Professional Documents

Culture Documents

Chapter 5 Regulation of FM

Uploaded by

mengistuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 Regulation of FM

Uploaded by

mengistuCopyright:

Available Formats

Chapter Five: Regulation of Financial Markets and Institutions

Why is the financial system so important? The purpose of the global financial system is simple, to

enable the lifeblood of capitalism to do its job, to enable capital to go where it can get the greatest

return for its owner. The system does that through a plethora of ever more complex arrangements

and devices, financial and technological, though its fundamental character remains the same. The

financial system has evolved to enable the safe movement of funds across boundaries, organizational

or national and, paraphrasing Shubik, money is a substitute for trust, in the world of trade. The

present global financial crisis has shown how much our welfare, economic and social, depends on a

sound global financial system.

system.

Aims Financial Regulators

The specific aims of financial regulators are usually:

To enforce applicable laws

To prosecute cases of market misconduct

To license providers of financial services

To protect clients, and investigate complaints

To maintain confidence in the financial system

Financial System Regulation

As noted in the introduction, regulation may be applied to facilitate the general operation of markets,

to enhance safety or to pursue social objectives. This section provides a basic framework for

considering whether and, if so, where and how each of these purposes of regulation should be

applied in the financial system.

General Market Regulation

All markets, financial and non-

non-financial, face potential problems associated with the conduct of

market participants, anti-

anti-competitive behaviour and incomplete information. These common forms

of market failure have justified at least a minimum level of regulatory intervention in markets on an

economy wide basis. Such intervention generally takes the form of:

Regulation of Financial Markets and Institutions 1

conduct regulation

regulation such as criminal sanctions for fraud and prohibitions on

anti-

anti-competitive behaviour; and

disclosure regulation

regulation such as general prohibitions on false and misleading statements

contained in fair trading laws.

There are some markets where this minimum level of economy wide regulation is considered to be

inadequate. These markets, or their products, have characteristics which warrant more specific

disclosure and conduct rules than apply in other industries. In many cases, it is also considered

necessary to establish a separate regulatory agency to conduct such specialised regulation.

A key question for the Inquiry was to decide where conduct and disclosure regulation of financial

markets is best left to general economy wide arrangements and where more specialised regulation is

required. As

As a general principle, greater regulatory consistency and efficiency will result from

economy wide regulation. Consequently, this should always be preferred unless a clear case for

sector specific arrangements can be demonstrated.

The Inquiry examines the case for specialized regulation in:

financial market integrity

retail consumer protection and

competition policy

Financial Market Integrity

Market integrity regulation aims to promote confidence in the efficiency and fairness of markets. It

seeks to ensure that markets are sound, orderly and transparent. Financial market prices can be

sensitive to information, and this raises the potential for misuse of information. For this reason,

regulators around the world impose specific disclosure requirements (such as prospectus rules) and

conduct rules (such as prohibitions on insider trading) on financial market participants. The

complexity of financial products and markets, their intrinsic risks including those due to limited

information

information and the detailed knowledge required to deliver efficient regulation in this area argue

strongly for continued specialised regulatory arrangements.

Regulation of Financial Markets and Institutions 2

Consumer Protection

Consumer protection refers to the forms of regulation aimed at ensuring that retail consumers have

adequate information, are treated fairly and have adequate avenues for redress. There are close links

and no clear dividing line between consumer protection and market integrity regulation in retail

markets since both use the same regulatory tools, namely disclosure and conduct rules. For example,

prospectus requirements can promote both consumer protection and confidence in the efficiency and

fairness of retail financial markets.

Specialist consumer protection in the financial system is justified on two grounds.

First, the complexity of financial products increases the probability that financially unsophisticated

consumers can misunderstand or be misled about the nature of financial promises, particularly their

obligations and risks. This, combined with the potential consequences of dishonour, has led most

countries to establish a disclosure regime for financial products that is considerably more intense

than disclosure rules for most non-

non-financial products.

Secondly, financial complexity also increases the incidence of misunderstanding and dispute. Given

this, and the high cost of litigation, a number of countries have imposed specific regulation of

financial sales and advice and established low-

low-cost industry complaints schemes or tribunals for

resolving disputes.

Competition Regulation

Competition regulation refers to laws which ensure that all markets are competitive. Two main areas

of concern are market concentration and collusion which can lead to overpricing of financial

products and underprovision of services essential to economic growth and welfare.

While financial products are complex and any assessment of competition requires detailed analysis

of markets, the key features relevant to competition assessment in this sector are not unique. The

application of economy wide competition regulation to the financial system ensures regulatory

consistency. Anti-

Anti-competitive behaviour is not unique to financial markets, and it is preferable to

establish both the bounds of acceptable competitive behaviour and rules for mergers and acquisitions

which are common to all industries. Accordingly, the case for specialised arrangements in this area

is relatively weak.

Regulation of Financial Markets and Institutions 3

Principles of Regulation

Competitive Neutrality

Competitive neutrality requires that the regulatory burden applying to a particular financial

commitment or promise apply equally to all who make such commitments. It requires further that

there be:

minimal barriers to entry and exit from markets and products;

no undue restrictions on institutions or the products they offer; and

markets open to the widest possible range of participants.

Cost Effectiveness

Cost effectiveness is one of the most difficult issues for regulatory cultures to come to terms with.

Any form of regulation involves a natural tension between effectiveness and efficiency. Regulation

can be made totally effective by simply prohibiting all actions potentially incompatible with the

regulatory objective. But, by inhibiting productive activities along with the anti-

anti-social, such an

approach is likely to be highly inefficient.

The underlying legislative framework must be effective, including by fostering compliance through

enforcement in cases where participants do not abide by the rules. However, a cost -effective

regulatory system also requires:

a presumption in favour of minimal regulation unless a higher level of intervention is

justified;

an allocation of functions among regulatory bodies which minimises overlaps, duplication

and conflicts;

an explicit mandate for regulatory bodies to balance efficiency and effectiveness;

a clear distinction between the objectives of financial regulation and broader social

objectives; and

the allocation of regulatory costs to those enjoying the benefits.

Regulation of Financial Markets and Institutions 4

Transparency

If there is a general perception that a particular group of financial institutions cannot fail because

they have the imprimatur of government, there is a great danger that perception will become reality.

Transparency of regulation requires that all guarantees be made explicit and that all purchasers and

providers of financial products be fully aware of their rights and responsibilities. It should be a top

priority of an effective financial regulatory structure that financial promises (both public and private)

be understood.

Flexibility

One of the most pervasive influences over the continuing evolution of the financial system will be

technology. While it is not possible to forecast with any certainty the precise impact that technology

will have on the shape of financial services and service delivery, it is certain that the impact will be

considerable. These developments make flexibility critical. The regulatory framework must have the

flexibility to cope with changing institutional and product structures without losing its effectiveness.

Accountability

Regulatory agencies should operate independently of sectional interests and with appropriately

skilled staff. In addition, the regulatory structure must be accountable to its stakeholders and subject

to regular reviews of its efficiency and effectiveness.

The fundamental costs brought about by regulations which are of major concern to financial

institutions as they alone are responsible for them. These are;

1. - Administrative costs of the SRO’s and the SIB.

2. - Administrative costs of the compliance of the regulated firms.

3. - The cost of dedicated capital to comply with requirements.

4. - Contributions of funds needed to compensate failure.

5. - Loss of competition

6. - Instability due to lack of diversification

7. - Loss of comparative advantage over foreign competitors

8. - A moral hazard

Financial Market Crash

Regulation of Financial Markets and Institutions 5

Financial markets across the globe have crashed repeatedly throughout history and a market crash is

a nightmare for any potential investor. There are certain causes that lead to a market crash,

including a high rise in stock prices over a considerable span of time. Economic optimism is the

prime reason, as a consistent rise in stock prices lead towards crash. A sudden crash can be the cause

of agony, anxiety and frustration. All through stock market history, financial analysts and investment

advisory service providers have failed to provide effective speculation regarding market crashes.

Financial market crash may be due to certain specific economic reasons. According to

investorwords.com, a crash is defined as “a precipitous drop in market prices or economic

conditions." This definition clarifies the sudden drop of a market crash and explains why many

investors have been turned away from stock trading.

An abrupt fall in share prices can create panic among the investors, and confused investors tend to

sell almost all of their shares. Shareholder's psychology changes and this leads towards confusion

and chaos. Stocks, securities and bonds are sold at random rates. To avoid the catastrophic effects of

financial market crash, it is wise to keep an eye on the financial market trends.

The major causes of stock market crash are as follows:

A drastic shift in price An alteration in earnings

earning ratio Changes in dividend

Thus, a persistent boom in the financial market can collapse and result in a sudden crash. In addition

to depending upon the advice of financial specialists, it is a good idea to keep an eye on the

prevailing market trends.

trends.

Some of the well known Financial Market Crashes can be classified as follows :

• Wall Street Crash of 1929 : The Wall Street crash occurred on Oct 29, 1929 and followed

the period of the “roaring twenties” when the stock markets had been experiencing robust growth.

Companies responsible for the stock market boom were the Radio Corporation of America (RCA),

General Motors and investment trusts such as Goldman Sachs trading Corporation. From August 24,

1921 to September 3, 1929, the Dow Jones Industrial Average (DJIA) experienced a six fold rise

from 63.9 to nearing 381.2 points. However, it became clear after a certain point of time that it was a

mere bubble and Oct 24, 1929 (Black Thursday) felt one of the first shocking market drops. This was

followed by Black Monday and Black Tuesdays on Oct 28 and Oct 29 which followed suit. While

Black Monday experienced a fall of 12.8% on the DJIA, Black Tuesday experienced a day of chaos

Regulation of Financial Markets and Institutions 6

where the shares of the RCA and Goldman Sachs fell dramatically. Across the two days, the DJIA

fell by about 23%.

• Dow Jones Crash of 1987 : The crash on Oct 19, 1987 also known as Black Monday was

preceded by strong economic optimism when the DJIA increased from 776 to 2722 from August

1982 till its peak in August 1987. The crash of Oct 19 started from Oct 14, Friday and continued for

five days consecutively following its initial fall of 3.81% and 4.60% followed by Black Monday

when the DJIA plummeted 508 points losing 22.6% in one day of intra-day trading. The S&P 500

dropped by 20.4% and the NASDAQ composite lost only about 11.3% largely due to the reason that

NASDAQ market system failed. The crash is recorded as the greatest single-day loss that Wall Street

ever suffered in the event of continuous trading. Between the start of trading on Oct 14 to the close

on Oct 19, the DJIA had lost 760 points or a decline by over 31%. The 1987 crash had a worldwide

phenomenon as the FTSE 100 Index lost by about 10.8% on Monday followed a decline of around

12.2% on the following day as all the world markets declined substantially. The collapse had mainly

been blamed on program trading, portfolio insurance and derivatives and the prior information of an

impending worsening of economic indicators.

• Asian Economic Crisis or East Asian Financial Crisis of 1997 : It was a period of

economic unrest that started in July 1997 in Thailand and South Korea with the collapse of Kia and

gradually translated into falling stock markets and other asset prices in the economies of the Four

Asian Tigers (namely Hong Kong, Singapore, Taiwan and South Korea). The economies of

Indonesia, Thailand and South Korea were the most affected by the crisis with their currencies

falling dramatically relative to the US dollar with the South Korean economy being hit the hardest.

Trouble started brewing long before in the months of May and June when the Asian Tigers grew at

an average of 8%-12% and attracted huge inflows foreign capital. The Thai Baht which was pegged

at 25 to the dollar from 1985 to July 2, 1997 fell to its nadir at 56 to the US dollar at January 1998.

The Thai Stock Market fell by about 75% in 1997. In the case of Philippines, the PSE Composite

Index fell by about 2000 points in 1997. The Peso fell from about 26 pesos to the dollar at the start

of the crisis to about 40 pesos at the end of the crisis. In the case of Korea, the Korean Won plunged

from less than 1000 per US dollar to less than 1700 per dollar. By the end of 1997, the Kuala

Lampur Stock Exchange (KLSE) lost more than 50% 1200 under 600 and the Malaysian Ringgit fell

from 2.50 to under 3.80 to the dollar. In case of Indonesia, after the financial crisis of 1997, it had a

severe impact on the Rupiah with continuing periods of devaluation which took the rate to 18000

Rupiah for 1 US dollar from the level 2000 Rupiah for 1 US dollar before the crisis.

Regulation of Financial Markets and Institutions 7

Summary of financial markets crashes

Year & Date Name

2006 Great Arabian Crash

2005-(till date) Iranian stock market crisis

October 2002 Stock market downturn of 2002

September 2001 post-9/11 crash

March 2000 Dot-com bubble crash

1998 Russian financial crisis

1997 1997 mini-crash

1992 Asian financial crisis of 1997

October 13, 1989 Black Wednesday

October 19, 1987 Friday the 13th mini-crash

October 29, 1929 Black Tuesday

October 28, 1929 Black Monday

October 24, 1929 Black Thursday

1929 Stock Market Crash of 1929

May 9, 1873 Der Krach

September 24, 1869 Black Friday

May 10, 1837 Panic of 1837

1819 Panic of 1819

Regulation of Financial Markets and Institutions 8

You might also like

- Vehicle RoutingDocument15 pagesVehicle RoutingmengistuNo ratings yet

- Warehouse Space Optimization Using A Linear Programming ModelDocument6 pagesWarehouse Space Optimization Using A Linear Programming ModelmengistuNo ratings yet

- Detailed Guideline For Article ReviewDocument5 pagesDetailed Guideline For Article ReviewmengistuNo ratings yet

- Employee BenefitsDocument15 pagesEmployee BenefitsmengistuNo ratings yet

- Cash and ReceivablesDocument97 pagesCash and ReceivablesmengistuNo ratings yet

- Overview of Financial SystemDocument33 pagesOverview of Financial SystemmengistuNo ratings yet

- Functions of Financial SystemDocument2 pagesFunctions of Financial SystemmengistuNo ratings yet

- Point of View in Academic Writing PDFDocument3 pagesPoint of View in Academic Writing PDFmengistuNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tools and Methods of Lean Manufacturing - A Literature ReviewDocument7 pagesTools and Methods of Lean Manufacturing - A Literature ReviewStefanus Gunawan SeputraNo ratings yet

- Just in Time ProductionDocument2 pagesJust in Time ProductionakshayaecNo ratings yet

- Making Automobile and Housing DecisionsDocument12 pagesMaking Automobile and Housing DecisionsSteve SenoNo ratings yet

- Industry 4.0 Engages CustomersDocument24 pagesIndustry 4.0 Engages CustomersAries SantosoNo ratings yet

- Asu 2019-09Document17 pagesAsu 2019-09janineNo ratings yet

- Struktur Organisasi GZ Kuta-BaliDocument1 pageStruktur Organisasi GZ Kuta-BalioxiNo ratings yet

- Exempt Sale of Goods Properties and Services NotesDocument2 pagesExempt Sale of Goods Properties and Services NotesSelene DimlaNo ratings yet

- Enotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Document291 pagesEnotesofm Com2convertedpdfnotesinternationalbusiness 100330064505 Phpapp01Hari GovindNo ratings yet

- Not Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormDocument16 pagesNot Printed in Mode "Fit Size" or "Shrink Size": General Instructions For The Completion SPT 1770 Digital FormJ. Aryadi P.No ratings yet

- The Job Responsibilities of IE OfficerDocument3 pagesThe Job Responsibilities of IE OfficerpiashNo ratings yet

- Magaya Cargo System OperationsDocument17 pagesMagaya Cargo System OperationsMohammed Al-GhannamNo ratings yet

- The High Probability Trading Strategy SummaryDocument2 pagesThe High Probability Trading Strategy SummaryJulius Mark Carinhay TolitolNo ratings yet

- McKinsey Webinar FINAL PDFDocument31 pagesMcKinsey Webinar FINAL PDFdlokNo ratings yet

- Rs Fund Transfer PricingDocument12 pagesRs Fund Transfer PricingAman JainNo ratings yet

- (ACCLIME) Quick Guide - Vietnam Capital Gains 2023Document1 page(ACCLIME) Quick Guide - Vietnam Capital Gains 2023Khoi NguyenNo ratings yet

- Evolution of HRMDocument5 pagesEvolution of HRMSrishti GaurNo ratings yet

- Ravindra EnergyDocument111 pagesRavindra EnergyCA Dipesh JainNo ratings yet

- CCD FailureDocument5 pagesCCD FailureSajan BhuvadNo ratings yet

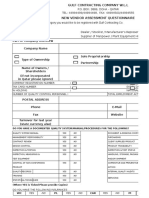

- QMS F 09A Rev 05 New Vendor Assessment QuestionnaireDocument16 pagesQMS F 09A Rev 05 New Vendor Assessment QuestionnairermdarisaNo ratings yet

- Pantene Brand Audit ReportDocument3 pagesPantene Brand Audit ReportSaad RazaNo ratings yet

- Hotel Master Critical PathDocument14 pagesHotel Master Critical Pathtaola80% (25)

- 3i Sustainabilityreport 2023Document97 pages3i Sustainabilityreport 2023Matthieu BlehouanNo ratings yet

- 10 SupplyDocument28 pages10 SupplySanjana ManchandaNo ratings yet

- Harley's Corner Positioning Dilemma.Document4 pagesHarley's Corner Positioning Dilemma.Nikita sharmaNo ratings yet

- Case Econ08 PPT 31Document26 pagesCase Econ08 PPT 31stephanieNo ratings yet

- Master CircularDocument53 pagesMaster CircularBalraj PadmashaliNo ratings yet

- 2022 Global Skills ReportDocument35 pages2022 Global Skills ReportJostNo ratings yet

- Project Management ConceptsDocument19 pagesProject Management ConceptsarunlaldsNo ratings yet

- Key Performance Indicators - KPIs - For Learning and TeachingDocument4 pagesKey Performance Indicators - KPIs - For Learning and Teachingxahidlala0% (1)

- BNP Paribas. The Challenge of OTC Derivarives ClearingDocument56 pagesBNP Paribas. The Challenge of OTC Derivarives ClearingGest DavidNo ratings yet