Professional Documents

Culture Documents

I Management Programme/ Post Graduate Diploma in Financial Markets Practice Term-End Examination December, 2019

Uploaded by

Rohit Ghuse0 ratings0% found this document useful (0 votes)

11 views2 pagesOriginal Title

MFP-01

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views2 pagesI Management Programme/ Post Graduate Diploma in Financial Markets Practice Term-End Examination December, 2019

Uploaded by

Rohit GhuseCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

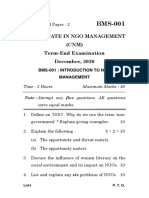

No.

of Printed Pages : 2 I MFP-001

MANAGEMENT PROGRAMME/

POST GRADUATE DIPLOMA IN FINANCIAL

MARKETS PRACTICE

Term-End Examination

December, 2019

1 1:3

MFP-001 : EQUITY MARKETS

Time : 3 hours Maximum Marks : 100

(Weightage : 70%)

Note : Attempt any five questions. All questions carry

equal marks.

1. Define Risk. Discuss the different types of risks

in the market.

2. Describe the structure and legal framework of

the Reserve Bank of India (RBI). What are the

functions of the RBI ? Discuss the roles and

responsibilities of the RBI.

3. Explain Book Building. What are the steps

involved in issue of equity shares using the book

building process ? Discuss the benefits and

limitations of book building issue.

MFP-001 1 P.T.O.

4. Describe the process of order execution. Discuss

the different types of order execution in

Securities trading.

5. Why should an investor develop an investment

philosophy before actually investing ? Discuss

the popular investment styles.

6. Explain the classification of Financial Ratios.

Describe the analysis and significance of

different financial ratios.

7. Define 'Dividends'. Why do corporates provide

dividends to investors ? What are the important

dates that need to be taken care of while

adjusting the stock prices ?

8. Write short notes on any four of the following :

(a) Anchor Investor

(b) Order Books

(c) Over-the-Counter Exchange of India

(d) Underwriting

(e) Stock Lending

MFP-001 2 1,500

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- MES-013 Dec 2013Document2 pagesMES-013 Dec 2013Rohit GhuseNo ratings yet

- MES-015 Dec 2013Document2 pagesMES-015 Dec 2013Rohit GhuseNo ratings yet

- MES-014 Dec 213Document2 pagesMES-014 Dec 213Rohit GhuseNo ratings yet

- MES-012 Dec 2013Document2 pagesMES-012 Dec 2013Rohit GhuseNo ratings yet

- MES-012 June 2014Document2 pagesMES-012 June 2014Rohit GhuseNo ratings yet

- MES-013 June 2014Document2 pagesMES-013 June 2014Rohit GhuseNo ratings yet

- MES-015 June 2014Document2 pagesMES-015 June 2014Rohit GhuseNo ratings yet

- Bachelor'S Degree Programme Term-End Examination June, 2019 (Application Oriented Course)Document4 pagesBachelor'S Degree Programme Term-End Examination June, 2019 (Application Oriented Course)Rohit GhuseNo ratings yet

- MES-015 Dec 2014Document2 pagesMES-015 Dec 2014Rohit GhuseNo ratings yet

- (Application Oriented Course) Asp-001: Secretarial PracticeDocument4 pages(Application Oriented Course) Asp-001: Secretarial PracticeRohit GhuseNo ratings yet

- Term-End Examination, 2019 Elective Course: Commerce ECO-001Document4 pagesTerm-End Examination, 2019 Elective Course: Commerce ECO-001Rohit GhuseNo ratings yet

- MES-011 Dec 2014Document2 pagesMES-011 Dec 2014Rohit GhuseNo ratings yet

- MES-011 Dec 2013Document2 pagesMES-011 Dec 2013Rohit GhuseNo ratings yet

- MES-011 June 2014Document2 pagesMES-011 June 2014Rohit GhuseNo ratings yet

- Term-End Examination December, 2019 Mc0-01: Organisation Theory and BehaviourDocument4 pagesTerm-End Examination December, 2019 Mc0-01: Organisation Theory and BehaviourRohit GhuseNo ratings yet

- CNCC-1: Certificate in Nutrition and Child Care (CNCC) Term-End Examination December, 2019Document12 pagesCNCC-1: Certificate in Nutrition and Child Care (CNCC) Term-End Examination December, 2019Rohit GhuseNo ratings yet

- Management Programme/ Post Graduate Diploma in Financial Markets Practice Term-End Examination December, 2019 MFP 002Document2 pagesManagement Programme/ Post Graduate Diploma in Financial Markets Practice Term-End Examination December, 2019 MFP 002Rohit GhuseNo ratings yet

- Certificate Programme in Food:And Nutrition (CFN) Term-End Examination December, 2019Document8 pagesCertificate Programme in Food:And Nutrition (CFN) Term-End Examination December, 2019Rohit GhuseNo ratings yet

- Post Graduate Diploma in International Business Operations/Master of Commerce Term-End Examination Deoember, 2019Document8 pagesPost Graduate Diploma in International Business Operations/Master of Commerce Term-End Examination Deoember, 2019Rohit GhuseNo ratings yet

- 4462 CNCC-2: Certificate in Nutrition and Child Care (CNCC) Term-End Examination December, 2019Document8 pages4462 CNCC-2: Certificate in Nutrition and Child Care (CNCC) Term-End Examination December, 2019Rohit GhuseNo ratings yet

- Term End Examination, 2019: No. of Printed Pages: 6 MCO-007 Master of CommerceDocument6 pagesTerm End Examination, 2019: No. of Printed Pages: 6 MCO-007 Master of CommerceRohit GhuseNo ratings yet

- Certificate Programme in Food and Nutrition (CFN) Term-End Examination December, 2019Document11 pagesCertificate Programme in Food and Nutrition (CFN) Term-End Examination December, 2019Rohit GhuseNo ratings yet

- Certificate in Nutrition and Child Care Term EndDocument7 pagesCertificate in Nutrition and Child Care Term EndRohit GhuseNo ratings yet

- Master of Commerce Term-End Examination December, 2019: No. of Printed Pages: 8Document8 pagesMaster of Commerce Term-End Examination December, 2019: No. of Printed Pages: 8Rohit GhuseNo ratings yet

- Certificate in Business Skills/ Bachelor'S Degree Programme Term-End Examination February, 2021 Bcoa-001: Business Communication and EntrepreneurshipDocument3 pagesCertificate in Business Skills/ Bachelor'S Degree Programme Term-End Examination February, 2021 Bcoa-001: Business Communication and EntrepreneurshipRohit GhuseNo ratings yet

- Certificate in Ngo Management (CNM) Term-End Examination December, 2020Document2 pagesCertificate in Ngo Management (CNM) Term-End Examination December, 2020Rohit GhuseNo ratings yet

- Master of Commerce (M. Com.) Term-End Examination December, 2019Document8 pagesMaster of Commerce (M. Com.) Term-End Examination December, 2019Rohit GhuseNo ratings yet

- Master of Commerce Term-End Examination December, 2019: No. of Printed Pages: 12Document12 pagesMaster of Commerce Term-End Examination December, 2019: No. of Printed Pages: 12Rohit GhuseNo ratings yet

- ÑZMVH$ Àma ( H$ H$M'©H $ - ( R.NR - NR.) ( ( ZM Gìm V Narjm /$adar, NR - Gr.Amo. DM (Uá' - Àma ( H$ NMR 'H $Document20 pagesÑZMVH$ Àma ( H$ H$M'©H $ - ( R.NR - NR.) ( ( ZM Gìm V Narjm /$adar, NR - Gr.Amo. DM (Uá' - Àma ( H$ NMR 'H $Rohit GhuseNo ratings yet

- Certificate Programme in Food and Nutrition Term-End ExaminationDocument8 pagesCertificate Programme in Food and Nutrition Term-End ExaminationRohit GhuseNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)