Professional Documents

Culture Documents

Bejwnwiwkwnsnn

Uploaded by

Thomas koshy0 ratings0% found this document useful (0 votes)

7 views2 pagesJdjdmdjsismsenk

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJdjdmdjsismsenk

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesBejwnwiwkwnsnn

Uploaded by

Thomas koshyJdjdmdjsismsenk

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Subject Code: - BVBFSI-104

Title of the Subject: - Fundamentals of Accounting

No. of Credits: - 3 Credits (45 Hours)

Objective of the course: -

To familiarize and develop an understanding of the basic concepts and principles of Accounting

and fundamentals of Financial Accounting system

Detailed Syllabus

Unit Contents of the Syllabus Number of

Lectures

1 Meaning and Framework of Accounting 10

Accounting- Meaning, Objectives and Functions

Book-keeping-Meaning and Objectives

Distinction between Book keeping and Accounting

Accounting Concepts, Principles, Conventions

Accounting Policies

Fundamental Accounting Assumptions

Accounting as a Measurement Discipline – Valuation Principles,

Accounting Estimates- Examples

Indian Accounting Standards-Introduction with examples

2 Accounting Process 12

Documents , Books of Accounts

Single Entry Accounting System

Double entry system, Classification of Accounts and Golden

rules

Invoice, Vouchers, Debit & Credit Notes, Day books, Journals,

Ledgers/ Registers and Trial Balance

Capital and Revenue: Expenditures and Receipts- Examples

Contingent Assets and Contingent Liabilities

Rectification of Errors

Depreciation -Meaning, Methods and Accounting treatment

Valuation of Stock

3 Bank Reconciliation Statement 12

Meaning of Bank Reconciliation Statement and its Importance

Bank Pass Book / Statement of Account/ Bank Statement

Causes of difference between Balance as per bank column of

Cash Book and Bank Pass Book / Bank Statement and the

procedure for Bank Reconciliation

4 Financial Statements 11

Introduction to Revised Schedule VI Balance Sheet

Preparation and Reading of Profit & Loss Account and Balance

Sheet - Exercise

Learning Outcomes:

1. Students develop conceptual understanding of the Basics of accounting

2. Students learn about how debits and credits are determined from transactions and events and

recording it in books of accounts.

3. Students understand the purpose of preparing Bank Reconciliation Statement (BRS) and its

utility.

4. Students know aboutwhat is schedule VI balance sheet and the final outcome of the

accounting process and its utility.

Suggested Text Books: -

1. T. P. Ghosh, A. Banerjee & K.M. Bansal Principles and Practice of Accounting, Galgotia

Publishing Company.

2. P. C. Tulsian Financial Accounting, Sultan Chand & Company.

3. R. Narayanaswamy Financial Accounting – A Managerial Prospective; PHI Learning Pvt.

Ltd.

4. Ashish K. Bhattacharyya Essentials of Financial Accounting; PHI Learning Pvt. Ltd.

You might also like

- Basics of Financial AccountingDocument2 pagesBasics of Financial AccountingGopinath SiddaiahNo ratings yet

- 1stsem - BBAFBA2023 24 Revised - Syllabus 23Document2 pages1stsem - BBAFBA2023 24 Revised - Syllabus 23gurulinguNo ratings yet

- Mastering Bookkeeping: Unveiling the Key to Financial SuccessFrom EverandMastering Bookkeeping: Unveiling the Key to Financial SuccessNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For Managersvivekgarg33.vgNo ratings yet

- Sub Committee For Curriculum Development Banking & Finance Specialization Post GraduateDocument3 pagesSub Committee For Curriculum Development Banking & Finance Specialization Post Graduatevineet lakraNo ratings yet

- Old BBA1 Styear NEPpg 17Document2 pagesOld BBA1 Styear NEPpg 17gurulinguNo ratings yet

- Fundamentals of Accounting and AuditingDocument458 pagesFundamentals of Accounting and Auditingrajeev sharma100% (1)

- 05bc0302 Financial Accounting and ManagementDocument1 page05bc0302 Financial Accounting and ManagementManav BhagiyaNo ratings yet

- Dmgt104 Financial AccountingDocument317 pagesDmgt104 Financial Accountingpriya_psalms100% (2)

- DMGT104 Financial Accounting PDFDocument317 pagesDMGT104 Financial Accounting PDFNani100% (1)

- 101 - T2111 Business AccountingDocument3 pages101 - T2111 Business AccountinguhyyuhNo ratings yet

- Financial Accounting - 1 PDFDocument73 pagesFinancial Accounting - 1 PDFSudhanva RajNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingKishore KambleNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingDebadri GhoshNo ratings yet

- Full Faa PDFDocument392 pagesFull Faa PDFruhi100% (1)

- Financial Accounting and Analysis - Session Plan VhuCxcmfdGDocument4 pagesFinancial Accounting and Analysis - Session Plan VhuCxcmfdGSnehil SinghNo ratings yet

- ACC 201: Financial Accounting: Course ObjectivesDocument12 pagesACC 201: Financial Accounting: Course ObjectivesHow HiringNo ratings yet

- Financial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - IDocument126 pagesFinancial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - Isambhav jindal100% (1)

- I-Xxiv Starting Pages A&ADocument14 pagesI-Xxiv Starting Pages A&APoonamNo ratings yet

- Commerce: Accounting & Taxation: Learning OutcomeDocument1 pageCommerce: Accounting & Taxation: Learning Outcomecostumercare85No ratings yet

- Course DetailDocument3 pagesCourse DetailNajlaNo ratings yet

- Detailed SyllabusDocument4 pagesDetailed Syllabussundaram MishraNo ratings yet

- Fundamentals of Accounting and Auditing PDFDocument396 pagesFundamentals of Accounting and Auditing PDFAlbert Moreno100% (1)

- Fundamentals of Accounting and Finance - Course Outline - F22Document5 pagesFundamentals of Accounting and Finance - Course Outline - F22Niveditha SrikrishnaNo ratings yet

- Nptel: Managerial Accounting - Video CourseDocument3 pagesNptel: Managerial Accounting - Video CourseNajlaNo ratings yet

- Dmgt104 Financial AccountingDocument318 pagesDmgt104 Financial AccountingNeha SharmaNo ratings yet

- Semester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4Document3 pagesSemester/Year: I Sem / I Year Course Code: 20MBA5101 Title of The Course: Accounting For Managers L: T/A: P: C: 4: 0: 0: 4tridib BhattacharjeeNo ratings yet

- D20BB003 - Financial AccountingDocument2 pagesD20BB003 - Financial Accountingmba departmentNo ratings yet

- Accounting For ManagersDocument286 pagesAccounting For Managersritesh_aladdinNo ratings yet

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- FMA - Non-Specific - MBA ZC415 COURSE HANDOUTDocument13 pagesFMA - Non-Specific - MBA ZC415 COURSE HANDOUTRavi KaviNo ratings yet

- INS3001 - IFRS Financial Accounting 1Document6 pagesINS3001 - IFRS Financial Accounting 1JF FNo ratings yet

- Financial Accounting-By MainaDocument316 pagesFinancial Accounting-By MainaEnock Mochama MainaNo ratings yet

- B. Tech Sem - I SUBJECT-Financial and Management Accounting (AF310) Teaching Scheme (Hr/week) Exam Scheme (Marks)Document6 pagesB. Tech Sem - I SUBJECT-Financial and Management Accounting (AF310) Teaching Scheme (Hr/week) Exam Scheme (Marks)ShaifaliMalukaniNo ratings yet

- Basic AccountingDocument2 pagesBasic AccountingAnjum MehtabNo ratings yet

- Course Pack FOR Accounting and Financial Management-Mca235Document6 pagesCourse Pack FOR Accounting and Financial Management-Mca235mohd azher sohailNo ratings yet

- Financial Accounting Induction Revised 123Document130 pagesFinancial Accounting Induction Revised 123Sreekanth DogiparthiNo ratings yet

- BBA102-1N SyllabusDocument2 pagesBBA102-1N SyllabusRITIKNo ratings yet

- Cima p4Document3 pagesCima p4fawad aslamNo ratings yet

- ACCOUNTANCY (Code No. 055) : RationaleDocument13 pagesACCOUNTANCY (Code No. 055) : Rationalepiraisudi013341No ratings yet

- Class 11 Accounts Syllabus Session 2015-16Document7 pagesClass 11 Accounts Syllabus Session 2015-16Nikhil MalhotraNo ratings yet

- Accounting StandardsDocument7 pagesAccounting StandardsPoojaNo ratings yet

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- Mba Course HandoutDocument11 pagesMba Course HandoutSajid RehmanNo ratings yet

- Principles of Accounting1Document3 pagesPrinciples of Accounting1Muhammad SaifullahNo ratings yet

- F.A IDocument2 pagesF.A IZara ShoukatNo ratings yet

- CBSE Accountancy Class 11 Term 1 Objective Question BankDocument141 pagesCBSE Accountancy Class 11 Term 1 Objective Question BankMohammed Roshan73% (11)

- Financial Reporting Statements and AnalysisDocument245 pagesFinancial Reporting Statements and AnalysisSandeep Singh100% (1)

- Fa Msu PDFDocument254 pagesFa Msu PDFSelvakumar Thangaraj100% (1)

- ISD ACC101 - v2 - 11.8.2022Document33 pagesISD ACC101 - v2 - 11.8.2022jingen0203No ratings yet

- Acct XIDocument41 pagesAcct XIsainimanish170gmailcNo ratings yet

- Mba I Accounting For Management (14mba13) NotesDocument58 pagesMba I Accounting For Management (14mba13) NotesAnonymous 4lXDgDUkQ100% (2)

- AFM Theory Notes-1Document58 pagesAFM Theory Notes-1pradeepNo ratings yet

- 1.3 Accounting For Managers: 1. General InformationDocument4 pages1.3 Accounting For Managers: 1. General InformationKartik KNo ratings yet

- Unit 2Document25 pagesUnit 2FantayNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Pke - End Sleeves - Cembre (1) - AKBAR TRADING EST - SAUDI ARABIADocument2 pagesPke - End Sleeves - Cembre (1) - AKBAR TRADING EST - SAUDI ARABIAGIBUNo ratings yet

- Cebex 305: Constructive SolutionsDocument4 pagesCebex 305: Constructive SolutionsBalasubramanian AnanthNo ratings yet

- The Macquarie Australian Slang DictionarDocument7 pagesThe Macquarie Australian Slang DictionarnetshidoNo ratings yet

- eLearnMarkets OptionsBuying HindiDocument17 pageseLearnMarkets OptionsBuying Hindisrinivas20% (1)

- Armenotech PCIDSS AOCDocument13 pagesArmenotech PCIDSS AOCHakob ArakelyanNo ratings yet

- Initial 2Document6 pagesInitial 2Asad HoseinyNo ratings yet

- English The Smiles and Tears of RasoolullahDocument130 pagesEnglish The Smiles and Tears of RasoolullahwildqafNo ratings yet

- HLSS 310 Critical Infrastructure ProtectionDocument12 pagesHLSS 310 Critical Infrastructure ProtectionMoffat HarounNo ratings yet

- ParaklesisDocument23 pagesParaklesisDiana ObeidNo ratings yet

- Letter of IntentDocument2 pagesLetter of Intentmansoorstanikzai4No ratings yet

- Assignment 1 To 7Document23 pagesAssignment 1 To 7KashishNo ratings yet

- Dassault Systems Academic CalenderDocument5 pagesDassault Systems Academic CalenderSarath KumarNo ratings yet

- 02 Photogrammetry - Vertical PhotoDocument37 pages02 Photogrammetry - Vertical PhotoAhmed ElsaidNo ratings yet

- A Christmas Memory. Lesson - AnthologyDocument24 pagesA Christmas Memory. Lesson - AnthologySherry CallisonNo ratings yet

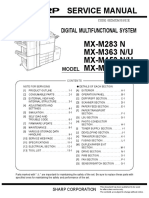

- Sharp MX M283 363 453 503 PDFDocument404 pagesSharp MX M283 363 453 503 PDFAlejandro Barraza100% (2)

- BC Caribou Recovery Program Stakeholders Teleconference MinutesDocument5 pagesBC Caribou Recovery Program Stakeholders Teleconference MinutesRevelstoke MountaineerNo ratings yet

- Data Science BooksDocument11 pagesData Science BooksAnalytics Insight100% (1)

- Research ProposalDocument2 pagesResearch Proposalsmh9662No ratings yet

- Shrutiand SmritiDocument9 pagesShrutiand SmritiAntara MitraNo ratings yet

- Calydracomfort PiDocument16 pagesCalydracomfort PiionNo ratings yet

- Arduino PDFDocument9 pagesArduino PDFMuhammad HazimNo ratings yet

- MBenz SLK350 R171 272 RepairDocument1,922 pagesMBenz SLK350 R171 272 RepairJavier ViudezNo ratings yet

- National Institute of Industrial Engineering: Part - B (10 Marks) : Answer All The QuestionsDocument4 pagesNational Institute of Industrial Engineering: Part - B (10 Marks) : Answer All The QuestionsTulasi PatleNo ratings yet

- Advanced Calculus For Applications - Francis B Hilderand 1962Document657 pagesAdvanced Calculus For Applications - Francis B Hilderand 1962prabu201No ratings yet

- Case Analysis: A Simple Strategy at Costco: Informative Background InformationDocument15 pagesCase Analysis: A Simple Strategy at Costco: Informative Background InformationFred Nazareno CerezoNo ratings yet

- Teacher Thought For InterviewDocument37 pagesTeacher Thought For InterviewMahaprasad JenaNo ratings yet

- Hermes - GodDocument19 pagesHermes - GodAvocadoraNo ratings yet

- Unit Plan - Yr 9 Vis ArtDocument5 pagesUnit Plan - Yr 9 Vis Artapi-333348168No ratings yet

- Mesa Quirurgica Opt 70 Ec 02 PDFDocument36 pagesMesa Quirurgica Opt 70 Ec 02 PDFTEYLER BARBOZANo ratings yet

- Proceso Gmaw (RMD)Document8 pagesProceso Gmaw (RMD)Wilfredo RamirezNo ratings yet