Professional Documents

Culture Documents

Premium Paid Certificate Details for Policy Number 261158786

Uploaded by

Bhavik ThakerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Premium Paid Certificate Details for Policy Number 261158786

Uploaded by

Bhavik ThakerCopyright:

Available Formats

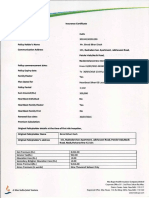

Date: 30-NOV-2021

Premium Paid Certificate

Duration For Which the Premium is Received: 20/04/2015 to 30/11/2021

Personal Details

Policy Number: 261158786 Current residential state: Gujarat

Policyholder Name: Mr. Bhavik Dipakkumar Thaker Mobile No. 9099919359

Commuinication Address: 5/B RAJESHWARI SOC Landline no. Please inform us for regular updates

. Life Insured Name: Mrs. Jankiben Bhavik Thaker

OPP. S.T. PAN Number: AICPT1804D

NAGAR,KAPADWANJ

ROAD,NADIAD

KHEDA - 387001

Email ID: bhavikthaker85@hotmail.com

Policy Details

Plan Name: Max Life Life Gain Premier - 104N079V01

Policy Term 20 Years Premium Payment Frequency Monthly

Date of Commencement 20-APR-2015 Date of Maturity 20-APR-2035

Last Premium Due Date 20-APR-2021 Next Due Date 20-MAY-2021

Reinstatement Interest (incl. ` 2,437.57 Model Premium (incl. GST) ` 0.00

GST/S.Tax)

Total Premium Received (incl. ` 3,73,658.63 Minimum Guaranteed Death Benefit / ` 4,08,906.84

GST/S.Tax)* Death Benefit of base plan and term rider

(if any)

Agent's Name Customer Services Agent's Contact No.

GST Details

Coverage Type SAC Code CGST/SGST/ GSTIN 24AACCM3201E1Z9

S.Tax (INR) GST Regd. State Gujarat

Base 997132 ` 8,660.09

Rider 997132 ` 0.00

Reinstatement Interest ` 371.84

Total ` 9,031.93

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premiums may be

eligible for tax benefits under section 80C/80CCC/80D/37(1) of the Income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due

to changes in legislation or government notification. GST shall comprise of CGST, SGST/UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable

taxes, cesses and levies, as per prevailing laws, shall be borne by you. *For GST purposes ,this premium receipt is Tax Invoice. Assessable Value in GST for Endowment First Year

is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%.

Authorised signatory

PRM23 V2.9 01082019

You might also like

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Life insurance premium receiptDocument1 pageLife insurance premium receiptani dNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- MediclaimDocument3 pagesMediclaimPrajwal ShettyNo ratings yet

- Renewal Premium ReceiptDocument1 pageRenewal Premium ReceiptShunta ShuntaNo ratings yet

- Mediclaim Premium Receipt 2018Document1 pageMediclaim Premium Receipt 2018faizahamed111100% (1)

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Premium Receipt for Life Insurance Policy Holder Shalini MathurDocument1 pagePremium Receipt for Life Insurance Policy Holder Shalini MathurRajul MathurNo ratings yet

- Mediclaim 1Document1 pageMediclaim 1Arnab RoyNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateSenthil balasubramanianNo ratings yet

- Star Health PolicyDocument5 pagesStar Health PolicyTripathy RadhakrishnaNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancerellu prasadNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- Premium Paid Certificate: Date: 14-SEP-20 16Document1 pagePremium Paid Certificate: Date: 14-SEP-20 16Koushik DuttaNo ratings yet

- RenewalReceipt 502-7066983 PolicyRenewalDocument2 pagesRenewalReceipt 502-7066983 PolicyRenewalSoumitra GuptaNo ratings yet

- FHP H0225594Document2 pagesFHP H0225594Raghavendra KamathNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuTrollstyleNo ratings yet

- Premium ReceiptDocument2 pagesPremium ReceiptPulkit KarnawatNo ratings yet

- 090003e88105430f SONIADocument3 pages090003e88105430f SONIAKoushik DuttaNo ratings yet

- Premium ReceiptDocument1 pagePremium ReceiptVivekanand Gupta0% (2)

- MEDCLAIM - Docx 80 DDocument1 pageMEDCLAIM - Docx 80 DNani krishnaNo ratings yet

- Health Insurance ParentsDocument1 pageHealth Insurance ParentscagopalofficebackupNo ratings yet

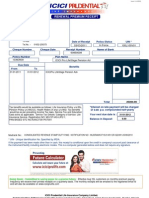

- Icici Premium Paid Certificate SampleDocument1 pageIcici Premium Paid Certificate SampleRahul Kandiyal100% (1)

- Receipt DocDocument1 pageReceipt Doccharchit123No ratings yet

- 2825100207112402000Document4 pages2825100207112402000bipin012No ratings yet

- Mediclaim ParentsDocument1 pageMediclaim ParentsCA Ashish MehtaNo ratings yet

- Dear Saurabh SinghDocument1 pageDear Saurabh SinghSaurabh SinghNo ratings yet

- 13 18 0038121 00 PDFDocument7 pages13 18 0038121 00 PDFRaoul JhaNo ratings yet

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementishanpatnaikNo ratings yet

- Sam Park DocumentDocument4 pagesSam Park DocumentShahadNo ratings yet

- CareHealth Policy 2020-21 Nihit FamilyDocument5 pagesCareHealth Policy 2020-21 Nihit FamilyJacob PruittNo ratings yet

- Abhay KumarDocument5 pagesAbhay KumarSunil SahNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- Prakash B Medical Insurance 22-23Document1 pagePrakash B Medical Insurance 22-23Prakash BattalaNo ratings yet

- LIC ReceiptDocument1 pageLIC ReceiptSun100% (4)

- Medical Insurance ParentsDocument1 pageMedical Insurance Parentsraghuveer9303No ratings yet

- Max Bupa Health Insurance Company LimitedDocument1 pageMax Bupa Health Insurance Company LimitedNiklesh ChandakNo ratings yet

- 80D - Medical Premium Receipt - SelfDocument1 page80D - Medical Premium Receipt - SelfJagdish Saini0% (1)

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuHAJARATHNo ratings yet

- Premium Paid Certificate For The Year 2020-2021Document1 pagePremium Paid Certificate For The Year 2020-2021Prince GoelNo ratings yet

- Medical Insurance Certificate Max BupaDocument1 pageMedical Insurance Certificate Max BupaBinod DashNo ratings yet

- Self & Wife - Mediclaim PolicyDocument5 pagesSelf & Wife - Mediclaim PolicyShrikant Sahu100% (4)

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- HDFC Ergo Policy Renewal 2023 SelfDocument5 pagesHDFC Ergo Policy Renewal 2023 SelfGopivishnu KanchiNo ratings yet

- Nov PDFDocument1 pageNov PDFSuresh PatelNo ratings yet

- Receiptsreceipts 04032011 25203Document1 pageReceiptsreceipts 04032011 25203Deepak KumarNo ratings yet

- Group Mediprime Certificate of Insurance: 380-Bsa-Dn188271Document4 pagesGroup Mediprime Certificate of Insurance: 380-Bsa-Dn188271Sangwan ParveshNo ratings yet

- ICICI COI IncomeProtect 445605Document5 pagesICICI COI IncomeProtect 445605sree koundinyaNo ratings yet

- Premium CertificateDocument2 pagesPremium CertificateSowmalya Mandal100% (4)

- Deepthi Medical Insurance 2022-2023Document1 pageDeepthi Medical Insurance 2022-2023Prakash BattalaNo ratings yet

- Health Insurance - Self and SpouseDocument1 pageHealth Insurance - Self and SpousePrashant TiwariNo ratings yet

- Medical Receipt Premium PDFDocument1 pageMedical Receipt Premium PDFe2arvindNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Mr. Bhavik Dipakkumar Thaker 5/B Rajeshwari Soc - Opp. S.T. Nagar, Kapadwanj Road, Nadiad KHEDA 387001 Gujarat 20-APR-2020Document2 pagesMr. Bhavik Dipakkumar Thaker 5/B Rajeshwari Soc - Opp. S.T. Nagar, Kapadwanj Road, Nadiad KHEDA 387001 Gujarat 20-APR-2020Bhavik ThakerNo ratings yet

- Congratulations! You Are Eligible To Receive A Bonus of 9,488.43 On Your Max Life Life Gain Premier For Paying All Your Premiums RegularlyDocument2 pagesCongratulations! You Are Eligible To Receive A Bonus of 9,488.43 On Your Max Life Life Gain Premier For Paying All Your Premiums RegularlyBhavik ThakerNo ratings yet

- Tution Fee - Qtr. 3 & 4Document1 pageTution Fee - Qtr. 3 & 4Bhavik ThakerNo ratings yet

- Tution Fee - Qtr. 1 & 2Document1 pageTution Fee - Qtr. 1 & 2Bhavik ThakerNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- NIB SVC Policy StatementDocument10 pagesNIB SVC Policy StatementmauriliodnaNo ratings yet

- ICICI Lombard General Insurance policy details for property in GurugramDocument13 pagesICICI Lombard General Insurance policy details for property in Gurugramsourav84No ratings yet

- Emily A. Moore: Audit Test - October 9 PayrollDocument3 pagesEmily A. Moore: Audit Test - October 9 PayrollJoel Christian MascariñaNo ratings yet

- Practice Set 3ADocument2 pagesPractice Set 3AHan Hung GiaNo ratings yet

- Abhishek Kumar Mab22Document96 pagesAbhishek Kumar Mab22Chandan SrivastavaNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- UBC-Sponsor Collaborative Research AgreementDocument12 pagesUBC-Sponsor Collaborative Research Agreement1105195794No ratings yet

- 1 A Odd Lot TendersDocument24 pages1 A Odd Lot Tendersbubb_rubbNo ratings yet

- NFRS 4 - Insurance ContractsDocument25 pagesNFRS 4 - Insurance ContractsNareshNo ratings yet

- UNIT 7 Compensation and BenefitsDocument12 pagesUNIT 7 Compensation and BenefitsDhearly NaluisNo ratings yet

- Mpharma 2021 Impact ReportDocument52 pagesMpharma 2021 Impact ReportmPharmaNo ratings yet

- EQUITYDocument222 pagesEQUITYRajesh Chowdary ParaNo ratings yet

- Taxation System: A Comparison Between Thailand and PhilippinesDocument2 pagesTaxation System: A Comparison Between Thailand and PhilippinesBeberlie LapingNo ratings yet

- Taking The Strain Off Medicaid's Long-Term Care ProgramDocument16 pagesTaking The Strain Off Medicaid's Long-Term Care ProgramManhattan InstituteNo ratings yet

- SalariesDocument35 pagesSalariesSamyak Jirawala100% (1)

- Law of Contracts II Lecture Notes 1 13Document56 pagesLaw of Contracts II Lecture Notes 1 13Mohit MalhotraNo ratings yet

- MDRT 2017 Membership InfoDocument14 pagesMDRT 2017 Membership InfoJayson Solomon50% (2)

- Final IC 38 - IA - General - EnglishDocument78 pagesFinal IC 38 - IA - General - EnglishssnvkirankumarNo ratings yet

- United India Insurance Company Limited: MR Satish KhandelwalDocument11 pagesUnited India Insurance Company Limited: MR Satish Khandelwalminakshi soamNo ratings yet

- Thank You For Insuring With Liberty Mutual: Contact UsDocument8 pagesThank You For Insuring With Liberty Mutual: Contact UsShannon StricklandNo ratings yet

- Gaborone DraftDocument16 pagesGaborone DraftKeemeNo ratings yet

- Theoretical and Regulatory Framework of Leasing: Management of Financial Services - MY KhanDocument28 pagesTheoretical and Regulatory Framework of Leasing: Management of Financial Services - MY KhanSuraj Rajpurohit50% (2)

- Costs - Concepts and ClassificationsDocument5 pagesCosts - Concepts and ClassificationsCarlo B CagampangNo ratings yet

- Visa Grant NotificationDocument4 pagesVisa Grant NotificationkellyNo ratings yet

- BEDA - CaseZ-Doctrines-InsuranceDocument5 pagesBEDA - CaseZ-Doctrines-InsuranceMalcolm CruzNo ratings yet

- 2019 Form 990 For St. Joseph's/CandlerDocument44 pages2019 Form 990 For St. Joseph's/Candlersavannahnow.comNo ratings yet

- Sun Wealth Prime 7 - Sept2022 - v8.2 - FINALDocument32 pagesSun Wealth Prime 7 - Sept2022 - v8.2 - FINALJean Rechell Frias Sultan100% (2)

- Manandhar Anju 218 22Document28 pagesManandhar Anju 218 22MDV VehiclesNo ratings yet

- Topic 1 - Overview of Financial SystemsDocument23 pagesTopic 1 - Overview of Financial SystemsĐinh PhươngNo ratings yet

- FIRST Wealth PrivilegesDocument16 pagesFIRST Wealth PrivilegesMohitNo ratings yet