Professional Documents

Culture Documents

tpo53综合写作

Uploaded by

MichelleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

tpo53综合写作

Uploaded by

MichelleCopyright:

Available Formats

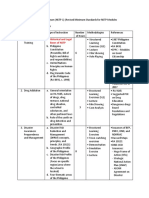

Both reading articles and listening are discussing about the result bought by the imposing high

taxes on cigarettes and other unhealthy products. The reading thinks this decision made by the

governments on the tax law will bring multiple benefits Both on citizens' health and social

development. However, the professor in the lecture raises the considerations for all the reading's

opinions, by saying they are challenged.

Firstly, the reading article holds the idea that raise of the taxes can prevent citizens on having

unhealthy behaviors, such as smoking and eating unhealthy food. To be exact, increase the take

rate on cigarettes can effectively encourage people purchase less of them. Moreover, similar as

raise taxes on cigarettes, increase the taxes on unhealthy food and drinks will help the obesity rate

decreases among people. The lecture, however, think the things from another perspective that

increase in the taxes are not necessarily led to a healthier behavior. If people need to pay for a

higher tax on the cigarettes, they will choose to purchase cheap and low-quality cigarette instead,

which will bring more serious health problems. Same in the food industry, increase in price will

not make citizens buy less unhealthy food, but they will have less money to spend on the healthy

and fresh food.

Secondly, the passage mentioned that people smoke and eat fast food every day will have a higher

risk to get serious health problems than people who kept a healthy living style, every citizen need

to pay the same amount of medical cost is not fair. Smoking people need to pay more money in the

taxes of smoke, so they can cover their future medical cost by their own money. The listening

opposes this opinion by saying that although the new policy on the taxes makes the medical cost

fairer for people who are not smoker and eating healthily, government need to consider about

citizens income when raise the taxes. For example, a person with a higher income whose brand of

cigarettes is same as a person who only earn small amount of money each month, and they all face

the problem of increase in the cigarette’s taxes. A problem raise by this taxes policy is that because

have less money, the person with lower income will have more economic pressure to afford the

cigarettes.

Thirdly, the author raises the idea that not only promote a healthier lifestyle among citizens, high

taxation also can support several governments ‘public welfare developing program which benefit

the whole society. Other than medical use, government can use the tax money to create more parks

for citizens; improve on the public educations such as building schools. At for this point, the truth

is that the millions dollar of taxation not only bring benefits to society but have several serious

down sides. To be exact, because the money is huge, the government will be over dependent on

the high tax rate and don’t want to lose it. Consequently, because governments don’t want to lose

the incomes, they will soon band both outside and inside smoking and charge on people who break

these rules. Citizens’ freedom will be over controlled by the government and will have a heavier

economic pressure on paying the tax and fine.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Guerrero ComplaintDocument13 pagesGuerrero ComplaintToast da MostNo ratings yet

- William Homerston ResumeDocument3 pagesWilliam Homerston Resumeapi-3006586040% (1)

- SUDP - UN-Habitat 9 Districts Profiling Report - May 2007Document51 pagesSUDP - UN-Habitat 9 Districts Profiling Report - May 2007yrdgcgf5664100% (1)

- 2017 Form 760 InstructionsDocument56 pages2017 Form 760 InstructionsicanadaaNo ratings yet

- The Tides of Agencification: Literature Development and Future DirectionsDocument27 pagesThe Tides of Agencification: Literature Development and Future Directionskhalil21No ratings yet

- Itsci Joint Industry Traceability and Due Diligence ProgrammeDocument11 pagesItsci Joint Industry Traceability and Due Diligence ProgrammeCarlos MaroveNo ratings yet

- Environmental AuditingDocument51 pagesEnvironmental AuditingSaket Kumar LohaniNo ratings yet

- Risk Assessment: Energy Sector: DescriptionDocument2 pagesRisk Assessment: Energy Sector: DescriptionavsecNo ratings yet

- Conditions of SecondmentDocument3 pagesConditions of SecondmentHenri Severien JuniorNo ratings yet

- Medical Cannabis in Europe Report FINAL REV2 1Document52 pagesMedical Cannabis in Europe Report FINAL REV2 1Camilo Parra CuadrosNo ratings yet

- MLC 2006 - Inspection and Certification of Indian Ships of GRT Below 500 T, Indian River Sea Vessels and Indian Coastal VesselsDocument23 pagesMLC 2006 - Inspection and Certification of Indian Ships of GRT Below 500 T, Indian River Sea Vessels and Indian Coastal VesselsEshwar BabuNo ratings yet

- Business CommunicationDocument2 pagesBusiness Communicationabdul wajidNo ratings yet

- Cascone Essay - ASPA Founders' Fellows ApplicationDocument5 pagesCascone Essay - ASPA Founders' Fellows ApplicationNatalie TroianiNo ratings yet

- TITP Guidelines Oct 2021Document22 pagesTITP Guidelines Oct 2021SHIVAMNo ratings yet

- DC37 Questionnaire FINALDocument10 pagesDC37 Questionnaire FINALAzi PaybarahNo ratings yet

- 364 Lorenzo V GSISDocument2 pages364 Lorenzo V GSISNN DDLNo ratings yet

- House Hearing, 113TH Congress - Departments of Labor, Health and Human Services, Education, and Related Agencies Appropriations For 2014Document542 pagesHouse Hearing, 113TH Congress - Departments of Labor, Health and Human Services, Education, and Related Agencies Appropriations For 2014Scribd Government Docs100% (1)

- As 1755-2000 Conveyors - Safety RequirementsDocument8 pagesAs 1755-2000 Conveyors - Safety RequirementsSAI Global - APACNo ratings yet

- Wagga City Council Annual Report 2017-18Document104 pagesWagga City Council Annual Report 2017-18Toby VueNo ratings yet

- Nogales Vs Capitol Medical CenterDocument2 pagesNogales Vs Capitol Medical CenterPatrick RamosNo ratings yet

- MENGES GROUP Assessment of Illinois Cost Trends Dec 5 2017Document8 pagesMENGES GROUP Assessment of Illinois Cost Trends Dec 5 2017Natasha KoreckiNo ratings yet

- Hand Book On LSDG For Ad and BdoDocument120 pagesHand Book On LSDG For Ad and Bdoapraba776No ratings yet

- Mou 2019Document1 pageMou 2019api-443217782100% (1)

- Potential Biden WH Administration Officials SP PDFDocument118 pagesPotential Biden WH Administration Officials SP PDFPaul SpivakNo ratings yet

- IA-AINP Family Sponsorship AffidavitDocument5 pagesIA-AINP Family Sponsorship AffidavitHasmukhNo ratings yet

- Oman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksDocument4 pagesOman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Final English NSOHSDocument25 pagesFinal English NSOHSayariseifallahNo ratings yet

- NSTP Training Program ModulesDocument3 pagesNSTP Training Program ModulesJoyce Respicio100% (2)

- IFRA Comitment PDFDocument40 pagesIFRA Comitment PDFSiti fatimahNo ratings yet

- Tobacco Industry Analysis ReportDocument52 pagesTobacco Industry Analysis ReportpravinreddyNo ratings yet