Professional Documents

Culture Documents

Problem: TH TH

Uploaded by

Mae Ann Raquin0 ratings0% found this document useful (0 votes)

9 views3 pagesThe corporation was formed by Robert Dennis and other investors to provide concrete construction work. During its first year of operations (2020), the corporation received investments totaling P100 million in exchange for shares, obtained a bank loan, purchased equipment on account, received payments from customers, received and paid construction bills, provided and collected payment for services, purchased and used construction supplies, redeemed shares from investors and declared dividends to be paid. In its second year (2021), similar transactions occurred. The corporation must record journal entries for these transactions and prepare comparative financial statements for the two years.

Original Description:

This is an activity which pertains to accounting system

Original Title

Acitivity-CIS (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe corporation was formed by Robert Dennis and other investors to provide concrete construction work. During its first year of operations (2020), the corporation received investments totaling P100 million in exchange for shares, obtained a bank loan, purchased equipment on account, received payments from customers, received and paid construction bills, provided and collected payment for services, purchased and used construction supplies, redeemed shares from investors and declared dividends to be paid. In its second year (2021), similar transactions occurred. The corporation must record journal entries for these transactions and prepare comparative financial statements for the two years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesProblem: TH TH

Uploaded by

Mae Ann RaquinThe corporation was formed by Robert Dennis and other investors to provide concrete construction work. During its first year of operations (2020), the corporation received investments totaling P100 million in exchange for shares, obtained a bank loan, purchased equipment on account, received payments from customers, received and paid construction bills, provided and collected payment for services, purchased and used construction supplies, redeemed shares from investors and declared dividends to be paid. In its second year (2021), similar transactions occurred. The corporation must record journal entries for these transactions and prepare comparative financial statements for the two years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

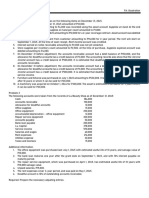

Problem

“Robert Dennis together with other investors formed a corporation to provide

concrete construction work. Their jobs typically involve building parking lots, drives,

and foundations. The company provided the following information about transactions

occurring during the first Year of operation. Evaluate the transactions and prepare

journal entries for this activity. Also prepare 5 sets of comparative financial statements

using excel.

The company has an authorized capital of P200,000,000 divided into 200,000

ordinary shares at P1,000 par value. There are 40 employees hired by the corporation in

January of the same year, each employee receives a monthly wage of P15,000 to be paid

every 5th and 20th day of the month. Monthly electric bill has an average cost of P30,000

a month. The billing was received on the month covered therefrom but is paid next

month from the receipt of the bill. Insurance premiums on building and materials is due

and is paid every end of the month with a premium cost of P15,000. Rent of the office

building used by the corporation costs P100,000 monthly. The company on January 1

had finished constructing a building for supplies warehousing at a cost of P5,000,000

which has an estimated useful life of 20 years to be depreciated using the straight-line

method. Based on Aging of account receivable, the company estimates that 5% of which

cannot be collected and the end of every year.

Jan. 2, 2020, Robert Dennis, together with others invested P100,000,000 cash

in exchange for 100,000 ordinary shares of stock at a price of P1,500 per share

of the newly formed corporation. In addition to finance its operation, the

corporation obtained a 5-year loan from a bank in the amount of P30,000,000

at 12% annual interest rate. Interest is payable monthly every 2 nd day of the

month.

Jan. 4, 2020 Purchased equipment on account for P7,000,000.

March. 12, 2020 Received P50,000,000 from customers for services

rendered.

June. 15, 2020 Received a bill for construction supplies

used in the amount of P20,000,000.

July. 18, 2020 Provided P50,000,000 of services on

account.

August 1, 2020 Collected 60% of the amount due for the

work provided on July 18.

September 2020 Paid 40% of the amount due on the

equipment purchased on January 4.

October 13, 2020 Purchased construction supplies for cash

in the amount of P 5,000,000. Supplies

amounting to P3,500,000 was used using

the construction projects.

November 5, 2020 Some investor surrendered its certificate

of stocks covering 3,000 shares paid by

the corporation at P900 per share. The

corporation however reissued 2,000

shares at a price of P800 per share. The

corporation also retired the remaining

1,000 shares.

December 15, 2020 The company declared dividends to be paid

on January 5 in the amount of P2,000,000.

Year 2021

Jan. 4, 2021 Purchased equipment on account for P1,000,000.

March. 12, 2021- Received P40,000,000 from customers for services

rendered.

June. 15, 2021 Received a bill for construction supplies

used in the amount of P10,000,000.

July. 18, 2021 Provided P30,000,000 of services on

account.

August 1, 2021 Collected 60% of the amount due for the

work provided on July 18.

September 2021 Paid 40% of the amount due on the

equipment purchased on January 4.

October 13, 2021 Purchased construction supplies for cash

in the amount of P 5,000,000. Supplies

amounting to P3,500,000 was used using

the construction projects.

November 5, 2021 Some investor surrendered its certificate

of stocks covering 500 shares paid by the

corporation at P900 per share. The

corporation however reissued 200 shares

at a price of P800 per share. The

corporation also retired the remaining

100 shares.

December 15, 2021 The company declared dividends to be paid

on January 5 in the amount of P2,000,000.

You might also like

- ACCOUNTING 3 PPE ProblemsDocument4 pagesACCOUNTING 3 PPE ProblemsMina ChouNo ratings yet

- Prelims QuizDocument12 pagesPrelims QuizJanine TupasiNo ratings yet

- ACC 226 Expanded OpportunityDocument4 pagesACC 226 Expanded OpportunityEllen MNo ratings yet

- Topic 6 Sample ProblemsDocument1 pageTopic 6 Sample ProblemsMary Jane Pedere VeranoNo ratings yet

- ACTG3M9ATSDocument3 pagesACTG3M9ATStrisha courseheroNo ratings yet

- Assessment Tasks 6Document4 pagesAssessment Tasks 6hahahahaNo ratings yet

- MIDTERM OUTPUT Worksheet v.43.12cDocument36 pagesMIDTERM OUTPUT Worksheet v.43.12chyunsuk fhebieNo ratings yet

- Pen and Paper Video Problem Solving Due Date: December 21, 2020 (You Can Submit Early) - Post The Link of Your Video in Our GC To Submit. Problem 1Document2 pagesPen and Paper Video Problem Solving Due Date: December 21, 2020 (You Can Submit Early) - Post The Link of Your Video in Our GC To Submit. Problem 1Lea MachadoNo ratings yet

- AE17 Quiz No. 1Document2 pagesAE17 Quiz No. 1nglc srzNo ratings yet

- Property, Plant and Equipment Sample Problems: Problem 1Document10 pagesProperty, Plant and Equipment Sample Problems: Problem 1Mark Gelo Winchester0% (1)

- ACCT 1026 2nd Dep QuizDocument8 pagesACCT 1026 2nd Dep QuizRizmonley Limbo Paguyod-FernandezNo ratings yet

- IA PPE (Unit Test)Document10 pagesIA PPE (Unit Test)Nina MarieNo ratings yet

- Property, Plant and EquipmentDocument6 pagesProperty, Plant and Equipmentela kikay40% (5)

- Activity 1 Audit of Shareholders EquityDocument4 pagesActivity 1 Audit of Shareholders EquityAnna Carlaine PosadasNo ratings yet

- FAR PRB Finals Dec 2017Document25 pagesFAR PRB Finals Dec 2017Dale Ponce100% (2)

- Adjusting EntriesDocument8 pagesAdjusting EntriesYusra PangandamanNo ratings yet

- Funda Manual Chapter 5 ExercisesDocument8 pagesFunda Manual Chapter 5 ExercisesRimuruNo ratings yet

- On January 1Document3 pagesOn January 1Jude Santos0% (1)

- PPEDocument18 pagesPPECarl Yry BitzNo ratings yet

- Dado BpsDocument6 pagesDado BpsmcannielNo ratings yet

- BASIC ACCOUNTING WORKBOOK Final Version 1Document50 pagesBASIC ACCOUNTING WORKBOOK Final Version 1ynarchive00No ratings yet

- ACCOUNTING 101 - No.2 - ProblemsDocument2 pagesACCOUNTING 101 - No.2 - ProblemslemerleNo ratings yet

- Ay16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 3Document4 pagesAy16!17!2nd Semester Acctg03 Fass 03-Questionnaire-Part 3Maketh.ManNo ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Seatwork 2Document8 pagesSeatwork 2Nasiba M. AbdulcaderNo ratings yet

- Problem 4Document6 pagesProblem 4jhobsNo ratings yet

- Orca Share Media1607163028300 6740930318253910768Document3 pagesOrca Share Media1607163028300 6740930318253910768Hell LuciNo ratings yet

- Audit PpeDocument4 pagesAudit Ppenicole bancoroNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Activity 12Document1 pageActivity 12Ma. Alexandra Teddy BuenNo ratings yet

- Assignment Number 2 Financial Accounting Reporting 1Document8 pagesAssignment Number 2 Financial Accounting Reporting 1Sheina Jane AbarquezNo ratings yet

- IA2Document14 pagesIA2Sitio BayabasanNo ratings yet

- ACC111 Finals ExaminationDocument4 pagesACC111 Finals ExaminationVan De LeonNo ratings yet

- AUD QuizesDocument9 pagesAUD QuizesDanielNo ratings yet

- A7 Audit of Intangible AssetsDocument4 pagesA7 Audit of Intangible AssetsKezNo ratings yet

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1Kathleen MaynigoNo ratings yet

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- Ai-1 RM2Document4 pagesAi-1 RM2SheenaNo ratings yet

- Unit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Document8 pagesUnit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Alyna JNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesmariannecarmNo ratings yet

- Cfas Fs PreparationDocument3 pagesCfas Fs PreparationEvelina Del RosarioNo ratings yet

- ACCO 201 - Bio Assets and PPE Assignment No. 2Document2 pagesACCO 201 - Bio Assets and PPE Assignment No. 2Nathalie Faye TajaNo ratings yet

- Ma PrelimDocument2 pagesMa PrelimLouisse Jeofferson TolentinoNo ratings yet

- Ce P1 13-14Document16 pagesCe P1 13-14shudayeNo ratings yet

- Exercises - Wasting Assets, Borrowing Costs, and Government GrantsDocument3 pagesExercises - Wasting Assets, Borrowing Costs, and Government GrantsMeeka CalimagNo ratings yet

- Adjusting Entries 11-23Document2 pagesAdjusting Entries 11-23Allen CarlNo ratings yet

- 3A Accounting Cycle Journal TBDocument1 page3A Accounting Cycle Journal TBDUDUNG dudongNo ratings yet

- ACCTG 306 Aud 2 2Document3 pagesACCTG 306 Aud 2 2Maureen Kaye PaloNo ratings yet

- Adjusting Entry ProblemsDocument5 pagesAdjusting Entry ProblemsRize Takatsuki100% (1)

- Exercises in Adjusting EntriesDocument5 pagesExercises in Adjusting EntriesJhon Robert BelandoNo ratings yet

- Pertemuan 1Document2 pagesPertemuan 1JaneNo ratings yet

- Audit of Shareholders EquityDocument10 pagesAudit of Shareholders Equityaira nialaNo ratings yet

- Quiz No 1 AuditingDocument11 pagesQuiz No 1 AuditingrylNo ratings yet

- Adjusting Entries Exercises LandscapeDocument3 pagesAdjusting Entries Exercises LandscapeTatyanna Kaliah100% (3)

- Problems Audit of Property Plant and Equipmentdocx PresentDocument10 pagesProblems Audit of Property Plant and Equipmentdocx PresentDominic RomeroNo ratings yet

- University of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEDocument3 pagesUniversity of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEElaine AntonioNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- BS Accountancy Qualifying Exam: Management Advisory ServicesDocument7 pagesBS Accountancy Qualifying Exam: Management Advisory ServicesMae Ann RaquinNo ratings yet

- Qualifying FarDocument11 pagesQualifying FarMae Ann RaquinNo ratings yet

- CHAPTER 2 and 3 MANAGEMENT ACCOUNTINGDocument14 pagesCHAPTER 2 and 3 MANAGEMENT ACCOUNTINGMae Ann RaquinNo ratings yet

- Financial Management Module 3Document10 pagesFinancial Management Module 3Mae Ann RaquinNo ratings yet

- Ae 15 Bs Acc 1 Home Based ActivityDocument4 pagesAe 15 Bs Acc 1 Home Based ActivityMae Ann RaquinNo ratings yet

- Ae 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Document4 pagesAe 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Mae Ann RaquinNo ratings yet

- AE 9 AY 2021-2022 Module 2 (Complete)Document32 pagesAE 9 AY 2021-2022 Module 2 (Complete)Mae Ann RaquinNo ratings yet

- Chapter 4 Intermediate AccountingDocument41 pagesChapter 4 Intermediate AccountingMae Ann Raquin100% (1)

- Chapter 3 Intermediate AccountingDocument56 pagesChapter 3 Intermediate AccountingMae Ann RaquinNo ratings yet

- Richardson vs. Arizona Fuels CorpDocument2 pagesRichardson vs. Arizona Fuels Corpเจียนคาร์โล การ์เซีย100% (1)

- Ch-3 Private, Public and Global Enterprises (Question/Answer) Short Answer QuestionsDocument5 pagesCh-3 Private, Public and Global Enterprises (Question/Answer) Short Answer QuestionsGajendra SainiNo ratings yet

- A Literature Review of Corporate GovernanceDocument6 pagesA Literature Review of Corporate GovernanceDewi Asri Rosalina0% (1)

- Chapter 1 Introduction To Accounting & BusinessDocument4 pagesChapter 1 Introduction To Accounting & BusinessPaw VerdilloNo ratings yet

- 17 Steps To Saving American DemocracyDocument14 pages17 Steps To Saving American DemocracyLast_honest_man100% (1)

- Business Entity Comparison OverviewDocument6 pagesBusiness Entity Comparison OverviewTRÂN PHẠM NGỌC BẢONo ratings yet

- Corporations Law Summary Sample v1.0Document18 pagesCorporations Law Summary Sample v1.0Michael0% (1)

- Counseling Start-Up High Technology CompaniesDocument3 pagesCounseling Start-Up High Technology Companiescgorman56No ratings yet

- Bylaws of Mekapay Solution, IncDocument17 pagesBylaws of Mekapay Solution, IncHerbertNo ratings yet

- Ch-3 (Public, Private & Global Entreprises) Multiple Choice Questions (MCQ Based On Hots and Applications)Document6 pagesCh-3 (Public, Private & Global Entreprises) Multiple Choice Questions (MCQ Based On Hots and Applications)JasleenNo ratings yet

- Seventh Day Adventist Conference Church of Southern Philippines, Inc.Document2 pagesSeventh Day Adventist Conference Church of Southern Philippines, Inc.Neptaly P. ArnaizNo ratings yet

- Stock Articles of IncorporationDocument5 pagesStock Articles of IncorporationEdward Raymond B. PalsiwNo ratings yet

- Yamane v. BA LepantoDocument2 pagesYamane v. BA LepantoRudejane TanNo ratings yet

- ITC Annual Report 2010Document168 pagesITC Annual Report 2010dosmau86No ratings yet

- FNCE101 wk1Document51 pagesFNCE101 wk1Ian ChengNo ratings yet

- La Bugal Bulaan DigestDocument6 pagesLa Bugal Bulaan DigestMyrna Espina LasamNo ratings yet

- Philip Turner v. Lorenzo Shipping Corporation G.R. 157479 2010Document23 pagesPhilip Turner v. Lorenzo Shipping Corporation G.R. 157479 2010TofuyaNo ratings yet

- 26 Manila Banking Corporation vs. CommissionerDocument11 pages26 Manila Banking Corporation vs. CommissionerFrancisca EnayonNo ratings yet

- Bacani Vs NacocoDocument2 pagesBacani Vs NacocoRowell Ian Gana-anNo ratings yet

- Valenzuela Hardwood vs. CADocument3 pagesValenzuela Hardwood vs. CANina CastilloNo ratings yet

- Conflicts Rules On Personal LawDocument10 pagesConflicts Rules On Personal LawYan IcoyNo ratings yet

- DLA Piper Guide To Going Global Corporate Full HandbookDocument736 pagesDLA Piper Guide To Going Global Corporate Full HandbookAndrea FuentesNo ratings yet

- Limited Liability Partnership ActDocument6 pagesLimited Liability Partnership ActUmang ModiNo ratings yet

- Registration and Process For Financing CompaniesDocument2 pagesRegistration and Process For Financing CompaniesLeizel ZafraNo ratings yet

- Imperial vs. ArmesDocument17 pagesImperial vs. ArmesWorstWitch TalaNo ratings yet

- 41st - AGM 300718 For WEBSITEDocument13 pages41st - AGM 300718 For WEBSITEAghora Kali Peetham DeccanNo ratings yet

- Practical Lawyer Resolutions 09.02Document13 pagesPractical Lawyer Resolutions 09.02misterpringlesNo ratings yet

- 08) Pacific Rehouse vs. CADocument2 pages08) Pacific Rehouse vs. CAAlfonso Miguel Lopez100% (1)

- Umali vs. CA, 189 SCRA 529 (1990)Document23 pagesUmali vs. CA, 189 SCRA 529 (1990)Ralf Vincent OcañadaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet