Professional Documents

Culture Documents

Chintan Case

Uploaded by

aadi sharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chintan Case

Uploaded by

aadi sharmaCopyright:

Available Formats

Case – Mr.

Chintan (Reference Date – April 01, 2016)

Chintan, aged 29 years, is working with a reputed company since December 2010. He has approached you, a

financial planner, for preparing his financial plan. He is staying in his own house at Ahmedabad. His wife Kavita,

aged 31 years, is a fashion designer. She has set up a boutique on rent and earned a net profit of Rs. 5.5 lakh in

the previous financial year. They have a son, Yash of age 4 years, and a year old daughter, Smriti. Chintan is also

supporting his parents to the extent of Rs. 20,000 per month. They stay at their ancestral house at Surat. The

family’s monthly house hold expenses are Rs. 40,000 p.m. (excluding insurance premium and EMIs). Chintan

normally gets 10% increase in his gross salary year-on-year in the beginning of every financial year, apart from

bonus. The bonus for the previous financial year at Rs. 3.3 lakh (net of tax) is agreed to be credited to his account

at the end of this month. He has taken a family floater policy for Health Insurance involving an annual premium of

Rs. 16,268 and a total cover of Rs. 15 lakh.

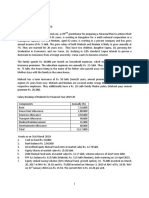

Chintan’s monthly salary (for FY 2016-17):

Particulars Amount (Rs.)

Basic Salary 60,000

DA 50% of Basic Salary

HRA Rs. 18,000

Transport Allowance Rs. 5,000

Medical Reimbursement Actual expenses up to

Rs. 1,250 per month

Executive Allowance Rs.10,000

Couple’s Current Assets & Liabilities (As on March 31, 2016)

Particulars Amount (Rs.)

Assets:

House Rs. 75.00 lakh (Current market value,

purchase cost Rs. 50 lakh)

Car Rs. 4.00 lakh (Depreciated value)

PPF1 Rs. 4.90 lakh

Insurance – Moneyback Rs. 3.00 lakh (Sum assured)

Policy2

Child Plan – Life Insurance3 Rs. 12.00 lakh (Sum Assured)

Gold ornaments4 Rs. 4.50 lakh

Equity MF schemes5 Rs. 7.85 lakh

Portfolio of Equity shares6 Rs. 3.95 lakh

Bank FDs7 Rs. 2.50 lakh (Principal, in Kavita’s

name from her business income)

Bank A/c - Chintan Rs. 0.75 lakh

Bank A/c - Kavita Rs. 0.95 lakh

Liabilities:

Home Loan8 Rs. 15.28 lakh (Principal outstanding)

Car Loan9 Rs. 1.62 lakh (Principal outstanding)

Important points to be considered:

1

Opened in March 2011 in the name of Chintan

2

Purchased on 25th October, 2012; annual premium paid Rs. 14,798; 20-year policy with 20% of sum assured

payable on survival on 5th, 10th and 15th years and the balance on maturity.

3

Purchased when Yash was 2 year old; term of 15 years; annual premium Rs. 41,374

4

Gifted on marriage in November 2010 at then value Rs. 1.75 lakh.

5

Three schemes; current assets value in one scheme is Rs. 2.5 lakh, in second Rs. 3.5 lakh with monthly Systematic

Investment Plan (SIP) of Rs. 10,000; the third is Equity Linked Saving scheme, invested Rs. 1 lakh in March 2014.

6

The Demat account in which Chintan and Kavita are respectively first and second holders was started in 2012

with last security purchased in May 2015.

7

Three deposits; Rs. 1 lakh made in July 2013 for 3 years at 9.25% p.a., Rs. 1 lakh made in May 2014 for 2 years at

rate 9% p.a. and Rs. 50,000 made in June 2015 for 1 year and 1 day at 8.75% p.a.

8

Home loan of Rs. 17 lakh for a 15-year term taken in April, 2013 at rate of interest fixed for first 3 years at 10%

p.a., and floating thereafter at 1.5% above RBI Repo rate.

9

Car loan of Rs. 5.5 lakh taken in April, 2013 at a fixed interest of 11.5% p.a. for a 4-year term; Car cost Rs. 8 lakh.

Goals:

1. Accumulate in a fund, higher education expenses of Yash and Smriti. Expenses at their respective age of 18 years

are Rs. 4 lakh p.a. (current cost) required for four years, cost escalation 8% p.a.

2. Marriage expenses of Rs. 10 lakh (current cost) for each child at around their respective age of 25 years, cost

escalation 9% p.a.

3. Retirement corpus at Chintan’s age of 58 years to sustain 70% of pre-retirement household expenses, inflation

adjusted, till his lifetime and 70% of then expenses till Kavita’s expected life.

4. A bigger house valued at Rs. 1 crore today, 5 years from now by disposing of the current house and foreclosing

the loan, the expected appreciation of current house from now onwards is 5% p.a.

5. Build a separate fund for vacation expenses of Rs. 1.5 lakh p.a. (current cost) starting from April 2018 and

continuing up to Chintan’s retirement, cost escalation 7%. A suitable lump sum is to be invested immediately with

regular investments and an annual withdrawal strategy

Life Parameters:

Chintan’s expected life : 75 years

Kavita’s expected life : 80 years

Assumptions regarding pre-tax returns on various asset classes:

Equity & Equity MF schemes/ 11.00% p.a.

Index ETFs

Balanced MF schemes 9.00% p.a.

Bonds/Govt. Securities/ Debt 7.00% p.a.

MF schemes

Liquid MF schemes 5.50% p.a.

Gold & Gold ETF 6.50% p.a.

Real Estate appreciation 7.00% p.a.

Bank/Post Office Term Deposits 7.25% p.a.

( > 1 year)

Public Provident Fund/EPFO 8.00% p.a.

Assumptions regarding economic factors:

1) Inflation : 5.00% p.a.

2) Expected return in Risk free instruments : 6.00% p.a.

Questions:

1. Chintan wants to estimate the amount of finance needed to buy the proposed new house after 5 years. This

could be arrived at by utilizing the net amount from the sale proceeds of his existing house after 5 years. The

outgoings from such proceeds would be the outstanding loan amount and a sum of Rs. 20 lakh towards meeting

capital gains tax liability on existing house and the statutory charges, furnishing expenses of new house. You

expect the average Repo rate of 6.5% to be maintained by RBI over the next 5 years.

2. Compute the value of additional life cover for Chintan by considering current household expenses, required

inflation adjusted to the extent of 80% until Kavita’s age of 55 years and 60% of then expenses for the remaining

period of her expected life by considering investment in debt MF schemes. This cover required to be taken as

term insurance is excluding the child plan.

3. Chintan’s ideal life cover has to be estimated which in case of any exigency will first repay the outstanding loans

and the remaining would be invested along with the couple’s existing financial assets. Such combined corpus

would be invested in a 7.5% p.a. return instrument to sustain the family’s living expenses and the specific

financial goals of higher education of their children. The living expenses need to be taken as inflation-adjusted

to the extent of 80% of their present household expenses for next 25 years and 60% for the subsequent 30

years. What should be this ideal cover?

4. Chintan and Kavita wish their retirement corpus, as proposed, to also have a provision of gifting Rs. 50 lakh to

each of their children and an additional Rs. 25 lakh towards charity to an Old Age Home at Chintan’s age of 70

years. The sums are at absolute values then. They also wish to provide in the corpus an additional Rs. 10,000

per month (current costs) towards healthcare after Chintan’s age of 70 years. Estimate the required corpus,

considering the same shall be invested in investment yielding 6.5% p.a.

5. Towards the marriage goal of the children, you suggest Chintan to make maximum permissible subscriptions

to his PPF account towards the end of every financial year and extend the account twice beyond initial maturity

for terms of 5 years each with similar subscriptions. The third term of 5 years is maintained without further

contribution. Chintan shall withdraw about 50% of accumulation for the marriage expenses of Yash and the

remaining for the marriage expenses of Smriti. What are the expected individual withdrawals and shortfalls in

meeting the marriage expenses?

6. Chintan and Kavita will set aside immediately a sum of Rs. 10 lakh towards setting up a fund for vacation. They

will start contributing annual investments beginning April 2017 till age 57 of Chintan. Such annual investment

will be doubled in 10th installment and again in 20th installment. The withdrawal from the fund towards

vacation will begin on annual basis from April 2018. You devise an asset allocation for the vacation fund to yield

11% p.a. in the first ten years, decreasing by 1.5% sequentially in the subsequent 10-year period, and the

remaining period thereafter. What should be the amount of initial annual investment?

7. For the higher education expenses for Yash and Smriti, Chintan starts accumulating funds with monthly

investment of Rs. 20,000 in an aggressive asset allocation yielding 12% p.a. After 7 years the allocation is

moderated to yield 9% p.a. and the accumulated funds invested at this rate for the next 5 years, while the

investment is raised to Rs. 40,000 p.m. The strategy is to shift the funds accumulated after 12 years to risk free

instruments from which distribution towards higher education is drawn as proposed. What would be the

shortfall expected after 12 years in following this strategy?

You might also like

- Priti CaseDocument3 pagesPriti Casecarry minatteeNo ratings yet

- Financial plan for Ashwin and familyDocument3 pagesFinancial plan for Ashwin and familyAditya BohraNo ratings yet

- Case Study For CFP Final ModuleDocument3 pagesCase Study For CFP Final ModuleImran Ansari0% (2)

- Mahehs 2019Document3 pagesMahehs 2019Aditya BohraNo ratings yet

- Retirement Planning Latest Examples 2014-2015Document8 pagesRetirement Planning Latest Examples 2014-2015Vandana ReddyNo ratings yet

- FPSBI/M-VI/01-01/10/SP-21: 1 FPSB India / PublicDocument11 pagesFPSBI/M-VI/01-01/10/SP-21: 1 FPSB India / Publicbhaw_shNo ratings yet

- Sahanubhuti UniqueDocument10 pagesSahanubhuti UniquePrashanth JogimuttNo ratings yet

- Financial Plan Goals, Assets, and Life Parameters for Roger G D'MelloDocument12 pagesFinancial Plan Goals, Assets, and Life Parameters for Roger G D'MellotarangtgNo ratings yet

- Probable Solution For Questions Asked - Current Batch - March 2015Document30 pagesProbable Solution For Questions Asked - Current Batch - March 2015aditiNo ratings yet

- Case - DDocument2 pagesCase - Dmoneshivangi29No ratings yet

- Case A Ashwin 34yDocument2 pagesCase A Ashwin 34yshreya sahuNo ratings yet

- FPWM_Time Value of Money QuestionsDocument4 pagesFPWM_Time Value of Money QuestionsvuppalashrimanthNo ratings yet

- Risk Planning QuestionsDocument6 pagesRisk Planning Questionsshashidhar5065No ratings yet

- Case ADocument2 pagesCase ALamka VijayNo ratings yet

- Time Value of Money Problems SolvedDocument13 pagesTime Value of Money Problems SolvedGajendra Singh Raghav50% (2)

- SP-1 NewDocument6 pagesSP-1 NewPrashin PatelNo ratings yet

- The Kapoors: Reside in Net Annual IncomeDocument3 pagesThe Kapoors: Reside in Net Annual IncomeArpit KulshreshthaNo ratings yet

- Ref Date 1/4/17 Sahanubhuti SP-2 Pattern Question Bank (15 Questions: 2 HRS)Document4 pagesRef Date 1/4/17 Sahanubhuti SP-2 Pattern Question Bank (15 Questions: 2 HRS)preeti chhatwalNo ratings yet

- Case: Roger: (Reference Date: 1st April, 2019)Document6 pagesCase: Roger: (Reference Date: 1st April, 2019)Krish BhutaNo ratings yet

- Sanjay: Negotiated by Monthly Granted FloatingDocument8 pagesSanjay: Negotiated by Monthly Granted FloatingPrashanth JogimuttNo ratings yet

- Basic Excel Functions - ProblemsDocument31 pagesBasic Excel Functions - ProblemsSushma Jeswani TalrejaNo ratings yet

- FPSB India / Public 1: FPSBI/M-VI/04-01/09/SP-12Document13 pagesFPSB India / Public 1: FPSBI/M-VI/04-01/09/SP-12bhaw_shNo ratings yet

- TVM: Time Value of Money Concepts and Retirement Planning ExamplesDocument8 pagesTVM: Time Value of Money Concepts and Retirement Planning ExamplesSocio Fact'sNo ratings yet

- Gurpreet 2020Document3 pagesGurpreet 2020Aditya BohraNo ratings yet

- Time Value of Money Class ExerciseseDocument2 pagesTime Value of Money Class ExerciseseRohan JangidNo ratings yet

- Case CDocument3 pagesCase Cnaveen0037No ratings yet

- Homework QuestionsDocument6 pagesHomework Questionsgaurav shetty100% (1)

- CF Assignment - 2Document2 pagesCF Assignment - 2vishnu607No ratings yet

- Encephalon - Riscon'13 Financial Planning - Case Study Round 2Document2 pagesEncephalon - Riscon'13 Financial Planning - Case Study Round 2abhishekbehal5012No ratings yet

- Wealth management case studies for retirement planningDocument5 pagesWealth management case studies for retirement planningLeela Sri NaveenNo ratings yet

- Case Study: PointDocument1 pageCase Study: PointprasadzinjurdeNo ratings yet

- 017 Sep 09 AvinashDocument11 pages017 Sep 09 Avinashdeepak goyalNo ratings yet

- RVS Wealth Management Project GoalsDocument3 pagesRVS Wealth Management Project GoalsMANIKANDANNo ratings yet

- AFP Case Study AnamikaDocument7 pagesAFP Case Study Anamikavenkat sbiNo ratings yet

- Developing a Retirement Plan and Financial GoalsDocument3 pagesDeveloping a Retirement Plan and Financial GoalsAtulit AgarwalNo ratings yet

- Time Value (Financial Management)Document9 pagesTime Value (Financial Management)Keyur BhojakNo ratings yet

- Recurring Deposit and Loan CalculationsDocument2 pagesRecurring Deposit and Loan CalculationsGaurav SomaniNo ratings yet

- 04 Valuation of Bond & SharesDocument1 page04 Valuation of Bond & SharesShekhar SinghNo ratings yet

- Business Standard analyses one woman's finances after divorce and suggests a way forwardDocument52 pagesBusiness Standard analyses one woman's finances after divorce and suggests a way forwardRahulNo ratings yet

- 2.1 Casswork Questions On Financial PlanningDocument3 pages2.1 Casswork Questions On Financial PlanningYash DedhiaNo ratings yet

- CFP RaipDocument3 pagesCFP RaipsinhapushpanjaliNo ratings yet

- Retirement planning & financial goals for coupleDocument4 pagesRetirement planning & financial goals for coupleARYA SHETHNo ratings yet

- Financial Plan for Mahesh and Neelam DesaiDocument2 pagesFinancial Plan for Mahesh and Neelam DesaiBharat SahniNo ratings yet

- Time Value of Money - Practical ApplicationsDocument3 pagesTime Value of Money - Practical Applicationsmanoj_yadav7350% (1)

- Cost of CapitalsDocument11 pagesCost of Capitals29_ramesh170No ratings yet

- RTPBDocument87 pagesRTPBKr PrajapatNo ratings yet

- TVM QuestionsDocument4 pagesTVM QuestionsSultan AwateNo ratings yet

- LalalDocument22 pagesLalalHetviNo ratings yet

- Case Study - 1 - Financial PlanningDocument4 pagesCase Study - 1 - Financial PlanningJyoti GoyalNo ratings yet

- Mutual FundDocument13 pagesMutual FundMd ThoufeekNo ratings yet

- Family Finances Case Study: The GuptasDocument1 pageFamily Finances Case Study: The Guptaskill_my_kloneNo ratings yet

- 0ecd7tvm AssignDocument1 page0ecd7tvm AssignAman WadhwaNo ratings yet

- Cost of CapitalDocument166 pagesCost of Capitalmruga_12350% (2)

- NMHYDWM019Document33 pagesNMHYDWM019SHAWKATMANZOORNo ratings yet

- CFP - SuggestedSolutions - RPEBDocument6 pagesCFP - SuggestedSolutions - RPEBSODDEYNo ratings yet

- Financial Planning for 3 Clients with Different NeedsDocument4 pagesFinancial Planning for 3 Clients with Different NeedsSaloni Jain 1820343No ratings yet

- This Is From FPSB India Sample Paper of RaipDocument25 pagesThis Is From FPSB India Sample Paper of RaipsinhapushpanjaliNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- As Que Ftca 21.05.2022Document5 pagesAs Que Ftca 21.05.2022AmirdavarshiniNo ratings yet

- Foodpanda OrderDocument2 pagesFoodpanda OrderMohd Azfarin100% (1)

- Conformity Certificate TemplateDocument1 pageConformity Certificate TemplateShahbaz Khan100% (1)

- Review of Related Literature and StudiesDocument11 pagesReview of Related Literature and StudiesDevilo AtutuboNo ratings yet

- Insurance Licenses Required for Foreign Insurer and Local AgentDocument2 pagesInsurance Licenses Required for Foreign Insurer and Local AgentAbilene Joy Dela CruzNo ratings yet

- Specific PerformanceDocument25 pagesSpecific PerformanceAgniv DasNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyBJ JavierNo ratings yet

- AC ENTERPRISES V FRABELLE PROPERTIES CORPDocument3 pagesAC ENTERPRISES V FRABELLE PROPERTIES CORPRhodz Coyoca EmbalsadoNo ratings yet

- Psref 325Document285 pagesPsref 325Alex OmegaNo ratings yet

- Tanito GroupDocument4 pagesTanito GroupJony YuwonoNo ratings yet

- Check Your English Vocabulary For Law - No KeysDocument70 pagesCheck Your English Vocabulary For Law - No Keysshako khositashviliNo ratings yet

- Corporate Finance: Project ReportDocument10 pagesCorporate Finance: Project ReportNeha ShawNo ratings yet

- BS7419 1991 PDFDocument13 pagesBS7419 1991 PDFsurangaNo ratings yet

- 375 1425035526891 PDFDocument404 pages375 1425035526891 PDFjmhdeveNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument24 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Consent Letter Karnataka1Document2 pagesConsent Letter Karnataka1sayeed66No ratings yet

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- BL 3 - Final Exam Answer SheetDocument1 pageBL 3 - Final Exam Answer SheetCarren Abiel OberoNo ratings yet

- HR Executive - International HomewareDocument4 pagesHR Executive - International HomewareS.M. MohiuddinNo ratings yet

- A-Life Medik FamiliDocument2 pagesA-Life Medik FamiliZaiham ZakariaNo ratings yet

- Election Offenses Omnibus Election CodeDocument12 pagesElection Offenses Omnibus Election CodeRaziele RanesesNo ratings yet

- King David & His Role as a Type of ChristDocument3 pagesKing David & His Role as a Type of ChristJo-Ann Chan Sook Yan ChanNo ratings yet

- Product Data Sheet: Dehydol Ls 7 THDocument2 pagesProduct Data Sheet: Dehydol Ls 7 THQuoc ThanhNo ratings yet

- WEB Threat AssessmentDocument3 pagesWEB Threat AssessmentWilliam N. GriggNo ratings yet

- Transmit Securities BondDocument2 pagesTransmit Securities BondSunita BasakNo ratings yet

- RV3-65D-R4-V2: General SpecificationsDocument5 pagesRV3-65D-R4-V2: General SpecificationsMario Alvarez GarciaNo ratings yet

- ANMs Multi Purpose Health Assistant (Female) (GR III) PDFDocument31 pagesANMs Multi Purpose Health Assistant (Female) (GR III) PDFNIKHIL MODINo ratings yet

- Draft Part 91 Plain English Guide (Interactive PDFDocument168 pagesDraft Part 91 Plain English Guide (Interactive PDFChris TagleNo ratings yet

- Corporate Counsel in Omaha NE Resume Jeff AndersonDocument3 pagesCorporate Counsel in Omaha NE Resume Jeff AndersonJeffAndersonNo ratings yet

- ED Advanced 1 - WorkbookDocument135 pagesED Advanced 1 - WorkbookAdriana Rosa PailloNo ratings yet