Professional Documents

Culture Documents

@GSTMCQ Chapter 7 REGISTRATION

Uploaded by

Indhuja MOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

@GSTMCQ Chapter 7 REGISTRATION

Uploaded by

Indhuja MCopyright:

Available Formats

Registration

REGISTRATION

CHAPTER – 6

Section Description

Section 22 Persons liable for registration

Section 23 Persons not liable for registration

Section 24 Compulsory registration in certain cases

Section 25 Procedure for registration

Section 26 Deemed registration

Section 27 Special provisions relating to casual taxable person & nonresident taxabie person

Section 28 Amendment of registration

Section 29 Cancellation of registration

Section 30 Revocation of cancellation of registration

INTRODUCTION

Registration under GST is not tax specific, which means that there is single registration for all the

taxes i.e. CGST, SGST/UTGST, IGST and cess.

Generally, Registration legally recognizes a person as supplier of goods or services, authorizes him

to collect taxes and pass on the credit of the taxes paid on the goods or services supplied to the

purchasers/ recipients.

Under the GST regime, registration is PAN based.

Registration has to be taken state-wise even though the establishments belong to a single entity

(i.e. No concept of centralised registration). But it is possible for the entities to be registered as

centralised, provided that it can declare one establishment as principal place of business (PPOB)

and other branches as additional place(s) of business (APOB) and such other establishments shall

be situated in the same state not being a different business vertical.

However, a business entity having separate business verticals (i.e. separate line of business) in a

State may obtain separate registration for each of its business verticals.

Registration under GST is not tax specific, i.e. single registration for all the taxes i.e. CGST,

SGST/UTGST, IGST and cesses.

PERSONS LIABLE FOR REGISTRATION [SECTION 22]

(i) Threshold limit for registration

States with threshold limit of ` 20

States with threshold limit of ` 10

States with threshold limit of ` 20 lakh for services and ` 40 lakh for

lakh for both goods and services

lakh for both goods and services goods**

Manipur Arunachal Pradesh Jammu and kashmir

Meghalaya

Mizoram Sikkim Assam

Nagaland Puducherry Himachal pradesh

Telangana

Tripura All other states

Uttarakhand

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.1

Registration

Doing Activity of Aggregate Applicable Whether

Supplier

turnover threshold liable to

limit for obtain

registration registration?

Prithiviraj Exclusive in supply of shoes ` 22 lakh `40 lakh NO

of Assam ` 22 lakh `20 lakh

Exclusive in supply of pan masala YES

` 22 lakh `20 lakh

Exclusive supply of taxable services YES

Supply of both taxable goods and services ` 22 lakh `20 lakh

YES

Exclusively in supply of toys ` 22 lakh `20 lakh

Shivaji of YES

Telangana ` 22 lakh `20 lakh

Exclusively in supply of ice cream YES

Exclusively in supply of taxable service ` 22 lakh `20 lakh

YES

Supply of both taxable goods and services ` 22 lakh `20 lakh

YES

Ashoka Exclusively in supply of ` 12 lakh `10 lakh YES

of

Manipur Exclusively in supply of tobacco ` 12 lakh `10 lakh YES

Exclusively in supply of taxable services ` 12 lakh `10 lakh YES

Supply of both taxable goods and Services ` 12 lakh `10 lakh YES

(ii) Aggregate Turnover

The term aggregate turnover as defined under section 2(6) of the CGST Act has been analysed

follows:

AGGREGATE TURNOVER

• Value of all outward supplies • CGST

• Taxable supplies • SGST

• Exempt supplies • UTGST

• Exports • IGST

• Inter-State supplies of persons having • Compensation cess

the same PAN be computed on all India • Value of inward supplies on which tax

basis is payable under reverse charge

(A) Aggregate turnover to include total turnover of all branches with same PAN

Exampl e : A dealer „X‟ has two offices – one in Delhi and another in Haryana. In order to

determine whether „X‟ is liable for registration, turnover of both the offices would be taken into

account and only if the same exceeds Rs. 20 lakh, X is liable for registration.

If a person having place of business in different States across India has one branch in any of the

Special Cate / gory States, the threshold limit for GST registration will be reduced to Rs. 10

lakh.

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.2

Registration

(B) Value of exported goods/services, exempted goods/services, inter-State supplies between

distinct persons having same PAN to be included in aggregate turnover.

Example : Rohan Oils, Punjab, is engaged in supplying machine oil as well as petrol. Supply of petrol

is not leviable to GST, but supply of machine oil is taxable. In order to determine whether Rohan

Oils is liable for registration, turnover of both the supplies – non-taxable as well as taxable - would

be taken into account and if the same exceeds Rs. 20 lakh, Rohan Oils is liable for registration.

(C) Aggregate turnover to include all supplies made by the taxable person, whether on his own

account or made on behalf of all his principals.

Example : Mohini Enterprises has appointed M/s Best fords & Associates as its agent. All the

supplies of goods made by M/s Best fords & Associates as agent of Mohini Enterprises will also be

included in the aggregate turnover of M/s Best fords & Associates.

(D) 'Aggregate turnover' Vs. 'Turnover in a State:

The aggregate turnover is different from turnover in a State. The former is used for determining

the threshold limit for registration as well as eligibility for composition scheme However, the

composition levy would be calculated on the basis of „turnover in the State‟.

(iii) Registration required only for a place of business from where taxable supply takes place

A person is required to obtain registration with respect to his each place of business in India from

where a taxable supply has taken place. However, a supplier is not liable to obtain registration if his

aggregate turnover consists exclusively of goods or services or both which are not taxable under

GST.

(iv) Tax payers registered under earlier indirect tax laws required to migrate

All the taxpayers who were registered under various earlier indirect tax laws are liable to be

registered under GST with effect from the appointed day [when the CGST Act came into force,

i.e. 22nd June, 2017].

Taxpayer obtains Taxpayer logins to Completes

Provisional id and password GST Common Portal, enrolment process

from “www.aces.gov.in ” or “www.gst.gov.in” and uploads

State VAT Authorities documents

Taxpayer obtains Gets Application

provisional GSTIN on Reference Number

appointed date

(v) Person liable for registration in case of transfer of business

Where a business is transferred, whether on account of succession/any

other reason, to another person as a going concern, the

transferee/successor, is to be registered with effect from the date of

such transfer/succession.

Where the business is transferred, pursuant to sanction of a

scheme/ arrangement for amalgamation/ de-merger of two or more

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.3

Registration

companies, pursuant to an order of a High Court/Tribunal, the transferee is to be registered with

effect from the date on which the Registrar of Companies issues a certificate of incorporation

giving effect to such order.

COMPULSORY REGISTRATION IN CERTAIN CASES [SECTION 24]

Following category of persons are mandatorily required to obtain the registration under GST

irrespective of their turnover:

Persons making any inter- Casual taxable person who A person receiving supplies

State taxable supply does not have a fixed place on which tax is payable by

of business in the State or recipient on reverse

Union Territory from where charge basis

he wants to make supply

Those ecommerce operators Non-resident taxable Persons who are required

who are notified as liable for persons who do not have a to deduct tax under

GST payment under section fixed place of business in section 51 (TDS)

9(5) India

A person who supplies on Suppliers other than notified E-commerce operators,

behalf of some other taxable under section 9(5) who who provide platform to

person (i.e. an Agent of some supply through an e- the suppliers to supply

Principal) commerce operator through it

Every person supplying online Person/ class of persons Distributor, whether or

information and database notified by the Central/ not separately registered

access or retrieval services State Government under this Act

from a place outside India to

a person in India other than

a registered person

Note: The provisions relating to tax deduction at source under section 51, collection of tax at source

under section 52, Input Service Distributors and online information and database access or retrieval

services have been discussed at the Final Level. Further, detailed provisions relating to electronic

commerce operators have been discussed at Final Level.

CONCEPT OF TAXABLE PERSON

As per section 2(107) of the CGST Act, taxable person means a person who is registered or liable to be

registered under section 22 or section 24. Persons liable to be registered under sections 22 and 24 have

been discussed in detail in the preceding paras.

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.4

Registration

Person not liable for registration under GST

Person engaged exclusively in Person engaged exclusively in

supplying goods/services/ both supplying goods/services/ both

not liable to tax chargeable under RCM

Persons not liable

for registration

Agriculturist to the extent of

Specified category of persons

supply of produce out of

notified by the Government**

cultivation of land

Persons making only reverse charge supplies exempted from obtaining registration

Persons who are only engaged in making supplies of taxable goods or services or both, the total tax

on which is liable to be paid on reverse charge basis by the recipient of such goods or services or both

under section 9(3) have been notified as the category of persons exempted from obtaining registration

under GST law [Notification No. 5/2017 CT dated 19.06.2017].

PROCEDURE FOR REGISTRATION [SECTIONS 25, 26 & 27]

Procedure for registration is governed by section 25 of the CGST Act read with Chapter III -

Registration of Central Goods and Services Tax (CGST) Rules, 2017. Relevant provisions of CGST Rules,

2017 have been incorporated at the relevant places. Further, special provisions have been provided for

registration of casual taxable person and non-resident taxable person under section 27. Concept of

deemed registration has been elaborated under section 26.

Under GST, the application for registration has to be submitted electronically at the GST Common

Portal – www.gst.gov.in, duly signed or verified through Electronic Verification Code (EVC) [Aadhar OTP].

(i) Where and by when to apply for registration? [Section 25(1)]

Particulars Where When

Person who is liable to be in every such State/UT in within 30 days from the date

registered under section 22 which he is so liable on which he becomes liable to

or section 24 registration

A casual taxable person or a at least 5 days prior to

non- resident taxable the commencement of

person business

(ii) State-wise registration [Section 25(2) read with rule 11]

(A) One registration per State

Registration needs to be taken State-wise, i.e. there are no centralized registrations under

GST. A business entity having its branches in multiple States will have to take separate State-

wise registration for the branches in different States.

Further, within a State, an entity with different branches would have single registration

wherein it can declare one place as principal place of business (PPoB) and other branches as

additional place of business (APoB).

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.5

Registration

(B) Separate registration for different business verticals within a State/UT may be granted

Although a taxpayer having multiple business verticals in one State is not mandatorily required

to obtain separate registration for each such vertical in the State, he has an option to obtain

independent registration with respect to each such separate business vertical.

Separate registration for each business vertical shall be granted provided all separately

registered business verticals pay tax on supply of goods/services/both made to another

registered business vertical, of such person and issue a tax invoice for such supply. Separate

registration application needs to be filed for each business vertical.

(C) Registration under composition levy

If one of the business verticals of a taxable person is paying tax under normal levy [Section 9],

no other business vertical shall be granted registration to pay tax under composition levy

[Section 10].

If one of the business vertical [separately registered] becomes ineligible to pay tax under

composition levy, all other business verticals would also become so ineligible.

The provisions of rules 9 and 10 relating to verification and grant of registration shall mutatis

mutandis apply to an application submitted under this rule.

(iii) Voluntary registration [Section 25(3)]

A person who is not liable to be registered under section 22 or section 24 may get himself

registered voluntarily. In case of voluntary registration, all provisions of this Act, as are

applicable to a registered person, shall apply to voluntarily registered person.

Voluntary registration is advantageous for the persons which supply of goods or services or

both to registered persons. The reason for the same is that by virtue of section 9(4) of the

CGST Act, in case of supplies received from unregistered supplier by registered recipient,

recipient has to pay the tax under reverse charge. Therefore, business units would prefer

receiving supplies from the registered persons only. Thus, voluntary registration enables a

supplier of goods or services or both to enhance its B2B [Business to Business] transactions.

However, once a person obtains voluntary registration, he has to pay tax even though his

aggregate turnover does not exceed ` 20 lakh/` 10 lakh.

(v) PAN must for obtaining registration [Section 25(6) & (7)]

A Permanent Account Number is mandatory to be eligible for grant of registration.

(vi) Unique Identity Number (UIN) [Section 25(9) & (10) read with rule 17]

Any specialized agency of the United Nations Organization or any Multilateral Financial

institution and organization as notified under the United Nations (Privileges and Immunities)

Act, 1947, consulate or embassy of foreign countries and any other person notified by the

Commissioner, is required to obtain a UIN from the GSTN portal.

Such person shall file an application in a different prescribed form. UIN shall be assigned and

registration certificate shall be issued within 3 working days from the date of submission of

application.

(vii) Suo-motu registration by the proper officer [Section 25(8) read with rule 16] Where,

pursuant to any survey, enquiry, inspection, search or any other proceedings under the Act, the

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.6

Registration

proper officer finds that a person liable to registration under the Act** has failed to apply for

such registration, such officer may register the said person on a temporary basis and issue an

order in prescribed form.

**Such person shall either:

submit an application for registration in prescribed form within 90 days from the date of grant

of temporary registration, or

PROCEDURE FOR REGISTRATION

Part – I

Every person liable to get registered and person seeking voluntary registration shall,

before applying for registration, declare his Permanent Account Number (PAN), mobile

number, e-mail address, State/UT in Part A of FORM GST REG- 01 on GST Common Portal.

PAN validated online by

Common Portal from Mobile number and

PAN, mobile number

CBDT database PAN email verified

and e- mail address

validated online by Common through one time

are validated

Portal from CBDT database password sent to it.

Temporary Reference Number (TRN) is generated and communicated to the applicant on

the validated mobile number and e-mail address.

Using TRN, applicant shall electronically submit application in Part B of application form,

along with specified documents at the Common Portal.

On receipt of such application, an acknowledgement in the prescribed form shall be issued

to the applicant electronically. A Causal Taxable Person (CTP) applying for registration gets

a TRN for making an advance deposit of tax in his electronic cash ledger and an

acknowledgement is issued only after said deposit.*

Application shall be forwarded to the Proper Officer.

The procedure after receipt of application by the Proper Officer is depicted in Part II of

the diagram.

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.7

Registration

Physical verification of business premises in certain cases after grant of registration [Rule 25]

Where the proper officer is satisfied that the physical verification of the place of business of a

registered person is required after grant of registration, he may get such verification done and the

verification report along with other documents, including photographs, shall be uploaded in the

prescribed form on the GST Common Portal, within 15 working days following the date of such

verification.

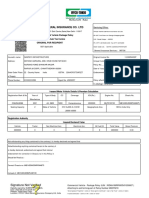

Issuance of registration certificate [Rule 10]

Where the application for grant of registration has been approved, a certificate of registration [duly

signed or verified through EVC by the proper officer] in FORM GST REG-06 showing the principal place

of business (PPoB) and additional place(s) of business (APoB) is made available to the applicant on the

Common Portal and a Goods and Services Tax Identification Number (hereinafter referred to as

“GSTIN”) i.e. the GST registration no. is communicated to applicant, within 3 days after the grant of

registration.

Display of registration certificate and GSTIN on the name board [Rule 18]

Every registered person shall display his registration certificate in a prominent location at his PPoB and

at every APoB. Further, his GSTIN also has to be displayed on the name board exhibited at the entry of

his PPoB and at every APoB.

(ix) Effective date of registration [Rule 10]

Where an applicant submits application for effective date of registration is

registration

within 30 days from the date he becomes the date on which he becomes liable to

liable to registration registration

after 30 days from the date he becomes date of grant of registration

liable to registration

(x) Special provisions for grant of registration in case of Non-Resident Taxable Person (NRTP)

and Casual Taxable Person (CTP) [Sections 25 & 27 read with rules 13 & 15]

Self study for students

Before going into nuances of the registration provisions of CTP and NRTP, let us first understand

the two terms. The two terms have been defined in the CGST Act as follows:

Casual Taxable Person: means a person who occasionally undertakes transactions involving supply

of goods or services or both in the course or furtherance of business, whether as principal, agent

or in any other capacity, in a State/UT where he has no fixed place of business [Section 2(20)].

Non-Resident Taxable Person: means any person who occasionally undertakes transactions

involving supply of goods or services or both, whether as principal or agent or in any other capacity,

but who has no fixed place of business or residence in India [Section 2(77)].

Based on the aforesaid definitions, following points merit consideration:

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.8

Registration

A CTP does not have a fixed place of business in the State/UT where he undertakes supply

though he might be registered with regard to his fixed place of business in some other

State/UT, while a NRTP does not have fixed place of business/residence in India at all.

A CTP has to undertake transactions in the course or furtherance of business whereas the

business test is absent in the definition of NRTP.

The special registration provisions pertaining to CTP and NRTP are as follows:

(A) Both CRTP and NRTP have to compulsorily get registered under GST irrespective of the

threshold limit, at least 5 days prior to commencement of business.

(B) As per section 25(6), every person must have a PAN to be eligible for registration. Since

NRTP will generally not have a PAN of India, he may be granted registration on the

basis of other prescribed documents.

He has to submit a self-attested copy of his valid passport along with the application signed

by his authorized signatory who is an Indian Resident having valid PAN. However, in case of a

business entity incorporated or established outside India, the application for registration

shall be submitted along with its tax identification number or unique number on the basis of

which the entity is identified by the Government of that country or its PAN, if available.

(C) Period of validity of registration certificate granted to CTP/NRTP

Registration Certificate granted to CTP/NRTP will be valid for:

(i) Period specified in the registration application, or

(ii) 90 days from the effective date of registration [can be extended further by a period not

exceeding 90 days by making an application before the end of the validity of registration

granted to him**]

whichever is earlier.

Provisions relating to verification of application and grant of registration [under rules 9 and 10] will

apply mutatis mutandis, to an application for registration filed by NRTP.

(D)Advance deposit of tax

At the time of submitting the registration application, CTP/NRTP are required to make an advance

deposit of tax in an amount equivalent to the estimated tax liability of such person for the period

for which the registration is sought.

Such person will get a TRN for making an advance deposit of tax which shall be credited to his

electronic cash ledger. An acknowledgement of receipt of application for registration is issued only

after said deposit.

AMENDMENT OF REGISTRATION [SECTION 28]

The provisions relating to amendment of registration are contained in section 28 read with rule 19

of CGST Rules, 2017. The significant aspects of the same are discussed hereunder:

Where there is any change in the particulars furnished in registration application/UIN

application, registered person shall submit an application in prescribed manner, within 15 days of

such change, along with documents relating to such change at the Common Portal.

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.9

Registration

In case of amendment of core fields of information, the proper officer may, on the basis of

information furnished or as ascertained by him, approve or reject amendments in the

registration particulars in the prescribed manner. Such amendment shall take effect from the

date of occurrence of event warranting such amendment.

However, where change relates to non-core fields of information, registration certificate shall

stand amended upon submission of the application for amendment on the Common Portal.

Where a change in the constitution of any business results in change of PAN of a registered

person, the said person shall apply for fresh registration. The reason for the same is that

GSTIN is PAN based. Any change in PAN would warrant a new registration.

Permission of proper officer

required if change relates to

core fields of information

Addition, deletion or

retirement of partners or

directors, Karta, Managing

Legal name Address of

Committee, Board of Trustees,

of business PPoB/APoB

Chief Executive Officer or

equivalent, responsible for day

to day affairs of the business

Change does not warrant cancellation of

registration under section 29

Change of such particulars shall be applicable for all registrations of a registered person

obtained under provisions of this Chapter on same PAN.

Mobile no./e-mail address of authorised

signatory can be amended only after online

verification through GST Portal.

CANCELLATION OF REGISTRATION AND REVOCATION OF CANCELLATION [SECTIONS 29 &

30]

The proper officer may, in such manner and within such period as may be prescribed, by order, either

revoke cancellation of the registration or reject the application.

(i) Circumstances where registration is liable to be cancelled [Section 29(1) & (2)]

A. Circumstances when the registration can be cancelled either suo motu by proper officer or on

an application of the registered person or his legal heirs (in case death of such person)

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.10

Registration

Business discontinued Change in Taxable person (other than

Transferred fully for any the voluntarily registered person)

reason including death of the constitution who is no longer liable to be

proprietor of the registered under section 22 or

Amalgamated with other legal business section 24.

entity

Demerged or

Otherwise disposed of

B. Circumstances when the proper officer can cancel registration on his own

In the following cases, registration can be cancelled by the proper officer from such date,

including any retrospective date, as he may deem fit:

Following contraventions

done by the registered

person:

(i) He does not conduct

A registered person

any business from the Voluntarily

has not filed returns Registration was

declared place of registered person

for continuous 6 obtained by

business, or has not commenced

months*. means of fraud,

(ii) He issues invoice/ the business within

wilful

bill without supply of 6

*3 consecutive tax misstatement or

goods/ services in months from the

periods in case of a suppression of

violation of the date of

person who opted for facts

provisions of this Act, registration

composition levy

or the rules made there

under.

(iii) If he violates the

provisions of section 171

of the CGST Act.*

(ii) Procedure for cancellation of registration

A registered person seeking cancellation of registration shall electronically submit the

application for cancellation of registration in prescribed form within 30 days of occurrence of

the event warranting cancellation.

He is required to furnish in the application the details of inputs held in stock or inputs

contained in semi-finished/finished goods held in stock and of capital goods held in stock on the

date from which cancellation of registration is sought, liability thereon, details of the payment,

if any, made against such liability and may furnish relevant documents thereof.

Where a person who has submitted an application for cancellation of his registration is no longer

liable to be registered, proper officer shall issue the order of cancellation of registration within

30 days from the date of submission of application for cancellation.

Join telegram channel for more updates:- https://t.me/ca_notes_by_ar

Whatsapp link:- https://chat.whatsapp.com/CvI4Go8GX3jD1spgyFYpnB

Compiled by :- CA. Arpit Rajawat (FCA, DISA, M.com) - 8058700725 6.11

You might also like

- Correction in GST 27.05.2023Document11 pagesCorrection in GST 27.05.2023Lalli DeviNo ratings yet

- Presentation ON: Goods and Service Tax: Applicability, Itc and ReturnsDocument31 pagesPresentation ON: Goods and Service Tax: Applicability, Itc and ReturnsSonal AggarwalNo ratings yet

- GM 3Document1 pageGM 3K2No ratings yet

- Bill FormateDocument1 pageBill FormateKirti EntarparishNo ratings yet

- GST MDLDocument98 pagesGST MDLIndhuja MNo ratings yet

- Formate of GST InvoiceDocument2 pagesFormate of GST InvoiceVinay VermaNo ratings yet

- Chapter 9 - RegistrationDocument20 pagesChapter 9 - Registrationcloudhunter910No ratings yet

- GST NotesDocument156 pagesGST NotesNishthaNo ratings yet

- Adobe Scan Jul 18, 2022Document1 pageAdobe Scan Jul 18, 2022lavi krishnaniNo ratings yet

- WB 68 A D 9916 DDocument1 pageWB 68 A D 9916 Dmdneyaz9831No ratings yet

- Tirupati Wood Industries: Twenty Two Thousand Four Hundred Rupees OnlyDocument1 pageTirupati Wood Industries: Twenty Two Thousand Four Hundred Rupees OnlyRaj PatelNo ratings yet

- Tax Invoice: Taxes RateDocument1 pageTax Invoice: Taxes Ratelavisha vijay vargiNo ratings yet

- Invoice No: 409/23-24 Date: 18 Oct 2023: 1,50,000.00 1,50,000.00 13,500.00 13,500.00 Grand Total 1,77,000.00Document1 pageInvoice No: 409/23-24 Date: 18 Oct 2023: 1,50,000.00 1,50,000.00 13,500.00 13,500.00 Grand Total 1,77,000.00prasadriri45No ratings yet

- 4 GSTDocument4 pages4 GSTafsiya.mjNo ratings yet

- 2223TBS0002241Document1 page2223TBS0002241Huskee CokNo ratings yet

- GST Tax Invoice Format For ServicesDocument2 pagesGST Tax Invoice Format For ServicesAjayNo ratings yet

- 6 Rent BillDocument1 page6 Rent BillBhavik DaveNo ratings yet

- GST at A GlanceDocument10 pagesGST at A Glancestr690No ratings yet

- Registration: GlimpsesDocument12 pagesRegistration: GlimpsesAdventure TimeNo ratings yet

- Impacts of GST On Indian EconomyDocument14 pagesImpacts of GST On Indian EconomyR.Deepak KannaNo ratings yet

- GST in India by Puneet Agrawal PDFDocument75 pagesGST in India by Puneet Agrawal PDFSaNo ratings yet

- Chapter 4Document26 pagesChapter 4Kritika JainNo ratings yet

- Goods & Service Tax (GST) Is A Huge Reform For Indirect Taxation in IndiaDocument49 pagesGoods & Service Tax (GST) Is A Huge Reform For Indirect Taxation in IndiaGauharNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceSiddharthNo ratings yet

- Kahrani FreshDocument1 pageKahrani FreshRahul KumarNo ratings yet

- Most Expected GST Questions Part 1 by Ca Vivek GabaDocument25 pagesMost Expected GST Questions Part 1 by Ca Vivek GabaLakshman MurthyNo ratings yet

- GST Nov22Document263 pagesGST Nov22MonikaNo ratings yet

- TYBAF - Indirect Taxation - GST - Set1 - SolutionDocument6 pagesTYBAF - Indirect Taxation - GST - Set1 - Solutionamityadav865783No ratings yet

- Indirect Taxation: 40MBAFM403Document23 pagesIndirect Taxation: 40MBAFM403Divya SNo ratings yet

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- Vijay Kumar GSTDocument1 pageVijay Kumar GSTKarthick KrishnaNo ratings yet

- 2.GST IntroductionDocument18 pages2.GST IntroductionTanishka NagpalNo ratings yet

- Od 225282454730662000Document4 pagesOd 225282454730662000SamayNo ratings yet

- PVR LTD: (Pvrlim)Document8 pagesPVR LTD: (Pvrlim)Vansh MalhotraNo ratings yet

- GST May2023 V1Document213 pagesGST May2023 V1FhfhhNo ratings yet

- Invest in Economic ZonesDocument45 pagesInvest in Economic ZonesParvez Syed RafiNo ratings yet

- GST Revision - IndigoLearn - Nov 23 Exam - Day 1Document10 pagesGST Revision - IndigoLearn - Nov 23 Exam - Day 1311903736No ratings yet

- GSTReturn Oct 2021Document1 pageGSTReturn Oct 2021Muhammad Ali Abdul RazzaqueNo ratings yet

- 2223 TBS0002240 AsDocument1 page2223 TBS0002240 AsHuskee CokNo ratings yet

- Tax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Document2 pagesTax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Rinku Singh RinkuNo ratings yet

- Padam InteriorsDocument1 pagePadam InteriorsAj choudharyNo ratings yet

- CG04NH9088 EndorsementDocument2 pagesCG04NH9088 EndorsementSiddhantNo ratings yet

- Book 2Document34 pagesBook 2Kritika JainNo ratings yet

- GST Law in Brief and Chart 2021Document18 pagesGST Law in Brief and Chart 2021sukumar basuNo ratings yet

- Registration Under GSTDocument36 pagesRegistration Under GSTHarshit JhaNo ratings yet

- Normal DC Dexter 49222Document1 pageNormal DC Dexter 49222Mohd Walid FaiyazNo ratings yet

- M/S Balaji Casting: Director NIT, RaipurDocument1 pageM/S Balaji Casting: Director NIT, RaipurDeepak PatelNo ratings yet

- Idt Compiler 2.0 CA Final New by CA Ravi AgarwalDocument402 pagesIdt Compiler 2.0 CA Final New by CA Ravi AgarwalAnisha PujNo ratings yet

- Presentation On : Kiet Group of InstitutionsDocument27 pagesPresentation On : Kiet Group of InstitutionsVaishali SharmaNo ratings yet

- Presentation On : Kiet Group of InstitutionsDocument27 pagesPresentation On : Kiet Group of InstitutionsVaishali SharmaNo ratings yet

- 2425TBS0000018Document1 page2425TBS0000018yogesh nagarNo ratings yet

- Tax 7538Document1 pageTax 7538bhavesh.a.negiNo ratings yet

- Fcipl Invoice Czika19200009495Document1 pageFcipl Invoice Czika19200009495sudhakar sudhakarNo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- 2223TBS0002256Document1 page2223TBS0002256Huskee CokNo ratings yet

- Gaana Plus Subscription-3 Months: Grand Total 0.00Document4 pagesGaana Plus Subscription-3 Months: Grand Total 0.00Naushad RazaNo ratings yet

- Chapter 12 - Computation of Total Income and Tax Payable - NotesDocument54 pagesChapter 12 - Computation of Total Income and Tax Payable - NotesDivya nraoNo ratings yet

- Unit 3Document11 pagesUnit 3basavaraj nayakNo ratings yet

- Chapter 1 Intro To GSTDocument3 pagesChapter 1 Intro To GSTkevin12345555No ratings yet

- Economics For Finance: A Capsule For Quick Recap: National IncomeDocument62 pagesEconomics For Finance: A Capsule For Quick Recap: National IncomeIndhuja MNo ratings yet

- @GSTMCQ Chapter 5 Input Tax CreditDocument15 pages@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNo ratings yet

- Eis Must Do List!! (Nov - 2021) - 211126 - 200216Document51 pagesEis Must Do List!! (Nov - 2021) - 211126 - 200216Indhuja MNo ratings yet

- Syllabus Class: - B.B.A. VI SemesterDocument61 pagesSyllabus Class: - B.B.A. VI SemesterIndhuja MNo ratings yet

- Banking Finanacial Services Management Unit I: Two Mark QuestionsDocument21 pagesBanking Finanacial Services Management Unit I: Two Mark QuestionsIndhuja MNo ratings yet

- Unit - 2 2.1issue Management: 2.1.1 The Role of The Merchant BankerDocument28 pagesUnit - 2 2.1issue Management: 2.1.1 The Role of The Merchant BankerIndhuja MNo ratings yet

- VIDYA SAGAR Analysis-AccountsDocument3 pagesVIDYA SAGAR Analysis-AccountsIndhuja MNo ratings yet

- Department of Management Studies: Question BankDocument12 pagesDepartment of Management Studies: Question BankIndhuja MNo ratings yet

- Accounts of CompaniesDocument6 pagesAccounts of CompaniesIndhuja MNo ratings yet

- SHRM Avs Iv UnitDocument33 pagesSHRM Avs Iv UnitIndhuja MNo ratings yet

- SM All UnitsDocument70 pagesSM All UnitsIndhuja MNo ratings yet

- Ba5015 Industrial Relations and Labour Welfare: Polytechnic, B.E/B.Tech, M.E/M.Tech, Mba, Mca & SchoolsDocument6 pagesBa5015 Industrial Relations and Labour Welfare: Polytechnic, B.E/B.Tech, M.E/M.Tech, Mba, Mca & SchoolsIndhuja MNo ratings yet

- @ProCA - Inter Income Tax Book Vol 2 Solution May2022Document139 pages@ProCA - Inter Income Tax Book Vol 2 Solution May2022Indhuja MNo ratings yet

- ANM Sir Chartbook DT - Volume 2Document264 pagesANM Sir Chartbook DT - Volume 2Indhuja MNo ratings yet

- BA5014 QB Entrepreneurship DevelopmentDocument11 pagesBA5014 QB Entrepreneurship DevelopmentIndhuja MNo ratings yet

- As 10 Revised NotesDocument37 pagesAs 10 Revised NotesIndhuja MNo ratings yet

- Ottoman LiberalismDocument79 pagesOttoman LiberalismAmirRJamaludin100% (1)

- Inb 372 Chapter 1Document24 pagesInb 372 Chapter 1Jawadul IslamNo ratings yet

- Tutorial 2 SolutionsDocument5 pagesTutorial 2 SolutionsDivyanshu ShuklaNo ratings yet

- Obhrd-6 Mgt. Industrial RelationsDocument37 pagesObhrd-6 Mgt. Industrial Relationsakanksha8No ratings yet

- 18bco45s U5Document10 pages18bco45s U5Sounder RajNo ratings yet

- Image 19313 14973 1240658740 Export Cash Invoice Id EiDocument2 pagesImage 19313 14973 1240658740 Export Cash Invoice Id EiFitri SukendarNo ratings yet

- India Confectionery MarketDocument118 pagesIndia Confectionery Marketjmisra71No ratings yet

- Chapter 11Document8 pagesChapter 11Regita AuliaNo ratings yet

- ListDocument6 pagesListalonsoNo ratings yet

- Fera and Fema: Submitted To: Prof. Anant AmdekarDocument40 pagesFera and Fema: Submitted To: Prof. Anant AmdekarhasbicNo ratings yet

- Glossary of International Customs Terms PDFDocument38 pagesGlossary of International Customs Terms PDFDaris Purnomo JatiNo ratings yet

- Letter of Credit MortuaryDocument3 pagesLetter of Credit MortuaryHiJackNo ratings yet

- Export Incentives: Types, Benefits and Everything Else You Need To KnowDocument13 pagesExport Incentives: Types, Benefits and Everything Else You Need To Knowsiddhant kohliNo ratings yet

- Discover Bank StatementDocument7 pagesDiscover Bank StatementOsberto TobiasNo ratings yet

- A Project On Retailing Sector Reference To Reliance RetailDocument64 pagesA Project On Retailing Sector Reference To Reliance RetailirujfhkewNo ratings yet

- Trade Restrictions: TariffsDocument22 pagesTrade Restrictions: TariffsVari GhumanNo ratings yet

- Free Trade and ProtectionismDocument12 pagesFree Trade and ProtectionismPrakshi Aggarwal100% (1)

- Stock MarketDocument4 pagesStock Marketrohan pandeyNo ratings yet

- AfterpayDocument6 pagesAfterpaykunwar showvhaNo ratings yet

- IBT-07 Quiz 1Document2 pagesIBT-07 Quiz 1Monique BalteNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDprernaNo ratings yet

- The ABCs of MoneyDocument254 pagesThe ABCs of Moneyalice michira100% (1)

- Grocery CatalogueDocument34 pagesGrocery CatalogueRakesh SharmaNo ratings yet

- Shahid Javed Burki ArticlesDocument218 pagesShahid Javed Burki ArticlesHamza KahlonNo ratings yet

- IS-LM Model - Part 2Document45 pagesIS-LM Model - Part 2Logan ThakurNo ratings yet

- Form 29Document7 pagesForm 29praveenNo ratings yet

- Evidencia 3: Ensayo "Free Trade Agreement (FTA) : Advantages and Disadvantages"Document4 pagesEvidencia 3: Ensayo "Free Trade Agreement (FTA) : Advantages and Disadvantages"jesus david franco barriosNo ratings yet

- Account - Statement - USD - 2023 11 01 2024 02 19Document8 pagesAccount - Statement - USD - 2023 11 01 2024 02 19azulina LIUNo ratings yet

- Meaning and Introduction of GSTDocument6 pagesMeaning and Introduction of GSTAshish BomzanNo ratings yet

- Certification, Timber Trade and Market: Maharaj MuthooDocument13 pagesCertification, Timber Trade and Market: Maharaj MuthookehicapNo ratings yet