Professional Documents

Culture Documents

Cash Deposit Bag Application Form

Uploaded by

Aarumilli SriramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Deposit Bag Application Form

Uploaded by

Aarumilli SriramCopyright:

Available Formats

Please send the form to:

T&O-SSB Cash Ops, Cashsupport

2 Changi Business Park Crescent

#04-05 Lobby B DBS Asia Hub

Singapore 486029

CASH DEPOSIT BAG SERVICE MULTI-PURPOSE FORM

Please read the following guidelines before completing the form:

1. DBS Bank Ltd (“Bank”) will only accept cash deposits of Singapore and Brunei dollar notes. The Bank will not accept cheques,

foreign currency cash (except Brunei dollars) and coins.

2. The Customer shall separate old series notes from current series notes, soiled/mutilated notes from usable notes, polymer

notes from paper notes and ensuring that notes of the same denominations are to be bundled in packs of 100 pieces.

3. The Customer shall provide details of the deposit either (a) by placing its deposit together with a deposit slip (in the Bank's

prescribed form) duly completed into a sealed, tamper-evident bag acceptable to the Bank. The Customer should only provide

one deposit slip for each bag.

4. The sealed, tamper-evident bags shall be deposited in the cash deposit bag machines at locations determined by the Bank.

5. The Bank may change these guidelines from time to time in accordance with the Terms and Conditions Governing DBS Cash

Deposit Bag Service.

☐New Application ☐Update ☐Termination

Section A – Customer Details

Name of Organisation: _____________________________________________________________________________

ACRA Number/ UEN: _____________________________________________________________________________

Section B - Crediting Account (please attach list to include additional crediting accounts)

Account Name: ________________________ Account No: ________________________

Account Name: ________________________ Account No: ________________________

Account Name: ________________________ Account No: ________________________

Agreement and AcceptanceSection B – Agreement and Acceptance

I/We are duly authorised by the organisation above (“Customer”) to apply for the Cash Deposit Bag Service and hereby agree to the

Terms and Conditions Governing Cash Deposit Bag Service (as may be amended, supplemented, substituted and/or replaced by DBS

Bank Ltd. (the “Bank”) from time to time). I/We confirm that the information given in this form is complete, true and accurate in all

respects. If any information given herein changes or becomes inaccurate in any way, I/we shall immediately notify the Bank in writing

of any such change and/or inaccuracy. (Note: Authorized signatories will be required for every account included and according to the

highest account mandate.)

____________________________________

Name(s) of authorised signatory(ies)

Date:

To be completed by the Bank: Verified by RM/ branch officer: __________________________________________ Date:

DBS Bank Ltd Page 1 of 4

Co. Reg. No. 196800306E v1.2 (Updated Mar’21)

Terms & Conditions Governing Cash Deposit Bag Service (“Terms”)

Unless otherwise defined or the context requires otherwise, capitalised terms in these Terms shall have the meanings given to them in

the Cash Deposit Bag Service Multi-Purpose Form.

1. THE SERVICE

1.1 The Bank shall provide the services set out in these Terms (“Deposit Bag Service”) to the Customer, and the Customer agrees that

the provision of the Deposit Bag Service shall be on the basis of these Terms read with the Terms and Conditions Governing

Accounts (Applicable for Businesses/Non-Individuals) (“Account Terms”). In the event of any inconsistency between these Terms

and the Account Terms, these Terms will prevail.

1.2 To use the Deposit Bag Service, the Customer must maintain a bank account with the Bank which the Bank deems eligible for use

with the Deposit Bag Service and which the Customer designates for receiving the cash deposited through the Service

(“Designated Account”).

2. SORTING, PACKING OF CASH

2.1 The Customer shall be responsible for sorting and packing the cash in accordance with the Bank’s prevailing requirements and

guidelines.

2.2 The Bank will only accept cash placed in sealed, tamper-evident bags provided by the Bank and will not accept cash in any other

manner from the Customer. The Bank reserves the right to reject in its sole discretion cash which are placed in bags not of

acceptable security standard to the Bank.

2.3 Any foreign currency cash (except Brunei dollars), local or foreign currency cheques and coins deposited will be at the Customer's

own risk and the Bank shall be entitled to deal with such cash, cheques or coins as the Bank deems fit . The Bank reserves the

right to impose fees and charges for the handling of any foreign currency, cheques and coins deposited.

3. PROCESSING OF CASH BY THE BANK’S SERVICE PROVIDER

3.1 The Customer agrees and acknowledges that the Bank may appoint any third party in its sole discretion (“Service Provider”) to

provide some or all of the Deposit Bag Service.

3.2 The Bank shall credit the Designated Account, with the amount of cash counted after deducting the value represented by

mutilated notes and/or notes suspected to be counterfeit, within two (2) Business Days from the time the sealed, tamper-evident

security bag is deemed to be received by the Bank provided that the cash is sorted and packed in accordance with the Bank’s

sorting and packing requirements.

“Business Day” means a day (excluding Sunday and public holidays) on which the Bank is generally open for banking business.

4. DISCREPANCY

4.1 The Customer agrees that where cash is delivered to the Service Provider’s or the Bank’s premises for processing and counting,

the Bank’s determination of the cash counted shall be final and conclusive and binding on the Customer, notwithstanding any

contrary information provided in the deposit slip. If there is any discrepancy between the cash counted by the Bank and the

deposit slip, the amount to be credited to the Designated Account shall be based on the Bank's count of the cash.

4.2 Where the Customer requests for supporting evidence of any discrepancy in the Bank’s Service Provider’s or the Bank’s count of

cash, the Bank may but shall not be obliged to provide (where available) the supporting evidence, and the Bank reserves the right

to impose fees and charges for the retrieval of such supporting evidence.

5. COUNTERFEIT/MUTILATED NOTES

5.1 If the Bank is of the view that the cash deposit received by the Bank contains:

(a) notes which it suspects to be counterfeit or fake, such notes shall be retained by the for further investigation; or

DBS Bank Ltd Page 2 of 4

Co. Reg. No. 196800306E v1.2 (Updated Mar’21)

(b) notes which the Bank is of the view are mutilated or damaged, such notes shall be sent to the relevant government

authorities for further assessment,

and in each case the value of such notes shall not be taken into account for the purposes of computing the amount of cash

deposits received by the Bank

6. DISCLOSURE OF INFORMATION AND PERSONAL DATA

6.1 The Customer agrees and consents to the disclosure of any Customer information, information in relation to the Deposit Bag

Service (including without limitation particulars of any payment transactions and/or the Customer’s bank accounts, any details

and/or transactions) or any other information provided to the Bank in connection with the provision of the Deposit Bag Service to

(a) any person to whom such disclosure is required or permitted under any law or regulation or required by any court,

government authority or regulator; (b) any person to whom the Bank assigns or transfers (or intend to assign or transfer) any of

the Bank’s rights or obligations under these Terms; (c) any person for the purposes of enforcing or protecting the Bank’s rights and

interests; (d) any entity of the DBS Group; and (e) any person in connection with the provision of insurance or services to meet

DBS Group’s operational, administrative or risk management requirements, including without limitation the Service Provider.

6.2 The Customer may provide personal data to the Bank (including without limitation personal data of any office holder, employee,

shareholder, beneficial owner or customer) in connection with the Customer establishing and maintaining its relationship with the

Bank. When providing any personal data to the Bank, the Customer confirms that the Customer is lawfully providing the data for

the Bank to use and disclose for the purposes of: (a) providing products or services to the Customer; (b) meeting the operational,

administrative and risk management requirements of DBS Group; and (c) complying with any requirement, as DBS Group

reasonably deems necessary, under any law or of any court, government authority or regulator.

“DBS Group” means DBS Group Holdings Ltd and its affiliates.

7. CHANGES TO TERMS AND CONDITIONS

7.1 At any time, we may make changes to these Terms. We will give you reasonable notice of changes by either sending you the

revised Terms, putting them on our website and telling you about them or publishing them in the media. All changes will apply from

the date stated in the notice or public announcement.

7.2 If you do not accept the revised Terms, you have the option to terminate the Cash Deposit Bag Service before they take effect. If

you do not terminate the Cash Deposit Bag Service after the date the revised Terms come into effect, we will treat you as having

agreed to the changes.

8. FEES

8.1 The Bank may impose a service charge for processing the cash deposits or change the amount of any existing service charge by

giving one month’s notice. Any service charge paid is not refundable.

9. TERMINATION AND/OR SUSPENSION

9.1 This Deposit Bag Service may be terminated by either the Bank or the Customer, provided prior written notice of at least 30 days is

given by the party proposing to terminate the Deposit Bag Service.

9.2 The Bank may suspend or terminate the Deposit Bag Service immediately if:

(a) the Customer fails to comply with these Terms;

(b) a receiver and/or manager or liquidator or similar officer is appointed over the Customer or any part of the Customer’s

undertaking or assets or if the Customer passes a resolution for winding-up or dissolution;

(c) the Bank is required by any law, rule or regulation to do so.

(d) if the Bank decides or have reason to suspect that the Deposit Bag Service and/or the Designated Account is being used for

or in connection with any fraudulent or illegal activities or transactions (including gambling, money laundering, funding,

terrorism or tax evasion);

(e) if the Designated Account is closed, frozen or suspended; or

(f) if the Customer is in any way involved in forgery or other unauthorised use of the Deposit Bag Service and/or the Designated

Account.

DBS Bank Ltd Page 3 of 4

Co. Reg. No. 196800306E v1.2 (Updated Mar’21)

9.3 The termination of the Deposit Bag Service shall not affect the rights, obligations or liabilities that have accrued or arisen before

the date of such termination.

10. Indemnity and Exclusion of Liability

10.1 The Customer undertakes to indemnify and keep the Bank indemnified on demand against all claims, losses, costs (including legal

costs on a full indemnity basis), charges, damages, expenses, actions, proceedings and any liability of whatsoever nature or

description which may be sustained or incurred by the Bank arising out of or in connection with the Bank acting in accordance

with the arrangement herein, or failing/refusing to act (“Losses”), except where such Losses arise as a direct result of the Bank’s

gross negligence or fraud.

10.2 The Customer hereby waives any rights, claims, actions or proceedings which it may have against the Bank for any losses or

liabilities which it may suffer as a consequence of the arrangement herein.

11. Set off and Payments to the Bank

11.1 Notwithstanding any other term or agreement the Customer may have with the Bank, the Bank has the right, at any time, without

giving the Customer notice, to set off and deduct from any account the Customer has with the Bank any amount due, owing or

payable to the Bank under these Terms, even if this would make that account overdrawn.

11.2 The Customer must make all payments owed to the Bank under these Terms free and clear of, and without deduction, withholding

or set-off on account of any tax or levy or any other charges present and future.

12. General

12.1 The Customer shall not assign or transfer (whether by way of security or otherwise),or declare or permit to subsist any trust

arrangement over, or otherwise dispose of any interest, benefit or obligation under these Terms without the Bank’s written

consent. The Bank may, at any time and without having to obtain the Customer’s consent, assign or transfer any or all of its rights

or obligation under these Terms or sub-contract or outsource any of the Deposit Bag Service.

12.2 If the Bank decides not to enforce any of its rights under these Terms, it will not mean that the Bank will not do so in the future. It

also does not mean the right no longer exists.

12.3 If any provision under these Terms is unlawful or unenforceable under any applicable law, it will, to the extent permitted by law,

be severed from these Terms and rendered ineffective but without modifying the other provisions of these Terms.

12.4 The Customer confirms that all information or documents provided by the Customer to the Bank are true, complete and accurate.

The Customer must tell the Bank promptly in writing of any change in any information or documents given to the Bank.

12.5 If there is any discrepancy between the Bank’s records and the Customer’s records, the Bank’s records shall prevail.

12.6 Any other person who is not a party to these Terms shall have no right under the Contracts (Right of Third Parties) Act (Cap. 53B)

to enforce or enjoy the benefit of any term of these Terms. Notwithstanding any term of these Terms, the consent of any person

who is not a party to these Terms is not required to rescind or vary these Terms at any time.

11.8 These Terms shall be governed by and construed in accordance with the laws of Singapore and the Customer agrees to submit to

the non-exclusive jurisdiction of the Singapore courts.

DBS Bank Ltd Page 4 of 4

Co. Reg. No. 196800306E v1.2 (Updated Mar’21)

You might also like

- TCs TBC Epaycard Jan 2022Document10 pagesTCs TBC Epaycard Jan 2022Aileen SalazarNo ratings yet

- Ecredit 01202021Document4 pagesEcredit 01202021Dj BacudNo ratings yet

- Business Correspondent AgreementDocument13 pagesBusiness Correspondent AgreementAjay ChouhanNo ratings yet

- RB Chapter 2A-Current Account-MITCDocument9 pagesRB Chapter 2A-Current Account-MITCRohit KumarNo ratings yet

- Compensation Policy 28 03 2019Document10 pagesCompensation Policy 28 03 2019Arnab MitraNo ratings yet

- Compensation PolicyDocument17 pagesCompensation PolicySwetha BuridiNo ratings yet

- Exhibit 4 - Terms and Conditions Governing The Opening and Maintenance of Deposit AccountsDocument6 pagesExhibit 4 - Terms and Conditions Governing The Opening and Maintenance of Deposit AccountsJohn Dennis Sugata-onNo ratings yet

- Cheque Collection Policy 2020 21Document27 pagesCheque Collection Policy 2020 21Hareesh LNo ratings yet

- Shahid HussainDocument16 pagesShahid HussainShahzaib Hussain100% (1)

- Loan PolicyDocument5 pagesLoan PolicySoumya BanerjeeNo ratings yet

- General T C S For Correspondent BanksDocument12 pagesGeneral T C S For Correspondent BankshabchiNo ratings yet

- Terms and Conditions Governing The Opening and Maintenance of AccountsDocument6 pagesTerms and Conditions Governing The Opening and Maintenance of Accountsjerald tanNo ratings yet

- DCB RTGSDocument2 pagesDCB RTGSBharat VardhanNo ratings yet

- EAST WEST - Ewb Bills Collect 08302018Document3 pagesEAST WEST - Ewb Bills Collect 08302018Junior MiicNo ratings yet

- Niyo SBM TCDocument12 pagesNiyo SBM TCShinchan NoharaNo ratings yet

- General Terms & Conditions: Applicable To All AccountsDocument7 pagesGeneral Terms & Conditions: Applicable To All AccountsKhalid Saif JanNo ratings yet

- HDFC PL AgreementDocument16 pagesHDFC PL AgreementAnilkumar chavanNo ratings yet

- MOUDocument7 pagesMOUMukesh SainiNo ratings yet

- Compensation Policy EnglishDocument5 pagesCompensation Policy EnglishpratibhashawNo ratings yet

- Key Fact Statement-Neobiz: Mashreqbank PSC Is Regulated by The Central Bank of The United Arab EmiratesDocument4 pagesKey Fact Statement-Neobiz: Mashreqbank PSC Is Regulated by The Central Bank of The United Arab Emiratesresources erpNo ratings yet

- Account Opening Terms & ConditionsDocument7 pagesAccount Opening Terms & ConditionsM. JAWAD AFZALNo ratings yet

- Business Integrated Account General Conditions HSBCDocument67 pagesBusiness Integrated Account General Conditions HSBCwalidb.businessNo ratings yet

- Deposit Account - Terms and Conditions - UpdatedDocument4 pagesDeposit Account - Terms and Conditions - UpdatedSodyJamalNo ratings yet

- Indian Bank Global Credit Card Usage GuideDocument14 pagesIndian Bank Global Credit Card Usage GuideJijithpillaiNo ratings yet

- HSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsDocument41 pagesHSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsfaridajirNo ratings yet

- Domestic Money Transfer - RelaxationDocument6 pagesDomestic Money Transfer - RelaxationMihir GandhiNo ratings yet

- Settlement LetterDocument3 pagesSettlement LetterKritikaNo ratings yet

- Brac Bank Statement PolicyDocument12 pagesBrac Bank Statement Policyuriaswalliser.frnb1.04.4No ratings yet

- PK Saadiq Most Important Document MidDocument8 pagesPK Saadiq Most Important Document MidZeeshan HameedNo ratings yet

- Terms and Conditions - Account OpeningDocument3 pagesTerms and Conditions - Account OpeningWasimullah KhanNo ratings yet

- General GuidelinesDocument385 pagesGeneral GuidelinesRuchi SharmaNo ratings yet

- SA Wadiah R&R EngBMDocument12 pagesSA Wadiah R&R EngBMsyamsudin75No ratings yet

- Individual Account Opening Form KeDocument5 pagesIndividual Account Opening Form Kekamararichard2No ratings yet

- CASA Terms & Conditions Eff 18 May 2020 - Ecai BM PDFDocument17 pagesCASA Terms & Conditions Eff 18 May 2020 - Ecai BM PDFARe-teaNa AbdullahNo ratings yet

- China Bank Credit Card Terms and ConditionsDocument15 pagesChina Bank Credit Card Terms and ConditionsDakuro A EthanNo ratings yet

- DIB Account Opening TCs and Key Fact Sheet KFSDocument8 pagesDIB Account Opening TCs and Key Fact Sheet KFSrock mirzaNo ratings yet

- Sub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptDocument20 pagesSub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptAmitKumarNo ratings yet

- FAB General Terms and Conditions For AccountsDocument31 pagesFAB General Terms and Conditions For AccountsWaqas BarikNo ratings yet

- Settlement LetterDocument3 pagesSettlement LetterKritikaNo ratings yet

- Deutsche Bank Compensation PolicyDocument7 pagesDeutsche Bank Compensation PolicySyed Ali AbbasNo ratings yet

- Account Closure FormDocument2 pagesAccount Closure FormchanduvermaNo ratings yet

- 07MCEN78A54033Document9 pages07MCEN78A54033Shailesh BapnaNo ratings yet

- Deposit - Policy in EnglishDocument22 pagesDeposit - Policy in Englishpawan soniNo ratings yet

- HSBC Bank Malaysia Berhad ("HSBC") Universal Terms & ConditionsDocument44 pagesHSBC Bank Malaysia Berhad ("HSBC") Universal Terms & ConditionsSim Yun YoungNo ratings yet

- Terms and Conditions For Notice Term DepositDocument2 pagesTerms and Conditions For Notice Term DepositdoctorirfanNo ratings yet

- Compensation Policy 2020 21Document14 pagesCompensation Policy 2020 21K. NikhilNo ratings yet

- Agreement On Bank TransactionsDocument16 pagesAgreement On Bank TransactionsYa LiNo ratings yet

- Terms and Conditions For Bank AL Habib ATM Debit CardDocument7 pagesTerms and Conditions For Bank AL Habib ATM Debit CardTanveer AhmedNo ratings yet

- Paying and Collecting BankerDocument12 pagesPaying and Collecting BankerartiNo ratings yet

- 3.export Letters of CreditDocument35 pages3.export Letters of CreditHarpreet SinghNo ratings yet

- 2021 April Terms and ConditionsDocument40 pages2021 April Terms and ConditionsAshley KoNo ratings yet

- Announcement From Systems - Circulars Issued by - Released Thru Systems (For December)Document18 pagesAnnouncement From Systems - Circulars Issued by - Released Thru Systems (For December)Andy EdonoNo ratings yet

- Rbi 202324 132Document11 pagesRbi 202324 132ambarishramanuj8771No ratings yet

- Shrikant SharmaDocument3 pagesShrikant SharmaShrikant SharmaNo ratings yet

- Policy On Bank DepositsDocument11 pagesPolicy On Bank DepositsAnshuman SharmaNo ratings yet

- SABB Umlaty Visa Card TC 1jan22 enDocument7 pagesSABB Umlaty Visa Card TC 1jan22 enimadz853No ratings yet

- Bank Account Agreement - Lu4shie - Uslugi - EPB - Contract - PersonalDocument4 pagesBank Account Agreement - Lu4shie - Uslugi - EPB - Contract - PersonalPhilippe ServajeanNo ratings yet

- Rules of BusinessDocument3 pagesRules of BusinessSidharth GuptaNo ratings yet

- Customer Compensation PolicyDocument15 pagesCustomer Compensation PolicyVaishnaviNo ratings yet

- Personal Loan Agreement and Terms and Conditions: PartiesDocument5 pagesPersonal Loan Agreement and Terms and Conditions: PartiesAarumilli SriramNo ratings yet

- Requirements:: To Fill Up in BLOCK/CAPITAL LETTERS OnlyDocument1 pageRequirements:: To Fill Up in BLOCK/CAPITAL LETTERS OnlyAarumilli SriramNo ratings yet

- In The Court of The Civil Judge (S.D) - AT - : Pplication OR Uccession Ertificate S F Ndian Uccession CTDocument2 pagesIn The Court of The Civil Judge (S.D) - AT - : Pplication OR Uccession Ertificate S F Ndian Uccession CTAarumilli SriramNo ratings yet

- TRONSCAN - TRON BlockChain Explorer - 波场区块链浏览器Document1 pageTRONSCAN - TRON BlockChain Explorer - 波场区块链浏览器Aarumilli SriramNo ratings yet

- Dwnload Full Personal Finance Turning Money Into Wealth 6th Edition Keown Solutions Manual PDFDocument36 pagesDwnload Full Personal Finance Turning Money Into Wealth 6th Edition Keown Solutions Manual PDFjulianchghhc100% (13)

- CLDDP Lca Constitution 20210726Document6 pagesCLDDP Lca Constitution 20210726Mcolisi GinindzaNo ratings yet

- Offer Letter For LA ASMDocument4 pagesOffer Letter For LA ASMAbdulBasitBilalSheikhNo ratings yet

- Contrato de Compraventa en Ingles 2Document2 pagesContrato de Compraventa en Ingles 2Ricardo OsorioNo ratings yet

- IHR Authorized Ports List SSCECDocument104 pagesIHR Authorized Ports List SSCECBryant CuisonNo ratings yet

- S.No State/UT's Name Rank Email Name Rank Contact EmailDocument3 pagesS.No State/UT's Name Rank Email Name Rank Contact EmailAnsh SinghNo ratings yet

- JLD 32103 Introduction To Risk Management and InsuranceDocument3 pagesJLD 32103 Introduction To Risk Management and InsurancehafidzNo ratings yet

- Bilingualism: Definitions and Distinctions: CHAPTER 1Document8 pagesBilingualism: Definitions and Distinctions: CHAPTER 1liaNo ratings yet

- Glorietta 1 - Popeyes Glorietta - HotworksDocument3 pagesGlorietta 1 - Popeyes Glorietta - HotworksRalph Adrian MielNo ratings yet

- Dhs Policy Directive 047-01-007 Handbook For Safeguarding Sensitive PII 12-4-2017Document20 pagesDhs Policy Directive 047-01-007 Handbook For Safeguarding Sensitive PII 12-4-2017jujachaves silvaNo ratings yet

- Tamilnadu Money Lenders ActDocument7 pagesTamilnadu Money Lenders ActSiva Rama Krishnan50% (2)

- Contract Awarded Notice Bangladesh Mymensingh Kewatkhali Bridge ProjectDocument2 pagesContract Awarded Notice Bangladesh Mymensingh Kewatkhali Bridge Projectzhenyu suNo ratings yet

- Saurashtra Gujarat Bathymetry Survey DTPDocument107 pagesSaurashtra Gujarat Bathymetry Survey DTPwapcosrajkotNo ratings yet

- John Gunn's Résumé July 2021Document1 pageJohn Gunn's Résumé July 2021John GunnNo ratings yet

- Hoer 1Document21 pagesHoer 1Ranjeet SinghNo ratings yet

- Experiment 3 GasesDocument8 pagesExperiment 3 GasesNathanael Kean DimasacatNo ratings yet

- 103 - Abdulla Paru (Plaintiff) v. Gannibai and Others (Defendants) (690-691) PDFDocument2 pages103 - Abdulla Paru (Plaintiff) v. Gannibai and Others (Defendants) (690-691) PDFmanideep reddyNo ratings yet

- Leave Form - Royette Roll - 14july2021Document4 pagesLeave Form - Royette Roll - 14july2021lnicolas00No ratings yet

- Cuison vs. Court of Appeals PDFDocument11 pagesCuison vs. Court of Appeals PDFYeu GihNo ratings yet

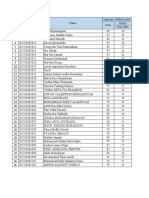

- 115 Date Wise List All GD Pi Final Rev RPDocument97 pages115 Date Wise List All GD Pi Final Rev RPRakeshDNo ratings yet

- ACARA 2 InggriDocument12 pagesACARA 2 InggriSyahrul Maulana As'ari HabibiNo ratings yet

- Premium ReceiptDocument1 pagePremium ReceiptAmeenNo ratings yet

- Alipio v. CADocument2 pagesAlipio v. CAAudreySyUyanNo ratings yet

- DG 3 Answer-Key 22-23 Ex2-4 2-6Document10 pagesDG 3 Answer-Key 22-23 Ex2-4 2-6SylwiaNo ratings yet

- Adverse Claim: Sps. Dominador Pauig and Vilma Pauig vs. Arnulfo Interior, Pacto de Retro SaleDocument2 pagesAdverse Claim: Sps. Dominador Pauig and Vilma Pauig vs. Arnulfo Interior, Pacto de Retro SaleVince ArugayNo ratings yet

- Rizal Law RA 1425Document2 pagesRizal Law RA 1425Alayka Mae Bandales LorzanoNo ratings yet

- EUJUS15A 1628 I01 EqualPayDayfactsheetsupdate2017 Countryfiles EuropeanUnion en V01 LRPDFDocument1 pageEUJUS15A 1628 I01 EqualPayDayfactsheetsupdate2017 Countryfiles EuropeanUnion en V01 LRPDFSKNo ratings yet

- Informe Camara Cemercio Internacional PDFDocument190 pagesInforme Camara Cemercio Internacional PDFNSANCHEZTNo ratings yet

- FransaDocument2 pagesFransaElena DafinaNo ratings yet

- Civil War Notes - Important People and Events PDFDocument6 pagesCivil War Notes - Important People and Events PDFawhammet100% (1)