Professional Documents

Culture Documents

Soriao Acctg 2200 Lab 3

Soriao Acctg 2200 Lab 3

Uploaded by

Kurt SoriaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Soriao Acctg 2200 Lab 3

Soriao Acctg 2200 Lab 3

Uploaded by

Kurt SoriaoCopyright:

Available Formats

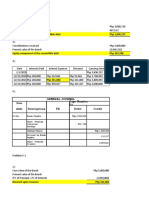

Problem 3-1

GENERAL JOURNAL

Page Number

Date

01

2020 Descriptions PR Debit Credit

12/31/2020 NO ENTRY

Retained Earnings Php 450,000

Estimated Liabilty for Income Tax Php 450,000

to record the probable payment of income tax for 2019

Accounts Receivable - Sunrise Company 420,000

Loss on Guarantee 280,000

Notes Payable - PNB 700,000

to record the probable payment of guarantee obligation

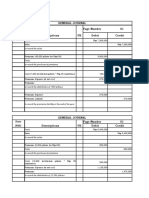

Problem 3-2

GENERAL JOURNAL

Page Number

Date

01

2020 Descriptions PR Debit Credit

Unearned Subscriptions Revenue Php 1,050,000

Subscriptions Revenue Php 1,050,000

to record the subscriptions revenue for 2020

Loss on Lawsuit 2,250,000

Estimated Liability on Lawsuit 2,250,000

to record the probable payments on charges for breach of contract

Loss on Lawsuit 1,500,000

Estimated Liability for Lawsuit 1,500,000

to record the probable payments on charges for industrial

espionage

Problem 3-3

Amount of provisions to be recognized on December 31, 2020.

Estimated long service leave owing to employees in respect of past services liabilities Php 3,600,000

* While the cost of relocation of the employee and the cost of the overhauling machine is just an estimation, it

does not qualify as a provision because they are both scheduled for a definite time and it is this uncertainty that

distinguishes a provision from other liabilities. The amounts that are owed to another company has a definite

time scheduled for payment and amount because it is an accrued liability.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cma QuizDocument2 pagesCma QuizKurt SoriaoNo ratings yet

- List of Money Market Funds CompaniesDocument8 pagesList of Money Market Funds CompaniesKurt SoriaoNo ratings yet

- Liability Component of The Convertible Debt PHP 3,696,232: Date 2021Document2 pagesLiability Component of The Convertible Debt PHP 3,696,232: Date 2021Kurt SoriaoNo ratings yet

- General Journal Page Number 01 Descriptions PR Debit CreditDocument12 pagesGeneral Journal Page Number 01 Descriptions PR Debit CreditKurt SoriaoNo ratings yet

- Income Taxes For CorporationsDocument35 pagesIncome Taxes For CorporationsKurt SoriaoNo ratings yet

- Mcgraw Hills Taxation of Individuals and Business Entities 2018 Edition 9th Edition Ebook PDFDocument27 pagesMcgraw Hills Taxation of Individuals and Business Entities 2018 Edition 9th Edition Ebook PDFrebecca.wilkerson420100% (26)

- Quiz No 2 Fsa Oral Recits Quiz PDF FreeDocument13 pagesQuiz No 2 Fsa Oral Recits Quiz PDF FreeTshina Jill BranzuelaNo ratings yet

- Bepalen Netto Besteedbaar InkomenDocument5 pagesBepalen Netto Besteedbaar InkomenB OnderwijzerNo ratings yet

- OLC Chap 20Document5 pagesOLC Chap 20NeelNo ratings yet

- 3 FeuillesDocument3 pages3 FeuillesYounes MedehousNo ratings yet

- Taxation - Vietnam (TX-VNM) : Syllabus and Study GuideDocument18 pagesTaxation - Vietnam (TX-VNM) : Syllabus and Study GuideNgo Phuong AnhNo ratings yet

- Cas Application N°1 TexteDocument9 pagesCas Application N°1 TexteRanaivosoa JhonNo ratings yet

- Dlp-Epp 6 - Week 1 - Day 2 - 3rd QuarterDocument1 pageDlp-Epp 6 - Week 1 - Day 2 - 3rd QuarterSHARON MAY CRUZNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document6 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)tayyabashehzadNo ratings yet

- Infografico 2 Classificacao e Tributacao de Fundos de InvestimentosDocument2 pagesInfografico 2 Classificacao e Tributacao de Fundos de InvestimentosBianca SouzaNo ratings yet

- Qué Son Los Tributos Municipales VenezuelaDocument3 pagesQué Son Los Tributos Municipales VenezuelaBest PayNo ratings yet

- Costo Promedio Ponderado de Capital 281022Document4 pagesCosto Promedio Ponderado de Capital 281022Edinson riveraNo ratings yet

- Shoppersville TradingDocument6 pagesShoppersville TradingJM Gamara - MindanaoNo ratings yet

- LD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaDocument30 pagesLD 1495 "Tax Reform" The Real Facts: Albert A. Dimillo, Jr. Retired Corp Orate Tax Director & CpaMelinda JoyceNo ratings yet

- Diagnostic Financier Syscohada Revise 230518 1 PDFDocument182 pagesDiagnostic Financier Syscohada Revise 230518 1 PDFissoufou Amadou100% (3)

- New Microsoft PowerPoint PresentationDocument29 pagesNew Microsoft PowerPoint PresentationMSR SAJIBNo ratings yet

- 07a ReviewedWithComment BAR2021 Carpenter-Hill KorCity Part1-Notes-to-FS CorrectedDocument8 pages07a ReviewedWithComment BAR2021 Carpenter-Hill KorCity Part1-Notes-to-FS Correctedkipar_16No ratings yet

- Quiz Quiz 2 Single Entry and Cash Accrual Accounting PDFDocument28 pagesQuiz Quiz 2 Single Entry and Cash Accrual Accounting PDFluismorenteNo ratings yet

- SenegalDocument17 pagesSenegalIbrahim Amadou SACKONo ratings yet

- GST (Goods and Services Tax) - Introduction and Tax Calculation - in ClassDocument4 pagesGST (Goods and Services Tax) - Introduction and Tax Calculation - in ClassShubhendu KambleNo ratings yet

- Guide: Income Tax ReturnDocument108 pagesGuide: Income Tax Returnbeth aguirreNo ratings yet

- RR 3-98Document7 pagesRR 3-98evelyn b t.No ratings yet

- Test Paper CA Final TpdtaaDocument3 pagesTest Paper CA Final TpdtaayeidaindschemeNo ratings yet

- FABM1 Formative Assessment Accounting Equation and Major AccountsDocument2 pagesFABM1 Formative Assessment Accounting Equation and Major AccountsSahib JotNo ratings yet

- SALARY SLIP - September 2022: Payments Amount (RM) Deductions Amount (RM)Document1 pageSALARY SLIP - September 2022: Payments Amount (RM) Deductions Amount (RM)Nor LiyanaNo ratings yet

- Precis de Fiscalite Des EntreprisesDocument32 pagesPrecis de Fiscalite Des EntrepriseseddyNo ratings yet

- Assignment 3 Financial Analysis Graphs Excel TemplateDocument3 pagesAssignment 3 Financial Analysis Graphs Excel TemplateDylan VanslochterenNo ratings yet

- Value Added Tax Policy and Business Performance.Document52 pagesValue Added Tax Policy and Business Performance.ABDIKARIN MOHAMEDNo ratings yet

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsDocument1 pageModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesNo ratings yet