Professional Documents

Culture Documents

SBR FS Disclosures Snippet April 20 2022

Uploaded by

abhishek0 ratings0% found this document useful (0 votes)

3 views1 pageNBFCs will need to include additional disclosures in their annual financial statements beginning with the financial year ending March 31, 2023. [1] These include disclosures on related party exposures, complaints received, and a corporate governance report. [2] Disclosures vary based on the NBFC layer - base, middle or upper - and include sectors exposed to, intra-group exposures, and divergences from RBI on asset classification and provisioning. [3] The objective is to increase transparency through these supplemental disclosures.

Original Description:

Original Title

SBR-FS-disclosures-snippet-april-20-2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNBFCs will need to include additional disclosures in their annual financial statements beginning with the financial year ending March 31, 2023. [1] These include disclosures on related party exposures, complaints received, and a corporate governance report. [2] Disclosures vary based on the NBFC layer - base, middle or upper - and include sectors exposed to, intra-group exposures, and divergences from RBI on asset classification and provisioning. [3] The objective is to increase transparency through these supplemental disclosures.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageSBR FS Disclosures Snippet April 20 2022

Uploaded by

abhishekNBFCs will need to include additional disclosures in their annual financial statements beginning with the financial year ending March 31, 2023. [1] These include disclosures on related party exposures, complaints received, and a corporate governance report. [2] Disclosures vary based on the NBFC layer - base, middle or upper - and include sectors exposed to, intra-group exposures, and divergences from RBI on asset classification and provisioning. [3] The objective is to increase transparency through these supplemental disclosures.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

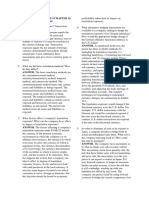

Additional disclosures under Scale Based Regulation for NBFCs Additional disclosures in

RBI Circular dated April 19, 2022 Annual Financial

Statements

[as per Scale Based

Effective for annual financial statements for year ending March 31, 2023 and onwards

Regulations (para 3.2.2.f)]

NBFC Base NBFC Middle NBFC Upper

Layer Layer Layer Corporate Governance

Report

Related Party Disclosure of Corporate Governance Other disclosures

Exposures Report (new)

Disclosure on modified

Disclosure (new) Complaints opinion, impact &

• (new) Breach of views

• Exposure to real • Related party – as • Received from • Listed NBFC: as per

estate sector covenant of loan

per Companies Act, customer SEBI LODR

availed/debt

• Exposure to capital 2013 and applicable • (new) Received from Regulations

securities

market accounting standard the office of • Unlisted NBFC: Items of income and

• (new) Divergence in expenditure of

• Sectoral exposure • Disclosures include: Ombudsman • As per formats Asset Classification exceptional nature

• (new) Intra-group Borrowings#, • (new) Top five given in this and Provisioning.

exposures deposits#, grounds of Circular which

advances#, • Based on the

complaints received includes Board &

• (new) Unhedged assessment by

investments#, from customers committees’ Breaches in covenants

foreign currency RBI/NHB including incidences of

purchase/sale of (indicative list has also composition

exposure & policies • Roadmap for default

assets, interest been provided) • Details of non-

to manage currency compliance with

paid/received, etc. compliances,

induced risk disclosure

# The outstanding at the penalties, etc.,

year end and the requirements of

shareholding of Divergence in asset

maximum during the year SEBI LODR (only for classification and

are to be disclosed. directors, no. of NBFC-UL)

meetings. provisioning.

These are additional disclosures and do not substitute disclosures

specified under other laws, regulations, or accounting and financial

reporting standards. However, if the disclosure is already covered in

other places the same may not be required to be repeated again. Vinod Kothari Consultants | finserv@vinodkothari.com

You might also like

- Leases Shepard e yDocument33 pagesLeases Shepard e ySWATI BANSALNo ratings yet

- 6 MA Cheat SheetDocument1 page6 MA Cheat SheetYASH MAKADIYANo ratings yet

- Accounting Standards (1 To 29)Document76 pagesAccounting Standards (1 To 29)Vipul I. PanchasaraNo ratings yet

- RBI Introduces Scale-Based Regulations For NBFCsDocument5 pagesRBI Introduces Scale-Based Regulations For NBFCsGrim ReaperNo ratings yet

- Ey Ctools Good Real Estate 2019Document132 pagesEy Ctools Good Real Estate 2019ariannemungcalcpaNo ratings yet

- Chapter 6 - Commercial Banks Financial Statements and AnalysisDocument19 pagesChapter 6 - Commercial Banks Financial Statements and AnalysisCassandra KarolinaNo ratings yet

- QRS & FFS (Controlling & Monitoring) Formats / Tools (Statement No 1)Document16 pagesQRS & FFS (Controlling & Monitoring) Formats / Tools (Statement No 1)waman.gokhaleNo ratings yet

- Good Real Estate Group (International) LimitedDocument127 pagesGood Real Estate Group (International) LimitedBanna SplitNo ratings yet

- Basel 2 - DeloitteDocument29 pagesBasel 2 - DeloitteSENTHIL KUMARNo ratings yet

- CH Audit IFRS 9 BrochureDocument12 pagesCH Audit IFRS 9 BrochurelinaNo ratings yet

- Framework Theory - StudentDocument27 pagesFramework Theory - StudentKrushna MateNo ratings yet

- STT 4Q23 Earnings Presentation VFinalDocument27 pagesSTT 4Q23 Earnings Presentation VFinalelusive.fotosNo ratings yet

- WST Cash Flow MetricsDocument2 pagesWST Cash Flow MetricsGabriel La MottaNo ratings yet

- Government Accounting ProcessDocument85 pagesGovernment Accounting ProcessLady Crystal RosalesNo ratings yet

- Cost of Trading and Clearing OTC Derivatives in The Wake of Margining and Other New Regulations Codex1529Document13 pagesCost of Trading and Clearing OTC Derivatives in The Wake of Margining and Other New Regulations Codex1529Ignasio Pedro Sanches ArguellesNo ratings yet

- Lecture 5 - Cost of Service Tariff Models and The Price-Cost Test of Excessive Pricing - S Labson April 2019Document30 pagesLecture 5 - Cost of Service Tariff Models and The Price-Cost Test of Excessive Pricing - S Labson April 2019Muhammad KolaNo ratings yet

- M&A Case Laws SlidesDocument61 pagesM&A Case Laws SlidesThant ZinNo ratings yet

- Australian GAAP Vs IFRSDocument25 pagesAustralian GAAP Vs IFRSMichael ZhangNo ratings yet

- PR RPP InfraProjects 18jan24Document8 pagesPR RPP InfraProjects 18jan24Akash DuttaNo ratings yet

- Assessment of Working Capital RequirementsDocument13 pagesAssessment of Working Capital Requirementsamit_kachhwaha100% (2)

- Fundamentals of IRSDocument12 pagesFundamentals of IRSSuresh SNo ratings yet

- MyPresentation FINALDocument51 pagesMyPresentation FINAL19hwang59No ratings yet

- Noble Tech Industries Private LimitedDocument3 pagesNoble Tech Industries Private Limitedkarthikeyan A INo ratings yet

- Regulatory Compliance Report - Sample ReportDocument4 pagesRegulatory Compliance Report - Sample ReportNesley ComendadorNo ratings yet

- IFRS Study Notes-Day 2Document46 pagesIFRS Study Notes-Day 2Obisike EmeziNo ratings yet

- Chapter 3 - The Government Accounting Process 2Document63 pagesChapter 3 - The Government Accounting Process 2Clark AgustinNo ratings yet

- Tata-Motors-Group-Investor-Presentation-Q3 FY23Document51 pagesTata-Motors-Group-Investor-Presentation-Q3 FY23Sai Biplab BeheraNo ratings yet

- 05 Ratios and Trend AnalysisDocument11 pages05 Ratios and Trend AnalysisHaris IshaqNo ratings yet

- Earnings Update - Q4FY19Document105 pagesEarnings Update - Q4FY19Kishan kumarNo ratings yet

- West Coast Paper Mills LTDDocument6 pagesWest Coast Paper Mills LTDRavi KNo ratings yet

- Thinking Allowed: IBOR ReplacementDocument29 pagesThinking Allowed: IBOR ReplacementSimon AltkornNo ratings yet

- Transfer Pricing (Part 2) - TP Documentation Dispute Resolution and Risk ManagementDocument78 pagesTransfer Pricing (Part 2) - TP Documentation Dispute Resolution and Risk ManagementCary ChenNo ratings yet

- Disclosure Issues: Financial Instruments With Characteristics of EquityDocument29 pagesDisclosure Issues: Financial Instruments With Characteristics of EquityMohammedYousifSalihNo ratings yet

- Sara International Private Limited May 19, 2020: RatingsDocument6 pagesSara International Private Limited May 19, 2020: RatingsRavi BabuNo ratings yet

- Auditing & Assurance MAC005 Trimester 2 2020 ASSIGNMENTDocument8 pagesAuditing & Assurance MAC005 Trimester 2 2020 ASSIGNMENTKarma SherpaNo ratings yet

- Taxation of Dividend: Change in Dividend Taxation Regime Under Finance Act, 2020Document4 pagesTaxation of Dividend: Change in Dividend Taxation Regime Under Finance Act, 2020Swapnil SudhanshuNo ratings yet

- Overview Rev ScheduleIII PravinsethiaDocument26 pagesOverview Rev ScheduleIII PravinsethiaRakhi SahaniNo ratings yet

- Chapter 2Document10 pagesChapter 2subeyr963No ratings yet

- Psak 71Document65 pagesPsak 71Bayu SaputraNo ratings yet

- E-Business Suite Lease Accounting Statement of DirectionDocument8 pagesE-Business Suite Lease Accounting Statement of DirectionfahadcaderNo ratings yet

- OEM and Equlisation LevyDocument16 pagesOEM and Equlisation LevyYash SharmaNo ratings yet

- Brinks Overview v4Document3 pagesBrinks Overview v4Bryan RandNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSrajdeeppawarNo ratings yet

- 12 Interpretation & AnalysisDocument20 pages12 Interpretation & AnalysispesseNo ratings yet

- Coptech Wire IndustryDocument4 pagesCoptech Wire IndustryKarthi KarthiNo ratings yet

- Difference BTW As IFRS and INDDocument5 pagesDifference BTW As IFRS and INDrahul jambagiNo ratings yet

- Reserve Bank of India: Disclosures in Financial Statements-Notes To Accounts of NbfcsDocument13 pagesReserve Bank of India: Disclosures in Financial Statements-Notes To Accounts of Nbfcsindia nesanNo ratings yet

- 4 - IASB Technical Update - FoF May 2023Document20 pages4 - IASB Technical Update - FoF May 2023Gabriel BuzziNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Goldman Sachs Presentation To Credit Suisse Financial Services ConferenceDocument20 pagesGoldman Sachs Presentation To Credit Suisse Financial Services ConferenceEveline WangNo ratings yet

- 40 - Copy of 42 - Cma Format For BankDocument20 pages40 - Copy of 42 - Cma Format For Bankcvrao04100% (4)

- Annexure 3.2 - TPRM Checklist For Collection VendorsDocument4 pagesAnnexure 3.2 - TPRM Checklist For Collection Vendorshp agencyNo ratings yet

- Intercorporate Investments - Study Session 5, Reading 14Document18 pagesIntercorporate Investments - Study Session 5, Reading 14Analyst832No ratings yet

- 4q Presentation 20210513 eDocument74 pages4q Presentation 20210513 eatvoya JapanNo ratings yet

- GM 2020 Q2 Earnings Presentation 7.29.20 VFDocument27 pagesGM 2020 Q2 Earnings Presentation 7.29.20 VFMeng KeNo ratings yet

- Ey Ctools Good Group 2021Document162 pagesEy Ctools Good Group 2021KGNo ratings yet

- Presentation BCIC Session On Companies Act April 23, 2021Document56 pagesPresentation BCIC Session On Companies Act April 23, 2021NEHA NAYAKNo ratings yet

- Intial Pages For TY Projects.Document7 pagesIntial Pages For TY Projects.Deva BhaiNo ratings yet

- Indivisual Assignment - Small Finance BanksDocument12 pagesIndivisual Assignment - Small Finance BanksPranav KaushalNo ratings yet

- First Quiz On Liquidity and Solvency Ratios PDFDocument2 pagesFirst Quiz On Liquidity and Solvency Ratios PDFRandy ManzanoNo ratings yet

- Chap 12 PDFDocument89 pagesChap 12 PDFNgơTiênSinhNo ratings yet

- CorpFin C07Document106 pagesCorpFin C07Huy PanhaNo ratings yet

- Chapter 11 Bonds PayableDocument27 pagesChapter 11 Bonds PayableNicho Deven HamawiNo ratings yet

- Ban204 - RegusDocument4 pagesBan204 - Regusshakhawat_cNo ratings yet

- Accaafm SLDocument21 pagesAccaafm SLRitesh KashyapNo ratings yet

- Engineering Economy FactorsDocument55 pagesEngineering Economy FactorsMuhammadMahmoudAbdelNabyNo ratings yet

- RichellehilomenorpillaDocument4 pagesRichellehilomenorpillabiklatNo ratings yet

- Markets With Frictions: Banks: Guido MenzioDocument36 pagesMarkets With Frictions: Banks: Guido MenzioDaniel GavidiaNo ratings yet

- TS Lite User Guide v1.0Document92 pagesTS Lite User Guide v1.0amirulNo ratings yet

- FixedIncome BeginnerGuide WebinarDocument22 pagesFixedIncome BeginnerGuide WebinarFrancis MejiaNo ratings yet

- SPF Managed SBLC Program OverviewDocument22 pagesSPF Managed SBLC Program OverviewPattasan UNo ratings yet

- Muhammad Yousuf: Account StatementDocument5 pagesMuhammad Yousuf: Account StatementYOUSUFNo ratings yet

- Change in Profit RatioDocument10 pagesChange in Profit RatioHansika SahuNo ratings yet

- FINACCREDocument187 pagesFINACCREKendall JennerNo ratings yet

- Economics-And-Finance-Video-Quiz-Questions 1Document3 pagesEconomics-And-Finance-Video-Quiz-Questions 1api-550118775No ratings yet

- Corporate Finance Cheat SheetDocument3 pagesCorporate Finance Cheat Sheetdiscreetmike50No ratings yet

- Chapters 6-10 PDFDocument40 pagesChapters 6-10 PDFeuwilla100% (4)

- Bernard W. Dempsey (1903-1960) - Interest and Usury. With An Introduction by Joseph A. Schumpeter (1948)Document242 pagesBernard W. Dempsey (1903-1960) - Interest and Usury. With An Introduction by Joseph A. Schumpeter (1948)Miles Dei100% (1)

- Chapter 11. Foreign Currency RiskDocument16 pagesChapter 11. Foreign Currency RiskHastings KapalaNo ratings yet

- Overcoming Challenges in An Unrecognized EconomyDocument8 pagesOvercoming Challenges in An Unrecognized Economyamira yonisNo ratings yet

- Transcript 1820115Document2 pagesTranscript 1820115Wasifa Tahsin AraniNo ratings yet

- Prachi Navghare, 29 ValuationDocument14 pagesPrachi Navghare, 29 ValuationPrachi NavghareNo ratings yet

- Questions CH 10Document4 pagesQuestions CH 10Maria DevinaNo ratings yet

- Purchase in The Open MarketDocument11 pagesPurchase in The Open MarketAshishNo ratings yet

- Bootstrapping Definition - InvestopediaDocument3 pagesBootstrapping Definition - InvestopediaBob KaneNo ratings yet

- Capital Budegting - Project and Risk AnalysisDocument46 pagesCapital Budegting - Project and Risk AnalysisUpasana Thakur100% (1)

- NISM KotakDocument167 pagesNISM KotakSachin Kumar100% (2)