial Militante0 ratings0% found this document useful (0 votes)

35 views15 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views15 pagesChapter 3

Chapter 3

Uploaded by

Marcial MilitanteCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

CHAPTER 3 ~ POWER PLANT ECONOMICS

A power plant cost $375,800 to build. Its life is assumed 20 years; salvage, 15%. Find the si

fund payment. Interest compounded annually at 5%.

Solution:

r

Sinking fund pamen-(0-8) ,—|

P=$375,800

$= 0.15($375 800) = $56,370

n=20

1=0.05

0.05

Sinking fund t= (375,800 - 56,370) ———,—_

inking fund payment =(375,8 ) aFo

Sinking fund payment = $960.39 (answer)

Find the production cost per 1000 kg steam in a steam plant when the evaporation rate is 7.2 kg

steam per kg coal; initial cost of plant, $150,000; annual operation cost exclusive of coal,

$15,000. Assume life of 20 years; no final value; interest on borrowed capital, 4%; on sinking

fund, 3%. Average steam production is 14,500 kg per hr; cost of coal, $8.00 per tonne.

Solution:

Coal required = 14,500 / 7.2 = 2013.89 ke/hr

Cost of Plant = $150,000

(150,000f 923 _]_

er 0.03)"

‘Annual operating cost exclusive of coal = $15,000

Interest on borrowed capital = 0.04($150,000) = $6,000.00

tonne

SOE otaata/m{

Annual Production Cost = Annual Depreciation + Interest on Borrowed Capital + Annual

Operating Cost exclusive of coal + Annual Fuel Cost

Annual Production Cost = $5,582.36 + $6,000.00 + $15,000.00 + $141,133.41

Annual Production Cost = $167,715.77

‘Annual Depreciation =

Annual fuel cost = (000m. $141,133.41

($167,715.77)(1000)

(14,500)8760)

‘Annual Production Cost per 1000 kg = $1.32 per 1000 kg (answer)

Determine the annual cost of a feedwater softener from the following data: Cost, $15,000; life,

10 years; salvage value, 0; annual repairs and maintenance, $500; annual cost of chemicals,

$825; labor, $20.00 month; sinking fund depreciation with r= 4%.

Solution:

Capital Cost = $15,000

Annual Production Cost per 1000 kg =

Annual Depreciation

5.

CHAPTER 3 ~ POWER PLANT ECONOMICS

Annual Repairs and Maintenance = $500.00

Annual Cost of Chemicals = $825.00

Annual Labor Cost = $20 x 12 = $240.00

Annual Cost of Feedwater Softener = Annual Depreciation + Annual Repairs and Maintenance +

Annual Cost of Chemicals + Annual Labor Cost

Annual Cost of Feedwater Softener = $1,249.36 + $500.00 + $825.00 + $240.00

Annual Cost of Feedwater Softener = $2,814.36 (answer)

‘The bonds issued to build a certain power plant have a face value of $2,500,000 and bear

interest at 4 4%. They are to be retired at end of 20 years by an accumulated sinking fund which

will yield 4% compounded annually. Find the annual payment to the account of capital

investment,

Solution:

P+.) Aooat—|

(2,500,000)1-+0.045)" =

A= $202,474.00 (answer)

‘The fixed element invested in a 100,000-kw power plant is $15,000,000. Find its average annual

cost per kw, based on straight line depreciation. Estimated life, 15 yr; salvage, 20%; r, 5%.

Solution:

PS _15,000,000—0.20(15,000,000)

7 15

Depreciation = $800,000.00

Interest = 0.05(15,000,000) = $750,000.00

Depreciation =

Annual Cost = Depreciation + Interest = $800,000.00+$750,000.00

Annual Cost = $1,550,000

Average annual cost per kw = $1,550,000 / 100,000

‘Average annual cost per kw = $15.50/kw (answer)

‘An ash disposal system of a steam plant cost $30,000 when new. It is now 4 years old. The

annual maintenance costs for the four years have been $2000, $2250, $2675, $3000. Interest

rate = 6%. A new system is guaranteed to have an equated annual maintenance and operation

cost not exceeding $1500. Its cost is $47,000 installed. Life of each system, 7 years; salvage

value, 5% of first cost. Present sale value of old system is same as salvage value. Would it be

profitable to install a new system?

Solution:

CHAPTER 3 ~ POWER PLANT ECONOMICS.

Prevented by replacement

Depreciation =

Ave. Interest

aos(a

7 342 \.95{20,00) = $1,140.00

Int, on Salvage Value = 0.06(0.05)(20,000) = $90.00

Average Maintenance = (1/4)(2000 + 2250 + 2675 + 3000) = $2,481.25

Total = 9,500 + 1,140 + 90 + 2,481.25 = $13,211.25

Incurred by replacement

47,000-0.05(47,000)

7

0.08; (ms

Ta .95(47,000) = $1,530.86

Depreciation = $6,378.57

Ave. interes

z

Int. on Salvage Value = 0.06(0.05 47,000) = $141.00

Maintenance and Operation = $1,500.00

Total = 6,378.57 + 1,530.86 + 141 + 1,500.00 = $9,550.43

Since incurred by replacement is less than prevented by replacement, itis profitable t

new system.

‘Ten years ago a small steam plant of 2000-kw capacity costing $125 per kw was erected. The life

was estimated at 15 years and the salvage value at 5%. At present, abandoning the old plant in

favor of a new Diesel plant is being considered. A market has been found for the old engine and

boiler equipment at $15,000. The remainder of the old plant can be utilized in the new and is

given a valuation of $8500. Depreciation has been figured on the straight line basis. What is the

difference between the depreciated book value of the old plant and its sale value? How would

‘the difference be taken care of in the reconstruction?

Solution:

Depreciated book value

(1-0.05)(2000)125)

15

Sale Value = $15,000.00 + $8,500.00 = $23,500.00

= (2000X125)-10) ] = $91,666.67

Difference = 91,666.67 ~ 23,500.00 = $68,166.67 (answer)

The difference is too high, therefore no reconstruction is to be considered. (answer)

‘The load duration curve and fuel characteristics for a 45,000 kw plant are given in Prob. 20,

Chapter 2. Other data for the same station are: Initial cost, $135 per kw; estimated life, 20 years;

salvage value, 8% of first cost; interest rate, 5%; taxes and insurance, 3 14%; labor, 45 men;

CHAPTER 3 ~ POWER PLANT ECONOMICS

average salary, $175 per month; maintenance and repairs, $65,000 per annum; oil, waste and

supplies, $20,000 per annum; coal, $8.25 per tonne. Find the production cost per kw hr.

Solution:

itonne _1kg

1000kg \ 2.205/b,

First cost of the Plant = (45,000 kw)($ 135 per kw) = $6,075,000.00

Salvage value = 0.08($ 6,075,000) = $486,000.00

Coal required = (2.83x10" worl. ssa asses

FIXED ELEMENT

Annual depreciation on straight line basis = oD

= $279,450

Interest rate = 0.05($ 6,075,000) = $303,750

Taxes and insurance = 0.035($ 6,075,000) = $ 212,625,

ENERGY ELEMENT

Labor = 45 ($ 175)(12) = $94,500

Maintenance and repair = $ 65,000

il, waste, and supplies = $ 20,000

Fuel cost = ($ 8.25)(128,345) = $ 1,058,846

Total production cost = $ 279,450 + $ 303,750 + $ 212,625 + $ 94,500 + $ 65,000 + $ 20,000 +$

1,058,846 = $ 2,034,171

sie hrprodices mat +2(33.0)+2(32.2)+2(28.8)+2(29.6) +2(29.2) |

2(a0) | +2(28.5)+-2(28.0)+-2(22.0)+-2(12)+-8

Kw hr produce = 233,278,800 kw hr

Production cost per kw hr=

Production cost per kw hi

Production cost per kw hr=

2,034,171 / 233,278,800

0.00825 / kw hr

.825 ¢ per kw hr (answer)

The annual costs expected by a utility system in supplying a certain residential suburb of 45,000

customers are: Fixed element, $345,000; energy element, $180,000; customer element,

$300,000; return on investment, $200,000.

17,050,000 kw hr will be registered on customer's meters during the year and their maximum

demand on the power plant will be of the order of S500 kw. Diversity factor from Table 2-2.

(a) Form a straight line meter rate. (b) Form a three charge rate, putting % of the profit in the

energy element, % in fixed element. (c) Form a room rate in which the customer element is

a fixed monthly service charge and the fixed element is obtained in the first 4 kw hr per

room. (Assume average home, 6 rooms.) Energy element is uniformly distributed.

Solution:

CHAPTER 3 ~ POWER PLANT ECONOMICS

(2) Straight Line Meter Rate = (Fiked element + Energy Element + Customer Element + Return

on Investment) / Energy Consumption

Straight Line Meter Rate = (345,000 + 180,000 + 300,000 + 200,000)/(17,050,000)

Straight Line Meter Rate = $0.06 per kwhr = 6 ¢ per kwhr (answer)

(b) Three charge rate

Demand Charge = Fixed Element + a portion of profit

Demand Charge = $345,000 + (1/4)($200,000) = $395,000

Over-all Diversity Factor=3x1.3x1.2x1.1=5.148,

Customer's Peak = (5,500 kw)(5.148) = 28,314 kw

Unit Demand Charge = ($395,000)/(28,314) = $13.95 per kw per annum = $1.16 per kw of,

maximum demand per month

Unit Energy Charge = [(3/4)($200,000) + $180,000)/(17,050,000) = $0.0194 per kw hr = 19.4

mills per kw hr

Service Charge = Customer Element = $300,000

Unit Service Charge = ($300,000)/(45,000) = $6.67 per yr = $0.56 per month = 56 ¢ per

month

Final Rate: $1.16 per kw of maximum demand per month, plus 19.4 mills per kw hr used,

plus a service charge of 56 ¢ per month. (answer)

(6) Room Rate

‘Annual sum = $345,000 + $300,000 = $645,000

Charge per kw hr per month for the first 4 kw hr per room = ($645,000)/(45,000 x 6 x 4x 12)

= $0.0498 = 4.98 ¢ per kw hr per month for the first 4 kw hr per room.

Remaining as a straight energy charge = $180,000 + $200,000 = $380,000

Kwhr remaining after this preliminary consumption = 17,050,000 ~ 45,000 x 6 x 4x 12 =

4,090,000

Energy Charge = 380,000 / 4,090,000 = $0.0929 = 9.29 ¢ per kw hr

Room rate:

= 4,98 ¢ per kw hr per month for the first four kw hr per counted room and 9.29 ¢ per kw hr

for all energy used in excess of this. (answer)

10.

11,

CHAPTER 3 ~ POWER PLANT ECONOMICS.

‘A town of 4500 population has 2000 connected customers. The maximum demand is 350 kw

and the annual output 1,950,000 kw hr. The plant is operated by the municipality and its rate

includes an element which goes towards defraying the expenses of town administration, The

rate is expected to produce: $12,500 per annum for fixed element; $20,000 per annum for

energy element; $30,000 per annum for customer element; $50,000 per annum for town

expenses element.

Work out a rate of the following form:

(A) © per kw hr for the first 25 kw hr per month; (B) ¢ per kw hr for all energy used in excess of

25 kw hr.

1 block to return fixed element, customer element, and $20,000 of town expenses,

Solution:

(A) Energy consumption for the first 25 kw hr= 25 x 12 x 2000 = 600,000 kw hr

‘Annual sum = $12,500 + $30,000 + $20,000 = $62,500

Rate = ($62,500)/(600,000) = $0.1042 = 10.42 ¢ per kw hr for the first 25 kw hr per month

fans).

(8) Remaining as a straight energy charge = $20,000 + $50,000 - $20,000 = $50,000

Kw hr remaining = 1,950,000 - 600,000 = 1,350,000

Rate = ($50,000}/(1,350,000) = $0.0371 = 3.71 ¢ per kw hr for all energy used in excess of 25

kw hr (ans).

‘The annual costs of operating an electric system are:

Coal, $300,000

Franchise and publicity, $70,000

Station depreciation, $190,000

Station supplies, $30,000

Primary line dep., $190,000

Interest, taxes and insurance:

Secondary lines dep., $120,000

Plant maintenance: Fixed $1000, variable $2000

Secondary lines maintenance, $50,000

Labor Generation, $105,000; Distribution $80,000; Accounting $150,000

Superintendence and management, $50,000

Dividends to stockholders, $350,000

Annual station output, 70 x 10° kw hr, 10% energy loss in transmission; peak load, 20,000 kw;

diversity, 3.33; 100,000 customers.

Compute a three-charge rate in which one-half of the dividends are in the service charge, the

other half in the demand charge.

Solution:

FIXED ELEMENT:

Station Depreciation = $ 190,000

nn plant and primary line, $50,000; on secondary lines, $85,000

CHAPTER 3 ~ POWER PLANT ECONOMICS

Primary line dep. = $ 30,000

reserve = $ 190,000 + $ 30,000 = $ 220,000

Interest, taxes and insurance on plant and primary line = $ 50,000

Maintenance (Fixed) = $ 1,000

Superintendence & Management = $ 50,000

Total annual cost for fixed element = $ 321,000

ENERGY ELEMENT:

Labor generation = $ 105,000

‘Accounting = $ 150,000

Coal = $ 300,000

Maintenance (Variable) = $ 2000

Total energy element charge = $ 557,000

CUSTOMER ELEMEN’

Secondary line dep. = $ 120,000

Interest, taxes and insurance on secondary line = $ 85,000

Secondary line maintenance = $ 50,000

Franchise and publication = $ 70,000

Distribution = $ 80,000

Total customer element charge = $ 405,000

‘Summing various elements of the cost:

Fixed element = $ 321,000

Energy = $557,000

Customer = $ 405,000

Dividends = $ 350,000

Annual production cost = $1,633,000

Demand charge = fixed + a portion of dividends

Demand charge = $ 321,000 + 0.5(350,000) = $ 496,000

Service charge = customer element = remainder of dividends

Service charge = $ 405,000 + 0.5(350,000) = $ 580,000

$580,000

Service charge = —> 20-000 _ $9.48 per month

rvice charge Goo,000\22) $i per mor

12.

13,

CHAPTER 3 ~ POWER PLANT ECONOMICS

Demand chase = 5 Ra =$0.62 per kw max. demand per month

$557,000

Energy charge = =

nerBy CharBE = 0.1) 70x10° KW - hr)

THREE-CHARGE RATE (answer)

$0.62 per kw of maximum demand per month, plus 9

of 48 ¢ per month.

(0.009 = 8 mills per kw hr

per kw hr used, plus a service charge

‘A customer owning an 8-room house has 365 kw hr recorded on his meter during a certain

month, The local electric rate is: 6¢ per kw hr for the first 6 kw hr per counted room, plus 4¢ per

kw hr for the next 8 kw hr per counted room, and 2¢ per kw hr for all remaining enerey

consumed during the month, Compute the electric bill for the month.

Solution:

Electric

[365 —(8+6)(8)1(0.02) + (8)(8)(0.04) + (6)(8)(0.06) = $10.50 (answer)

‘Annual costs in certain power system are:

For fixed costs: Plant, $1,750,000; primary lines, $600,000; secondary lines, $1,250,000.

For operating cost: Plant, $75,000 indirect and $950,000 direct.

For distribution system, $500,000

Direct customer expense, $400,000; profit, 7% of fixed cost.

Peak load on plant, 45,000 kw; diversity factor, 4; annual plant output, 1.2 x 10" kw hr. Assume

50,000 customers and 20% transmission loss.

Find the straight line meter rate.

Solution;

FIXED ELEMENT

‘Annual cost for plant fixed cost = $ 1,750,000

Annual cost for primary lines fixed cost = $ 600,000

Total annual cost for fixed element = $ 2,350,000

ENERGY ELEMENT

Direct customer expense = $ 400,000

For distribution system = $ 500,000

For indirect operating cost = $ 75,000

Total energy element charge = $ 975,000

CUSTOMER ELEMENT

Annual cost for secondary lines fixed cost = $ 1,250,000

For direct operating cost = $ 950,000

Total customer element charge = $ 2,200,000

14,

CHAPTER 3 ~ POWER PLANT ECONOMICS

PROFIT

Total annual fixed cost = $ 1,750,000 + $ 600,000 + $ 1,250,000 = $ 3,600,000

Profit element = 0.07 x $ 3,600,000 = $ 252,000

‘STRAIGHT LINE METER RATE:

‘Summing the various elements of cost:

2,350,000

Energy = $975,000

Customer = $ 2,200,000

Profit = $ 252,000

Annual production co:

5,777,000

$5,777,000

Rate * G—oa.2xi0" kWh)

Using data of Prob. 13, construct a Doherty rate, putting profit into the proper elements, in

proportion to the investment.

Solution:

For this rate let the profit element be placed with fixed and customer elements in proportion to

the capital investment in each. Total capital investment (annual) = $ 2,350,000 + $ 950,000 = $

3,300,000.

Demand charge = fixed + a portion of profit

Demand charge = $ 2,350,000 + (2,350,000 / 3,300,000)(252,000) = $ 2,529,455,000

(0.08 . Say 6 ¢ per kw hr rate (answer)

Service charge = customer element + remainder of profit

Service charge = $ 2,200,000 + (950,000 / 3,300,000)(252,000) (350,000) = $ 2,272,555.00

$2,272,585

. 7

Service charge = Fo y= 8379 Per month

Demand charge = nes $1.05 per kw max. demand per month

$975,000

Energy charg

=$0.010 = 10 mills per kwh

a.2x10" Ew} sieaiiaaiied

THREE-CHARGE RATE (answer)

$ 1.05 per kw of maximum demand per month, plus 10 mills per kw hr used, plus a service

charge of $ 3.79 ¢ per month.

15.

16.

7.

CHAPTER 3 ~ POWER PLANT ECONOMICS

‘An air preheater installation will cost $12,500. Its life is assumed to be 8 years. Salvage value is

nothing. Annual maintenance and repair is estimated to average $150. Use compound interest

‘at 6% and find the annual cost of the preheater.

Solution:

Annual Cost = os} | + Annual maintenance and repair cost

i

Gy

0.08

(+0.06)—

Annual Cost = $1,412.95 (answer)

‘Annual Cost (2500-0) | +150

What initial cost will an annual saving of $675 per year for ten years amortize at 4% interest

compounded annually?

Solution:

Cr

Initial Cost = Annual Saving x [oer

r

0.04

Initial Cost = $8,104.12 (answer)

Initial Cost = $675 x [Ssseer=s)

‘A 30 mhp condensate pump motor has been burned beyond repair. The plant superintendent

has two replacement alternatives. Manufacturer “A” offers to replace the original (which was an

“A” motor) for $510. Manufacturer "8" offers a cheaper motor at $400 but can only guarantee

87% efficiency whereas the “A” motor is guaranteed for 89%. The installation operates 25% of

the time at full load, and 75% of the time at half load where the two efficiencies become 85%

and 84% respectively. Assume a motor comparison period of 5 years, interest rate 8%, equal

maintenance costs. Electric energy is charged for at the rate of 1 % ¢ per kw hr.

(a) Which motor is the more economical buy? (b) At what energy cost do they become equal

alternatives?

Solution:

Operation Cost:

Manufacturer A

Operation cost = 8760 [0.25(22.05/0.89) + 0.75(0.5)(22.05/0.84)](1.5/100) = $2009.70

Manufacturer 8

Operation cost = 8760 [0.25(22.05/0.87) + 0.75(0.5)(22.05/0.85)]{1.5/100) = $2110.80

10

CHAPTER 3 ~ POWER PLANT ECONOMICS

(a) Comparison:

Manufacturer A Manufacturer 8

Depreciation | = 510/5 $102.0 | = 400/5 $20.0

Ay. Interest = (0.08/2)((5+1)/5)x510 24.5 | = (0.08/2)((5+1)/5)x400 19.2

Operation cost, 2009.7 210.8

Total $2136.20 $2210.0

Manufacturer A is more economical. (answer).

(b) Energy cost

Manufacturer A operation cost = ($2009.7/1.5)(x) = 1339.8x

Manufacturer 8 operation cost = ($2110.8/1.5)(x) = 1407.2x

Equating:

102 + 24.5 + 1339.8x= 80 + 19.2 + 1407.2x

x= 0.408 ¢ per kw-hr (answer)

18, Make a comparative analysis of the production cost per kw hr of the two plants for which data

are given. Annual production = 1.x 10° kw hr.

Diese! Plant ‘Steam Plant

Engine and generator $53,000 Turbogen. and $24,000

condenser

‘swbd. and wiring $5,600 Boller and stoker $20,000

Miscellaneous $8,000 Swbd, and wiring $5,600

Building $10,500 Miscellaneous $10,000

Labor, per month $350 Building $12,000

Fixed charges 11% Labor, per month $450

Oil, per liter (0.621 g/ml) 4.1¢ Fixed charges 12%

Fuel economy 0.49 Ib/kw hr Coal, per ton $3.50

Fuel economy ‘1.72 Ib/kw hr

Solution:

Fixed Charges:

Diesel Plant = 0.11(53,000 + 5,600 + 8,000 + 10,500) = $8,481

Steam Plant = 0.12(24,000 +20,000 + 5,600 + 10,000 + 12,000) = $8,592

Operation Costs:

Diesel Plant:

Labor = $350x 12 = $4,200

Fuel economy = (0.49 Ib/kw-hr)(1 kg / 2.208 Ib) = 0.2222 ke/kw-hr

0.621 g/ml. = 0.621 ke/L

Fuel consumption = (0.2222)(1 x 10°) = 222,200 kg

Fuel cost = (222,200 / 0.621)(4.1/100) = $14,670

Operation cost = Labor + Fuel cost = $4,200 + $14,670 = $18,870

1

19.

CHAPTER 3 ~ POWER PLANT ECONOMICS

Steam Plant:

Labor = $450x 12 = $5,400

Fuel economy = (1.72 lb/kw-hr)(1 kg / 2.205 Ib) = 0.78 ke/kw-hr

Fuel consumption = (0.78)(1 x 10°) = 780,000 kg

Fuel cost = (780,000 kg)(2.205 Ib/kg)(1 ton / 2000 Ib)($3.50/ton) = $3,010

Operation cost = Labor + Fuel cost = $5,400 + $3,010 = $8,410

Comparative analysis:

Diesel Plant ‘Steam Plant

Fixed Charges $8,481 $8,592

Operation Cost $18,870 $8,410

Total $27,351 $17,002

Production cost per kw-hr 2.7¢/kw-br 1-7¢/kw-br

Steam plant is more economical. (answer)

Using data of the example in Sec. 3-10, form a block meter rate with the fixed element and one-

half the customer element collected in the first 12 kw hr per month per customer. In the second

block, reduce the rate to % of the first block for the collection of the energy element and the

remainder of the customer element. Assume that % of the customers will average full

‘consumption of the second block. Collect the profit element in the third and final block.

Solution:

Fixed element = $795,840.00

Energy element = $546,000.00

Customer element = $1,033,000.00

Profit element = $610,400.00

Annual production cost = $2,985,240.00

Customer = 150,000

Energy used = 76,000,000 kwhr

First Block:

Charge = Fixed element + (1/2) Customer element

Charge = $798,840 + (1/2)($1,033,000) = $1,312,340.00

First 12 kwhr per month per customer

_ $1,312,340

© 150,000%12%1:

Second Black:

Charge = (3/4) Energy element + (1/2) Customer element

Charge = (3/4)($546,000) + (1/2)($1,033,000) = $926,000.00

Next 12 kwhr per month per customer

s $926,000

~ 0.75%150,000x42«12

= $0.061 = 6.1 ¢ per kwhr

7 ¢ per kwhr

2

20.

21.

CHAPTER 3 ~ POWER PLANT ECONOMICS

‘Third and Final Block

Charge = (1/4) Energy element + Profit

Charge = (1/4)($546,000) + $610,400 = $746,900.00

Kw hr remaining = 76,000,000 ~ 150,000 x 12 x 120.75 x 150,000 x 12 x12 = 38,200,000.00

$746,900

Remaining use rate =

38,200,000

=$0.020 =2.0 ¢ per kwhr

Answer:

First 12 kw hr per month or less at 6.1 ¢ per kw hr; next 12 kw at 5.7 ¢ per kw hr; and all

remaining use at 2.0 ¢ per kw hr

‘A 500-kw electric lighting plant cost $95 per kw installed. Fixed charges, 14%; operating costs,

1.3¢ per kw hr. The plant averages 150 kw for 5000 hr of the year, 420 kw for 1000 hr, and 20

kw for the remainder. What is the unit cost of production of electric energy?

Solution:

Plant consumption = 150 x 5000 + 420 x 1000 + 20 (8760-5000 - 1000) = 1,225,200 kw-hr

Capital cost = 500 x 95 = $47,500.00

Fixed charges = 0.14 x 47,500 = $6,650.00

Operating cost = 1.3 x 1,225,200 / 100 = $15,927.60

Unit cost of production = Fixed charges + Operating cost

Unit cost of production = $6,650.00 + $15,927.60 = $22,577.60 (answer)

‘The load duration of a group of residential customers served by a substation is given by the

following data:

Percent of the year | 0 | 10] 20] 30] 40] 50] 60] 70] 80) 90] 100

Kilowatts 95 | 50 | 40 | 30 | 29 | 29 | 28 | 28 | 22/12] 8

Average efficiency of distribution is 95%. Customer's rate is 8¢ per kw for the first 25 kw-hr, 5¢

per kw hr for the next 30 kw hr, 3¢ per kw hr for the next 50 kw hr, and 2¢ per kw hr for all

remaining energy. What is the average monthly gross income from this group of customers if 20

of them average taking 300 kw hr per month, 50 of them take 130 kw hr per month, while the

remaining average 70 kw hr per month each? How many customers are there in the whole

group?

Solution:

Energy Consumption = (1/2)(95 +2 x50 +2x40+2x 3042x2942 x29 42x28 +2x28+2x22

+2.x 12 +8)(10/100)(8760) = 279,882 kw-hr/year = 23,323,5 kw-hr/month

B

22.

23,

24,

CHAPTER 3 ~ POWER PLANT ECONOMICS

Remaining number of customer

20x 300 + 50x 130 + Px 70 = 23,3235 x0.95

P = 138 customers

Average monthly gross income

For 20 taking 300 kwhr per month

= (0.08 x 25 + 0.05 x 30 + 0.03 x 50 + 0.02(300 ~ 50 ~ 30 ~ 25))x20 = $ 178.00

For 50 taking 130 kwhr per month

= (0.08 x 25 + 0.05 x 30 + 0.03 x 50 + 0.02(130 ~ 50-30 ~ 25))x50 = $275.00

For 138 taking 70 kwhr per month

= (0.08 x 25 + 0.05 x 30 + 0.03(70 ~ 30 -25))x138 = $545.10

Average monthly gross income = $178.00 + $275.00 + $545.10 = $998.10 (answer)

A customer's meter reads 29,543 kw hr on May 1, and 29,598 kw hr on June 1. Find the amount

of his electric bill for May based on the following rates.

(2) 7¢ per kw hr

(b) 10¢ per kw hr for the first 35 kw hr; 5¢ per kw hr for the next 25 kw hr; 3¢ per kw hr forall in

excess of 60 kw hr.

Solution:

(a) Electric Bill = (29,598 - 29,543)(0.07) = $3.85 (answer)

(b) Electric Bill

Energy consumption - 29,598 - 29,543 = 55 kw hr

35+ 25 = 60 kwhr> 55 kw hr

Electric Bill = (55 ~35)(0.05) + (35)(0.10) = $4.50 (answer)

Assume that a customer's maximum monthly demand was recorded as 120 kw. His energy

consumption for the same period was 40,500 kw hr. His rate is: $2.40 per month per kw for the

first 50 kw of maximum demand; $2.00 per month per kw for the excess of maximum demand

‘over 50 kw; plus 5¢ per kw hr for the first 1000 kw hr per month; 3¢ per kw hr for the next 4000

kw hr per month; and 2¢ per kw hr for all energy in excess of 5000 kw hr. What is his bill for the

month considered?

Solution:

Bill = (120 - 50)(2) + (50)(2.4) + (40,500 - 4000 ~ 1000)(0.02) + (4000)(0.03) + (1000)(0.05) =

$1,140 (answer)

A customer having a 7-room house used 55 kw hr during a certain month. What i his electric bill

for that month if his rate is that given as the example of “Room rated charge,” Sec 3-9, and

‘there is a 5% discount for payment in 15 days.

Solution:

From Example of Sec 3-9.

14

25.

26.

CHAPTER 3 ~ POWER PLANT ECONOMICS

10 ¢ per kw hr per month for the first 3 kw hr per counted room; plus 7 ¢ per kw hr per month

for the next three kw hr per counted room; plus 4 ¢ per kw hr per month for the excess over 6

kw hr per counted room.

Electric Bill =[ (55 —7(6)](0.04) + 7(3)(0.07) + 7(3)(0.10)](1- 0.15) = $3.89

‘A customer owning an eight-room house has electric service under the following rate: 9¢ per kw

bir for the first 3 kw hr per room; 5¢ per kw hr for the next 5 kw hr per room; 3¢ per kw hr for all

in excess of 8 kw hr per room. His meter readings for three consecutive months were: May 5—

2789 kw hr; June 5 ~ 2984 kw hr; July 5 ~ 3154 kw hr. What is the amount of his bill for May 5 ~

June 5? For June 5 — July 5? What is the average cost per kw hr for each of the two periods?

Solution:

May 5 to June 5: 2984 ~ 2789 = 195 kw hr

Bill = [195 ~ (8)(8)](0.03) + (5)(8)(0.05) + (3)(8)(0.08) = $8.09 (answer)

June 5 to July 5: 3154-2984 = 170 kw hr

Bill = [170 ~ (8)(8)](0.03) + (5)(8)(0.05) + (3)(8(0.08) = $7.34 (answer)

Average cost per kw hr from May 5 toJune 5

= ($8.09)/(195 kw hr) = $0.0415 per kw hr= 4.15 ¢ per kw hr (answer)

Average cost per kw hr from June 5 to July 5

= ($7.34)/(170 kw hr) = $0.0432 per kw hr

32 ¢ per kw hr (answer)

‘The rate for a commercial customer is $6.00 per kw per month for the first kw of maximum

demand, plus $5.00 per kw per month for the next 6 kw of maximum demand, plus $4.00 per kw

er month for all of the maximum demand in excess of 7 kw, plus energy charge as follows: First

1100 kw hr at 4¢ per kw hr. All remaining energy at 1 ¢ per kw hr. What type of rate is this? How

much is the customer's bill in @ month when he registers 15-kw maximum demand and

‘consumes 1850 kw hr?

Solution:

‘Type of rate = Block Hopkinson Demand Rate

Bill = (15 ~7)(4) + (6)(5) + (2)(6) + (1850 - 100)(0.01) + (100}(0.04) = $89.50 (answer)

- End~

15

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 9822/1045 V810-7-1 TURBOCHARGER ASSEMBLY 75kW: Marcial MilitanteDocument5 pages9822/1045 V810-7-1 TURBOCHARGER ASSEMBLY 75kW: Marcial MilitanteMarcial MilitanteNo ratings yet

- Machines 07 00070Document15 pagesMachines 07 00070Marcial MilitanteNo ratings yet

- Student - S Trivia Exam 2Document6 pagesStudent - S Trivia Exam 2Marcial Militante100% (1)

- Subject Code Subject Description Professor: Machine Elements IDocument2 pagesSubject Code Subject Description Professor: Machine Elements IMarcial MilitanteNo ratings yet

- Terminology (Hvac)Document5 pagesTerminology (Hvac)Marcial MilitanteNo ratings yet

- Thermodynamics Trivia 2Document5 pagesThermodynamics Trivia 2Marcial MilitanteNo ratings yet

- Trivia (Elements) 3Document6 pagesTrivia (Elements) 3Marcial MilitanteNo ratings yet

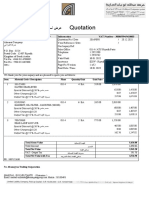

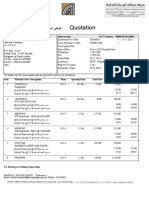

- Quotation: Customer Code: 10002349 Information VAT Number - 300055945410003Document2 pagesQuotation: Customer Code: 10002349 Information VAT Number - 300055945410003Marcial MilitanteNo ratings yet

- Part I. Multiple Choice Questions: Prepared By: Engr. Jose R. Francisco, PMEDocument6 pagesPart I. Multiple Choice Questions: Prepared By: Engr. Jose R. Francisco, PMEMarcial MilitanteNo ratings yet

- Quotation: Customer Code: 10002349 Information VAT Number - 300055945410003Document2 pagesQuotation: Customer Code: 10002349 Information VAT Number - 300055945410003Marcial MilitanteNo ratings yet

- Quotation: Customer Code: 10002349 Information VAT Number - 300055945410003Document2 pagesQuotation: Customer Code: 10002349 Information VAT Number - 300055945410003Marcial MilitanteNo ratings yet

- Quotation: Customer Code: 10002349 Information VAT Number - 300055945410003Document2 pagesQuotation: Customer Code: 10002349 Information VAT Number - 300055945410003Marcial MilitanteNo ratings yet

- Chapter 5Document20 pagesChapter 5Marcial MilitanteNo ratings yet

- Trivia (Problems) 2Document6 pagesTrivia (Problems) 2Marcial MilitanteNo ratings yet

- Chapter 2Document20 pagesChapter 2Marcial MilitanteNo ratings yet

- 9822/1045 V240-1-1 ROCKER SHAFT 320/25007/1: Marcial MilitanteDocument3 pages9822/1045 V240-1-1 ROCKER SHAFT 320/25007/1: Marcial MilitanteMarcial Militante0% (1)

- Rocker Cover AssemblyDocument5 pagesRocker Cover AssemblyMarcial MilitanteNo ratings yet

- 10.03128 Quotation EL SEIFDocument2 pages10.03128 Quotation EL SEIFMarcial MilitanteNo ratings yet

- Lifting Brackets AssemblyDocument3 pagesLifting Brackets AssemblyMarcial MilitanteNo ratings yet

- 9822/1045 V210-7-1 CYLINDER HEAD DETAILS 320/02721 1: Marcial MilitanteDocument3 pages9822/1045 V210-7-1 CYLINDER HEAD DETAILS 320/02721 1: Marcial MilitanteMarcial MilitanteNo ratings yet