Professional Documents

Culture Documents

Case 1: Patent 1: Requirements

Uploaded by

Clarito, Trisha Kareen F.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 1: Patent 1: Requirements

Uploaded by

Clarito, Trisha Kareen F.Copyright:

Available Formats

Trisha Kareen F.

Clarito

BSA 2

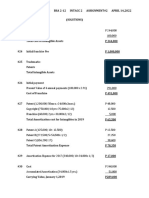

Case 1: Patent 1

Requirements:

a. Provide the adjusting entries.

Entries Made (EM)

2021

July 1 Patent- 1 P 120,000

Cash P 120,000

#

Dec. 31 Amortization expense P 5,000

Accumulated amortization P 5,000

#

2022

July 1 Patent P 35,000

Cash P 35,000

#

Dec. 31 Amortization expense P 12,500

Accumulated amortization P 12,500

#

Should be Entries (SBE)

2021

July 1 Patent - 1 P 120,000

Cash P 120,000

#

Dec. 31 Amortization expense P7,500

Accumulated amortization P 7,500

#

2022

July 1 Other expenses P 35,000

Cash P 35,000

#

Dec. 31 Amortization expense P 15,000

Accumulated amortization P 15,000

#

Adjusting Journal Entries (AJE)

2021

Dec. 31 Amortization expense P 2,500

Accumulated amortization P 2,500

#

2022

July 1 Other expenses P35,000

Patent P 35,000

#

Dec. 31 Amortization expense P 2,500

Accumulated amortization P 2,500

#

b. Compute for the adjusted balances of the accounts related to Patent 1

2021 2022

Patent 1 120,000 120,000

Accumulated amortization (7,500) (22,500)

Amortization expense 7,500 15,000

Other expenses 35,000

Purchased on Patent 1 P 120,000

less: Amortization (120,000/8) (15,000) x 6/12 (7, 500)

Patent 1 on Dec 31, 2021 P 112,500

Patent 1 on Dec 31, 20x1 112,500

less: Amortization (120,000/8) (15,000)

Patent 1 on Dec 31, 2022 P 97,500

Accumulated amortization 2021 P 7,500

Accumulated amortization 2022 (7,500+ 15,000) 22,500

Other expenses 2022 35,000

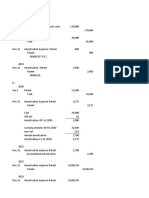

Case 2: Patent 2

a. Provide the adjusting entries.

Entries Made (EM)

2021

Dec. 31 Patent- 2 P 200,000

Cash P 200,000

#

2022

Sept. 1 R&D expense P 60,000

Cash P 60,000

#

Dec. 31 Amortization expense P 8,000

Accumulated amortization P 8,000

#

Should be Entries (SBE)

2021

Dec. 31 R&D expense P 200,000

Cash P 200,000

#

2022

Sept. 1 Patent-2 P 60,000

Cash P 60,000

#

Dec. 31 Amortization expense P 1000

Accumulated amortization P 1000

#

Adjusting Journal Entries (AJE)

2021

Dec. 31 R&D expense P 200,000

Cash P 200,000

#

2022

Sept. 1 Patent-2 P 60,000

R&D expense P 60,000

#

Dec. 31 Accumulated amortization P 7,000

Amortization expense P 7,000

#

b. Compute for the adjusted balances of the accounts related to Patent 2

Patent 2 on Dec 31, 2021 0

Research and Development cost 200,000

Accumulated amortization 2022 1,000

Registration of Patent 2 60,000

Less: Amortization (60,000/20) x 4/12 (1,000)

Patent 2 on Dec 31, 2022 59,000

1. Patent 2 (net 2021) = P 0

2. Patent 2 (net 2022) = P 59,000

3. Accumulated amortization 2021= P 0

4. Accumulated amortization 2022= P 1,000

5. R&D Expense = P 200,000

Case 3: Organization Cost

a. Provide the adjusting entries.

Entries Made (EM)

2021

Organization costs P 80,000

Cash P 80,000

#

Amortization expense P 16,000

Accumulated amortization P 16,000

#

2022

Amortization expense P 16,000

Accumulated amortization P 16,000

#

Should be Entries (SBE)

2021

Other expenses P 80,000

Cash P 80,000

#

Adjusting Journal Entries (AJE)

2021

Other expenses P 80,000

Organization costs P 80,000

#

Accumulated amortization P 16,000

Amortization expense P 16,000

#

2022

Accumulated amortization P 16,000

Amortization expense P 16,000

#

b. Compute for the adjusted balances of the accounts related to Organization cost

1. Organizational expense 2021= P 80,000

2. Organizational expense 2022= P 0

Case 4: Software costs

a. Provide the adjusting entries.

Entries Made (EM)

2021

Dec. 31 Software costs P 100,000

Cash P 100,000

#

2022

Dec. 31 Software costs P 90,000

Cash P 90,000

#

Amortization expense P 10,000

Accumulated amortization P 10,000

#

Should be Entries (SBE)

2021

Dec. 31 R&D expense P 100,000

Cash P 100,000

#

2022

Dec. 31 R&D expense P 90,000

Cash P 90,000

#

Adjusting Journal Entries (AJE)

2021

Dec. 31 R&D expense P 100,000

Software costs P 100,000

#

2022

Dec. 31 R&D expense P 90,000

Software costs P 90,000

#

Accumulated amortization P 10,000

Amortization expense P 10,000

#

b. Compute for the adjusted balances of the accounts related to Software cost

1. Software Cost 2021 = P 0

2. Software Cost 2022= P 0

3. R&D Expense 2021= P 100,000

4. R&D Expense 2022= P 90,000

Case 5: Adjusted Balances

2021 2022

Patent 1 P 120,000 P 120,000

Accumulated amortization (7,500) (22,500)

Patent 2 0 60,000

Accumulated amortization 0 (1,000)

Organization costs 0 0

Accumulated amortization 0 0

Software costs 0 0

Accumulated amortization 0 0

Amortization expense 7,500 16,000

R&D expense 300,000 90,000

Other expenses 80,000 35,000

You might also like

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Jackson Kervin Rey G. Intacc 189 Activity 1 Unit 4 1Document8 pagesJackson Kervin Rey G. Intacc 189 Activity 1 Unit 4 1Kervin Rey JacksonNo ratings yet

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDocument7 pagesFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNo ratings yet

- 4Q Week 2 BK Group ActDocument11 pages4Q Week 2 BK Group ActReymsoNo ratings yet

- Exercise Number 8 (E08) : InvestmentsDocument12 pagesExercise Number 8 (E08) : Investmentszhyrus macasilNo ratings yet

- M2.3e Diy-Problems (Answer Key)Document7 pagesM2.3e Diy-Problems (Answer Key)Liandrew MadronioNo ratings yet

- SbaDocument4 pagesSbaahyenn cabello100% (1)

- Financial Statement ExampleDocument12 pagesFinancial Statement ExampleRhem Capisan100% (1)

- Joint Arrangement Answer KeyDocument8 pagesJoint Arrangement Answer KeyMonica DespiNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- Domondon - Acctg 3 - Prelim Quiz 1Document2 pagesDomondon - Acctg 3 - Prelim Quiz 1Prince Anton DomondonNo ratings yet

- Arias, Kyla Kim B. - Midterm Project October 8,2021Document6 pagesArias, Kyla Kim B. - Midterm Project October 8,2021Kyla Kim AriasNo ratings yet

- ACC5116 - HOBA - Additional ProblemsDocument6 pagesACC5116 - HOBA - Additional ProblemsCarl Dhaniel Garcia Salen100% (1)

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- Gonzales, Ian Rogel L. - Assignment #2Document4 pagesGonzales, Ian Rogel L. - Assignment #2GONZALES, IAN ROGEL L.No ratings yet

- ReSA B46 AFAR Final PB Exam Questions Answers SolutionsDocument24 pagesReSA B46 AFAR Final PB Exam Questions Answers SolutionsJohair BilaoNo ratings yet

- RESA FAR PreWeek (B43)Document10 pagesRESA FAR PreWeek (B43)MellaniNo ratings yet

- ENG - Jawaban Mojakoe Akuntansi Keuangan 1 UAS Genap 2021 - 2022Document8 pagesENG - Jawaban Mojakoe Akuntansi Keuangan 1 UAS Genap 2021 - 2022Reta AzkaNo ratings yet

- Accounting ExamDocument14 pagesAccounting ExamSally SalehNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Prelim Exam - Attempt Review (Page 2 of 50)Document1 pagePrelim Exam - Attempt Review (Page 2 of 50)christoper laurenteNo ratings yet

- Mini Exercise Answer KeyDocument3 pagesMini Exercise Answer KeyKaren TumabiniNo ratings yet

- PDF Topic No 2 Statement of Cash Flows PDF - CompressDocument3 pagesPDF Topic No 2 Statement of Cash Flows PDF - CompressMillicent AlmueteNo ratings yet

- Topic No. 2 - Statement of Cash Flows PDFDocument3 pagesTopic No. 2 - Statement of Cash Flows PDFSARAH ANDREA TORRESNo ratings yet

- Problem 10Document2 pagesProblem 10ela kikayNo ratings yet

- Chapter 12Document7 pagesChapter 12Xynith Nicole RamosNo ratings yet

- 2019 Intacc2A MA1 CLiabilitiesDocument1 page2019 Intacc2A MA1 CLiabilitiesAlyssa MabalotNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Quiz Quiz 2 Single Entry and Cash Accrual Accounting PDFDocument28 pagesQuiz Quiz 2 Single Entry and Cash Accrual Accounting PDFluismorenteNo ratings yet

- Tugas Intangible AssetDocument31 pagesTugas Intangible AssetMonica0% (1)

- Adjusting EntriesDocument4 pagesAdjusting EntriesVeronica ShaneNo ratings yet

- IA Quiz ImadeDocument4 pagesIA Quiz ImadeKuro ZetsuNo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- I. Contingent Consideration Based On Future Earnings With Measurement Period Rule ApplicationDocument5 pagesI. Contingent Consideration Based On Future Earnings With Measurement Period Rule Applicationjerald cerezaNo ratings yet

- PRE BATTERY EXAM 2018 Part 1 FARDocument11 pagesPRE BATTERY EXAM 2018 Part 1 FARFrl RizalNo ratings yet

- Chapter 1 Illustrative Case 1 - AuditDocument7 pagesChapter 1 Illustrative Case 1 - AuditanonymousNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Quiz - Quiz 2 Single Entry and Cash Accrual AccountingDocument27 pagesQuiz - Quiz 2 Single Entry and Cash Accrual AccountingluismorenteNo ratings yet

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- AJE Yr End - 725106223Document20 pagesAJE Yr End - 725106223Nichole TanNo ratings yet

- 73264bos59105 Inter P1aDocument12 pages73264bos59105 Inter P1aRaish QURESHINo ratings yet

- Kier 2022Document7 pagesKier 2022Sander D. PeraNo ratings yet

- Unit 1 ActvitiesDocument6 pagesUnit 1 ActvitiesLeslie Mae Vargas ZafeNo ratings yet

- Bsa3b Ia Ipppe BaltazarDocument6 pagesBsa3b Ia Ipppe BaltazarElaine Joyce GarciaNo ratings yet

- Andiam: January 2, 2019Document5 pagesAndiam: January 2, 2019Avox EverdeenNo ratings yet

- This Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LDocument4 pagesThis Study Resource Was: A. B. C. D. E. F. G. H. I. J. K. LRian RorresNo ratings yet

- Mock Answers Far-1 Autumn 2022Document13 pagesMock Answers Far-1 Autumn 2022rana m harisNo ratings yet

- Pasahol-Far - Adusting Entries - Assignment 2Document5 pagesPasahol-Far - Adusting Entries - Assignment 2Angel PasaholNo ratings yet

- Assignment Auditing Problemmichelle PagulayanDocument7 pagesAssignment Auditing Problemmichelle PagulayanEsse ValdezNo ratings yet

- IV. Financial Study A. Project CostDocument13 pagesIV. Financial Study A. Project CostKeil Joshua VerdaderoNo ratings yet

- Global kons-COns ContractDocument2 pagesGlobal kons-COns ContractSandeep GyawaliNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- Investment in Associate ExercisesDocument7 pagesInvestment in Associate ExercisesJo KeNo ratings yet

- Mock QE Questionnaire - Second Year Answer KeyDocument30 pagesMock QE Questionnaire - Second Year Answer KeyBrian Daniel BayotNo ratings yet

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- San Beda College Alabang: INSTRUCTION: Worksheet PreparationDocument1 pageSan Beda College Alabang: INSTRUCTION: Worksheet PreparationMarriel Fate CullanoNo ratings yet

- Clarito, Trisha Bacostmx - Hw7 - Part 1Document4 pagesClarito, Trisha Bacostmx - Hw7 - Part 1Clarito, Trisha Kareen F.No ratings yet

- Clarito, Trisha Bacostmx - Hw7 - Part 2Document3 pagesClarito, Trisha Bacostmx - Hw7 - Part 2Clarito, Trisha Kareen F.No ratings yet

- ACTIVITY 01 - Accounting Environment and Accounting Framework (A.y 2022-2023)Document13 pagesACTIVITY 01 - Accounting Environment and Accounting Framework (A.y 2022-2023)Clarito, Trisha Kareen F.No ratings yet

- Final Exam 2021-2022Document10 pagesFinal Exam 2021-2022Clarito, Trisha Kareen F.No ratings yet

- An Introduction To Financial Management: Chapter OrientationDocument4 pagesAn Introduction To Financial Management: Chapter OrientationClarito, Trisha Kareen F.No ratings yet

- Research 101Document14 pagesResearch 101Clarito, Trisha Kareen F.No ratings yet

- Finals Output-AgadDocument16 pagesFinals Output-AgadClarito, Trisha Kareen F.No ratings yet

- Exchange Rate MechnismDocument16 pagesExchange Rate MechnismojasvitaNo ratings yet

- Reliance BP Mobility LimitedDocument63 pagesReliance BP Mobility LimitedMaheshNo ratings yet

- 2023-10-28 Sub Prime Mortgage Crisis V0.02amDocument13 pages2023-10-28 Sub Prime Mortgage Crisis V0.02amb23036No ratings yet

- Instructions For BiddingDocument3 pagesInstructions For BiddingEye RobeNo ratings yet

- 1.5-Case StudyDocument11 pages1.5-Case StudyPradeep Raj100% (1)

- Govt. Securities Market in India: Presentation OnDocument19 pagesGovt. Securities Market in India: Presentation OnHitesh PandeyNo ratings yet

- GO2 BankDocument1 pageGO2 Bank邱建华No ratings yet

- Chapter Two PDFDocument6 pagesChapter Two PDFKate PereiraNo ratings yet

- Commercial Law (UCC 3, 4, 9)Document23 pagesCommercial Law (UCC 3, 4, 9)Victoria Liu0% (1)

- Consumer Client Manual CitibankDocument32 pagesConsumer Client Manual CitibankGuillermo CarranzaNo ratings yet

- General AnnuityDocument15 pagesGeneral AnnuityJORENCE PHILIPP ENCARNACIONNo ratings yet

- Page: Papua New Guinea Constabulary StatementDocument6 pagesPage: Papua New Guinea Constabulary StatementJohn Asi TomanaNo ratings yet

- Re: Notice of Dishonor of Checks: 29 April 2017 Ms. Maria Clara 22 Fatima ST, Barangay Plainview, Mandaluyong CityDocument2 pagesRe: Notice of Dishonor of Checks: 29 April 2017 Ms. Maria Clara 22 Fatima ST, Barangay Plainview, Mandaluyong CitykookNo ratings yet

- Fac22a2 SuppDocument11 pagesFac22a2 Suppsacey20.hbNo ratings yet

- AC1101 Lesson 3 Discussion QuestionsDocument7 pagesAC1101 Lesson 3 Discussion QuestionsMTNo ratings yet

- FINA3020 Assignment3Document5 pagesFINA3020 Assignment3younes.louafiiizNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument20 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- CA Related Syllabus For 2024 - 2025Document4 pagesCA Related Syllabus For 2024 - 2025loganathanNo ratings yet

- Definition of Mutual FundDocument12 pagesDefinition of Mutual FundArnab GangopadhyayNo ratings yet

- F7 - C9 LeaseDocument48 pagesF7 - C9 LeaseNgô Thành DanhNo ratings yet

- Error CorrectionDocument5 pagesError CorrectionBea ChristineNo ratings yet

- Sbi - Google SearchDocument3 pagesSbi - Google SearchsubgNo ratings yet

- Bank Version Personal Financial StatementDocument9 pagesBank Version Personal Financial StatementJk McCrea100% (1)

- Question Paper Investment Banking and Financial Services-I (261) : October 2005Document22 pagesQuestion Paper Investment Banking and Financial Services-I (261) : October 2005api-27548664No ratings yet

- Cara Menghitung Ex-Factory Price (Contoh Soal)Document2 pagesCara Menghitung Ex-Factory Price (Contoh Soal)Gilang ArafatNo ratings yet

- Tally 9Document326 pagesTally 9raju_rch100% (1)

- Pledge - : Far 6810 - Receivable FinancingDocument3 pagesPledge - : Far 6810 - Receivable FinancingKent Raysil PamaongNo ratings yet

- Car FinanceDocument32 pagesCar FinanceAshish V MeshramNo ratings yet

- Img 20230315 0001Document6 pagesImg 20230315 0001Jeremiah PrintingNo ratings yet

- DLF Announces Annual Results For FY10: HistoryDocument7 pagesDLF Announces Annual Results For FY10: HistoryShalinee SinghNo ratings yet