Professional Documents

Culture Documents

Chapter 7: Inventories Goods Includible in Inventory

Uploaded by

AngelaMariePeñaranda0 ratings0% found this document useful (0 votes)

11 views4 pagesThis document summarizes key concepts related to inventories. It defines different types of inventories like finished goods, work in process, and raw materials. It discusses accounting methods for valuing inventories like periodic and perpetual systems. It also outlines how to determine the cost of inventories and common adjustments for inventory shortages or overages.

Original Description:

Original Title

CHAPTER 7

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes key concepts related to inventories. It defines different types of inventories like finished goods, work in process, and raw materials. It discusses accounting methods for valuing inventories like periodic and perpetual systems. It also outlines how to determine the cost of inventories and common adjustments for inventory shortages or overages.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views4 pagesChapter 7: Inventories Goods Includible in Inventory

Uploaded by

AngelaMariePeñarandaThis document summarizes key concepts related to inventories. It defines different types of inventories like finished goods, work in process, and raw materials. It discusses accounting methods for valuing inventories like periodic and perpetual systems. It also outlines how to determine the cost of inventories and common adjustments for inventory shortages or overages.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

CHAPTER 7: INVENTORIES GOODS INCLUDIBLE IN INVENTORY

- Held for resale in the ordinary course of the - Installment contracts

business (finished goods) o Retention of the titles by the seller

- In the process of production for such sale until the selling price is fully

(work in process) collected (included in the seller)

- In the form of materials or supplies to be o Treated as a regular sale where

consumed in the production process or in income is deferred on the part of the

rendering of services (raw material and seller (excluded from the seller)

manufacturing supplies) - Goods in transit

o FOB destination where goods sold is

transferred only upon receipt of

EXAMPLE OF INVENTORIES goods (included in the seller)

o FOB shipping point where goods

- Merchandise purchased by a trading entity

sold is transferred upon shipment

and held for resale

(excluded from the seller)

- Land and other property held for sale in the

- Others

ordinary course of business

o Goods out on consignment –

- Finished goods, goods undergoing

included in the seller

production, and raw materials and supplies

o Goods consigned in – excluded from

of waiting used in the production process by

the seller

a manufacturing entity

o Goods held by customers on

approval or trial – included in the

seller

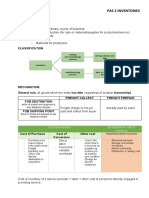

CLASSES OF INVENTORIES

- Inventories of trading or merchandising

concern FREIGHT TERMS

o An entity buys and sells the goods

Freight Term Interpretation

purchased in the same form

Freight collect Paid by the buyer

o Merchandise inventory

Freight prepaid Paid by the seller

- Inventories of manufacturing concern

FOB destination Seller is responsible for

o An entity buys goods and alter

freight

(converts) them into another form FOB shipping point Buyer is responsible for

before they are made available for freight

sale

o Raw or direct materials, work in

process, finished goods PRESENTATION

- Inventories are classified as current assets

- It shall be presented as one-line items with

TYPES OF INVENTORIES the details disclosed in the notes to the

- Finished goods – completed goods ready financial statements

for sale

- Work in process – partially completed

goods which required further or additional ACCOUNTING FOR INVENTORIES

processing before they ca be sold - Periodic system – calls for the physical

- Raw materials – goods to be used in counting of goods on hand at the end of the

production accounting period to determine quantities

- Direct materials – goods that are already o The quantities at the end of the

issued in production period are multiplies by its unit cost

- Factory or manufacturing supplies – are raw to determine the inventory value of

material issued t production financial statement purposes

o Do not form a part of the finished o Used when inventory have small

product peso investment and are fast

o If they form part of the finished moving

product, they cannot be - Perpetual system – requires the

economically, directly or easily maintenance of stock cards that shows the

identifiable or that their cost is running balance of the inventory including

insignificant its movements

o An inventory count is conducted at period

the end of the period to verify

quantities reflected in the records

COST OF INVENTORY

o It is used for inventory items with a

relatively large peso investment - Purchase cost, purchase price, import

o The inventory quantity and value is duties, non-happy refundable or non-

known at any time recoverable purchased assets, and

transport, handling and other costs directly

attributable to the acquisition of the

INVENTORY SHORTAGE/OVERAGE inventory

o Trade discounts are directly

- The difference between the physical

deducted

inventory and amount recorded in the stock

o Foreign exchange gains or loss are

records is accounted for as inventory short

excluded

or over which requires an adjustment to the

o The difference between the

inventory account

purchase price for normal credit

o Inventory shortage – physical

terms and the amount paid is

inventory is less than the amount

recognized as interest expense

recorded in the books

- Conversion cost refers to the costs

o Inventory overage – physical

necessary in converting raw materials into

inventory is greater than the amount

finished goods which included direct labor

recorded in the books

and production overhead

- Other costs are necessary in bringing the

inventories to their present location and

INVENTORY DISCOUNTS

condition

- Trade discounts – deductions from the list - Abnormal amounts of waste material, labor

or catalog prices in order to arrive at the or other production costs

invoice prices which is the amount - Storage costs, unless this costs are

chargeable to the buyer necessary in the production process before

o Trade discounts are not recorded a further production stage

o Its purpose is to encourages trading - Administrative overhead that do not

or increase sales contribute to bringing inventory so their

o It suggests the price at which the present location and condition

goods may be resold - Selling costs

- Cash discounts – deductions from the

invoice price when payment is made within

the discount period COST OF INVENTORIES OF A SERVICE PROVIDER

o Its purpose is to encourage prompt

- Includes primarily of the labor and other

payment or early payment of costs of personnel directly engaged in

account providing the service (supervisory personnel

o Purchase discount/sales discount and overhead)

METHOD OF RECORDING PURCHASES - Generally, they are classified as work in

progress

- Gross method – both the purchase and - Labor and other costs relating to sales and

account payable are recorded at gross general administrative personnel are

(100%) excluded (classified as expense)

- Net method – both the purchases and

accounts payable are recorded at net of

discount COST FORMULAS

Transaction Gross Net - Cost formulas deal with the computation of

Purchase Purchase and Purchase and cost of inventories that are charged as

AP at gross AP at net

expense and when the related revenue is

Payment AP Accounts

recognized as well as the cost of unsold

withing the Cash payable and

inventories at the end of the period that are

discount Purchase cash at net

period Discount recognized as an asset

Payment Accounts AP o Specific identification – specific

outside the Payable and PD costs are attributed to identifies

discount cash at gross Cash items of inventory

Characteristics: multiplied with the

The cost of inventory inventory quantity on

is determined by hand to arrive at the

multiplying the units cost of the ending

on hand by their inventory

actual unit cost It is relatively easy to

This should be used apply, especially with

for inventories that the use of computers

are not ordinarily It produces inventory

interchangeable and valuation that

those that are approximates current

segregated for value if there is rapid

specific projects turn over of inventory

The flow of inventory There may be

corresponds with the considerable lag

actual physical flow between current cost

It is very costly to and inventory

implement valuation since it

includes early

purchases

o First-in, First-out – it is assumed that In rising prices,

inventories that were purchased or inventory valuation

produced first are sold first or issued will be less than

to production current cost

Characteristics

The costs of sales

represent costs from Moving average – the terms

earlier purchases used in computing the

The cost of ending weighted average unit cost of

inventory represents inventory under the perpetual

costs from the most method

recent purchases A new weighted

It favors balance average cost per unit

sheet presentation is computed after

There is improper every purchase or

matching of costs purchase return

against revenue

because the COGS is

stated as an earlier NET REALIZABLE VALUE

purchase price

- Inventories shall be measured at lower cost

In rising prices, FIFI

and net realizable value

produces the highest

- Net realizable value refers to the estimated

net income

selling price in the ordinary course of

o Weighted average – the cost of sales

business less the estimated cost of

and ending inventory are determined

completion and the estimated costs

based on the weighted average cost

necessary to make the sale

of beginning inventory and all

- Assets shall not be carried in excess of

inventories purchase or produced

amounts expected to realized from their

during the period

sale or use

Characteristics

The weighted average

unit cost is computed

UNRECOVERABLE INVENTORIES

by dividing the total

costs available for - If the inventories are damaged, wholly or

sale by the total partially obsolete, or if the selling prices

number of units have declined

available for sale - If the estimated cost of completion or the

The weighted average estimated cost of disposal has increased

unit costs is

DETERMINATION OF NET REALIZABLE VALUE made – loss (other expense) is recorded in

the period of the price decline

- Inventories are written down to net

- Entry:

realizable value on an item per item or

o Loss on purchase commitment

individual basis

Estimated liability for

- It is not appropriate to write down

purchase commitment

inventories based on classification of

- If the market price rises at the time of the

inventory (finished goods or all inventories

purchase – gain on purchase commitment

in a particular industry or geographical

is recorded that is limited to the loss on the

segment)

purchase commitment previously recorded

- Materials and other supplies for production

are not written down to NRV if the related

finished products are expected to be sold at

or above cost

- If the price of the material and other

supplies declines and the cost of the related

finished products exceeds NRV, the material

and other supplies are written down to NRV

using its replacement cost

ACCOUNTING FOR INVENTORY WRITEDOWN

- If the cost is lower than NRV – no

adjustment

- If the NRV is lower than cost – inventory is

measured at NRV

o Direct method or the COGS method

– the inventory is recorded at lower

of cost or NRV

Any loss on inventory write-

down is not accounted for

separately but absorbed or

buried in the COGS

Ending inventory is recorded

opposite the income and

expense summary account at

the lower of cost or NRV

o Allowance method – the inventory is

recorded at cost and any loss is

accounted for separately

Gain or loss in inventory

write-down is recorded as an

adjustment to the COGS

Allowance for inventory

write-down is a reduction in

the cost of the inventory

PURCHASE COMMITMENTS

- Obligations of the entity to acquire certain

goods sometime in the future at a fixed

price and fixed quantity

o When purchase commitments are

significant or unusual – disclosure is

required

o Losses from firm and non-

cancellable commitments shall be

recognized

- Decline in the purchase price after a non-

cancellable purchase commitment has been

You might also like

- Cfas - InventoriesDocument6 pagesCfas - InventoriesYna SarrondoNo ratings yet

- Chap 10 and 11Document5 pagesChap 10 and 11Mary Claudette UnabiaNo ratings yet

- Materials and Supplies Awaiting Use in The Production ProcessDocument3 pagesMaterials and Supplies Awaiting Use in The Production ProcessMizumi IshiharaNo ratings yet

- Intacc 1 Notes Part 4Document10 pagesIntacc 1 Notes Part 4Crizelda BauyonNo ratings yet

- Chapter 10: InventoriesDocument39 pagesChapter 10: InventoriesCarl Aaron LayugNo ratings yet

- Module 5 - Inventories: Maritime Shipping TermsDocument4 pagesModule 5 - Inventories: Maritime Shipping TermsAva RodriguesNo ratings yet

- INVENTORIESDocument28 pagesINVENTORIESLourdios EdullantesNo ratings yet

- ACC 203 Module 4 PAS 2 Inventories PAS 41 Biological AssetsDocument15 pagesACC 203 Module 4 PAS 2 Inventories PAS 41 Biological AssetsKirsty SicamNo ratings yet

- FINACC1 Inventories PDFDocument6 pagesFINACC1 Inventories PDFJerico DungcaNo ratings yet

- CHAPTER 16-Inventories: Far SummaryDocument3 pagesCHAPTER 16-Inventories: Far SummaryFuturamaramaNo ratings yet

- Subsequent Measurement:: Differ in Inventory ValueDocument4 pagesSubsequent Measurement:: Differ in Inventory ValueCharina Jane PascualNo ratings yet

- 1 Inventories Pas 2 Reviewer Intermediate AccountingDocument5 pages1 Inventories Pas 2 Reviewer Intermediate AccountingDalia ElarabyNo ratings yet

- 1010 2. InventoriesDocument9 pages1010 2. Inventorieslizie elizaldeNo ratings yet

- Inventories Basic PrinciplesDocument7 pagesInventories Basic PrinciplesSandia EspejoNo ratings yet

- Intacc ReviewerDocument2 pagesIntacc ReviewerCassandra CeñidoNo ratings yet

- INVENTORIESDocument64 pagesINVENTORIESLuisa Janelle BoquirenNo ratings yet

- INVENTORIESDocument89 pagesINVENTORIESLuisa Janelle BoquirenNo ratings yet

- IA 1 - 5 InventoriesDocument8 pagesIA 1 - 5 InventoriesVJ MacaspacNo ratings yet

- Inventories: Financial Accounting and ReportingDocument6 pagesInventories: Financial Accounting and ReportingcolNo ratings yet

- Accounting NotesDocument12 pagesAccounting NotesKrystelle JalemNo ratings yet

- InventoriesDocument9 pagesInventoriesDon John David100% (2)

- Chapter 10: Inventories: CustomersDocument4 pagesChapter 10: Inventories: CustomersireneNo ratings yet

- Pas 2 Inventories: Nature: DefinitionDocument3 pagesPas 2 Inventories: Nature: DefinitionKristalen ArmandoNo ratings yet

- 161 12 PAS 2 InventoriesDocument2 pages161 12 PAS 2 InventoriesRegina Gregoria SalasNo ratings yet

- Inventories: PERIODIC SYSTEM-physical Counting of Goods OnDocument4 pagesInventories: PERIODIC SYSTEM-physical Counting of Goods OnGirl Lang AkoNo ratings yet

- Inventories: Classes of Inventories ConsignmentDocument3 pagesInventories: Classes of Inventories ConsignmentJonathan NavalloNo ratings yet

- Inventories HandoutDocument4 pagesInventories HandoutRoselle Jane LanabanNo ratings yet

- 4.1 Audit of Inventories and Cost of SalesDocument2 pages4.1 Audit of Inventories and Cost of SalesNavsNo ratings yet

- Far Notes For QualiDocument10 pagesFar Notes For QualiMergierose DalgoNo ratings yet

- 121 Prelims ReviewerDocument6 pages121 Prelims Reviewerjohnmichaelaspe1234No ratings yet

- Accounting For INVENTORIESDocument4 pagesAccounting For INVENTORIESMeludyNo ratings yet

- InventoriesDocument3 pagesInventoriesNikki RañolaNo ratings yet

- Inventories and Cost of Sales What Is Inventory?: Financial Accounting For BusinessDocument19 pagesInventories and Cost of Sales What Is Inventory?: Financial Accounting For BusinessĐàm Quang Thanh TúNo ratings yet

- Inventories 2024Document27 pagesInventories 2024Charish Ann SimbajonNo ratings yet

- JPIAN - S Digest - InventoriesDocument12 pagesJPIAN - S Digest - InventoriesMyrrh ErosNo ratings yet

- IntAcc 2 Midterm NotesDocument93 pagesIntAcc 2 Midterm NotesAlmaera CeninaNo ratings yet

- GROUP 2 - PAS 2 InventoriesDocument7 pagesGROUP 2 - PAS 2 InventoriesNhicoleChoiNo ratings yet

- TM 10 InventoriesDocument91 pagesTM 10 Inventories2310111212No ratings yet

- Inventories P1Document8 pagesInventories P1Shane CalderonNo ratings yet

- Cfas Lesson 3 Pas 2 (Activity)Document3 pagesCfas Lesson 3 Pas 2 (Activity)Michelle CabezoNo ratings yet

- Scope: Allocation of Fixed Production OverheadsDocument8 pagesScope: Allocation of Fixed Production OverheadsjayveeNo ratings yet

- Inventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocument4 pagesInventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayNo ratings yet

- Intermediate-Accounting Handout Chap 10Document4 pagesIntermediate-Accounting Handout Chap 10Joanne Rheena BooNo ratings yet

- C7 Inventories (MT)Document2 pagesC7 Inventories (MT)Cyril Grace DedumoNo ratings yet

- Pas 2 InventoriesDocument12 pagesPas 2 InventoriesLETIGIO, RHEANA ROSE M.No ratings yet

- InventoryDocument20 pagesInventoryE.D.J33% (3)

- CH 08Document54 pagesCH 08Jessie jorgeNo ratings yet

- CH 8 - AnswerDocument58 pagesCH 8 - Answer金沛霓No ratings yet

- UFAS2Document4 pagesUFAS2Romylen De GuzmanNo ratings yet

- InventoriesDocument8 pagesInventoriesangel ciiiNo ratings yet

- Chapter 10 - Intermediate AccountingDocument4 pagesChapter 10 - Intermediate AccountingPrincess PriyaNo ratings yet

- PDF Warren SM ch07 Final - CompressDocument20 pagesPDF Warren SM ch07 Final - CompressBerliana MustikasariNo ratings yet

- InventoriesDocument3 pagesInventoriesZance JordaanNo ratings yet

- Accounting For A Merchandising BusinessDocument3 pagesAccounting For A Merchandising BusinessAngelique Faye CalucinNo ratings yet

- Inventories: Inventories Net Sales FormulaDocument6 pagesInventories: Inventories Net Sales Formulagab camonNo ratings yet

- Inventories NotesDocument7 pagesInventories NotesJessel Ann MontecilloNo ratings yet

- Presentation4.1 - Audit of Inventories, Cost of Sales and Other Related AccountsDocument37 pagesPresentation4.1 - Audit of Inventories, Cost of Sales and Other Related AccountsRoseanne Dela CruzNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotesMinh ThưNo ratings yet

- Week Five:: Reporting andDocument38 pagesWeek Five:: Reporting andIzham ShabdeanNo ratings yet

- Intermediate Accounting 3Document10 pagesIntermediate Accounting 3AngelaMariePeñarandaNo ratings yet

- 2019 IntAcc Vol 3 CH 5 AnswersDocument9 pages2019 IntAcc Vol 3 CH 5 AnswersAngelaMariePeñarandaNo ratings yet

- Code of Conduct or Employee ManualDocument6 pagesCode of Conduct or Employee ManualAngelaMariePeñarandaNo ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- Financial ManagementDocument96 pagesFinancial ManagementAngelaMariePeñarandaNo ratings yet

- CFAS - Biological Assets, Intangibles, and InvestmentsDocument8 pagesCFAS - Biological Assets, Intangibles, and InvestmentsAngelaMariePeñarandaNo ratings yet

- CFAS Chapter 5 - Accounts ReceivableDocument6 pagesCFAS Chapter 5 - Accounts ReceivableAngelaMariePeñarandaNo ratings yet

- Conceptual Framework and Accounting StandardsDocument14 pagesConceptual Framework and Accounting StandardsAngelaMariePeñarandaNo ratings yet

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- Star BucksDocument3 pagesStar BucksRoger YoungNo ratings yet

- Compare and Contrast The Industrial Organisation Approach To The ResourceDocument3 pagesCompare and Contrast The Industrial Organisation Approach To The ResourceMarvin AlleyneNo ratings yet

- Assignment 3 HBS Case 1 ValuationDocument15 pagesAssignment 3 HBS Case 1 ValuationqrpiotrNo ratings yet

- CRM - Future Group Big BazaarDocument25 pagesCRM - Future Group Big BazaarAadit ShahNo ratings yet

- FSA Case Study SolutionDocument6 pagesFSA Case Study SolutionConnor CooperNo ratings yet

- Pdiso-Ts 55010-2019 (E)Document50 pagesPdiso-Ts 55010-2019 (E)Pedro Pastrana SocorroNo ratings yet

- RAJNEESH AWASTHI MINI PROJECT Final - RAJNEESH AWASTHI MBA 1st Semester RSMTDocument37 pagesRAJNEESH AWASTHI MINI PROJECT Final - RAJNEESH AWASTHI MBA 1st Semester RSMTrajawasthi7133No ratings yet

- Foreign Collaboration and Joint Venture-Key Ppts-2020Document70 pagesForeign Collaboration and Joint Venture-Key Ppts-2020najiath mzeeNo ratings yet

- Ebook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFDocument67 pagesEbook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFgina.letlow138100% (27)

- Sol. Man. Chapter 8 Acctg For Franchise Operations Franchisor 2021 EditionDocument11 pagesSol. Man. Chapter 8 Acctg For Franchise Operations Franchisor 2021 EditionkoyNo ratings yet

- CH 21 No.4-6Document2 pagesCH 21 No.4-6adeline ikofaniNo ratings yet

- EntreprDocument112 pagesEntreprmeow meowwNo ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/32Document4 pagesCambridge International AS & A Level: BUSINESS 9609/32Fatema NawrinNo ratings yet

- Maria HernandezDocument6 pagesMaria Hernandezchtbox1039No ratings yet

- Deepwater Well Project and Risk Management DR-TC3-NXT17530Document1 pageDeepwater Well Project and Risk Management DR-TC3-NXT17530GUILLERMONo ratings yet

- SCML 200: - Supply Chain Management & OperationsDocument25 pagesSCML 200: - Supply Chain Management & OperationsHello WorldNo ratings yet

- Sravan Digital Marketing ResumeDocument2 pagesSravan Digital Marketing ResumeRavi RanjanNo ratings yet

- B2B Marketing and Sales - OrangeDocument62 pagesB2B Marketing and Sales - OrangeMuhammad UsmanNo ratings yet

- Prosultative Selling - Mike PilcherDocument119 pagesProsultative Selling - Mike PilcherMike PilcherNo ratings yet

- Chapter 1Document8 pagesChapter 1Rizalyn Jo YanosNo ratings yet

- Need For The StudyDocument7 pagesNeed For The StudyKalyan RagampudiNo ratings yet

- Top SupermarketsDocument3 pagesTop SupermarketsAvinash GowdaNo ratings yet

- Business Model Canvas For 'The Vanity Fur' - Pet Care StartupDocument2 pagesBusiness Model Canvas For 'The Vanity Fur' - Pet Care StartupVedant KarnatakNo ratings yet

- Accounting Techniques For Decision MakingDocument24 pagesAccounting Techniques For Decision MakingRima PrajapatiNo ratings yet

- Ias 8Document7 pagesIas 8Jan Joshua Paolo GarceNo ratings yet

- B. Com (CA) SyllabusDocument70 pagesB. Com (CA) SyllabusBhaskar ReddyNo ratings yet

- Operations Management: Emin IlyasDocument24 pagesOperations Management: Emin IlyasAsifIsmayilovNo ratings yet

- Million Dollar BrandDocument13 pagesMillion Dollar BrandkyleNo ratings yet

- Assignment 20 09 20Document9 pagesAssignment 20 09 20Sherwin AuzaNo ratings yet

- Comparing Alternative Approaches To Calculating Long-Run Incremental CostDocument20 pagesComparing Alternative Approaches To Calculating Long-Run Incremental CostCore ResearchNo ratings yet