Professional Documents

Culture Documents

Book 3

Uploaded by

Hannah Pearl Flores Villar0 ratings0% found this document useful (0 votes)

4 views3 pagesThe document shows a trial balance before and after adjustments, an income statement, and a balance sheet for a business. The trial balance includes asset, liability, capital, revenue and expense accounts. Adjustments were made for doubtful accounts, general expenses allocation, supplies inventory change, earned commissions, and accumulated depreciation. The adjusted trial balance rolls into an income statement showing revenues, expenses and net income. The balance sheet presents assets, liabilities, capital and income after closing entries.

Original Description:

Original Title

Book 3 (1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows a trial balance before and after adjustments, an income statement, and a balance sheet for a business. The trial balance includes asset, liability, capital, revenue and expense accounts. Adjustments were made for doubtful accounts, general expenses allocation, supplies inventory change, earned commissions, and accumulated depreciation. The adjusted trial balance rolls into an income statement showing revenues, expenses and net income. The balance sheet presents assets, liabilities, capital and income after closing entries.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesBook 3

Uploaded by

Hannah Pearl Flores VillarThe document shows a trial balance before and after adjustments, an income statement, and a balance sheet for a business. The trial balance includes asset, liability, capital, revenue and expense accounts. Adjustments were made for doubtful accounts, general expenses allocation, supplies inventory change, earned commissions, and accumulated depreciation. The adjusted trial balance rolls into an income statement showing revenues, expenses and net income. The balance sheet presents assets, liabilities, capital and income after closing entries.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

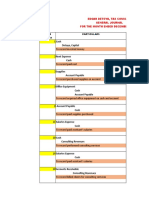

UNADJUSTED

TRIAL BALANCE ADJUSTMENTS

DEBIT CREDIT DEBIT CREDIT

Cash on hand and in Bank 25,000

Accounts Receivable 170,000

Merchandise Inventory 44,000

Supplies Unused 8,000

Furniture and Fixture 310,000

Accumulated Depreciation 31,000 (5) 31,000

Accounts Payable 38,000

Unearned Commissions 11,100 (4) 6,100

Mortgage Payable 10,000

Allan, Capital 140,000

Wally, Capital 175,500

Allan, Drawing 4,000

Wally, Drawing 4,000

Sales 500,000

Sales Returns and Allowances 20,000

Purchases 196,000

Freight- In 4,000

Purchases Returns and Allowances 7,800

Salary Expense 65,400

Advertising Expense 20,000

Insurance Expense 7,000

Rent Expense 35,000

Interest Expense 2,000

Interest Income 1,000

914,400 914,400

Doubtful Accounts (2) 8,500

General Expenses (2) 8,500 (3) 2,000

Supplies on hand (3) 2,000

Earned Commissions (4) 6,100

Accumulated Depreciation-FF (5) 31,000

Income tax Payable

Income tax Expense

47,600 47,600

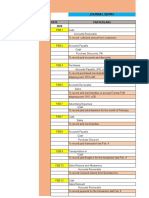

ADJUSTED INCOME BALANCE

TRIAL BALANCE STATEMENT SHEET

DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT

25,000

170,000

44,000 44,000 40,000 40,000

8,000

310,000

62,000

38,000

5,000

10,000

140,000

175,500

4,000

4,000

500,000

20,000

196,000

4,000

7,800

65,400

20,000

7,000

35,000

2,000

1,000

914,400 939,300

8,500

8,500 2,000

2,000

6,100

31,000

931,000 949,800

You might also like

- Teresita Buenaflor ShoesDocument30 pagesTeresita Buenaflor ShoesHannah Pearl Flores Villar100% (1)

- Edgar Detoya Tax Consultant (Acca101)Document56 pagesEdgar Detoya Tax Consultant (Acca101)Hannah Pearl Flores VillarNo ratings yet

- Marichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitDocument4 pagesMarichu Fornolles Novelties Transactions in December 2020: Date Particulars DebitHannah Pearl Flores Villar100% (1)

- Comprehensive Problem - (Merchandising Concern)Document19 pagesComprehensive Problem - (Merchandising Concern)Hannah Pearl Flores VillarNo ratings yet

- Receivable FinancingDocument8 pagesReceivable FinancingHannah Pearl Flores VillarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Aman Feed Limited 12.05.2015Document117 pagesAman Feed Limited 12.05.2015MD Zahidul Islam SuzanNo ratings yet

- 8 Case Notes 3MDocument20 pages8 Case Notes 3MjielahiNo ratings yet

- Matrix For Overtime and Premium PayDocument2 pagesMatrix For Overtime and Premium PayKyle DionisioNo ratings yet

- Financial Analysis For Chevron Corporation 1Document12 pagesFinancial Analysis For Chevron Corporation 1Nuwan Tharanga LiyanageNo ratings yet

- Bridal Shop Business PlanDocument35 pagesBridal Shop Business PlanCarlo Canimo Villaver50% (2)

- Open Book Examination Course: Principles of Financial Accounting I Course Code: PAC1103 Duration: 2 HoursDocument7 pagesOpen Book Examination Course: Principles of Financial Accounting I Course Code: PAC1103 Duration: 2 HoursNUR BALQIS BINTI MOHD TAJUDDIN BGNo ratings yet

- Exercises On Formation of Final Accounts: Particulars Amount AmountDocument4 pagesExercises On Formation of Final Accounts: Particulars Amount AmountNeelu AggrawalNo ratings yet

- Land, Building MachineryDocument2 pagesLand, Building Machinerybittersweet24100% (1)

- Bagan Akun Ud BuanaDocument2 pagesBagan Akun Ud BuanaYose SuprapmanNo ratings yet

- AP - Mockboard ExaminationDocument10 pagesAP - Mockboard Examinationjc limNo ratings yet

- Tugas 11Document4 pagesTugas 11ahmad shinigamiNo ratings yet

- Charts and Diagrams - Past Other MBA Test Questions 3: Reports ForDocument17 pagesCharts and Diagrams - Past Other MBA Test Questions 3: Reports ForvishalNo ratings yet

- Summer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala CityDocument104 pagesSummer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala Cityjs60564No ratings yet

- Exercise 2b Financial AccountingDocument23 pagesExercise 2b Financial AccountingkeziaNo ratings yet

- Case Study 1 Spreadsheet 1 17Document1 pageCase Study 1 Spreadsheet 1 17kTNo ratings yet

- Ev Charging Business PlanDocument38 pagesEv Charging Business PlantewahidogeneneNo ratings yet

- AFM Class NotesDocument33 pagesAFM Class NotesSamil MusthafaNo ratings yet

- Raymond PPT FinalDocument17 pagesRaymond PPT FinalTAJ26No ratings yet

- Accounting Quiz 2 With AnswersDocument5 pagesAccounting Quiz 2 With AnswersSabah SiddiquiNo ratings yet

- Mitra S.K. Group of Companies: Accounts ManualDocument21 pagesMitra S.K. Group of Companies: Accounts ManualdebashisdasNo ratings yet

- Exercises On Cash Flow Statement AnalysisDocument3 pagesExercises On Cash Flow Statement AnalysisBoa HancockNo ratings yet

- Advanced Cost and Management Accounting ConceptsDocument17 pagesAdvanced Cost and Management Accounting ConceptsharlloveNo ratings yet

- ACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument26 pagesACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The Questionphilker21No ratings yet

- Advanced Accounting Chapter 5Document21 pagesAdvanced Accounting Chapter 5leelee030275% (4)

- What Do You Mean by OverheadsDocument6 pagesWhat Do You Mean by OverheadsNimish KumarNo ratings yet

- BRI Monthly Oct 2022Document5 pagesBRI Monthly Oct 2022Andri MirzalNo ratings yet

- Amendment in Section 43B of Income Tax Act Related To MSMEDocument4 pagesAmendment in Section 43B of Income Tax Act Related To MSMEcszohebsayaniNo ratings yet

- The Accounting Equation and Financial StatementsDocument30 pagesThe Accounting Equation and Financial StatementsAlya CandyNo ratings yet

- DT Compact May 23 by BB SirDocument796 pagesDT Compact May 23 by BB SirSorish Sethi100% (5)

- Accounts Unit 01Document5 pagesAccounts Unit 01Sana JKNo ratings yet