Professional Documents

Culture Documents

Prelim Quiz 27

Uploaded by

Michael Angelo Laguna Dela FuenteOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prelim Quiz 27

Uploaded by

Michael Angelo Laguna Dela FuenteCopyright:

Available Formats

Prelim-Quiz-27

VA loans cont'd

Assumability-

Any VA mortgage loan made before March 1, 1988, may be assumed by the

next owner of the property, who need not be a veteran and need not

prove qualification to the lender or the VA. For loans made after

March 1, 1988, the assumer (who need not be a veteran) must prove

creditworthiness, and the original borrower is free of future

liability.

Refinancing-

VA loans may be refinanced with a streamline process for a fee of 0.5

percent.

Government Backing via the Secondary Market

- A market for the purchase and sale of existing mortgages, i.e.

HELOCs, 2nd mortgages, designed to provide greater liquidity of

mortgages.

-Lenders in the primary mortgage market originate loans directly to

borrowers. Other primary lenders may sell packages of loans to large

investors in what is known as the secondary mortgage market. A lender

may wish to sell a number of loans when it needs more money to meet

the mortgage demands in its area.

- A major source of secondary mortgage market activity is warehousing

agencies, which purchase mortgage loans and assemble them into large

packages of loans for resale to investors such as insurance companies

and pension funds. The major warehousing agencies are Fannie Mae,

Ginnie Mae, and Freddie Mac.

Govt Backing cont'd

-Fannie Mae (FNMA)-

a privately owned corporation. It raises funds to purchase loans by

selling government-guaranteed FNMA bonds. Originally, FNMA started

out as a governmental agency. Mortgage bankers are actively involved

with FNMA, originating loans and selling them to FNMA while retaining

the servicing functions. FNMA is the nation's largest purchaser of

mortgage. When Fannie Mae talks, lenders listen. Because FNMA

eventually purchases one mortgage out of every ten, it has great

influence on lending policies. When Fannie Mae announces that it will

buy a certain type of loan, local lending institutions often change

their own regulations to meet the requirements.

Govt Backing cont'd

-Ginnie Mae (GNMA)-

formerly called the Government National Mortgage Association. The

Ginnie Mae pass-through certificate lets small investors buy a share

in a pool of mortgages that provides for a monthly "pass-through" of

principal and interest payments directly to the certificate holder.

-Freddie Mac-

provides a secondary market for mortgage loans. Freddie Mac buys

mortgages, pools them, and sells bonds with the mortgages as

security.

Most lenders use a standardized mortgage application and other forms

that are accepted by Freddie Mac and Fannie Mae.

Noncomforming loans

- When Fannie Mae and Freddie Mac announce that they will buy loans

only up to a certain size ($417,000 for one-family homes), many local

lenders set that as their own limit. Loans higher than Fannie Mae's

or Freddie Mac's maximum loan limit are known as nonconforming loans.

A nonconforming loan usually carries a slightly higher rate of

interest.

- A loan that goes from $417,000 to $625,500 is called a non-jumbo

loan, or a high balance loan.

- Anything over $625,500 uses a 'Jumbo' loan.

The 'Jumbo loans' are not purchased by Fannie Mae or Freddie.

Typically are sold on the secondary market to a REIT or some sort of

Equity Company, or Wall Street firm, or another bank. But they don't

always follow the guidelines for the conventional as well as the high

balanced loans.

- Nonconforming mortgages (portfolio loans) do not have to meet

uniform underwriting standards and can be flexible in their

guidelines. The borrower with an unusual credit situation or a unique

house may need a nonconforming loan.

Financing Legislation

The federal government regulates the lending practices of mortgage

lenders through the Truth-in-Lending Act, Equal Credit Opportunity

Act (ECOA), and Real Estate Settlement Procedures Act (RESPA).

Regulation Z

The Truth-in-Lending Act, enforced through Regulation Z (that is, the

Truth-in-Lending Act as it applies to the advertisement of credit

terms), requires that credit institutions inform the borrower of the

true cost of obtaining credit so that the borrower can compare the

costs of various lenders and avoid the uninformed use of credit. All

real estate transactions made for personal or agricultural purposes

are covered. The regulation does not apply to business or commercial

loans.

It requires that the customer be fully informed of all finance

charges, as well as the true annual interest rate, before a

transaction is consummated. In the case of a mortgage loan made to

finance the purchase of a dwelling, the lender must compute and

disclose the annual percentage rate (APR) in a written Truth-in-

Lending statement provided to the mortgagor.

Three-day right of rescission

Lenders close on the loan, but need to withhold the funds from the

borrower until the 3 day rescission period has passed. In extreme

situations the lender might agree to waive that period for the

borrower, but there can be serious consequences for the lender.

Borrowers have the right to change their minds about the loan in 3

days with no questions asked by giving written notice to the lender

before the 3 days are up.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Land Titles and Deeds-Case Digests-Espina-M2Document32 pagesLand Titles and Deeds-Case Digests-Espina-M2NiellaNo ratings yet

- Answer Key of Ppe Recognition ProblemDocument19 pagesAnswer Key of Ppe Recognition ProblemJaneNo ratings yet

- Special Proceedings: (Rules 72 - 109)Document3 pagesSpecial Proceedings: (Rules 72 - 109)Perla Viray0% (1)

- Sample Lodger AgreementDocument4 pagesSample Lodger Agreementmusy9999No ratings yet

- 05 Hospicio v. DARDocument21 pages05 Hospicio v. DARdos2reqjNo ratings yet

- Tenancy ContractDocument4 pagesTenancy ContractАндрей МатюшинNo ratings yet

- Tupaz v. CA, 475 SCRA 398 24. American Home Insurance v. FF. Cruz & Co., G.R. No. 174926Document36 pagesTupaz v. CA, 475 SCRA 398 24. American Home Insurance v. FF. Cruz & Co., G.R. No. 174926yodachanNo ratings yet

- MidTerm Quiz101Document3 pagesMidTerm Quiz101Michael Angelo Laguna Dela FuenteNo ratings yet

- Prelim Quiz19Document3 pagesPrelim Quiz19Michael Angelo Laguna Dela FuenteNo ratings yet

- Prelim Quiz18Document3 pagesPrelim Quiz18Michael Angelo Laguna Dela FuenteNo ratings yet

- Prelim Quiz21Document3 pagesPrelim Quiz21Michael Angelo Laguna Dela FuenteNo ratings yet

- Prelim Quiz23Document3 pagesPrelim Quiz23Michael Angelo Laguna Dela FuenteNo ratings yet

- Prelim Quiz22Document3 pagesPrelim Quiz22Michael Angelo Laguna Dela FuenteNo ratings yet

- Prelim Quiz26Document3 pagesPrelim Quiz26Michael Angelo Laguna Dela FuenteNo ratings yet

- Midterm Quiz 20Document4 pagesMidterm Quiz 20Michael Angelo Laguna Dela FuenteNo ratings yet

- Prelim Quiz2Document3 pagesPrelim Quiz2Michael Angelo Laguna Dela FuenteNo ratings yet

- Midterm Quiz 19Document3 pagesMidterm Quiz 19Michael Angelo Laguna Dela FuenteNo ratings yet

- Bases of Credit and Credit Investigation AppraisalDocument14 pagesBases of Credit and Credit Investigation AppraisalLaraya, Roy MatthewNo ratings yet

- Unit 3 Notes For 6th Sem JurisprudenceDocument23 pagesUnit 3 Notes For 6th Sem Jurisprudenceyuvikahans06No ratings yet

- Revised Panel of Dedicated Consultant For Jaipur Development RajasthanDocument34 pagesRevised Panel of Dedicated Consultant For Jaipur Development Rajasthanaman3327No ratings yet

- Lesson 5 - New CU1.8 and CU2.12Document16 pagesLesson 5 - New CU1.8 and CU2.12nightlight123No ratings yet

- Cause List: 011-28031838 011-28032406 Fax No. 28032381Document71 pagesCause List: 011-28031838 011-28032406 Fax No. 28032381kaminiNo ratings yet

- Sale and Purchase of Land in SEZDocument2 pagesSale and Purchase of Land in SEZvimalNo ratings yet

- SALN BlankDocument3 pagesSALN BlankJeric Espinosa CabugNo ratings yet

- Priority of Mortgages Over Registered Land - Priority of MortgagesDocument3 pagesPriority of Mortgages Over Registered Land - Priority of MortgagesschoolemailsdumpNo ratings yet

- Split-Forms-2021-Forms Sna Romulo Sira LimuhayDocument31 pagesSplit-Forms-2021-Forms Sna Romulo Sira LimuhayIan DalisayNo ratings yet

- Final Exam Hosp - Law - 2019Document3 pagesFinal Exam Hosp - Law - 2019kimberley dela cruz0% (1)

- BSK 6TH Stage SRDocument10 pagesBSK 6TH Stage SRManjunathNo ratings yet

- Alesna and Bacolod - Judicial AffidavitDocument4 pagesAlesna and Bacolod - Judicial AffidavitJames Christian BacolodNo ratings yet

- CPC Q BankDocument11 pagesCPC Q BankSRI MADHURANo ratings yet

- CBM - Pre-Qualification App PDFDocument3 pagesCBM - Pre-Qualification App PDFJosh KwonNo ratings yet

- Lease Agreement: AND M/S. AABHARANA JEWELLERS Represented by Its M.D Dupati Sudhakar S/o Vara PrasadDocument2 pagesLease Agreement: AND M/S. AABHARANA JEWELLERS Represented by Its M.D Dupati Sudhakar S/o Vara Prasadkrk.infotech8670100% (1)

- Defect List C-21-01, Zizz Cosmo DamansaraDocument5 pagesDefect List C-21-01, Zizz Cosmo DamansaraFamy MiorNo ratings yet

- Residential Building - 6Document1 pageResidential Building - 6antonyNo ratings yet

- CFAS PPT LastDocument21 pagesCFAS PPT LastCarl Aaron LayugNo ratings yet

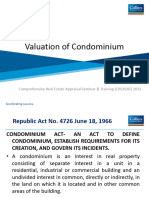

- Valuation of CondominiumDocument19 pagesValuation of CondominiumRalph BacarNo ratings yet

- FNG Guidelines PDFDocument18 pagesFNG Guidelines PDFSamuel TolentinoNo ratings yet

- Standard RentDocument2 pagesStandard RentShayan ZafarNo ratings yet

- Affordable CountriesDocument16 pagesAffordable CountriesjemalNo ratings yet