Professional Documents

Culture Documents

Mutuality and Diversification

Uploaded by

Maulik PanchmatiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutuality and Diversification

Uploaded by

Maulik PanchmatiaCopyright:

Available Formats

RESERVE---PREMIUM COLLECTEDIN EARLY YEARS OF THE CONTRACT ARE HELD

IN TRUST BY INSURER FOR THE BENEFIT OF POLICYHOLDER.

LIFE FUND---THE AMOUNT ALSO CREATE A FUND KNOWN AS THE LIFE FUND. LIFE

INSURERS INVEST THIS FUND AND EARN AN INTEREST.

MUTUALITY AND DIVERSIFICATION

MUTUALITY----MUTUALITY IS ONE OF THE IMPORTANT WAY TO REDUCE RISK IN

FINANCIAL MARKET, OTHER BEING DIVERSIFICATION. MUTUALITY

AND DIVERSIFICATION ARE FUNDAMENTALLY DIFFERENT...

MUTUALITY DIVERSIFICATION

1.MUTUALITY OR POOLING ,THE 1..UNDER DIVERSIFICATION THE FUNDS ARE

FUNDS OF VARIOUS INDIVIDUAL SREADOUT AMONG THE VARIOUS ASSET..

ARE COMBINED..

2 UNDER MUTUALITY WE HAVE FUNDS 2.. UNDER DIVERSIFICATION WE HAVE

FLOW FROM MANY SOURCES TO ONE. FUNDS FLOWING FROM ONE SOURCE TO

MANY DESTINATION..

ADVANTAGES OF MUTUALITY---

1..IT PROVIDES PROTECTION AGAINST ECONOMIC LOSS ARISING

AS A RESULT OF ONES UNTIMELY DEATH.

2..IT CAN INVOLVE THE POOLING AND EVENING OUT OF FINANCIAL

FINANCIAL RISK AS WELL..IT GIVES UNIFORM RATE OF RETURN THROUGH BONUS

ACROSS THE TIME..

COMPONENT OF LIFE INSURANCE—1..RISK COVER

2..SAVING ELEMENT

ADVANTAGES OF LIFE INSURANCE-

1... INVESTMENT IN LIFE INSURANCE IS SAVE & SECURE..

2..REGULARLY PREMIUM PAYMENT MAKE PLANNING ONE'S SAVINGS AND PROVIDES

the discipline that savers require .

3..Insurer takes care of investment management and frees the individual of this

responsibility .

4..It provides liquidity. The insured can take a loan on or surrender the policy and

thus convert it into cash

5..Both cash value type life insurance and annuities may enjoy some income tax

advantages.

6..It may be safe from creditors‘ claims, generally in the event of the insured ‟s

bankruptcy or death

DISADVANTAGES OF LIFE INSURANCE---

1..As an instrument with relatively stable returns it is subjected to the corroding

effect of inflation on all fixed income investments.

2..The high marketing and other initial costs of life insurance policies, reduces

the amount of money accumulated in earlier years.

3..The yield, while guaranteed, may be less than that on other financial market

instruments. Lower yield is the result of a trade-off, which also reduces the risk.

HLV is to divide the annual income a family would like to have, even if the bread earner was no

longer alive, with the rate of interest that can be earned.

You might also like

- Solution Manual For Investments Analysis and Management 12th Edition by JonesDocument4 pagesSolution Manual For Investments Analysis and Management 12th Edition by Jonesa48721063250% (6)

- Solution Manual Fundamentals of Investments 3rd Edition by Gordon J. Alexander SLP1137Document10 pagesSolution Manual Fundamentals of Investments 3rd Edition by Gordon J. Alexander SLP1137Thar Adelei50% (2)

- Certification of Trust ExampleDocument2 pagesCertification of Trust Examplejpschubbs100% (11)

- CA Final Audit RISK ASSESSMENT AND INTERNAL CONTROL NotesDocument21 pagesCA Final Audit RISK ASSESSMENT AND INTERNAL CONTROL NotesSARASWATHI SNo ratings yet

- Chapter 13Document11 pagesChapter 13Hương LýNo ratings yet

- Income Statement: Year 2023 2024 2025 2026 2027Document3 pagesIncome Statement: Year 2023 2024 2025 2026 2027Bryan Dino Lester GarnicaNo ratings yet

- Chapter - 1: Introduction To The StudyDocument63 pagesChapter - 1: Introduction To The Studykarthickrajan88No ratings yet

- Risk and Its Measurement - v.1Document3 pagesRisk and Its Measurement - v.1ashleysavetNo ratings yet

- Insurance NotesDocument46 pagesInsurance NotespuruNo ratings yet

- ULIP1Document19 pagesULIP1Dev PillaiNo ratings yet

- Institute OF Commerce, Nirma University (Honors) Programme (2017-2020)Document15 pagesInstitute OF Commerce, Nirma University (Honors) Programme (2017-2020)Paras MasariaNo ratings yet

- Insurance Sales Associate PDFDocument97 pagesInsurance Sales Associate PDFIrfan MasoodiNo ratings yet

- UntitledDocument26 pagesUntitledKrishna YadavNo ratings yet

- Principles of Insurance and Loss Assessment: Unit - 1 Introduction To InsuranceDocument71 pagesPrinciples of Insurance and Loss Assessment: Unit - 1 Introduction To InsuranceVenkat Deepak SarmaNo ratings yet

- Life & General InsuranceDocument59 pagesLife & General Insurancedranita@yahoo.comNo ratings yet

- Table & ContentDocument43 pagesTable & Contentsweety coolNo ratings yet

- 1.type of Risk 2.sources of Risk 3.need and Importance of InvestingDocument30 pages1.type of Risk 2.sources of Risk 3.need and Importance of InvestingEleine AlvarezNo ratings yet

- Insurance: MeaningDocument4 pagesInsurance: MeaningAkash PoddarNo ratings yet

- Ba5012 Security Analysis and Portfolio ManagementDocument13 pagesBa5012 Security Analysis and Portfolio ManagementShobanashree RNo ratings yet

- Final Avenues of Investments1Document55 pagesFinal Avenues of Investments1Mukesh ManwaniNo ratings yet

- 3-Financial Services - Non Banking Products-Part 2Document47 pages3-Financial Services - Non Banking Products-Part 2Kirti GiyamalaniNo ratings yet

- Insurance: Presented byDocument15 pagesInsurance: Presented bypinkydhamiNo ratings yet

- LIT NotesDocument737 pagesLIT NotesMegat AlifNo ratings yet

- Equity Mutual FundsDocument49 pagesEquity Mutual FundskeneoNo ratings yet

- 1.1 Background of The Study:: Chapter - 1Document45 pages1.1 Background of The Study:: Chapter - 1Vinutha EllurNo ratings yet

- Marketing in InsuranceDocument56 pagesMarketing in Insurancepallavi guravNo ratings yet

- UntitledDocument28 pagesUntitledKrishna YadavNo ratings yet

- Tutorial 1 - Introduction - QuestionDocument4 pagesTutorial 1 - Introduction - QuestionSHU WAN TEHNo ratings yet

- INSURANCES (Livestock)Document41 pagesINSURANCES (Livestock)ÖñkárSátámNo ratings yet

- Function's of Insurance . by Aftab MullaDocument12 pagesFunction's of Insurance . by Aftab MullaImran Khan SharNo ratings yet

- Unit 1Document22 pagesUnit 1MathangiNo ratings yet

- A Project Report On Ulips V S Mutual Funds Under Banking Sector With Reference To HDFC BankDocument22 pagesA Project Report On Ulips V S Mutual Funds Under Banking Sector With Reference To HDFC Bank21UGDF005 Akhΐl.KNo ratings yet

- A Project Report On Ulips V S Mutual Funds Under Banking Sector With Reference To HDFC BankDocument17 pagesA Project Report On Ulips V S Mutual Funds Under Banking Sector With Reference To HDFC Bankblackpantherr2101No ratings yet

- Investment ManagementDocument20 pagesInvestment Managementsunita agrawalNo ratings yet

- Reliance Life InsuranceDocument101 pagesReliance Life InsuranceVicky Mishra100% (2)

- Life Insurance An Investment AlternativeDocument60 pagesLife Insurance An Investment AlternativesumitNo ratings yet

- Ty BMS Project Detail PDFDocument69 pagesTy BMS Project Detail PDFnarayan patelNo ratings yet

- Roles and Functions of AMC and Insurance Firms: by Santosh KumarDocument19 pagesRoles and Functions of AMC and Insurance Firms: by Santosh KumarSuraj KumarNo ratings yet

- SAPMDocument126 pagesSAPMMithunNo ratings yet

- Risk-Return Analysis of Mutual FundsDocument11 pagesRisk-Return Analysis of Mutual FundsKhushbu GosherNo ratings yet

- Risk Return Analysis of Equity Mutual FundsDocument34 pagesRisk Return Analysis of Equity Mutual FundskeneoNo ratings yet

- Rupee Maker ProjectDocument48 pagesRupee Maker ProjectPrince PanwarNo ratings yet

- Banking Services: Central BanksDocument3 pagesBanking Services: Central BanksSukhjinder SinghNo ratings yet

- MGT of Financial MKT & Institu Ch-4Document10 pagesMGT of Financial MKT & Institu Ch-4fitsumNo ratings yet

- Inv. Ch-1 (Ma in PP&M)Document50 pagesInv. Ch-1 (Ma in PP&M)Mahamoud HassenNo ratings yet

- Life Insurance Corporation of India: Presented by - Karthik RDocument8 pagesLife Insurance Corporation of India: Presented by - Karthik RKARTHIK RNo ratings yet

- +2 Insurance New Syllabus 2016Document24 pages+2 Insurance New Syllabus 2016Basanta K SahuNo ratings yet

- Icic BankDocument66 pagesIcic Bankjassi7nishadNo ratings yet

- Principles of InsuranceDocument69 pagesPrinciples of InsuranceGeoffreyNo ratings yet

- Aids To TradeDocument3 pagesAids To TradeDakshita ShandilyaNo ratings yet

- IntroductionDocument49 pagesIntroductionSumit JoshiNo ratings yet

- Objective of Study Concepts Investment Options Data Collection Analysis Recommendation Limitations ReferencesDocument26 pagesObjective of Study Concepts Investment Options Data Collection Analysis Recommendation Limitations Referenceshtikyani_1No ratings yet

- Life Insurance 2Document50 pagesLife Insurance 2Veena NhivekarNo ratings yet

- Asia AssigmentDocument9 pagesAsia AssigmentHibo AnwarNo ratings yet

- Chapter-I: Introduction: Particulars NoDocument42 pagesChapter-I: Introduction: Particulars Noharteg dhanjalNo ratings yet

- MBA Project Report On Kotak Life InsuranceDocument61 pagesMBA Project Report On Kotak Life InsuranceCyberfunNo ratings yet

- 5 Benefits of Investing in UlipsDocument4 pages5 Benefits of Investing in UlipsAishwarya SundararajNo ratings yet

- APM NotesDocument24 pagesAPM NotesDaniyal BilalNo ratings yet

- The Role of INSURANCEDocument22 pagesThe Role of INSURANCEJosephine CepedaNo ratings yet

- Sarmin Akther's AssignmentDocument7 pagesSarmin Akther's AssignmentKamruzzaman HasibNo ratings yet

- 2 Financial Services AssignmentDocument10 pages2 Financial Services AssignmentajayNo ratings yet

- Bus. Finance Q2 - W1 (ANSWER)Document3 pagesBus. Finance Q2 - W1 (ANSWER)Rory GdLNo ratings yet

- Growth & Guarantee Is Now Reality: Diamond Saving PlanDocument2 pagesGrowth & Guarantee Is Now Reality: Diamond Saving PlanMaulik PanchmatiaNo ratings yet

- List of Documents For JoiningDocument1 pageList of Documents For JoiningMaulik PanchmatiaNo ratings yet

- Documentation - Policy Condition - IDocument29 pagesDocumentation - Policy Condition - IMaulik PanchmatiaNo ratings yet

- Notes - Insurance Presentation 2Document9 pagesNotes - Insurance Presentation 2Maulik PanchmatiaNo ratings yet

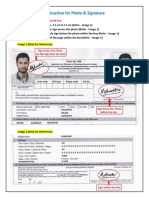

- Instruction For Photo & Signature: Sign With Black Ink PenDocument2 pagesInstruction For Photo & Signature: Sign With Black Ink PenMaulik PanchmatiaNo ratings yet

- Notes - Insurance PresentationDocument8 pagesNotes - Insurance PresentationMaulik PanchmatiaNo ratings yet

- IRDA Declaration For Agent and RelativesDocument1 pageIRDA Declaration For Agent and RelativesMaulik PanchmatiaNo ratings yet

- Documentation - Proposal StageDocument28 pagesDocumentation - Proposal StageMaulik PanchmatiaNo ratings yet

- Chapter No 12:: Documentation Proposal Stage: ProspectusDocument3 pagesChapter No 12:: Documentation Proposal Stage: ProspectusMaulik PanchmatiaNo ratings yet

- Payments Under A Life Insurance PolicyDocument3 pagesPayments Under A Life Insurance PolicyMaulik PanchmatiaNo ratings yet

- Life Insurance Products - I: Chapter IntroductionDocument7 pagesLife Insurance Products - I: Chapter IntroductionMaulik PanchmatiaNo ratings yet

- What Is Healthcare ?: Introduction To Health Insurance)Document5 pagesWhat Is Healthcare ?: Introduction To Health Insurance)Maulik PanchmatiaNo ratings yet

- Insurance Documentation: Proposal FormDocument3 pagesInsurance Documentation: Proposal FormMaulik PanchmatiaNo ratings yet

- Health Insurance Claims Chapter Introduction: CustomerDocument35 pagesHealth Insurance Claims Chapter Introduction: CustomerMaulik PanchmatiaNo ratings yet

- Health Insurance Products: Key PointsDocument3 pagesHealth Insurance Products: Key PointsMaulik PanchmatiaNo ratings yet

- Insurance Documentation: Proposal FormDocument3 pagesInsurance Documentation: Proposal FormMaulik PanchmatiaNo ratings yet

- Chapter No 12:: Documentation Proposal Stage: ProspectusDocument3 pagesChapter No 12:: Documentation Proposal Stage: ProspectusMaulik PanchmatiaNo ratings yet

- FINANCIAL PLANNING: Process of Identified GoalDocument5 pagesFINANCIAL PLANNING: Process of Identified GoalMaulik PanchmatiaNo ratings yet

- CHP 1:: Introduction To InsuranceDocument3 pagesCHP 1:: Introduction To InsuranceMaulik PanchmatiaNo ratings yet

- Chapter No 13:DOCUMENTTION: Policy Condition - IDocument3 pagesChapter No 13:DOCUMENTTION: Policy Condition - IMaulik PanchmatiaNo ratings yet

- Chapter No 15 UnderwritingDocument4 pagesChapter No 15 UnderwritingMaulik PanchmatiaNo ratings yet

- Life Insurance Products - Ii: Chapter IntroductionDocument5 pagesLife Insurance Products - Ii: Chapter IntroductionMaulik PanchmatiaNo ratings yet

- CH 4 5Document7 pagesCH 4 5Maulik PanchmatiaNo ratings yet

- Ic-38 Pointer: Customer Service & Grievance Redressal MechanismDocument2 pagesIc-38 Pointer: Customer Service & Grievance Redressal MechanismMaulik PanchmatiaNo ratings yet

- Assignment of B.S (Ashish Tiwari)Document3 pagesAssignment of B.S (Ashish Tiwari)Shashwat ShuklaNo ratings yet

- Resume of Ronaldperry1966Document2 pagesResume of Ronaldperry1966api-23836341No ratings yet

- Ageing Analysis, Bad Debts - PDDDocument3 pagesAgeing Analysis, Bad Debts - PDDRaman AgnihotriNo ratings yet

- U U U U U: Online Banking Internet Banking E-Banking Virtual BankingDocument1 pageU U U U U: Online Banking Internet Banking E-Banking Virtual BankingDẽo DẽoNo ratings yet

- A. Prepare On Pruin Company's Books Journal Entries To Record The Investment Related Activities For 2020Document2 pagesA. Prepare On Pruin Company's Books Journal Entries To Record The Investment Related Activities For 2020sameerNo ratings yet

- Lembar Kerja EAL EDL Inhouse - FajarSuparnoDocument10 pagesLembar Kerja EAL EDL Inhouse - FajarSuparnoPKK Akomodasi Perhotelan 2018No ratings yet

- Company Secretary N.K.SinhaDocument4 pagesCompany Secretary N.K.SinhaMohit KeswaniNo ratings yet

- Garrison 17e GEs PPT Chapter 1Document15 pagesGarrison 17e GEs PPT Chapter 1Princess Jullyn ClaudioNo ratings yet

- Form101 Notice of New DeductionDocument1 pageForm101 Notice of New DeductionJerome BaylonNo ratings yet

- ISA 800 Revised Updated 2022Document27 pagesISA 800 Revised Updated 2022peieng0409No ratings yet

- Icici Nri BankingDocument6 pagesIcici Nri BankingNedaabdiNo ratings yet

- English4Accounting - Unit 1 VocabularyDocument2 pagesEnglish4Accounting - Unit 1 VocabularyCristina FigueroaNo ratings yet

- Example Pooling and Servicing Agreement PDFDocument2 pagesExample Pooling and Servicing Agreement PDFTrentonNo ratings yet

- Financial Statements of Insurance Companies (PDFDrive)Document106 pagesFinancial Statements of Insurance Companies (PDFDrive)Putin PhyNo ratings yet

- Unit 5: Cash Book: Learning OutcomesDocument20 pagesUnit 5: Cash Book: Learning OutcomesMonica NallathambiNo ratings yet

- FY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Document26 pagesFY19 - QBDT Client - Lesson 1 - Get Started - BDB - v4Nyasha MakoreNo ratings yet

- Chapter 26: Derivatives and Hedging Risk: Answers To End-of-Chapter Problems BDocument11 pagesChapter 26: Derivatives and Hedging Risk: Answers To End-of-Chapter Problems BEvan JordanNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeMarie FeNo ratings yet

- Check TamperingDocument28 pagesCheck TamperingandreasNo ratings yet

- Singapore: Insurance & ReinsuranceDocument12 pagesSingapore: Insurance & ReinsurancegargramNo ratings yet

- UntitledDocument8 pagesUntitledWesNo ratings yet

- Buscom Excel-Solution DiazDocument6 pagesBuscom Excel-Solution DiazErico PaderesNo ratings yet

- LTCC Problem 2 Complete Journal EntriesDocument4 pagesLTCC Problem 2 Complete Journal EntriesMerliza JusayanNo ratings yet

- Disbursement Voucher BIRDocument6 pagesDisbursement Voucher BIRBhen Almodal100% (1)

- Adjusting EntriesDocument18 pagesAdjusting EntriesTristan John MagrareNo ratings yet

- Budgetary Changes TrainingDocument2 pagesBudgetary Changes TrainingNoel ArenaNo ratings yet