Professional Documents

Culture Documents

WP15903 10 28 09

WP15903 10 28 09

Uploaded by

mamatha mamta0 ratings0% found this document useful (0 votes)

11 views21 pagesOriginal Title

WP15903-10-28-09-

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views21 pagesWP15903 10 28 09

WP15903 10 28 09

Uploaded by

mamatha mamtaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 21

IN THE HIGH COURT OF KARNATAKA, BANGALORE

DATED THIS THE 28™ DAY OF SEPTEMBER, 2010

BEFORE

THE HON'BLE MR.JUSTICE RAM MOHAN REDDY

WRIT PETITION No. 15963 OF 2010(BDA)

BETWEEN:

S VENKOJI RAQ

S/O. LATE G Ki SHANKAR NARAYANA RAO.

AGE 64 YEARS

R/AT NO.99, 28D BLOCK

2NP STAGE, WEST OF CHORD ROAD

MAHALAKSHMIPURAM,

BAGNALORE ~ 86. PETITIONER

(BY SRI. R S HEGDE, ADV)

AND:

THE BANGALORE DEVELOPMENT AUTHORITY,

1 CHOWDAIAH ROAD

KUMARA FARK WEST

BANGALORE - 20

R#P.BY ITS COMMISSIONER. .. RESPONDENT

(BY SRI. M N RAMANJANEYA GOWDA, ADV)

THIS WRIT PETITION IS FILED UNDER ARTICLE 226

OF THE CONSTITUTION OF INDIA PRAYING TO QUASH

THE IMPUGNED ORDER DATED 28.4,2010 VIDE ANN-N

ISSUED BY THE RESPONDENT AS ILLEGAL AND WITHOUT

AUTHORITY OF LAW; AND ETC.

THIS PETITION COMING ON FOR PRL.HEARING IN ‘B’

GROUP THIS DAY, THE COURT MADE THE FOLLOWING:

ORDER

Industrial Site No.80/E, Industriai. Suburb I

Stage in the layout formed by the Bangalore

Development Authority (for short “BDA), was allotted to

one Kulle Gowda, S/o. Yalakki Gowda and put in

jon under Possessicn Certificate dated

poss

25.02.1981 Annexure:

" ona lease for 10 years. It

appears that the respondent ~ BDA executed and lodged

for registration a conditional deed of sale dated 6.2.1987

Annexure-“B” conveying the property in question to the

allottee, for a valuable consideration including the lease

reatals for the period 12.01.1981 to 11.01.1991,

entitling the allottee to exercise absolute and full

ownership rights over the property conveyed, however,

with 2 condition to put up construction within the

period specified under the lease-cum-sale agreement or

such further period as may be allowed by the BDA in

terms of the lease-cum-sale agreement dated

12.01.1981. Thereafterwards, one K.T. Gowda, claiming

be

to be the son of the allottec, executed a sale deed dated

12.02.1987 conveying the property in favour of the

petitioner for a valuable consideration: The BDA having

accepted the sale deed conveying the preperty in favour

of the petitioner, issued a Katha certificate dated

16.03.1991 Annexure-"D" certifying that the katha of

the property was changed te the name of the petitioner

and thereafterwards issued property tax challans in the

name of the petitioner, who paid the taxes. The site

having fallen within the territorial jurisdiction of the

BBMP, tre petitioner paid taxes as acknowledged by the

BBMP. Years rolled by but the industrial building was

not erected though a condition in the allotment of the

site. The BDA, by show cause notice dated 7.1.2010

Annexure-“M”, proposed cancellation of the site for

violation of the condition in not erecting the building

within the time stipulated in the lease-cum-sale

agreement and sought an explanation within seven days

which was promptly responded to by reply dated

ba

11.01.2010 Annexure-“M1” of the petitioner iieratia

contending that though the plan was approved. fer

construction of the building, nevertheless, due to

inadequate financial support fron: Banks arid ill health,

the petitioner again made an unsuccessful attempt in

the year 2001 since there was recession and his

children were unabie to assist. him as they were

pursuing studies, was unable to put up the

construction. Jn addition, it was stated that a borewell

was installed anda compound wall erected and that

Kulle Gowda to whem the notice was addressed, was

not the owner. It is also stated that the petitioner's son

is returning after having studied abroad and intends to

start a design and consultancy business and that a

portion of that site is intended to be gifted to a

charitable institution for construction of a Prarthana

Mandir as the petitioner has promised his Guru and

therefore, there is no violation of the conditions of

allotment. Lastly it is stated that he has filed an

bd

5

application for change of land use by which a portion

will be put to use for public purpose and the remaining

for construction of an office. The BDA did not take

kindly to the explanation offered and by order dated

28.04.2010, Annexure-“N", cancelled. the allotment.

Hence, this writ petition.

2. Petition is opposed by filing Statement of

objections inigratia acinitting the fact of allotment of the

sale and that the original allottee Kulle Gowda having

violated the conditions of allotment, the notices issued

on 21.04.1988 and 20.06.2000 whence no reply was

received and therefore, the Commissioner, by order

dated 2:1.2010, directed issue of yet another show

cause notice to the petitioner on 7.1.2010 for violating

the condition of allotment. The failure to put up

construction of an industrial building in the industrial

suburb is the cause for the cancellation.

3, Having heard the learned counsel for the parties

and perused the pleadings, the following two questions

arise for decision making:

(i)

(ii)

{iii}

Whether in the facts ‘ond circumstances,

respondent ~ BDA has complied with sub-

rule (7) of Ruie 12 of the Bangalore

Development Authority (Allotment of Sites)

Rules, 1984 in the matter of cancellation of

the aliotment?

Whether the power to cancel the conditional

sale deed Annexure-“B” vests with the Court

or with the BDA?

Whetiver the initiation of suo-moto power to

cancel the allotment is within reasonable

time?

Reg. Point No.1:

In the admitted facts the allotment of an industrial

site in an industrial suburb, a layout formed by the

respondent - BDA, cannot but be for establishing an

industry, by industrious entrepreneurs in the State of

Ish

Karnataka. There can be no dispute that the allotment

was on the condition that the allettee put up

construction of an industrial building within a period of

two years, in terms of the lease-cum-sale agreement

dated 12.01.1981. So also, it is not in dispute that the

allotment was subjected to the City of Bangalore

Improvement (Restrictions, Conditions and Limitations

as sales of sites} Rules, 1968 as set out in the

convenants. in the conditional deed of sale Annexure-

“B", although by 6.2,1987, the date of Annexure-“B"

conditional saie deed, there was in force the BDA

(Allotment of Sites), Rules, 1984 repealing the Bangalore

Development Authority (Allotment of Sites) Rules, 1982.

The reiévant rule under the City of Bangalore

Improvement (Restrictions, Conditions and Limitations

as Sales of Sites) Rules, 1968 is not made available to

the Court nor is it relied upon by the respondent in the

matter of cancellation of the allotment except to contend

that the conditional sale deed imposed a condition of

bk

construction of the building within the time stipulated

under the lease-cum-sale agreement dated 12.01.1981.

4, In the light of the admitted facts, the allottee

having not put up the construction of the building

during the period of 10 years iease, the BDA took no

action at the earliest over the violation/breach of

condition of allotment or terms of the lease-cum-sale

agreement. In addition though there was a specific bar

not to alienate the industrial site during the lease

period, the BDA, for reasons not known, executed a

conditional saie deed on 6.2.1987 Annexure-"B”, much

after the expiry of the period during which the

industrial building had to be constructed. There is no

explanation of the BDA as to why such a course of

action was taken and why the allotment was not

cancelled for violation/breach of the terms of the lease-

cum-sale agreement. After the execution of the

conditional sale deed, the allottee did not put up

ba

construction and the BDA, did not take actior: against

the allottee. Significantly, the BDA accepted

conveyance of the site under the sale deed dated

12.02.1987 Annexure ~ ‘C’ in favour of the petitioner by

the person claiming to be the son of the allottee, as is

animated from the Katha Certificate dated 16.03.1991

Annexure-"D". Yet again, the BDA fafied to take action

against cither the allottes or the petitioner for

violation/kreach of the terms and conditions of the

lease-cum-sai# agreement as well as the conditional sale

deed. ‘the BDA in fact acquiesced in the right of the

petitioner by receiving from him the taxes on the

property.

5. When things stood thus, the BDA, without an

explanation, issued the show cause notice in the year

2010 alleging violation of terms and conditions of the

lease-cum-sale agreement and the condition of sale

deed followed by the cancellation of the site by the order

I

10.

impugned. Apparently. as can be gathered from the

arguments advanced by the learned counsel for the

BDA, what was invoked for the cancellation of. the

allotment was sub-rule (7) of Rule 15 of the BDA

{Allotment of Sites) Rules, 1984 which reads thus:

“13(7) The allotiee shai! construct a

building within a period of five years from

the sate of execution cf the agreement or

such extended period as the Authority may

in any specified case by written order permit.

If the building is not constructed within the

said period the allotment may after

reasonable notice to the alllottee be

cancelled, the agreement revoked, the lease

determined and the allottee evicted from the

site by the authority and after forfeiting

twelve and half per cent of the value of the

site paid by the allottee the authority shall

refund the balance to the allottee.”

6. The rule is para materia with sub-rule (6) of

Rule 13 as it existed prior to the amendment to the

pA

Rules, and interpreted by a learned Singic Judge in

SMT. B.K. PARVATHAMMA vs. BANGALORE

DEVELOPMENT AUTHORITY, BANGALORE!. In the

said decision, the very question as to whether the

cancellation of the allotment by the BDA was in

accordance with Rute 13(6) of tne Rules, was answered

thus:

“A perusal of this rule and the term of

the agreement per s¢ reveal that cancellation

of allotment is not in itself sufficient to

deprive the allottee of his right over the

property, subject-matter of an agreement of

Jease-cum-sale or lease-cum-sale agreement,

really, that agreement has to be revoked, the

jease had to be determined in accordance

with law, terms and conditions of the

agreement and possession could only be

taken after having paid the balance of

amount deposited by the lessee or purchaser

to him not in full, but after deduction of 12

and 4%. The remainder of the amount

“998 LIST ne

42

deposited after deduction of the 12 and 72%,

has to be refunded by the authority. to the

allottee, then and then only the cancellation

could be said to have been effectively done.”

7. In my opinion, applying the eaid observation to

the facts of this case, the procedure followed by the

respondent - BDA not being consistent with the view

taken by this Court, the order dated 28.04.2010

Annexure-"N” must fail. ‘fhe first point is answered

accordingly.

Reg, Point No.

The power to cancel the conditional sale deed

Annexure-"B" undoubtedly vests with the Court and

cannot be exercised by the BDA in the light of Section

31 of the Specific Relief Act. This Court, claborately

considered the applicability of Sec.31, in BINNY MILL

LABOUR WELFARE HOUSE BUILDING CO-

hu

uN

OPERATIVE SOCIETY LIMITED vs.

MRUTHYUNJAYA ARADHYA?, and obser ed thus:

“37, A reading of the aforesaid

provision makes it clear that both void and

voidable instruments ean be cancelled by the

Court. The cause of action for such an

action is an apprehension, i such an

instrument is left outstanding may cause

serious iajury to the person against whom

the written instrument 's void or voidable.

Such a person has the discretion to

approach a competent Civil Court for

adjudging the. said instrument to be

delivered up and cancelled. Even though in

law a void instrument is unenforceable, has

no value in the eye of law, void ab initio, the

very physical existence of such a document

may cause a cloud on the title of the party or

cause injury or one can play mischief.

Therefore, the law provides for cancellation

of such instruments which are also non est.

but which are in existence as a fact

physically to get over the effect of such

TLR 2008 KAR 2245 dwt

instrument. Once such an instrument is

registered, the said registration has the effect

of informing and giving notice to the World

at large that such a document has been

executed. Registration of a docuraent is a

notice to all the subsequent purci:asers or

encumbrances of the same property. The

doctrine of construciive notice is attracted

Therefore, the effect of registration of an

rights of the

Parties to the instrument but also affects

instrument not only affects it

parties. who may clam under them.

Therefore, once such an instrument. is

ordered to be delivered up and cancelled an

obligation is cast upon the Court to send a

copy of its decree to the officer in whose

office the instrument was registered, so that

such an officer shall note on the copy of the

instrument contained in his books the fact of

its cancellation. Once such an entry is made

in the books of the Sub-Registrar about the

cancellation of the registered instrument, it

also acts as a notice of cancellation to the

whole World and it is also a constructive

notice of cancellation of the said instrument.

Jak

ds

38. Part X of the Indian Registration

Act, 1908 deals with effect of registration

and non-registration of an instrument. A

combined reading of Sections 47, 48 and 49

makes it clear that an instrumeat which

purports to transfer iitle to the property

requires to be registered, the title does not

pass until registration has been affected.

The registration by itself does not create a

new title. It only affirms a titie that has been

created by the deed. The title is complete

and the effect of registration is to make it

unquestionable and absolute. Section 47 of

the Act makes it clear that a registered

document shell operate from the time from

which it would have commenced to operate if

no registration thereof had been required or

made and not from the time of its

registration. The Section however does not

say when a sale would be deemed to be

complete. However, Section 47 of the

Registration Act makes it clear that, though

a document is registered on a_ particular

date, the effective date would be the date on

which the said document was executed and

J

16

not from the date of registration. if the

document is not registered but — is

compulsorily registerable, though — the

document is duly executed, it as no iegai

effect and it does not affect the iramevable

property comprised in the said document in

view of Section 49 of tke Act. The

registration of such a duly executed

document comes inte operation, the moment

is duly registered, not from the date of

registration put frem the date of execution of

the said document. Section 54 of the

Transfer of Property Act, 1882, which deals

with sales of immovable property mandates

emphatically the transfer of _ tangible

immovable property of the value of one

hundred rupees and upwards, can be made

only by a registered instrument. Thus,

without registration there is no transfer of

ownership of the property. Therefore, it is

clear that the act of registration in the

scheme of things is not a mere instance of

the State collecting some registration fee and

providing authenticity to a written

instrument. It is by the act of registration,

Ink

at

the title in the property passes to the

transferor, from the date of execution of the

deed of transfer. Once such sale takes

place, transfer is complete, the vendor of the

Property ceases to be the owner of the

Property. Thereafter if ne executes one more

sale deed in respect of tie same property or

a cancellation deed in respect of the property

already sold, in faw it has no value, and it in

no way affects the sale deed already

executed. It is invalid, void, and non-est.”

8. Having regard to the covenants in the

conditional sale deed Annexure-“B” that Kulle Gowda,

the allottee is entitled to exercise absolute and full

ewnership rights in the property conveyed, the

respondent —- BDA the cancellation of the conditional

sale deed without taking recourse to the provisions of

the Specific Relief Act, is illegal. The second point is

answered accordingly.

8

9. All that can be said in this case is that the BDA

instead of initiating action at the earli

st opportunity

against the allottee Kulle Gowda in accordance with the

allotment rules as in force en the date when the Gefault

was committed, for whatsoever reasons. assisted Kulle

Gowda by executing < conditicna! sale deed covenanting

that he was entitled to exercise absolute rights over the

property. ‘The failure on the part of the BDA to ensure

strict cempliarice witit the terms of the allotment to put

up the construction within the time stipulated, is

inaction on the part of the BDA, for various reasons.

The Board of the BDA is instrumental in assisting the

ailottee who had committed breach of the terms of the

agreement, are guilty of mal-administration. The non-

exercise of statutory duty invested in the respondent —

BDA has resulted in the petitioner not otherwise entitled

to the public property in question by purchasing the

same within the period of non-alienation did flout rule

of law. There is an imminent need to take action

bt

against the officers concerned after holding an enquiry

and ensure that such conduct by either the officers or

the Board of the BDA is not repeated in future.

Reg. Point N

10. In the backdrop of admitted facts, the

allotment in the year 198i coupled with delivery of

possession and the execution of the lease-cum-sale

agreemeni, the corditional sale deed, and the sale of the

site by the allottee acqiiesced in by the BDA, the action

of the respondent — BDA proposing cancellation of the

allotment, after expiry of 29 years, smacks of abuse of

power. A Division Bench of this Court in the case of

BANGALORE DEVELOPMENT AUTHORITY REP. BY

iTS COMMISSIONER vs. SMT. SUMITRADEVI? while

invalidating an action of cancellation of allotment

initiated after a long gap of 18 years held thus:

“There can be no doubt that where no

power of limitation is prescribed by an Act or

the Rules made thereunder for the exercise

MILR 2004 KAR 1386 It

20

of suo moto statutory power, the exercise of

that power cannot be impugned on the

ground that it is barred by limitation. No

period of limitation can be — imposed

otherwise than by statute or the rules made

thereunder. But, nonetheless, the power

vested in an authority to revise the orders of

the subordinate authorities er to take any

adverse action against a person suo moto,

has to be exercised within a reasonable time.

In our view, in cases where no period of

limitation is prescribed under the Statute or

the Ruics made thereunder for exercise of

powers suo moto, the question for

consideration is not whether the exercise of

the power is barred by limitation for in the

absence of a period of limitation prescribed

under the Act, the question of bar of

jimitation cannot arise, but it is a question of

reasonable period within which that power

should be exercised. What is reasonable

period within which the statutory suo moto

power could be exercised would undoubtedly

be dependent upon the facts and

circumstances of each case.”

bh

2b

11. In the light of the observations and the fact

that a long period of 29 years having rolled by, it is

needless to state that the initiation of proceeding by the

BDA was unreasonableness, unfairness and arbitrary,

and hence unsustainable. Point No.3 is answered

accordingly,

12. In the result the writ petition is allowed. The

show cause aotice dated 7.1.2010 Annexure-“M" and

the order 28.04.2010 Apnexure-“N" are quashed. The

Commissioner, BDA is directed to hold an enquiry into

the mal-administration noticed supra and to take

action, in accordance with law and submit a report to

the Registrar General within six months.

Sd/-

Judge

KS

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- OpTransactionHistory26 01 2020Document2 pagesOpTransactionHistory26 01 2020mamatha mamtaNo ratings yet

- This Is A System Generated Payslip and Does Not Require SignatureDocument1 pageThis Is A System Generated Payslip and Does Not Require Signaturemamatha mamtaNo ratings yet

- The 'S of CSW BillingDocument2 pagesThe 'S of CSW Billingmamatha mamtaNo ratings yet

- OpTransactionHistory03 12 2019Document2 pagesOpTransactionHistory03 12 2019mamatha mamtaNo ratings yet

- Hmo Msa OverviewDocument28 pagesHmo Msa Overviewmamatha mamtaNo ratings yet

- COVID-19 Vaccination Appointment Details: Center Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Preferred Time Slotmamatha mamtaNo ratings yet

- Dvanceceipt2021 07 10 13 46 46Document3 pagesDvanceceipt2021 07 10 13 46 46mamatha mamtaNo ratings yet

- The Medicare Appeals Process: Five Levels To Protect Providers, Physicians, and Other SuppliersDocument3 pagesThe Medicare Appeals Process: Five Levels To Protect Providers, Physicians, and Other Suppliersmamatha mamtaNo ratings yet

- This Is A System Generated Payslip and Does Not Require SignatureDocument1 pageThis Is A System Generated Payslip and Does Not Require Signaturemamatha mamtaNo ratings yet

- AdvanceReceipt2021 07 117 15Document6 pagesAdvanceReceipt2021 07 117 15mamatha mamtaNo ratings yet

- APCS494 - May 2020Document1 pageAPCS494 - May 2020mamatha mamtaNo ratings yet

- This Is A System Generated Payslip and Does Not Require SignatureDocument1 pageThis Is A System Generated Payslip and Does Not Require Signaturemamatha mamtaNo ratings yet

- July Operations Exempt Town Hall - FINALDocument31 pagesJuly Operations Exempt Town Hall - FINALmamatha mamtaNo ratings yet

- COVID-19 Vaccination Appointment Details: Center Date Time Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Date Time Preferred Time Slotmamatha mamtaNo ratings yet

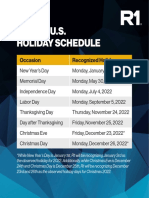

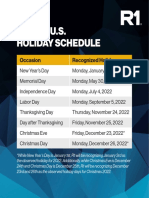

- 2022 US Holiday ScheduleDocument1 page2022 US Holiday Schedulemamatha mamtaNo ratings yet

- Laptop Policy - CernerDocument2 pagesLaptop Policy - Cernermamatha mamtaNo ratings yet

- 2022 US Holiday ScheduleDocument1 page2022 US Holiday Schedulemamatha mamtaNo ratings yet

- Certificate For COVID-19 Vaccination: Beneficiary DetailsDocument1 pageCertificate For COVID-19 Vaccination: Beneficiary Detailsmamatha mamtaNo ratings yet

- Certificate For COVID-19 Vaccination: Beneficiary DetailsDocument1 pageCertificate For COVID-19 Vaccination: Beneficiary Detailsmamatha mamtaNo ratings yet

- D M E (DME) : Urable Edical QuipmentDocument30 pagesD M E (DME) : Urable Edical Quipmentmamatha mamtaNo ratings yet

- Tax Invoice: Name Address State Gstin State Code Description AmountDocument1 pageTax Invoice: Name Address State Gstin State Code Description Amountmamatha mamtaNo ratings yet