Professional Documents

Culture Documents

Set Problems

Uploaded by

Hyeju SonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Set Problems

Uploaded by

Hyeju SonCopyright:

Available Formats

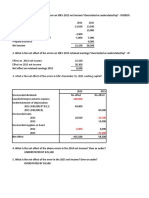

2. What is the amount to be reported as the carrying value of the building held for sale as December 31, 2014?

Cost of building 4,000,000

Acc. Depreciation 1,600,000

Carrying amount - Dec. 31 2014 2,400,000

3. What is the amount of loss to be recognized by Blazer Company in its income statement as a result of reclassification?

Carrying amount 2,400,000

Fair value less cost to sell 1,850,000

Impairment loss 550,000

4. What amount of impairment is allocated to the PPE?

18,000,000

divide: 29,000,000

0.62068965517

multiply: 4,000,000

2,482,758.62

5. What amount of the impairment os allocated to the goodwill?

6. What amount of the impairment is allocated to the inventory?

10,000,000

divide: 29,000,000

0.34482758621

multiply: 4,000,000

1,379,310.34

7. Immediately after classification as held for sale, what amount should be presented as the carrying value of the disposal grou

Noncurrent asset for sale 29,000,000

Goodwill write off 6,000,000

Financial asset liability 4,000,000

Goodwill 6,000,000

PPE 18,000,000

Inventory 10,000,000

Financial asset 5,000,000

Impairment loss 4,000,000

Noncurrent asset held for sale 4,000,000

mber 31, 2014?

esult of reclassification?

ying value of the disposal group?

1. How much will be reported as loss from ordinary activities of the discontinued segment during 2014?

Revenue:

Jan 1-June 1 3,000,000

June 1 - Dec. 31 1,400,000 4,400,000

Expenses:

Jan. 1 - June 1 4,000,000

June 1 - Dec. 31 1,800,000 5,800,000

Impairment loss:

Carrying value of net assets 4,000,000

Recoverable amount 3,600,000 400,000

Serverance and relocation cost 200,000

loss -2,000,000

Tax savings (2,000,000*35%) 700000

Net -1,300,000

You might also like

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- Chapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Document38 pagesChapter 1 - Statement of Financial Position: Problem 1-1 (IFRS)Asi Cas Jav0% (1)

- Chapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentDocument21 pagesChapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentKimberly Claire Atienza100% (5)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Ap RmycDocument16 pagesAp RmycJoseph Bayo BasanNo ratings yet

- Advanced Financial Accounting: Solutions ManualDocument18 pagesAdvanced Financial Accounting: Solutions ManualTịnh DiệpNo ratings yet

- SCI Handout 1 PDFDocument4 pagesSCI Handout 1 PDFhairu keyansamNo ratings yet

- Chapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Document14 pagesChapter 4 - Statement of Comprehensive Income: Problem 4-1 (AICPA Adapted)Asi Cas Jav100% (1)

- Chapter 9 Depreciation, Amortization and DepletionDocument11 pagesChapter 9 Depreciation, Amortization and DepletionKrissa Mae Longos100% (1)

- Test Bank For Australian Financial Accounting 7th Edition by Deegan PDFDocument14 pagesTest Bank For Australian Financial Accounting 7th Edition by Deegan PDFGen S.No ratings yet

- Lecture 8 - 8 Point and EV To EBITDA by CA Rachana RanadeDocument8 pagesLecture 8 - 8 Point and EV To EBITDA by CA Rachana RanadeMufaddal DaginawalaNo ratings yet

- Quiz - SFP With AnswersDocument4 pagesQuiz - SFP With Answersjanus lopezNo ratings yet

- Inventory Valuation and Gross Profit MethodDocument3 pagesInventory Valuation and Gross Profit MethodLuiNo ratings yet

- Financial Accounting and Reporting Final ExaminationDocument13 pagesFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Drill 4 AK FSUU AccountingDocument10 pagesDrill 4 AK FSUU AccountingRobert CastilloNo ratings yet

- Drill 4 FSUU AccountingDocument6 pagesDrill 4 FSUU AccountingRobert CastilloNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- Hyperinflation and Current CostDocument2 pagesHyperinflation and Current CostAna Marie IllutNo ratings yet

- Sanchez Activity2.2Document5 pagesSanchez Activity2.2Carmina SanchezNo ratings yet

- Chapter 1Document20 pagesChapter 1Coursehero PremiumNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- (Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Document2 pages(Cpar2016) Far-6183 (Statement of Financial Position and Comprehensive Income)Irene ArantxaNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Fernandez - SIM Activity - HyperinflationDocument5 pagesFernandez - SIM Activity - HyperinflationJeric TorionNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- December-12Document3 pagesDecember-12Kathleen MarcialNo ratings yet

- Financial Accounting P 1 Quiz 3 KeyDocument6 pagesFinancial Accounting P 1 Quiz 3 KeyJei CincoNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Fundamentals of ABM 2Document2 pagesFundamentals of ABM 2Xivaughn SebastianNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- P1 Day1 RMDocument4 pagesP1 Day1 RMabcdefg100% (2)

- Quiz 8 - Hyperinflation Current Cost AccountingDocument3 pagesQuiz 8 - Hyperinflation Current Cost AccountingCaballero, Charlotte MichaellaNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Marjorie PalmaNo ratings yet

- R4acads Finacc PrefinalDocument4 pagesR4acads Finacc PrefinalChristine Herico CurryNo ratings yet

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- Ia3 Quiz 3Document5 pagesIa3 Quiz 3Magdaraog LutzNo ratings yet

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocument3 pagesQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasNo ratings yet

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Quiz - 4B UpdatesDocument7 pagesQuiz - 4B UpdatesAngelo HilomaNo ratings yet

- DUAZO - 6th EXAM SIM ANSWERSDocument7 pagesDUAZO - 6th EXAM SIM ANSWERSJeric TorionNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaRaquel Villar DayaoNo ratings yet

- Officers' Salaries Officers' SalariesDocument6 pagesOfficers' Salaries Officers' SalariesCaptain ObviousNo ratings yet

- Exercise 4Document17 pagesExercise 4LoyalNamanAko LLNo ratings yet

- 6937 - Statement of Cash FlowsDocument2 pages6937 - Statement of Cash FlowsAljur SalamedaNo ratings yet

- 7105 - Inventory Cost Flow and LCNRVDocument2 pages7105 - Inventory Cost Flow and LCNRVGerardo YadawonNo ratings yet

- Mary Joy Asis QUIZ 1Document6 pagesMary Joy Asis QUIZ 1Joseph AsisNo ratings yet

- FABM 2 ProjectDocument14 pagesFABM 2 ProjectMilanie Rose Mendoza 11- ABMNo ratings yet

- 1909 Gross Profit and Retail MethodDocument3 pages1909 Gross Profit and Retail MethodCykee Hanna Quizo Lumongsod50% (4)

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Assignment On LCNRV and GP MethodDocument6 pagesAssignment On LCNRV and GP MethodAdam CuencaNo ratings yet

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Document4 pagesComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Jericho VillalonNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- 6938 - Operating, Investisng and Financing ActivitiesDocument2 pages6938 - Operating, Investisng and Financing ActivitiesAljur SalamedaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- QuizDocument1 pageQuizHyeju SonNo ratings yet

- ErrorsDocument2 pagesErrorsHyeju SonNo ratings yet

- Independent Auditors ' Report: Management 'S Responsibility For The Financial StatementsDocument2 pagesIndependent Auditors ' Report: Management 'S Responsibility For The Financial StatementsHyeju SonNo ratings yet

- The Book Value Per Share of Ordinary Share Is?Document2 pagesThe Book Value Per Share of Ordinary Share Is?Hyeju SonNo ratings yet

- Multiple-Choice Questions: Not A Type of Statistical Method That Provides Results in Dollar Terms?Document19 pagesMultiple-Choice Questions: Not A Type of Statistical Method That Provides Results in Dollar Terms?Hyeju SonNo ratings yet

- Noncurrent Asset NotesDocument4 pagesNoncurrent Asset NotesHyeju SonNo ratings yet

- Auditors Responsibility MCDocument26 pagesAuditors Responsibility MCHyeju SonNo ratings yet

- TOPIC 4: The Value of Inductive and Deductive Reasoning in WorkplaceDocument8 pagesTOPIC 4: The Value of Inductive and Deductive Reasoning in WorkplaceHyeju SonNo ratings yet

- Cost of Capital ChapterDocument25 pagesCost of Capital ChapterHossain Belal100% (1)

- AFAR Quiz 2Document3 pagesAFAR Quiz 2Philip LarozaNo ratings yet

- 10 Chapter 8Document6 pages10 Chapter 8Motiram paudelNo ratings yet

- ACC Final 3 Flashcards - QuizletDocument13 pagesACC Final 3 Flashcards - QuizletAbdul Rahim RattaniNo ratings yet

- (8b) Analysis of Leverages (Cir. 9.3.2017)Document44 pages(8b) Analysis of Leverages (Cir. 9.3.2017)Sarvar PathanNo ratings yet

- Adjusting Entries (Accounting)Document25 pagesAdjusting Entries (Accounting)Elaiza Jane CruzNo ratings yet

- Exam Financial Statement AnalysisDocument18 pagesExam Financial Statement AnalysisBuketNo ratings yet

- CA Inter New Syllabus - Subjectwise AnalysisDocument21 pagesCA Inter New Syllabus - Subjectwise AnalysisShubham TiwariNo ratings yet

- Sapm PPT 1 - Introduction To InvestmentDocument57 pagesSapm PPT 1 - Introduction To InvestmentNithin Mathew Jose MBA 2020No ratings yet

- Auditing (Problems) Book Value Per ShareDocument12 pagesAuditing (Problems) Book Value Per ShareJasper Bryan BlagoNo ratings yet

- IFRS 2 - HandoutDocument10 pagesIFRS 2 - HandoutkeyiceNo ratings yet

- Financial Institutions and Markets Case Study On Trading in SecuritiesDocument4 pagesFinancial Institutions and Markets Case Study On Trading in SecuritiesSaurabh SinghNo ratings yet

- ch03 Acct1 7e TKDocument22 pagesch03 Acct1 7e TKSharun RavishankarNo ratings yet

- Technical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDocument3 pagesTechnical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDIVYA PANJWANINo ratings yet

- 4.1 Debt and Equity FinancingDocument13 pages4.1 Debt and Equity FinancingAliza UrtalNo ratings yet

- Balance SheetDocument28 pagesBalance SheetrimaNo ratings yet

- Why Is Considering Cash So Important in Entrepreneurial Ventures?Document4 pagesWhy Is Considering Cash So Important in Entrepreneurial Ventures?Jennifer CarliseNo ratings yet

- CFA Investments Problems - SetDocument85 pagesCFA Investments Problems - SetGeorge Berberi100% (1)

- BIOCON Case StudyDocument5 pagesBIOCON Case StudyShreya AnturkarNo ratings yet

- The Ten Trillion Dollar ManDocument15 pagesThe Ten Trillion Dollar ManJorgeNo ratings yet

- Types of Businesses Chart WorksheetDocument1 pageTypes of Businesses Chart WorksheetYousif Jamal Al Naqbi 12BENo ratings yet

- Error Correction Sample ProblemsDocument42 pagesError Correction Sample ProblemsKatie BarnesNo ratings yet

- GL Determination Document - SAP B1Document9 pagesGL Determination Document - SAP B1Kaushik ShindeNo ratings yet

- F7 InterpretationDocument16 pagesF7 Interpretationnoor ul anumNo ratings yet

- Variable Costing Discussion ProblemsDocument2 pagesVariable Costing Discussion ProblemsVatchdemonNo ratings yet

- EBusiness A Canadian Perspective For A Networked World Canadian 4th Edition Trites Solutions Manual 1Document25 pagesEBusiness A Canadian Perspective For A Networked World Canadian 4th Edition Trites Solutions Manual 1ronald100% (30)