Professional Documents

Culture Documents

Solutions To Exam 1

Uploaded by

alison dreamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solutions To Exam 1

Uploaded by

alison dreamCopyright:

Available Formats

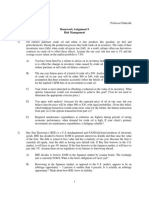

FINA 4120 Exam 1 Solution

Solutions to Exam 1:

1. b Set P/Y and C/Y to 1

PV = 120,000, I/Y = 8/12, N=360

CPT PMT = $ 880.52

2. b Whenever the price of the bond increases above the call price, it will be optimal for the issuer to

call the bond.

3. b Adjust the principal at the end of each period (in this case each six months) to reflect inflation.

End of period 1: 100,000(1.015) = $101,500.00.

End of period 2: 101,500(1.015) = $103,022.50.

4. d d = (par – p)(360/T)/par = 3.59%.

5. a The relevant risk in (a) is the liquidity risk.

6. c WSJ quotes clean price. (105.219)*1000/100 = $1,052.19

7. d Note the difference between foreign bonds and Eurobonds. Yankee bonds are issued in US

dollars even though they are issued by non-American firms.

8. a Set P/Y and C/Y to 2

FV=1000, I/Y=15, N=10, PMT=50

CPT PV = -$828.40

9. b Since the bond is noncallable for the first two years, there is no prepayment risk. All the other

risks are relevant.

10. b Coupon rate is greater than the required yield for (b)

11. c First note that the coupon bonds can be replicated using zeros. Also note that the YTM on 2-year

zeros are too high, indicting under-pricing. To buy low sell high, we want to buy the replicating

portfolio of zeros and sell the coupon bonds.

12. d Fed can influence expectations and short-term rates (to some extent), but Markets determine

interest rates.

13. (a) Interest rate risk. The 30-year treasury becomes a 29-year instrument after one year and its

price depends on the interest rate one year later.

(b) Reinvestment risk. The principal of the one-year zero has to be reinvested at the end of one

year.

(c) Credit risk. Japanese government bonds have greater credit risk.

Exchange rate risk. Japanese government bonds are denominated in Yen.

14. a) Since Co-cos became equity when the issuing bank is in financial distress, the bank gets an

automatic equity boost when it is most needed.

b) Investors should be aware of the downside risk that they may not get back their principals but

the distressed bank shares instead. The high yield is to compensate for such downside risk.

FINA 4120 – Exam 1 1 practice

You might also like

- ICT Advanced Market StructureDocument19 pagesICT Advanced Market Structurepaola andrea pastrana martinez100% (10)

- Tài ChínhDocument14 pagesTài ChínhMinh Nguyen Phuc100% (2)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Investments Global Edition 10th Edition Bodie Solutions ManualDocument6 pagesInvestments Global Edition 10th Edition Bodie Solutions Manuala609526046No ratings yet

- Solution Manual For Essentials of Investments 9th Edition by BodieDocument18 pagesSolution Manual For Essentials of Investments 9th Edition by BodieCameronHerreracapt100% (38)

- BOND VALUATION With SolutionsDocument30 pagesBOND VALUATION With Solutionschiaraferragni78% (9)

- Chapter 12 HW SolutionDocument5 pagesChapter 12 HW SolutionZarifah Fasihah67% (3)

- Chapter 16 AssignmentDocument4 pagesChapter 16 Assignmentsam broughtonNo ratings yet

- IEC Code - Gujrat List-4Document31 pagesIEC Code - Gujrat List-4Mohammad Delwar HossainNo ratings yet

- Undergraduate Prospectus 2Document49 pagesUndergraduate Prospectus 2Esther DalamuNo ratings yet

- Darren FIXED INCOMEDocument31 pagesDarren FIXED INCOMEAzadNo ratings yet

- HW Nongraded AnsDocument3 pagesHW Nongraded AnsAnDy YiMNo ratings yet

- TVM Test BankDocument52 pagesTVM Test BankShahzaib MaharNo ratings yet

- 48001-Chapter 5 PDFDocument8 pages48001-Chapter 5 PDFMarwa HassanNo ratings yet

- MCQ (Diversifed)Document3 pagesMCQ (Diversifed)Amine IzamNo ratings yet

- ETS Finance Review QuizDocument4 pagesETS Finance Review QuizRaine PiliinNo ratings yet

- Corporate FinanceDocument10 pagesCorporate FinanceAnna BudaevaNo ratings yet

- Mock Examination IYSBDocument12 pagesMock Examination IYSBSheira Mae GuzmanNo ratings yet

- Chapter 18Document9 pagesChapter 18Selena JungNo ratings yet

- Bai Tap Chap 7-8Document3 pagesBai Tap Chap 7-8SonNo ratings yet

- Key STQ - Fixed Income Securities Fall 2021Document3 pagesKey STQ - Fixed Income Securities Fall 2021Alina AltafNo ratings yet

- L3 The Arbitrage Approach of Bond PricingDocument52 pagesL3 The Arbitrage Approach of Bond PricingVy HàNo ratings yet

- 15 Bond Valuation Part ADocument24 pages15 Bond Valuation Part AprernaNo ratings yet

- Bond Yields and Prices Multiple Choice QuestionsDocument13 pagesBond Yields and Prices Multiple Choice QuestionsManuel BoahenNo ratings yet

- Advanced Accounting 12th Edition Fischer Test Bank DownloadDocument39 pagesAdvanced Accounting 12th Edition Fischer Test Bank DownloadJoyce Santiago100% (25)

- Refinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenDocument6 pagesRefinancing Risk: Solutions For End-of-Chapter Questions and Problems: Chapter SevenJeffNo ratings yet

- Mini Case - Chapter 4Document5 pagesMini Case - Chapter 4mfitani100% (1)

- Chapter 14Document12 pagesChapter 14Selena JungNo ratings yet

- Quiz Chapter 3 Bonds Docx CompressDocument7 pagesQuiz Chapter 3 Bonds Docx CompressKurumi KunNo ratings yet

- Bond ValuationDocument51 pagesBond ValuationRudy Putro100% (1)

- Lec 6 SlidesDocument29 pagesLec 6 Slidesc5y5f562y4No ratings yet

- MBA 7427 Sample Questions CH 7: Multiple ChoiceDocument5 pagesMBA 7427 Sample Questions CH 7: Multiple ChoiceAlaye OgbeniNo ratings yet

- IFM TB ch18Document9 pagesIFM TB ch18Mon LuffyNo ratings yet

- Homework Assignment 8 Risk ManagementDocument5 pagesHomework Assignment 8 Risk ManagementJorge SmithNo ratings yet

- FM Course Exam 2 2021Document12 pagesFM Course Exam 2 2021abu semanNo ratings yet

- Tutorial 2 QuestionsDocument5 pagesTutorial 2 QuestionsHiền NguyễnNo ratings yet

- Problem Set 3Document3 pagesProblem Set 3kaylovelluNo ratings yet

- Lecture 7 BH CH 7 Bond and ValuationDocument41 pagesLecture 7 BH CH 7 Bond and ValuationAydin GaniyevNo ratings yet

- Example Questions Finance 2016-2017Document6 pagesExample Questions Finance 2016-2017comllikNo ratings yet

- FileDocument12 pagesFileAyaz RukNo ratings yet

- BFW1001 Foundations of Finance: Valuation of Fixed Income Securities: Updated April 28, 2020Document14 pagesBFW1001 Foundations of Finance: Valuation of Fixed Income Securities: Updated April 28, 2020Quoc Viet DuongNo ratings yet

- 2nd Q Exam Sta Moincs HSDocument3 pages2nd Q Exam Sta Moincs HSJettCortez Alolod100% (1)

- F9 - Mock B - AnswersDocument3 pagesF9 - Mock B - Answersshahidmustafa429No ratings yet

- Valuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers BelowDocument7 pagesValuation of Debt Contracts and Their Price Volatility Characteristics Questions See Answers Belowevivanco1899No ratings yet

- Mcqs Help FahadDocument7 pagesMcqs Help FahadAREEBA ABDUL MAJEEDNo ratings yet

- Test Bank For Corporate Finance 4th Canadian Edition by BerkDocument37 pagesTest Bank For Corporate Finance 4th Canadian Edition by Berkangelahollandwdeirnczob100% (24)

- Bond Valuation Question Bank PDFDocument27 pagesBond Valuation Question Bank PDFMOHIT KAUSHIKNo ratings yet

- TB Chapter 18Document9 pagesTB Chapter 18Haris FadžanNo ratings yet

- FINA Exam1 - PracticeDocument6 pagesFINA Exam1 - Practicealison dreamNo ratings yet

- FAR-4214 (Bonds - Other Long-Term Liabilities)Document4 pagesFAR-4214 (Bonds - Other Long-Term Liabilities)saligumba mikeNo ratings yet

- CH 9Document5 pagesCH 9bsodoodNo ratings yet

- Chapter 4 - MinicaseDocument4 pagesChapter 4 - MinicaseMuhammad Aditya TMNo ratings yet

- F9 Test 2 AnswersDocument2 pagesF9 Test 2 Answersasif iqbalNo ratings yet

- FN2201solution ch10Document2 pagesFN2201solution ch10Seong Hye AnNo ratings yet

- Ch28 Test Bank 4-5-10Document14 pagesCh28 Test Bank 4-5-10KarenNo ratings yet

- 335 Chap 6x BondsDocument10 pages335 Chap 6x BondsEbenezerMebrateNo ratings yet

- Financial Markets and Institutions 8th Edition Mishkin Solutions ManualDocument8 pagesFinancial Markets and Institutions 8th Edition Mishkin Solutions Manualmichaelkrause22011998gdj100% (33)

- Time Value of MoneyDocument45 pagesTime Value of MoneyKimberly BanuelosNo ratings yet

- IFM TB ch18Document9 pagesIFM TB ch18Faizan Ch100% (1)

- Quiz Chapter+3 Bonds+PayableDocument3 pagesQuiz Chapter+3 Bonds+PayableRena Jocelle NalzaroNo ratings yet

- Assignment 6 2020Document7 pagesAssignment 6 2020林昀妤100% (1)

- Corporate Finance 3rd Edition Ehrhardt Test BankDocument51 pagesCorporate Finance 3rd Edition Ehrhardt Test BankSreeman RevuriNo ratings yet

- AppcDocument46 pagesAppcNicolas ErnestoNo ratings yet

- FINA Past Questions 2 AnswerDocument2 pagesFINA Past Questions 2 Answeralison dreamNo ratings yet

- FINA Exam1 - PracticeDocument6 pagesFINA Exam1 - Practicealison dreamNo ratings yet

- FINA Final - PracticeDocument9 pagesFINA Final - Practicealison dreamNo ratings yet

- FINA Final - Practice - AnsDocument2 pagesFINA Final - Practice - Ansalison dreamNo ratings yet

- Pre-Test Chapter 8Document7 pagesPre-Test Chapter 8Karen SomcioNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of Monetary PolicyDocument5 pagesAP Macroeconomics Assignment: Apply Concepts of Monetary PolicySixPennyUnicorn0% (1)

- Fundamentals of Multinational Finance Global Edition 6Th Edition Full ChapterDocument41 pagesFundamentals of Multinational Finance Global Edition 6Th Edition Full Chapterrobert.luckman563100% (22)

- PV 06 Mandaue Foam Pavia Rev0!07!07 22Document1 pagePV 06 Mandaue Foam Pavia Rev0!07!07 22AatroxNo ratings yet

- Comparative Analysis of Insurance Product of HDFC BankDocument67 pagesComparative Analysis of Insurance Product of HDFC BankUmar ThukarNo ratings yet

- Strategic Alliance FinalDocument10 pagesStrategic Alliance FinalVarun TejaNo ratings yet

- Listing of Philippine Government Bureaus and OfficesDocument111 pagesListing of Philippine Government Bureaus and OfficesCebuInstitute TechnologySeventy-oneNo ratings yet

- ProposalDocument2 pagesProposalSan Pedro CCLDONo ratings yet

- UNIT-05 Industrial Patterns During The Five Year Plans in IndiaDocument8 pagesUNIT-05 Industrial Patterns During The Five Year Plans in IndiaSAJAHAN MOLLANo ratings yet

- S.No Image Product Name Content Actual Rate 80% OFF Price Quantity TotalDocument15 pagesS.No Image Product Name Content Actual Rate 80% OFF Price Quantity TotalsowmiNo ratings yet

- Organizational - Chart of Barangay ConelDocument2 pagesOrganizational - Chart of Barangay ConelWahida IbnoNo ratings yet

- Analisis Efisiensi Aktivitas Dengan Menggunakan Activity Based Management (Studi Kasus Pada PG Candi Baru Sidoarjo)Document10 pagesAnalisis Efisiensi Aktivitas Dengan Menggunakan Activity Based Management (Studi Kasus Pada PG Candi Baru Sidoarjo)Shafa Alya ChairunnisahNo ratings yet

- Impact of Globalization On National Security: March 2019Document12 pagesImpact of Globalization On National Security: March 2019Rohit Agrawal PG19CM008No ratings yet

- Iecep Manila PRC Geas EecoDocument26 pagesIecep Manila PRC Geas EecoMark Anthony RagayNo ratings yet

- Economics - Regular BookDocument210 pagesEconomics - Regular BookmonikaNo ratings yet

- 2012 03 23 Duplex HandoverDocument1,240 pages2012 03 23 Duplex HandoverAnonymous j3w8EmJb8No ratings yet

- Tutorial 4 SolutionsDocument24 pagesTutorial 4 Solutionseya KhamassiNo ratings yet

- Lecture1 Chapter 1 InvMath2021 UpdatedDocument38 pagesLecture1 Chapter 1 InvMath2021 UpdatedNada NaderNo ratings yet

- For PSA - Export and Import - Revised - 052522Document4 pagesFor PSA - Export and Import - Revised - 052522Jacket TralalaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Company BackgroundDocument8 pagesCompany BackgroundAbdullah Ahmad AfhammuddinNo ratings yet

- University of The Immaculate Conception: Master in Business Administration ProgramDocument21 pagesUniversity of The Immaculate Conception: Master in Business Administration ProgramCINDY MAE DUMAPIASNo ratings yet

- Post Office Time Deposit (Amendment) Rules, 2001.Document16 pagesPost Office Time Deposit (Amendment) Rules, 2001.Latest Laws TeamNo ratings yet

- Organization Study of Canara BankDocument56 pagesOrganization Study of Canara BankChethan .MNo ratings yet

- Minutes For 51st NR LTA - Connectivity MeetingDocument20 pagesMinutes For 51st NR LTA - Connectivity MeetingjsvikasNo ratings yet

- L7796 Otm Workbook KenyaDocument80 pagesL7796 Otm Workbook Kenyaangela mwangiNo ratings yet

- Wec12 01 Que 20230118Document32 pagesWec12 01 Que 20230118nael fayssalNo ratings yet