Professional Documents

Culture Documents

Solution Ia

Uploaded by

Adyagila Ecarg Neleh0 ratings0% found this document useful (0 votes)

17 views2 pagesOriginal Title

SOLUTION-IA

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesSolution Ia

Uploaded by

Adyagila Ecarg NelehCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

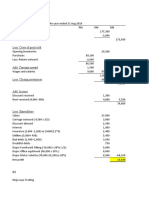

Faith Kryzl Pahilagao BSA-2

1. Short term obligation - Mar. 1 150,000

Feb. 5 3,600,000

Loan (per year) 1,000,000

Debt obligation 1,000,000

Current Liabilities 5,750,000

2. Long term loan – Dec. 1 ,2019 2,500,000

Debt Obligation (4,000,000-1,000,000) 3,000,000

Non-current Liabilities 5,500,000

3. B= 10% (4,650,00-B-T)

T= 30%(4,650,000-B)

B= 10%[(4,650,000-B-30)- (4,650,000-B)]

B= 10%(4,650,000-B-1,395,000+30%B)

B= 465,000-10%B-139,500+3%B

B+10%-3%B = 465,00-139,500

B=1.07B=325,500

B=325,000 ÷ 1.07B

B= ₱304,205.61

4. Income Tax for the year = (4,650,000-304,205.61)30%

=₱1,303,738.20

5. Bonus Expense 304,205.61

Bonus Payable 304,205.61

6. 2017 (Deliveries) 85,000

2107 (Returned from deliveries) (57,500)

Revenue Recognized for 2019 27,500

7. Deliveries held by customer:

2018 240,000

2019 430,000 670,000

Companies Returned

2018 140,000

2019 157,000 (297,000)

Liability for returnable containers 373,000

Faith Kryzl Pahilagao BSA-2

8. Current Liability (₱810 x 270 x 1/3) = ₱72,900

9. 18,000+36,000 = 54,000

10. Non-current Liability ( ₱810 x 270 x 2/3) = 145,800

11. Sales from musical instruments 54,000 000

Estimated warranty cost x 2%

Warranty expense 1 080 000

12. Estimated Warranty Expense 1 080 000

Estimated Liability from warranties 1 360 000

Actual Warranty expense (1 640 000)

Estimated warranty Liabilities 800 000

13. Premium Expense (CD player) = 340-200=140

Prem. Coupons expense = 1 200 000 – 1 080 000 = 120 000

Units in expense = 120 000 ÷ 200 = 600

Premium Expense = 6 000 – 600 x 140=756 000

14. Beg. Inv. 1 175

Purchases 6 500

Redemption (6 000)

Inventory 1 675

x 340

Inventory of premium CD players 569,500

15. Estimated premium claims outstanding – Jan. 1 , 2014 448 000

Add: Premium Expense 756 000

Less: Actual Redemption (1 200 0000 ÷200=6 000 x 140) 840 000

364 000

You might also like

- 0010a Kill Them With Paper WorkDocument21 pages0010a Kill Them With Paper Workrhouse_192% (12)

- Highest and Best Use AnalysisDocument20 pagesHighest and Best Use Analysisrevita100% (3)

- Problem: Andres Adi Putra S 43220110067 AKM2-Forum 6Document17 pagesProblem: Andres Adi Putra S 43220110067 AKM2-Forum 6tes doangNo ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Assignment 22 23 26 39Document4 pagesAssignment 22 23 26 39Georgina Francheska RamirezNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- Sample WorksheetDocument4 pagesSample WorksheetSam Rae LimNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- Magic Dominique Julius Julius TotalDocument4 pagesMagic Dominique Julius Julius TotalPaupauNo ratings yet

- Answers To Reviewer in Acctg 2Document3 pagesAnswers To Reviewer in Acctg 2Fatima AsprerNo ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- Multiple Choices - Computational Answer KeyDocument4 pagesMultiple Choices - Computational Answer KeyAleah kay BalontongNo ratings yet

- Natasya V.Sampelan 1217210167 Kuis Akuntansi Keuangan IIDocument3 pagesNatasya V.Sampelan 1217210167 Kuis Akuntansi Keuangan IIVero SampelanNo ratings yet

- Receivable Financing IllustrationDocument3 pagesReceivable Financing IllustrationVatchdemonNo ratings yet

- Vdocuments - MX - Answers Chapter 3 Vol 2 RvsedDocument13 pagesVdocuments - MX - Answers Chapter 3 Vol 2 RvsedmirayNo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- Business Accounting Quiz 2 (Answers) Updated.Document7 pagesBusiness Accounting Quiz 2 (Answers) Updated.Hareen JuniorNo ratings yet

- Adv Acc 2 Module 1 Topic1.2Document5 pagesAdv Acc 2 Module 1 Topic1.2James CantorneNo ratings yet

- q.5 h077 Isha Syjc Chp.1Document10 pagesq.5 h077 Isha Syjc Chp.1Isha KatiyarNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- ACCT 1002 Past Paper (1) SolutionsDocument9 pagesACCT 1002 Past Paper (1) SolutionsClaire CumminsNo ratings yet

- Tutorial 12Document15 pagesTutorial 12lkaixin 02No ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- ACCT1101 Wk6 Tutorial 5 SolutionsDocument7 pagesACCT1101 Wk6 Tutorial 5 SolutionskyleNo ratings yet

- Model Test Paper 13Document15 pagesModel Test Paper 13ganeshNo ratings yet

- Accounting Review-Activity 1 Answers 1. B. 2,200,000Document6 pagesAccounting Review-Activity 1 Answers 1. B. 2,200,000Junvy AbordoNo ratings yet

- HITDocument16 pagesHITSIRUI DINGNo ratings yet

- Midterms Solutions - Pre-Test, SW, Assignment, DiscussionDocument12 pagesMidterms Solutions - Pre-Test, SW, Assignment, DiscussionGianna ReyesNo ratings yet

- Prac SolutionsDocument5 pagesPrac SolutionschrstncstlljNo ratings yet

- AccountingDocument8 pagesAccountingfarhan anwarNo ratings yet

- In Other Words RE Increased by P250,000 (Income Less Dividends)Document6 pagesIn Other Words RE Increased by P250,000 (Income Less Dividends)Agatha de CastroNo ratings yet

- Class Practice QsDocument10 pagesClass Practice QsIsha KatiyarNo ratings yet

- Solution Far560 Jun2019Document9 pagesSolution Far560 Jun2019ohksy ilyNo ratings yet

- Chapter17 BuenaventuraDocument8 pagesChapter17 BuenaventuraAnonnNo ratings yet

- Answer: PH P 1,240: SolutionDocument18 pagesAnswer: PH P 1,240: SolutionadssdasdsadNo ratings yet

- Chapter 1 - Contingent LiabilitiesDocument6 pagesChapter 1 - Contingent LiabilitiesJoshua AbanalesNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Answers AFADocument6 pagesAnswers AFAMaithri Vidana KariyakaranageNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- SaginawValleyResort F22 SolutionDocument3 pagesSaginawValleyResort F22 SolutionFalguni ShomeNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Afn AssignmentDocument1 pageAfn AssignmentBill ENo ratings yet

- Finman 108 (Quiz 4) ...Document6 pagesFinman 108 (Quiz 4) ...CHARRYSAH TABAOSARESNo ratings yet

- Santos - Solution FinalsDocument3 pagesSantos - Solution FinalsIan SantosNo ratings yet

- May 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestDocument14 pagesMay 2018 Crammer's Guide Answers: Inventory To Be Removed From Inventory Because of Purchase Cutoff TestJamieNo ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- 4.2 Answers and Solutions - Assignment On Materials and LaborDocument8 pages4.2 Answers and Solutions - Assignment On Materials and LaborRoselyn LumbaoNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- ALEJAGA FM Project Week 4Document5 pagesALEJAGA FM Project Week 4Andrea Monique AlejagaNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Buscom Subsequent MeasurementDocument6 pagesBuscom Subsequent MeasurementCarmela BautistaNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Business Combination Asset Acquisition: Third YearDocument6 pagesBusiness Combination Asset Acquisition: Third YearRosalie Colarte LangbayNo ratings yet

- Audit CH 9Document6 pagesAudit CH 9Phoebe Dayrit CunananNo ratings yet

- AC13.1.2 Module 1 Answer KeyDocument6 pagesAC13.1.2 Module 1 Answer KeyDianaNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Pool Performance Report Abs and Mbs Pools June 2023Document32 pagesPool Performance Report Abs and Mbs Pools June 2023greencafeNo ratings yet

- Ashwin Kotian: Experience SummaryDocument4 pagesAshwin Kotian: Experience Summarynm3105No ratings yet

- Stout v. Jefferson County (Alabama) - Doc 1001 - AttachmentsDocument385 pagesStout v. Jefferson County (Alabama) - Doc 1001 - AttachmentsTrisha Powell CrainNo ratings yet

- RSH Qam11 Module03Document14 pagesRSH Qam11 Module03Fyaj RohanNo ratings yet

- Rahman CVDocument3 pagesRahman CVRahman AqaNo ratings yet

- PawnshopDocument25 pagesPawnshopapi-289042707No ratings yet

- Chapter 3 CreditDocument2 pagesChapter 3 Creditcoleen100% (2)

- Designing Trading SystemsDocument20 pagesDesigning Trading Systemsvijay7775303100% (1)

- Baba Ans Sevil (2020)Document11 pagesBaba Ans Sevil (2020)apostolos katsafadosNo ratings yet

- National Monetization Pipeline Aviation SectorDocument3 pagesNational Monetization Pipeline Aviation SectorStudy AllyNo ratings yet

- Mutual FundDocument20 pagesMutual FundRupesh KekadeNo ratings yet

- Manufacturing Overhead Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMDocument5 pagesManufacturing Overhead Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMJacob ChinyokaNo ratings yet

- Ma1 Examreport July Dec 2018 PDFDocument4 pagesMa1 Examreport July Dec 2018 PDFeiffa batrisyiaNo ratings yet

- Ham - 16062017Document17 pagesHam - 16062017sumit pamecha100% (1)

- Lsenergialawsuitdocumentangola PDFDocument268 pagesLsenergialawsuitdocumentangola PDFAnonymous NOduLwMHNo ratings yet

- PAS 24 Related PartiesDocument4 pagesPAS 24 Related Partiesjapvivi ceceNo ratings yet

- Kamadhenu Unclaimedandunpaid Dividend 2017Document28 pagesKamadhenu Unclaimedandunpaid Dividend 2017Jayraj RajputNo ratings yet

- Herrera v. Petrophil CorporationDocument1 pageHerrera v. Petrophil CorporationNicole Marie Abella CortesNo ratings yet

- Ar 15Document324 pagesAr 15ed bookerNo ratings yet

- Study Guide For Great DepressionDocument4 pagesStudy Guide For Great DepressionKyle Panek-KravitzNo ratings yet

- Loi Sha009 GicDocument2 pagesLoi Sha009 GicgreenindiacargoplNo ratings yet

- HK JobsdbDocument1 pageHK JobsdbmartinaccNo ratings yet

- Account Statement 010420 310321Document107 pagesAccount Statement 010420 310321vaibhav patilNo ratings yet

- Gas Bill (July)Document1 pageGas Bill (July)Khyber AutosNo ratings yet

- Chapter 2 (The Asset Allocation Decision)Document28 pagesChapter 2 (The Asset Allocation Decision)Abuzafar AbdullahNo ratings yet

- Barton Co. Balance Sheet For Branch December 31, 20x4Document27 pagesBarton Co. Balance Sheet For Branch December 31, 20x4Love FreddyNo ratings yet

- PH Customs Brokers For BOC Suspension - Feb3Document7 pagesPH Customs Brokers For BOC Suspension - Feb3PortCalls0% (1)

- Accounting TemplatesDocument21 pagesAccounting TemplatesVaniamarie VasquezNo ratings yet