Professional Documents

Culture Documents

Generally, Any Real-Estate Transfer Exceeding $100 in Value Within Michigan Is Subject To Transfer Tax. However, There Are Notable Exemptions

Uploaded by

Adebayo EmmanuelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Generally, Any Real-Estate Transfer Exceeding $100 in Value Within Michigan Is Subject To Transfer Tax. However, There Are Notable Exemptions

Uploaded by

Adebayo EmmanuelCopyright:

Available Formats

MICHIGAN R/E TRANSFER TAX

1) WHAT IS THE TRANSFER TAX?

The Michigan R/E Transfer Tax is, in general, a tax imposed on the “total consideration” of the

real property, based on the actual value of the property conveyed. If “total consideration” is not

stated on the deed (or written instrument), then a “Real Estate Transfer Valuation Affidavit”

shall be filed. In these instances, the written instrument should state that such affidavit is on file.

The transfer tax is actually two taxes: the State Transfer Tax of .75% (MCL 207.526, effective

1-1-1995) and the County Transfer of .11% (MCL 207.505), charged against “total

consideration”. For instance, on a qualifying real estate actual value sale of $50,000 the State

Transfer Tax would by $375.00 and the County Transfer Tax an additional $55.00, both payable

to the County Register of Deeds office.

II) WHAT PROPERTY TRANSFERS TRIGGERS THIS TAX?

Generally, any real-estate transfer exceeding $100 in value within Michigan is subject to

transfer tax. However, there are notable exemptions:

A) Conveyances from Parent to Children;

B) Conveyances from one Spouse to the other;

C) Conveyance from Grandparents to Grandchildren is exempt from State transfer tax, but

not County transfer tax;

D) Land contracts are exempted Until contract is paid off and warranty deed is issued. Then

transfer tax is invoked;

E) Transfer of mineral right, underground gas storage, leases (including oil/gas leases), or

assessed personal property is exempt.

F) Simply adding name(s) as joint owners where grantor is already owner is exempt;

G) Granting (or discharge) of security interest is exempt;

H) Property sold by (or given to) the U.S. Michigan, or subdivisions thereof is exempted;

I) Court-Ordered transfers are exempt, unless specific monetary remuneration is ordered for

transfer;

J) Simply straightening boundary lines, or correcting a flaw in Title is exempted.

Mich Real Estate Transfer Tax page 1 03/17/2000

ADDITIONALLY, THE FOLLWING SITUATIONS ARE EXEMPT FROM STATE

TRANSFER TAX, BUT NOT EXEMPT FROM COUNTY TAX:

1) A R/E transfer made, subject to a binding sales agreement in place before 01-01-1995, if

such agreement cannot be withdrawn, altered, or price changed.

2) R/E transfer involving “homestead exemption” qualifying property (which includes most

primary residences and farm properties) IF:

“The State Equalized Value” (SEV) of the property transferred is equal to or less

than the SEV of the same property when the seller acquired it.

3) Property transferred through foreclosure of a mortgage. However, subsequent sales are

not exempt.

III) OTHER NOTES ON TRANSFER TAX:

A) Tax is sellers (or grantors) responsibility;

B) If transfer is exempt, such exemptions are to be stated on the face of the deed or

instrument;

C) An exchange of two properties subjects each parcel to the transfer tax, based on

respective actual values;

D) Conveyances affecting property situated in more than one county must allocate the

portion of the actual value of each parcel lying in each respective county, and transfer tax

allocation paid accordingly to each county.

By Glenn Kole

District Farm Management Agent

County Extension Director, Kalkaska

Mich Real Estate Transfer Tax page 2 03/17/2000

You might also like

- Real Estate Transfer DeclarationDocument2 pagesReal Estate Transfer Declarationjrothschild412No ratings yet

- Taxation Law 2 Reviewer (Long)Document44 pagesTaxation Law 2 Reviewer (Long)Gertz Mayam-o Pugong100% (21)

- Taxation Law 2 ReviewerDocument44 pagesTaxation Law 2 ReviewerShi MartinezNo ratings yet

- Tax2 Reviewer NotesDocument57 pagesTax2 Reviewer NotescardeguzmanNo ratings yet

- Of Res Mobilia Sequuntur Personam and Situs of Taxation)Document47 pagesOf Res Mobilia Sequuntur Personam and Situs of Taxation)Stephanie ValentineNo ratings yet

- JamesHogan - Oct17, Guidance PresentationDocument49 pagesJamesHogan - Oct17, Guidance Presentationodovacar1No ratings yet

- UDM Tax Law Review 2017-2018 - Tax 2 Transfer Taxes, Estate and Donor's Tax Full NotesDocument53 pagesUDM Tax Law Review 2017-2018 - Tax 2 Transfer Taxes, Estate and Donor's Tax Full NotesJoan PabloNo ratings yet

- Transfer Taxes Who Owes What and How Much NLIDocument161 pagesTransfer Taxes Who Owes What and How Much NLImpoxNo ratings yet

- Spring 2012 EGT OutlineDocument63 pagesSpring 2012 EGT OutlineJessica Rae FarrisNo ratings yet

- Lifetime Giving AND Inter Vivos Gifts: Greenfield Stein & Senior LLP New York, Ny Updated and Co-Authored byDocument30 pagesLifetime Giving AND Inter Vivos Gifts: Greenfield Stein & Senior LLP New York, Ny Updated and Co-Authored byVlad ZernovNo ratings yet

- Virginia Tax Exemption Code - 84-178Document12 pagesVirginia Tax Exemption Code - 84-178tysontaylorNo ratings yet

- MICHIGAN STATE TAX COMMISSION Transfer of Ownership GuidelinesDocument73 pagesMICHIGAN STATE TAX COMMISSION Transfer of Ownership GuidelinesBeverly TranNo ratings yet

- Additional Property Transfer Tax Foreign Entities VancouverDocument3 pagesAdditional Property Transfer Tax Foreign Entities VancouverfinniNo ratings yet

- Transfer Taxes and Wealth Planning Solutions Manual: Discussion QuestionsDocument29 pagesTransfer Taxes and Wealth Planning Solutions Manual: Discussion QuestionsAstha GoplaniNo ratings yet

- TAX-101 (Estate Tax)Document11 pagesTAX-101 (Estate Tax)Edith DalidaNo ratings yet

- Tax Chapter 5 Draft IIDocument88 pagesTax Chapter 5 Draft IIRuiz, CherryjaneNo ratings yet

- Taxation Law 2 Reviewer PDFDocument58 pagesTaxation Law 2 Reviewer PDFLizCruz-Kim0% (1)

- Form 2766 Affidavit of Property TransferDocument2 pagesForm 2766 Affidavit of Property Transferricetech100% (15)

- 1st Semester Transfer Taxation Module 2 Estate TaxationDocument16 pages1st Semester Transfer Taxation Module 2 Estate TaxationNah Hamza100% (1)

- UP 2008 Taxation Law (Taxation 2)Document100 pagesUP 2008 Taxation Law (Taxation 2)CHow Gatchallan100% (1)

- Review Notes For Taxation 2: Ňas, Marie Mae Buliyat, Wilhelmina Diwa, Feliza KadatarDocument54 pagesReview Notes For Taxation 2: Ňas, Marie Mae Buliyat, Wilhelmina Diwa, Feliza KadatarVladimir MarquezNo ratings yet

- Deductions From Gross EstateDocument3 pagesDeductions From Gross EstateMark Lawrence YusiNo ratings yet

- Estate TaxDocument10 pagesEstate Taxrandomlungs121223No ratings yet

- Closing of Real Estate Sale Transactions and Transfer of TitleDocument6 pagesClosing of Real Estate Sale Transactions and Transfer of TitleescaNo ratings yet

- CCH Federal Taxation Comprehensive Topics 2013 Harmelink Edition Solutions ManualDocument27 pagesCCH Federal Taxation Comprehensive Topics 2013 Harmelink Edition Solutions ManualCindyCurrydwqzr100% (70)

- Excel Professional Services, Inc.: Donation Donor'S TaxDocument11 pagesExcel Professional Services, Inc.: Donation Donor'S TaxMae Angiela TansecoNo ratings yet

- Taxation Review Atty Lock-Transfer Tax ClaveriacadDocument8 pagesTaxation Review Atty Lock-Transfer Tax Claveriacadamor claveriaNo ratings yet

- 03 Transfer Taxes: Clwtaxn de La Salle UniversityDocument35 pages03 Transfer Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- State in The Accumulation of Properties Transferred GratuitouslyDocument2 pagesState in The Accumulation of Properties Transferred GratuitouslyJen AquinoNo ratings yet

- Estate Tax: Bantolo, Javier, MusniDocument31 pagesEstate Tax: Bantolo, Javier, MusniPatricia RodriguezNo ratings yet

- Taxation Report - Valuation of Properties - Vanishing DeductionDocument49 pagesTaxation Report - Valuation of Properties - Vanishing DeductionAnonymous S6CQnxuJcINo ratings yet

- M U S: Ift and Estate: OD LE Taxe GDocument2 pagesM U S: Ift and Estate: OD LE Taxe GEl-Sayed MohammedNo ratings yet

- Transfer TaxesDocument7 pagesTransfer TaxesDesiree Ann MiralNo ratings yet

- 06 Chap 13 14 Mamalateo 2019 Tax BookDocument65 pages06 Chap 13 14 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Full Download Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions Manual PDF Full Chapteruraninrichweed.be1arg100% (17)

- Prentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions ManualDocument36 pagesPrentice Halls Federal Taxation 2013 Corporations Partnerships Estates Trusts Pope 26th Edition Solutions Manualcreptclimatic0anwer100% (50)

- CARL ANDREW Assignment Tax 102Document7 pagesCARL ANDREW Assignment Tax 102Carl Andrew Aborquez Arcinal0% (1)

- A Transfer tax-WPS OfficeDocument2 pagesA Transfer tax-WPS OfficeAnn StylesNo ratings yet

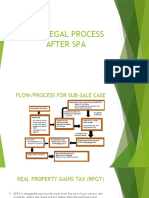

- The Legal Process After SpaDocument16 pagesThe Legal Process After SpaIzat AmirNo ratings yet

- Estate & Donors TaxDocument31 pagesEstate & Donors TaxMea De San AndresNo ratings yet

- Steps of Land TransferDocument6 pagesSteps of Land TransferKeith LlaveNo ratings yet

- Tax 02-Lesson 05 - Estate Tax Credit, Distributable Estate, and Estate Tax ReturnsDocument31 pagesTax 02-Lesson 05 - Estate Tax Credit, Distributable Estate, and Estate Tax ReturnsMama MiyaNo ratings yet

- Gruba Transfer Tax NotesDocument30 pagesGruba Transfer Tax NoteskennethNo ratings yet

- Taxation Law 2 ReviewerDocument57 pagesTaxation Law 2 ReviewerJunior DaveNo ratings yet

- Gruba Transfer Tax Notes PDFDocument30 pagesGruba Transfer Tax Notes PDFDomingo Jonathan CabalongaNo ratings yet

- Property Taxation Real Property Gain Tax CEA 1043Document57 pagesProperty Taxation Real Property Gain Tax CEA 1043Afiq AfhamNo ratings yet

- Review Notes Tax 2Document6 pagesReview Notes Tax 2angelli45No ratings yet

- Module 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxDocument2 pagesModule 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxZeyad El-sayedNo ratings yet

- SAN - BERNARDINO County Form BOE-502-A For 2021Document4 pagesSAN - BERNARDINO County Form BOE-502-A For 2021summitNo ratings yet

- DocxDocument47 pagesDocxhowaanNo ratings yet

- Gross Estate The Value of All The Property, Real or Personal, TangibleDocument40 pagesGross Estate The Value of All The Property, Real or Personal, TangibleRomz NuneNo ratings yet

- Tax 2 PrelimsDocument34 pagesTax 2 PrelimsAndrei Jose V. LayeseNo ratings yet

- Tax 2 Selected TopicsDocument303 pagesTax 2 Selected TopicschosNo ratings yet

- Tax Remedies HandoutssssDocument5 pagesTax Remedies HandoutssssfantasighNo ratings yet

- FAQs On Florida Tax Deed SalesDocument9 pagesFAQs On Florida Tax Deed SalesrafarecNo ratings yet

- Collections: Unpaid Utility Bills and Tax LiensDocument36 pagesCollections: Unpaid Utility Bills and Tax Liensmlbenham100% (1)

- Safari - Jan 12, 2018 at 5:46 PMDocument1 pageSafari - Jan 12, 2018 at 5:46 PMAnnika ConsunjiNo ratings yet

- Activity No. 1: Estate Tax (Pages 440-461) : Multiple Choice QuestionsDocument5 pagesActivity No. 1: Estate Tax (Pages 440-461) : Multiple Choice QuestionsSara Andrea SantiagoNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Securitized Real Estate and 1031 ExchangesFrom EverandSecuritized Real Estate and 1031 ExchangesNo ratings yet

- SuccessionDocument6 pagesSuccessionJeremiah TrinidadNo ratings yet

- "Could I Leave You" (Key of BB)Document8 pages"Could I Leave You" (Key of BB)ShowstartersNo ratings yet

- ChapterDocument44 pagesChapterAnna Marie DayanghirangNo ratings yet

- Deed of Donation (Raval)Document3 pagesDeed of Donation (Raval)cagayatNo ratings yet

- 9 Partition DeedDocument9 pages9 Partition DeedSwati PednekarNo ratings yet

- Luigi ReportingDocument7 pagesLuigi ReportingLuigi RodelasNo ratings yet

- 1 - Overview of The IP System - RepairedDocument39 pages1 - Overview of The IP System - RepairedXerxa LinganNo ratings yet

- Shangri-La International Hotel Management, Ltd. vs. Developers Group of Companies, Inc.Document2 pagesShangri-La International Hotel Management, Ltd. vs. Developers Group of Companies, Inc.Artfel Lazo0% (1)

- Transfer of Property ActDocument537 pagesTransfer of Property Actarvind66792% (13)

- PCIB V EscolinDocument4 pagesPCIB V EscolinamberspanktowerNo ratings yet

- Rachmaninoff Prel. Op.23,5.Document11 pagesRachmaninoff Prel. Op.23,5.george777No ratings yet

- Patents #3 - Creser V CA GR No 118708Document2 pagesPatents #3 - Creser V CA GR No 118708Dan ChuaNo ratings yet

- Any Land Related Document Rent Agreement, Rent Receipt, Land Deed, Porcha, Lease Document As ApplicableDocument6 pagesAny Land Related Document Rent Agreement, Rent Receipt, Land Deed, Porcha, Lease Document As Applicableaparna tiwariNo ratings yet

- Tsai v. Court of Appeals, G.R. Nos. 120098 and 120109, October 2, 2001Document1 pageTsai v. Court of Appeals, G.R. Nos. 120098 and 120109, October 2, 2001Jube Kathreen ObidoNo ratings yet

- Ejari Unified Tenancy Contract v3Document2 pagesEjari Unified Tenancy Contract v3vetrivelrajaselviNo ratings yet

- Prop Crime March 2010Document1 pageProp Crime March 2010Albuquerque JournalNo ratings yet

- Notarial WillDocument3 pagesNotarial Willarmeh1No ratings yet

- LL. B. V Term: Paper - LB - 5033 - Rent Control and Slum ClearanceDocument11 pagesLL. B. V Term: Paper - LB - 5033 - Rent Control and Slum ClearanceV M S GandhiNo ratings yet

- ABSOLUTE DEED OF SALE Casiwan and LaunioDocument4 pagesABSOLUTE DEED OF SALE Casiwan and LaunioMinNo ratings yet

- Finals Notes For Land TitlesDocument10 pagesFinals Notes For Land TitlesJoy Navaja DominguezNo ratings yet

- Jis M 8100 - 1992Document123 pagesJis M 8100 - 1992Jose Carlos tiraccayaNo ratings yet

- COVID-19 Diagnosis & ManagementDocument115 pagesCOVID-19 Diagnosis & ManagementJumar ValdezNo ratings yet

- Commercial Lease AgreementDocument11 pagesCommercial Lease Agreementtine dethNo ratings yet

- Secuya V de SelmaDocument14 pagesSecuya V de Selma1222No ratings yet

- Transfer of Property Act NotesDocument31 pagesTransfer of Property Act Notesmahboobulhaq67% (3)

- Chapter I W & CDocument8 pagesChapter I W & CGio TriesteNo ratings yet

- 01 IntroductionDocument2 pages01 IntroductionShawnNo ratings yet

- Francisca Tioco de PapaDocument1 pageFrancisca Tioco de PapaRajkumariNo ratings yet

- Chua v. LoDocument9 pagesChua v. LoMark Anthony ViejaNo ratings yet

- AGA 3 Gas Measurement Orifice PDFDocument100 pagesAGA 3 Gas Measurement Orifice PDFmilecsaNo ratings yet