Professional Documents

Culture Documents

Dealings in Property

Uploaded by

Ronnie TolentinoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dealings in Property

Uploaded by

Ronnie TolentinoCopyright:

Available Formats

DEVELLES, JOHN RENZO G.

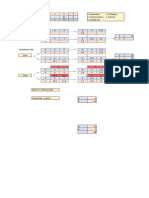

SBAC-2B *Capital Gain

1)Sale of shares of 15% CGT (net)

Notes in DEALINGS in PROPERTIES domestic corporations

directly to a buyer

2) Sale of shares of a Stock transaction tax

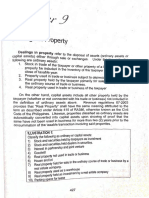

Dealings in property- refers to the disposal of domestic corporations 6/10 of 1% of gross

assets(1)ordinary assets or (2)capital assets through LSE selling price

either through sale or exchanges. 3) Sale of real CGT 6% (SP or FMV or

properties classified as ZV whichever is

Ordinary assets capital assets in the higher) (gross)

1. Stock in trade of the taxpayer or other PH.

property of a kind which would properly TRIVIA: TREATMENT

be included in the inventory of the FOR THE SALE OF

taxpayer if on hand at the close taxable PRINICIPAL RESIDENCE

year. 4)Sale of real Either 6% CGT or basic

2. Property used in trade or business subject properties classified as tax at the opt. of the

to depreciation. capital assets in the taxpayer.

3. Real property held by the taxpayer PH to the gov’t., it’s

primarily for sale to customers in the agencies or GOCCs by

ordinary course of trade or business. an individual taxpayer.

4. Real property used in trade or business of 5)**Other Basic income tax

the taxpayer.

Note: Ordinary assets are for sale in the **Capital Gains subject to Basic Income Tax

ordinary course of business and/or properties RULES:

use in business. 1) Capital asset

2) From sale or exchange

Capital assets

Note: If it is not in the criteria of ordinary assets, 3) net capital loss- can’t be deducted in

it is capital asset. Income Tax Return; net capital gain- add to

Ordinary assets will automatically classified as Income Tax Return.

capital assets if it is not used in business for two

years.(NEED PROOF) 4) Holding period- applicable only to

individual taxpayers, estates, trusts(12 months

APPLICABLE TAXES or less=100% ; more than 12 months=50%)

Ordinary Gain= Basic income tax

5) Net Capital Loss Carry-over - applicable

*CAPITAL GAIN only to individual taxpayers. The net capital loss

CGT? If YES, subject to 6% or 15% CGT carry-over should not be more than the net

taxable income at the time the net capital loss

If NO! was incurred.

Subject to Stock Transaction Tax? Yes, subject to

6/10 of 1% of gross selling price

If NO!

Then it is subject to BASIC INCOME TAX!

You might also like

- Adobe Scan Oct 19, 2023Document7 pagesAdobe Scan Oct 19, 2023Renalyn Ps MewagNo ratings yet

- Capital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp TaxDocument2 pagesCapital Gains Tax: Selling Price Basis of Share (Inc. Dividend-On, Net of Tax) Doc. Stamp Taxloonie tunesNo ratings yet

- Income Tax On CorporationsDocument8 pagesIncome Tax On CorporationsDevonNo ratings yet

- Chapter 09 - Dealings in PropertyDocument14 pagesChapter 09 - Dealings in PropertyAubrey Mae Dela CruzNo ratings yet

- Capital Gains Tax PDFDocument6 pagesCapital Gains Tax PDFjanus lopezNo ratings yet

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- Dealings in PropertiesDocument2 pagesDealings in PropertiesJamaica DavidNo ratings yet

- TAXATION - 6 Dealings in Cap. AssetsDocument2 pagesTAXATION - 6 Dealings in Cap. AssetsMIKAELA ANDREA LAYOGNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentMaria DubloisNo ratings yet

- Chapter 6 - Capital Gains TaxationDocument4 pagesChapter 6 - Capital Gains Taxationclaritaquijano526No ratings yet

- Capital Gains Tax Implications of Domestic Stock and Real Property SalesDocument2 pagesCapital Gains Tax Implications of Domestic Stock and Real Property Salesfrancis dungcaNo ratings yet

- ACCO 20133 - UNIT IX - UpdatedDocument29 pagesACCO 20133 - UNIT IX - UpdatedHarvey AguilarNo ratings yet

- M6 - Capital Gains TaxationDocument31 pagesM6 - Capital Gains TaxationTERRIUS AceNo ratings yet

- Taxn - Gains and Losses (Dealings With Properties)Document3 pagesTaxn - Gains and Losses (Dealings With Properties)Kaye BernardinoNo ratings yet

- MSU-GSC Income Taxation of Capital AssetsDocument7 pagesMSU-GSC Income Taxation of Capital Assetstrixie maeNo ratings yet

- Module 9 PDFDocument7 pagesModule 9 PDFtrixie maeNo ratings yet

- MSU-GSC Income Taxation of Capital AssetsDocument7 pagesMSU-GSC Income Taxation of Capital Assetstrixie maeNo ratings yet

- Module 9 PDFDocument7 pagesModule 9 PDFtrixie maeNo ratings yet

- Capital Gains Tax GuideDocument24 pagesCapital Gains Tax GuideJezza Mae Gomba RegidorNo ratings yet

- Income Tax Calculation of Gains and LossesDocument7 pagesIncome Tax Calculation of Gains and LossesJason Robert MendozaNo ratings yet

- Capital Gain TaxationDocument3 pagesCapital Gain TaxationjoannaNo ratings yet

- Capital Gains Tax (Ampongan)Document11 pagesCapital Gains Tax (Ampongan)didit.canonNo ratings yet

- Capital Gains Tax Ordinary Assets-Assets Used in BusinessDocument3 pagesCapital Gains Tax Ordinary Assets-Assets Used in Businessjoevitt delfinadoNo ratings yet

- Tax Rates for CorporationsDocument14 pagesTax Rates for CorporationsMendoza Khlareese AndreaNo ratings yet

- Introduction to Income Tax in the PhilippinesDocument33 pagesIntroduction to Income Tax in the PhilippinesKristelleNo ratings yet

- Chapter 5 v5 RevisedDocument18 pagesChapter 5 v5 RevisedThe makas AbababaNo ratings yet

- CPAR Intro To Income Tax and Tax On Individuals Batch 91 HandoutDocument33 pagesCPAR Intro To Income Tax and Tax On Individuals Batch 91 Handoutjohn paulNo ratings yet

- Capital Asset and Capital Gains LossDocument4 pagesCapital Asset and Capital Gains LossAmy Olaes DulnuanNo ratings yet

- Income Tax Rules for CorporationsDocument7 pagesIncome Tax Rules for CorporationsKaren Joy Magsayo100% (1)

- CPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutDocument29 pagesCPAR Intro To Income Tax and Tax On Individuals (Batch 89) - HandoutMark LapidNo ratings yet

- Understanding Philippine Income TaxDocument29 pagesUnderstanding Philippine Income TaxMyrrielNo ratings yet

- Study GuideDocument22 pagesStudy Guidedave_88opNo ratings yet

- CHP 4-6 NotesDocument6 pagesCHP 4-6 NotesPrincess Niña Layne SususcoNo ratings yet

- Dealings in Property NotesDocument6 pagesDealings in Property NotesLinrhay RicohermosoNo ratings yet

- Dealings in Properties and The Withholding Tax SystemDocument38 pagesDealings in Properties and The Withholding Tax SystemKenzel lawasNo ratings yet

- Gross Income and Dealing in PropertiesDocument18 pagesGross Income and Dealing in PropertiesChannel BucoyNo ratings yet

- INCOMETAX M45 ReviewerDocument15 pagesINCOMETAX M45 ReviewerCaryl Isabel Francisco100% (1)

- Properties Acquired (ROPA) by Banks: Page 1 of 3Document3 pagesProperties Acquired (ROPA) by Banks: Page 1 of 3Jhon Ariel JulatonNo ratings yet

- Ordinary V CapitalDocument26 pagesOrdinary V CapitalerwinNo ratings yet

- DISCUSSION ON DEALINGS OF ORDINARY AND CAPITAL ASSETSDocument2 pagesDISCUSSION ON DEALINGS OF ORDINARY AND CAPITAL ASSETShazeerkeedNo ratings yet

- 94-02 Individual Income Tax - HandoutDocument38 pages94-02 Individual Income Tax - HandoutSilver LilyNo ratings yet

- Income, Capital Gains, VAT, Transfer Taxation GuideDocument62 pagesIncome, Capital Gains, VAT, Transfer Taxation GuideAllen SoNo ratings yet

- CPAR Income Tax of Individuals (Batch 93) - HandoutDocument36 pagesCPAR Income Tax of Individuals (Batch 93) - HandoutJuan Miguel UngsodNo ratings yet

- Capital Gains Tax and Dealings in Property: Income TaxationDocument105 pagesCapital Gains Tax and Dealings in Property: Income TaxationRonna Mae DungogNo ratings yet

- TAX-1101: Capital Assets, Capital Gains & Losses: - T R S ADocument3 pagesTAX-1101: Capital Assets, Capital Gains & Losses: - T R S AVaughn TheoNo ratings yet

- Ast TX 1001 Capital Assets (Batch 22)Document3 pagesAst TX 1001 Capital Assets (Batch 22)CeciliaNo ratings yet

- capital-gains-losses-1Document2 pagescapital-gains-losses-1shai santiagoNo ratings yet

- CTT ReviewerDocument28 pagesCTT ReviewerAlexa Mae BuenafeNo ratings yet

- Capital Gains Taxation: Lesson 6Document30 pagesCapital Gains Taxation: Lesson 6lc100% (4)

- Chap 12 Dealings in PropertiesDocument11 pagesChap 12 Dealings in PropertiesyvonneNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxAii Lyssa UNo ratings yet

- Sale or Exchange of PropertyDocument7 pagesSale or Exchange of PropertyJohnallenson DacosinNo ratings yet

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsElleNo ratings yet

- MAT Credit - Maximise tax savingsDocument3 pagesMAT Credit - Maximise tax savingssrushti thoratNo ratings yet

- Gain or Loss from Sale or ExchangeDocument7 pagesGain or Loss from Sale or Exchangejohn paulNo ratings yet

- Review TaxDocument2 pagesReview TaxRose May AdanNo ratings yet

- Chapter 6 Capital Gains TaxationDocument4 pagesChapter 6 Capital Gains TaxationBisag AsaNo ratings yet

- Introduction To Income TaxDocument4 pagesIntroduction To Income Taxjumawaymichaeljeffrey65No ratings yet

- Chapter 4-Final Income TaxationDocument17 pagesChapter 4-Final Income TaxationPrincesa RoqueNo ratings yet

- Tech Guidelines For Breakout Room: Kasama Niyo Yung Respective Audit Niyo For Each BRDocument3 pagesTech Guidelines For Breakout Room: Kasama Niyo Yung Respective Audit Niyo For Each BRRonnie TolentinoNo ratings yet

- Guidelines For Breakout Room (Eliminations)Document6 pagesGuidelines For Breakout Room (Eliminations)Ronnie TolentinoNo ratings yet

- Critical PathDocument4 pagesCritical PathRonnie TolentinoNo ratings yet

- Research Methodology: Research 2 Emmanuel Paciano M. MabulayDocument53 pagesResearch Methodology: Research 2 Emmanuel Paciano M. MabulayRonnie TolentinoNo ratings yet

- TESTDocument3 pagesTESTRonnie TolentinoNo ratings yet

- Marketing Plan ClothDocument10 pagesMarketing Plan ClothArenzma YamsuanNo ratings yet

- L5.chapter IIDocument30 pagesL5.chapter IIRonnie TolentinoNo ratings yet

- Basic Math and AlgebraDocument296 pagesBasic Math and AlgebralenograNo ratings yet

- Accounting Handout Chapter 8Document5 pagesAccounting Handout Chapter 8EdrielleNo ratings yet

- Ssp04 Quiz FinalsDocument3 pagesSsp04 Quiz FinalsElla Mae Clavano NuicaNo ratings yet

- E-Commerce Website Using MERN StackDocument5 pagesE-Commerce Website Using MERN StackIJRASETPublicationsNo ratings yet

- Just Dial Limited Letter of OfferDocument68 pagesJust Dial Limited Letter of Offervarun_bhuNo ratings yet

- Claim Form GMCDocument7 pagesClaim Form GMCBhaskar RawatNo ratings yet

- Pre-Test - Performing The EngagementDocument2 pagesPre-Test - Performing The EngagementSHARMAINE CORPUZ MIRANDANo ratings yet

- Reading 70 Code of Ethics and Standards of Professional ConductDocument16 pagesReading 70 Code of Ethics and Standards of Professional ConductNeerajNo ratings yet

- Indian Film Manufacturers Adding Capacities To Meet Growing Demand For Bopp and BopetDocument8 pagesIndian Film Manufacturers Adding Capacities To Meet Growing Demand For Bopp and BopetSanjay Kumar ShahiNo ratings yet

- Output Determination: Contributed by Prabhakant Tiwari Under The Guidance of SAP GURU INDIADocument9 pagesOutput Determination: Contributed by Prabhakant Tiwari Under The Guidance of SAP GURU INDIASeren SökmenNo ratings yet

- CH 3Document17 pagesCH 3FBusinessNo ratings yet

- Financial assistance proposal for 108-acre farm projectDocument11 pagesFinancial assistance proposal for 108-acre farm projectDilip Devidas JoshiNo ratings yet

- CV of Asabea Tannor.Document2 pagesCV of Asabea Tannor.Naana TannorNo ratings yet

- Project: Venture Capital & Private EquityDocument16 pagesProject: Venture Capital & Private EquityDhairya JainNo ratings yet

- GST Filing in IndiaDocument13 pagesGST Filing in IndiaKriti vardhanNo ratings yet

- Financial Statement Analysis ReportDocument47 pagesFinancial Statement Analysis Reportgaurang90% (80)

- Final Exam Theories ValuationDocument6 pagesFinal Exam Theories ValuationBLN-Hulo- Ronaldo M. Valdez SRNo ratings yet

- Regulating E-hailing in Malaysia - Over-regulation DebateDocument8 pagesRegulating E-hailing in Malaysia - Over-regulation DebateAmin AkasyafNo ratings yet

- Airline Business Plan Air LeoDocument64 pagesAirline Business Plan Air LeokgmakNo ratings yet

- MINIMALPLAN Project Launch Workbook ENG V3Document21 pagesMINIMALPLAN Project Launch Workbook ENG V30177986100% (2)

- Mba FT 2024-26Document27 pagesMba FT 2024-26Khushi BerryNo ratings yet

- Ex Parte Petition To Assume JurisdictionDocument2 pagesEx Parte Petition To Assume JurisdictionNasir AhmedNo ratings yet

- Entrepreneurship Relevance to SHS StudentsDocument7 pagesEntrepreneurship Relevance to SHS StudentsAndrea Grace Bayot AdanaNo ratings yet

- ABBA - Annual Report 2019Document232 pagesABBA - Annual Report 2019Bambang HarsonoNo ratings yet

- Business Implications of Sustainability Practices in Supply ChainsDocument25 pagesBusiness Implications of Sustainability Practices in Supply ChainsBizNo ratings yet

- Intermodal Transportation System in An Evolving Economy: Research PaperDocument7 pagesIntermodal Transportation System in An Evolving Economy: Research PaperUsiwo FranklinNo ratings yet

- TL 9000 Quality Management System Measurements Handbook: Release 3.0Document168 pagesTL 9000 Quality Management System Measurements Handbook: Release 3.0kumarNo ratings yet

- Nomco Charter 2022Document3 pagesNomco Charter 2022abcNo ratings yet

- Credit Portfolio Management of Bangladesh Krishi Bank: CreditportfoliomanagementofbangladeshkrishibankDocument7 pagesCredit Portfolio Management of Bangladesh Krishi Bank: CreditportfoliomanagementofbangladeshkrishibankBokulNo ratings yet

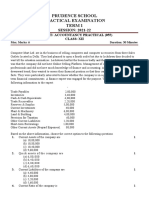

- Prudence School Accountancy Practical ExamDocument2 pagesPrudence School Accountancy Practical Examicarus fallsNo ratings yet

- CA 08105001 eDocument3 pagesCA 08105001 eRicardo LopezNo ratings yet