Professional Documents

Culture Documents

SYBCom - Financial Services and Production Management - Module 2

Uploaded by

Yash SuranaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SYBCom - Financial Services and Production Management - Module 2

Uploaded by

Yash SuranaCopyright:

Available Formats

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

S.Y.B.Com. (Hons.)

Financial Services and Production Management

Content Index

No. Particulars

Module 1: Introduction to Financial Market

1 Financial Markets- Meaning –Classification- Money Market- Capital

Market- Primary Market.

2 Private Placement – Rights Issue – Bonus Issue – Recent trends in

public issues e.g, Book Building.

3 Secondary Markets- Role of Stock Exchanges in India

4 SEBI: Role and Functions of SEBI, SEBI and Investor Protection

5 Concept of Commodity Market- Fundamental Analysis and Technical

Analysis of Market – Meaning and Importance

6 Derivatives Market-Types- Participants-Types of Derivative Instruments

7 Case Studies-Presentations

Module 2: Financial Services

1 Financial Services-Concepts- Objectives-Characteristics- Growth of

financial Services in India

2 Merchant Banking: Meaning, Concept and Significance

3 Venture Capital – Nature and Scope – Venture Capital in India

4 Mutual Funds – Nature, Significance and Types of Mutual Funds.

5 Micro Finance - Meaning-Micro Finance Services-Micro Financial

Service Providers

6 Credit Rating- Meaning- Significance- Credit Rating Agencies.

7 Case Studies-Presentations

Compiled by CS Harsh Vira 1

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Module 3: Introduction to Production Management

1 Production Management: Concept- Objectives of Production Planning

and Control

2 Steps in Production Planning and Control

3 Concept and Types of Production System

4 Inventory Management: Concept, Objectives

5 Techniques of Inventory Control

6 Productivity – Concept, Factors Influencing Productivity

7 Case Studies-Presentations

Module 4: Quality Management

1 Meaning of Quality Management, Concepts of Product and Service

Quality, Dimensions of Quality Management

2 Cost of Quality- Meaning, Types

3 Techniques of Quality Management- Six Sigma, Kaizen, ISO 9000,

TQM

4 Quality Circles

5 Quality Audit, Measures to Improve Quality

6 Importance of Service Quality Management- SERVQUAL Model

7 Case Studies and Presentations

Compiled by CS Harsh Vira 2

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Module Financial Services

2

1 Financial Services

Concepts

Objectives

Characteristics

Growth of financial Services in India

2 Merchant Banking

Meaning

Concept

Significance

3 Venture Capital

Nature and Scope

Venture Capital in India

4 Mutual Funds

Nature

Significance

Types of Mutual Funds

5 Micro Finance

Meaning

Micro Finance Services

Micro Financial Service Providers

6 Credit Rating

Meaning

Significance

Credit Rating Agencies

7 Case Studies & Presentations

Compiled by CS Harsh Vira 3

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Chapter

Financial Services

1

1.1 Meaning & Concept of Financial Services

Financial services are the economic services provided by the finance industry, which

encompasses a broad range of businesses that manage money, including credit unions, banks,

credit-card companies, insurance companies, accountancy companies, consumer-finance

companies, stock brokerages, investment funds, individual managers, and some government

sponsored enterprises.

Financial services refer to services provided by the banks and financial institutions in a

financial system. In general, all types of activities which are of financial nature may be

regarded as financial services. In a broad sense, the term financial services mean mobilization

and allocation of savings. Thus, it includes all activities involved in the transformation of

savings into investment.

Following are some of the examples of financial services:

Mutual Fund management

Leasing, credit card, factoring, portfolio management & financial consultancy services

Underwriting, discounting and rediscounting of bills

Acceptances, brokerage and stock holding

Depository services, housing finance and book building

Hire purchases and installment credit

Financial and performance guarantees

Loan syndicating and credit rating

Insurance

Compiled by CS Harsh Vira 4

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

1.2 Objective of Financial Services

1. Raises Fund: Financial services serve as an efficient tool for raising funds in an economy.

It provides various financial instruments to individuals, investors, corporations, and

institutions where they can invest their money thereby raising funds from them.

2. Promotes Savings: These services provide different types of convenient investment

options that can grow people’s savings. A mutual fund is one such good option where people

can invest and earn reasonable returns without much risk.

3. Deployment of Funds: Financial services enable the proper deployment of financial

resources into productive means. There are numerous investment avenues and instruments

available in the financial market where people can invest their funds for earning income.

4. Minimizes Risk: Risk minimization is an important role played by financial services. These

services help in diversifying the risk and protect people against damages by providing

insurance policies.

5. Economic Growth: Financial services help the government in attaining the overall growth of

the economy. The government can easily raise both short-term and long term funds for its

various needs. It helps in improving overall infrastructural facilities and employment

opportunities in a country.

Compiled by CS Harsh Vira 5

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

1.3 Characteristics of Financial Services

1. Customer-centric: Financial services are usually customer focused. Financial Services are

provided, depending on the need of customer for example, leasing finance service may be

needed by an industrial customer, while merchant banker’s services may be needed by a

company issuing new equity share in the market.

2. Intangibility: Financial services are intangible in nature. In a highly competitive global

environment, brand image is very important. Unless the financial institutions providing

financial products and services have good image, enjoying the confidence of their clients,

they may not be successful.

3. Concomitant: Production of financial services and delivery of these services have to be

concomitant. Both these functions i.e. production of new and innovative financial services

and supplying of these services are to be performed simultaneously.

4. Perishable in nature: Like other services, financial services also require a match between

demand and supply. Services cannot be stored. They have to be supplied when customers

need them.

5. Dominance of human element: Financial services are dominated by human element. Thus,

financial services are labour intensive. It requires competent and skilled personnel to

market the quality financial products.

6. Advisory: Financial services can be of three types i.e. a fund based or a fee-based or both.

In case of fee-based services, the advisory function is dominant. Issue management,

registrar of issue, merchant banking, pricing of securities etc. are few examples of

advisory financial services.

7. Heterogeneity: Financial services are customized services. It cannot be uniform for all

clients. Financial services vary from one client to other. Institutional client requirements

differ from individual client. After analysing the needs of the clients, financial institutions

offer customised financial services to the clients.

8. Information based: Financial service industry is an information based industry. It involves

creation, dissemination and use of information. Information is an essential component in

the production of financial services.

Compiled by CS Harsh Vira 6

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

1.4 Growth of Financial Services in India

The growth of financial sector in India at present is nearly 8.5% per year. The rise in the

growth rate suggests the growth of the economy. The financial policies and the monetary

policies are able to sustain a stable growth rate.

The reforms pertaining to the monetary policies and the macro economic policies over the last

few years has influenced the Indian economy to the core. The major step towards opening up

of the financial market further was the nullification of the regulations restricting the growth

of the financial sector in India. To maintain such a growth for a long term the inflation has to

come down further.

The financial sector in India had an overall growth of 15%, which has exhibited stability over

the last few years although several other markets across the Asian region were going through

a turmoil. The development of the system pertaining to the financial sector was the key to the

growth of the same. With the opening of the financial market variety of products and services

were introduced to suit the need of the customer. The Reserve Bank of India (RBI) played a

dynamic role in the growth of the financial sector of India.

Compiled by CS Harsh Vira 7

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

The growth of financial sector in India was due to the development in sectors:

1. Growth of the banking sector in India

The banking system in India is the most extensive. The total asset value of the entire banking

sector in India is nearly US$ 270 billion. The total deposits is nearly US$ 220 billion. Banking

sector in India has been transformed completely. Presently the latest inclusions such as

Internet banking and Core banking have made banking operations more user friendly and easy.

2. Growth of the Capital Market in India

The ratio of the transaction was increased with the share ratio and deposit system

The removal of the pliable but ill-used forward trading mechanism

The introduction of infotech systems in the National Stock Exchange (NSE) in order to

cater to the various investors in different locations

Privatization of stock exchanges

3. Growth in the Insurance sector in India

With the opening of the market, foreign and private Indian players are keen to convert

untapped market potential into opportunities by providing tailor-made products.

The insurance market is filled up with new players which has led to the introduction of

several innovative insurance based products, value add-ons, and services. Many foreign

companies have also entered the arena such as Tokio Marine, Aviva, Allianz, Lombard

General, AMP, New York Life, Standard Life, AIG, and Sun Life.

The competition among the companies has led to aggressive marketing, and distribution

techniques.

The active part of the Insurance Regulatory and Development Authority (IRDA) as a

regulatory body has provided to the development of the sector.

4. Growth of the Venture Capital market in India

The venture capital sector in India is one of the most active in the financial sector inspite

of the hindrances by the external set up.

Presently in India there are around 34 national and 2 international SEBI registered

venture capital funds

Compiled by CS Harsh Vira 8

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Chapter Merchant Banking

2

2.1 Meaning & Concept of Merchant Banking:

Merchant banking is a professional

service provided by the merchant

banks to their customers considering

their financial needs, for adequate

consideration in the form of fee.

Merchant banks are banks that

conduct fundraising, financial advising

and loan services to large corporations.

These banks are experts in international trade, which makes them experts in dealing with

large corporations and industries. Merchant banking provides funds to the multinational

businesses and large business entities in the country which helps to boost the country’s

economic strength.

Merchant banks do not provide services to the general public; their services are limited

to business entities and large business corporations.

Merchant banker is a person who provides assistance for the subscription of securities.

The merchant banker plays an important role and carries a lot of responsibilities like, private

placement of securities, managing public issue of securities, stock broking, international

financial advisory services, etc.

Compiled by CS Harsh Vira 9

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

2.2 Significance of Merchant Banking:

The functions & Significance of merchant banking in India are governed by Securities and

Exchange Board of India (SEBI) regulations, 1992.

1. Portfolio Management

Merchant banking provides investment advice to the investors to make the investment

decisions. The merchant bank provides portfolio managing assistance to the investors

by trading securities on their behalf.

2. Raising funds for clients

Merchant banks assist clients in raising funds from the domestic and

international market by buying securities.

3. Promotional activities

The merchant bank also helps in the promotion of the business institute in its initial stages.

It helps the organisation to work on their business idea and to get the approval from the

government.

4. Loan Syndication

This is the service provided by merchant banks to its clients for raising credit from banks

and financial institutions.

5. Project Management

Merchant bankers use several ways to render their service to the client in financial related

project management.

6. Leasing Services

Merchant banks also provide leasing services to their customers.

Merchant banking provides a lot of support and opportunities for new businesses. This in

turn also has a positive effect on the country’s economic growth.

Compiled by CS Harsh Vira 10

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Chapter Venture Capital

3

3.1 Meaning, Nature & Scope of Venture Capital

It is a private or institutional investment made

into early-stage / start-up companies (new

ventures). As defined, ventures involve risk (having

uncertain outcome) in the expectation of a sizeable

gain. Venture Capital is money invested in

businesses that are small; or exist only as an

initiative, but have huge potential to grow. The

people who invest this money are called venture

capitalists (VCs). The venture capital investment is

made when a venture capitalist buys shares of such

a company and becomes a financial partner in the

business.

Venture Capital investment is also referred to risk capital or patient risk capital, as it

includes the risk of losing the money if the venture doesn’t succeed and takes medium to long

term period for the investments to fructify.

Venture Capital typically comes from institutional investors and high net worth individuals

and is pooled together by dedicated investment firms.

It is the money provided by an outside investor to finance a new, growing, or troubled

business. The venture capitalist provides the funding knowing that there’s a significant risk

associated with the company’s future profits and cash flow. Capital is invested in exchange for

an equity stake in the business rather than given as a loan.

Venture Capital is the most suitable option for funding a costly capital source for

companies and most for businesses having large up-front capital requirements which have no

other cheap alternatives. Software and other intellectual property are generally the most

common cases whose value is unproven. That is why; Venture capital funding is most

widespread in the fast-growing technology and biotechnology fields.

Compiled by CS Harsh Vira 11

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

3.2 Venture Capital in India

The top 10 most active Venture Capitals alone contributed to 32% of the total deal

count. Venture Capital investment is also referred to as risk capital or patient risk capital, as

it includes the risk of losing the money if the venture doesn’t succeed and takes a medium to

long term period for the investments to fructify. The Indian startups secured over $12.1

billion from venture capitalists in the first 6 months of 2021, which is $1 billion more than the

overall funding that they received last year. Venture Capital (VC) investment in India more

than doubled from its previous quarterly high of $6.7 billion in Q2 2021 to $14.4 billion

during Q3 2021, according to a recent report by KPMG. Therefore, raising funds from

venture capitalists is the way to go for Indian startups.

Top VC Firms in India

1. Sequoia Capital

2. Accel

3. Blume Ventures

4. Elevation Capital

5. Tiger Global Management

6. Kalaari Capital

7. Matrix Partners

8. Nexus Venture Partners

9. Indian Angel Network

10. Omidyar Network India

Compiled by CS Harsh Vira 12

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Case Study: Ratan Tata as Top Venture Capitalist in India

Ratan Tata is a prolific investor and has

made numerous investment in many Startups.

His style of investment and funding are

revered by many across the globe. And his

investments are known to emerge as giants in

their respective sectors with time. Ola Cabs is

an example.

An investment from Ratan Tata gives a

boost to startups in terms of publicity,

acquiring finances, and brand-building. Here is

a list of the startups that Ratan Tata has

funded over the years. Consequently, the behemoth organization of Ratan tata - Tata Group

has also infiltrated a number of markets such as telecom, software, groceries, and fashion.

What is the Name of Ratan Tata's venture capital?

Ratan Tata’s investment firm, RNT Associates, has partnered with the University of

California (UC Investments) to jointly fund startups in India.

How can I get funding from Ratan Tata?

Create a company that is innovative and provides value to others. Ratan Tata does not have a

preferred niche that he likes to invest in. Some of the e-mail addresses that can be

corresponded to are srtt@tatatrusts.org, rntata@tata.com, rnt@tata.com,

or talktous@tatatrusts.org.

What are the names of some Ratan Tata funded startups?

Some startups funded by Ratan Tata are Ola cabs, Zivame, Paytm, Snapdeal, Xiaomi, Urban

Ladder, UrbanCompany, Cash Karo, and Abra.

What sector does Ratan Tata like to fund in?

Ratan Tata does not prefer any specific sectors. He has funded startups in sectors ranging

from e-commerce and real estate to electric mobility and food delivery.

Compiled by CS Harsh Vira 13

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Chapter Mutual Funds

4

4.1 Meaning of Mutual Fund

Mutual fund is a financial instrument that pools money from different investors. The

pooled money is then invested in securities like stocks of listed companies, government bonds,

corporate bonds, and money market instruments.

As an investor, you don’t directly own the company’s stocks that mutual funds purchases.

However, you share the profit or loss equally with the other investors of the pool. This is how

the word “mutual” is associated with a mutual fund.

You get the advantage of the expertise of the fund manager and regulatory safety of the

Securities Exchange and Board of India (SEBI). The professional fund manager ensures a

maximum return to investors.

Compiled by CS Harsh Vira 14

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

4.2 Nature of Mutual Fund

Mutual fund investment is simple. You invest in a fund consisting of several assets. Thus,

you need not risk putting all eggs in one basket. Additionally, the headache of tracking market

movements is not there. The mutual fund house takes care of the research, fund management,

and market tracking. This makes the mutual fund a highly popular investment option for all

types of investors.

A mutual fund is managed by the asset management company (AMC). Mutual fund investment

starts with the pooling of money from several investors. The pooled money is invested in a

meticulously built portfolio of different asset classes like equity, debt, money market

instruments, and other funds. Hence, you have the advantage of diversification, the time

tested market mantra. Additionally, your money is invested in instruments like Government

bonds, that you wouldn’t be able to afford individually.

The best part about mutual funds is that a team of experts along with the fund manager picks

all the investments to build a portfolio. The investments are made according to the defined

objective of the mutual fund. Expert and professional fund management help you outperform

the returns of traditional investment vehicles like a bank savings account and fixed deposits.

As an investor, you are allotted units for your contribution to the pooled fund. The portfolio

value depends on the price movements of the underlying assets. The portfolio value is net

assets divided by the number of outstanding units which is called the net asset value or NAV.

The gains are reflected in higher NAV and lower NAV indicates a loss in portfolio value.

Compiled by CS Harsh Vira 15

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

4.3 Types of Mutual Funds

Based on Asset Class

Equity Funds

Equity funds primarily invest in stocks, and hence go by the name of stock funds as well. They

invest the money pooled in from various investors from diverse backgrounds into

shares/stocks of different companies. The gains and losses associated with these funds

depend solely on how the invested shares perform (price-hikes or price-drops) in the stock

market. Also, equity funds have the potential to generate significant returns over a period.

Hence, the risk associated with these funds also tends to be comparatively higher.

Debt Funds

Debt funds invest primarily in fixed-income securities such as bonds, securities and treasury

bills. They invest in various fixed income instruments such as Fixed Maturity Plans (FMPs), Gilt

Funds, Liquid Funds, Short-Term Plans, Long-Term Bonds and Monthly Income Plans, among

others. Since the investments come with a fixed interest rate and maturity date, it can be a

great option for passive investors looking for regular income (interest and capital

appreciation) with minimal risks.

Hybrid Funds

As the name suggests, hybrid funds (Balanced Funds) is an optimum mix of bonds and stocks,

thereby bridging the gap between equity funds and debt funds. The ratio can either be

variable or fixed. In short, it takes the best of two mutual funds by distributing, say, 60% of

assets in stocks and the rest in bonds or vice versa. Hybrid funds are suitable for investors

looking to take more risks for ‘debt plus returns’ benefit rather than sticking to lower but

steady income schemes.

Money Market Funds

Investors trade stocks in the stock market. In the same way, investors also invest in

the money market, also known as capital market or cash market. The government runs it in

association with banks, financial institutions and other corporations by issuing money market

securities like bonds, T-bills, dated securities and certificates of deposits, among others. The

fund manager invests your money and disburses regular dividends in return. Opting for a

short-term plan (not more than 13 months) can lower the risk of investment considerably on

such funds.

Compiled by CS Harsh Vira 16

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Based on Investment Goals

Growth Funds

Growth funds usually allocate a considerable portion in shares and growth sectors, suitable for

investors (mostly Millennials) who have a surplus of idle money to be distributed in riskier

plans (albeit with possibly high returns) or are positive about the scheme.

Income Funds

Income funds belong to the family of debt mutual funds that distribute their money in a mix

of bonds, certificate of deposits and securities among others. Helmed by skilled fund

managers who keep the portfolio in tandem with the rate fluctuations without compromising on

the portfolio’s creditworthiness, income funds have historically earned investors better

returns than deposits. They are best suited for risk-averse investors with a 2-3 years

perspective.

Tax-Saving Funds

ELSS or Equity Linked Saving Scheme, over the years, have climbed up the ranks among all

categories of investors. Not only do they offer the benefit of wealth maximisation while

allowing you to save on taxes, but they also come with the lowest lock-in period of only three

years. Investing predominantly in equity (and related products), they are known to generate

non-taxed returns in the range 14-16%. These funds are best-suited for salaried investors

with a long-term investment horizon.

Aggressive Growth Funds

Slightly on the riskier side when choosing where to invest in, the Aggressive Growth Fund is

designed to make steep monetary gains. Though susceptible to market volatility, one can

decide on the fund as per the beta (the tool to gauge the fund’s movement in comparison with

the market). Example, if the market shows a beta of 1, an aggressive growth fund will reflect

a higher beta, say, 1.10 or above.

Capital Protection Funds

If protecting the principal is the priority, Capital Protection Funds serves the purpose while

earning relatively smaller returns (12% at best). The fund manager invests a portion of the

money in bonds or Certificates of Deposits and the rest towards equities. Though the

probability of incurring any loss is quite low, it is advised to stay invested for at least three

years (closed-ended) to safeguard your money, and also the returns are taxable.

Fixed Maturity Funds

Compiled by CS Harsh Vira 17

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Many investors choose to invest towards the of the FY ends to take advantage of triple

indexation, thereby bringing down tax burden. If uncomfortable with the debt market trends

and related risks, Fixed Maturity Plans (FMP) – which invest in bonds, securities, money

market etc. – present a great opportunity. As a close-ended plan, FMP functions on a fixed

maturity period, which could range from one month to five years (like FDs). The fund manager

ensures that the money is allocated to an investment with the same tenure, to reap accrual

interest at the time of FMP maturity.

Pension Funds

Putting away a portion of your income in a chosen pension fund to accrue over a long period to

secure you and your family’s financial future after retiring from regular employment can take

care of most contingencies (like a medical emergency or children’s wedding). Relying solely on

savings to get through your golden years is not recommended as savings (no matter how big)

get used up. EPF is an example, but there are many lucrative schemes offered by banks,

insurance firms etc.

Based on Structure

Mutual funds are also categorised based on different attributes (like risk profile, asset class,

etc.). The structural classification – open-ended funds, close-ended funds, and interval funds –

is quite broad, and the differentiation primarily depends on the flexibility to purchase and sell

the individual mutual fund units.

Open-Ended Funds

Open-ended funds do not have any particular constraint such as a specific period or the

number of units which can be traded. These funds allow investors to trade funds at their

convenience and exit when required at the prevailing NAV (Net Asset Value). This is the sole

reason why the unit capital continually changes with new entries and exits. An open-ended

fund can also decide to stop taking in new investors if they do not want to (or cannot manage

significant funds).

Closed-Ended Funds

In closed-ended funds, the unit capital to invest is pre-defined. Meaning the fund company

cannot sell more than the pre-agreed number of units. Some funds also come with a New Fund

Offer (NFO) period; wherein there is a deadline to buy units. NFOs comes with a pre-defined

maturity tenure with fund managers open to any fund size. Hence, SEBI has mandated that

investors be given the option to either repurchase option or list the funds on stock exchanges

to exit the schemes.

Compiled by CS Harsh Vira 18

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Based on Risk

Very Low-Risk Funds

Liquid funds and ultra-short-term funds (one month to one year) are known for its low risk,

and understandably their returns are also low (6% at best). Investors choose this to fulfil

their short-term financial goals and to keep their money safe through these funds.

Low-Risk Funds

In the event of rupee depreciation or unexpected national crisis, investors are unsure about

investing in riskier funds. In such cases, fund managers recommend putting money in either

one or a combination of liquid, ultra short-term or arbitrage funds. Returns could be 6-8%, but

the investors are free to switch when valuations become more stable.

Medium-risk Funds

Here, the risk factor is of medium level as the fund manager invests a portion in debt and the

rest in equity funds. The NAV is not that volatile, and the average returns could be 9-12%.

High-Risk Funds

Suitable for investors with no risk aversion and aiming for huge returns in the form of

interest and dividends, high-risk mutual funds need active fund management. Regular

performance reviews are mandatory as they are susceptible to market volatility. You can

expect 15% returns, though most high-risk funds generally provide up to 20% returns.

Specialized Mutual Funds

Sector Funds

Sector funds invest solely in one specific sector, theme-based mutual funds. As these funds

invest only in specific sectors with only a few stocks, the risk factor is on the higher side.

Investors are advised to keep track of the various sector-related trends. Sector funds also

deliver great returns. Some areas of banking, IT and pharma have witnessed huge and

consistent growth in the recent past and are predicted to be promising in future as well.

Index Funds

Suited best for passive investors, index funds put money in an index. A fund manager does not

manage it. An index fund identifies stocks and their corresponding ratio in the market index

and put the money in similar proportion in similar stocks. Even if they cannot outdo the market

(which is the reason why they are not popular in India), they play it safe by mimicking the

index performance.

Compiled by CS Harsh Vira 19

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Funds of Funds

A diversified mutual fund investment portfolio offers a slew of benefits, and ‘Funds of Funds’

also known as multi-manager mutual funds are made to exploit this to the tilt – by putting

their money in diverse fund categories. In short, buying one fund that invests in many funds

rather than investing in several achieves diversification while keeping the cost down at the

same time.

Emerging market Funds

To invest in developing markets is considered a risky bet, and it has undergone negative

returns too. India, in itself, is a dynamic and emerging market where investors earn high

returns from the domestic stock market. Like all markets, they are also prone to market

fluctuations. Also, from a longer-term perspective, emerging economies are expected to

contribute to the majority of global growth in the following decades.

International/ Foreign Funds

Favoured by investors looking to spread their investment to other countries, foreign mutual

funds can get investors good returns even when the Indian Stock Markets perform well. An

investor can employ a hybrid approach (say, 60% in domestic equities and the rest in overseas

funds) or a feeder approach (getting local funds to place them in foreign stocks) or a theme-

based allocation (e.g., gold mining).

Global Funds

Aside from the same lexical meaning, global funds are quite different from International

Funds. While a global fund chiefly invests in markets worldwide, it also includes investment in

your home country. The International Funds concentrate solely on foreign markets. Diverse

and universal in approach, global funds can be quite risky to owing to different policies, market

and currency variations, though it does work as a break against inflation and long-term returns

have been historically high.

Real Estate Funds

Despite the real estate boom in India, many investors are still hesitant to invest in such

projects due to its multiple risks. Real estate fund can be a perfect alternative as the

investor will be an indirect participant by putting their money in established real estate

companies/trusts rather than projects. A long-term investment negates risks and legal hassles

when it comes to purchasing a property as well as provide liquidity to some extent.

Commodity-focused Stock Funds

These funds are ideal for investors with sufficient risk-appetite and looking to diversify their

portfolio. Commodity-focused stock funds give a chance to dabble in multiple and diverse

Compiled by CS Harsh Vira 20

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

trades. Returns, however, may not be periodic and are either based on the performance of the

stock company or the commodity itself. Gold is the only commodity in which mutual funds can

invest directly in India. The rest purchase fund units or shares from commodity businesses.

Market Neutral Funds

For investors seeking protection from unfavourable market tendencies while sustaining good

returns, market-neutral funds meet the purpose (like a hedge fund). With better risk-

adaptability, these funds give high returns where even small investors can outstrip the market

without stretching the portfolio limits.

Inverse/Leveraged Funds

While a regular index fund moves in tandem with the benchmark index, the returns of an

inverse index fund shift in the opposite direction. It is nothing but selling your shares when

the stock goes down, only to repurchase them at an even lesser cost (to hold until the price

goes up again).

Asset Allocation Funds

Combining debt, equity and even gold in an optimum ratio, this is a greatly flexible fund.

Based on a pre-set formula or fund manager’s inferences based on the current market

trends, asset allocation funds can regulate the equity-debt distribution. It is almost like

hybrid funds but requires great expertise in choosing and allocation of the bonds and stocks

from the fund manager.

Exchange-traded Funds

It belongs to the index funds family and is bought and sold on exchanges. Exchange-traded

Funds have unlocked a new world of investment prospects, enabling investors to gain extensive

exposure to stock markets abroad as well as specialised sectors. An ETF is like a mutual fund

that can be traded in real-time at a price that may rise or fall many times in a day.

Compiled by CS Harsh Vira 21

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Chapter Micro Finance

5

5.1 Meaning of Micro Finance

Microfinance generally refers to the

provision of basic financial services such as

loans, saving accounts and insurances for low-

income but economical active people.

In most instances the term microfinance

refers to the provision of small loans (=micro

credits) for micro-entrepreneurs.

Why Microfinance?

Around two thirds of the world population is cut off from the conventional financial

market. Low-income people typically have no collateral and therefore no chance to take out a

loan, to save money or to invest for the future. Women especially are often considered as

not credit-worthy by banks.

The purchase of a small plot of land, a sewing machine or a market stand for example

would help many people to put their ideas into practice and to escape poverty. Often, the

only alternative are local moneylenders, so called “loan sharks”, who charge extortionate

interest rates of up to several hundred percent a month.

Compiled by CS Harsh Vira 22

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

5.2 Micro Finance Services

Microfinance services are provided to unemployed or low-income individuals because most

of those trapped in poverty, or who have limited financial resources, do not have enough

income to do business with traditional financial institutions.

Despite being excluded from banking services, however, those who live on as little as Rs. 100 a

day do attempt to save, borrow, acquire credit or insurance, and they do make payments on

their debt. Thus, many poor people typically look to family, friends, and even loan sharks (who

often charge exorbitant interest rates) for help.

Microfinance allows people to take on reasonable small business loans safely, and in a

manner that is consistent with ethical lending practices. Although they exist all around the

world, the majority of micro financing operations occur in developing nations, such as Uganda,

Indonesia, Serbia, and Honduras. Many microfinance institutions focus on helping women in

particular.

Micro financing organizations support a large number of activities that range from providing

the basics—like bank checking and savings accounts—to startup capital for small business

entrepreneurs and educational programs that teach the principles of investing. These

programs can focus on such skills as bookkeeping, cash-flow management, and technical or

professional skills, like accounting. Unlike typical financing situations, in which the lender is

primarily concerned with the borrower having enough collateral to cover the loan, many

microfinance organizations focus on helping entrepreneurs succeed.

5.3 Micro Financial Service Providers

Top Microfinance Companies in India

Equitas Small Finance.

ESAF Microfinance and Investments (P) Ltd.

Fusion Microfinance Pvt Ltd.

Annapurna Microfinance Pvt Ltd.

Arohan Financial Services Limited.

BSS Microfinance Limited.

Asirvad Microfinance Limited.

Cashpor Micro Credit.

Compiled by CS Harsh Vira 23

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Chapter Credit Rating

6

6.1 Meaning of Credit Rating

Definition:

Credit rating is an analysis of the credit

risks associated with a financial instrument or a

financial entity. It is a rating given to a particular

entity based on the credentials and the extent to

which the financial statements of the entity are

sound, in terms of borrowing and lending that has

been done in the past.

Usually, is in the form of a detailed report based on the financial history of borrowing or

lending and credit worthiness of the entity or the person obtained from the statements of its

assets and liabilities with an aim to determine their ability to meet the debt obligations. It

helps in assessment of the solvency of the particular entity. These ratings based on detailed

analysis are published by various credit rating agencies like Standard & Poor's, Moody's

Investors Service, and ICRA, to name a few.

6.2 Significance of Credit Rating

Following are the key important factors of credit rating:

Credit rating is a tool that offers quantitative analysis of the creditworthiness of an

individual

Credit rating offered to a debt or investment instrument helps investors to track the risk

profile of the instrument and thereby, take a wise and informed decision

Credit rating for corporates helps them to attract investors and improves their presence

across the corporate spectrum

Credit rating is a powerful tool that helps companies to raise money in times of need

Individuals having higher credit rating will help them acquire loans at lower rate and quickly

Credit ratings are used by investors, intermediaries such as investment banks, issuers of debt,

and businesses and corporations.

Both institutional and individual investors use credit ratings to assess the risk related to

investing in a specific issuance, ideally in the context of their entire portfolio.

Compiled by CS Harsh Vira 24

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

Intermediaries such as investment bankers utilize credit ratings to evaluate credit risk

and further derive pricing of debt issues.

Debt issuers such as corporations, governments, municipalities, etc., use credit ratings as

an independent evaluation of their creditworthiness and credit risk associated with their

debt issuance. The ratings can, to some extent, provide prospective investors with an idea

of the quality of the instrument and what kind of interest rate they should be expecting

from it.

Businesses and corporations that are looking to evaluate the risk involved with a certain

counterparty transaction also use credit ratings. They can help entities that are looking to

participate in partnerships or ventures with other businesses evaluate the viability of the

proposition.

6.3 Credit Rating Agencies

Following is the list of some of the top credit rating agencies in India.

CRISIL

CRISIL is the abbreviation of Credit

Rating Information Service of India

Limited. The CRISIL credit agency is

one of the oldest agencies in India.

CRISIL was established in the year

1987, which latter went on to go for

public investment in the year 1993. The

headquarters of CRISIL is based in

Mumbai, Maharashtra. CRISIL is one of the most popular credit rating agencies in India that

offers efficient credit ratings for mutual funds ranking, Unit Linked Insurance Plans

(ULIP) rankings, CRISIL coalition index etc.

ICRA

ICRA stands for Information and Credit Rating Agency of India is a public limited credit

rating agency that was established in the year 1991. ICRA has its headquarters in Gurugram.

The company ICRA was previously called Investment Information and Credit Rating Agency of

India Limited. This credit rating company offers comprehensive credit rating system to

corporates through transparent rating system and offers credit rating for -corporate debt,

bank loan rating, financial rating, structured finance, infrastructure, insurance, mutual funds,

project and public finance, SME Rating, issuer rating, market linked debentures and so on.

Compiled by CS Harsh Vira 25

FINANCIAL SERVICES AND PRODUCTION MANAGEMENT SYBCOM

CARE

CARE (Credit Analysis and Research Limited) agency was launched in the year 1993. CARE

offers credit rating services to areas such as corporate governance, debt ratings, financial

sector, bank loan ratings, issuer ratings, recovery ratings, and infrastructure ratings. The

CARE credit rating agency’s headquartered in Mumbai, Maharashtra. CARE offers two types

of bank loan ratings to its investors namely, long-term debt instrument and short-term debt

instruments. Apart from this, the company also offers ratings for Initial Public Offerings

(IPOs), real estate, renewable energy service companies (RESCO), financial assessment of

shipyards, Energy service companies (ESCO) grades various courses of educational

institutions.

ONICRA

ONICRA Credit Rating Agency is one of the leading private credit rating agencies established

to offer performance and credit ratings. The headquarters of this company is situated in

Gurugram, Haryana. This credit rating agency is responsible to provide credit ratings,

performance rating based on risk assessment and also offers analytical solutions to

individuals, corporates as well as MSMEs (micro, small and medium enterprises). The credit

ratings offered by ONICRA helps various organisations to take informed decisions regarding

lending funds to individuals, MSMEs and other organisations. The company, since its inception,

has been dedicated in providing in-depth research of various parameters related to credit and

creditworthiness.

SMERA

SMERA stands for small and medium enterprise rating agency of India was established in the

year 2005. This credit rating agency was formed by SIDBI, Dun & Bradstreet India and

leading banks in India. SMERA has its headquarters in Mumbai, Maharashtra and offers credit

rating services for various investment instruments like IPO, Non-Convertible Debentures,

Fixed deposits, Bonds, CP etc.

Brickwork Ratings India Private Limited

Brickwork Rating India Private Limited is a Bengaluru based credit rating agency established

in the year 2007. This credit rating agency is promoted by the Canara Bank and it offers

ratings for various investment and debt instruments like bank loans, SME companies, etc. as

well as rating for corporate governance, rating for Municipal Corporation, capital market

instruments ratings, financial institutions etc. Apart from these, the company also offers

ratings for NGOs, Initial Public Offers, Investments in the Real Estate, Tourism, Hospitals,

IREDA, Micro Finance Institutions, Educational institutions, etc.

Compiled by CS Harsh Vira 26

You might also like

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- CHP 1 Intro To FS TextbkDocument31 pagesCHP 1 Intro To FS TextbkVenom BhaiyaNo ratings yet

- Financial Services NotesDocument62 pagesFinancial Services NotesHari Haran MNo ratings yet

- Financial Services - Unit - 1Document19 pagesFinancial Services - Unit - 1rajesh337masssNo ratings yet

- Soft Copy of Project... 2Document21 pagesSoft Copy of Project... 2Jahid KhanNo ratings yet

- Indian Financial SystemDocument260 pagesIndian Financial SystemRamya Gowda0% (1)

- Financial Markets GuideDocument30 pagesFinancial Markets GuideYash SuranaNo ratings yet

- Financial ServicesDocument86 pagesFinancial ServicesSahana Sameer Kulkarni100% (1)

- Unit 3 Financial Services: An Introduction: ObjectivesDocument19 pagesUnit 3 Financial Services: An Introduction: ObjectivesKashif UddinNo ratings yet

- Study MaterialDocument46 pagesStudy MaterialSRISHTINo ratings yet

- Financial Services Guide: Investment, Credit Ratings, Consumer FinanceDocument54 pagesFinancial Services Guide: Investment, Credit Ratings, Consumer Financeananya_nagrajNo ratings yet

- Financial Service Review - IcfaiDocument7 pagesFinancial Service Review - IcfaiS.Kumar0% (1)

- Financial ServicesDocument85 pagesFinancial ServicesPankaj KumarNo ratings yet

- NBFC Full NotesDocument69 pagesNBFC Full NotesJumana haseena SNo ratings yet

- CASE: Financial Services in IndiaDocument8 pagesCASE: Financial Services in IndiaANCHAL SINGHNo ratings yet

- Management of Financial ServicesDocument76 pagesManagement of Financial ServicesVickey Chouhan100% (2)

- Bharathidasan University MBA Elective Course Merchant BankingDocument257 pagesBharathidasan University MBA Elective Course Merchant BankingParivel ParivelNo ratings yet

- MFS NotesDocument139 pagesMFS NotesSHANAT BENNYNo ratings yet

- DFS SyllabusDocument3 pagesDFS SyllabusSakshi GourNo ratings yet

- Banking products marketing strategiesDocument5 pagesBanking products marketing strategiesJanaki KaruppusamyNo ratings yet

- Financial Services KMN FinalDocument27 pagesFinancial Services KMN FinalkmnarayanNo ratings yet

- Unit - I Learning ObjectivesDocument277 pagesUnit - I Learning Objectiveskashyap00No ratings yet

- Assignment of Financial ServicesDocument24 pagesAssignment of Financial ServicesBALPREET_SVIETNo ratings yet

- Financial Markets and ServicesDocument12 pagesFinancial Markets and Servicessrilekha thamalampudiNo ratings yet

- MBFS Financial SystemDocument40 pagesMBFS Financial SystemNagendra Basetti100% (1)

- Financial ServicesDocument392 pagesFinancial ServicesCLAUDINE MUGABEKAZINo ratings yet

- Post-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IDocument5 pagesPost-Graduate Diploma in Management (Banking & Financial Services) 2021-23 Term IAbhinav MahajanNo ratings yet

- MMPB-005 Marketing of Financial ServicesDocument306 pagesMMPB-005 Marketing of Financial ServicesMahesh N JethvaNo ratings yet

- Summer Internship Report.................. Docx132Document37 pagesSummer Internship Report.................. Docx132Rashmin TomarNo ratings yet

- Financial Services Notes - Jeganraj - 2020Document23 pagesFinancial Services Notes - Jeganraj - 2020jeganrajraj100% (1)

- Fund Based ActivitiesDocument35 pagesFund Based Activitiesyaminipawar509100% (3)

- Project Report On A Comparative Study of Business Models of Co-Operatives Mfis and Financial InclusionDocument43 pagesProject Report On A Comparative Study of Business Models of Co-Operatives Mfis and Financial Inclusionsoham sheteNo ratings yet

- Financial Services MbaDocument251 pagesFinancial Services MbaMohammed Imran50% (2)

- IFS Notes 1Document43 pagesIFS Notes 1Tejas NagulwarNo ratings yet

- Financial Services PPtsDocument37 pagesFinancial Services PPts22MBAB14 Cruz Slith Victor CNo ratings yet

- Adarsh SrivastavDocument35 pagesAdarsh Srivastavpooja vermaNo ratings yet

- Commercial Banking Structure EvolutionDocument11 pagesCommercial Banking Structure EvolutionChinedu JosephNo ratings yet

- As Per Section 6a5Document7 pagesAs Per Section 6a5vasimahmad20No ratings yet

- Management of Financial ServicesDocument0 pagesManagement of Financial ServicesDrYamini SharmaNo ratings yet

- Credit Risk Management at SbiDocument66 pagesCredit Risk Management at Sbipradeep singh0% (3)

- Unit 4 Management of Risk in Financial Services: ObjectivesDocument23 pagesUnit 4 Management of Risk in Financial Services: ObjectivesSHYAM GOELNo ratings yet

- Definition of Financial ServicesDocument25 pagesDefinition of Financial ServicesShailesh SoniNo ratings yet

- Third Year B'Com (Banking & Insurance) Revised Syllabus 2017-18 Semester 5 1. Marketing in Banking and InsuranceDocument3 pagesThird Year B'Com (Banking & Insurance) Revised Syllabus 2017-18 Semester 5 1. Marketing in Banking and InsuranceVineet ShettyNo ratings yet

- Xe AbgDocument259 pagesXe AbgTanvi DeshmukhNo ratings yet

- Merchant Banking and Financial ServicesDocument41 pagesMerchant Banking and Financial Servicesthamizt100% (6)

- Marketing of Financial Products & Services_Code 307_BBA (B & I)_Sem VDocument118 pagesMarketing of Financial Products & Services_Code 307_BBA (B & I)_Sem V21rahul.ranjanNo ratings yet

- Unit1 Financial Services 1 PDFDocument6 pagesUnit1 Financial Services 1 PDFRoshan SinghNo ratings yet

- Nisha SipDocument35 pagesNisha Sippooja vermaNo ratings yet

- Unit 9 Monetary Policy: 9.0 ObjectivesDocument21 pagesUnit 9 Monetary Policy: 9.0 ObjectivesShashank Cooled RanaNo ratings yet

- Hidayatullah National Law University Raipur (C.G)Document22 pagesHidayatullah National Law University Raipur (C.G)mukteshNo ratings yet

- Wealth Management: Trends and IssuesDocument17 pagesWealth Management: Trends and Issuesagrawal.ace9114100% (1)

- Bank MarketingDocument5 pagesBank MarketingvaaaadNo ratings yet

- 8 NBFCDocument110 pages8 NBFCrohit sharmaNo ratings yet

- 20211217091025MBFS NotesDocument112 pages20211217091025MBFS Noteskomalsidhu1235No ratings yet

- Finan Service TodayDocument18 pagesFinan Service TodayRanji SelvaNo ratings yet

- Introduction to Indian Financial SystemDocument12 pagesIntroduction to Indian Financial SystemAishwarya SharmaNo ratings yet

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1From EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1No ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- Business Finance ReviewerDocument3 pagesBusiness Finance ReviewerEmelita abagatNo ratings yet

- Archesh Tiwari (Updated)Document4 pagesArchesh Tiwari (Updated)Archman comethNo ratings yet

- Avon Make A Payment Information July 2021 PDFDocument1 pageAvon Make A Payment Information July 2021 PDFHeggies StaeraNo ratings yet

- Comenity Capital Bank outage FAQs 6/30Document2 pagesComenity Capital Bank outage FAQs 6/30yitayewamlakNo ratings yet

- Paper 1 (INT) Recording Financial TransactionsDocument8 pagesPaper 1 (INT) Recording Financial TransactionsWatson K PhiriNo ratings yet

- E-Commerce FundamentalsDocument17 pagesE-Commerce FundamentalsKannan KhanNo ratings yet

- World Bank, IMF, and It's ImpactsDocument24 pagesWorld Bank, IMF, and It's ImpactsAli JumaniNo ratings yet

- Moss Co. bonds and warrants analysisDocument65 pagesMoss Co. bonds and warrants analysisJoy Montalla Sangil80% (5)

- HNB Report-2Document37 pagesHNB Report-2Samith GurusingheNo ratings yet

- 55-58.2 - Credit Line Deed of Trust Defined Relative Priority of Credit Line Deed of Trust and Other Instruments of JudgmentDocument2 pages55-58.2 - Credit Line Deed of Trust Defined Relative Priority of Credit Line Deed of Trust and Other Instruments of JudgmentKNOWLEDGE SOURCENo ratings yet

- Appraisal of The Role of Commercial BankDocument3 pagesAppraisal of The Role of Commercial BankKelly O NwosehNo ratings yet

- Protocols For Economic Collapse in America by Al MartinDocument12 pagesProtocols For Economic Collapse in America by Al Martininformationawareness100% (1)

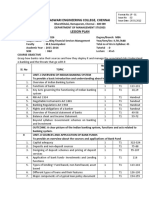

- Banking Financial Services Management Lesson PlanDocument3 pagesBanking Financial Services Management Lesson PlanRamalingam Chandrasekharan0% (1)

- FRTB Crisil Circulation PDFDocument12 pagesFRTB Crisil Circulation PDF4GetMNo ratings yet

- E Passbook 2022 10 12 12 43 26 PMDocument30 pagesE Passbook 2022 10 12 12 43 26 PMManohar NMNo ratings yet

- Cibn 2020 TimetableDocument1 pageCibn 2020 TimetableAromasodun Omobolanle IswatNo ratings yet

- A Comparative Study of Performance of Local Banks in Sultanate of OmanDocument10 pagesA Comparative Study of Performance of Local Banks in Sultanate of OmanResearch StudiesNo ratings yet

- Your Commercial Card Statement: MR Imran Munir Narmi Limited 19 Thorpe Road London E17 4LADocument4 pagesYour Commercial Card Statement: MR Imran Munir Narmi Limited 19 Thorpe Road London E17 4LAaoshi321No ratings yet

- Secretary's Certificate of The Board Resolution-BLANKDocument2 pagesSecretary's Certificate of The Board Resolution-BLANKEverest Safety Supplies100% (1)

- Financial Markets: Our Lady of The Pillar College-Cauayan CampusDocument58 pagesFinancial Markets: Our Lady of The Pillar College-Cauayan CampusMaricar Dela Cruz VLOGSNo ratings yet

- A Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaDocument49 pagesA Report On Merchant Banking and Portfolio Management Rules: A Comparison of Bangladesh and IndiaYeasir ArafatNo ratings yet

- Lalit Srivastava Aml Iba BangaloreDocument33 pagesLalit Srivastava Aml Iba Bangaloreparshu7No ratings yet

- Customer Satisfaction On Online Banking Services - A Case Study On HSBC Bank UKDocument73 pagesCustomer Satisfaction On Online Banking Services - A Case Study On HSBC Bank UKMahmudur Rahman94% (34)

- HundiDocument21 pagesHundinitesh kumar satsangiNo ratings yet

- AnnuityDocument10 pagesAnnuityJiru Kun0% (1)

- IBM Banking: Core Systems Transformation For BankingDocument2 pagesIBM Banking: Core Systems Transformation For BankingIBMBankingNo ratings yet

- Mid MCDocument47 pagesMid MCPhuong PhamNo ratings yet

- Business Plan FULLDocument27 pagesBusiness Plan FULLJoseph Israel100% (1)

- General Banking Law of 2000Document25 pagesGeneral Banking Law of 2000John Rey Bantay RodriguezNo ratings yet

- Settlement QuoteDocument1 pageSettlement QuoteKaylin NaickerNo ratings yet