Professional Documents

Culture Documents

Source-Www - Taxguru.in: (Sec 17 and 18 of IGST Act and Sec 53 of CGST/SGST Act)

Uploaded by

rajeshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Source-Www - Taxguru.in: (Sec 17 and 18 of IGST Act and Sec 53 of CGST/SGST Act)

Uploaded by

rajeshCopyright:

Available Formats

32 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC.

3(i)]

(ix) Copy of sanction shall also be endorsed to concerned State Accountant General.

(x) The Central Accounting Authority shall generate an Inter Government Advice on the basis of Sanction

received from Department of Revenue and send it to Reserve Bank of India [Central Accounts

Section, Nagpur] electronically within three days of issue of sanction order.

(xi) Reserve Bank of India shall make the necessary fund settlement between the Consolidated Fund of

India and the Consolidated Fund of States of the respective State, on the basis of electronic Inter

Government Advice; generate the ‘Clearance Memo’ and transmit the same to Central Accounting

Authority and State Accounting Authorities and Accountant General.

(xii) The Central Accounting Authorities shall make appropriate accounting entries at the time of issuance

of inter Government Advice to Reserve Bank of India.

(xiii) The respective State Accounting Authorities and Accountant General shall make appropriate

accounting entries at the time of receipt of clearance Memo from Reserve Bank of India.

[F. No. 31013/16/2017-ST-I-DoR]

S. R. MEENA, Under Secy.

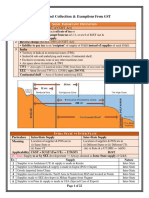

Report GST STL - 01.01

Statement of transfer of funds between Centre and State/UT based on returns, other than returns and information received from

Customs authorities

[Sec 17 and 18 of IGST Act and Sec 53 of CGST/SGST Act]

State/UT -

Year -

Month -/ All

(Amount in Rs.)

Sr. No. Month IGST liability SGST/ UTGST SGST/ SGST/ UTGST SGST/ UTGST

adjusted liability adjusted UTGST portion of IGST for portion of IGST

against SGST/ against IGST portion of inter-State/UT collected on B to B

UTGST ITC ITC IGST collected supplies made to supplies where ITC

(including on B2C Composition is declared as

cross supplies taxable person/ ineligible, including

utilization by including ISD Non-resident lapsed ITC due to

ISD) distribution to taxable person/ UIN opting composition

unregistered holders scheme

unit, exports

and supplies to

SEZ

1 2 3 4 5 6 7

SGST/ UTGST SGST/ SGST/ UTGST SGST/ UTGST SGST/ UTGST SGST/ Net Amount

portion of IGST UTGST portion of IGST portion of IGST portion of IGST UTGST payable (-) by

collected on B to portion of for supplies collected on collected on goods portion of State/UT to

B supplies where IGST imported by goods/services imported by interest Centre/

ITC remains collected on Composition imported by registered person related to receivable (+)

unutilized till supplies taxable persons/ registered person where ITC remains returns paid from Centre to

specified period imported by / UIN holders (other than unutilized till on IGST State/UT

unregistered composition) specified period [sum of col. 4 to

persons where ITC is 13 - col. 3]

declared as

ineligible

8 9 10 11 12 13 14

Download Source- www.taxguru.in

¹Hkkx IIμ[k.M 3(i)º Hkkjr dk jkti=k % vlk/kj.k 33

Report GST STL - 01.02

List of registered persons of the State/UT who have adjusted IGST liability from ITC of SGST/ UTGST and CGST

(for col. 3 of 01.01& 02.01)

[Sec 53 of CGST/SGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. GSTIN Trade name Category of ARN/ IGST Tax period IGST paid IGST paid

(Legal name, cross-utilization Demand id of return from CGST from SGST/

if not (Returns/Other ITC UTGST ITC

available) than returns)

1 2 3 4 5 6 7 8

Total

Note: 1. Invalid return of supplier shall not be taken into consideration for the purpose of apportionment/settlement. Invalid return of

buyer, however, shall be considered in case he uses cross utilization for payment of liability since the supplier has already made

payment and revenue has accrued to the Government from supplier.

2. In case of cross-utilization of the credit for purposes other than returns, demand id will be mentioned.

3. ARN refers to Acknowledgement Reference Number of Return

Report GST STL - 01.03

List of registered persons of the State/UT who have adjusted SGST/ UTGST liability from ITC of IGST

(for col. 4 of 01.01)

[Sec 18 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. GSTIN Trade Category of ARN/ ARN Tax SGST/ CGST

name cross-utilization SGST/UTGST period of UTGST paid from

(Legal (Returns/Other Demand id return paid from IGST

name, if than returns) IGST ITC credit

not

available)

1 2 3 4 5 6 7 8

Total

Note: Invalid return in case of cross-utilization will also be considered for settlement.

In case of cross-utilization of the credit for purposes other than returns, demand id will be mentioned.

Download Source- www.taxguru.in

34 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC. 3(i)]

Report GST STL - 01.04

List of persons registered in other State/UT who have made outward inter-State supply, including ISD distribution, to unregistered

persons or units of the State/UT (including Online Services supplied to unregistered persons)or taxpayers who have made exports or

supplies to SEZ including non-return filers up to specified period.

(for col. 5 of 01.01& 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month –

(Amount in Rs.)

Sr. State/UT GSTIN of Category Trade ARN Tax GSTIN IGST SGST/ CGST

No. of supplier supplier of Supply name period of non- paid UTGST portion

(Legal of return return portion of of IGST

name, if filers of IGST

not the

available) State, if

any

1 2 3 4 5 6 7 8 9 10 11

Total

Note: Column (4) shall be given in the following categories:

Category A : Inter State supplies made to unregistered persons or ISD distributed to unregistered units

Category B : Information relating to online services supplied to unregistered persons by persons located outside country.

Category C : Details of recipient taxable persons who have not filed the return till the specified period as provided for in

section 37 and 38 of the CGST/SGST Act.

Category D : Details of recipient taxable persons who have received ITC credit post filing of annual return

Category E : Details of exports made with payment of tax

Category F : Details of supplies made to SEZ unit or SEZ developer with payment of tax.

Report GST STL - 01.05

List of other State/UT registered persons who have made inter-State supply to composition taxable person /Non-resident taxable

person/ UIN holder of the State/UT

(for col. 6 of 01.01& 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. State/UT GSTIN Trade Category GSTIN of Trade ARN Tax IGST SGST/ CGST

No. of of name of Recipient/ name period paid UTGST portion

supplier supplier (Legal persons UIN (Legal of portion of

name, if name, if return of IGST

not not IGST

available) available)

1 2 3 4 5 6 7 8 9 10 11 12

Total

Note: Column 5 shall have following categories :

(a) Category A: Composition taxable persons,

(b) Category B: non-resident taxable persons and

(c) Category C : UIN holders

Download Source- www.taxguru.in

¹Hkkx IIμ[k.M 3(i)º Hkkjr dk jkti=k % vlk/kj.k 35

Report GST STL - 01.06

List of registered persons who have made inter-State inward supplies for which ITC is declared as ineligible including ITC lapsed due

to opting into composition scheme

(for col. 7 of 01.01& 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. GSTIN of Category of Trade name ARN Tax period Amount of SGST/ CGST

recipient ITC to be (Legal of return/ IGST UTGST portion of

distributed name, if not Month of available for portion of IGST

available) filing Stock distribution IGST

intimation

1 2 3 4 5 6 7 8 9

Total

Note : 1. Relevant section for claiming and reversing ITC - Section 17(5) and 18(4) of CGST/SGST Act

2. Categories of Column 3 shall be as follows :

Category A : Supply for which ITC is ineligible as per section 17(5) of CGST/SGST Act

Category B : ITC lapsed due to opting for composition scheme as per section 18(4) of CGST/SGST Act

Category C : ITC lapsed due to cancellation of Registration as per section

Report GST STL - 01.07

List of registered persons who have made inter-state inward supplies on which ITC remains unutilized till specified period

(for col. 8 of 01.01 & 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. GSTIN Trade name ARN Tax period Unavailed SGST/ CGST

(Legal name, of return IGST ITC UTGST portion of

if not available for portion of unutilized

available) distribution unutilized portion of

portion of IGST

IGST

1 2 3 4 5 6 7 8

Total

Note: This report will include the details of those recipient taxable persons who have filed the return but not claimed ITC till the

specified period as provided for in section 37,38 and 44 of CGST/SGST Act

Download Source- www.taxguru.in

36 THE GAZETTE OF INDIA : EXTRAORDINARY [PART II—SEC. 3(i)]

Report GST STL - 01.08

List of unregistered persons who have made import of goods

(for col. 9 of 01.01 & 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. Name of Address IGST paid SGST/ UTGST CGST portion of

unregistered Person including interest, portion of IGST IGST

if any

1 2 3 4 5 6

Total

Note: This report will include details of persons as received from Customs authorities, if made available.

Source: Import data from Custom authorities

Report GST STL - 01.09

List of composition taxable person/ UIN holder who have made imports

(for col. 10 of 01.01 & 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. GSTIN of Trade Category ARN, if Tax Goods/ IGST SGST/ CGST

importer/UIN name of any period Services paid UTGST portion of

(Legal taxpayers (G/S) portion of IGST

name, if IGST

not

available)

1 2 3 4 5 6 7 8 9 10

Total

Note:

1) This report will include information about import of goods as received from custom authorities.

2) Data of import of services will be as declared in return

3) Column 5 shall have following categories :

(a) Category A: Composition taxable persons, and

(b) Category B : UIN holders

Report GST STL - 01.10

List of registered persons who have made import on which ITC is declared as ineligible

(for col. 11 of 01.01 & 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

Download Source- www.taxguru.in

¹Hkkx IIμ[k.M 3(i)º Hkkjr dk jkti=k % vlk/kj.k 37

(Amount in Rs.)

Sr. No. GSTIN of Trade name ARN Tax period IGST SGST/ CGST

importer (Legal name, of return available UTGST portion of

if not portion of IGST

available) IGST

1 2 3 4 5 6 7 8

Total

Report GST STL - 01.11

List of registered persons who have made import on which ITC remains unutilized till specified period as provided for in section 37,38

and 44 of CGST/SGST Act

(for col. 12 of 01.01 & 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. GSTIN of Trade name ARN Tax period Unavailed SGST/ CGST

importer (Legal name, of return IGST ITC UTGST portion of

if not available for portion of unutilized

available) distribution unutilized portion of

portion of IGST

IGST

1 2 3 4 5 6 7 8

Total

Note: This report will cover the cases which were not reported by importer in his GSTR 2/ GSTR 5

Report GST STL - 01.12

List of registered persons who have paid interest on IGST related to returns

(for col. 13 of 01.01 & 02.01)

[Sec 17 of IGST Act]

State/UT -

Year -

Month -

(Amount in Rs.)

Sr. No. GSTIN Trade name ARN Tax period Interest on SGST/ CGST

(Legal name, of return IGST paid UTGST portion of

if not portion of interest paid

available) interest paid on IGST

on IGST

1 2 3 4 5 6 7 8

Total

Note:

1) The interest will be apportioned among the States of recipient.

Download Source- www.taxguru.in

You might also like

- PMT 1Document3 pagesPMT 1Hemant KumarNo ratings yet

- Integrated Goods & Services-0508Document5 pagesIntegrated Goods & Services-0508shree varanaNo ratings yet

- Notfctn 79 Central Tax English 2020Document19 pagesNotfctn 79 Central Tax English 2020Shaik MastanvaliNo ratings yet

- PMT-3 PDFDocument2 pagesPMT-3 PDFHemant KumarNo ratings yet

- Form GSTR 3bDocument2 pagesForm GSTR 3bEasy Renewable Pvt LtdNo ratings yet

- GSTR 3B NewDocument2 pagesGSTR 3B Newarpit85No ratings yet

- Form Gstr-2: Government of India/State Department ofDocument13 pagesForm Gstr-2: Government of India/State Department ofParameshwar RaoNo ratings yet

- Goods and Services Tax (GST) Presentation To The Members of GJEPCDocument53 pagesGoods and Services Tax (GST) Presentation To The Members of GJEPCAnkita TomarNo ratings yet

- Form GST PMT 01Document4 pagesForm GST PMT 01Akash KamathNo ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- Levy and Collection of TaxDocument22 pagesLevy and Collection of Tax7013 Arpit DubeyNo ratings yet

- Circular CGST 131 NewDocument5 pagesCircular CGST 131 NewSanjeev BorgohainNo ratings yet

- INPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inDocument20 pagesINPUT TAX CREDIT (ITC) " Under GST Regime - Taxguru - inAtin KumarNo ratings yet

- GSTR 3B Excel FormatDocument2 pagesGSTR 3B Excel Formatravibhartia1978No ratings yet

- GSTR2BQ 23Z6 032024 24042024Document7 pagesGSTR2BQ 23Z6 032024 24042024Neha JainNo ratings yet

- 1a. Refund Formats17052017 Revised3 28Document28 pages1a. Refund Formats17052017 Revised3 28Ravi Kiran KandimallaNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- BookletDocument371 pagesBookletRohan KulkarniNo ratings yet

- Form Gstr-2A (See Rule ..) : Details of Auto Drafted SuppliesDocument2 pagesForm Gstr-2A (See Rule ..) : Details of Auto Drafted SuppliesParameshwar RaoNo ratings yet

- Sample Format Form GSTR 2aDocument2 pagesSample Format Form GSTR 2aDeepanshu JaiswalNo ratings yet

- Form GSTR 2aDocument2 pagesForm GSTR 2aparam.ginniNo ratings yet

- 19kxcps4738e1zy - 092023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 092023 - GSTR-3B MSheksNo ratings yet

- 3B Apr To June 21Document2 pages3B Apr To June 21Sachin NandeNo ratings yet

- ProjectDocument37 pagesProjectcontactnilkanth123No ratings yet

- Asli Pracheen Ravan Samhita PDFDocument2 pagesAsli Pracheen Ravan Samhita PDFgirish SharmaNo ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- GST Question BankDocument359 pagesGST Question BankSiddhesh Kamat AzrekarNo ratings yet

- UNIT 2 (2) Interstate, Intrastate SuppliesDocument24 pagesUNIT 2 (2) Interstate, Intrastate SuppliesSania KhanNo ratings yet

- 19kxcps4738e1zy - 062023 - GSTR-3B MDocument4 pages19kxcps4738e1zy - 062023 - GSTR-3B MSheksNo ratings yet

- ITC Condition TaxmanDocument5 pagesITC Condition TaxmanSubhasish ChatterjeeNo ratings yet

- Cbic Notifies Effective Date For Amendments Under GST Law Made Vide Finance Act 2021 and 2023Document6 pagesCbic Notifies Effective Date For Amendments Under GST Law Made Vide Finance Act 2021 and 2023PradeepkumarNo ratings yet

- Goods and Services Tax (GST) Presentation To The Members of GJEPCDocument54 pagesGoods and Services Tax (GST) Presentation To The Members of GJEPCTheking OfsexNo ratings yet

- Annual Return - Salem BranchDocument23 pagesAnnual Return - Salem BranchSureshkumarNo ratings yet

- Integrated Goods & ServicesDocument4 pagesIntegrated Goods & ServicesSunilNo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- GST ChallanDocument1 pageGST ChallanVineet KhuranaNo ratings yet

- CA Inter Compact Books For May 21Document216 pagesCA Inter Compact Books For May 21Rahul AgrawalNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Mdrrmo San MiguelNo ratings yet

- Order 119 MiscComm 31 1 24Document6 pagesOrder 119 MiscComm 31 1 24Mmkpss Sriram Sista MmkpssNo ratings yet

- GST Circulars Issued On 6th July - A SummaryDocument8 pagesGST Circulars Issued On 6th July - A SummaryVijaya ChandNo ratings yet

- Notes On GST (Law of Taxation)Document15 pagesNotes On GST (Law of Taxation)Bhoomika SinghNo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxGANGARAJU NALINo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxTEst User 44452No ratings yet

- Certification DraftDocument47 pagesCertification DraftndNo ratings yet

- GSTR3B 24AHSPS6763P1Z6 012023 SystemGeneratedDocument8 pagesGSTR3B 24AHSPS6763P1Z6 012023 SystemGeneratedsammy shergilNo ratings yet

- Goods and Services Tax - 2021Document43 pagesGoods and Services Tax - 2021gsvighneshnairNo ratings yet

- Unit 2 - Part III - Returns Under GST - 30!07!2021Document4 pagesUnit 2 - Part III - Returns Under GST - 30!07!2021Milan ChandaranaNo ratings yet

- GST Implication 17Document14 pagesGST Implication 17Priyadarshan KrishnaNo ratings yet

- Gstr3b 09cthpc2168r1z3 012024 SystemgeneratedDocument11 pagesGstr3b 09cthpc2168r1z3 012024 SystemgeneratedColt HogeNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BMaddy GamerNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- Charges Under GSTDocument80 pagesCharges Under GSTVijeshNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3Bhiteshmohakar15No ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocument6 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BMUJAHIDUL ISLAM SHAIKHNo ratings yet

- BIR FORM 2307 SampleDocument6 pagesBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.No ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- GST Question Bank - by CA Yachana Mutha BhuratDocument349 pagesGST Question Bank - by CA Yachana Mutha BhuratP LAVANYA100% (1)

- ELP IDT Newsletter April 2023 FinalDocument12 pagesELP IDT Newsletter April 2023 FinalELP LawNo ratings yet

- GST ChallanDocument1 pageGST ChallanAshish VishnoiNo ratings yet

- PMP Audit ChecklistDocument6 pagesPMP Audit ChecklistSyerifaizal Hj. MustaphaNo ratings yet

- Executive Order No 292 (Books 1-3) AND RA 9492Document18 pagesExecutive Order No 292 (Books 1-3) AND RA 9492June Lester100% (1)

- Brecht's The Good Person of SzechwanDocument5 pagesBrecht's The Good Person of Szechwankshithisingh83% (6)

- DOG Houser Incident ReportDocument1 pageDOG Houser Incident ReportDuff LewisNo ratings yet

- BeerCraftr Recipe Booklet 37Document41 pagesBeerCraftr Recipe Booklet 37Benoit Desgreniers0% (1)

- PPM Executive Development Program 2021Document12 pagesPPM Executive Development Program 2021ahadiyat jayaNo ratings yet

- HNDBK 2018Document60 pagesHNDBK 2018rlelonno_444057301No ratings yet

- r220 1Document216 pagesr220 1Mark CheneyNo ratings yet

- Indian Zinc Industry, Zinc Industry in India, Zinc Industry, Zinc IndustriesDocument7 pagesIndian Zinc Industry, Zinc Industry in India, Zinc Industry, Zinc IndustriesNitisha RathoreNo ratings yet

- TeaserDocument8 pagesTeaserEllen GonzalvoNo ratings yet

- Relaxo Footwears LTD Leave Policy Final V3 0Document13 pagesRelaxo Footwears LTD Leave Policy Final V3 0Joseph RajkumarNo ratings yet

- NA To Sls en 1992-1-2Document12 pagesNA To Sls en 1992-1-2Shan Sandaruwan AbeywardeneNo ratings yet

- Adeela Khalil-Mms151024Document66 pagesAdeela Khalil-Mms151024Muhammad Sohail AbidNo ratings yet

- What Is Brexit?: When Will Brexit Happen?Document2 pagesWhat Is Brexit?: When Will Brexit Happen?tomalNo ratings yet

- Appendix A: Base VariablesDocument9 pagesAppendix A: Base VariablesMarlhen EstradaNo ratings yet

- Whatsapp Pay Jyoti PatelDocument9 pagesWhatsapp Pay Jyoti PatelJyoti PatelNo ratings yet

- Final T5 MKT 205Document2 pagesFinal T5 MKT 205Thenappan GanesenNo ratings yet

- Commercial Law ReviewDocument256 pagesCommercial Law ReviewRobert Kane Malcampo ReyesNo ratings yet

- Accounting For Overheads by DR Kamlesh KhoslaDocument16 pagesAccounting For Overheads by DR Kamlesh KhoslaKrati SinghalNo ratings yet

- P.E (L1-4th Quarter) Folk DanceDocument7 pagesP.E (L1-4th Quarter) Folk Danceprinces molinaNo ratings yet

- Thomas Plummer-Living Your DreamDocument274 pagesThomas Plummer-Living Your Dreammehr6544100% (1)

- Citibank V Sps CabamonganDocument2 pagesCitibank V Sps Cabamongangel94No ratings yet

- Nsu Spring 2013 All Course Final Exam List PDFDocument29 pagesNsu Spring 2013 All Course Final Exam List PDFRakib_234No ratings yet

- Narrative Report in School: Department of EducationDocument2 pagesNarrative Report in School: Department of EducationKairuz Demson Aquilam100% (1)

- GentlenessDocument3 pagesGentlenessHai NeNo ratings yet

- Case 10 KPCDocument19 pagesCase 10 KPCabraamNo ratings yet

- 5993 Energy Consumption in The Uk All Data Tables in TDocument132 pages5993 Energy Consumption in The Uk All Data Tables in TtmturnbullNo ratings yet

- 023 CV02 E - GuideDocument6 pages023 CV02 E - GuidejamesbeaudoinNo ratings yet

- 05-Physical Progress ReportDocument1 page05-Physical Progress ReportAtish kumarNo ratings yet

- Paraphilic DisorderDocument2 pagesParaphilic DisorderJESSEL LEA LAGURANo ratings yet