Professional Documents

Culture Documents

Profitable Growth Will Define Success: The New World of Virtual Banks

Uploaded by

darma bonarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profitable Growth Will Define Success: The New World of Virtual Banks

Uploaded by

darma bonarCopyright:

Available Formats

THE NEW WORLD OF VIRTUAL BANKS:

PROFITABLE GROWTH WILL DEFINE SUCCESS

Progressive regulation is creating open and collaborative As A Customer Moves Across Lifecycle,

ecosystems with both banks and customers moving up the The Satisfaction Drops And Digital Engagement Drops

technology maturity scale. With customer sentiment ripe for a new

way of banking, virtual banks need to grow at scale, leveraging Satisfaction

Level

open, cloud-based platforms.

While a perfect storm supporting the growth of virtual banks is

brewing, success is not guaranteed unless new banks are able to

transform into a data-driven, high-performance and profitable

organization.

Exceeding Your Customer’s Expectations Consistently and

Across the Financial Lifecycle

Virtual banks globally have done well in the on-boarding process but Origination Payments Personal Home Investment

must prove themselves across the financial lifecycle as they & Transfers Loans Loans & Financing

expand into more complex product areas such as SME Banking,

Mortgages, and Business Banking.

A global survey conducted by Oracle showed that existing

customers of traditional incumbent banks are ready for churn not at

the beginning of the lifecycle but when more complexity appears in

69% 30%

the relationship. This is where the rubber meets the road.

Virtual banks need to have a nimble, friction-free approach across want their entire are open to trying

processes, and an ability to act on customer data insights to financial lifecycle a virtual bank

elevate the overall service experience. on digital channels.

Source: Oracle Report - The New Digital Demand in Retail Banking

3 Critical Aspects of Running a Virtual Bank

Using Data as a Core Asset Across the Business

1 Enable the Strategic Role of CFOs & Customer-facing Teams

Virtual banks can leverage data insights via agile CFOs have increased responsibility for providing data-driven business

technology stacks to offer the customer unique enablement: 40% of banking CFOs say they need to provide proactive

personalization. To grow market share and reduce analysis of future business scenarios.

churn, it is critical to implement an analytical

architecture and automate using artificial Also, 66% of global banking executives consider aligning financial

intelligence and machine learning. To ensure performance and risk data very important or critical to success. A common

long-term profitability, data-driven tools should be analytics platform helps give a real-time picture of a bank’s business and

used to optimize on capital allocation, customer aligns finance, risk and performance management strategies under the same

data management and to mitigate risks. data-decisioning engine and platform.

2 Enable Regulatory & Finance Crime Compliance

Anti-Money Laundering (AML) technologies like graph analytics and machine

learning, applied to histories of transactional data, can help virtual banks curtail

criminal flows of capital that put their customers at risk. With the ever

increasingly complex business and regulatory landscape, virtual banks need to

make use of Know Your Customer (KYC), risk or compliance data associated

with running a new bank to gain business insight.

3 Drive Ecosystems Partnerships

The ability to tie up options for eCommerce, transport, lifestyle and payment

all in one seamless digital banking experience is critical. Oracle is enabling

virtual banks to jumpstart such initiatives with more than 1600 ready to deploy

Oracle Banking APIs. Virtual banks can scale and react with speed and agility

to incorporate new products and processes onto their platform and easily

connect with third-party products — offering more choices to the end user.

The new wave of virtual banks will need to journey through different stages of

ongoing adaptation in the bid for growth and profitability, greater customer traction

and market share. Oracle is assisting banks in redesigning the customer journey -

CONTACT US right from the API strategy, front-end customer-facing applications to the back-end

rails of modern and digital core platforms. The result is better digital services that

financialservices_ww@oracle.com boost customer value and understanding their needs more deeply across the

blogs.oracle.com/financialservices financial lifecycle.

You might also like

- Elft Workstyles Inventory ScoringDocument2 pagesElft Workstyles Inventory Scoringdarma bonarNo ratings yet

- Rating Asset Bank Q2-2019Document11 pagesRating Asset Bank Q2-2019darma bonarNo ratings yet

- 2019-07-29 - LKTT JUNI 2019-2 VictoriaDocument149 pages2019-07-29 - LKTT JUNI 2019-2 Victoriadarma bonarNo ratings yet

- Bankreport-Laporan-Neraca-Juni-2019-219 SulutGoDocument1 pageBankreport-Laporan-Neraca-Juni-2019-219 SulutGodarma bonarNo ratings yet

- Working Styles Characteristics: A - Analytical B - DriverDocument2 pagesWorking Styles Characteristics: A - Analytical B - Driverdarma bonarNo ratings yet

- Designing A Customer Service Strategy: SEEP Annual Meeting & Workshops 23 October 2003Document11 pagesDesigning A Customer Service Strategy: SEEP Annual Meeting & Workshops 23 October 2003Kuldeep BishtNo ratings yet

- Daftar Alamat Kantor Pusat Bank Umum Dan Syariah Desember 2019Document12 pagesDaftar Alamat Kantor Pusat Bank Umum Dan Syariah Desember 2019sales manxi0% (1)

- Direktori Fintech Juni 2019Document24 pagesDirektori Fintech Juni 2019Adam BasrinduNo ratings yet

- Contoh Action Plan Penerapan - English VersionDocument2 pagesContoh Action Plan Penerapan - English VersionDiah NurJulianaNo ratings yet

- I.37. Posisi Deposito Berjangka Pada Seluruh Bank Menurut Penggolongan Pemilikan 1) (Miliar RP)Document33 pagesI.37. Posisi Deposito Berjangka Pada Seluruh Bank Menurut Penggolongan Pemilikan 1) (Miliar RP)darma bonarNo ratings yet

- Tabel1 17Document30 pagesTabel1 17Soesiadhy PalimbuNo ratings yet

- Bank Jtrust Indonesia Vendor Evaluation Form: Kreteria Rating Komentar (1 2 3 4 5)Document2 pagesBank Jtrust Indonesia Vendor Evaluation Form: Kreteria Rating Komentar (1 2 3 4 5)darma bonarNo ratings yet

- 1-Jan 1-Feb 1-Mar 1-Apr 1-May 1-Jun 1-Jul 1-AugDocument41 pages1-Jan 1-Feb 1-Mar 1-Apr 1-May 1-Jun 1-Jul 1-Augdarma bonarNo ratings yet

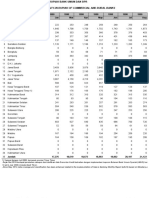

- (Billions of RP) I.20 Outstanding of Private Deposits in Rupiah of Commercial and Rural Banks by ProvincesDocument42 pages(Billions of RP) I.20 Outstanding of Private Deposits in Rupiah of Commercial and Rural Banks by Provincesdarma bonarNo ratings yet

- 1) Termasuk Modal Cadangan: Statistik Ekonomi Dan Keuangan Indonesia Bank IndonesiaDocument2 pages1) Termasuk Modal Cadangan: Statistik Ekonomi Dan Keuangan Indonesia Bank Indonesiadarma bonarNo ratings yet

- SOC Incident Log BookDocument13 pagesSOC Incident Log Bookdarma bonarNo ratings yet

- I.24 Posisi Simpanan Berjangka Bank Umum Dan BPR Menurut Jangka Waktu (Miliar RP)Document2 pagesI.24 Posisi Simpanan Berjangka Bank Umum Dan BPR Menurut Jangka Waktu (Miliar RP)Izzuddin AbdurrahmanNo ratings yet

- Ratio TreeDocument1 pageRatio Treedarma bonarNo ratings yet

- Letter of Credit Checklist: If You Receive An L/C Please Pay Attention To Following PointsDocument2 pagesLetter of Credit Checklist: If You Receive An L/C Please Pay Attention To Following PointsJessica WardNo ratings yet

- Daftar Alamat Kantor Pusat Bank Umum Dan Syariah Desember 2019Document12 pagesDaftar Alamat Kantor Pusat Bank Umum Dan Syariah Desember 2019sales manxi0% (1)

- Direktori LKM - Desember 2019Document239 pagesDirektori LKM - Desember 2019Darma Bonar TampubolonNo ratings yet

- AR IK 2019 - Struktur Perseroan Corporate Structure en IDDocument1 pageAR IK 2019 - Struktur Perseroan Corporate Structure en IDdarma bonarNo ratings yet

- Direktori Perusahaan Pialang Reasuransi - Maret 2020Document8 pagesDirektori Perusahaan Pialang Reasuransi - Maret 2020darma bonarNo ratings yet

- Direktori Dana Pensiun Januari 2020Document55 pagesDirektori Dana Pensiun Januari 2020Darma Bonar Tampubolon100% (1)

- BCP Template 2012Document58 pagesBCP Template 2012Amirul IqbalNo ratings yet

- Minutes Funding Weekly 080419Document1 pageMinutes Funding Weekly 080419darma bonarNo ratings yet

- Outlets EChannelDocument1 pageOutlets EChanneldarma bonarNo ratings yet

- Mom 01112018Document1 pageMom 01112018darma bonarNo ratings yet

- Tabel1 10Document4 pagesTabel1 10ali jabarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unit 7 - Outsourcing - R&WDocument5 pagesUnit 7 - Outsourcing - R&WVăn ThànhNo ratings yet

- Purcari Wineries Public Company Limited: Report and Separate Financial StatementsDocument68 pagesPurcari Wineries Public Company Limited: Report and Separate Financial StatementsMihaela PulbereNo ratings yet

- Responsibility Accounting, Transfer Pricing & Balanced ScorecardDocument11 pagesResponsibility Accounting, Transfer Pricing & Balanced Scorecardmartinfaith958No ratings yet

- Plws by JPPMDocument45 pagesPlws by JPPMVaalu MuthuNo ratings yet

- Inventory Management System Research PaperDocument8 pagesInventory Management System Research Paperkkxtkqund100% (1)

- CIM Original TemplateDocument5 pagesCIM Original Templatekashif4987No ratings yet

- Food and Beverages - AlliedDocument5 pagesFood and Beverages - AlliedAyman KhalidNo ratings yet

- Breaking Down The Work Breakdown Structure and Critical PathDocument7 pagesBreaking Down The Work Breakdown Structure and Critical PathGRUPOPOSITIVO POSITIVONo ratings yet

- Visual Merchandising in Sportswear Retail: Teerada Chongkolrattanaporn, Wasana Thai-EiadDocument15 pagesVisual Merchandising in Sportswear Retail: Teerada Chongkolrattanaporn, Wasana Thai-EiadArya Nata SaputraNo ratings yet

- ACCOUNTS (858) : Class XiDocument4 pagesACCOUNTS (858) : Class XiYour Laptop GuideNo ratings yet

- Business Case Ppt-CorporateDocument24 pagesBusiness Case Ppt-Corporatesambaran PGPM17No ratings yet

- 1.1 Concept of BankingDocument12 pages1.1 Concept of BankingsidharthNo ratings yet

- Unicredit International Bank (Luxembourg) S.ADocument126 pagesUnicredit International Bank (Luxembourg) S.AViorel GhineaNo ratings yet

- Solutions Manual For Operations Management 11E Jay Heizer Barry Render (PDFDrive)Document9 pagesSolutions Manual For Operations Management 11E Jay Heizer Barry Render (PDFDrive)ASAD ULLAH0% (2)

- HRM MCQ CilDocument6 pagesHRM MCQ CilUmeshkumar LangiyaNo ratings yet

- Material Costing - Theory & Practical Questions-3Document12 pagesMaterial Costing - Theory & Practical Questions-3sakshi.sinha56327No ratings yet

- Organizational Behavior 15th Ed: Foundations of Organizational StructureDocument22 pagesOrganizational Behavior 15th Ed: Foundations of Organizational StructureJerome MogaNo ratings yet

- M.B.A. Degree Examination, 2013: 120. Human Resource ManagementDocument2 pagesM.B.A. Degree Examination, 2013: 120. Human Resource ManagementMystariouss SahirNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationArti YadavNo ratings yet

- Systemize Your BusinessDocument27 pagesSystemize Your BusinessvlaseNo ratings yet

- Roject Harter: 1.0 Project Identification Name Description Sponsor Project Manager Project Team ResourcesDocument2 pagesRoject Harter: 1.0 Project Identification Name Description Sponsor Project Manager Project Team ResourcesKomal SoomroNo ratings yet

- Module 5 - Possible Products and Services Based On Viability Profitability and Customer Requirement PDFDocument51 pagesModule 5 - Possible Products and Services Based On Viability Profitability and Customer Requirement PDFJuliana Maaba Tay-isNo ratings yet

- Intro - S4HANA - Using - Global - Bike - Case - Study - PP - Fiori - en - v3.3 (Step 10)Document5 pagesIntro - S4HANA - Using - Global - Bike - Case - Study - PP - Fiori - en - v3.3 (Step 10)Rodrigo Alonso Rios AlcantaraNo ratings yet

- How The Johnson and Johnson Brand Does Has Positioned Itself in ConsumerDocument4 pagesHow The Johnson and Johnson Brand Does Has Positioned Itself in ConsumerAreej Choudhry 5348-FMS/BBA/F18No ratings yet

- The Economic & Business Environment WorksheetsDocument13 pagesThe Economic & Business Environment WorksheetsKareem AghaNo ratings yet

- Chapter - 1Document5 pagesChapter - 1MAG MAGNo ratings yet

- Business Model Innovation in The Aviation IndustryDocument26 pagesBusiness Model Innovation in The Aviation IndustrydavidNo ratings yet

- 04 Cafmst14 - CH - 02Document86 pages04 Cafmst14 - CH - 02Mahabub AlamNo ratings yet

- Fauji Fertilizer Company LimitedDocument74 pagesFauji Fertilizer Company LimitedAnaya Choudhry75% (4)