Professional Documents

Culture Documents

Depreciation Schedules and Asset Impairment Calculations

Uploaded by

Rehab ElsamnyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Schedules and Asset Impairment Calculations

Uploaded by

Rehab ElsamnyCopyright:

Available Formats

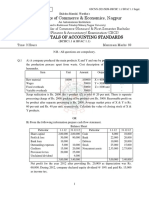

ABC bought a machine on January 1, 2014 where the company was charged for

$21,000 which was paid. ABC also paid $3,000 for setup. The company signed a

long-term note payable of $6,000. The machine is expected to be useful for five

years with a residual value of $2,000. The machine is expected to produce 10,000

in first year, 8,000 in second, 6,000 in third, 4,000 in fourth, and 2,000 in the last

year (total units of production 30,000 units)

Required:

1.Journalize the purchase transaction on January 1, 2014.

2.Prepare the depreciation schedule assuming that company uses:

. a) The straight-line method

. b) Units of production

3.Journalize the depreciation transaction on December 31, 2015.

4.Which method would produce the highest income for 2015?

5.For income tax purposes for 2015, which method would the company prefer?

1. Purchase transaction:

Dr. Machine.................................................. 30,000

Cr. Cash (21,000 + 3,000) ........................ 24,000

Cr. Note payable..................................... 6,000

Date Depreciable Depreciation Accumulated Book value

cost Expense depreciation

12-31-2014 28,000 5,600 5,600 24,400

2-31-2015 28,000 5,600 11,200 18,800

12-31-2016 28,000 5,600 16,800 13,200

2-31-2017 28,000 5,600 22,400 7,600

12-31-2018 28,000 5,600 28,000 2,000

Date Depreciable Depreciation Units Depreciation

cost rate produced per expense

(28,000/30,000 year

)

12-31-2014 28,000 0.93 10,000 9,300

2-31-2015 28,000 0.93 8,000 7440

12-31-2016 28,000 0.93 6000 5,580

2-31-2017 28,000 0.93 4000 3,720

12-31-2018 28,000 0.93 2000 1,860

C) a. Dr. depreciation expense 5,600

Cr. Accumulated depreciation 5,600

b. Dr. depreciation expense 9,300

Cr. Accumulated depreciation 9,300

4. Straight-line method

5. double decline method/ in our case, it will be units of production

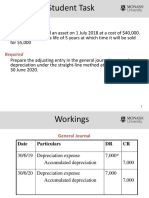

On January 9, 20X6, J. T. Orlando Co. paid $240,000 for a computer system. In

addition to the basic purchase price, the company paid a setup fee of $2,000,

$8,000 sales tax, and $30,000 for a special platform on which to place the

computer. J. T. Orlando management estimates that the computer will remain in

service for five years and have a residual value of $20,000. The computer will

process 30,000 documents the first year, with annual processing decreasing by

2,500 documents during each of the next four years (that is, 27,500 documents in

year 20X7; 25,000 documents in year 20X8; and so on). In trying to decide which

depreciation method to use, the company president has requested a depreciation

schedule for each of the two depreciation methods (straight-line and units-of-

production)

Asset cost: $240,000 + $2,000 + $8,000 + $30,000 = 280,000

Depreciation for each year: ($280,000 − $20,000) / 5 years = $52,000

Date Depreciable Depreciation Accumulated Book value

cost Expense depreciation

12-31-2016 260,000 52,000 52,000 228,000

2-31-2017 260,000 52,000 104,000 176,000

12-31-2018 260,000 52,000 156,000 124,000

2-31-2019 260,000 52,000 208,000 72,000

12-31-2020 260,000 52,000 260,000 20,000

Date Depreciable Depreciation Units Depreciation

cost rate produced expense

(260,000/125,000) per year

12-31-2016 260,000 2.08 30,000 62,400

2-31-2017 260,000 2.08 27,500 57,200

12-31-2018 260,000 2.08 25,000 52,000

2-31-2019 260,000 2.08 22,500 46,800

12-31-2020 260,000 2.08 20,000 41,600

On January 1, 2010, XYZ Co purchased equipment for $550,000. XYZ expects the

equipment to remain useful for 5 years and to have a residual value of $50,000.

The company uses the straight-line method to depreciate its equipment. The

company used the equipment for two years and sold it on January 1, 2012 for

$370,000.

Required:

1. Record the sale of the equipment on January 1, 2012.

2. Record the sale of the equipment on January 1, 2012 assuming it was sold

for $340,000.

Depreciation expense = 550,000 – 50,000/5 = $100,000

Accumulated depreciation on Jan 1, 2012 = 100,000 X 2 = 200,000

Cash received = 370,000

Book value = 550,000 – 200,000 = 350,000

Gain on sale = 20,000

Entry:

Cash 370,000

Accumulated depreciation 200,000

Equipment 550,000

Gain on sale of equipment 20,000

Entry

Cash 340,000

Accumulated depreciation 200,000

Loss on sale 10,000

Equipment 550,000

Intangibles and Amortization

Suppose ABC pays $170,000 to acquire a patent on January 1, and the business

believes the useful life is 5 years

Dr. Patent 170,000

Cr. Cash 170,000

Amortization

Dr. Amortization expense (170,000/5) 34,000

Cr. Accumulated amortization/ patent 34,000

If there is no lifetime, the asset is tested for impairment

The carrying amount of a factory was $700 million. The recoverable amount was

$300 million. Toshiba recognized an impairment loss of $400 million with the

following journal entry

Dr. Impairment loss 400,000,000

Cr. Accumulated depreciation and impairment loss 400,000,000

If the asset was intangible one

We will do the following

Dr. impairment loss

Cr. (the intangible assets itself)

Natural resources and depletion

An oil lease costs Royal Dutch Shell $100,000 and contain an estimated 10,000

barrels of oil. If 3,000 barrels are extracted (assuming the company paid cash, $10

a barrel)

Dr. Depletion expense (3000*10) 30,000

Cr. Accumulated Depletion 30,000

You might also like

- Direct Tax Law and Practice BookDocument694 pagesDirect Tax Law and Practice BookPrem MahalaNo ratings yet

- OCR GCSE 9-1 Business: My Revision GuideDocument113 pagesOCR GCSE 9-1 Business: My Revision GuideAnya JohalNo ratings yet

- VAT ReviewerDocument11 pagesVAT ReviewerMarianne AgunoyNo ratings yet

- PPEDocument18 pagesPPECarl Yry BitzNo ratings yet

- Financial Accounting Reviewer - Chapter 57Document7 pagesFinancial Accounting Reviewer - Chapter 57Coursehero PremiumNo ratings yet

- Calculation of GSTDocument13 pagesCalculation of GSTSukanta PalNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Problem 27 5Document20 pagesProblem 27 5Cjezerei Dangue VerdaderoNo ratings yet

- CFA Level III Outline-Notes (2010)Document114 pagesCFA Level III Outline-Notes (2010)Mark Oblad100% (2)

- DEED OF CONDITIONAL SALE PutlodDocument3 pagesDEED OF CONDITIONAL SALE PutlodHoward UntalanNo ratings yet

- Final Exam - Submitted Version PDFDocument19 pagesFinal Exam - Submitted Version PDFUmarul AimanNo ratings yet

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- Correction of ErrorsDocument6 pagesCorrection of ErrorsJanjielyn MoralesNo ratings yet

- Akuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-IDocument14 pagesAkuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-Imuhammad alfariziNo ratings yet

- Chapter 9-1Document5 pagesChapter 9-1jou20220354No ratings yet

- Working Papers in PPEDocument22 pagesWorking Papers in PPETrisha VillegasNo ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- Chapter 26 - Review QuestionsDocument7 pagesChapter 26 - Review QuestionsAli MohamedNo ratings yet

- Managerial Accounting mid-term assessment test solutionsDocument3 pagesManagerial Accounting mid-term assessment test solutionsOyon Nur newazNo ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- 8th Homework FAR 1Document3 pages8th Homework FAR 1Ahmed RazaNo ratings yet

- Working Papers in PPE UpdatedDocument29 pagesWorking Papers in PPE UpdatedTrisha VillegasNo ratings yet

- DepreciationDocument3 pagesDepreciationSumanth KumarNo ratings yet

- PARALEL QUIZ - Introduction of AccountingDocument5 pagesPARALEL QUIZ - Introduction of AccountingCut Farisa MachmudNo ratings yet

- ACC1100 S1 2018 Exam SolutionDocument15 pagesACC1100 S1 2018 Exam SolutionFarah PatelNo ratings yet

- Unit 1 - Essay QuestionsDocument7 pagesUnit 1 - Essay QuestionsJaijuNo ratings yet

- DepreciationDocument14 pagesDepreciationKris Hazel RentonNo ratings yet

- Analysis of Financial StatementsDocument11 pagesAnalysis of Financial StatementsBri CorpuzNo ratings yet

- Review Questions For Final Exam ACC210Document13 pagesReview Questions For Final Exam ACC210AaaNo ratings yet

- Management Accounting (Acct 321) P2 PT 2ND Trimester 2017Document5 pagesManagement Accounting (Acct 321) P2 PT 2ND Trimester 2017Nodeh Deh SpartaNo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- Cost estimation questionsDocument7 pagesCost estimation questionsOwais Khan KhattakNo ratings yet

- Juishat Financial Plan AnalysisDocument11 pagesJuishat Financial Plan AnalysisMeosjinNo ratings yet

- Depreciation Methods and CalculationsDocument5 pagesDepreciation Methods and CalculationsAvox EverdeenNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- BudgetingDocument51 pagesBudgetingVignesh KivickyNo ratings yet

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- DEPRECIATION2Document9 pagesDEPRECIATION2Darlianne Klyne BayerNo ratings yet

- ACCOUNT- 1Document6 pagesACCOUNT- 1kakajumaNo ratings yet

- Project 3 Develop and Use A Personal Budget and Saving PlanDocument7 pagesProject 3 Develop and Use A Personal Budget and Saving PlanKen Lati100% (1)

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Chapter 8Document7 pagesChapter 8jeanNo ratings yet

- CPA Financial Accounting Exam PrepDocument10 pagesCPA Financial Accounting Exam PrepTuryamureeba JuliusNo ratings yet

- Zoom SlidesDocument10 pagesZoom SlidesTuấn Kiệt NguyễnNo ratings yet

- Final New Scmpe Full Test 1 Nov 2023 Test Paper 1689226950Document18 pagesFinal New Scmpe Full Test 1 Nov 2023 Test Paper 1689226950sweaths2001No ratings yet

- Chapter 10Document11 pagesChapter 10Saharin Islam ShakibNo ratings yet

- Kic02 Nhóm9 Topic2 Ktqt1enDocument10 pagesKic02 Nhóm9 Topic2 Ktqt1enLy BùiNo ratings yet

- 2.3 Paper 2.3 - Accounting For Business - 1Document6 pages2.3 Paper 2.3 - Accounting For Business - 1Himanshu SinghNo ratings yet

- Mini-Case 1 Ppe AnswerDocument11 pagesMini-Case 1 Ppe Answeryu choong100% (2)

- (CBCS) (Regular) Commerce Paper - 4.5: Innovations in AccountingDocument4 pages(CBCS) (Regular) Commerce Paper - 4.5: Innovations in AccountingSanaullah M SultanpurNo ratings yet

- Jomo Kenyatta University Accounting Exam QuestionsDocument4 pagesJomo Kenyatta University Accounting Exam QuestionsFRANCISCA AKOTHNo ratings yet

- FM Paper Solution (2012)Document6 pagesFM Paper Solution (2012)Prreeti ShroffNo ratings yet

- Book Value (Carrying Value) at 2020 25,000 Remaining Life 10 YrsDocument5 pagesBook Value (Carrying Value) at 2020 25,000 Remaining Life 10 YrsMichael PanizaNo ratings yet

- 1 - 4-1Document11 pages1 - 4-1sandeshjhanbia021No ratings yet

- Bac 202 Second CatDocument2 pagesBac 202 Second CatBrian MutuaNo ratings yet

- Project One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowDocument6 pagesProject One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowYesakNo ratings yet

- Answer Key - Assignment PPE Part 2Document8 pagesAnswer Key - Assignment PPE Part 2Silvermist AriaNo ratings yet

- Specific Financial Reporting Ac413 MAY2016Document5 pagesSpecific Financial Reporting Ac413 MAY2016AnishahNo ratings yet

- MA Submit-3Document19 pagesMA Submit-3KaiQiNo ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- Acc 308-Week3 - 3-2 Homework Chapter 11Document7 pagesAcc 308-Week3 - 3-2 Homework Chapter 11Lilian LNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Chapter 01Document19 pagesChapter 01midel sienaNo ratings yet

- Notebook Page 31 - Abnormal Behavior IIIDocument10 pagesNotebook Page 31 - Abnormal Behavior IIIRehab ElsamnyNo ratings yet

- Who Are We?: Daily DeliveriesDocument7 pagesWho Are We?: Daily DeliveriesRehab ElsamnyNo ratings yet

- Damon Corporation machine replacement analysisDocument5 pagesDamon Corporation machine replacement analysishai0% (1)

- Modified Disorder Treatment IDocument7 pagesModified Disorder Treatment IRehab ElsamnyNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument4 pagesCambridge International Advanced Subsidiary and Advanced LevelRehab ElsamnyNo ratings yet

- Notebook Page 31 - Abnormal Behavior IIIDocument10 pagesNotebook Page 31 - Abnormal Behavior IIIRehab ElsamnyNo ratings yet

- Cambridge Assessment International Education: Business 9609/33 October/November 2019Document15 pagesCambridge Assessment International Education: Business 9609/33 October/November 2019Rehab ElsamnyNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument4 pagesCambridge International Advanced Subsidiary and Advanced LevelRehab ElsamnyNo ratings yet

- Mrs - Mona YounesDocument14 pagesMrs - Mona YounesRehab ElsamnyNo ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/33Document20 pagesCambridge International AS & A Level: BUSINESS 9609/33Rehab ElsamnyNo ratings yet

- Cash Flow StatmentDocument2 pagesCash Flow StatmentRehab ElsamnyNo ratings yet

- Mariam 3Document4 pagesMariam 3Rehab ElsamnyNo ratings yet

- Explain and analyse exam questionsDocument2 pagesExplain and analyse exam questionsRehab ElsamnyNo ratings yet

- 4 - Government The MacroeconomyDocument6 pages4 - Government The MacroeconomyRehab ElsamnyNo ratings yet

- 5 - Economic DevelopmentDocument3 pages5 - Economic DevelopmentRehab ElsamnyNo ratings yet

- MediaDocument2 pagesMediaRehab ElsamnyNo ratings yet

- Admission Agreement FormDocument4 pagesAdmission Agreement FormRehab ElsamnyNo ratings yet

- Business Documents ExplainedDocument11 pagesBusiness Documents ExplainedAccounts SSTNo ratings yet

- Payroll FAQ For Santa EmployeesDocument1 pagePayroll FAQ For Santa EmployeesLeigh ScottNo ratings yet

- Islamabad Office InvoiceDocument2 pagesIslamabad Office InvoiceIrfan FarooqNo ratings yet

- Chapter 2Document124 pagesChapter 2Cha Boon KitNo ratings yet

- PWC QaDocument14 pagesPWC QaClyde RamosNo ratings yet

- The Impact of Tax Expenditures on Customs RevenueDocument23 pagesThe Impact of Tax Expenditures on Customs RevenueEnat EndawokeNo ratings yet

- Today's Supreme Court Ruling on Interest for Past Tax DeficienciesDocument1 pageToday's Supreme Court Ruling on Interest for Past Tax DeficienciesChou TakahiroNo ratings yet

- LGU Requirements - PhilippinesDocument11 pagesLGU Requirements - Philippinesni_kai2001100% (2)

- Njord - Mislov, Mauro - Za Slanje PDFDocument9 pagesNjord - Mislov, Mauro - Za Slanje PDFMauroNo ratings yet

- Train TicketsDocument1 pageTrain TicketsBhavesh PoojariNo ratings yet

- Com - Magmahdi TWIPC P1056842504Document5 pagesCom - Magmahdi TWIPC P1056842504Chetan SharmaNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- Sales and Use Tax Resale CertificateDocument2 pagesSales and Use Tax Resale CertificatejesbmnNo ratings yet

- Nicanor Perlas PlatformDocument20 pagesNicanor Perlas PlatformManuel L. Quezon IIINo ratings yet

- Chapter 13 Efficiency, Equity and The Role of Government (I) (1) - 34-43Document10 pagesChapter 13 Efficiency, Equity and The Role of Government (I) (1) - 34-43Kayla YuNo ratings yet

- MQ Tech FY2022 Q3Document12 pagesMQ Tech FY2022 Q3zul hakifNo ratings yet

- Scheme 1Document19 pagesScheme 1Jayesh ValwarNo ratings yet

- Audit Book B ComDocument34 pagesAudit Book B ComSethu SangurajanNo ratings yet

- All 59 E-Business Quizzes As On DateDocument74 pagesAll 59 E-Business Quizzes As On Datepoojadixit1090No ratings yet

- Swanzy RidgeDocument21 pagesSwanzy RidgeRyan SloanNo ratings yet

- Quiz No. 6 - Accounting Changes and ErrorsDocument2 pagesQuiz No. 6 - Accounting Changes and ErrorsWindel L GabuyaNo ratings yet

- Inflation in PakistanDocument4 pagesInflation in PakistanZambalbanNo ratings yet

- Wind Farm Project Analysis and Site AssessmentDocument29 pagesWind Farm Project Analysis and Site AssessmentayobamiNo ratings yet

- Macro Economy Today 14th Edition Schiller Test Bank 1Document96 pagesMacro Economy Today 14th Edition Schiller Test Bank 1deborah100% (50)

- Efw 2017 Master Index Data For ResearchersDocument50 pagesEfw 2017 Master Index Data For ResearchersVivian Katherine Suarez HurtadoNo ratings yet

- DAC Minutes 7&8 Jan 2019 AmendedDocument19 pagesDAC Minutes 7&8 Jan 2019 AmendedarshadNo ratings yet