Professional Documents

Culture Documents

1601c Dec Previous Year

1601c Dec Previous Year

Uploaded by

ACYATAN & CO., CPAs 20200 ratings0% found this document useful (0 votes)

12 views6 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views6 pages1601c Dec Previous Year

1601c Dec Previous Year

Uploaded by

ACYATAN & CO., CPAs 2020Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

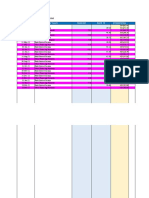

BIR Form No. L601cv2018 @ @ Page 1 of 1

"Epieaane

url Scat ar

Monthly Remittance Return y

of Income Taxes Withheld on Compensation "

SS iemerar at teee aman Notes

fT emnenpaneg a maainan lS ayeeianas a eae aeRO TE

intone, ma Tee ew)! rege fe ra

PARTI - BACKGROUND FORMATION

tame mma ne BET Bel Ra 7 ates Te

[8 wirwcsng Aes Naw (Las ane Ft Nan, Mee None nn OR Reps nomad

fo Regs terete rn hn as nT RRR roan pe a RP BA

Ue 6125 PACIFIC CENTER SLOG, 460 GUNN FAREDES ST BF

@ to | 434 tyes specty [7

‘PART I- COMPUTATION OF TAX

4 _Tou Anatol Ganperaton mT Tier

ce Non Tsasebnnet Conpnstin

15 Stuy wnmum wae onan age Eras ES) Ca

16 oo Pay, Ovrme Pay, Mat SCHR Py, cr Pay rE ot) 10 eo

AT tanaern Py andor Goats 7 art

118. Dems Seats 10: oe

19. Ss, is, Pt, HoMF wana Contin sen ae en shar ‘eo a

120. overnen- Tele caroenaten pecan 2 a

[at Toner Twa Conger (um athens 18 20) 2 [Tt

}22. Tau Teane carport 1st tm 21) 2 [aes

[23 as, Tea compesnan ett wr nang @ ses

24 Ne Tel Capen am 22 es am 23 4 ce

25. Toate nina sa re

25 Aaues Adjustment Tate Wert Pav Mo 2

27 Taw Wereatr Renan Su ar 262) 7 eee

2B oss Tax Roisin Fen Preys Fl tne an arena ten 2

29° oreereitaces ace eectp 3 or

30 Tot Terenas ase (Suttons 289829) 0 oy

[31 Ter Su OsefOvecemtacs)an27 Lat tr 2) ay

aa Panes 32 Sucane 8 See

33a 3 eae

34 Campane ‘a

135 To Pnaie Samet tam 325034) 33 [7

[36 _roraLawounr smu. oUETOvrventana (un thane 3 e35) 0

Ti ger a porn pay at os wT Ta STFS GW AST ER OAT NS TO

one a ce, yb onan el be eran Reve Gaes sears de apace sas sno Dre

cy san ecsing tr aon cop new Pa Py Heke RA NH mee tlk pape

RR eT ST ST AT eae PST TTT IT

ee re rangi ora Seno Rapesaa

TF Reconrg ORNS ot Oe TRS ROT SOOT

crt

anano2 ‘Gmail Tax Return Receipt Confrmation

fi Gmail AXIS LEVEL

Tax Return Receipt Confirmation

ebirforms-noreply @bir.gov.ph ‘Mon, Apr 12, 2021 at 9:07 AM

To: axislevelmarketing@gmail.com

This confirms receipt of your submission with the folowing details subject to validation by BIR.

File name: 009480448000-1601Cv2018-122020V1.xml

Date received by BIR: 12 April 2021

Time received by BIR: 08:42 AM

Penalties may be imposed for any violation ofthe provisions of the NIRC and issuances thereof,

FOR RETURNS WITH PAYMENT

Please print this e-mail together with the RETURN and proceed to pay through the Authorized Agent Bank /

Collection Agent / GCASH or use other payment options.

This is a system-generated email, Please do not reply.

Bureau of Internal Revenue

DISCLAIMER,

‘This email and its attachments may be confidential and are intended solely

for the use of the individual or entity to whom itis addressed,

Ifyou are not the intended recipient ofthis email and its attachments, you

must take no action based upon them, nor must you disseminate, distribute or

copy this e-mail. Please contact the sender immediately if you believe you

have received this email in error.

E-mail transmission cannot be guaranteed to be secure or error-free. The

recipient should check this email and any attachments for the presence of

viruses. The Bureau of Internal Revenue does not accept libilty for any

errors or omissions in the contents ofthis message which arise as a result

of e-mail transmission,

hitps1imai google. com/maivu't c= Saf8721688vew=plAsoarchalpermmegidemsg-f%3A16967042806021750758simplmsg-PAIAIES67S42.... 1/1

BIR Form No. L601Cv2018@ @ Page 1 of 1

Tepe

em: Om.

rom Monthly Remittance Return y

1601-C | ofincome Taxes Withheld on Comper He

ren | Se Tor pee MST el on EB ‘eot-c eteenos Pt

ea 1 Rae et BE

ieoeme BT | [owe eg 3 ad ron

‘PARTI - BACKGROUND INFORMATION,

Toone teen omeeion POS 7 FOO RAB OO 7 noe came [30

1B wii gers ae as ane, Fr Mane Morne OR Roped ne Moe

ISLEVEL UARKETING CORPORATION

9 Begs Ase (nct ra s Fomc an iaie Fnapoes voto bron 74 ROD Bier pene a

‘Be iba once cen en 00, MONT PEDET ST ORGY TONE

eA Ceo

a ee nee

Sietesene ere eee | a trees

FART COMPTTATONOF TAK

ie aeRO To

}15. Soy aman Wap rman ge Ears NES)

18 Hoty Pay Ove Ps, No SHR eet Pay, zat Pay Pr MES on)

}19 3,686 Pec, HoMF Mando Canroutns & Unen ute enya ey

20, Ober NenTstie Compaen (ec

21. Tost Norra Canpaaatn Su Rens 81620)

22, To Tete Conperaton (em 4 ess am 21)

23. sities onpereton el ep war ene rar gent

24 ‘hai Campana ten 72 es on 2)

25. To Teme i

26 Aden) Adnan Tae Wn tem Prva Me

[27 Tes vin Renan (ue ans 25 26)

28 Lee Tc Remuodn Rati Preveuty Fle teen eta um

28

30

‘Omer Remitances ate ect

“ll Tax Rents a (Sm fae 2rd)

[31 Text Det Ovecorta) hm 27 Lass tm 0)

nas Pens 32 Sioage

33 mat

34 crpromie

35 Yost Pern (Sr of e321 4)

NT SLL DUEAOveertacs [Su tars 1 a3) 1

Ta po py Taf os A AT NGA, OSS RTO Ty ota aR TERE ma

Tite scaea plaa'eitm onions ch woe rains Com og aaa wae eqanone sind nt oui ewe

tion ry ASD A Ne 17 lohan eae

FREE

Te a EES | See eS aa

PARTI DETAILS OF PAYMENT

or a ERE

—

——

—

BIR Form No. 1601Cv2018 @

1601-C

ary 200,608)

Monthly Remittance Return

of Income Taxes Withheld on Compensation

Page | of 2

HEAPS RTE

Mto-c OUABENCS F2

a TES EATER

os a

RX Lave. MARKETING CORPORATION

PARTIV- SCHEDULE

Tara cag oT

mer ‘arte

T Fe

Sales

T ae

Taurine Gonet wns Te)

ane

“Galati

"Monthly Remittance Retu

Who Stall File

‘Ths monthly remitane rerum shal be fed in tplicae by

every withholding agent (WAYpayor requited to deduct and

‘withhold taxes on compensation pad to employees.

It the person required to withhold and payremit the ta i 2

corporation, the retum stall be made im the name of the

corporation and shall be signed and verified by the president,

vie-presient, or any authorized office.

the Government ofthe Philippines or any ofits agencies,

political subdivisions or instrumentals, or a. government-

‘ued or conroled corporation, i the witoldingagentpayor,

the retum shall be accomplished and signed by the officer of

employee having control of disbursement of income payments oF

‘ther officer or employee appropriately designated for the

porpose.

With respect wo a fiduciary, the rotun shall be made in the

ame of the individual, estate or tust for which such fiduciary

‘sand sal be signed and verified by such fiduciary In case of

{to oF more joint fiduciaries, the ret shall be signed and

‘verfled by one of such fiduciaries

‘Authorized Representative and Accredited Tax Agent filing,

in behalf ofthe taxpayer, shall also use this return to payiemuit

the creditable taxes withheld

In the case of hazardous employment, the employer in the

private sector shall attach to BIR’ Form No, 1601-C, for seta

petiods March, June, September and December a copy ofthe lis,

Submited to” the Deparment of Labor & Employment

Reglonal/Provincial Ofices-Operations DivisionUnit. The ist

shal show the names of the Minimum Wage Earers ho

‘eecived the hazard pay, period of employment, amount of hazard

pay per month and jusufcaton for payment of hazard pay as

‘ried by said DOLEalied agency that the hazard pay 15

justifiable. In the same manner for the aforementioned return

periods, employer in the public stor shal atch a copy of

Department of Budget and Management (DBM) ciculas or

equivalent, a to who are allowed ro receive hazard pay

‘When and Where to File and Pay/Remit

‘The retun shall be filed and the wx paidemited on of

‘before the tenth (10) day ofthe month following the moath in

which withholding wae made except for taxes withheld for

December which shall be filed and paidremited on or before

January 15 ofthe sueceeding year

Provided, however, tat with respect to non-large and large

taxpayers who shall file through the Elestonic Filing and

Payment System (€FPS), the deadline for eleconically fling the

eum and paying/emiing the taxes due thereon shall be in

‘acontdance with the provisions of existing applicable revenue

‘The totum shal be filod and the tax pairemitd withthe

‘Authorized Agent Bank (AAB) of the Revenue District Office

(RDO) having juriscition over the withholding agents place of

Dusinesfffice! In paces where there are no Authorized Agent

Banks, the tum shall be led andthe tx paidemited withthe

Revenue Collection Officer (RCO) of the RDO having

jurisdiction aver the WA's place of businessofice, who al

Issue an Elestronic Revenve Official Receipt (¢ROR) therefor

When the retum is fled with an AB, taxpayer must

accomplish and submit BIR-presribed deposit sip, which the

‘bank "teller shall machine validate ss evidence that

paymenvfemittance was received by the AAB. The AAB.

‘ceiving the tx tum shall samp matk the word "Reseed" on

‘he reum and also machine valida the retum a8 peoot of ling

land paymenvremitance of the tx by the taxpayer The machine

‘aldation shall reflec the dite of paymentremitance, emount

paidremited and waneacuons code, the name of te bank, branch

‘and Tastructions for BIR Form No, 160-C

‘of lacome Taxes Withheld on Compensation

snuary 201SENCS

4 Will neglect to file the retum within. the period

prescribed by the Code or by rules and regulations, ot

A fale o rauduent eum i wlll made,

3. Interest atthe rate of double the legal interest rate fr loans or

forbearance of any money in the absence of an express

stipulation asset bythe Bangko Sentral ng Pilipinas fom the

dete prescribed for payment unl the amount i ily remited

Provided, ‘That inno case shall the deficiency and the

delinquency interest prescribed under Section 249 Subsections

() and (C) of the National Intoral Revenue Code, a

‘mended, be imposed simulisneousl.

44 Compromise penalty as provided under applicable ules and

regulations.

Violation of Withholding Tax Provisions

‘Any person required 10 withhold account for, and payremit

any tax imposed by the National Internal Revenue Code (NIRC),

1 amended, or who willfully fas to withhold such tx, oF

account for and payiremit such tax, oF ads of abets in any

‘manner o evade any such ax or the paymentemitance threo,

Shall, in adetion to other penalties provided for under the Law,

be liable upon conviction toa penalty equal tothe total amount of

the tax not witeld or not accounted for and paidremited

‘Any petson required under the NIRC, as amended, or by

rales and regulations promulgated thereunder to payremit any

tax, make a return, Keep any record, or supply corect and

accurate information, who wilfully fails to pay/emit such ta,

‘make such return, keep Such recor, or supply Such correct and

‘accurate information, or withhold orpay/emit taxes withbel, oF

Tefund exces taxes withheld on compensation, at the time oF

times required by law or rules and regulations shall, in aditon to

the ater penalties provided bylaw. upon conviction thereof, be

punished bya fie of aot les han ten thousand pesos. (P

10,000.00) and suffer imprisonment of not less than one (1) year

‘but not more than ten (10) yeas.

Every officer or employee of the Government of the

Republic of the Philipines or any of is agencies and

ingrumentalites, is political subdivisions, as well as

fgovernment-ovmed or controlled corprstions, including the

Bangko Senral ng Pilipinas, who, under the provisions ofthe

[NIRC, a6 amended, of regulations promulgated thereunder,

charged with the duty to deduct and witbold any intemal

revenue tx and to paytemit the same in accordance withthe

rovsions ofthe NIRC. as amended, and other laws and who is

found gully of any ofease herein below specified shall, upon

‘cmviction ofeach act or omission, be fined in a sum not ess than

five thousand pesos (P= 5,000) but not more than fity thousand

pesos (P= 50,000) or imprisoned for aterm of not less than six

(G)monts and one day but nt more than two (2) yeas, or both

1 Those who fil or cause the fire to deduct and withhold

ny intemal revenue tax under any of the withholding tax

Iaws and implementing regulations,

1b Those who fil or cause the faire to pay/emit taxes

edcted nd sitheld within the time preseibed by In,

tnd implementing regulations, and

‘© Those who fil or case the failure © fle a return or

staomene within theme preseribed. or render or Tanish

{aise or ffaudulent return or statement required under the

withholding tos lws and regulations

If the withholding agent is the Goverment or any ofits

agencies, political subdivisions or instrumentals, of

government-owned or controlled corporation, the employee

‘hereor responsible for the withholding and paymenvremtance

of tx shall be personally liable for the additions to he tax

preserbed by the NIRC, os amended.

Required Attachments:

TT For Private Sectr, copy of the list submitted tothe DOLE

BIR Form No. 1601Cv2018 e

code, telle’s code and tellers inital Bank debit memo

amber and date should be indisied inthe return fo axpeyers

pavig/remiting under the bank debit system.

eaRemitance may also be made thru the epayment

channels of ABS thru” either their online fait,

credi/debiprepad card, and mobile payments

A taxpayer may fle a separate return forthe bead office and

for each branch or place of busiessofice or a consolidated

retum forthe head office andl the Branchesloffics. In the case

‘oflarge taxpayers only one consolidated retum is require,

Penalties

There shall be imposed and collected as prof the tax

1A surcharge of twenty-five peroent (259%) forthe fllowing

‘lations

‘2 Failure to file any retum and pay the amount of ex or

‘nsallment due on o befor the dv dst

', Fling return with a person or office other than those

with whom iti reqited to be fled, unless otherwise

authorized by the Commissioner,

Failure o pay the fl or part ofthe amount of ax shown

‘nthe eur, or the fll amount of ax de fr which 0

return is required tobe fled on or before the due date;

4. Failure to pay the deficiency tax within the time

prescribed for is payment in the notice of assessment

2A surcharge of fifty percent (50%) of the tax or of the

Tax Return Receipt Confirmation

ebirforms-noreply @bir.gov.ph Fri, Jan 15, 2021 at 6:36 PM

To: axislevelmarketing@amail.com |

‘This confirms receipt of your submission with the following details subject to validation by BIR:

Filename: 009480448000-1601Gv2018-122020.xml

Date received by BIR: 18 January 2021,

‘Time received by BIR: 06:13 PM

Penalties may be imposed for any violation of the provisions of the NIRC and issuances thereof.

FOR RETURNS WITH PAYMENT

Please prin this e-mail together with the RETURN and proceed to pay through the Authorized Agent Bank /

Collection Agent / GCASH or use other payment options.

This is a system-generated email. Please do not reply.

Bureau of Internal Revenue

DISCLAIMER

‘This email and its attachments may be confidential and are intended solely

for the use of the individual or entity to whom itis addressed

Ifyou are not the intended recipient of this email and its attachments, you

‘must take no action based upon them, nor must you disseminate, distribute or

copy this e-mail. Please contact the sender immediately if you believe you

have received this email in error.

E-mail transmission cannot be guaranteed to be secure or error-free. The

recipient should check this email and any attachments for the presence of

viruses. The Bureau of Internal Revenue does not accept lability for any

‘errors or omissions in the contents of this message which arise as a result

of e-mail transmission.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Almc - Cash Position - 11may2021Document246 pagesAlmc - Cash Position - 11may2021ACYATAN & CO., CPAs 2020No ratings yet

- Almc TB 2021Document23 pagesAlmc TB 2021ACYATAN & CO., CPAs 2020No ratings yet

- 1601-E Dec Previous YearDocument6 pages1601-E Dec Previous YearACYATAN & CO., CPAs 2020No ratings yet

- Certificate of IncorporationDocument20 pagesCertificate of IncorporationACYATAN & CO., CPAs 2020No ratings yet

- Inventory Listing Received by BirDocument3 pagesInventory Listing Received by BirACYATAN & CO., CPAs 2020No ratings yet

- Barangay ClearanceDocument3 pagesBarangay ClearanceACYATAN & CO., CPAs 2020No ratings yet

- Secretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021Document1 pageSecretary Certificate - Intra-Corporate - JELMACT REALTY CORP 2021ACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Directors Certificate - JELMACT REALTY 2021 (Revised June 15, 2021)Document2 pagesDirectors Certificate - JELMACT REALTY 2021 (Revised June 15, 2021)ACYATAN & CO., CPAs 2020No ratings yet