Professional Documents

Culture Documents

Mock Test August 2018

Uploaded by

Suzhana The WizardCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mock Test August 2018

Uploaded by

Suzhana The WizardCopyright:

Available Formats

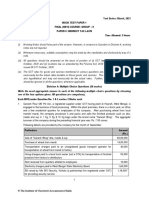

Test Series: August, 2018

MOCK TEST PAPER - 1

FINAL (NEW) GROUP - II

PAPER 8: INDIRECT TAX LAWS

Question no. 1 is compulsory. Attempt any four questions out of the remaining five questions

Maximum Marks: 100 Marks Time Allowed: 3 Hours

Note:

(i) Working Notes should form part of the answer.

(ii) Wherever necessary, suitable assumptions may be made by the candidates and disclosed by way of a

note.

(iii) All questions should be answered on the basis of position of (i) GST law as amended up to 30th April,

2018 and (ii) customs law as amended by the Finance Act, 2017 and notifications/circulars issued till

30th April, 2018.

(iv) The GST rates for goods and services mentioned in various questions are hypothetical and may not

necessarily be the actual rates leviable on those goods and services. The rates of customs duty are

also hypothetical and may not necessarily be the actual rates. Further, GST compensation cess should

be ignored in all the questions, wherever applicable.

1. (a) Manoharlal Company Ltd. of Bengaluru is a manufacturer and registered supplier of machine. It

has provided the following details for the month of November, 2017.

Details of GST paid on inward supplies during the month:

Items GST paid (Rs.)

Health insurance of factory employees. 20,000

Raw materials for which invoice has been received and GST has also been paid

for full amount but only 50% of material has been received, remaining 50% will 18,000

be received in next month.

Work contractor’s service used for installation of plant and machinery. 12,000

Purchase of manufacturing machine directly sent to job worker’s premises under

50,000

challan.

Purchase of car used by director for the business meetings only. 25,000

Outdoor catering service availed for business meetings. 8,000

Manoharlal Company Ltd. also provides service of hiring of machines along with man power for

operation. As per trade practice machines are always hired out along with operators and also

operators are supplied only when machines are hired out.

Receipts on outward supply (exclusive of GST) for the month of November, 2017 are as follows:

Items Receipts (Rs.)

Hiring receipts for machine 5,25,000

Service charges for supply of man power operators 2,35,000

Assume all the transactions are inter State and the rates of IGST to be as under:

(i) Sale of machine 5%

(ii) Service of hiring of machine 12%

1

© The Institute of Chartered Accountants of India

(iii) Supply of man power operator service 18%

Compute the amount of input tax credit available and also the net GST payable for the month of

November 2017 by giving necessary explanations for treatment of various items.

Note: Opening balance of input tax credit is Nil. (10 Marks)

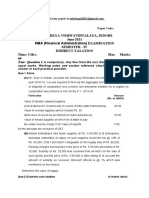

(b) Determine the place of supply for the following independent cases under the IGST Act, 2017:

(i) Mega Events, an event management company at Kolkata, organises two award functions for

Shagun Jewellers of Chennai (Registered in Chennai) at New Delhi and at Singapore.

(ii) Crown Planners (Bengaluru) is hired by Dr. Banta (unregistered person based in Kochi) to

plan and organise his son's wedding at Mumbai.

Will your answer be different if the wedding is to take place at Malaysia? (5 Marks)

(c) Ganesh Enterprises, India imported a machine costing US $ 17,000 from Sheraton Corp., US

through a vessel. Determine the assessable value of the said machine under the Customs Act,

1962 with the help of the additional information given below:

US $

(i) Transport charges from the factory of Sheraton Corp. to the port for shipment 850

(ii) Freight charges from US to India 1,700

(iii) Handling charges paid for loading the machine in the ship 85

(iv) Buying commission paid by Ganesh Enterprises 85

(v) Exchange rate to be considered: 1$ = Rs. 60

(vi) Actual insurance charges paid are not ascertainable (5 Marks)

2. (a) Niwas Sadan Charitable Trust is registered under section 12AA of the Income Tax Act, 1961. It

owns and manages a temple located at Mathura meant for general public. The temple compound

has residential dwellings, rooms, Kalyan Mandapam, Halls and shops. It provides the following

information relating to supply of its services for the month of August 2017. You are required to

compute the total taxable value of supply for the month of August 2017 assuming that the given

amounts are exclusive of GST:-

Rs.

Renting of residential dwellings for use as a residence 18,00,000

Renting of rooms for pilgrims (Charges per day Rs. 1,200) 8,00,000

Renting of rooms for devotees (Charges per day Rs. 750) 6,00,000

Renting of kalyana mandapam (Charges per day Rs. 15,000) 12,00,000

Renting of halls (Charges per day Rs. 7,500) 10,75,000

Renting of shops for business (Charges per month Rs. 9,500) 4,75,000

Renting of shops for business (Charges per month Rs. 12,000) 7,50,000

(7 Marks)

(b) Cool Trade Links Pvt. Ltd. is a registered manufacturer of premium ceiling fans. It sells its fans

exclusively through distributors appointed across the country. The maximum retail price (MRP)

printed on the package of a fan is Rs. 10,000. The company sells the ceiling fans to distributors

at Rs. 7,000 per fan (exclusive of applicable taxes). The applicable rate of GST on ceiling fans is

18%.

© The Institute of Chartered Accountants of India

The stock is dispatched to the distributors on quarterly basis - stock for a quarter being dispatched in

the second week of the month preceding the relevant quarter. However, additional stock is

dispatched at any point of the year if the company receives a requisition to that effect from any of its

distributors. The company charges Rs. 1,000 per fan from distributors towards packing expenses.

The company has a policy to offer a discount of 10% (per fan) on fans supplied to the distributors

for a quarter, if the distributors sell 500 fans in the preceding quarter. The discount is offered on

the price at which the fans are sold to the distributors (excluding all charges and taxes).

The company appoints Gupta Sales as a distributor on 1st April and dispatches 750 fans on

8th April as stock for the quarter April-June. Gupta Sales places a purchase order of 1,000 fans

with the company for the quarter July-September. The order is dispatched by the company on

10th June and the same is received by the distributor on 18 th June. The distributor makes the

payment for the fans on 26 th June and avails applicable input tax credit. The distributor reports

sales of 700 fans for the quarter April-June and 850 fans for the quarter July-September.

Examine the scenario with reference to section 15 of the CGST Act, 2017 and compute the taxable

value of fans supplied by Cool Trade Links Pvt. Ltd. to Gupta Sales for the quarter July-September.

Note: The supplier and the recipient of supply are not related and price is the sole consideration

for the supply. Make suitable assumptions, wherever necessary. (8 Marks)

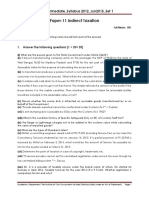

(c) Discuss briefly the similarities and differences between Advance Authorisation(AA) and DFIA (Duty

Free Import Authorisation) Schemes. (5 Marks)

OR

Indicate five benefits available to "Status Holders" under the reward scheme of Foreign Trade

Policy 2015-2020. There is no need to define the term "status holder". (5 Marks)

3. (a) Maahi Ltd. of Bhopal (Madhya Pradesh) is a supplier of machinery. Maahi Ltd. has supplied

machinery to ABC Enterprises in Indore (Madhya Pradesh) on 1 st October, 2017. The invoice for

supply has been issued on 1 st October, 2017. Maahi Ltd. and ABC Enterprise are not related and

price is the sole consideration for the supply.

Following information is provided:

Basic price of machinery excluding all taxes is Rs. 20,00,000. In addition to the basic price, Maahi

Ltd. has collected the design and engineering charges of Rs. 10,000 and loading charges of

Rs. 20,000 for the machinery.

Maahi Ltd. provides 1 year mandatory warranty for the machinery on payment of additional charges

of Rs. 1,00,000.

Maahi Ltd. has collected consultancy charges in relation to pre-installation planning of

Rs. 10,000 and freight and insurance charges from place of removal to buyer's premises of

Rs. 20,000.

Maahi Ltd. received subsidy of Rs. 50,000 from Central Government for supplying the machinery

to backward region since receiver was located in a backward region. Maahi Ltd. also received

Rs. 50,000 from the joint venture partner of ABC Enterprises for making timely supply of machinery

to the recipient.

A cash discount of 1% on the basic price of the machinery is offered at the time of supply, if ABC

Enterprises agrees to make the payment within 30 days of the receipt of the machinery at his

premises. Discount @ 1% was given to ABC Enterprises as it agreed to make the payment within

30 days.

The machinery attracts CGST and SGST @ 18% (9% + 9%) and IGST @18%.

Compute the CGST and SGST or IGST payable, as the case may be, on the machinery. (10 Marks)

© The Institute of Chartered Accountants of India

(b) Determine the value of supply and the GST liability, to be collected and paid by the owner, with the

following particulars:

Rs.

Rent of the commercial building 18,00,000

Maintenance charges collected by local society from the owner and reimbursed

2,50,000

by the tenant

Owner intends to charge GST on refundable advance, as GST is applicable on

6,00,000

advance

Municipal taxes paid by the owner 3,00,000

Rent and maintenance charges are exclusive of GST.

GST rates applicable on renting of business premises is as follows:

CGST 9%

SGST 9%

Provide suitable explanations where required. (5 Marks)

(c) Shyam Lal has imported goods from Germany and is finally re-assessed u/s 18(2) of the Customs

Act, 1962 for two such consignments. Particulars are as follows:

Date of provisional assessment 12th December, 2017

Date of final re-assessment 2nd February, 2018

Duty demand for 1st consignment Rs. 1,80,000

Refund for the 2nd consignment Rs. 4,20,000

Date of refund made by the department 28th April, 2018

Date of payment of duty demanded 5th February, 2018

Determine the interest payable and receivable, if any, by Shyam Lal on the final re-assessment of

the two consignments, with suitable notes thereon. (5 Marks)

4. (a) (i) Alpha Pvt. Ltd., Pune provides house-keeping services. The company supplies its services

exclusively through an e-commerce website owned and managed by Clean Indya Pvt. Ltd.,

Pune. The turnover of Alpha Pvt. Ltd. in the current financial year is Rs. 18 lakh.

Advise Alpha Pvt. Ltd. as to whether they are required to obtain GST registration. Will your

advice be any different if Alpha Pvt. Ltd. sells readymade garments exclusively through the

e-commerce website owned and managed by Clean Indya Pvt. Ltd.? (6 Marks)

(ii) LMN Enterprises, Kanpur started trading in ayurvedic medicines from July 1, 20XX. Its

turnover exceeded Rs. 20 lakh on October 3, 20XX. The firm applied for registration on

October 31, 20XX and was issued registration certificate on November 5, 20XX.

Examine whether any revised invoice can be issued in the given scenario. If the answer to

the first question is in affirmative, determine the period for which the revised invoices can be

issued as also the last date upto which the same can be issued. (4 Marks)

(b) Discuss briefly provisions of CGST Act, 2017 regarding questions for which advance ruling can be

sought. (5 Marks)

(c) Alpha Corporation has imported goods and the following particulars are available for claiming duty

drawback under sections 74 & 75 of Customs Act, 1962:

(i) Custom duty has been paid on goods imported for use and have been out Rs. 14,00,000

of customs control for 14 months

(ii) Baadshah exports manufactured goods having FOB value of Rs. 86,000.

Rate of duty drawback on FOB value of exports 40%

Market value of the export product Rs. 96,000

© The Institute of Chartered Accountants of India

Determine duty drawback with explanations in the above cases. (5 Marks)

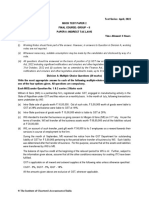

5. (a) (i) Richmond has self-assessed tax liability under IGST Act, 2017, as Rs. 80,000. He fails to pay

the tax within 30 days from the due date of payment of such tax.

Determine the interest and penalty payable by him explaining the provisions of law, with the

following particulars available from his records:

Date of collection of tax 18th December, 2017

Date of payment of tax 26th February, 2018

No Show Cause Notice (SCN) has been issued to him so far, while he intends to

discharge his liability, even before it is issued to him, on the assumption that no penalty is

leviable on him as payment is made before issue of SCN. (4 Marks)

(ii) Tripathi, registered under the CGST Act, 2017 has made a breach in payment of tax

amounting to Rs. 6,100. Assessing Authority has imposed a penalty as per law applicable to

the breach. Invoking the provisions of section 126, Tripathi argues that it is a minor breach

and therefore, no penalty is imposable.

In another instance, Tripathi has omitted certain details in documentation that is not easily

rectifiable. This has occurred due to the gross negligence of his accountant and he makes a

plea that he was unaware of it and therefore no penalty should be levied.

Tripathi voluntarily writes accepting a major procedural lapse from his side and requests the

officer to condone the lapse as the loss caused to the revenue was not significant.

Also a lapse on the part of Tripathi has no specific penalty provision under the CGST Act,

2017. He is very confident that no penalty should be levied without a specific provision under

the Act.

Discuss, what action may be taken by the Assessing Authority under law for each of the above

breaches. (6 Marks)

(b) With reference to the provisions of CGST Act, 2017, explain the liability of partners of firm to pay

tax? (5 Marks)

(c) Write a brief note on rule 1 of the Rules of Interpretation of the First Schedule to Customs Tariff

Act, 1975. (5 Marks)

6. (a) (i) What is the validity period of the registration certificate issued to a casual taxable person and

non- resident taxable person? (4 Marks)

(ii) With reference to the provisions of section 120 of the CGST Act, 2017, list the cases in which

appeal is not to be filed. (6 Marks)

(b) Discuss briefly the procedure for issue of adjudication order under section 74(9) & (11) and the

time limit for passing adjudication order under section 74(10) of the CGST Act, 2017. (5 Marks)

(c) An importer imported certain inputs for manufacture of final product. A small portion of the imported

inputs were damaged in transit and could not be used in the manufacture of the final product. An

exemption notification was in force providing customs duty exemption in respect of specified raw

materials imported into India for use in manufacture of specified goods, which was applicable to

the imports made by the importer in the present case.

Briefly examine with the help of a decided case law whether the importer could claim the benefit of

the aforesaid notification in respect of the entire lot of the imported inputs including those that were

damaged in transit. (5 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Certificate in Accounting and Finance Stage Examination: Inventory Valuation and Cash FlowsDocument86 pagesCertificate in Accounting and Finance Stage Examination: Inventory Valuation and Cash FlowsS Usama S75% (8)

- Cost Accounting Past PapersDocument66 pagesCost Accounting Past Paperssalamankhana100% (2)

- Questions On Value PF SupplyDocument4 pagesQuestions On Value PF SupplyMadhuram SharmaNo ratings yet

- CAF-6 Mock Paper by SkansDocument6 pagesCAF-6 Mock Paper by SkansMehak AliNo ratings yet

- MTP May 2021 QDocument10 pagesMTP May 2021 QÑïkêţ BäûðhåNo ratings yet

- Test Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Case ScenarioDocument11 pagesCase Scenariopujitha vegesnaNo ratings yet

- Income Tax Question Note 1Document6 pagesIncome Tax Question Note 1Vishal Kumar 5504No ratings yet

- Indirect Taxation Paper for MBA Exam with Questions on Composition SchemeDocument3 pagesIndirect Taxation Paper for MBA Exam with Questions on Composition SchemeShubham NamdevNo ratings yet

- Pakistan Institute of Public Finance Accountants: TaxationDocument3 pagesPakistan Institute of Public Finance Accountants: TaxationAzfar AliNo ratings yet

- 6104 - Accounting For Managers MBA FT 2021Document4 pages6104 - Accounting For Managers MBA FT 2021akshitapaul19No ratings yet

- Mock Test Cma June 19Document6 pagesMock Test Cma June 19amit jangraNo ratings yet

- GST and Customs Laws Questions on FMCG Supplies, Agent TransactionsDocument19 pagesGST and Customs Laws Questions on FMCG Supplies, Agent TransactionsShantanuNo ratings yet

- 71239bos57247 p8Document23 pages71239bos57247 p8bhagirath prakrutNo ratings yet

- RTP Nov 22Document23 pagesRTP Nov 22Sundar AbhimanyuNo ratings yet

- GST Term Paper QuestionsDocument2 pagesGST Term Paper QuestionsSai Ram BachuNo ratings yet

- GST Practical Questions Vol - 1 (New) by CA Vivek GabaDocument13 pagesGST Practical Questions Vol - 1 (New) by CA Vivek Gabavamshi9686No ratings yet

- ST ST: © The Institute of Chartered Accountants of IndiaDocument19 pagesST ST: © The Institute of Chartered Accountants of IndiaÑïkêţ BäûðhåNo ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- Chpter 1, Scope & Levy, Nat & POS, AllDocument14 pagesChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument31 pages© The Institute of Chartered Accountants of IndiaJayanth RamNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- Idt MTP - May 2018 To May 2021Document168 pagesIdt MTP - May 2018 To May 2021Kanchana SubbaramNo ratings yet

- Caf 6 All PDFDocument80 pagesCaf 6 All PDFMuhammad Yahya100% (1)

- IPCC - November 2014Document11 pagesIPCC - November 2014suhaib1282No ratings yet

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument31 pages© The Institute of Chartered Accountants of IndiaMala M PrasannaNo ratings yet

- Practicesheet - Input Tax CreditDocument5 pagesPracticesheet - Input Tax CreditHemmu sahuNo ratings yet

- Paper 4 IDT - Pdfpaper 4 IDTDocument7 pagesPaper 4 IDT - Pdfpaper 4 IDTharsh agarwalNo ratings yet

- Top 20 Tricky Question From MTPDocument22 pagesTop 20 Tricky Question From MTPsanjanarawal09No ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- TAX COMPUTATIONDocument5 pagesTAX COMPUTATIONRamzan AliNo ratings yet

- Advanced Taxation: Certified Finance and Accounting Professional Stage ExaminationDocument5 pagesAdvanced Taxation: Certified Finance and Accounting Professional Stage ExaminationRoshan ZamirNo ratings yet

- 52593bos42131 Finalold p8Document13 pages52593bos42131 Finalold p8Rakesh MauryaNo ratings yet

- GST Pracital Class 2Document7 pagesGST Pracital Class 2Nayan JhaNo ratings yet

- Tax Professionals’ Academy Mock ExamDocument3 pagesTax Professionals’ Academy Mock ExamMuhammad Hassan AliNo ratings yet

- Mock Sep 2023 - Question PaperDocument8 pagesMock Sep 2023 - Question Paperfahadkhn871No ratings yet

- Paper-11 Indirect Taxation: MTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1Document7 pagesPaper-11 Indirect Taxation: MTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1RAj BardHanNo ratings yet

- GST Questions on Agent Supply, Services Import & Inverted Duty RefundDocument19 pagesGST Questions on Agent Supply, Services Import & Inverted Duty RefundNick VincikNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument5 pages© The Institute of Chartered Accountants of IndiaRahul ToshanNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Icai 3Document14 pagesIcai 3Raghav TibdewalNo ratings yet

- Caf 5 Far-IDocument5 pagesCaf 5 Far-IYahyaNo ratings yet

- Cost and Management AccountingDocument4 pagesCost and Management AccountingHooriaNo ratings yet

- Idt l2 CombinedDocument21 pagesIdt l2 CombinedMilan NayaniNo ratings yet

- Multiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaDocument7 pagesMultiple Choice Questions Paper 8: Indirect Tax Laws: © The Institute of Chartered Accountants of IndiaVIHARI DNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Mock Test Cma June 20 Set 2 PDFDocument7 pagesMock Test Cma June 20 Set 2 PDFamit jangraNo ratings yet

- PAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaDocument7 pagesPAPER 6E: Global Financial Reporting Standards Case Study 6: © The Institute of Chartered Accountants of IndiaAnmol JajuNo ratings yet

- Caf-6 Tax PDFDocument5 pagesCaf-6 Tax PDFRamzan AliNo ratings yet

- Test 7 (QP)Document2 pagesTest 7 (QP)iamneonkingNo ratings yet

- Ca FinalDocument11 pagesCa FinalHadia HNo ratings yet

- BS 6th Taxation Final Term PaperDocument3 pagesBS 6th Taxation Final Term PaperFarjad AliNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Lesson 6 Contworld With ActivitiesDocument8 pagesLesson 6 Contworld With ActivitiesAngelyn MortelNo ratings yet

- BGD 01-02Document6 pagesBGD 01-02muthum44499335No ratings yet

- CEFTADocument28 pagesCEFTAlovleshrubyNo ratings yet

- 08a Slides - LBO and FinancingDocument68 pages08a Slides - LBO and FinancingValentinNo ratings yet

- CIPS Diploma Qualification Fees and Exams QuoteDocument1 pageCIPS Diploma Qualification Fees and Exams QuoteResia ToorieNo ratings yet

- Bahamas Company Cash Items ReportDocument26 pagesBahamas Company Cash Items ReportMarie MagallanesNo ratings yet

- LogDes FinalDocument163 pagesLogDes FinalRihana Nhat KhueNo ratings yet

- Company ProfileDocument13 pagesCompany Profileconcerptlord2000No ratings yet

- Solution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungDocument24 pagesSolution Manual For South Western Federal Taxation 2020 Individual Income Taxes 43rd Edition James C YoungJohnValenciaajgq100% (35)

- Al-E20-0124 Celsius Eagle - Final #1Document2 pagesAl-E20-0124 Celsius Eagle - Final #1Jefe de Operaciones AlmacolNo ratings yet

- Germany BranchDocument2 pagesGermany BranchparuNo ratings yet

- Direct Financing & Sales Type LeaseDocument1 pageDirect Financing & Sales Type LeaseKent Raysil PamaongNo ratings yet

- Chap3 (L4)Document32 pagesChap3 (L4)Hisfan NaziefNo ratings yet

- Woodbank Interpretaion of Financial StatementsDocument3 pagesWoodbank Interpretaion of Financial Statementsnikitashrestha830No ratings yet

- Reading Test A Gr5 AKDocument8 pagesReading Test A Gr5 AKAsmaa MostafaNo ratings yet

- Amazon Seller Services Mumbai (7350) - Invoice 2 (1190)Document1 pageAmazon Seller Services Mumbai (7350) - Invoice 2 (1190)Swamy ChNo ratings yet

- FM Reviewer MidtermDocument21 pagesFM Reviewer MidtermPablo CoelhoNo ratings yet

- In Voice 8077122617129115647Document2 pagesIn Voice 8077122617129115647Vibrant PixelsNo ratings yet

- Days Sales Outstanding ScriptDocument4 pagesDays Sales Outstanding ScriptRogeliza PajaronNo ratings yet

- Accountancy Cash Flow Statement Class 12thDocument3 pagesAccountancy Cash Flow Statement Class 12thTilak DudejaNo ratings yet

- Vat No.300445529: Arn Number: Ad071219001506bDocument1 pageVat No.300445529: Arn Number: Ad071219001506bpradip guptaNo ratings yet

- Question 1666013841Document6 pagesQuestion 1666013841SheikhFaizanUl-HaqueNo ratings yet

- Rehabilitation of BusinessDocument1 pageRehabilitation of BusinessMuhammad AsifNo ratings yet

- Domestic Other Services Address CorrectionDocument6 pagesDomestic Other Services Address CorrectionRuss HaxNo ratings yet

- Ecuador: Where From, Where To: EconomicsDocument17 pagesEcuador: Where From, Where To: EconomicsIván GonzálezNo ratings yet

- 8 VatDocument11 pages8 VatRiyo Mae MagnoNo ratings yet

- Data Analysis.1669623881614Document50 pagesData Analysis.1669623881614BARTOLOME, JARAINE P.No ratings yet

- Trac Nghiem TTQT Dai Hoc Ngan HangDocument19 pagesTrac Nghiem TTQT Dai Hoc Ngan Hang31 Trà Thị Hoàng NhưNo ratings yet

- Foreign Trade Policy: Ministry of Commerce and Industry Government of IndiaDocument70 pagesForeign Trade Policy: Ministry of Commerce and Industry Government of Indiavarun_bathulaNo ratings yet

- TBZ Awards RevisedDocument34 pagesTBZ Awards Revisedambady_mmNo ratings yet