Professional Documents

Culture Documents

Lab Chapt 3 P3-33

Uploaded by

Meisya Vianqa0 ratings0% found this document useful (0 votes)

3 views3 pagesThis document records the consolidation of Peanut Company acquiring a 90% interest in Snoopy Company. It provides the basic consolidation entry to record the investment in Snoopy Company, eliminates accumulated depreciation between the companies, and presents a consolidation worksheet and balance sheet combining the financial statements of the two companies.

Original Description:

Original Title

Lab Chapt 3 P3-33_

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document records the consolidation of Peanut Company acquiring a 90% interest in Snoopy Company. It provides the basic consolidation entry to record the investment in Snoopy Company, eliminates accumulated depreciation between the companies, and presents a consolidation worksheet and balance sheet combining the financial statements of the two companies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesLab Chapt 3 P3-33

Uploaded by

Meisya VianqaThis document records the consolidation of Peanut Company acquiring a 90% interest in Snoopy Company. It provides the basic consolidation entry to record the investment in Snoopy Company, eliminates accumulated depreciation between the companies, and presents a consolidation worksheet and balance sheet combining the financial statements of the two companies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

P3-33

a. Record the nvestment in Snoopy Company,

Investment in Snoopy Company $ 270,000

Cash $ 270,000

Book value calculation :

NCI + Peanut Company = Common + Retained

10% 90% Stock Earning

Book value at acquisition : $ 30,000 + 270,000 = 200,000 + 100,000

Basic consoladation entry

Common stock $ 200,000

Retained earnings 100,000

Investment in Snoopy Company $ 270,000

NCI in NA of Snoopy Company 30,000

Optional Accumulated Depreciation Elimination Entry :

Accumulated Depreciation $ 10,000

Buildings and Equipment $ 10,000

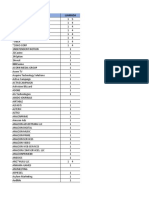

b. Consolidation Worksheet

Peanut Snoopy Consolidation Entries Consolidated

Company Company

DR CR

Balance Sheet

Assets

Cash $55,000 20,000 75,000

Account Receivable 50,000 30,000 80,000

Inventory 100,000 60,000 160,000

Investment in Snoopy Stock 270,000 270,000 0

Land 225,000 100,000 325,000

Bilding & Equipment 700,000 200,000 10,000 890,000

Less: Accumulated Depreciation (400,000) (10,000) 10,000 (400,000)

Total Assets $1,000,000 400,000 10,000 280,000 $1,130,000

Liabilities & Stockholders Equity

Account Payable 75,000 25,000 100,000

Bonds Payable 200,000 75,000 275,000

Common Stock 500,000 200,000 200,000 500,000

Retained Earnings 225,000 100,000 100,000 225,000

NCI in NA of Snoopy Company 30,000 30,000

Total Liabilities & Equity $1,000,000 400,000 300,000 30,000 $1,150,000

c.

Peanut Company and Subsidiary

Consolidation Balance Sheet

January 1, 20x8

Assets

Cash $ 75,000 Liabilities & Stockholders Equity

Accont Receivable 80,000 Account Payable $ 100,000

Inventory 160,000 Bonds Payable 275,000

Land 325,000 Commong Stock 500,000

Buildings & Equipment 890,000 Retained Earnings 225,000

Less:Accumulated Depreciation (400,000) NCI in NA of Snoopy Company 30,000

Total Assets $1,130,000 Total Liabilities & Equity $1,130,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Postmoney Safe - Valuation Cap Only v1.1 (Singapore)Document7 pagesPostmoney Safe - Valuation Cap Only v1.1 (Singapore)Krishana RanaNo ratings yet

- Caliber Lone Star LSF9 IPO Investment Prospectus S 1 ADocument2,569 pagesCaliber Lone Star LSF9 IPO Investment Prospectus S 1 ANye LavalleNo ratings yet

- SMDM Quiz Financial Accounting Quiz (1) : CCS ActivitiesDocument2 pagesSMDM Quiz Financial Accounting Quiz (1) : CCS ActivitiesSouradipta ChowdhuryNo ratings yet

- Blaine Kitchenware Inc. Written Case AnalysisDocument1 pageBlaine Kitchenware Inc. Written Case AnalysisomirNo ratings yet

- AKL1 TugasDocument2 pagesAKL1 TugasFarrell DmNo ratings yet

- IabDocument559 pagesIabarq613No ratings yet

- Audit of Shareholder's EquityDocument6 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- CS183 Startup Class at Stanford - Class 6 - Peter Thiel PDFDocument20 pagesCS183 Startup Class at Stanford - Class 6 - Peter Thiel PDFTensonNo ratings yet

- Greenhill Interns 2016 RGBDocument3 pagesGreenhill Interns 2016 RGBc0n0r201No ratings yet

- Takeover & AcquisitionsDocument18 pagesTakeover & AcquisitionssambitacharyaNo ratings yet

- Argentum ForumDocument12 pagesArgentum Forumligue marc marcel djoNo ratings yet

- IFRS - 12 Interests in Other EntitiesDocument6 pagesIFRS - 12 Interests in Other EntitiessaadalamNo ratings yet

- Listado Proveedores InternosDocument2 pagesListado Proveedores InternosAnil VishwakarmaNo ratings yet

- Class 12 Complete Book of Accountancy Part 2 EnglishDocument296 pagesClass 12 Complete Book of Accountancy Part 2 EnglishShubham LabhadeNo ratings yet

- RCC Section 1-21Document9 pagesRCC Section 1-21ZenNo ratings yet

- Prestadores Servicios Digitales Desde Diciembre 2022Document22 pagesPrestadores Servicios Digitales Desde Diciembre 2022Valentina OrtizNo ratings yet

- 400scale A380 EmiratesDocument1 page400scale A380 EmiratesSarandhorn (Paul) SuphasetthawitNo ratings yet

- I. Solve The Following Problems. Show Your Computations in Good FormDocument4 pagesI. Solve The Following Problems. Show Your Computations in Good FormAlelie dela CruzNo ratings yet

- Sebi Takeover Code 2011 - DecodifiedDocument25 pagesSebi Takeover Code 2011 - DecodifiedRahul BajajNo ratings yet

- Credit Cases For Digest PledgemortgageDocument11 pagesCredit Cases For Digest PledgemortgageMel Manatad0% (1)

- VFC Meeting 8.31 Discussion Materials PDFDocument31 pagesVFC Meeting 8.31 Discussion Materials PDFhadhdhagshNo ratings yet

- Comparitive Analysis of Certain Sections of Companies Act, 1956 & Companies Act, 2013Document11 pagesComparitive Analysis of Certain Sections of Companies Act, 1956 & Companies Act, 2013MOUSOM ROYNo ratings yet

- Anadarko Case Study 2Document7 pagesAnadarko Case Study 2izazNo ratings yet

- Gmac 2007 Request For Advisory OpinionDocument10 pagesGmac 2007 Request For Advisory OpinionjohngaultNo ratings yet

- List of Preference Shares 15.11.18Document213 pagesList of Preference Shares 15.11.18amoosh masseyNo ratings yet

- FAR PresentationDocument2 pagesFAR PresentationNajwan Amat YahayaNo ratings yet

- Voltas: Sub: Annual Report 2018-19Document278 pagesVoltas: Sub: Annual Report 2018-19dharmendraNo ratings yet

- Definitions Companies Act 2013 - Akanksha BohraDocument23 pagesDefinitions Companies Act 2013 - Akanksha BohraAkanksha BohraNo ratings yet

- Ap04-01 Audit of SheDocument7 pagesAp04-01 Audit of Shenicole bancoroNo ratings yet

- ShowPdf PDFDocument927 pagesShowPdf PDFgirija naikNo ratings yet