Professional Documents

Culture Documents

CH 1

CH 1

Uploaded by

Kenneth Joshua Cinco Narit0 ratings0% found this document useful (0 votes)

7 views22 pagesOriginal Title

Ch1

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views22 pagesCH 1

CH 1

Uploaded by

Kenneth Joshua Cinco NaritCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 22

‘ACCOUNTING FOR PARTNERSHIPS

Basic Considerations and Formation

Learning Objectives:

after studying this chapter, you should be able to:

Define partnership. ,

Identify the characteristics of a partnership,

explain the advantages and disadvantages of a partnership.

Distinguish between partnership and corporation.

Identify and describe the different classifications of partnerships and the

different kinds of partners.

6. Outline the essential contents of the articles of partnership.

Summarize how a partnership is registered with SEC.

8. Explain the accounting differences between a sole proprietorship and a

partnership.

9. Distinguish between partner's capital and drawing accounts.

10. Discuss the fair value concept.

11. Prepare and explain the entries for partnership formation.

12. Describe a limited liability company.

“In this new wave of technology, you can’t do it all yourself, you have to

form alliances.” -- Carlos Slim Helu, 73, with $73 billion net worth, world’s

richest (The World’s Billionaires, Forbes, March 2013). ;

s billionaire’ Carlos Slim Helu learned early in his career: ‘that money

made his money creating

Telmex, he had to partner

is native Mexico's phone

Telecommunication

partnering is critical to helping ensure success. While Helu

Mexico's first privately owned telecommunications company,

with French and American telecom companies in order to take hi

service away from the government.

Both only 40 years old, Larry Page with $23 billion net worth and Sergey

Brin with $22.8 billion, ranked 20" and 21%, respectively (The World's

Billionaires, Forbes, March 2013). They are the founders of Google.

: t

| i xd. Since taki

Ilion. They erres

In 2003, Forbes estimated their collective worth 2 $1. 7 8 Hoa behind Gog

their Internet search engine public in August 200 , a0 illion each, 7

aaa arene bined fortune soar to $8.0 billon. IM 70° “in the case of Bri, e

Sees aoort schools. Both have math teacher FA a.cow, Russia at ag

wether was a research scientist at NASA. Brin erisrat

Page grew up in Lansing, Michigan.

+ stanford and dropp 1

prin met co-founder Page in a computer science Ph.» program a

out in 1998 to start Google from 2 fiends garage, The are guys solved the prob f

Google Guys, founded Google in Sept. 7, 199% irsite importance.

of search engines by developing an !

of Apple or Microsoft in a

years. And, in the October 2013 Forbes Richest Americans, eed eee om e

13" and 14°, respectively. Google is into satellite MappinBy onl a pein nt vs =

ews, YouTube and smartphones powered by Android. Brin heads Google X divisig

seh ie dedicated to breakthrough ideas like driverless cars and wearable comput

such as the Glass. Glass is an augmented-reality spectacles which will allow a user tod

tverything from chat on video to view Google Maps while walking. q

Google rocketed from being unknown to having the statu!

At the outset of their endeavor, the partnership form of business may have provid

Brin and Page the necessary advantages to start-up their software venture. How mi

should they contribute to the business considering its business potential? In what fo

will the investment be? How should the partners divide profits and losses? If ever, hi

should a partner who leaves the entity compensated for his share of the business?

BRIEF HISTORY

The idea of partnership is quite ancient. In 2200 B.C., Hammurabi, King of Babylo

provided for the regulation of partnerships. In ancient Rom i

: e, the

a societa. partnership was call

Partnership Act of 1890. In the US, the Uniform Pai

and the Uniform Limited Partnership Actin 1916, NP Act W9S approved in

In the Philippines, before the effectivit

; fectivity of the new Civil 3

Ce

are two types of partnerships: commercial and. civil Coen ee

. rcial or mer

Partnerships were governed by the Cod

par le of Com ivil

civil or non-commercial partnerships. eee ge hil Coe

2 I Dartnarchin and Paramenti

The new Civil Code repealed the provisions of th

civil partnerships. Rules from the two Amey

incorporated into the new Civil Code,

}e two codes relating to mercantile and

rican Uniform Partnership Acts were

DEFINITION

Ina contract of Partnership, wo omar persons ind

i themselves to contribute Mone)

\property))or industry to a common fund, ere meiremmmeniys ficie

Two oF more persons may also form a partnership for the exercise of a

themselves:

profession (Civil Code of the Philippines, Article 1767).

‘An association of two or more persons to carry on, as'co-owners, a business for profit

wer Partnership Act, Section 6).

The parthership has a juridical personality separate and distinct from thé

i iat of each of the

partners\(Civil Code of the Philippines, Article 1768). Thus, for example, where Vincent

Fabella and Wilhelmina Neis established a partnership, three persons are involved,

; the partnership and the partners, Fabella and Neis.

Partnerships resemble sole proprietorships, except that there are two or more owners of

the business. Each owner is called a partner. Partnerships are often formed to bring

together various talents and knowledge.

Partnerships provide a means of obtaining»

(ore equity capital than a single individual can obtain and allow the sharing of risks for...

* rapidly growing businesses.

A profession is an occupation that involves a higher education or its equivalent, and

mental rather than manual labor. Strictly speaking, the exercise of a profession is not a

business or an enterprise for profit but the,

|. Partnerships are generally associated, with

the practice of law, public accounting, medicine and other professions. Partnerships of

this nature are called, general professional partnerships. On the other hand, service

industries, retail trade, wholesale and manufacturing enterprises may also be organized

as partnerships.

« *

CHARACTERISTICS OF A PARTNERSHIP -

.s are different from the sole proprietorships already

re as follows:

The characteristics of partnership:

studied in basic accounting. Some of the more important characteristics a1

Mutual Contribution: There

15 which may either be personal manual efforts

Property.or:industry (i.e. work or service: ft

or intellectual) to a common fund.

Division of Profits or Losse§, The essence of partnership is thateachpartnermust share,

inthe profits orlosses of the venturens

Basic Considerations and Formation | 3

{ted into the pa |

Co-Ownership of Contributed Assets. All-assets:contribu on

owned by the.partnership'by virtue‘of its'separate’and distinct juridical-pers |

‘ne partner contributes an asset to the business, all partners jointly own it ina Pd

sense. |

Limited Life. A partnership has a fimited lifé: It may be dissolved by the’admission,

deaths insolvency; incapacity, withdrawal of a partner or expiration of the-term specified

in the partnership agreement.

Unlimited Liability. All-partners (except limited partners); including industrial partners,

ate-personally liable for all debts incurred'by the partnership. If the partnership can not

settle its obligations, creditors’ claims will be satisfied from the"personal-assets ofthe

Rartners.without prejudice.to.therightsofithesgparate.creditors of the parties”

income Taxes. Partrierships)except general professional partnerships, are subjecttotta

‘atthe rate of 30% (per R.A. No. 9337) of taxable income.

Partners’ Equity Accounts. Accounting for partnerships are much like accounting for

sole proprietorships. The difference lies in the number of partners’ equity accounts,

Each partner has a capital account and a withdrawal account that serves similar

functions as the related accounts for sole proprietorships.

’

«ADVANTAGES AND DISADVANTAGES OF A PARTNERSHIP’

A partnership offers certain advantages over a sole proprietorship and a corporation. It

also has a number of disadvantages, They are as follows:

‘Advantages versus Proprietorship

1. Brings'@f€ater-financial.capability to the biisiness,

2. Gombines'special sills; expertise-and-experiencesof the partners.

3. Offers relative freedonvand flexibility’ GF action in decision-making.

‘Advantages versus Corporations

1. Easienand:less’expensive to organize.

2. More.personaland informal.

‘Disadvantages’

1. Easily dissolved and thus.unstable compared to:acorporation. '

i Mutual agency and unimitedsiabilty may.create personal obligations o partners:

3. Lessieffective than a-corporation in raising large amounts of capital,

. 3 A

4 | Partnership and Corporation Accounting

PARTNERSHIP DISTINGUISHED FROM CORPORATION

Manner of Creation. A partnership is created by mere agreement of the partners while

a corporation is created by operation of law.

Number of Persons. Two or more persons may form a partnership; in a corporation, at

least five (5) persons, not exceeding fifteen (15).

commencement of Juridical Personality, in a partnership, juridical personality

commences from the execution of the articles of partnership; in a corporation, from the

issuance of certificate of incorporation by the Securities and Exchange Commission.

Management. In a partnership, every partner is an agent of the partnership if the

partners did not appoint a managing partner; in a corporation, management is vested on

the Board of Directors.

Extent of Liability. In a partnership, each of the partners except a limited partner is

liable to the extent of his personal assets; in a corporation, stockholders are liable only

to the extent of their interest or investment in the corporation.

Right of Succession. In a partnership, there is no right of succession; in a corporation,

there is right of succession, A corporation has the capacity of continued existence

regardless of the death, withdrawal, insolvency or incapacity of its directors or

stockholders.

Terms of Existence. in a partnership, for any period of time stipulated by the partners;

ina corporation, not to exceed fifty (50) years but subject to extension.

CLASSIFICATIONS OF PARTNERSHIPS

1. According to object:

‘A. Universal partnership of alll present property. All contributions become part of

the partnership fund. °

B. Universal partnership of profits. All that the partners may acquire by their

industry or work during the existence of the partnership and the use of

whatever the partners contributed at the time of the institution of the contract

belong to the partnership. If the articles of universal partnership did not

specify its nature, it will considered a universal partnership of profits.

. Particular partnership. The object of the partnership is determinate—its use or

fruit, specific undertaking, or the exercise of a profession or vocation.

2. According to liability:

‘A. General. All partners are liable to the extent of their separate properties.

fent of their personal

B, Limited, The limited partners are liable only to the ext

hat there shall be at

contributions. In a limited partnership, the law states tl

least one general partner.

Basic Considerations and Formation | 5

3. According to duration:

A. Partnership with a fixed term or for a particular undertaking.

‘ecified and is not formed for any

B. Partnership at will. One in which no term is SP!

particular undertaking.

4, According to purpose:

A. Commercial or trading partnership.

business.

B. Professional or non-trading partnership.

‘One formed for the transaction of

‘One formed for the exercise of

profession.

5. According to legality of existence:

A. De jure partnership. One which has complied with all the legal requirements

for its establishment.

B. De facto partnership. One which has failed to comply with all the legal

requirements for its establishment.

KINDS OF PARTNERS

1. General partner. One who is liable to the extent of his separate property after all

the assets of the partnership are exhausted.

2. Limited partner. One who is liable only to the extent of his capital contribution.

He is not allowed to contribute industry or services only.

3. Capitalist partner. One who contributes money or property to the common fund

of the partnership.

4. Industrial partner. One who contributes his knowledge or personal service to the

partnership. -

5. Managing partner. One whom the partners has appointed as manager of the

partnership. :

6. Liquidating partner. One who is designated to wind up or airs ofthe

partnership after dissolution. eee eee

7. Dormant partner. One who does'not take active part in the business of the

partnership and is not known as a partner,

8. Silent partner. One who does not take active part in’ the business of the

partnership though may be known as a partner,

9, Secret partner. One who takes active part in the business but is not known to be?

partner by outside parties.

10. Nominal partner or partner by estoppel. One who is actually not a partner bit

who represents himself as one. p

& | Dartnarchin and Carnoration Accounting

ARTICLES OF PARTNERSHIP

A partnership may be Constituted orally or in writing. In the latter case, partnership

agreements are embodied in the Articles of Partnership. The following essential

provisions may be contained in the agreement:

1. The partnership name, nature, purpose and location;

2, The names, citizenship and residences of the partners;

3. The date of formation and the duration of the partnership;

4

The capital contribution of each partner, the procedure for valuing non-cash

investments, treatment of excess contribution (as capital or as loan) and the

penalties for a partner's failure to invest and maintain the agreed capital;

5. The rights and duties of each partner;

6. The accounting period to be adopted, the nature of accounting records,

financial statements and audits by independent public accountants;

7, The method of sharing profit or loss, frequency of income measurement and

distribution, including any provisions for the recognition of differences in

contributions;

8. The drawings or salaries to be allowed to partners;

9. The provision for arbitration of disputes, dissolution, and liquidation.

A contract of partnership is void whenever immovable property or real rights are

contributed and a signed inventory of the said property is not made and attached to a

public instrument.

SEC REGISTRATION

When the partnership capital is P3,000 or more, in money or property, the public

instrument must be recorded with the Securities and Exchange Commission (SEC). Even

if it not registered, the partnership having a capital of P3,000 or more is still valid and

therefore has legal personality.

The SEC shall not register any corporation organized for the practice of public

accountancy (The Philippine Accountancy Act of 2004, Sec. 28).

‘The purpose of the registration is to set “a condition for the issuance of the licenses to

engage in business or trade. In this way, the tax liabilities of big partnerships cannot be

evaded, and the public can also determine more accurately their membership and

capital before dealing with them.” (Dean Capistrano, IV Civil Code of the Philippines)

Basic Considerations and Formation | 7

Bs

fe the basic steps to follow:

To register a partnership with the SEC, here ar

.e verification unit of SEC;

posed business name verified in th

me shall bear the word “Company” oF “Co.” and if it’s a

ited” or “Ltd.” A professional partnership

» "pssociates” or “Partners” or other similar

cular 5, Series 2008).

> Have your proy

The partnership na

limited partnership, the word "

may bear the word “Company,

descriptions (SEC Memorandum Cit

>» Submit the following documents:

= Articles of Partnership

= Verification Slip for the Business Name :

Written undertaking to change business name if required

er of each partner and/or that of the

= Tax identification: numb

partnership

= Registration data sheet for

copies

= Other documents that may be required:

endorsement from other government agencies if the proposed

partnership will engage in an industry regulated’ by the

partnership duly accomplished in six

government. .

* for partnership with foreign partners: SEC Form F-105, bank

certificate on the capital contribution of partners, proof of

remittance of contribution of foreign partners;

Pay the registration/filing and miscellaneous fees: filing fee equivalent to

1/5 of 1% of the partnership capital but not less than P1,000 and legal

research fee which is 1% of the filing fee;

>» Forward documents to the SEC Commissioner for signature.

ACCREDITATION TO PRACTICE PUBLIC ACCOUNTANCY

Certified public accountants (CPAs), firms and i ;

fi : , partnerships of CPAs, i

practice of public accountancy, including the partners and, staff nese oad

register with the Professional Regulation Commission and the Professional Regulatory

Board of Accountancy. The registration shall be renewed every three a (the

Philippine Accountancy Act of 2004, Sec. 31). The rules and regulations aig the

1 For example, for air transport, the endorsement will come fe a ,

Pavtations and social welfare organizations, from the Dep.of Social Welfae and. Developsrent. F!

prot education from the Dept. of Education, college from the Commission on incnar|euteassataa!

he Technical Education ills and Development Authority. For hospitals, dental

technical-vocational from t

erry cine and health maintenance orearizatons, rom the Dept of Hea For insurance and mut

penefit associations, from the Insurance Commsin, In the case of recruitment for overseas employments

from the Philippine Overseas Employment ‘Administration.

professional organizations,

=) naeenerchio and Corporation Accounting

accreditation for the practice of public accountancy are specified in Annex B of The Rules

and Regulations Implementing Republic Act 9298 otherwise known as the Philippine

Accountancy. Act of 2004.

[ACCOUNTING FOR PARTNERSHIPS

‘owners’ Equity Accounts

In Basic Accounting, generally accepted accounting principles were discussed in the

context of a sole proprietorship. These accounting principles also apply to a partnership.

Thus, the recording of assets, liabilities, income and expenses is consistent for both

proprietorships and partnerships. Comparing two businesses of the same nature, one

‘organized as a sole proprietorship and another as a partnership, there will be no marked

difference in their operations.

However, differences arise between the two forms of business concerning owners’

equity. For a proprietorship, there is only a single owner. Therefore, there is only.one

capital account and one drawing account. On the other hand, since a partnership has

‘two or more owners, separate capital and drawing accounts are established for each

partner.

A partner's capital account is credited for his initial and additional net investments

(assets contributed Jess liabilities assumed by the partnership), and credit balance of the

drawing account at the end of the period. It is debited for his permanent withdrawals

and debit balance of the drawing account at the end of the period.

‘Typically, partners do not wait until the end of the year to determine how much of the

profits they wish to withdraw from the partnership. To meet personal living expenses,

partners customarily withdraw money on a periodic basis throughout the year. A

partner's drawing account is debited to reflect assets temporarily withdrawn by him

from the partnership. At the end of each accounting period, the balances in the drawing

accounts are closed to the related capital accounts.

Partner's Capital Account

Debit Credit

1. Permanent withdrawals. 1. Original investment.

2. Debit balance of the drawing. 2, Additional investment.

account at the end of the period. | 3. Credit balance of the drawing

account at the end of the period.

Basic Considerations and Formation | 9

Partner's Drawing Account

Debit Credit

1, Share in profit (this may be

1. Temporary withdrawals.

credited directly to Capital).

2. Share in loss (this may be debited

directly to Capital).

ntion of permanently decreasing the

Permanent withdrawals are made with the inte

ade by the

partner's capital while temporary withdrawals are regular advances mi

partners in anticipation of their share in profit.

hdrawals provides a record of each

The use of drawing accounts for temporary wit 2

drawings in excess of the

partner’s drawings during an accounting period. Hence,

allowed amounts as stated in the partnership agreement may be controlled.

Notice that profit (or loss) is credited (or debited) either to the drawing account or to the

capital account. The choice of the account to credit or debit depends on the intention of

the partners, If they wish to maintain their capital accounts for investments and

permanent withdrawals, then profit or loss should be entered in the drawing account.

On the other hand, if the purpose of the partners is to make profit or loss part of their

capital, then the capital account should be used. In either case, the resulting partners’

ending capital balances will be the same.

On Sept. 6, 2007, the International Accounting Standards Board (IASB) issued a revised

International Accounting Standards (IAS) No. 1, Presentation of Financial Statements.

This standard supersedes the 2003 version of IAS 1 as amended in 2005. It’s common to

encounter “profit or loss” rather than usual “net income or net loss” as the descriptive

term used in the Statement of Comprehensive’ Income (the new title of the income

statement per revised IAS No. 1). The balance sheet is called the Statement of Financial

Position. The complete set of financial statements will be in Chapter 2.

Several Asian countries, whose Partnership Law have st

: trong resemblances to the

Partnership Act of 1890 of England, are using two or three accounts in the capital section

of the statement of financial position (as capital, drawings and current accounts). These

accounts and interest on drawings will be discussed in Chapter 2. :

Loans Receivable from or Payable to Partners

If a partner withdraws a substantial amount of money with the intention of repaying t

the debit should be to Loans Receivable-Partner account instead of to Partner’s Drawing

account, This account should be classified separately from the other receivables of the

partnership.

110 | Partnership and Corporation Accounting

‘A partner may lend amounts to the partnership in excess of his intended permanent

investment. These advances should be credited to Loans Payable-Partner account and

not to Partner's Capital account classified among the liabilities but separate from

liabilities to outsiders. This distinction is important in case of liquidation. Loans payable

to partners must be paid after the claims of outside creditors have been paid in full.

These loanis have priority over partners’ equity.

PARTNERSHIP FORMATION

Valuation of Investments by Partners

The books of the partnership are opened with entries reflecting the net contributions of

the partners to the firm. Asset accounts are debited for assets contributed to the

partnership, liability accounts are credited for any liabilities assumed by the partnership

and separate capital accounts are credited for the amount of each partner's net

investment (assets less liabilities).

Partners may invest cash or non-cash assets in the partnership. When a partner invests

non-cash assets, they are to be recorded at values agreed upon by the partners. In the

absence of any agreement, the contributions will be recognized at their fair market

values at the date of transfer to the partnership.

‘The fair market value of an asset is the estimated amount that a willing seller would

receive from a financially capable buyer for the sale of the asset in a free market. Per

International Financial Reporting Standards (IFRS) No. 3, fair value.is the price at which

an asset or liability could be exchanged in a current transaction between knowledgeable,

unrelated willing parties.

Adjustment of Accounts Prior to Formation

In cases when the prospective partners have existing businesses, their respective books

will have to be adjusted to reflect the fair market values of their assets or to correct

misstatements in the accounts. If the adjustments will not be made, the initial capital

balances of the partners may be inequitable.

llustration, A reconditioned printing equipment invested by Agapito Rubio was

recorded incorrectly in the partnership books at P730,000—its book value from the

proprietorship’s records. If the partnership immediately sold the printing equipment for

its fair market value of P800,000, the resulting P70,000 gain would increase the capital

balances of both Partners Agapito Rubio and Nora Bisana. The printing equipment

should have been recorded at P800,000 and Rubio ’s capital credited with P800,000.

Simply stated, increases in asset values accruing before formation should be for the

benefit of the contributing partner.

The adjustments of the assets and liabilities prior to formation will be similar to the

adjustments that we are already familiar with. However, when the adjustment involves

debit or credit to a nominal account, the Capital account would instead be debited or

Basic Considerations and Formation | 11

credited. This is so because the business has ceased to be a going concern. A business

Tot viewed as a going concern if liquidation appears imminent. For example, two sole

proprietorships will cease operations because of ‘their agreement to enter into a

partnership. Both proprietorships have ceased to be going concerns.

Illustration. Emerita Geron and Emerita Modesto formed a general professional

partnership. Emerita Geron will invest sufficient cash to get an equal interest in the

partnership while Emerita Modesto will transfer the assets and liabilities of her business,

“The account balances on the books of Modesto prior to partnership formation follows:

Debit Credit

Cash 180,000

Accounts Receivable 300,000

Office Equipment 41,500,000

Accumulated Depreciation . 600,000

Accounts Payable 155,000,

Salaries Payable 25,000

Emerita Modesto, Capital 1,200,000

It is agreed that for purposes of establishing Emerita Geron’s interest, the following

adjustments shall be made in the books of Emerita Modesto:

1. An allowance for uncollectible accounts of 5% of accounts receivable is to be

established.

Prepaid expenses amounting to P30,000 were omitted by the accountant. This is to

be recognized.

3. Additional salaries payable in the amount of P10,000 is to be established.

To understand the adjustments that will be made prior to formation, it will be helpful to

review the basics. The book—Basic Financial Accounting and Reporting Made Easy

2018 Edition by Prof. WIN Ballada ably discussed the basi¢s of accounting in a mannef

similar to the following: c

The accounting equation states that assets must iabiliti

always equal liabi

equity. The basic accounting model is: : boat aay

Assets = abilities + ‘Owner's Equity

Note that the assets are on the left side of the equation opposite the liabilities and

owner's equity. This explains why increases and decreases in assets are recorded in

the opposite manner as.liablities and owner's equity are recorded, The equation also

explains why liabilities and capital follow the same rules of debit and eee a low

of debiting and crediting is related to the accounting equation. ;

‘Accounting is based on a double-entry system which means that the dual effects of@

business transaction are recorded. A debit side entry must have’a corresponding

credit side entry. For every transaction, there must be one or more accounts debited

and one or more accounts credited. Each transaction affects at least two accounts-

The total debits for a transaction must always equal the total credits.

12 | Partnership and Corporation Accounting

The account type determines how increases and decreases in it are recorded.

Increases in assets are recorded as debits (left side of the account) while decreases in

assets are recorded as credits (on the right side). Conversely, increases in liabilities

and owner's equity are recorded by credits; decreases in liabilities and owner's equity

are recorded by debits.

The rules of debit and credit for income and expense accounts are based on the

relationship of these accounts to owner's equity. Income increases owner's equity

and expense decreases owner's equity. Hence, increases in income are recorded as

credits and decreases as debits. Increases in expenses are recorded as debits and

decreases as credits. These are the rules of debit and credit.

Using the accounting equation approach of analysis, the adjustments are as follows:

Assets = Liabilities + =~ Owner's Eat

1 -P15,000 = + -P15,000

2 + 30,000 + +30,000

3 +4P10,000 + = 10,000

+P15,000 4P10,000__— + $P 5,000

+P15,000, = +P15,000,

Entries and Explanations:

1. An allowance of 5% of P300,000 or P25,000 needs to be established. The account Allowance

for Uncollectible Accounts is a contra-asset account. When this account is increased, the

effect is to decrease the related asset account. The owner's equity is also decreased since this

provision for uncollectibles is considered as an expense in the ordinary course of business.

Emerita Modesto, Capital 15,000 :

Allowance for Uncollectible Accts. 15,000

2. An omission to record the asset—prepaid expenses will denote that the expenses of the

business are overstated. When the expenses are overstated, profit and correspondingly the

owner's equity is understated. To recognize the prepaid expense, the entry will be:

Prepaid Expenses 30,000

Emerita Modesto, Capital 30,000

3. The establishment of additional salaries payable will increase liabilities. It can be deduced that

the salaries expenses are understated and to correct the misstatement the owner's equity will

bbe decreased,

Emerita Modesto, Capital 10,000

Salaries Payable 10,000

The adjustments prior to formation will entail debits or credits to asset or liability

accounts. To maintain the double entry system of accounting, a corresponding debit or

Credit to owner's equity account will be made. The following T-account will serve to

Summarize the necessary adjustments to the capital account:

Basic Considerations and Formation | 13,

‘Owner's Equity Account |

/

Debit * Credit J

1. Decrease in asset. 1, Increase in asset.

2. Increase in liability. 2. Decrease in liability.

3, Increase in contra-asset. | 3, Decrease in contra-asset-

Opening Entries of a Partnership Upon Formation

Apartnership may be formed in any of the following ways:

1. Individuals with no existing business form a partnership.

2... Conversion of a sole proprietorship to a partnership. ’

a. A sole proprietor and an individual without an existing

business form a partnership.

b. Two or more sole proprietors form a partnership.

3, Admission or retirement of a partner (to be covered in Chapter 3).

Individuals with No Existing Business Form a Partnership

‘The opening entry to recognize the contributions of each partner into the partnership is

simply to debit the assets contributed, and to credit the liabilities assumed and the

capital account of each partner.

Mlustration. On July 1, 2018, Nilo Burgos and. Helenita Ruiz agreed to form a

partnership. The partnership agreement specified that Burgos is to invest cash of

P700,000 and Ruiz is to contribute land with a fair market value of P1,300,000 with

300,000 mortgage to be assumed by the partnership. The entries are as follows:

Cash 700,000

ane be 1,300,000

lortgage Payable 300,04

Nilo Burgos, Capital 700,000

Helenita Ruiz, Capital 2,000,000

To record the initial investments =

of Burgos and Ruiz. :

After the formation, the statement of financial position of the partnership is:

Burgos and Ruiz

Statement of Financial Position

July 1, 2018

. Assets

Cash P 700,000

tand 1,300,000

Total Assets 2,000,000.

14 | Partnership and Corporation Accounting

ities and Owners’ Equity

Mortgage Payable

Nilo Burgos, Capital

Helenita Ruiz, Capital

Total Liabilities and Owners’ Equity

Ilustration. Suppose that Burgos and Ruiz formed another partnership with Nora

Elizabeth Maniquiz. Burgos and Ruiz considered Maniquiz who has a vast business

network in Bicol as an industrial partner. The partnership did not receive any asset from

Maniquiz. In this case, only a memorandum entry in the general journal will be made.

ASole Proprietor and Another Individual Form a Partnership

‘A sole proprietor may consider forming a partnership with an individual who has no

existing business. Under this type of formation, the assets and the liabilities of the

proprietorship will be transferred to the newly formed partnership at values agreed

upon by all the partners or at their current fair prices,

Illustration. The statement of financial position of Galicano Del Mundo on Oct. 1, 2018,

‘before accepting Christine Resultay as partner is shown as follows:

Galicano Del Mundo

Statement of Financial Position

Oct. 1, 2018

Assets

Cash "60,000

Notes Receivable 30,000

Accounts Receivable 240,000

Less: Allowance for Uncollectible Accts. 10,000 230,000

Merchandise Inventory 80,000

Furniture and Fixtures 60,000

Less: Accumulated Depreci 6,000__ 54,000

Total Assets P454,000

Liabilities and Owner's Equity

Notes Payable P 40,000

‘Accounts Payable 100,000

Galicano Del Mundo, Capital 314,000

Total Liabilities and Owner's Equity 454,000

Christine Resultay offered to invest cash to get a capital credit equal to one-half of

Galicano Del. Mundo’s capital after giving effect to the adjustments'below. Del Mundo

accepted the offer. ‘

Basi¢ Considerations and Formation | 15

‘The merchandise is to be valued at P74,000.

2, The accounts receivable is estimated to be 95% collectible.

3. Interest accrued on the notes receivable will be recognized: P10,000, 12%

dated July 1, 2018 and P20,000, 12% dated August 1, 2018. i

4.

Interest on notes payable to be accrued at 14% annually from Apr. 4

2018.

5. The furniture and fixtures are to be valued at P46,000.

6. Office supplies on hand that have been charged to expense in the past

amounted to P4,000. These will be used by the partnership.

New books for the Partnership (required per National Internal Revenue Code)

‘The following procedures may be used in recording the formation of the

partnership:

Books of Galicano Del Mundo:

1. Adjust the assets and liabilities of Galicano Del Mundo in accordance with

the agreement. Adjustments are to be made to his capital account.

2. Close the books.

Books of the Partnership:

1. Record the investment of Galicano Del Mundo.

2. Record the investment of Christine Resultay.

Following the procedures, the entries are:

{, Books of Galicano Del Mundo

(a)

Galicano Del Mundo, Capital® 14,100

Office Supplies 4,000

Interest Receivable” 700

‘Merchandise Inventory! 6,009

Allowance for Uncollectible Accounts? 2,000

Interest Payable* 2,800

Accumulated Depreciation* 8,000

To record adjustments to

restate Del Mundo’s capital,

(2) :

Notes Payable 40,000

Accounts Payable 100,000

Interest Payable 2,800 3

Allowance for Uncollectible Accts. 32,000

‘Accumulated Depreciation 14,000

16 | Partnership and Corporation Accounting

Galicano Del Mundo, Capital 299,900

Cash 60,000

Notes Receivable 30,000

Accounts Receivable 240,000

Interest Receivable 700

Merchandise Inventory 74,000

Office Supplies 4,000

Furniture and Fixtures 60,000

To close the books of Del Mundo.

Books of the Partnership

(a)

Cash 60,000

* Notes Receivable 30,000

Accounts Receivable 240,000

Interest Receivable 700

Merchandise Inventory 74,000

Office Supplies 4,000

Furniture and Fixtures” 46,000

Notes Payable 40,000

Accounts Payable 100,000

Interest Payable 2,800

Allowance for Uncollectible Accounts 12,000

Galicano Del Mundo, Capital 299,900

To record the investment of Del Mundo.

(2)

Cash® 149,950

Christine Resultay, Capital 149,950

To record the investment of Resultay.

= Computations:

1. Merchandise Inventory, per ledger 80,000

Merchandise Inventory, as agreed 74,000

Decrease in Merchandise Inventory P.6,000

2. Accounts Receivable, net per ledger 230,000

Accounts Receivable, net as agreed

(P240,000 x 95%) 228,000

Increase in Allowance P2,000

3. Interest accrued on Notes Receivable: Interest = Principal x Rate x Time

‘On P10,000: 10,000 x 12% x 3/12 300

‘On P20,000: 20,000 x 12% x 2/12 400

e700

4, Interest accrued on Notes Payable:

‘on P40,000: 40,000 x 14% x 6/12 2,800

Basic Considerations and Formation | 17

5, Furniture and,

Furniture and Firtres, net a5 agreed 46,000 '

Increase in Accumulated Depreciation 8,000 /

6. Net effect of adjustments on Capital: /

Decrease in Merchandise Inventory (6,000)

Increase in Allowance for Uncollectibles (2,000)

Increase in Interest Receivable 700

(2,800)

Increase in Interest Payable

Increase in Accumulated Depreciation (8,000)

Increase in Office Supplies — 4,000

Decrease in Capital (24.100)

7. Furniture and Fixtures, cost per books 60,000

Furniture and Fixtures, cost as agreed 46,000

\Writedown of Furniture and Fixtures 14,000

314,000

8, Galicano Del Mundo, Capital before adjustment

Net Adjustments to Capital 14,100

Galicano Del Mundo, Capital after adjustment P299,900

‘Agreed Capital Credit for Christine Resultay 50%

Cash Investment of Christine Resultay 149,950

After the formation, the statement of financial position of the newly formed

partnershil

Del Mundo and Resultay

Statement of Financial Position

Oct. 1, 2018

Assets

cash

Nts Reco 000

‘Accounts Receivable 240,000 ’

|. Less: Allowance for Uncollectible Accts. 12

Interest Receivable mae

Merchandise Inventory io

Office Supplies. 74000,

Furniture and Fixtures 008

Total Assets Se

P592,650

bilities and Owners’ Equity

. Notes Payable

Accounts Payable Foe

Interest Payable oe

Galicano Del Mundo, Capital oper

299,300

Christine Resultay, Capital

Total Liabilities and Owners’ Equity ~p502,650°

592,650

18 | Partnership and Corporation Accounting

Note that furniture and fixtures are now recorded in the partnership books at

the agreed amount of P46,000 which represented the cost of the asset to the

partnership. On the other hand, the accounts receivable is still recorded at

gross amount of P240,000 with a related allowance for uncollectible accounts

of P12,000. The P12,000 is only a provision for possible uncollectibles.

two or More Sole Proprietors Form a Partnership

illustration. On June 30, 2018, Deogracia Corpuz and Esterlina Gevera, friendly

competitors in a certain line of business, decided to combine their talents and capital to

form a partnership. Their statements of financial position are as follows:

Deogracia Corpuz

Statement of Financial Position

June 30, 2018

Assets

Cash P 50,000

Accounts Receivable 100,000

Merchandise Inventory 80,000

Furniture and Fixtures si 60,000

Total Assets 290,000

Liabilities and Owner's Equity

‘Accounts Payable P 30,000

Deogracia Corpuz, Capital

Total Liabilities and Owner's Equity

Esterlina Gevera

Statement of Financial Position

June 30, 2018 :

Assets

Cash P 40,000

‘Accounts Receivable 7 80,000

Merchandise Inventory 100,000

Delivery Equipment 90,000

Total Assets 310,000

Liabilities and Owner's Equity

Accounts Payable P 60,000

Esterlina Gevera, Capital 250,000

Total Liabilities and Owner's Equity 310,000

Basic Considerations and Formation | 19

The ‘conditions. avid adjustments agreed upon by the partners for Punposes of j

determining their interests in the partnership are:

tion on Corpuz proprietorship’s cash

ded expenses of P3,500.

1. Actual count and bank reconcil

account revealed cash short and unrecor

Establishment of 10% allowance for uncollectible accounts in each book,

‘The merchandise inventory of Gevera is to be increased by P10,000.

The furniture and fixtures of Corpuz are to be depreciated by P6,000.

yerun

‘The delivery equipment of Gevera is to be depreciated by P9,000.

New books for the Partnership (required per National internal Revenue Code)

The following procedures

partnership:

Books of Deogracia Corpuz and Esterlina Gevera:

41. Adjust the accounts of both parties in accordance with the agreement.

Adjustments are to be made to their respective capital accounts.

2. Close the books.

may be used in recording the formation of the

Books of the Partnership:

1. Record the investment of Deogracia Corpuz.

2. Record the investment of Esterlina Gevera.

Following the procedures, the entries are:

Books of Deogracia Corpuz

(a)

Deogracia Corpuz, Capital 19,500,

% Cash

Allowance for Uncollectible Accounts a

Accumulated Depreciation “6000

To record adjustments to ;

restate Corpur's capital.

(2)

Accounts Payable 30,000

Allowance for Uncollectible Accts. 10,000

‘Accumulated Depreciation 6000

Deogracia Corpuz, Capital 240,500

Cash : 46,500

Accounts Receivable 100,000

Merchandise Inventory 80,000 -

Furmiture and Fixtures 60,000

To close the books of Corpuz.

20 | Partnership and ‘Corporation Accounting

Books of Esterlina Gevera

(a)

Merchandise Inventory 10,000

Esterlina Gevera, Capital 7,000

‘Allowance for Uncollectible Accounts

‘Accumulated Depreciation

To record adjustments to restate

Gevera’s capital.

(2)

‘Accounts Payable 60,000

Allowance for Uncollectible Accts. 8,000

‘Accumulated Depreciation 9,000

Esterlina Gevera, Capital 243,000

Cash

Accounts Receivable

Merchandise Inventory

Delivery Equipment

To close the books of Gevera.

Books of the Partnership

(a)

Cash 46,500

‘Accounts Receivable 100,000

Merchandise Inventory 80,000

Furniture and Fixtures 54,000

‘Accounts Payable

Allowance for Uncollectible Accts.

Deogracia Corpuz, Capital

To record the investment of Corpuz.

(2)

Cash 40,000

Accounts Receivable . 80,000

Merchandise Inventory “110,000

Delivery Equipment 81,000

Accounts Payable

Allowance for Uncollectible Accts.

Esterlina Gevera, Capital

To record the investment of Gevera.

Basic Considerations and Formation | 21.

8,000

9,000

40,000

80,000

110,000

90,000

30,000

10,000

240,500

60,000

8,000

243,000

4. iti ewly Formed

After the formation, the statement of financial position of the newly

partnership is:

Corpuz and Gevera

Statement of Financial Position

June 30, 2018

Assets

cash P 86,500

as

Accounts Receivable ee sp1c00

Less: Allowance for Uncollectible Accts. 18, a

‘Merchandise Inventory spd

+ Furniture and Fixtures eae

Delivery Equipment sy

Total Assets ,

Liabilities and Owners’ Equity

Accounts Payable P 90,000

Deogracia Corpuz, Capital 240,500

Esterlina Gevera, Capital 243,000

Total Liabilities and Owners’ Equity 573,500

LIMITED LIABILITY COMPANY >

A limited liability company (LLC) is a hybrid form of business for it combines the best

features of a partnership and a corporation. LLC is a form of legal entity that provides

limited liability to its owners. In 1988, the Internal Revenue Service (IRS) of the United

States of America ruled that LLC may be treated as a partnership for tax purposes subject

to conditions. As a result of this ruling, all 50 U.S. states allow LLCs.

The owners of an LLC are called members. These owners may be individuals,

partnerships, corporations or other entities. Many states even allow one-person LLCS.

The members have limited liability even if they are active in the company.

This type of entity is attractive for professional service firms because the owners will not-

have personal liability for the other owners’ malpractice,

A limited liability partnership (LLP) is very similar to an LLC except that investment in LL?

is restricted to professionals. The four major international accounting firms KPMG, Ernst

& Young, PricewaterhouseCoopers and Deloitte Touche started as Partnerships. As they.

grew and the risk increased, these firms were allowed to change, by operation of law, t0

LLPs. The LLP concept is different from that of a limited partnership, i

The accounting for LLCs is the similar to partnerships. The terms “member” and

member's equity” are used instead of “partner” and “partner's equity.”

22 | Partnership ‘and Corporation Accounting

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (347)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CashDisbursementCycle ReDocument5 pagesCashDisbursementCycle ReKenneth Joshua Cinco NaritNo ratings yet

- Causes of Confusion #1Document2 pagesCauses of Confusion #1Kenneth Joshua Cinco NaritNo ratings yet

- Discuss The Principles of Psychology Which Are Used in Industrial PsychologyDocument4 pagesDiscuss The Principles of Psychology Which Are Used in Industrial PsychologyKenneth Joshua Cinco NaritNo ratings yet

- 7 Types of AccountingDocument2 pages7 Types of AccountingKenneth Joshua Cinco NaritNo ratings yet

- Chapter 10 TBTDocument11 pagesChapter 10 TBTKenneth Joshua Cinco NaritNo ratings yet

- The Essentials: Folders and Files DefinedDocument1 pageThe Essentials: Folders and Files DefinedKenneth Joshua Cinco NaritNo ratings yet

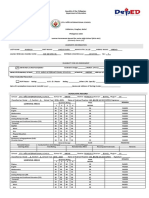

- Sto. Niño International School: (Formerly Form 137)Document9 pagesSto. Niño International School: (Formerly Form 137)Kenneth Joshua Cinco NaritNo ratings yet

- Name of Officers Position Course & Year Address Contact NumberDocument1 pageName of Officers Position Course & Year Address Contact NumberKenneth Joshua Cinco NaritNo ratings yet

- School ID 446540 Region VIII Division Bohol District Panglao School Name Sto. Nino International School School Year 2019-2020 8 Section ADocument17 pagesSchool ID 446540 Region VIII Division Bohol District Panglao School Name Sto. Nino International School School Year 2019-2020 8 Section AKenneth Joshua Cinco NaritNo ratings yet

- How A Law Becomes A BillDocument4 pagesHow A Law Becomes A BillKenneth Joshua Cinco NaritNo ratings yet

- Kenneth Joshua C. Narit August 01, 2019 BSA-2 GEC RIZAL (7:00pm-8:30pm)Document1 pageKenneth Joshua C. Narit August 01, 2019 BSA-2 GEC RIZAL (7:00pm-8:30pm)Kenneth Joshua Cinco NaritNo ratings yet

- Kenneth Joshua C. Narit Gec Rizal BSA-2 7:00-8:30 PMDocument1 pageKenneth Joshua C. Narit Gec Rizal BSA-2 7:00-8:30 PMKenneth Joshua Cinco NaritNo ratings yet