Professional Documents

Culture Documents

IT New Vs Old Regime

Uploaded by

suhasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IT New Vs Old Regime

Uploaded by

suhasCopyright:

Available Formats

Excel Income tax Calculator for FY 20

Fill only the Red-Highlighted field

(i) Gross Salary of Employee (ia + ib + ic)

(a) Salary as per section 17(1)

B1 (b) Value of perquisites as per section 17(2)

Salary /

Pension (c) Profits in lieu of salary as per section 17(3)

LESS :- Allowance to extent exempt u/s 10 like Travelling allowance, washing

allowance, Child education allowance etc.

Less: Standard deduction u/s 16(iv) - Flat Rs. 50,000 to all

Income Under the Head Salaries

Type of House Property Self Occupied / Let out

Rent Recived Total in FY, if 'Let Out'

B2 (After deducting 30%)

Less (Interest on Home Loan)

Income chargeable under the head ‘House Property’

B3 Income from other sources Like FD, Bond etc.

B4 Gross Total Income B1+B2+B3

Part C - Deductions and Taxable Total Incom

Deductions Description / Remarks

Less: Deductions U/s 80C (PF, LIC, SSY,

SCSS, NSC, KVP etc.)

Less: NPS / Atal PY Contribution U/s Maximum 150,000 can be claimed by

80CCD(1) - by Employee only combining both 80C + 80CCD(1)

Less: NPS Contribution U/s 80CCD(1B) - Maximum 50,000 can be claimed in addition

by Employee only to 150,000 above.

Less: NPS Contribution U/s 80CCD(2) - Maximum 10 % of 'Basic+DA' can be claimed

by Employer only annualy

Health premium - 25,000 for Individual and

Less: Deduction u/s 80D 50,000 including parents above 60

Total Deductions (C1)

Total Income B4 - C1

Part D - Computation of Tax Payable

INCOME TAX SALBS

Up to 2.5 Lakh

D1

D1 2.5 Lakh - 5 Lakh

5 Lakh - 7.5 Lakh

7.5 Lakh - 10 Lakh

10 Lakh - 12.5 Lakh

12.5 Lakh - 15 Lakh

more than 15 Lakh

Net Tax Payable

Education Cess 4%

Total Tax Payable

FINAL TAX Difference

tor for FY 20-21, AY 21-22

-Highlighted field

1,400,000 1,400,000

1,350,000 1,350,000

50000 50,000

0 0

CEA-I-IDA 10000 0

50,000 0

1,340,000 1,400,000

0

200,000

-200,000 1,400,000

0

1,140,000

axable Total Income

Invested /

Claimed

Expenditure

130,000

150,000

45,000

50000 50,000

75000 75,000 75,000

60000 50,000

325,000

815,000 1,325,000

of Tax Payable

Old Tax Rate Old Tax New Tax New Tax

(%) Amount (Rs.) Amount (Rs.) Rate (%)

0 0 0

5 12,500 12,500 5

20 50,000 25,000 10

20 13,000 37,500 15

30 0 50,000 20

30 0 18,750 25

30 0 0 30

75,500 143,750

3,020 5,750

78,520 149,500

70,980

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Letter of AuthorizationDocument1 pageLetter of AuthorizationVaishakh NazareNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- D.C. Bar Annual Labor and Employment Law Update 2011Document55 pagesD.C. Bar Annual Labor and Employment Law Update 2011Robert B. FitzpatrickNo ratings yet

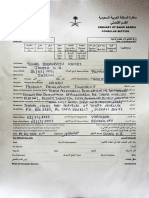

- Visa Application Form For SaudiDocument1 pageVisa Application Form For SaudisuhasNo ratings yet

- New Visa Application Form For Kingdom of Saudi ArabiaDocument1 pageNew Visa Application Form For Kingdom of Saudi ArabiasuhasNo ratings yet

- New Visa Application FormDocument1 pageNew Visa Application FormsuhasNo ratings yet

- Account Statement 2019-2020Document2 pagesAccount Statement 2019-2020suhasNo ratings yet

- C 514 ElectricalDocument17 pagesC 514 ElectricalsuhasNo ratings yet

- Menifee Transcript 1Document32 pagesMenifee Transcript 1Dan LehrNo ratings yet

- Philippine Journalists Inc V CIR GR No 162852Document2 pagesPhilippine Journalists Inc V CIR GR No 162852crizaldedNo ratings yet

- Par. 2 Sec. 5 Art. VI, 1987 ConstituionDocument4 pagesPar. 2 Sec. 5 Art. VI, 1987 ConstituionChristine ErnoNo ratings yet

- Buslaw Reviewer Guide QuestionsDocument9 pagesBuslaw Reviewer Guide QuestionsFrances Alandra SorianoNo ratings yet

- Italian Embassy - Colombo Tourist Visa: Yes No N/aDocument1 pageItalian Embassy - Colombo Tourist Visa: Yes No N/aAsitha RathnayakeNo ratings yet

- NYCDCC Report 07 ECFNo.1755 FourthInterimReportoftheIndependentMon...Document24 pagesNYCDCC Report 07 ECFNo.1755 FourthInterimReportoftheIndependentMon...Latisha Walker0% (1)

- Civil LawDocument3 pagesCivil LawzairaawatNo ratings yet

- AM X - Settlement of Disputes Outside CourtDocument7 pagesAM X - Settlement of Disputes Outside CourtbhavikaNo ratings yet

- Raquiza vs. BradfordDocument2 pagesRaquiza vs. BradfordLorielle May AranteNo ratings yet

- Digest of Impaired Driving LawsDocument579 pagesDigest of Impaired Driving LawsQuinton BoltinNo ratings yet

- Baritua vs. MercaderDocument15 pagesBaritua vs. MercaderArs MoriendiNo ratings yet

- National Accountability Bureau OrdinanceDocument20 pagesNational Accountability Bureau OrdinanceMahnoor SalmanNo ratings yet

- Civil Moot ProblemDocument4 pagesCivil Moot ProblemMagrothiya SatakshiNo ratings yet

- Criminal Code EN 2017 05 03 For PublicationDocument130 pagesCriminal Code EN 2017 05 03 For PublicationsuelazeNo ratings yet

- Cases in Palege 2Document36 pagesCases in Palege 2Russel SirotNo ratings yet

- Outline EvidenceDocument83 pagesOutline EvidenceJeanne ChauNo ratings yet

- People vs. Tirol, 102 SCRA 558 (1981)Document7 pagesPeople vs. Tirol, 102 SCRA 558 (1981)akosiJRNo ratings yet

- Gatmaytan Oposa ArticleDocument24 pagesGatmaytan Oposa ArticleJefferson G. NuñezaNo ratings yet

- Atty. Cabaniero Tax QuestionsDocument9 pagesAtty. Cabaniero Tax QuestionsYen Yen NicolasNo ratings yet

- Spouses vs. PobocanDocument9 pagesSpouses vs. PobocanRaya Alvarez TestonNo ratings yet

- The POCSO Act and Associated Issues - ForumIAS BlogDocument8 pagesThe POCSO Act and Associated Issues - ForumIAS BlogAjeet KumarNo ratings yet

- MNG 3203 - Business, Society & Ethics (FINAL)Document4 pagesMNG 3203 - Business, Society & Ethics (FINAL)keyon dukeNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Aujero vs. Philcosmat DigestDocument1 pageAujero vs. Philcosmat DigestIñigo Mathay RojasNo ratings yet

- CPF Life Payout SammyBoy ForumDocument4 pagesCPF Life Payout SammyBoy ForumTan SoNo ratings yet

- BISQUE v. ASPLUNDH TREE EXPERT COMPANY - Document No. 5Document2 pagesBISQUE v. ASPLUNDH TREE EXPERT COMPANY - Document No. 5Justia.comNo ratings yet

- Herras Teehankee vs. RoviraDocument7 pagesHerras Teehankee vs. RoviraEJ PajaroNo ratings yet

- Non Disclosure Agreement Yehuda Guzzi SodynaDocument3 pagesNon Disclosure Agreement Yehuda Guzzi SodynayguzziNo ratings yet