Professional Documents

Culture Documents

Q

Q

Uploaded by

Rosemarie Villanueva0 ratings0% found this document useful (0 votes)

14 views9 pagesOriginal Title

q

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views9 pagesQ

Q

Uploaded by

Rosemarie VillanuevaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

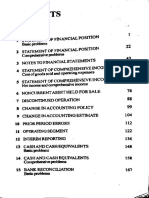

You are on page 1of 9

‘ana, 1:50 PM. Aco109-P1 quiZt

ACC109-P1 QUIZ1

roca.villanueva.up@phinmaed.com Switch account

® draft saved

Your email will be recorded when you submit this form

* Required

For this part just write the number. No units, no comma, no space, round off to whole number if there is a

decimal, no Peso or other denomination sign. Example answer: 100000 or 123456. For loss, use negative

sign. Example -500. Upload your solutions in as attachment in the ger.

hitpssldocs.google.comvformsds/1FAlpQLSeU_nBHRWA_ZqUCmsS74_hzY Vidgz2tn.J8Viiq3pnJjoGe-gitormRespons

19

‘ana, 1:50 PM. Ace:08-P1 quizs

Below are the account balances prepared by the bookkeeper for 5 points

ASTRAZENECA Company as of December 31, 20x1: How much is the

adjusted Accounts Receivable balance, net of AFDA? *

aaa “Tatas

Cait 30000 Accwunts payate aoe

Accoutis eesable ek 85000 Note payable 0,000

Inventory 80.000

Prepaid income tc 16.000

Prapaid arsets 10000

Investment in subsidiary 20,000

[Land hald forsale 55.000

Property, plant and 300,000

Totals 200,000 BH 000

Additional information:

~ Cash consists of the following,

‘Petty cash fund (unzeplerushed petty cash expenses, P3000), 400

Cashinbank (20,000)

Payroll fund 25,000

Tax fund 14,000

‘Cash to be contributed to a sinking fund set up for the retirement

of bonds maturing on December 31, 20x3 4.000

Total Cask 30,000

~ Checks amounting to P61,000 were written to suppliers and recorded on December 30, 2x1, resulting

to abank overdraft of 720,000, The checks were malled on January 9, 20%2.

~ Accounts recelvable consists of the following:

Accounis recevable 80,000

Allowance for uncollectabiity ( 10.000)

‘Ceedit balance m customers’ accounts (6000)

Selling price of unsold goods sent on consignment te SFUTNIK, Inc.

at 120". of cost and excluded from ASTRAZENECA’sinventory 24,000

counts receioable, net 36,

~ Theinventory includes cost of goods amounting to ?20,000 that are expected to be sold beyond

‘2monthsbut within the ordinary course of business. Also, the inventory includes cost of

‘consigned goods received on consignment from Alpha-Numerix Co. amounting to ?10,000.

= Prepaid mcome tax represents excess of payments for quarterly corporate income taxes during,

20x! over the actual annual corporate income tax as of December 31, 20x.

= Prepaid assets myludes.a P4,000 security deposit on an operating lease whichis expected

expire on March 31, 20:3. The security deposit will be received on lease expiration.

go = Theland qualified for dastification as “asset held for sale” unde: PFRS5 Non-cwrent Asseis Hela

‘or Sale and Discontinued Operations as of December 31, 0x1.

= “Accounts vavable isnet of P12.000 debit balance in supoliers’ accounts. Accounts vavable

hitps:idocs.google.comvformsis/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iInJ8Viiq3pnJjoGo-gormResponse 29

‘ana, 1:50PM.

Acc108-P1 quiz:

meludes the cost of goods held on consignment from Alpha-Numenx Co. which were included.

in inventory.

= Tnenotes payable age dated July 1, 20x! and are due on July 1, 20x4. The notes payable bearsan

annual interest rate of 10%. Interest is payable annually.

70000

Below are the account balances prepared by the bookkeeper for S points

ASTRAZENECA Company as of December 31, 20x

adjusted Accounts Receivable balance, net of AFDA? *

jow much is the

aaa “Tatas

Cait 30000 Accwunts payate aoe

Accoutis eesable ek 85000 Note payable 00,000

Inventory 80.000

Prepaid income tc 16.000

Prapaid arsets 10000

Investment in subsidiary 20,000

[Land hald forsale 55.000

Property, plant and 300,000

Totals 200,000 BH 000

Additional information:

~ Cash consists of the following,

‘Petty cash fund (unzeplerushed petty cash expenses, P3000), 400

Cashinbank (20,000)

Payroll fund 25,000

Tax fund 14,000

‘Cash to be contributed to a sinking fund set up for the retirement

of bonds maturing on December 31, 20x3 4.000

Total Cask 30,000

~ Checks amounting to P61,000 were written to suppliers and recorded on December 30, 2x1, resulting

to abank overdraft of 720,000, The checks were malled on January 9, 20%2.

~ Accounts recelvable consists of the following:

Accounis recevable 80,000

Allowance for uncollectabiity ( 10.000)

‘Ceedit balance m customers’ accounts (6000)

Selling price of unsold goods sent on consignment te SFUTNIK, Inc.

at 120". of cost and excluded from ASTRAZENECA’sinventory 24,000

counts receioable, net 36,

~ Theinventory includes cost of goods amounting to ?20,000 that are expected to be sold beyond

‘2monthsbut within the ordinary course of business. Also, the inventory includes cost of

‘consigned goods received on consignment from Alpha-Numerix Co. amounting to ?10,000.

= Prepaid mcome tax represents excess of payments for quarterly corporate income taxes during,

20x! over the actual annual corporate income tax as of December 31, 20x.

= Prepaid assets myludes.a P4,000 security deposit on an operating lease whichis expected

expire on March 31, 20:3. The security deposit will be received on lease expiration.

= Theland qualified for dastification as “asset held for sale” unde: PFRS5 Non-cwrent Asseis Hela

‘or Sale and Discontinued Operations as of December 31, 0x1.

= “Accounts vavable isnet of P12.000 debit balance in supoliers’ accounts. Accounts vavable

hitps:idocs.google.comvformsis/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iInJ8Viiq3pnJjoGo-gormResponse a9

‘ana, 1:50PM. Acc108-P1 quiz:

meludes the cost of goods held on consignment from Alpha-Numenx Co. which were included.

in inventory.

= Tnenotes payable age dated July 1, 20x! and are due on July 1, 20x4. The notes payable bearsan

annual interest rate of 10%. Interest is payable annually.

70000

The records of MODERNA Co. show the following information: How much

is the total distribution (selling) costs? *

Interest expense 24,000

Cost of inventories sold 600,000

Insurance expense 100,000

Advertising expense 20,000

Freight-out 10,000

Freight-in 4,000

Loss on sale of equipment 2,000

Legal and other professional fees 12,000

Rent expense (one-half occupied by sales department) §,000

Sales commission expense 14,000

Doubtful accounts expense 16,000

48000

hitps:idocs.google.comvformsids/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iIn J8Vitg3pnvjoGo-gitormResponse

5 point

‘ana, 1:50 PM. Ace:08-P1 quizs

Below are the account balances prepared by the bookkeeper for 5 points

ASTRAZENECA Company as of December 31, 20x1: How much is the

adjusted Cash balance? *

aaa “Tatas

Cait 30000 Accwunts payate aoe

Accoutis eesable ek 85000 Note payable 0,000

Inventory 80.000

Prepaid income tc 16.000

Prapaid arsets 10000

Investment in subsidiary 20,000

[Land hald forsale 55.000

Property, plant and 300,000

Totals 200,000 BH 000

Additional information:

~ Cash consists of the following,

‘Petty cash fund (unzeplerushed petty cash expenses, P3000), 400

Cashinbank (20,000)

Payroll fund 25,000

Tax fund 14,000

‘Cash to be contributed to a sinking fund set up for the retirement

of bonds maturing on December 31, 20x3 4.000

Total Cask 30,000

~ Checks amounting to P61,000 were written to suppliers and recorded on December 30, 2x1, resulting

to abank overdraft of 720,000, The checks were malled on January 9, 20%2.

~ Accounts recelvable consists of the following:

Accounis recevable 80,000

Allowance for uncollectabiity ( 10.000)

‘Ceedit balance m customers’ accounts (6000)

Selling price of unsold goods sent on consignment te SFUTNIK, Inc.

at 120". of cost and excluded from ASTRAZENECA’sinventory 24,000

counts receioable, net 36,

~ Theinventory includes cost of goods amounting to ?20,000 that are expected to be sold beyond

‘2monthsbut within the ordinary course of business. Also, the inventory includes cost of

‘consigned goods received on consignment from Alpha-Numerix Co. amounting to ?10,000.

= Prepaid mcome tax represents excess of payments for quarterly corporate income taxes during,

20x! over the actual annual corporate income tax as of December 31, 20x.

= Prepaid assets myludes.a P4,000 security deposit on an operating lease whichis expected

expire on March 31, 20:3. The security deposit will be received on lease expiration.

go = Theland qualified for dastification as “asset held for sale” unde: PFRS5 Non-cwrent Asseis Hela

‘or Sale and Discontinued Operations as of December 31, 0x1.

= “Accounts vavable isnet of P12.000 debit balance in supoliers’ accounts. Accounts vavable

hitps:idocs.google.comvformsis/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iInJ8Viiq3pnJjoGo-gormResponse 59

‘ana, 1:50PM. Acc108-P1 quiz:

meludes the cost of goods held on consignment from Alpha-Numenx Co. which were included.

in inventory.

= Tnenotes payable age dated July 1, 20x! and are due on July 1, 20x4. The notes payable bearsan

annual interest rate of 10%. Interest is payable annually.

84000

The following items were presented for the purpose of determining 5 points

comprehensive income. How much is the total comprehensive income? *

Profit for the year 2,000

Increase in revaluation surplus 1,000

Remeasurements of the net defined benefit liability (asset) - loss (200)

Net change in translation of foreign operation (400)

Dividends declared (100)

Stock rights 300

2400

hitps:idocs.google.comvformsids/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iIn J8Vitg3pnvjoGo-gitormResponse

69

‘ana, 1:50 PM. Ace:08-P1 quizs

Below are the account balances prepared by the bookkeeper for 5 points

ASTRAZENECA Company as of December 31, 20x1: How much is the

adjusted working capital? *

aaa “Tatas

Cait 30000 Accwunts payate aoe

Accoutis eesable ek 85000 Note payable 0,000

Inventory 80.000

Prepaid income tc 16.000

Prapaid arsets 10000

Investment in subsidiary 20,000

[Land hald forsale 55.000

Property, plant and 300,000

Totals 200,000 BH 000

Additional information:

~ Cash consists of the following,

‘Petty cash fund (unzeplerushed petty cash expenses, P3000), 400

Cashinbank (20,000)

Payroll fund 25,000

Tax fund 14,000

‘Cash to be contributed to a sinking fund set up for the retirement

of bonds maturing on December 31, 20x3 4.000

Total Cask 30,000

~ Checks amounting to P61,000 were written to suppliers and recorded on December 30, 2x1, resulting

to abank overdraft of 720,000, The checks were malled on January 9, 20%2.

~ Accounts recelvable consists of the following:

Accounis recevable 80,000

Allowance for uncollectabiity ( 10.000)

‘Ceedit balance m customers’ accounts (6000)

Selling price of unsold goods sent on consignment te SFUTNIK, Inc.

at 120". of cost and excluded from ASTRAZENECA’sinventory 24,000

counts receioable, net 36,

~ Theinventory includes cost of goods amounting to ?20,000 that are expected to be sold beyond

‘2monthsbut within the ordinary course of business. Also, the inventory includes cost of

‘consigned goods received on consignment from Alpha-Numerix Co. amounting to ?10,000.

= Prepaid mcome tax represents excess of payments for quarterly corporate income taxes during,

20x! over the actual annual corporate income tax as of December 31, 20x.

= Prepaid assets myludes.a P4,000 security deposit on an operating lease whichis expected

expire on March 31, 20:3. The security deposit will be received on lease expiration.

go = Theland qualified for dastification as “asset held for sale” unde: PFRS5 Non-cwrent Asseis Hela

‘or Sale and Discontinued Operations as of December 31, 0x1.

= “Accounts vavable isnet of P12.000 debit balance in supoliers’ accounts. Accounts vavable

hitps:idocs.google.comvformsis/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iInJ8Viiq3pnJjoGo-gormResponse 79

‘ana, 1:50PM. Acc108-P1 quiz:

meludes the cost of goods held on consignment from Alpha-Numenx Co. which were included.

in inventory.

= Tnenotes payable age dated July 1, 20x! and are due on July 1, 20x4. The notes payable bearsan

annual interest rate of 10%. Interest is payable annually.

215000

SINOVAC Co. had the following information for 20x1: How muchis the 5 points

total assets as of December 31, 20x1? *

‘Accounts receivable tumover 10:1

Total assets turnover 125:

Average receivables during the year 400,000

Total assets, January 1, 20x1 800,000

3200000

The records of SINOVAC Co. showed the following information: How 5 point:

much is the gross profit for the year? *

Increase in accounts receivable 100,000

Collections on accounts 800,000

Cash sales 120,000

Increase in inventory 40,000

Freight-in 14,000

Freight-out 13,000

Decrease in accounts payable 60,000

Disbursements for purchases 480,000

Purchase discounts 4,000

626000

hitps:idocs.google.comvformsids/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iIn J8Vitg3pnvjoGo-gitormResponse

‘ana, 1:50 PM. Aco109-P1 quiZt

The ledger of JANSEN SICK Co. as of December 31, 20x! includes the 5 points

following: How much is the total current liabilities? *

10% Note payable 240,000

12% Note payable 120,000

14% Mortgage note payable 60,000

Interest payable -

Additonal information:

JANSEN Co.'s financial statements were authorized for issue on Apsil 15, 2052.

- The 10% note payable is dise on July 15, 20x2 and pays semi-annual interest every July 15 and

December 15. On January 28, 20x2, JANSEN Co. entered into a refinancing, agreement with a bank

to refinance the entire note by issuing 3 long term obligation.

The 12% note payable is due on March 1, 20x2 and pays anual interest every March 1. On January

31, 20:2, JANSEN Co, extended the matuity of the sote to March 1, 20x3 under the existing loan

agreement. The extension of mnaturity dato is atthe option of JANSEN.

- The 14% mortgage note is due on December 31, 209. Pee agreement with the erediter, JANSEN isto

pay quacterly interests on the note, failure to do 20 will zendes the nete payable on demand. JANSEN

failed to pay the 2nd to 4 quarterly interests on the note during 20x.

315000

Back Submit Clear form

Never submit passwords through Google Forms.

This form was created inside of Phinma Education, Report Abuse

Google Forms

hitps:idocs.google.comvformsids/1FAlpQLSeU_nBHRWA_ZaUCmsS74_hzYVidez2iIn J8Vitg3pnvjoGo-gitormResponse 99

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Audit of Intangibles Consolidated PDFDocument29 pagesAudit of Intangibles Consolidated PDFRosemarie VillanuevaNo ratings yet

- Bam 242 - P2 Examination - (Part 1) : I. Multiple Choice Questions. 1 Point EachDocument20 pagesBam 242 - P2 Examination - (Part 1) : I. Multiple Choice Questions. 1 Point EachRosemarie VillanuevaNo ratings yet

- Bam 242 - P2 Examination - (Part 2) : Ii. Modified True or False. 2 Pts EachDocument6 pagesBam 242 - P2 Examination - (Part 2) : Ii. Modified True or False. 2 Pts EachRosemarie VillanuevaNo ratings yet

- ACC109 P2 Exam.1Document12 pagesACC109 P2 Exam.1Rosemarie VillanuevaNo ratings yet

- Bam 242 - P2 Examination - (Part 1) : Ii. Modified True or False. 2 Pts EachDocument9 pagesBam 242 - P2 Examination - (Part 1) : Ii. Modified True or False. 2 Pts EachRosemarie VillanuevaNo ratings yet

- DDocument16 pagesDRosemarie VillanuevaNo ratings yet

- P2 Examination - BAM 031 - Income Taxation.1Document4 pagesP2 Examination - BAM 031 - Income Taxation.1Rosemarie VillanuevaNo ratings yet

- Bam 242 - P2 Examination - (Part 2) : I. Multiple Choice Questions. 1 Point EachDocument12 pagesBam 242 - P2 Examination - (Part 2) : I. Multiple Choice Questions. 1 Point EachRosemarie VillanuevaNo ratings yet

- ACC109-P2-Exam: Problem SolvingDocument18 pagesACC109-P2-Exam: Problem SolvingRosemarie VillanuevaNo ratings yet

- DDocument16 pagesDRosemarie VillanuevaNo ratings yet

- Villanueva, Rosemarie C. 3bsa03 Bam 213 Day 8&11Document2 pagesVillanueva, Rosemarie C. 3bsa03 Bam 213 Day 8&11Rosemarie VillanuevaNo ratings yet

- P2 Examination - BAM 031 - Income Taxation.3Document9 pagesP2 Examination - BAM 031 - Income Taxation.3Rosemarie VillanuevaNo ratings yet

- Villanueva, Rosemarie C. Bam 213 Day 12&13Document3 pagesVillanueva, Rosemarie C. Bam 213 Day 12&13Rosemarie VillanuevaNo ratings yet

- Villanueva, Rosemarie C. Acc 139 Day11-14Document9 pagesVillanueva, Rosemarie C. Acc 139 Day11-14Rosemarie VillanuevaNo ratings yet

- Villanueva, Rosemarie C. Bam 213 Day 11-17Document5 pagesVillanueva, Rosemarie C. Bam 213 Day 11-17Rosemarie VillanuevaNo ratings yet

- Villanueva, Rosemarie C. Bam 213 P2 Assignment1Document6 pagesVillanueva, Rosemarie C. Bam 213 P2 Assignment1Rosemarie VillanuevaNo ratings yet

- Villanueva, Rosemarie C. A13bsa03 Day1-9Document33 pagesVillanueva, Rosemarie C. A13bsa03 Day1-9Rosemarie VillanuevaNo ratings yet

- Villanueva R. Fin 073 Day 6Document4 pagesVillanueva R. Fin 073 Day 6Rosemarie VillanuevaNo ratings yet

- Chapter 1 Pfa 1 Valix 2018Document13 pagesChapter 1 Pfa 1 Valix 2018Rosemarie VillanuevaNo ratings yet

- Research Respondents 1Document80 pagesResearch Respondents 1Rosemarie VillanuevaNo ratings yet

- Business Dagupan - Group 3highlightedDocument480 pagesBusiness Dagupan - Group 3highlightedRosemarie VillanuevaNo ratings yet

- Curriculum Vitae: Clark Kein C. VillanuevaDocument3 pagesCurriculum Vitae: Clark Kein C. VillanuevaRosemarie VillanuevaNo ratings yet

- Bibliography Appendix CVDocument24 pagesBibliography Appendix CVRosemarie VillanuevaNo ratings yet

- Chapter 3 Pfa 1 Valix 2018Document4 pagesChapter 3 Pfa 1 Valix 2018Rosemarie VillanuevaNo ratings yet

- Buscmb - 3Rd FQ: PointsDocument14 pagesBuscmb - 3Rd FQ: PointsRosemarie VillanuevaNo ratings yet