Professional Documents

Culture Documents

Assignment #1 - EnergetiCo

Assignment #1 - EnergetiCo

Uploaded by

Tharanath ShettyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment #1 - EnergetiCo

Assignment #1 - EnergetiCo

Uploaded by

Tharanath ShettyCopyright:

Available Formats

Assignment #1: EnergetiCo

Deadline:20th August 2021

EnergetiCo is a company in the area of electric mobility solutions. After multiple rounds of funding

and investing significant effort and resources they developed and released two models of electric

scooters in the market. They have been relatively successful with a present market share of 17%

which translates to revenues of $14 million USD (~₹100 Cr. INR). The electric scooters segment

estimated to be worth $82 million USD (~₹560 Cr. INR).

Being one of the first companies in this segment,

after a break-even period of 6 years, EnergetiCo

enjoyed a steady growth rate of 10-12% over a 5 yr.

stretch. With the introduction of a “pay-as-you-use”

business model they have added to their top-line and

continued to grow. They are now planning their

business strategy for the next 5 years. EnergetiCo

has an R&D budget of 5% of their annual revenues.

Competitor products in this emerging segment of two

wheelers are steadily increasing and with the costs of

manufacturing not expected to decrease sharply in

the mid-term, EnergetiCo is faced with deciding its

future. Market penetration in rural locations are still

very low at 0.1% of addressable market. Several options are open to them and they have decided to

hire a team of strategy consultants to develop their mid-term strategy. Your main goal is to

increase overall revenue to $23 million USD.

Assess the case and make your recommendations.

Questions

1. Should EnergetiCo diversify into a different segment of products that may be more

profitable? Use the 5-Forces model to suggest a few segments. State your assumptions

clearly (10 marks)

2. With the available R&D budget, make your recommendations as to how they should prioritize

their investments (10 Marks)

3. How do you think EnergetiCo’s biggest closest rival ElectricJump will react to these strategic

priorities? (10 marks)

You might also like

- Bear Market Trading Strategies (Matthew R. Kratter)Document64 pagesBear Market Trading Strategies (Matthew R. Kratter)Ashish SinghNo ratings yet

- Apollo Tyres - Group 12Document5 pagesApollo Tyres - Group 12Pallav PrakashNo ratings yet

- Hybrid Vehicle Marketing PlanDocument15 pagesHybrid Vehicle Marketing PlanrdbrockxNo ratings yet

- Union BankDocument4 pagesUnion Bankanandsingh1783100% (1)

- Innopreneurship 1Document35 pagesInnopreneurship 1Archie Bob Panilag100% (2)

- KPMG 23rd Annual Global Automotive Executive SurveyDocument24 pagesKPMG 23rd Annual Global Automotive Executive SurveyRaúlNo ratings yet

- A Comparative Analysis of Hero Honda Motors Ltd. and Bajaj Auto Ltd.Document33 pagesA Comparative Analysis of Hero Honda Motors Ltd. and Bajaj Auto Ltd.shvmkushwah5556% (9)

- Ezz Steel Financial AnalysisDocument31 pagesEzz Steel Financial Analysismohamed ashorNo ratings yet

- Project ReportDocument7 pagesProject ReportShahrooz JuttNo ratings yet

- Crompton Gr. Con: CMP: INR455Document28 pagesCrompton Gr. Con: CMP: INR455Jayash KaushalNo ratings yet

- Infotech Enterprises Result UpdatedDocument11 pagesInfotech Enterprises Result UpdatedAngel BrokingNo ratings yet

- Mahindra & Mahindra: CMP: INR779 TP: INR900 (+16%) Focus Shifts To Growth Post Capital Allocation ChangesDocument20 pagesMahindra & Mahindra: CMP: INR779 TP: INR900 (+16%) Focus Shifts To Growth Post Capital Allocation ChangesM StagsNo ratings yet

- Tata Motors: CMP: INR353 Reimagine' To Drive JLR TransformationDocument14 pagesTata Motors: CMP: INR353 Reimagine' To Drive JLR TransformationAndjelko BrajkovicNo ratings yet

- E OnDocument42 pagesE Onaditya ozaNo ratings yet

- Lighting Up': Sector: Mid CapsDocument12 pagesLighting Up': Sector: Mid Capsfriendajeet123No ratings yet

- Company Name: Shivalik Bimetal Controls LTDDocument4 pagesCompany Name: Shivalik Bimetal Controls LTDSandyNo ratings yet

- Financial Report DraftDocument6 pagesFinancial Report Draftapi-700124541No ratings yet

- Assignment On Annual ReportsDocument4 pagesAssignment On Annual ReportsPranay JainNo ratings yet

- Annual Report 2018Document19 pagesAnnual Report 2018Raj RathoreNo ratings yet

- SFM Cia 1Document13 pagesSFM Cia 1thememeswala7546No ratings yet

- OswalDocument13 pagesOswalPRIYANKA KNo ratings yet

- Module 3 Group Case Study - General ElectricDocument8 pagesModule 3 Group Case Study - General ElectricCalvinNo ratings yet

- Exide LTD Market Impact Q1FY19Document2 pagesExide LTD Market Impact Q1FY19Shihab MonNo ratings yet

- Ey 3q20 Mobility Quarterly FinalDocument4 pagesEy 3q20 Mobility Quarterly FinalAbcd123411No ratings yet

- Chairman's Message PDFDocument2 pagesChairman's Message PDFharshit abrolNo ratings yet

- Industry Analysis of Ceat Lt1Document9 pagesIndustry Analysis of Ceat Lt1santosh panditNo ratings yet

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaNo ratings yet

- Marico Valuation Report - Aryan KuhadDocument8 pagesMarico Valuation Report - Aryan KuhadAryan KuhadNo ratings yet

- Colgate: Secure Moats, Growth Opportunity ProtectedDocument30 pagesColgate: Secure Moats, Growth Opportunity ProtectedDevsom DasNo ratings yet

- Exercise Session 1Document8 pagesExercise Session 1EdoardoMarangonNo ratings yet

- Colgate Axis 210920Document16 pagesColgate Axis 210920Βίκη ΒβββNo ratings yet

- Godrej Consumer: Investment Rationale IntactDocument24 pagesGodrej Consumer: Investment Rationale IntactbradburywillsNo ratings yet

- Ankit Aggarwal: Career & TimelineDocument3 pagesAnkit Aggarwal: Career & TimelineAnkit AggarwalNo ratings yet

- General ElectricDocument12 pagesGeneral ElectricRasha ElbannaNo ratings yet

- Affle India Limited 05-Dec-2019Document6 pagesAffle India Limited 05-Dec-2019Adarsh PoojaryNo ratings yet

- Jacobs Engineering Group Inc. Initiating Coverage ReportDocument13 pagesJacobs Engineering Group Inc. Initiating Coverage Reportbarone4375No ratings yet

- Crompton Greaves: Riding A New MustangDocument14 pagesCrompton Greaves: Riding A New Mustangrohitkhanna1180No ratings yet

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikNo ratings yet

- Week Seven SummaryDocument15 pagesWeek Seven SummarySekyewa JuliusNo ratings yet

- (ACTS2324) C2 - Green Dream TeamDocument8 pages(ACTS2324) C2 - Green Dream Teamenzo.goNo ratings yet

- HCLDocument80 pagesHCLapi-3807600100% (1)

- Company Analysis Note TACLDocument8 pagesCompany Analysis Note TACLmadhu vijaiNo ratings yet

- Ankit - Resume - 10 Yrs Exp - MBA + BE - 2020Document2 pagesAnkit - Resume - 10 Yrs Exp - MBA + BE - 2020Ankit AggarwalNo ratings yet

- Generali Launches Lifetime Partner 24: Driving: GrowthDocument4 pagesGenerali Launches Lifetime Partner 24: Driving: GrowthMislav GudeljNo ratings yet

- HCL Technologies (HCLT IN) : Management Meet UpdateDocument14 pagesHCL Technologies (HCLT IN) : Management Meet UpdateSagar ShahNo ratings yet

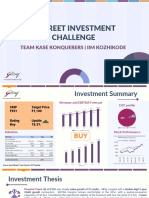

- R-Street Investment Challenge: Team Kase Konquerers - Iim KozhikodeDocument12 pagesR-Street Investment Challenge: Team Kase Konquerers - Iim KozhikodeApoorva JainNo ratings yet

- Tata Motors: CMP: INR308Document16 pagesTata Motors: CMP: INR308VARUN SINGLANo ratings yet

- Hcltech Ibm Deal Mosl 10.12.18Document12 pagesHcltech Ibm Deal Mosl 10.12.18Cilantaro BearsNo ratings yet

- Summative Assignment 2Document14 pagesSummative Assignment 2Ethiopian TubeNo ratings yet

- 3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveDocument4 pages3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveMinh NguyenNo ratings yet

- File 1686286056102Document14 pagesFile 1686286056102Tomar SahaabNo ratings yet

- P5 RM March 2016 Questions PDFDocument12 pagesP5 RM March 2016 Questions PDFavinesh13No ratings yet

- April 2022Document43 pagesApril 2022Indraneel MahantiNo ratings yet

- 23 - 02 Weekly IdeasDocument11 pages23 - 02 Weekly Ideasrupesh4286No ratings yet

- FY2016AnnualRepL&T Annual Report 2015-16Document412 pagesFY2016AnnualRepL&T Annual Report 2015-16OngfaNo ratings yet

- Innovative Financing Mechanisms For Energy Efficiency in IndiaDocument21 pagesInnovative Financing Mechanisms For Energy Efficiency in IndiaAsia Clean Energy ForumNo ratings yet

- Tech Sector Update 01122022Document4 pagesTech Sector Update 01122022VictorioNo ratings yet

- Amazing Chemicals - Case StudyDocument11 pagesAmazing Chemicals - Case StudyKrishna HarshitaNo ratings yet

- Make in India - Mobile Manufacturing AssemblyDocument28 pagesMake in India - Mobile Manufacturing Assemblymaheshna100% (1)

- Fin 200Document2 pagesFin 200raj mishraNo ratings yet

- Mindtree LTD Initiating CoverageDocument15 pagesMindtree LTD Initiating CoverageAkshat KediaNo ratings yet

- FIN 3224 - PensonicDocument8 pagesFIN 3224 - PensonicjuliahuiniNo ratings yet

- PI Industries Ltd. - Initiating CoverageDocument19 pagesPI Industries Ltd. - Initiating Coverageequityanalystinvestor100% (1)

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- How To Overcome The Scarcity of Capital and Low Rate of Capital FormationDocument13 pagesHow To Overcome The Scarcity of Capital and Low Rate of Capital FormationTharanath ShettyNo ratings yet

- SDMM T3 Assignment1Document5 pagesSDMM T3 Assignment1Tharanath ShettyNo ratings yet

- Product: Consult Laboratory Order Medicine Expert Opinion NDHM Integrated Health Drive Health Insurance / ClaimsDocument4 pagesProduct: Consult Laboratory Order Medicine Expert Opinion NDHM Integrated Health Drive Health Insurance / ClaimsTharanath ShettyNo ratings yet

- Subject Your Observations in Your Own Words: Tharanatha P - CMS20EMB444Document22 pagesSubject Your Observations in Your Own Words: Tharanatha P - CMS20EMB444Tharanath ShettyNo ratings yet

- Short Term FinanceDocument26 pagesShort Term FinanceBharti JoisorNo ratings yet

- Asset and Liability Management: Interest Rate Risk ManagementDocument38 pagesAsset and Liability Management: Interest Rate Risk ManagementAbdullah Al FaisalNo ratings yet

- Unilever PresentationDocument16 pagesUnilever PresentationAmmar ArshadNo ratings yet

- Running Head: Monetary Policy and Theory: A Study of 1724 France 1Document4 pagesRunning Head: Monetary Policy and Theory: A Study of 1724 France 1Jan RunasNo ratings yet

- Orientation, Training and Development, and Career Planning: Chapter ObjectivesDocument17 pagesOrientation, Training and Development, and Career Planning: Chapter ObjectiveslinhNo ratings yet

- Gen MathDocument2 pagesGen MathLorbie Castañeda FrigillanoNo ratings yet

- 9am With Emkay: Research ViewsDocument31 pages9am With Emkay: Research ViewsrajeevdudiNo ratings yet

- Chapter 6Document27 pagesChapter 6adNo ratings yet

- Economic Analysis of The Zimbabwe EconomyDocument3 pagesEconomic Analysis of The Zimbabwe EconomyMardha Tilla SeptianiNo ratings yet

- Cityam 2012-03-22Document48 pagesCityam 2012-03-22City A.M.No ratings yet

- Dpco 2013Document7 pagesDpco 2013Angel BrokingNo ratings yet

- Wiley Online Notes For Inventory FinalDocument14 pagesWiley Online Notes For Inventory FinalsukoorNo ratings yet

- 132 Studymat FM Nov 2009Document72 pages132 Studymat FM Nov 2009Ashish NarulaNo ratings yet

- Kuratko 8 e CH 09Document24 pagesKuratko 8 e CH 09waqasNo ratings yet

- C.A Accounting Project HindiDocument27 pagesC.A Accounting Project HindiVicky SinghNo ratings yet

- CHAPTER 2 International Commercial BankingDocument38 pagesCHAPTER 2 International Commercial BankingMuhammad HanifNo ratings yet

- Raytracker BrochureDocument6 pagesRaytracker BrochureRajeev KiranNo ratings yet

- Covenant of IntegrityDocument2 pagesCovenant of IntegritytanujaayerNo ratings yet

- 7020 Commerce and FinanceDocument13 pages7020 Commerce and FinanceMhiz MercyNo ratings yet

- FOF Group Assignment (Essay)Document9 pagesFOF Group Assignment (Essay)Jie Yin SiowNo ratings yet

- Estimation of Operating Cost: Dr. Pradipta Chattopadhyay - BITS Pilani, Pilani CampusDocument19 pagesEstimation of Operating Cost: Dr. Pradipta Chattopadhyay - BITS Pilani, Pilani CampusPratik BansalNo ratings yet

- Accounts Receivable ManagementDocument7 pagesAccounts Receivable Managementsubbu2raj3372No ratings yet

- Case Study Barclays FinalDocument13 pagesCase Study Barclays FinalShalini Senglo RajaNo ratings yet

- Principles of Finance-Course-Orientation-Material v.2Document7 pagesPrinciples of Finance-Course-Orientation-Material v.2Justine Ashley SavetNo ratings yet