Professional Documents

Culture Documents

Supply Side Policies

Uploaded by

tawandaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Supply Side Policies

Uploaded by

tawandaCopyright:

Available Formats

Supply Side Policies

Supply-side policies are government attempts to increase productivity and

increase efficiency in the economy. If successful, they will shift aggregate supply

(AS) to the right and enable higher economic growth in the long-run.

There are two main types of supply-side policies.

1. Free-market supply-side policies involve policies to increase

competitiveness and free-market efficiency. For example, privatisation,

deregulation, lower income tax rates, and reduced power of trade unions.

2. Interventionist supply-side policies involve government intervention to

overcome market failure. For example, higher government spending on

transport, education and communication.

Benefits of Supply-Side Policies

In theory, supply-side policies should increase productivity and shift long-run

aggregate supply (LRAS) to the right.

1. Lower Inflation

Shifting AS to the right will cause a lower price level. By making the economy

more efficient, supply-side policies will help reduce cost-push inflation. For

example, if privatisation leads to more efficiency it can lead to lower prices.

2. Lower Unemployment

Supply-side policies can contribute to reducing structural, frictional and real wage

unemployment and therefore help reduce the natural rate of unemployment.

3. Improved economic growth

Supply-side policies will increase the sustainable rate of economic growth by

increasing LRAS; this enables a higher rate of economic growth without causing

inflation.

4. Improved trade and Balance of Payments.

By making firms more productive and competitive, they will be able to export

more. This is important in light of the increased competition from an increasingly

globalised marketplace

Examples of supply-side policies

1. Privatisation

This involves selling state-owned assets to the private sector. It is argued that the

private sector is more efficient in running businesses because they have a profit

motive to reduce costs and develop better services.

2. Deregulation

This involves reducing barriers to entry to allow new firms to enter the market.

This will make the market more competitive. For example, BT used to be a

monopoly in telecommunications, but now several firms compete for our

business. Competition tends to lead to lower prices and better quality of

goods/service.

The difficulty is that not all industries are amenable to competition. For

example, power generation and water supply is a natural monopoly.

Privatising and deregulating these industries tends to create a private

monopoly who can charge higher prices.

3. Reducing income tax rates

It is argued that lower income tax rates increase the incentives for people to work

harder, leading to an increase in labour supply and more output. Similarly, a cut

in corporation tax gives firms more retained profit they can use for investment.

However this is not necessarily true, lower taxes do not always increase

work incentives (e.g. if income effect outweighs substitution effect). Firms

may not invest the increased profit but give to shareholders or save.

4. Deregulate Labour Markets

Labour markets can be deregulated through policies such as

Make it easier to hire and fire workers. Abolish redundancy pay or right of

appeal

Reduce maximum working weeks and minimum holiday pay.

Enable zero-hour contracts which allow firms to employ workers when

demand is greater.

If it is cheaper to hire and fire workers, the argument is that it encourages firms to

take on workers in the first place, creating more employment opportunities.

However, more flexible labour markets can cause increased uncertainty

and lower productivity.

5. Reducing the power of trades unions

This can involve legislation which reduces the ability of trade unions to go on

strike. This should:

Increase efficiency of firms e.g. less time lost to strikes.

Reduce real wage unemployment. (if labour markets are competitive)

6. Reducing unemployment benefits

Lower benefits may encourage the unemployed to take jobs. Lower means-

tested benefits for those in work may increase the incentive to work longer hours.

7. Deregulate financial markets

For example, building societies were allowed to become for profit-making banks.

Deregulation should allow more competition and, in theory, lead to lower

borrowing costs for consumers and firms.

7. Increase free-trade

Lower tariff barriers will increase trade and provide an incentive for export firms

to invest. Increasingly important are non-tariff barriers. For example, the EU

Single Market has harmonisation over regulations, which enables more

frictionless trade. Negotiating frictionless trade-deals can lead to lower cost for

business and improve productivity.

9. Removing unnecessary red tape

Planning restrictions can make it difficult for firms to expand and invest in new

capacity. Reducing red tape and levels of bureaucracy reduce firms’ costs and

encourage an environment conducive to encouraging investment.

10. Encourage immigration

Free-movement of labour can enable firms to fill labour shortages – whether they

are skilled jobs, in construction and engineering or low-skilled jobs such as fruit

picking. Liberal immigration policies make labour markets more flexible and in

economic booms – help firms keep up with growing demand. This can prevent

wage inflation and enable firms to increase productive capacity.

Interventionist supply-side policies

1. Increased education and training

Better education can improve labour productivity and increase AS. Often there is

under-provision of education in a free market, leading to market failure. Therefore

the government may need to subsidise suitable education and training schemes

to fill vacancies in the labour market.

However govt intervention will cost money and require higher taxes, It will

take time to have an effect and the government may subsidise the wrong

types of training.

2. Improving transport and infrastructure

With transport, there is usually a degree of market failure – congestion and

pollution. Government spending on improved transport links can help reduce

congestion and overcome this market failure. Improved transport provision helps

reduce the cost of transport and will encourage firms to invest. Transport

bottlenecks on the road, rail and air – are often cited as a major stumbling block

for the UK economy.

However, in a crowded country like the UK, it can be difficult to increase

transport capacity, especially in London.

3. Build more affordable homes

Building affordable council homes in expensive areas can make it easier for

workers to move and find jobs in expensive areas reducing geographical

immobility. Firms can suffer from labour shortages in areas that have become

very expensive to live in.

4. Improved healthcare

Business can face substantial costs from time lost to ill-health. Health care

spending which improves a nation’s health can improve labour productivity.

Improved health can also come from discouraging unhealthy habits. For

example, tax on cigarettes, alcohol and sugar can reduce health care costs

associated with drunkenness, obesity and polluted environments.

Limitations of supply-side policies

Productivity growth depends largely on private enterprise and trends

in technological innovation. There is a limit to which the government can

accelerate the growth of technological change and improvements in

working practices.

Supply-side policies can be counter-productive. For example, flexible

labour markets may reduce costs for business – but if they cause job-

insecurity, workers may become demotivated and labour productivity

stagnates. Since 2009, the UK has seen a fall in structural unemployment

due to more flexible labour markets – but productivity growth is almost

stagnant.

In a recession, supply-side policies cannot tackle the fundamental

problem which is lack of aggregate demand.

Time. All supply-side policies take a long time to have an effect. Some

policies, such as education spending may not influence the economy for

20-30 years.

You might also like

- Balance of Payments Multiple Choice QuestionsDocument11 pagesBalance of Payments Multiple Choice QuestionsSagar100% (1)

- Market FailureDocument3 pagesMarket FailureAbhishek Raj100% (1)

- Market Failure Tutor2uDocument28 pagesMarket Failure Tutor2usharmat1963No ratings yet

- Mankiw's Ten Principles of EconomicsDocument3 pagesMankiw's Ten Principles of EconomicsVeronica KateNo ratings yet

- IGCSE Economics Self Assessment Chapter 28 AnswersDocument3 pagesIGCSE Economics Self Assessment Chapter 28 AnswersDesre100% (1)

- Supply-Side Policy: Improving Productivity of FactorsDocument3 pagesSupply-Side Policy: Improving Productivity of FactorsMakoy AceronNo ratings yet

- What Can Be Done at The Macro Level To Control Unemployment?Document3 pagesWhat Can Be Done at The Macro Level To Control Unemployment?Mohammed AshroffNo ratings yet

- Govt Intervention and Market FailureDocument42 pagesGovt Intervention and Market FailureAsad AliNo ratings yet

- Policies To Control InflationDocument5 pagesPolicies To Control InflationMohsin ManzoorNo ratings yet

- MDS 529 - Handout 3Document6 pagesMDS 529 - Handout 3faruque.ddsNo ratings yet

- Ab) Government Intervention To Protect Consumers, Suppliers and EmployeesDocument6 pagesAb) Government Intervention To Protect Consumers, Suppliers and EmployeesCharlie DeltaNo ratings yet

- CH.7 External Economic Influences On Business AcivityDocument5 pagesCH.7 External Economic Influences On Business Acivitytaha ChniberNo ratings yet

- Tejvan Pettinger: Poor InformationDocument6 pagesTejvan Pettinger: Poor InformationtawandaNo ratings yet

- Supply Side Policy: Labour: How The Government Can Increase The Quality/Quantity of LabourDocument9 pagesSupply Side Policy: Labour: How The Government Can Increase The Quality/Quantity of LabourkirstinroseNo ratings yet

- Supply Side PoliciesDocument5 pagesSupply Side PoliciesVanessa KuaNo ratings yet

- IBDP Macro 3.7 FinalDocument7 pagesIBDP Macro 3.7 FinalSandeep SudhakarNo ratings yet

- Supply Side PolicyDocument1 pageSupply Side PolicyStephanieNo ratings yet

- Chapter 7 External Economic Influences On Business ActivityDocument3 pagesChapter 7 External Economic Influences On Business ActivityVakim KNo ratings yet

- Supply Side PolicyDocument6 pagesSupply Side Policyxf48qwb9gcNo ratings yet

- Policies For Reducing UnemploymentDocument6 pagesPolicies For Reducing UnemploymentAnushkaa DattaNo ratings yet

- Advantages of PrivatisationDocument2 pagesAdvantages of PrivatisationRigved DarekarNo ratings yet

- Advantages and Problems of PrivatisationDocument4 pagesAdvantages and Problems of PrivatisationShahriar HasanNo ratings yet

- Video NotesDocument2 pagesVideo NotesHarold WhistlerNo ratings yet

- CIE Economics A-level Topic 3: Government Microeconomic Intervention NotesDocument12 pagesCIE Economics A-level Topic 3: Government Microeconomic Intervention NotesFarzan AliNo ratings yet

- MB0037 - International Business Management Assignment Set-1Document28 pagesMB0037 - International Business Management Assignment Set-1RK SinghNo ratings yet

- Model 25 MarkerDocument2 pagesModel 25 MarkertaviNo ratings yet

- MacroeconomicsDocument4 pagesMacroeconomicsBurhan barchaNo ratings yet

- Government Intervention in Markets: Correcting Market FailuresDocument4 pagesGovernment Intervention in Markets: Correcting Market FailuresOzkar Zaldivar100% (1)

- Privatisation of Public Sector Enterprises in India MethodsDocument12 pagesPrivatisation of Public Sector Enterprises in India MethodsSwayam SethiyaNo ratings yet

- How To Control MonopoliesDocument3 pagesHow To Control MonopoliesSharma GokhoolNo ratings yet

- Quest International University PerakDocument6 pagesQuest International University PerakMalathi SundrasaigaranNo ratings yet

- Supply-Side PoliciesDocument2 pagesSupply-Side PoliciesSubashini ManiamNo ratings yet

- Microeconomics Year 10 CommerceDocument13 pagesMicroeconomics Year 10 CommerceSodhit SuranaNo ratings yet

- Supply-Side PolicyDocument5 pagesSupply-Side PolicyElaine chenNo ratings yet

- ECO107 Economics and The Modern Business EnterpriseDocument6 pagesECO107 Economics and The Modern Business EnterpriseSakif AhsanNo ratings yet

- Unit 12 - Lesson 9 7 Supply-Side PoliciesDocument14 pagesUnit 12 - Lesson 9 7 Supply-Side Policiesapi-260512563No ratings yet

- Supply-Side PoliciesDocument12 pagesSupply-Side PoliciesBezalel OLUSHAKINNo ratings yet

- Supply Side PolicyDocument5 pagesSupply Side PolicyDIPALI GOREGAONKAR�No ratings yet

- Policies For Reducing UnemploymentDocument14 pagesPolicies For Reducing UnemploymentAnushkaa DattaNo ratings yet

- Supply Side PoliciesDocument18 pagesSupply Side Policiesandrew.collananNo ratings yet

- Economics Question and AnswersDocument144 pagesEconomics Question and Answersmarvadomarvellous67No ratings yet

- Assignment Business EnvironmentDocument9 pagesAssignment Business EnvironmentDashanka WarnakulasooriyaNo ratings yet

- Econ Ans 2Document1 pageEcon Ans 2najla nistharNo ratings yet

- YED Business RelevanceDocument6 pagesYED Business RelevanceAnusree SivasamyNo ratings yet

- Differentiate Between Privatization and Commercialization of Public Enterprise and Discuss It Merit and DemeritDocument8 pagesDifferentiate Between Privatization and Commercialization of Public Enterprise and Discuss It Merit and DemeritUsman AbubakarNo ratings yet

- Inflation Is Generally Controlled by The Central Bank or The Government Itself. Below Are Several Methods That Can Be UsedDocument6 pagesInflation Is Generally Controlled by The Central Bank or The Government Itself. Below Are Several Methods That Can Be UsedNur Aida Mohd SabriNo ratings yet

- External Influences On Business Activity YR 13Document82 pagesExternal Influences On Business Activity YR 13David KariukiNo ratings yet

- Shivamgupta Covid-19Document5 pagesShivamgupta Covid-19Shivam GuptaNo ratings yet

- Edexcel Economics AS-level Series Complete NotesDocument8 pagesEdexcel Economics AS-level Series Complete NotesShahab HasanNo ratings yet

- Eco 10Document47 pagesEco 10156502906No ratings yet

- Price As A RegulatorDocument12 pagesPrice As A RegulatorWalid SobhyNo ratings yet

- Section 4 TB Fourpart Q-ADocument17 pagesSection 4 TB Fourpart Q-AmaaheerjainNo ratings yet

- Chapter 3 - Global Trading EnvironmentDocument46 pagesChapter 3 - Global Trading Environmentkirthi nairNo ratings yet

- ICNSGCase 4 CompetitionDocument8 pagesICNSGCase 4 CompetitionRiya MukherjeeNo ratings yet

- (2013) Abdel-Kader - What Are Structural Policies PDFDocument2 pages(2013) Abdel-Kader - What Are Structural Policies PDF0treraNo ratings yet

- 4.5 - Supply Side PolicyDocument2 pages4.5 - Supply Side PolicysuramyaNo ratings yet

- Business Studies Notes A LevelDocument41 pagesBusiness Studies Notes A LevelhereanurajNo ratings yet

- Economia Trabajo 1Document9 pagesEconomia Trabajo 1Elizabeth SaldañaNo ratings yet

- PrivatizationDocument3 pagesPrivatizationDilane AmonNo ratings yet

- Topic 2.33 Measures To Promote Economic GrowthDocument3 pagesTopic 2.33 Measures To Promote Economic GrowthweijuanshihkuNo ratings yet

- Policies for Reducing UnemploymentDocument9 pagesPolicies for Reducing UnemploymentMuhammad Waleed ArsalNo ratings yet

- BankingDocument3 pagesBankingtawandaNo ratings yet

- jbms-9-2-3Document11 pagesjbms-9-2-3tawandaNo ratings yet

- 0460_s22_i2_21Document2 pages0460_s22_i2_21tawandaNo ratings yet

- S303I.sarmaDocument15 pagesS303I.sarmaapersonjust47No ratings yet

- 0460_s22_i2_23Document2 pages0460_s22_i2_23tawandaNo ratings yet

- Economics Assignment 1 Final DraftDocument10 pagesEconomics Assignment 1 Final DrafttawandaNo ratings yet

- Measures To Restore ConfidenceDocument7 pagesMeasures To Restore ConfidencetawandaNo ratings yet

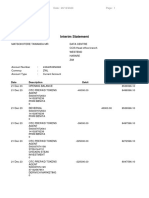

- Interim Statement: Date: 29/12/2023Document2 pagesInterim Statement: Date: 29/12/2023tawandaNo ratings yet

- Report 1698833017896Document1 pageReport 1698833017896tawandaNo ratings yet

- Individual Written AssignmentDocument2 pagesIndividual Written AssignmenttawandaNo ratings yet

- Marketing Assignment 2 WordDocument6 pagesMarketing Assignment 2 WordtawandaNo ratings yet

- ANNIE PHIRI Log BookDocument3 pagesANNIE PHIRI Log BooktawandaNo ratings yet

- Praise and Worship List1Document3 pagesPraise and Worship List1tawandaNo ratings yet

- AFRISUN14Document178 pagesAFRISUN14tawandaNo ratings yet

- Intermediate MacroeconomicsDocument6 pagesIntermediate MacroeconomicstawandaNo ratings yet

- AFDIS14Document52 pagesAFDIS14tawandaNo ratings yet

- International FinanceDocument6 pagesInternational FinancetawandaNo ratings yet

- XYZ Limited ratio analysis and interest rate determinantsDocument4 pagesXYZ Limited ratio analysis and interest rate determinantstawandaNo ratings yet

- Corporate Governance - Non Executive DirectorsDocument7 pagesCorporate Governance - Non Executive DirectorstawandaNo ratings yet

- Corporate Governance Government MeasuresDocument9 pagesCorporate Governance Government MeasurestawandaNo ratings yet

- Why Some Corporate Boards Fail: Lack of Oversight and ProbityDocument9 pagesWhy Some Corporate Boards Fail: Lack of Oversight and ProbitytawandaNo ratings yet

- Chapter 2Document15 pagesChapter 2tawandaNo ratings yet

- Assignment 5Document5 pagesAssignment 5tawandaNo ratings yet

- Why Corporate Boards Fail Due to Lack of Oversight and Monitoring (25Document1 pageWhy Corporate Boards Fail Due to Lack of Oversight and Monitoring (25tawandaNo ratings yet

- Assignment 1Document6 pagesAssignment 1tawanda100% (2)

- Course Outline BLPDocument2 pagesCourse Outline BLPtawandaNo ratings yet

- Chapter 1 Lupane State UniversityDocument8 pagesChapter 1 Lupane State UniversitytawandaNo ratings yet

- Corporate FinanceDocument3 pagesCorporate FinancetawandaNo ratings yet

- Assignment 2 BACC205 - 2022Document3 pagesAssignment 2 BACC205 - 2022tawandaNo ratings yet

- Corporate Finance 1B Study Pack CUZDocument169 pagesCorporate Finance 1B Study Pack CUZtawandaNo ratings yet

- G11 Applied Econ Q1WK2 ABCD With Answer KeyDocument9 pagesG11 Applied Econ Q1WK2 ABCD With Answer Keyella mayNo ratings yet

- Social Inequality in India, Social Development, and GlobalizationDocument4 pagesSocial Inequality in India, Social Development, and GlobalizationBarkhaNo ratings yet

- Cases in Nonprofit ManagementDocument5 pagesCases in Nonprofit ManagementestherNo ratings yet

- Competing Through SustainabilityDocument4 pagesCompeting Through SustainabilitySean SimNo ratings yet

- Introduction To UnemploymentDocument3 pagesIntroduction To UnemploymentNozeelia BlairNo ratings yet

- UnemploymentDocument26 pagesUnemploymentSangeetha K SNo ratings yet

- Test Bank For Employee Benefits 6th Edition Joseph MartocchioDocument15 pagesTest Bank For Employee Benefits 6th Edition Joseph MartocchioCharles Pando100% (35)

- CARE GBV - Concept Note Summary Budget TDocument10 pagesCARE GBV - Concept Note Summary Budget TtawandaeltonNo ratings yet

- The case against the 'gig economy' and its impact on workersDocument7 pagesThe case against the 'gig economy' and its impact on workersDQ MarshallNo ratings yet

- Unit 1: Exercise 1: Read The Groups of Words That Begin With The Same Prefix. Match The Meanings With The PrefixesDocument12 pagesUnit 1: Exercise 1: Read The Groups of Words That Begin With The Same Prefix. Match The Meanings With The Prefixesrose juliaNo ratings yet

- Socio Economic FactorsDocument22 pagesSocio Economic Factorslance sibayanNo ratings yet

- MNGT 367 CH 14 MC Answers OnlyDocument14 pagesMNGT 367 CH 14 MC Answers OnlyDyenNo ratings yet

- Components of Wage System in Human Resource ManagementDocument7 pagesComponents of Wage System in Human Resource Managementbk1_786100% (1)

- HRM - Excel Books - Chapter 16Document20 pagesHRM - Excel Books - Chapter 16Soumya Jyoti BhattacharyaNo ratings yet

- Entrepreneurship Development (DAF - MUBS) : BY AMBROSE TUBENAWE 0772467417Document4 pagesEntrepreneurship Development (DAF - MUBS) : BY AMBROSE TUBENAWE 0772467417tubenaweambroseNo ratings yet

- Texas Unemployment Benefits GuideDocument2 pagesTexas Unemployment Benefits Guideandy millerNo ratings yet

- STEEPLE ANALYSIS (External Forces Analysis)Document2 pagesSTEEPLE ANALYSIS (External Forces Analysis)Komal AnwarNo ratings yet

- Income Tax Explained: Types, Deductions, and MoreDocument11 pagesIncome Tax Explained: Types, Deductions, and MorePrince Isaiah JacobNo ratings yet

- Benefits and Drawbacks of Major Sporting EventsDocument11 pagesBenefits and Drawbacks of Major Sporting EventsLaurențiu PopușoiNo ratings yet

- MMO Sample Papers For Class 9Document19 pagesMMO Sample Papers For Class 9Thúy Hà NguyễnNo ratings yet

- Giz2022 en Social Protection DisabilitiesDocument18 pagesGiz2022 en Social Protection DisabilitiesKim KaundaNo ratings yet

- Module-Lecture 6-National Income AccountingDocument14 pagesModule-Lecture 6-National Income AccountingGela ValesNo ratings yet

- Unemployment and Unemployment in PakistanDocument63 pagesUnemployment and Unemployment in Pakistanstrongcrazysolid86% (7)

- Design Bid Build: AdvantagesDocument2 pagesDesign Bid Build: AdvantagesNayab NoumanNo ratings yet

- Section: Readings in Philippine HistoryDocument10 pagesSection: Readings in Philippine HistoryJomar CatacutanNo ratings yet

- Chapter One Mening and Scope of Public FinanceDocument12 pagesChapter One Mening and Scope of Public FinanceHabibuna Mohammed100% (1)

- Reviewer HR108Document9 pagesReviewer HR108Girlie CruzNo ratings yet

- Idioms and Fixed PhrasesDocument5 pagesIdioms and Fixed PhrasesAnna SobolevaNo ratings yet