Professional Documents

Culture Documents

Abhi 17

Abhi 17

Uploaded by

ashish barwadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abhi 17

Abhi 17

Uploaded by

ashish barwadCopyright:

Available Formats

Following the first-time share issuance IPO exercise called the listing process,

the stock exchange also serves as the trading platform that facilitates regular

buying and selling of the listed shares. This constitutes the secondary market. The

stock exchange earns a fee for every trade that occurs on its platform during

secondary market activity.3

Special Considerations

The stock exchange shoulders the responsibility of ensuring price transparency,

liquidity, price discovery, and fair dealings in such trading activities. As almost

all major stock markets across the globe now operate electronically, the exchange

maintains trading systems that efficiently manage the buy and sell orders from

various market participants. They perform the price-matching function to facilitate

trade execution at a price that is fair to both buyers and sellers.

A listed company may also offer new, additional shares through other offerings at a

later stage, such as through rights issues or follow-on offerings. They may even

buy back or delist their shares. The stock exchange facilitates such transactions.

The stock exchange often creates and maintains various market-level and sector-

specific indicators, like the S&P (Standard & Poor’s) 500 index or the Nasdaq 100

index, which provide a measure to track the movement of the overall market. Other

methods include the Stochastic Oscillator and the Stochastic Momentum Index.

The stock exchanges also maintain all company news, announcements, and financial

reporting, which can usually be accessed on their official websites. A stock

exchange also supports various other corporate-level, transaction-related

activities. For instance, profitable companies may reward investors by paying

dividends that usually come from part of the company’s earnings. The exchange

maintains all such information and may support its processing to a certain extent.

Functions of a Stock Market

A stock market primarily serves the following main functions:

Fair Dealing in Securities Transactions

Depending on the standard rules of supply and demand, the stock exchange needs to

ensure that all interested market participants have instant access to data for all

buy and sell orders, thereby helping in the fair and transparent pricing of

securities. Additionally, it should also perform efficient matching of appropriate

buy and sell orders.4

For example, there may be three buyers who have placed orders for buying Microsoft

shares at $100, $105, and $110, and there may be four sellers who are willing to

sell Microsoft shares at $110, $112, $115, and $120. The exchange (through

automated trading systems) needs to ensure that the best buy and the best sell are

matched, which in this case is at $110 for the given quantity of trade.

Efficient Price Discovery

Stock markets need to support an efficient mechanism for price discovery, which

refers to the act of deciding the proper price of a security and is usually

performed by assessing market supply and demand and other factors associated with

the transactions.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Remembering Joel Braverman A'HDocument6 pagesRemembering Joel Braverman A'HYOFHSNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 20 Finance Project ExamplesDocument5 pages20 Finance Project ExamplesGustavoMontoyaNo ratings yet

- PCO Accreditation Application FormDocument3 pagesPCO Accreditation Application FormGeronimo M. Ponte Jr.No ratings yet

- Exhibit A Formal Challenge To The Twelve Presumptions of LawDocument6 pagesExhibit A Formal Challenge To The Twelve Presumptions of LawHelen Walker Private Person100% (1)

- Sytch Motion For ModificationDocument6 pagesSytch Motion For ModificationJennifer SwiftNo ratings yet

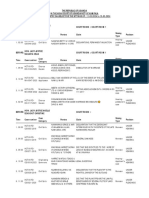

- Investment Proof Submission Form - 2017-18Document5 pagesInvestment Proof Submission Form - 2017-18vishalkavi18No ratings yet

- Family Division Court Cause List Monday March 11 - Friday March 15 2024Document27 pagesFamily Division Court Cause List Monday March 11 - Friday March 15 2024samurai.stewart.hamiltonNo ratings yet

- Globalization and The Future of Labour Law (John D. R. Craig, S. Michael Lynk (Editors) ) (Z-Library)Document520 pagesGlobalization and The Future of Labour Law (John D. R. Craig, S. Michael Lynk (Editors) ) (Z-Library)Teja Vardhan BikkasaniNo ratings yet

- Module 1 - Development of Financial Reporting Framework and Standard Setting Body PDFDocument6 pagesModule 1 - Development of Financial Reporting Framework and Standard Setting Body PDFAubrey CatalanNo ratings yet

- Khair AL MajalisDocument378 pagesKhair AL MajalisMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaNo ratings yet

- JPM India Ahead of The PackDocument3 pagesJPM India Ahead of The PacksirdquantsNo ratings yet

- Laguna v. ManabatDocument14 pagesLaguna v. ManabatRJ RioNo ratings yet

- Maybank Auto Finance Centre (Afc) Johor: No. Afc Address Telephone NoDocument23 pagesMaybank Auto Finance Centre (Afc) Johor: No. Afc Address Telephone NoNOR HALWANI BINTI MAT SHAH MoeNo ratings yet

- Pozzolith 300RDocument6 pagesPozzolith 300RAnush Upulwan Malawara ArachchiNo ratings yet

- Commissioning and Configuration Guide (V800R006C02 - 03, GPON)Document573 pagesCommissioning and Configuration Guide (V800R006C02 - 03, GPON)Pastai de Vanilie100% (1)

- InvoiceDocument1 pageInvoiceAmit PrajapatiNo ratings yet

- Bonding of Public OfficialsDocument2 pagesBonding of Public OfficialsNotarysTo Go100% (2)

- 41 Lim Et Al, V. BarcelonaDocument10 pages41 Lim Et Al, V. BarcelonaRae Angela GarciaNo ratings yet

- Update On International Financial Reporting Standards (IFRS)Document29 pagesUpdate On International Financial Reporting Standards (IFRS)Beth Diaz LaurenteNo ratings yet

- Islām, Īmān, Iḥsān Climbing The Spiritual Mountain - Yaqeen Institute For Islamic ResearchDocument34 pagesIslām, Īmān, Iḥsān Climbing The Spiritual Mountain - Yaqeen Institute For Islamic ResearchAbdourahamane GarbaNo ratings yet

- Law of Criminal Revisions: S.S. UpadhyayDocument60 pagesLaw of Criminal Revisions: S.S. UpadhyayChaitanya KumarNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "The Judgment of Princeton" (UVA-QA-0813)Document9 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "The Judgment of Princeton" (UVA-QA-0813)AshleyNo ratings yet

- A10 5.1.0 FirewallDocument350 pagesA10 5.1.0 Firewallamel6320% (1)

- Assignment #2 CH322 PDFDocument2 pagesAssignment #2 CH322 PDFShafi KhanNo ratings yet

- Mujin FinalDocument19 pagesMujin FinalSandy HongNo ratings yet

- Surat Tempahan Tiket PetrosainsDocument2 pagesSurat Tempahan Tiket PetrosainsABD AZIZ BIN ABD PATAH KPM-GuruNo ratings yet

- Code 2021 Sept 15 InglesDocument164 pagesCode 2021 Sept 15 InglesGianniNo ratings yet

- Michael Reed TranscriptDocument108 pagesMichael Reed TranscriptDaily KosNo ratings yet

- Berdina Crowe, Ernestine Walkingstick, Nancy Rose Long, John C. Standingdeer, Sr., Pauline Thompson Gutierrez, Ella Jackson, Helen Jacobs, Geraldine Sarah Thompson, Robert S. Youngdeer, Ruth Taylor and Richard (Geet) Crowe, on Behalf of Themselves and All Other Eligible Enrolled Voters of the Eastern Band of Cherokee Indians Similarly Situated v. Eastern Band of Cherokee Indians, Inc., 584 F.2d 45, 4th Cir. (1978)Document2 pagesBerdina Crowe, Ernestine Walkingstick, Nancy Rose Long, John C. Standingdeer, Sr., Pauline Thompson Gutierrez, Ella Jackson, Helen Jacobs, Geraldine Sarah Thompson, Robert S. Youngdeer, Ruth Taylor and Richard (Geet) Crowe, on Behalf of Themselves and All Other Eligible Enrolled Voters of the Eastern Band of Cherokee Indians Similarly Situated v. Eastern Band of Cherokee Indians, Inc., 584 F.2d 45, 4th Cir. (1978)Scribd Government Docs100% (1)

- Case Digest GuidelinesDocument5 pagesCase Digest GuidelinesKeij Ejercito100% (2)