Professional Documents

Culture Documents

FTU Mid-Term Exam Paper on Finance Projects & Machine Replacement

Uploaded by

Sơn Hoàng0 ratings0% found this document useful (0 votes)

4 views2 pagesThis document contains a 3 question midterm exam for a finance class. Question 1 involves graphing a production opportunity set and calculating investment amounts based on interest rates. Question 2 analyzes whether a company should replace an old machine by calculating the net present value of cash flows from a new machine using depreciation rates and costs. Question 3 involves calculating expected utility with and without insurance for an individual, determining fair premiums, maximum premiums willing to pay, and risk premium.

Original Description:

Original Title

Đề thi giữa kỳ TCHE341(GD1-HK2-2122)CLC.1 1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a 3 question midterm exam for a finance class. Question 1 involves graphing a production opportunity set and calculating investment amounts based on interest rates. Question 2 analyzes whether a company should replace an old machine by calculating the net present value of cash flows from a new machine using depreciation rates and costs. Question 3 involves calculating expected utility with and without insurance for an individual, determining fair premiums, maximum premiums willing to pay, and risk premium.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesFTU Mid-Term Exam Paper on Finance Projects & Machine Replacement

Uploaded by

Sơn HoàngThis document contains a 3 question midterm exam for a finance class. Question 1 involves graphing a production opportunity set and calculating investment amounts based on interest rates. Question 2 analyzes whether a company should replace an old machine by calculating the net present value of cash flows from a new machine using depreciation rates and costs. Question 3 involves calculating expected utility with and without insurance for an individual, determining fair premiums, maximum premiums willing to pay, and risk premium.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

FOREIGN TRADE UNIVERSITY MID-TERM EXAM PAPER

FACULTY OF BANKING AND FINANCIAL ECONOMICS TCHE341

FINANCE __________________________________

DEPARTMENT OF

SECURITIES INVESTMENT

_________________________ Phase 1 Semester 2 Academic year: 2021 – 2022

Full-time Class: TCHE341(GD1-HK2-

2122)CLC.1

Date: 16/03/2022 Time: 12:30 - 13:15

Duration: 45 minutes (not include paper distribution time)

Question 1 (3 marks): Suppose your production opportunity set in a world of certainty

consists of the possible investments as shown in the following table, and your endowment

point is ($10,000, $10,000).

(a) Graph the production opportunity set in the intertemporal consumption diagram.

(b) If the market interest rate is 11%, how much should you invest?

Project Investment Rate of Return

Outlay (in %)

A $1,000 25

B $2,000 5

C $3,000 10

D $1,000 15

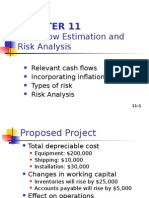

Question 2 (3 marks): The Dauten Toy Corporation is considering the replacement of an

8-year-old riveting machine with a new one that will increase earnings before depreciation

from $24,000 to $46,000 per year. The new machine will cost $80,000; and it will have an

estimated life of 8 years and no salvage value. The new machine will be depreciated over

its 5-year MACRS recovery period, so an asset may be fully depreciated before the end of

its service life. Following are the applicable depreciation rates.

Year 1 2 3 4 5 6 Sum

Applicable MACRS Rate 20% 32% 19% 12% 11% 6% 100%

The applicable corporate tax rate is 40%, and the firm’s WACC is 10%. The old machine

has been fully depreciated and has no salvage value. Should the old riveting machine be

replaced by the new one? Explain your answer.

Question 3 (4 marks): Consider an individual with a current wealth of $100,000, who

faces a chance of 25% of losing $20,000. Suppose that this person’s utility function is

expressed as U(W) = ln(W).

(a) What is his expected utility if he does not purchase insurance?

(b) How much is the fair insurance premium?

(c) What is the expected utility if this individual purchases the insurance and pays the fair

insurance premium?

(d) What is the maximum insurance premium he is willing to pay?

(e) What is his risk-premium?

--------------------------------------End of test--------------------------------------

Note: - This paper contains 03 questions.

- Students must not use any material during the examination.

- Invigilators will not provide further explanation.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- BIWS Reading GuideDocument2 pagesBIWS Reading GuideRahul GuptaNo ratings yet

- LSE - The Future of FinanceDocument294 pagesLSE - The Future of FinancethirdeyepNo ratings yet

- Day 11 Chap 6 Rev. FI5 Ex PRDocument8 pagesDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- The Economic Times Wealth - March 27 2023Document26 pagesThe Economic Times Wealth - March 27 2023Bakary DjabyNo ratings yet

- 55 Rules Successful Investing BlueprintDocument5 pages55 Rules Successful Investing BlueprintBirju Patel100% (1)

- NAT. FSA. E. C4. Cash Flow StatementDocument25 pagesNAT. FSA. E. C4. Cash Flow StatementNguyễn Hoàng DươngNo ratings yet

- Income StatementsDocument6 pagesIncome StatementsSơn HoàngNo ratings yet

- NAT. FSA. E. C3. The Income StatementDocument23 pagesNAT. FSA. E. C3. The Income StatementSơn HoàngNo ratings yet

- Balance SheetsDocument3 pagesBalance SheetsSơn HoàngNo ratings yet

- International Financial Mgnt-TCHE425 For 2023-2025 - For 6 GroupsDocument17 pagesInternational Financial Mgnt-TCHE425 For 2023-2025 - For 6 GroupsSơn HoàngNo ratings yet

- 10-15'-1-ĐỀ LẺ PDFDocument2 pages10-15'-1-ĐỀ LẺ PDFSơn HoàngNo ratings yet

- Outline C A TCQTDocument1 pageOutline C A TCQTSơn HoàngNo ratings yet

- The Article Introduces David BlaineDocument2 pagesThe Article Introduces David BlaineSơn HoàngNo ratings yet

- 10-15'-ĐỀ CHẴNDocument2 pages10-15'-ĐỀ CHẴNSơn HoàngNo ratings yet

- 202E06Document21 pages202E06foxstupidfoxNo ratings yet

- Management Accounting Midterm TestDocument5 pagesManagement Accounting Midterm TestSơn HoàngNo ratings yet

- W5 Module 8 Financial Instrument FrameworkDocument9 pagesW5 Module 8 Financial Instrument FrameworkElmeerajh JudavarNo ratings yet

- Assignment 2 Maf653 - Group 6Document11 pagesAssignment 2 Maf653 - Group 6nurul syakirin0% (1)

- Accountancy Comprehensive ProjectDocument11 pagesAccountancy Comprehensive ProjectPreetiNo ratings yet

- 8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionDocument29 pages8 (Terbaru) CHANGES in OWNERSHIP INTEREST - Advanced Accounting, 5th EditionParamithaNo ratings yet

- Do Indian Business Group Owned Mutual Funds Maximize Value For Their InvestorsDocument39 pagesDo Indian Business Group Owned Mutual Funds Maximize Value For Their InvestorsaakashkagarwalNo ratings yet

- Repici MuluDocument17 pagesRepici MuluDEVAN VITO VALENTINONo ratings yet

- U.S. Rep. Cindy Axne Financial DisclosureDocument9 pagesU.S. Rep. Cindy Axne Financial DisclosureGazetteonlineNo ratings yet

- Lloyds TSB Bank PLC: Report and Accounts 2008Document109 pagesLloyds TSB Bank PLC: Report and Accounts 2008saxobobNo ratings yet

- 5 Financial ManagementDocument16 pages5 Financial Managementchandu aelooriNo ratings yet

- C32 - PFRS 5 Noncurrent Asset Held For SaleDocument4 pagesC32 - PFRS 5 Noncurrent Asset Held For SaleAllaine ElfaNo ratings yet

- Chain Roop Bhansali Scam (The CRB Scam)Document16 pagesChain Roop Bhansali Scam (The CRB Scam)taeyong leeNo ratings yet

- Ding of Accounting Standards 1-15Document25 pagesDing of Accounting Standards 1-15Moeen MakNo ratings yet

- Private Placement MemorandumDocument40 pagesPrivate Placement MemorandumtomerNo ratings yet

- Factors Affecting Stock MarketDocument80 pagesFactors Affecting Stock MarketAjay SanthNo ratings yet

- Aakarsh - Report EVA and VASDocument20 pagesAakarsh - Report EVA and VASaakarshbhardwajNo ratings yet

- 2024 U.S. Stock Market Outlook - A Time For BalanceDocument5 pages2024 U.S. Stock Market Outlook - A Time For Balancesandboxkl.1No ratings yet

- Discount Cash Flow Analysis Chapter 9Document46 pagesDiscount Cash Flow Analysis Chapter 9Sidra KhanNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- FOA Questions & AnswersDocument4 pagesFOA Questions & Answersaman9936543060No ratings yet

- CRDB Bank Q3 2020 Financial Statement PDFDocument1 pageCRDB Bank Q3 2020 Financial Statement PDFPatric CletusNo ratings yet

- Financial Statement AnalysisDocument29 pagesFinancial Statement AnalysisMohamed HussienNo ratings yet

- Mid Term Test 1Document5 pagesMid Term Test 1Tú Anh NguyễnNo ratings yet

- Current Statistics: EPW Research FoundationDocument1 pageCurrent Statistics: EPW Research FoundationshefalijnNo ratings yet

- KOTAK IAP Investmentor - LatestDocument34 pagesKOTAK IAP Investmentor - LatestWealth FinmartNo ratings yet

- Causal Loop ModelingDocument8 pagesCausal Loop Modelingomid yNo ratings yet

- Contoh Soal WPPEDocument19 pagesContoh Soal WPPEArman WiratmokoNo ratings yet