Professional Documents

Culture Documents

Paint Industry in India-Bright or Tight? A Whitepaper Paint Industry in India-Bright or Tight?

Paint Industry in India-Bright or Tight? A Whitepaper Paint Industry in India-Bright or Tight?

Uploaded by

SoUmYa HeGdEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paint Industry in India-Bright or Tight? A Whitepaper Paint Industry in India-Bright or Tight?

Paint Industry in India-Bright or Tight? A Whitepaper Paint Industry in India-Bright or Tight?

Uploaded by

SoUmYa HeGdECopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/326096738

Paint Industry in India-Bright or Tight? A Whitepaper Paint Industry in India-

Bright or Tight?

Article · December 2017

CITATIONS READS

0 7,170

2 authors:

Abhay Tiwari Saurabh Chhabra

Tokyo Institute of Technology Concept International Business Consulting

6 PUBLICATIONS 3 CITATIONS 3 PUBLICATIONS 3 CITATIONS

SEE PROFILE SEE PROFILE

Some of the authors of this publication are also working on these related projects:

India - Accelerating EV mobility View project

Efficycle View project

All content following this page was uploaded by Abhay Tiwari on 01 July 2018.

The user has requested enhancement of the downloaded file.

Paint Industry in India – Bright or Tight?

A Whitepaper

Paint Industry in India – Bright or Tight?

INTRODUCTION

Indian paint industry has witnessed a paradigm shift in the preferences and requirement of the

customers – A shift from using traditional whitewash to superior quality paints such as enamel and

emulsions.

The paint industry in the country is the 7th largest in the world and is valued at USD 6 Bn (4 million

metric tonnes by volume) for 2016-17. CIBC estimates that the industry would continue to exhibit

a double-digit growth of 12%-13% over next 4-5 years.

©2017 Concept International Business Consulting Pvt. Ltd.

1

Paint Industry in India – Bright or Tight?

A Whitepaper

MARKET SCENARIO

The Indian paint industry has seen substantial traction over last few years and has been named as

second largest paint market in Asia. The fact that India’s economic growth rate has been ahead of

its other counterparts in Asia, the associated infrastructure development has been the key reason

for a surge in demand of paint products.

➢ The Indian paint market is expected to have already touched USD 6

billion in FY 2016-17, with ~38-40% of the contribution from unorganized

sector

➢ The industry is expected to reach USD 10 billion by 2020, growing at a

CAGR of over 13% over 2016-20

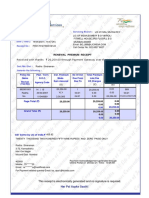

The paint market is broadly categorized into the two segments - Decorative Paint and Industrial

Paint with ~70% of the market is controlled by Decorative paints that comprises household/wall

paintings, architectural and other display products.

Decorative vs Industrial Paint Market 2016 (in %)

30%

Decorative Paint

Industrial Paint

70% “India’s GDP growth is

expected to recover from

demonetization and GST

Total Domestic Demand Size ~ USD 6 billion implementation effects to

resort to 7% basepoint and

The growth of industrial paint segment that constitutes likely to sustain the fortunes of

30% of the market size, is highly dependent upon construction industry”

automotive sector. The sector has been leading consumer

of the industrial paints with 45% of the demand coming

from it.

©2017 Concept International Business Consulting Pvt. Ltd.

2

Paint Industry in India – Bright or Tight?

A Whitepaper

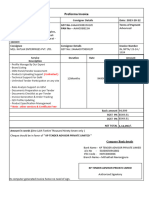

GST IMPACT -

Implementation of Goods and Services Tax (GST) hasn’t had any significant impact on the paint

industry. The paints are categorized in 28% GST slab which doesn’t really differ from the existing

rate that the industry is paying at present (with VAT, excise and VAT on excise all put together).

So, it is neutral situation (no-loss no-gain) for the paint industry post GST commissioning. In

addition, the industry is highly organized with unorganized players comprising 20%-25% of the

market. As such, it will benefit the organised players (even if marginally) and they can expect

some market share gains.

Before Post

GST GST

12.5% VAT

**

SGST

~27% 12.5% Excise 28%

CGST

3% Cess*

* Cess is charged upon the excise value and **Though there is absolute increment of

not on price after excise ~1% in GST vs earlier tax rate, the input

credit benefit neutralizes the same

KEY MARKET PLAYERS

The leaders in the organized paint market comprises big names such as Asian paints, Kansai

Nerolac, Berger Paints and Akzo Nobel to name a few. While in the unorganized segment (that is

~20%-25%), there are about 2,000+ players having small to medium sized paints manufacturing

facilities.

Asian paints has been the market leader and controlling ~30% market share, followed by Kansai

Nerolac, Berger and Akzo Nobel.

©2017 Concept International Business Consulting Pvt. Ltd.

3

Paint Industry in India – Bright or Tight?

A Whitepaper

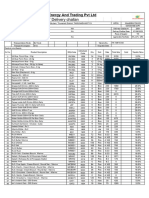

PERFORMANCE AND FUTURE PLANS OF KEY MARKET PLAYERS

©2017 Concept International Business Consulting Pvt. Ltd.

4

Paint Industry in India – Bright or Tight?

A Whitepaper

Asian Paints

Asian paints will be investing about USD 153 Mn towards two new production facilities being setup

at Mysuru and Vizag in the Southern part of the country. The first phase of both the plants is

expected to be commissioned in FY 2018-2019.

Berger Paints

Berger Paints has recently entered into two MOUs with two foreign companies – one with Promat

International Ltd. (Belgium) for cooperation in the field of passive fire protective coatings and the

other with Chugoku Marine Paints Ltd. (Japan) for co-operation and collaboration in the field of

marine and related industrial paints.

Kansai Nerolac

To boost the production capability, Kansai Nerolac Paint Ltd. is creating new production facilities at

Saykha in Gujarat, Amritsar in Punjab and Vishakhapatnam in Andhra Pradesh.

AkzoNobel

In December 2016, with an investment of ~ USD 5 Mn, AkzoNobel India commissioned a specialty

coatings production facility in Noida that has annual manufacturing capacity of 600 kiloliters. In the

same month, it also bought BASF India’s industrial coating business. The company is setting up a

facility in Mumbai to expand its manufacturing footprints. AkzoNobel India has six manufacturing

facilities in India in the cities of Navi Mumbai, Gwalior, Raigad, Hyderabad, Bengaluru, and Mohali.

©2017 Concept International Business Consulting Pvt. Ltd.

5

Paint Industry in India – Bright or Tight?

A Whitepaper

KEY INDUSTRY DRIVERS

Key Drivers

#1,2

Key Points

• Government reforms/stimulus to boost

economy is going to have a bigger impact

on infrastructure and construction

industry, thus creating high demand for

paints

✓ For instance, Pradhan Mantri Awas

Yojna (aims at providing fiscal

incentive to the people) is a boost

for housing sector, creating demand

for decorative paints.

✓ The Indian real estate market is

expected to touch ~USD 250 Bn by

2020.

“High competition in the

organized market with small

• Increased industrialization under “Make in unorganized players catching

India” and expected traction in automobile up fast in terms of technology

sector would propel the industrial paint and quality of paint, leaving

segment little room for suppliers to

bargain in the market”

• Automobile segment generates over 45%

of the demand of industrial paint, and

growth in automobile sector is expected to

be ~5% YoY. The sector would remain one

of the biggest consumer of industrial

paints and provide sustainable business

opportunities.

©2017 Concept International Business Consulting Pvt. Ltd.

6

Paint Industry in India – Bright or Tight?

A Whitepaper

CONCLUSION

In India, rapid urbanization and industrialization would lay the path for new and existing players in

the paint market.

• Urban Population would nearly double in the coming decade, which will directly impact

the demand for decorative paints.

• Rapid Industrialization is putting India on the fore fronts of transforming economy;

With the increased inflow of capital from foreign and domestic investments in order to

develop infrastructure and business facilities, the paint industry would surely reap the

benefits out of it.

• Paint is a highly raw material intensive industry, and employs over 900 different raw

material and their grades. Thus, companies look to invest constantly in R&D to address

factors such as performance, cost reduction, new application and shades development.

It will also be very critical for Indian companies to curb their manufacturing cost

(which is higher by 20%) than their foreign counterparts to remain competitive.

• There is a significant market opportunity for the new entrants who are planning to

strategize for India entry, but technology can be a key differentiating factor to beat

the existing competition.

©2017 Concept International Business Consulting Pvt. Ltd.

7

Paint Industry in India – Bright or Tight?

A Whitepaper

Authors

About CIBC

CIBC is one of the fastest growing India entry business consulting firm with presence in Mumbai and Gurgaon. It is a cross-

border strategy consulting firm helping foreign companies to set-up their operations in India and thus, has been

instrumental in bringing significant foreign investments in India. It's service offerings encompasses market due diligence,

strategy consulting, implementation and incubation support for new entrant in the Indian market

For more information, please refer: http://www.consultcibc.com/

©2017 Concept International Business Consulting Pvt. Ltd.

8

View publication stats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Packaging-Initiating CoverageDocument27 pagesPackaging-Initiating CoverageRajkumar MathurNo ratings yet

- AoBR-amendment 2015Document2 pagesAoBR-amendment 2015Rajkumar MathurNo ratings yet

- B.sc. (Hons (I Micrbiology - Paper V (Biostatistics and Introduction To Computer)Document5 pagesB.sc. (Hons (I Micrbiology - Paper V (Biostatistics and Introduction To Computer)Rajkumar MathurNo ratings yet

- MACP Order 27-28.9.2016Document2 pagesMACP Order 27-28.9.2016Rajkumar MathurNo ratings yet

- B.sc. (Hons.) Botany Zoology Microbiology Bio-Chemistry I Sem. Paper CHCT-301 ChemistryDocument8 pagesB.sc. (Hons.) Botany Zoology Microbiology Bio-Chemistry I Sem. Paper CHCT-301 ChemistryRajkumar MathurNo ratings yet

- Lucknow - The City of NawabsDocument2 pagesLucknow - The City of NawabsRajkumar Mathur100% (1)

- Paint Industry in India-Bright or Tight? A Whitepaper Paint Industry in India-Bright or Tight?Document9 pagesPaint Industry in India-Bright or Tight? A Whitepaper Paint Industry in India-Bright or Tight?Rajkumar MathurNo ratings yet

- For More Previous Year Question Papers VisitDocument15 pagesFor More Previous Year Question Papers VisitRajkumar MathurNo ratings yet

- General Clause ActDocument20 pagesGeneral Clause ActRajkumar MathurNo ratings yet

- SC Order On SFIO-v.-Neeraj-Singal PDFDocument11 pagesSC Order On SFIO-v.-Neeraj-Singal PDFRajkumar MathurNo ratings yet

- Excel Formula FunctionDocument40 pagesExcel Formula FunctionRajkumar MathurNo ratings yet

- Science CombinedDocument315 pagesScience CombinedRajkumar MathurNo ratings yet

- COMPAT Repeal Notification 26.05.2017Document18 pagesCOMPAT Repeal Notification 26.05.2017Rajkumar MathurNo ratings yet

- Baking Soda Benefits PDFDocument17 pagesBaking Soda Benefits PDFRajkumar MathurNo ratings yet

- Combined EngilishDocument198 pagesCombined EngilishRajkumar MathurNo ratings yet

- Air India LTC-80 Fare Wef 01 August 2017Document6 pagesAir India LTC-80 Fare Wef 01 August 2017Rajkumar MathurNo ratings yet

- Ceilings in Respect of Office Expenditure0001Document2 pagesCeilings in Respect of Office Expenditure0001Rajkumar MathurNo ratings yet

- Registration Under GST ProjectDocument40 pagesRegistration Under GST ProjectmominzeenatNo ratings yet

- DSL Bill 012046118853 DSL HT2309I002052351Document4 pagesDSL Bill 012046118853 DSL HT2309I002052351Sandeep BoseNo ratings yet

- EXC QuoteDocument1 pageEXC QuoteSwapnilNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document6 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Venki GajaNo ratings yet

- Ajio FL0121578679 1567781799754 PDFDocument1 pageAjio FL0121578679 1567781799754 PDFIndian ChannelNo ratings yet

- Tax BulletinDocument72 pagesTax BulletinSamuel Mervin NathNo ratings yet

- 7 - Bcom Benefits of GST To Economy and IndustryDocument13 pages7 - Bcom Benefits of GST To Economy and Industrymnr81No ratings yet

- CRN2885008082Document3 pagesCRN2885008082Ruchit SharmaNo ratings yet

- LIC Receipt - RadhaDocument1 pageLIC Receipt - RadhaRohan NNo ratings yet

- Atria Convergence Technologies Limited, Due Date: 15/05/2022Document6 pagesAtria Convergence Technologies Limited, Due Date: 15/05/2022jagannath swamyNo ratings yet

- GST Invoice Format No. 5Document1 pageGST Invoice Format No. 5Kritik PatlareNo ratings yet

- 30-06-2022 - Hand Written NotesDocument14 pages30-06-2022 - Hand Written NotesPratik ChaudhariNo ratings yet

- Room 205Document1 pageRoom 205Hotel EkasNo ratings yet

- IB Jury FINAL MuskanDocument43 pagesIB Jury FINAL MuskanNishant KumarNo ratings yet

- Hindustan Shipyard LTD.: ISO 9001 2008 COMPANY Tel: +91 9493792211 Tele Fax: +91 891 2577502/2577356 Email:, WebDocument8 pagesHindustan Shipyard LTD.: ISO 9001 2008 COMPANY Tel: +91 9493792211 Tele Fax: +91 891 2577502/2577356 Email:, WebsandeepNo ratings yet

- Ortech Engineering services-INVOICEDocument2 pagesOrtech Engineering services-INVOICEKartik RajputNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesKuldeep KushwahaNo ratings yet

- Boat InvoiceDocument1 pageBoat Invoicelogeshkannan078No ratings yet

- ROJA ETPL GST Sheet 2021-2022 - Google SheetsDocument2 pagesROJA ETPL GST Sheet 2021-2022 - Google SheetsAnand PrintNo ratings yet

- STO Configuration For GST: PurposeDocument6 pagesSTO Configuration For GST: PurposeTirupatirao Bashyam100% (1)

- Important MCQ's of February 2020: TelegramDocument227 pagesImportant MCQ's of February 2020: TelegramRupam DattaNo ratings yet

- TAX Invoice: Scheme Discount DetailsDocument36 pagesTAX Invoice: Scheme Discount DetailsSadaf RazzaqueNo ratings yet

- Palkesh Asawa - S Answer To How Is GST Beneficial For The Country - How Would It Help To Improve The Country - S Economy - QuoraDocument3 pagesPalkesh Asawa - S Answer To How Is GST Beneficial For The Country - How Would It Help To Improve The Country - S Economy - QuoraAshit AgarwalNo ratings yet

- Iffco - Tokio General Insurance Co. LTDDocument2 pagesIffco - Tokio General Insurance Co. LTDkRiZ kRiShNaNo ratings yet

- 2019 Industrial and Warehousing Market1Document22 pages2019 Industrial and Warehousing Market1gautham kumarNo ratings yet

- TW2A12823900009RPOSDocument3 pagesTW2A12823900009RPOSarun poojariNo ratings yet

- Tendernotice 1Document138 pagesTendernotice 1Rama Rao MNo ratings yet

- Issues in GST On Banking SectorDocument9 pagesIssues in GST On Banking SectorrmenterprisescraptradersNo ratings yet

- 0068 NehaDocument1 page0068 Nehang.neha8990No ratings yet

- Vivo T1 5G (Rainbow Fantasy, 128 GB) : Grand Total 16019.00Document2 pagesVivo T1 5G (Rainbow Fantasy, 128 GB) : Grand Total 16019.00Rahul KumarNo ratings yet