Professional Documents

Culture Documents

KN Ewt 10.25

Uploaded by

Ian InandanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

KN Ewt 10.25

Uploaded by

Ian InandanCopyright:

Available Formats

RMC 35-2006 clarifies the treatment of EWTs for the business of freight forwarders.

Consequently, please note the following –

1. For cross-border movement of goods

a. Forwarders are the duly constituted withholding agents. Thus, forwarders shall

withhold and remit the EWTs from its payments to third party service providers

since it is the party having control over the disbursements of funds;

b. Further, forwarders shall be responsible in preparing the corresponding

certificates of creditable taxes withheld;

c. Lastly, forwarders shall prepare a listing/summary of the shippers/clients

indicating therein the amounts charged as freight and accessorial charges (net of

commission) which shall be attached to the ETW return filed with the BIR.

Please note that all payments to third party service providers (actual freight, together

with accessorial charges, and the offshore origin/destination charges), must be

covered by official receipts issued by the international carrier and the foreign freight

forwarder or foreign agent, respectively, in the name of the Freight Forwarder plus

any acceptable proofs of payment and other documents.

Otherwise, any such payments claimed to have been made by the forwarders to the

said third-party service providers which are not covered by the acceptable proofs

and relevant documents, shall be treated as forming part of the gross receipts of the

forwarders subject to VAT and not allowed as a deduction for income tax purposes.

2. For local transactions

If the forwarder issues its VAT official receipt for the entire amount received:

a. The shipper who claims the expenses for income tax purposes shall be

responsible in withholding and remitting the EWTs.

If the forwarder books a portion of the amount received as advances or reimbursable

expenses because it is earmarked for payments to third-party service provider:

a. The forwarder shall withhold the EWTs due on the payments;

b. Consequently, the forwarder shall issue the corresponding certificate of tax

withheld in the name of (1) the third-party service provider as the payee, and (2)

the name of the shipper as the real payor of income payment with parenthetical

mention of the name of the forwarder as agent of the shipper;

c. The forwarder shall be responsible to instruct the third-party service providers to

issue official receipts directly in the name of the shippers of the forwarders;

d. In the demand for reimbursement by the forwarder to the shippers, the

forwarder shall demand the amount actually paid (net of EWT) and shall instruct

the shipper to remit the EWT to the BIR.

Please note that the reimbursement received by the forwarder is no longer

subject to EWT since no income is derived from collection of these advances.

Consequently, these reimbursements do not form part of the forwarder’s gross

receipts, and covered by non-VAT acknowledgement receipts.

However, should the reimbursement redound to the benefit of the forwarder,

the said reimbursement must be subject to EWT to be withheld by the shippers.

Consequently, these reimbursements form part of the forwarder’s gross receipts

and must be covered by VAT official receipts.

Please be guided accordingly.

We hope you find the foregoing helpful. Should you have questions or clarifications,

please let us know.

Regards,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Annex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsDocument1 pageAnnex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsEliza Corpuz Gadon89% (19)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Income Tax 2nd PretestDocument3 pagesIncome Tax 2nd PretestEllaMay Delazerna0% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Bor RomeoDocument21 pagesBor RomeoIan InandanNo ratings yet

- Republic of The Philippines Quezon City: Court of Tax AppealsDocument20 pagesRepublic of The Philippines Quezon City: Court of Tax AppealsIan InandanNo ratings yet

- QDocument2 pagesQIan InandanNo ratings yet

- Affidavit No Professional Fee ChargedDocument1 pageAffidavit No Professional Fee ChargedReegan MasarateNo ratings yet

- Handbook On Workers Statutory Monetary Benefits 2020 EditionDocument80 pagesHandbook On Workers Statutory Monetary Benefits 2020 EditionDatulna Benito Mamaluba Jr.No ratings yet

- Cta Eb CV 00652 D 2011jul12 RefDocument31 pagesCta Eb CV 00652 D 2011jul12 RefIan InandanNo ratings yet

- En BancDocument27 pagesEn BancIan InandanNo ratings yet

- Supreme Court ruling on mandamus petition to compel prosecution of witness in Maguindanao massacre caseDocument5 pagesSupreme Court ruling on mandamus petition to compel prosecution of witness in Maguindanao massacre caseIan InandanNo ratings yet

- Today Is Saturday, July 25, 2015Document9 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Today Is Saturday, July 25, 2015: SearchDocument10 pagesToday Is Saturday, July 25, 2015: SearchIan InandanNo ratings yet

- Ampatuan v. Hon. Puno, June 7, 2011Document15 pagesAmpatuan v. Hon. Puno, June 7, 2011Bianca Camille Bodoy SalvadorNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon Second DivisionDocument32 pagesRepublic of The Philippines Court of Tax Appeals Quezon Second DivisionIan InandanNo ratings yet

- Republic of The Philippines Manila en Banc: Today Is Saturday, July 25, 2015Document19 pagesRepublic of The Philippines Manila en Banc: Today Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Today Is Saturday, July 25, 2015: PetitionersDocument14 pagesToday Is Saturday, July 25, 2015: PetitionersIan InandanNo ratings yet

- Supreme Court: Today Is Saturday, July 25, 2015Document9 pagesSupreme Court: Today Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Roseller T. Lim For Petitioners. Antonio Belmonte For RespondentsDocument3 pagesRoseller T. Lim For Petitioners. Antonio Belmonte For RespondentsIan InandanNo ratings yet

- Today Is Saturday, July 25, 2015Document17 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Supreme Court denies petition to compel judicial independenceDocument9 pagesSupreme Court denies petition to compel judicial independenceIan InandanNo ratings yet

- Supreme CourtDocument14 pagesSupreme CourtIan InandanNo ratings yet

- Today Is Saturday, July 25, 2015Document11 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Republic of The Philippines Manila en Banc: Today Is Saturday, July 25, 2015Document34 pagesRepublic of The Philippines Manila en Banc: Today Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Today Is Saturday, July 25, 2015Document17 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Supreme Court: Today Is Saturday, July 25, 2015Document12 pagesSupreme Court: Today Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Today Is Saturday, July 25, 2015Document15 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Today Is Saturday, July 25, 2015Document4 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Today Is Saturday, July 25, 2015Document16 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- Decision, Leonen (J) Separate Concurring Opinion, Carpio (J) Separate Concurring Opinion, Perlas-Bernabe (J) Dissenting Opinion, Brion (J)Document3 pagesDecision, Leonen (J) Separate Concurring Opinion, Carpio (J) Separate Concurring Opinion, Perlas-Bernabe (J) Dissenting Opinion, Brion (J)Ian InandanNo ratings yet

- Today Is Saturday, July 25, 2015: PetitionersDocument14 pagesToday Is Saturday, July 25, 2015: PetitionersIan InandanNo ratings yet

- BPI Family Savings Bank v. CTADocument3 pagesBPI Family Savings Bank v. CTATheodoreJosephJumamilNo ratings yet

- Tax LawDocument8 pagesTax LawAmie Jane MirandaNo ratings yet

- 178 00 ADIT Paper-IIIF-Transfer-Pricing-Manual Combined PDFDocument336 pages178 00 ADIT Paper-IIIF-Transfer-Pricing-Manual Combined PDFCristina IancuNo ratings yet

- 6 RR 05-99 PDFDocument5 pages6 RR 05-99 PDFbiklatNo ratings yet

- ARROW Hospitality Consulting: Tax InvoiceDocument1 pageARROW Hospitality Consulting: Tax InvoiceShaShockNo ratings yet

- GST and Mutual Funds in India: A Case StudyDocument6 pagesGST and Mutual Funds in India: A Case StudyIAEME PublicationNo ratings yet

- IT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideDocument13 pagesIT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideThapeloNo ratings yet

- PR2EPDocument127 pagesPR2EPKat Pichay33% (6)

- Final Income Taxation Lesson 5: Passive Income and Withholding Tax RatesDocument28 pagesFinal Income Taxation Lesson 5: Passive Income and Withholding Tax Rateslc50% (4)

- IncomeDocument4 pagesIncomeapi-3839889No ratings yet

- What Is An ESOP Infographic 2022Document1 pageWhat Is An ESOP Infographic 2022Erwin MainsteinNo ratings yet

- Mominul Joyanto Mosarraf Soumendro HanifDocument5 pagesMominul Joyanto Mosarraf Soumendro HanifbanglauserNo ratings yet

- Tax Chronicles Issue 57 FinaDocument26 pagesTax Chronicles Issue 57 FinaMeagen Steven Brown SeidelNo ratings yet

- Taxation CH 6Document2 pagesTaxation CH 6Kristel Nuyda LobasNo ratings yet

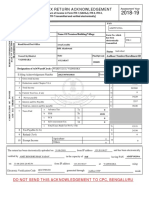

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- Nani Palkhivala Moot Court BrochureDocument17 pagesNani Palkhivala Moot Court BrochureCyberpunk 2077No ratings yet

- US Citizens Cannot Deduct Foreign Taxes from Philippine IncomeDocument2 pagesUS Citizens Cannot Deduct Foreign Taxes from Philippine IncomeShariqah Hanimai Indol Macumbal-YusophNo ratings yet

- 0LH47 0LH47 0429 20180101 1095report 001Document1 page0LH47 0LH47 0429 20180101 1095report 001charly4877No ratings yet

- Form 2306 Witn Computation Electric BillDocument3 pagesForm 2306 Witn Computation Electric BillJanus Salinas100% (2)

- Tax Invoice for Headphones PurchaseDocument1 pageTax Invoice for Headphones PurchaseSharp CutsNo ratings yet

- Air Canada vs. CIRDocument3 pagesAir Canada vs. CIRBenedick LedesmaNo ratings yet

- Summary of Final Income TaxDocument7 pagesSummary of Final Income TaxeysiNo ratings yet

- Invoice Z7FZESDocument1 pageInvoice Z7FZESrishabh srivastavaNo ratings yet

- Boq Notes PDFDocument1 pageBoq Notes PDFJaimin ShahNo ratings yet

- PAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Document2 pagesPAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Elaine Belle OgayonNo ratings yet

- Aqua Suppliers Invoice and GST Summary ReportDocument8 pagesAqua Suppliers Invoice and GST Summary ReportKishnsNo ratings yet

- Post Office Monthly Income Scheme (MIS)Document2 pagesPost Office Monthly Income Scheme (MIS)rupesh_kanabar1604100% (1)

- Colorado Office of State Planning & Budgeting May Forecast Slide ShowDocument16 pagesColorado Office of State Planning & Budgeting May Forecast Slide ShowMichael_Roberts2019No ratings yet

- Tax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Document5 pagesTax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Shivani Jani0% (3)