Professional Documents

Culture Documents

Toshiba Information Equipment

Uploaded by

Guile Gabriel AlogOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Toshiba Information Equipment

Uploaded by

Guile Gabriel AlogCopyright:

Available Formats

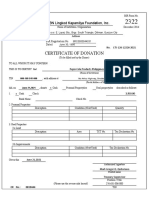

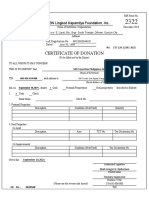

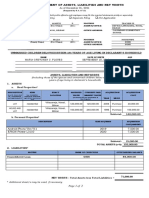

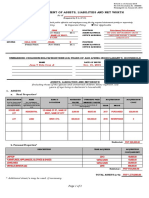

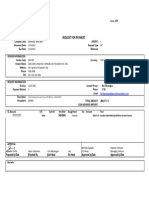

BIR Form No.

ABS-CBN Lingkod Kapamilya Foundation, Inc. 2322

Name of Institution / Organization December 2014

Mother Ignacia cor. E. Lopez Sts., Brgy. South Triangle, Diliman, Quezon City

Address

BIR Registration No. 8RC0000044031

Dated June 30, 1996

No. LTS-126-12255-2021

CERTIFICATE OF DONATION

(To be filled out by the Donee)

TO ALL WHOM IT MAY CONCERN:

THIS IS TO CERTIFY that Toshiba Information Equipment (Phils.), Inc

(Name of Institution)

TIN 004-739-137-000 , with address at 103 East Main Ave. Extension, Laguna Technopark, SEPZ, Binan City, Laguna

(Postal Address of Institution)

did, on April 30,2021 , donate x Cash Personal Property/ies Real property/ies described as follows:

1. x Cash Check 100,000.00

Bank Name: Check No.

2. Personal Properties

Description Condition (New/Used) Quantity

3. Real Properties

3.a Land

Description Area TCT No. Tax Declaration No.

3.b Improvements

Description Condition (New/Used) Tax Declaration No.

Given this April 30,2021

Authorized Signature

Mark Gregor Q. Quitoriano

Printed name

Treasury Supervisor

Position / Title

(Please use the reverse side hereof) 276-631-006-000

OR No.: 0813171 TIN

BIR Copy Printed Date: 10/12/2021

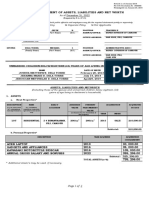

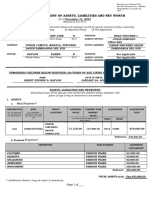

VALUATION OF DONATION

FOR PURPOSES OF DEDUCTIBILITY FROM GROSS INCOME

(To be filled out by the Donor)

1. Personal Property/ies

Description Condition (New/Used) Acquisition Cost Depreciation Net Book Value

Cash 100,000.00

Total Value of Personal Properties 100,000.00

2. Real Property/ies

2.a Land

Location Area (In sq. m.) TCT No. Acquisition Cost

2.b Improvements

Latest Tax Zonal /

Description Location

Declaration No. Market Value

Total Value of Real Property/ies -

TOTAL AGGREGATE VALUE OF DONATION 100,000.00

Signature

Name

Position / Title

TIN

Instructions

1. The first page shall be filled out by the Donee and the second page shall be filled out by the Donor.

2. Deductibility of Donations:

a. The amount to be deducted from the gross income shall be based on the Net Book Value of said property as reflected in the financial

statements of the donor. Please attach certified true copy of Deed of Sale of a certification under oath by the Donor of the Net Book

Value and acquisition cost. The values declared by the donor shall still be subject to further confirmation by the Bureau as to its

correctness and accuracy.

3. The Donee shall assume responsibility for the consecutive numbering of each Certificate of Donation, as follows:

For Regular Taxpayers : Dxxx-xxx-20xx Dxxx - RDO No.; xxx - number of Certificate; 20xx - year issued

Example D039-001-2019

For Large Taxpayers : LTS-xxx-20xx LTS - Large Taxpayers Service; xxx - number of Certificate; 20xx - year issued

Example LTS-001-2019

4. Consecutively numbered certification of donation should be distributed within thirty (30) days from receipt of donation, as follows:

(1) Original Copy - Donor

(2) Duplicate Copy - BIR

(3) Triplicate Copy - Donee

You might also like

- Noli Me Tangere Script (Rizal)Document10 pagesNoli Me Tangere Script (Rizal)Bryan Cabugao83% (335)

- Lululemon Form10-K AnalysisDocument7 pagesLululemon Form10-K Analysisapi-503259295No ratings yet

- Saln 2023Document3 pagesSaln 2023Osman G. Lumbos LptNo ratings yet

- Income Taxation 1 PDFDocument11 pagesIncome Taxation 1 PDFShayne PenalosaNo ratings yet

- Entrepreneurship Quarter 2: Module10Document19 pagesEntrepreneurship Quarter 2: Module10Primosebastian Tarrobago0% (1)

- Pepsi-Cola ProductsDocument2 pagesPepsi-Cola ProductsGuile Gabriel AlogNo ratings yet

- BIR Form No. 2322 Certificate of DonationDocument2 pagesBIR Form No. 2322 Certificate of DonationGuile Gabriel AlogNo ratings yet

- Autoland Subic MotorsDocument2 pagesAutoland Subic MotorsGuile Gabriel AlogNo ratings yet

- Ito Subic TrucksDocument2 pagesIto Subic TrucksGuile Gabriel AlogNo ratings yet

- UBS Securities Philippines Inc-SignedDocument2 pagesUBS Securities Philippines Inc-SignedGuile Gabriel AlogNo ratings yet

- Subic Water&Sewerage CompanyDocument2 pagesSubic Water&Sewerage CompanyGuile Gabriel AlogNo ratings yet

- Certificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncDocument2 pagesCertificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncGuile Gabriel AlogNo ratings yet

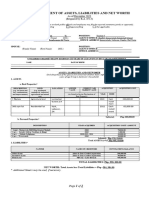

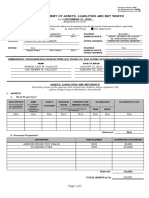

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthAdministrative DivisionNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth December 31, 2021Document3 pagesSworn Statement of Assets, Liabilities and Net Worth December 31, 2021Catherine RenanteNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument4 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableGerah Arcayos BiñasNo ratings yet

- Sworn Statement of Assets, Liabilities and Networth: A. Real PropertiesDocument3 pagesSworn Statement of Assets, Liabilities and Networth: A. Real PropertiesJudith CabisoNo ratings yet

- Sdoc 02 10 SiDocument5 pagesSdoc 02 10 Siمحي الدين محمدNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthMark DomingoNo ratings yet

- SALN-Format-4 (1)Document5 pagesSALN-Format-4 (1)Edmarie P. TabacoldeNo ratings yet

- Revised SWORN STATEMENTDocument2 pagesRevised SWORN STATEMENTmarianne pendonNo ratings yet

- Mac RingDocument3 pagesMac RingMaricris MitraNo ratings yet

- SALNDocument2 pagesSALNMayvic CarmonaNo ratings yet

- Revised SWORN STATEMENT of ASSETS, LIABILITIES and NET WORTHDocument2 pagesRevised SWORN STATEMENT of ASSETS, LIABILITIES and NET WORTHJewel CajudoyNo ratings yet

- 2015 Saln RevisedDocument2 pages2015 Saln RevisedJaytee Cornelius Navarro BachillerNo ratings yet

- SALN FormDocument2 pagesSALN Formcharles albaNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument6 pagesSworn Statement of Assets, Liabilities and Net WorthPao LucNo ratings yet

- 2015 SALN FormDocument3 pages2015 SALN Formmarilou severinoNo ratings yet

- Revised SALN Form for 2023Document3 pagesRevised SALN Form for 2023Vina Mae AtaldeNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthrustomNo ratings yet

- Revised SWORN STATEMENT OF ASSETSDocument3 pagesRevised SWORN STATEMENT OF ASSETSChuck Cunahap NobleNo ratings yet

- Saln 2015 FormDocument3 pagesSaln 2015 FormEloisa VillarNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthGina BundaNo ratings yet

- 2015 Saln FormDocument2 pages2015 Saln FormJAMES JAYONANo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthBayani JarabaNo ratings yet

- Revised SALN Form for Government EmployeesDocument3 pagesRevised SALN Form for Government EmployeesRose DSNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthJohn Robert FloresNo ratings yet

- Saln Form 2015 BlankDocument2 pagesSaln Form 2015 BlankJelyn Dela TorreNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument2 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not Applicablesairana disomangcopNo ratings yet

- SALN - CopyDocument4 pagesSALN - CopyPaida SandagNo ratings yet

- SALN If The Spouse Is An OFW EditedDocument2 pagesSALN If The Spouse Is An OFW EditedAgnes Dispo RamirezNo ratings yet

- Saln YotchobDocument2 pagesSaln YotchobMeneleo Jr Dela cruzNo ratings yet

- Certification On Appropriations, Funds and Obligation of AllotmentDocument20 pagesCertification On Appropriations, Funds and Obligation of AllotmentEmmanuel RecodoNo ratings yet

- Saln 2018Document2 pagesSaln 2018Jaime ValentonNo ratings yet

- 2023 Saln. BaylonDocument2 pages2023 Saln. BaylonMary Jane BaylonNo ratings yet

- SWORN STATEMENT OF ASSETS AND LIABILITIESDocument2 pagesSWORN STATEMENT OF ASSETS AND LIABILITIES아오아오No ratings yet

- 2015 Saln FormDocument2 pages2015 Saln FormDelonix Regia GutierezNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthLani VerdaderoNo ratings yet

- SALN Format 2023 LMDDocument2 pagesSALN Format 2023 LMDReymund VertudesNo ratings yet

- Hutamares Kean P SALN2022Document3 pagesHutamares Kean P SALN2022liliNo ratings yet

- 2015 Saln Form From CSCDocument3 pages2015 Saln Form From CSCHR OFFICE TAYUGNo ratings yet

- SAMPLE SALN (For Married-House or Private Spouse)Document2 pagesSAMPLE SALN (For Married-House or Private Spouse)DanielZamoraNo ratings yet

- 2022 Saln FormDocument2 pages2022 Saln FormJohn Michael DegilloNo ratings yet

- Saln 2022Document3 pagesSaln 2022Rhea DonaNo ratings yet

- 2015 SALN Additional SheetsDocument2 pages2015 SALN Additional SheetsArlyn P. Serafin - PaclitNo ratings yet

- 2015 SALN Additional SheetsDocument2 pages2015 SALN Additional SheetsErna May DematawaraNNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthJayson Deocareza Dela Torre100% (1)

- 2015 SALN FormDocument4 pages2015 SALN FormRay DeMolayNo ratings yet

- Revised SWORN STATEMENT OF ASSETS, LIABILITIES AND NET WORTHDocument3 pagesRevised SWORN STATEMENT OF ASSETS, LIABILITIES AND NET WORTHSheryl FaelnarNo ratings yet

- Sworn Statement of Assets Long ParasDocument2 pagesSworn Statement of Assets Long ParasCatherine Mae ChiongNo ratings yet

- Sworn Statement of AssetsDocument2 pagesSworn Statement of AssetssalihaNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Valles Von Virchel EDocument3 pagesSworn Statement of Assets, Liabilities and Net Worth: Valles Von Virchel EMabel AruyalNo ratings yet

- Saln Format - New 2023 MalouDocument4 pagesSaln Format - New 2023 MalouLou LucenaNo ratings yet

- Statement of Assets Liabilities and Net WorthDocument3 pagesStatement of Assets Liabilities and Net WorthDiaRamosAysonNo ratings yet

- PG To Afi GF Payment of Network CHRG 2019 2021 SignedDocument1 pagePG To Afi GF Payment of Network CHRG 2019 2021 SignedGuile Gabriel AlogNo ratings yet

- Bacolod Coinbank - Account Closure FT BB Bacolod Coinbank To BDO BB GFDocument1 pageBacolod Coinbank - Account Closure FT BB Bacolod Coinbank To BDO BB GFGuile Gabriel AlogNo ratings yet

- WEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedDocument2 pagesWEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedGuile Gabriel AlogNo ratings yet

- Erika Laureano Internship Journal Week 8 SignedDocument2 pagesErika Laureano Internship Journal Week 8 SignedGuile Gabriel AlogNo ratings yet

- Erika Laureano Internship Journal Week 10 SignedDocument2 pagesErika Laureano Internship Journal Week 10 SignedGuile Gabriel AlogNo ratings yet

- RFP Request for Payment FormDocument1 pageRFP Request for Payment FormGuile Gabriel AlogNo ratings yet

- RFP Request for Payment FormDocument59 pagesRFP Request for Payment FormGuile Gabriel AlogNo ratings yet

- BB OPD To ALKFI GF-ER Share July To September 2021Document1 pageBB OPD To ALKFI GF-ER Share July To September 2021Guile Gabriel AlogNo ratings yet

- VAT Exempt Transaction Codes and Payment DetailsDocument187 pagesVAT Exempt Transaction Codes and Payment DetailsGuile Gabriel AlogNo ratings yet

- BB OPD To ALKFI GF-ER Share July To September 2021Document1 pageBB OPD To ALKFI GF-ER Share July To September 2021Guile Gabriel AlogNo ratings yet

- Cost Center Description Total ECC ER SharesDocument9 pagesCost Center Description Total ECC ER SharesGuile Gabriel AlogNo ratings yet

- Erika Laureano - Internship Journal Week 9Document2 pagesErika Laureano - Internship Journal Week 9Guile Gabriel AlogNo ratings yet

- WEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedDocument2 pagesWEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedGuile Gabriel AlogNo ratings yet

- WEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedDocument2 pagesWEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedGuile Gabriel AlogNo ratings yet

- ABS CBN Foundation Bank Statement April 2021Document51 pagesABS CBN Foundation Bank Statement April 2021Guile Gabriel AlogNo ratings yet

- PNP3 Sweeping of Funds To Gendi Account As of September 2021 From BPI 3051 1155 88Document1 pagePNP3 Sweeping of Funds To Gendi Account As of September 2021 From BPI 3051 1155 88Guile Gabriel AlogNo ratings yet

- WEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedDocument2 pagesWEEK 9. Internship Journal. Christine Joyce G. Cerrero (1) SignedGuile Gabriel AlogNo ratings yet

- OC - ALKFI Oct 18Document1,453 pagesOC - ALKFI Oct 18Guile Gabriel AlogNo ratings yet

- PNP3 Sweeping of Funds To Gendi Account As of September 2021 From BPI 3051 1155 88Document1 pagePNP3 Sweeping of Funds To Gendi Account As of September 2021 From BPI 3051 1155 88Guile Gabriel AlogNo ratings yet

- RFP FT - Corral Yr 2021Document152 pagesRFP FT - Corral Yr 2021Guile Gabriel AlogNo ratings yet

- Erika Laureano Internship Journal Week 10 SignedDocument2 pagesErika Laureano Internship Journal Week 10 SignedGuile Gabriel AlogNo ratings yet

- PNP3 Sweeping of Funds To Gendi Account As of September 2021 From BPI 3051 1155 88Document1 pagePNP3 Sweeping of Funds To Gendi Account As of September 2021 From BPI 3051 1155 88Guile Gabriel AlogNo ratings yet

- Gendi Sweeping of Funds To Gendi Account As of Sep 2021 From BPIDocument1 pageGendi Sweeping of Funds To Gendi Account As of Sep 2021 From BPIGuile Gabriel AlogNo ratings yet

- SDSSU Financial Aspect ChapterDocument13 pagesSDSSU Financial Aspect ChapterGian CarloNo ratings yet

- Taxation One CompleteDocument90 pagesTaxation One CompleteCiena MaeNo ratings yet

- Taxation-2 2Document5 pagesTaxation-2 2Yeshua Liebt PhoenixNo ratings yet

- Sample FAUJI VS NATIONALDocument38 pagesSample FAUJI VS NATIONALAbubakr siddiqueNo ratings yet

- BAR QUESTIONS (From 2005 To 2012 Bar Exams)Document60 pagesBAR QUESTIONS (From 2005 To 2012 Bar Exams)Em LayronNo ratings yet

- Short Descriptive EssayDocument8 pagesShort Descriptive Essayrbafdvwhd100% (2)

- Particle Board ProjectDocument28 pagesParticle Board ProjectSisay Tesfaye100% (1)

- AVERAGEDocument4 pagesAVERAGEClyde RamosNo ratings yet

- TAX QsDocument131 pagesTAX QsUser 010897020197No ratings yet

- Exclusion From Gross IncomeDocument8 pagesExclusion From Gross IncomeRonna Mae DungogNo ratings yet

- TAX First 11 PagesDocument12 pagesTAX First 11 PagesMary Therese Gabrielle EstiokoNo ratings yet

- Review construction contract gross profit calculationsDocument3 pagesReview construction contract gross profit calculationsAvishchal ChandNo ratings yet

- Crescent Textile Mills LTD AnalysisDocument23 pagesCrescent Textile Mills LTD AnalysisMuhammad Noman MehboobNo ratings yet

- Individual Income TaxationDocument76 pagesIndividual Income TaxationRoronoa ZoroNo ratings yet

- Corporate Recovery & Tax Incentives For Enterprises Act (CREATE)Document54 pagesCorporate Recovery & Tax Incentives For Enterprises Act (CREATE)Edmart VicedoNo ratings yet

- Introduction to Income Taxation ReviewDocument8 pagesIntroduction to Income Taxation Reviewdaenielle reyesNo ratings yet

- Aftab Annual Report 2018 PDFDocument77 pagesAftab Annual Report 2018 PDFTousif GalibNo ratings yet

- Bar Review Material 2019 TaxDocument41 pagesBar Review Material 2019 Taxsam cadley0% (1)

- CPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryDocument8 pagesCPA in Transit Reviewer: Tax Reform R.A. 10963 SummaryZaaavnn VannnnnNo ratings yet

- RIA Fed Tax Course 2012Document434 pagesRIA Fed Tax Course 2012jmcbogueNo ratings yet

- Gross IncomeDocument21 pagesGross IncomeRey ViloriaNo ratings yet

- Chapter 14 Percentage TaxesDocument11 pagesChapter 14 Percentage TaxesGeraldNo ratings yet

- Document 1510 4516Document54 pagesDocument 1510 4516rubyhien46tasNo ratings yet

- Exclusions From Gross IncomeDocument63 pagesExclusions From Gross IncomegeorgeNo ratings yet

- SS Topic 6Document8 pagesSS Topic 6ibrahimkingpubg7No ratings yet

- Financial and Management Accounting Sample Exam Questions: MBA ProgrammeDocument16 pagesFinancial and Management Accounting Sample Exam Questions: MBA ProgrammeFidoNo ratings yet

- TAX Create LawDocument4 pagesTAX Create LawIris FenelleNo ratings yet