Professional Documents

Culture Documents

What Is The Liability of A Taxpayer Becoming Liable To VAT and Did Not Register As Such

Uploaded by

Jeremias Cusay0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

What is the Liability of a Taxpayer Becoming Liable to VAT and Did Not Register as Such

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageWhat Is The Liability of A Taxpayer Becoming Liable To VAT and Did Not Register As Such

Uploaded by

Jeremias CusayCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

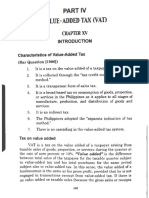

What is the liability of a taxpayer becoming liable to VAT and did not register as such?

Any person who becomes liable to VAT and fails to register as such shall be liable to pay the output

tax as if he is a VAT-registered person, but without the benefit of input tax credits for the period in

which he was not properly registered.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Welcome Message. PLRDocument2 pagesWelcome Message. PLRJeremias CusayNo ratings yet

- On Frats.Document11 pagesOn Frats.Jeremias CusayNo ratings yet

- 06 Chap 13 14 Mamalateo 2019 Tax BookDocument65 pages06 Chap 13 14 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- 07 Chap 15 16 Mamalateo 2019 Tax BookDocument19 pages07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Hildegard Proper PaperDocument16 pagesHildegard Proper PaperJeremias CusayNo ratings yet

- 08 Chap 17 18 Mamalateo 2019 Tax BookDocument35 pages08 Chap 17 18 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Technology Operations and ConceptsDocument3 pagesTechnology Operations and ConceptsJeremias CusayNo ratings yet

- Consti 1 Midyear Case Digests August 10 2021Document1 pageConsti 1 Midyear Case Digests August 10 2021Jeremias CusayNo ratings yet

- Technology Operations and ConceptsDocument3 pagesTechnology Operations and ConceptsJeremias CusayNo ratings yet

- College of Engineering, Architecture and Technology: Engr. Joel C. Villaruz, PHDDocument2 pagesCollege of Engineering, Architecture and Technology: Engr. Joel C. Villaruz, PHDJeremias CusayNo ratings yet

- Binds Himself, With Respect To The Other, To Give Something or To Render Some ServiceDocument94 pagesBinds Himself, With Respect To The Other, To Give Something or To Render Some ServiceJeremias CusayNo ratings yet

- Murguia, Fitz Gerald J. 1w-AutomotiveDocument4 pagesMurguia, Fitz Gerald J. 1w-AutomotiveJeremias CusayNo ratings yet

- CRIMINAL-PROCEDURE - Q&aDocument28 pagesCRIMINAL-PROCEDURE - Q&aJeremias CusayNo ratings yet

- Years Act (EYA), Herein Defined As Persons Primarily Engaged in The Provision of EarlyDocument3 pagesYears Act (EYA), Herein Defined As Persons Primarily Engaged in The Provision of EarlyJeremias Cusay100% (1)

- Chanrob 1es Virtua L 1aw Libra RyDocument5 pagesChanrob 1es Virtua L 1aw Libra RyJeremias CusayNo ratings yet

- Commercial Law - Negotiable Instruments LawDocument31 pagesCommercial Law - Negotiable Instruments LawJeremias CusayNo ratings yet